Second Quarter Highlights include:

- Reported second quarter revenues of $178.8 million, net income

of $4.5 million and operating cash flow of $19.4 million;

- Delivered second quarter Adjusted EBITDA of $31.6 million and

free cash flow of $12.9 million;

- Recorded highest quarterly occupancy in Civeo’s Australian

owned-villages since 2014; and

- Reduced debt and continued to return capital to shareholders

through the share repurchase program.

Civeo Corporation (NYSE:CVEO) today reported financial and

operating results for the second quarter ended June 30, 2023.

“In the second quarter of 2023, we delivered financial results

in line with our expectations while continuing to operate safely

and effectively. We generated solid free cash flow in the quarter

which was used to repurchase approximately 212,000 Civeo shares and

pay down $6.5 million in debt. The second quarter’s results

demonstrate the value of our diversified revenue drivers and were

notable for the significant year-over-year growth in our Australian

segment, driven by a 33% increase in integrated services revenue

related to new contracts as well as a 14% increase in Australian

owned-village revenue. This quarter’s Australian village occupancy

marks the highest level we’ve experienced since 2014. The

improvement in Australia in the quarter was offset by lower

LNG-related Canadian lodge occupancy and mobile camp activity,”

said Bradley J. Dodson, Civeo's President and Chief Executive

Officer.

Mr. Dodson concluded, “As we highlighted on the first quarter

earnings conference call, our two strategic priorities for the

remainder of 2023 were mitigating inflationary pressures in our

Western Australian integrated services business and evaluating

commercial alternatives for our Canadian McClelland Lake lodge

assets. I'm happy to report that during the second quarter we made

progress on both. We will provide additional updates regarding

these developments on our earnings conference call later

today.”

Second Quarter 2023 Results

In the second quarter of 2023, Civeo generated revenues of

$178.8 million and reported net income of $4.5 million, or $0.30

per diluted share. During the second quarter of 2023, Civeo

produced operating cash flow of $19.4 million, Adjusted EBITDA of

$31.6 million and free cash flow of $12.9 million.

By comparison, in the second quarter of 2022, Civeo generated

revenues of $185.0 million and reported net income of $9.1 million,

or $0.54 per diluted share. During the second quarter of 2022,

Civeo produced operating cash flow of $21.7 million, Adjusted

EBITDA of $37.1 million and free cash flow of $17.6 million.

The year-over-year decrease in Adjusted EBITDA in the second

quarter of 2023 was primarily driven by lower Canadian LNG-related

lodge occupancy and mobile camp activity, partially offset by

increased billed rooms at the Australian Bowen Basin villages.

Business Segment Results

(Unless otherwise noted, the following discussion compares the

quarterly results for the second quarter of 2023 to the results for

the second quarter of 2022.)

Canada

During the second quarter of 2023, the Canadian segment

generated revenues of $95.5 million, operating income of $3.2

million and Adjusted EBITDA of $19.8 million, compared to revenues

of $109.0 million, operating income of $11.2 million and Adjusted

EBITDA of $28.7 million in the second quarter of 2022. Results from

the second quarter of 2023 reflect the impact of a weakened

Canadian dollar relative to the U.S. dollar, which decreased

revenues and Adjusted EBITDA by $5.1 million and $1.1 million,

respectively.

On a constant currency basis, the Canadian segment experienced

an 8% period-over-period decrease in revenues largely related to

Canadian mobile camp activity winding down as well as a 6%

year-over-year decrease in Canadian lodge billed rooms. Adjusted

EBITDA for the Canadian segment decreased 27% due to the

aforementioned dynamics as well as inflationary pressures across

the business.

Australia

During the second quarter of 2023, the Australian segment

generated revenues of $82.5 million, operating income of $9.2

million and Adjusted EBITDA of $19.6 million, compared to revenues

of $67.8 million, operating income of $5.5 million and Adjusted

EBITDA of $15.5 million in the second quarter of 2022. Results from

the second quarter of 2023 reflect the impact of a weakened

Australian dollar relative to the U.S. dollar, which decreased

revenues and Adjusted EBITDA by $5.7 million and $1.3 million,

respectively.

On a constant currency basis, the Australian segment experienced

a 30% period-over-period increase in revenues primarily driven by

increased integrated services revenue related to new contracts as

well as a 16% year-over-year increase in village billed rooms.

Adjusted EBITDA for the Australian segment increased 35% due the

aforementioned dynamics, partially offset by a weakened Australian

dollar relative to the U.S. dollar.

