Form 8-K - Current report

September 20 2023 - 3:49PM

Edgar (US Regulatory)

FALSE000170968200017096822023-09-142023-09-140001709682us-gaap:CommonStockMember2023-09-142023-09-140001709682ctos:RedeemableWarrantsMember2023-09-142023-09-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 14, 2023

CUSTOM TRUCK ONE SOURCE, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-38186 | | 84-2531628 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | |

7701 Independence Avenue Kansas City, Missouri | | 64125 |

| (Address of principal executive offices) | | (Zip code) |

(816) 241-4888

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Exchange on Which Registered |

| Common Stock, $0.0001 par value | | CTOS | | New York Stock Exchange |

| Redeemable warrants, exercisable for Common Stock, $0.0001 par value | | CTOS.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On September 14, 2023, the Board of Directors of Custom Truck One Source, Inc. (the “Company”) approved a stock repurchase program that authorizes the repurchase of up to $25 million of shares of the Company’s common stock. Under the repurchase program, repurchases can be made from time to time using a variety of methods, which may include open market purchases, privately negotiated transactions, or otherwise, all in accordance with the rules of the Securities and Exchange Commission and other applicable legal requirements. The specific timing, price and size of purchases will depend on prevailing stock prices, general economic and market conditions, and other considerations. The repurchase program does not obligate the Company to acquire any particular amount of its common stock, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, as amended, and within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. When used in this Current Report on Form 8-K, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s management’s control, that could cause actual results or outcomes to differ materially from those discussed in this Current Report on Form 8-K. This Current Report on Form 8-K is based on certain assumptions that the Company’s management has made in light of its experience in the industry, as well as the Company’s perceptions of historical trends, current conditions, expected future developments and other factors the Company believes are appropriate in these circumstances. As you read and consider this Current Report on Form 8-K, you should understand that these statements are not guarantees of performance or results. Many factors could affect the Company’s actual performance and results and could cause actual results to differ materially from those expressed in this Current Report on Form 8-K. Important factors, among others, that may affect actual results or outcomes include: increases in labor costs, our inability to obtain raw materials, component parts and/or finished goods in a timely and cost-effective manner, and our inability to manage our rental equipment in an effective manner; our sales order backlog may not be indicative of the level of our future revenues; increases in unionization rate in our workforce; our inability to recruit and retain the experienced personnel, including skilled technicians, we need to compete in our industries; our inability to attract and retain highly skilled personnel and our inability to retain our senior management; material disruptions to our operation and manufacturing locations as a result of public health concerns, equipment failures, natural disasters, work stoppages, power outages or other reasons; potential impairment charges; any further increase in the cost of new equipment that we purchase for use in our rental fleet or for sale as inventory; aging or obsolescence of our existing equipment, and the fluctuations of market value thereof; disruptions in our supply chain; our business may be impacted by government spending; we may experience losses in excess of our recorded reserves for receivables; unfavorable conditions in the capital and credit markets and our inability to obtain additional capital as required; increases in price of fuel or freight; regulatory technological advancement, or other changes in our core end-markets may affect our customers’ spending; difficulty in integrating acquired businesses and fully realizing the anticipated benefits and cost savings of the acquired businesses, as well as additional transaction and transition costs that we will continue to incur following acquisitions; material weakness in our internal control over financial reporting which, if not remediated, could result in material misstatements in our financial statements; the interest of our majority stockholder, which may not be consistent with the other stockholders; our significant indebtedness, which may adversely affect our financial position, limit our available cash and our access to additional capital, prevent us from growing our business and increase our risk of default; our inability to generate cash, which could lead to a default; significant operating and financial restrictions imposed by our debt agreements; changes in interest rates, which could increase our debt service obligations on the variable rate indebtedness and decrease our net income and cash flows; disruptions in our information technology systems or a compromise of our system security, limiting our ability to effectively monitor and control our operations, adjust to changing market conditions, and implement strategic initiatives; we are subject to complex laws and regulations, including environmental and safety regulations that can adversely affect cost, manner or feasibility of doing business; we are subject to a series of risks related to climate change; and increased attention to, and evolving expectations for, sustainability and environmental, social and governance initiatives. For a more complete description of these and other possible risks and uncertainties, please refer to the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and its subsequent reports filed with the Securities and Exchange Commission. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

|

| Date: | September 20, 2023 | Custom Truck One Source, Inc. |

| | | |

| | /s/ Christopher J. Eperjesy |

| | | Christopher J. Eperjesy

Chief Financial Officer |

v3.23.3

Cover Page

|

Sep. 14, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 14, 2023

|

| Entity Registrant Name |

CUSTOM TRUCK ONE SOURCE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38186

|

| Entity Tax Identification Number |

84-2531628

|

| Entity Address, Address Line One |

7701 Independence Avenue

|

| Entity Address, City or Town |

Kansas City

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

64125

|

| City Area Code |

816

|

| Local Phone Number |

241-4888

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001709682

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

CTOS

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for Common Stock, $0.0001 par value

|

| Trading Symbol |

CTOS.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ctos_RedeemableWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

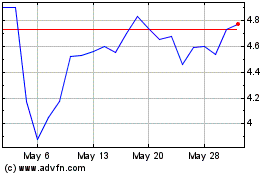

Custom Truck One Source (NYSE:CTOS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Custom Truck One Source (NYSE:CTOS)

Historical Stock Chart

From Nov 2023 to Nov 2024