Financial Condition

As of June 30, 2023, Civeo had total liquidity of approximately

$89.0 million, consisting of $77.6 million available under its

revolving credit facilities and $11.4 million of cash on hand.

Civeo’s total debt outstanding on June 30, 2023 was $136.1

million, a $6.5 million decrease since March 31, 2023.

Civeo reported a net leverage ratio of 1.2x as of June 30,

2023.

During the second quarter of 2023, Civeo invested $6.9 million

in capital expenditures compared to $5.1 million invested during

the second quarter of 2022. Capital expenditures in both periods

were predominantly related to maintenance spending on the Company’s

lodges and villages.

In the second quarter of 2023, Civeo repurchased approximately

212,000 shares through its share repurchase program for a total of

approximately $4.2 million.

Full Year 2023 Guidance

For the full year of 2023, Civeo is increasing the lower end of

its previously provided revenue and Adjusted EBITDA guidance

ranges. The revised revenue and Adjusted EBITDA guidance ranges are

$640 million to $650 million and $90 million to $95 million,

respectively. The Company is decreasing full year 2023 capital

expenditure guidance to a range of $35 million to $40 million. The

$10 million decrease in capital expenditure guidance is entirely

driven by downward revisions to the scope of the customer-funded

infrastructure upgrades to three Australian villages announced last

quarter. As these upgrades will be fully funded by the customer

upfront, this change will not impact our 2023 free cash flow

guidance.

Conference Call

Civeo will host a conference call to discuss its second quarter

2023 financial results today at 11:00 a.m. Eastern time. This call

is being webcast and can be accessed at Civeo's website at

www.civeo.com. Participants may also join the conference call by

dialing (877) 423-9813 in the United States or (201) 689-8573

internationally and using the conference ID 13740254#. A replay

will be available after the call by dialing (844) 512-2921 in the

United States or (412) 317-6671 internationally and using the

conference ID 13740254#.

About Civeo

Civeo Corporation is a leading provider of hospitality services

with prominent market positions in the Canadian oil sands and the

Australian natural resource regions. Civeo offers comprehensive

solutions for lodging hundreds or thousands of workers with its

long-term and temporary accommodations and provides food services,

housekeeping, facility management, laundry, water and wastewater

treatment, power generation, communications systems, security and

logistics services. Civeo currently operates a total of 26 lodges

and villages in Canada, Australia and the U.S., with an aggregate

of approximately 28,000 rooms. Civeo is publicly traded under the

symbol CVEO on the New York Stock Exchange. For more information,

please visit Civeo's website at www.civeo.com.

Forward Looking Statements

This news release contains forward-looking statements within the

meaning of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements are

those that do not state historical facts and are, therefore,

inherently subject to risks and uncertainties. The forward-looking

statements herein, including the statements regarding Civeo’s

future plans and outlook, strategic priorities, guidance, current

trends and liquidity needs, are based on then current expectations

and entail various risks and uncertainties that could cause actual

results to differ materially from those expressed or implied by

these forward-looking statements. Such risks and uncertainties

include, among other things, risks associated with the general

nature of the accommodations industry, risks associated with the

level of supply and demand for oil, coal, iron ore and other

minerals, including the level of activity, spending and

developments in the Canadian oil sands, the level of demand for

coal and other natural resources from, and investments and

opportunities in, Australia, and fluctuations or sharp declines in

the current and future prices of oil, natural gas, coal, iron ore

and other minerals, risks associated with failure by our customers

to reach positive final investment decisions on, or otherwise not

complete, projects with respect to which we have been awarded

contracts, which may cause those customers to terminate or postpone

contracts, risks associated with currency exchange rates, risks

associated with inflation and volatility in the banking sector,

risks associated with the company’s ability to integrate

acquisitions, risks associated with labor shortages, risks

associated with the development of new projects, including whether

such projects will continue in the future, risks associated with

the trading price of the company’s common shares, availability and

cost of capital, risks associated with general global economic

conditions, inflation, global weather conditions, natural

disasters, global health concerns, and security threats and changes

to government and environmental regulations, including climate

change, and other factors discussed in the “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of Civeo’s most recent annual report on

Form 10-K and other reports the company may file from time to time

with the U.S. Securities and Exchange Commission. Each

forward-looking statement contained herein speaks only as of the

date of this release. Except as required by law, Civeo expressly

disclaims any intention or obligation to revise or update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Non-GAAP Financial Information

EBITDA, Adjusted EBITDA, free cash flow, net debt, bank-adjusted

EBITDA and net leverage ratio are non-GAAP financial measures. See

“Non-GAAP Reconciliation” below for definitions and additional

information concerning non-GAAP financial measures, including a

reconciliation of the non-GAAP financial information presented in

this press release to the most directly comparable financial

information presented in accordance with GAAP. Non-GAAP financial

information supplements and should be read together with, and is

not an alternative or substitute for, the Company’s financial

results reported in accordance with GAAP. Because non-GAAP

financial information is not standardized, it may not be possible

to compare these financial measures with other companies’ non-GAAP

financial measures.

- Financial Schedules Follow -

CIVEO CORPORATION

UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share amounts)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Revenues

$

178,843

$

184,954

$

346,434

$

350,632

Costs and expenses:

Cost of sales and services

131,425

130,053

264,939

255,896

Selling, general and administrative

expenses

16,459

17,682

32,649

32,895

Depreciation and amortization expense

20,701

23,083

42,363

43,210

Other operating expense (income)

86

(106

)

215

152

168,671

170,712

340,166

332,153

Operating income

10,172

14,242

6,268

18,479

Interest expense

(3,604

)

(2,608

)

(7,260

)

(5,076

)

Interest income

50

2

82

2

Other income

427

415

2,877

2,111

Income before income taxes

7,045

12,051

1,967

15,516

Income tax expense

(2,878

)

(1,821

)

(4,111

)

(3,378

)

Net income (loss)

4,167

10,230

(2,144

)

12,138

Less: Net income (loss) attributable to

noncontrolling interest

(296

)

662

(254

)

1,160

Net income (loss) attributable to Civeo

Corporation

4,463

9,568

(1,890

)

10,978

Less: Dividends attributable to Class A

preferred shares

—

490

—

977

Net income (loss) attributable to Civeo

common shareholders

$

4,463

$

9,078

$

(1,890

)

$

10,001

Net income (loss) per share attributable

to Civeo Corporation common shareholders:

Basic

$

0.30

$

0.55

$

(0.13

)

$

0.60

Diluted

$

0.30

$

0.54

$

(0.13

)

$

0.60

Weighted average number of common shares

outstanding:

Basic

14,970

14,148

15,064

14,122

Diluted

15,000

14,275

15,064

14,271

CIVEO CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

June 30, 2023

December 31, 2022

(UNAUDITED)

Current assets:

Cash and cash equivalents

$

11,421

$

7,954

Accounts receivable, net

140,090

119,755

Inventories

7,171

6,907

Assets held for sale

8,204

8,653

Prepaid expenses and other current

assets

8,992

10,280

Total current assets

175,878

153,549

Property, plant and equipment, net

275,561

301,890

Goodwill, net

7,522

7,672

Other intangible assets, net

80,635

81,747

Operating lease right-of-use assets

14,023

15,722

Other noncurrent assets

5,343

5,604

Total assets

$

558,962

$

566,184

Current liabilities:

Accounts payable

$

47,763

$

51,087

Accrued liabilities

27,524

39,211

Income taxes

100

178

Current portion of long-term debt

14,664

28,448

Deferred revenue

3,097

991

Other current liabilities

9,534

8,342

Total current liabilities

102,682

128,257

Long-term debt

120,999

102,505

Deferred income taxes

8,628

4,778

Operating lease liabilities

11,446

12,771

Other noncurrent liabilities

19,874

14,172

Total liabilities

263,629

262,483

Shareholders' equity:

Common shares

—

—

Additional paid-in capital

1,626,556

1,624,512

Accumulated deficit

(939,983

)

(930,123

)

Treasury stock

(9,063

)

(9,063

)

Accumulated other comprehensive loss

(385,350

)

(385,187

)

Total Civeo Corporation shareholders'

equity

292,160

300,139

Noncontrolling interest

3,173

3,562

Total shareholders' equity

295,333

303,701

Total liabilities and shareholders'

equity

$

558,962

$

566,184

CIVEO CORPORATION

UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

Six Months Ended

June 30,

2023

2022

Cash flows from operating activities:

Net income (loss)

$

(2,144

)

$

12,138

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

42,363

43,210

Deferred income tax expense

3,985

3,256

Non-cash compensation charge

2,044

1,974

Gains on disposals of assets

(2,445

)

(1,895

)

Provision for credit losses, net of

recoveries

(65

)

(24

)

Other, net

1,242

1,544

Changes in operating assets and

liabilities:

Accounts receivable

(19,669

)

(23,119

)

Inventories

(297

)

(1,180

)

Accounts payable and accrued

liabilities

(14,713

)

(6,713

)

Taxes payable

(78

)

(99

)

Other current and noncurrent assets and

liabilities, net

9,538

(5,461

)

Net cash flows provided by operating

activities

19,761

23,631

Cash flows from investing activities:

Capital expenditures

(11,717

)

(8,647

)

Proceeds from dispositions of property,

plant and equipment

2,719

3,302

Other, net

—

190

Net cash flows used in investing

activities

(8,998

)

(5,155

)

Cash flows from financing activities:

Term loan repayments

(14,942

)

(15,763

)

Revolving credit borrowings (repayments),

net

15,993

(2,576

)

Repurchases of common shares

(7,970

)

(542

)

Taxes paid on vested shares

—

(1,013

)

Net cash flows used in financing

activities

(6,919

)

(19,894

)

Effect of exchange rate changes on

cash

(377

)

(82

)

Net change in cash and cash

equivalents

3,467

(1,500

)

Cash and cash equivalents, beginning of

period

7,954

6,282

Cash and cash equivalents, end of

period

$

11,421

$

4,782

CIVEO CORPORATION

SEGMENT DATA

(in thousands)

(unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Revenues

Canada

$

95,470

$

109,023

$

184,923

$

204,975

Australia

82,544

67,820

159,533

131,349

Other (2)

829

8,111

1,978

14,308

Total revenues

$

178,843

$

184,954

$

346,434

$

350,632

EBITDA (1)

Canada

$

19,818

$

28,659

$

31,829

$

45,878

Australia

19,606

15,537

33,815

30,974

Corporate, other and eliminations (2)

(7,828

)

(7,118

)

(13,882

)

(14,212

)

Total EBITDA

$

31,596

$

37,078

$

51,762

$

62,640

Adjusted EBITDA (1)

Canada

$

19,818

$

28,659

$

31,829

$

45,878

Australia

19,606

15,537

33,815

30,974

Corporate, other and eliminations (2)

(7,828

)

(7,118

)

(13,882

)

(14,212

)

Total adjusted EBITDA

$

31,596

$

37,078

$

51,762

$

62,640

Operating income (loss)

Canada

$

3,177

$

11,197

$

(1,325

)

$

15,235

Australia

9,176

5,452

14,073

11,587

Corporate, other and eliminations (2)

(2,181

)

(2,407

)

(6,480

)

(8,343

)

Total operating income

$

10,172

$

14,242

$

6,268

$

18,479

(1) Please see Non-GAAP Reconciliation

Schedule.

(2) Prior to the first quarter of 2023, we

presented the U.S. operating segment as a separate reportable

segment. Our operating segment in the U.S. no longer meets the

reportable segment quantitative thresholds, and is included within

the Other and Corporate, other and eliminations categories. Prior

periods have been adjusted.

CIVEO CORPORATION

NON-GAAP

RECONCILIATIONS

(in thousands)

(unaudited)

Three Months Ended

Six Months Ended

Twelve Months Ended

June 30,

June 30,

June 30,

2023

2022

2023

2022

2023

EBITDA (1)

$

31,596

$

37,078

$

51,762

$

62,640

Adjusted EBITDA (1)

$

31,596

$

37,078

$

51,762

$

62,640

Free Cash Flow (2)

$

12,912

$

17,561

$

10,763

$

18,286

Net Leverage Ratio (3)

1.2x

(1)

The term EBITDA is a non-GAAP financial measure that is defined

as net income (loss) attributable to Civeo Corporation plus

interest, taxes, depreciation and amortization. The term Adjusted

EBITDA is a non-GAAP financial measure that is defined as EBITDA

adjusted to exclude certain other unusual or non-operating items.

EBITDA and Adjusted EBITDA are not measures of financial

performance under generally accepted accounting principles and

should not be considered in isolation from or as a substitute for

net income or cash flow measures prepared in accordance with

generally accepted accounting principles or as a measure of

profitability or liquidity. Additionally, EBITDA and Adjusted

EBITDA may not be comparable to other similarly titled measures of

other companies. Civeo has included EBITDA and Adjusted EBITDA as

supplemental disclosures because its management believes that

EBITDA and Adjusted EBITDA provide useful information regarding its

ability to service debt and to fund capital expenditures and

provide investors a helpful measure for comparing Civeo's operating

performance with the performance of other companies that have

different financing and capital structures or tax rates. Civeo uses

EBITDA and Adjusted EBITDA to compare and to monitor the

performance of its business segments to other comparable public

companies and as a benchmark for the award of incentive

compensation under its annual incentive compensation plan.

The following table sets forth a

reconciliation of EBITDA and Adjusted EBITDA to net income (loss)

attributable to Civeo Corporation, which is the most directly

comparable measure of financial performance calculated under

generally accepted accounting principles (in thousands)

(unaudited):

Three Months Ended

Six Months Ended

Twelve Months Ended

June 30,

June 30,

June 30,

2023

2022

2023

2022

2023

Net income (loss) attributable to Civeo

Corporation

$

4,463

$

9,568

$

(1,890

)

$

10,978

$

(8,871

)

Income tax expense

2,878

1,821

4,111

3,378

5,135

Depreciation and amortization

20,701

23,083

42,363

43,210

86,367

Interest income

(50

)

(2

)

(82

)

(2

)

(119

)

Interest expense

3,604

2,608

7,260

5,076

13,658

EBITDA

$

31,596

$

37,078

$

51,762

$

62,640

$

96,170

Adjustments to EBITDA

Impairment of long-lived assets (a)

—

—

—

—

5,721

Adjusted EBITDA

$

31,596

$

37,078

$

51,762

$

62,640

$

101,891

(a)

Relates to asset impairments in the fourth quarter of 2022. In

the fourth quarter of 2022, we recorded a pre-tax loss related to

the impairment of long-lived assets in our Australian segment of

$3.8 million and a pre-tax loss related to the impairment of

long-lived assets in the U.S. of $1.9 million.

(2)

The term Free Cash Flow is a non-GAAP financial measure that is

defined as net cash flows provided by operating activities less

capital expenditures plus proceeds from asset sales. Free Cash Flow

is not a measure of financial performance under generally accepted

accounting principles and should not be considered in isolation

from or as a substitute for cash flow measures prepared in

accordance with generally accepted accounting principles or as a

measure of profitability or liquidity. Additionally, Free Cash Flow

may not be comparable to other similarly titled measures of other

companies. Civeo has included Free Cash Flow as a supplemental

disclosure because its management believes that Free Cash Flow

provides useful information regarding the cash flow generating

ability of its business relative to its capital expenditure and

debt service obligations. Civeo uses Free Cash Flow to compare and

to understand, manage, make operating decisions and evaluate

Civeo's business.

The following table sets forth a

reconciliation of Free Cash Flow to Net Cash Flows Provided by

Operating Activities, which is the most directly comparable measure

of financial performance calculated under generally accepted

accounting principles (in thousands) (unaudited):

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Net Cash Flows Provided by Operating

Activities

$

19,403

$

21,678

$

19,761

$

23,631

Capital expenditures

(6,945

)

(5,055

)

(11,717

)

(8,647

)

Proceeds from dispositions of property,

plant and equipment

454

938

2,719

3,302

Free Cash Flow

$

12,912

$

17,561

$

10,763

$

18,286

(3)

The term net leverage ratio is a non-GAAP financial measure that

is defined as net debt divided by bank-adjusted EBITDA. Net debt,

bank-adjusted EBITDA and net leverage ratio are not financial

measures under GAAP and should not be considered in isolation from

or as a substitute for total debt, net income (loss) or cash flow

measures prepared in accordance with GAAP or as a measure of

profitability or liquidity. Additionally, net debt, bank-adjusted

EBITDA and net leverage ratio may not be comparable to other

similarly titled measures of other companies. Civeo has included

net debt, bank-adjusted EBITDA and net leverage ratio as a

supplemental disclosure because its management believes that this

data provides useful information regarding the level of the

Company’s indebtedness and its ability to service debt.

Additionally, per Civeo’s credit agreement, the Company is required

to maintain a net leverage ratio below 3.0x every quarter to remain

in compliance with the credit agreement.

The following table sets forth a

reconciliation of net debt, bank-adjusted EBITDA and net leverage

ratio to the most directly comparable measures of financial

performance calculated under GAAP (in thousands) (unaudited):

As of June 30,

2023

Total debt

$

136,105

Less: Cash and cash equivalents

11,421

Net debt

$

124,684

Adjusted EBITDA for the twelve months

ended June 30, 2023 (a)

$

101,891

Adjustments to Adjusted EBITDA

Stock-based compensation

3,857

Interest income

119

Bank-adjusted EBITDA

$

105,867

Net leverage ratio (b)

1.2x

(a) See footnote 1 above for

reconciliation of Adjusted EBITDA to net income (loss) attributable

to Civeo Corporation

(b) Calculated as net debt divided by

bank-adjusted EBITDA

CIVEO CORPORATION

NON-GAAP RECONCILIATIONS -

GUIDANCE

(in millions)

(unaudited)

Year Ending

December 31, 2023

EBITDA Range (1)

$

90.0

$

95.0

(1) The following table sets

forth a reconciliation of estimated EBITDA to estimated net loss,

which is the most directly comparable measure of financial

performance calculated under generally accepted accounting

principles (in millions) (unaudited):

Year Ending

December 31, 2023

(estimated)

Net income

$

(13.0

)

$

(10.0

)

Income tax expense

11.0

13.0

Depreciation and amortization

79.0

79.0

Interest expense

13.0

13.0

EBITDA

$

90.0

$

95.0

CIVEO CORPORATION

SUPPLEMENTAL QUARTERLY SEGMENT

AND OPERATING DATA

(U.S. dollars in thousands,

except for room counts and average daily rates)

(unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2023

2022

2023

2022

Supplemental Operating Data - Canadian

Segment

Revenues

Accommodation revenue (1)

$

72,355

$

79,431

$

136,583

$

146,625

Mobile facility rental revenue (2)

17,407

24,058

37,438

48,076

Food and other services revenue (3)

5,708

5,534

10,902

10,274

Total Canadian revenues

$

95,470

$

109,023

$

184,923

$

204,975

Costs

Accommodation cost

$

52,431

$

53,108

$

104,529

$

106,235

Mobile facility rental cost

11,598

14,458

26,100

29,342

Food and other services cost

5,060

4,976

9,834

9,335

Indirect other cost

2,756

2,467

5,287

5,303

Total Canadian cost of sales and

services

$

71,845

$

75,009

$

145,750

$

150,215

Average daily rates (4)

$

100

$

103

$

98

$

104

Billed rooms (5)

724,299

771,267

1,367,095

1,406,822

Canadian dollar to U.S. dollar

$

0.745

$

0.784

$

0.742

$

0.787

Supplemental Operating Data -

Australian Segment

Revenues

Accommodation revenue (1)

$

44,342

$

39,052

$

84,941

$

76,651

Food and other services revenue (3)

38,202

28,768

74,592

54,698

Total Australian revenues

$

82,544

$

67,820

$

159,533

$

131,349

Costs

Accommodation cost

$

20,948

$

18,840

$

41,266

$

37,247

Food and other services cost

35,372

27,008

71,234

51,371

Indirect other cost

2,225

1,844

4,353

3,588

Total Australian cost of sales and

services

$

58,545

$

47,692

$

116,853

$

92,206

Average daily rates (4)

$

75

$

77

$

76

$

78

Billed rooms (5)

587,855

505,310

1,110,568

979,784

Australian dollar to U.S. dollar

$

0.668

$

0.715

$

0.676

$

0.719

(1)

Includes revenues related to lodge and

village rooms and hospitality services for owned rooms for the

periods presented.

(2)

Includes revenues related to mobile assets

for the periods presented.

(3)

Includes revenues related to food

services, laundry and water and wastewater treatment services, and

facilities management for the periods presented.

(4)

Average daily rate is based on billed

rooms and accommodation revenue.

(5)

Billed rooms represents total billed days

for owned assets for the periods presented.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230728280636/en/

Carolyn J. Stone Civeo Corporation Senior Vice President &

Chief Financial Officer 713-510-2400

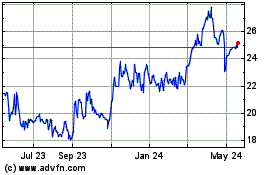

Civeo (NYSE:CVEO)

Historical Stock Chart

From Jan 2025 to Feb 2025

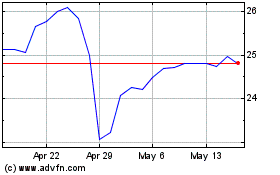

Civeo (NYSE:CVEO)

Historical Stock Chart

From Feb 2024 to Feb 2025