Cushman & Wakefield: U.S. Industrial Quarterly Net Absorption Up 10.5% While Vacancy Inches Higher by 20 bps

January 10 2025 - 8:00AM

Business Wire

Projects under construction drop by 36% to 291 msf amid elevated

vacancies and modest demand totals

The overall national industrial vacancy rate edged higher in the

fourth quarter, climbing 20 basis points (bps) to 6.7%, according

to the latest research by Cushman & Wakefield (NYSE:CWK). This

remains 30 basis points (bps) below the 10-year, pre-pandemic

average.

“Industrial vacancy is likely nearing its peak for this cooling

cycle in the coming quarters,” said Jason Price, Senior Director,

Americas Head of Logistics & Industrial Research. “In Q4 we saw

positive annual absorption in 60% of the 84 markets we track, and

eight markets reported more than 5 million square feet (msf) of

absorption for the year.”

Overall net absorption in the fourth quarter measured 36.8 msf

up from the 33.3 msf recorded in Q3 but down 20% on a

year-over-year basis. Approximately 135 msf of industrial product

was absorbed in 2024 by year-end as some markets struggled with

occupier consolidations and right-sizing throughout the year.

Quarterly new leasing activity remained slow at approximately

130 msf in the fourth quarter and was down 15.7% compared to one

year ago. Since the start of the year, 591.3 msf of deals were

transacted, down 4.8% year-over-year. However, 2024 ranked as the

sixth strongest year on record for new deal activity. There were

seven markets which surpassed 20 msf of new leasing activity for

2024 with the Inland Empire (46 msf) and Dallas/Fort Worth (45.5

msf) exceeding the 45-msf mark for the year.

“We've witnessed an uptick among firms looking to lease larger

buildings to support their omnichannel fulfillment strategies and

maintain inventory for their e-commerce, wholesale, and retail

stock. This trend is not just about space, but about efficiency and

customer satisfaction,” said Jason Tolliver, President, Logistics

& Industrial Services. “Meanwhile, we're also seeing a flurry

of activity to support forward-deployed stock models, a strategy

that keeps products closer to the market they serve and where

customers order them, promising quicker deliveries and happier

customers.”

New construction deliveries continued to decelerate for the

second straight quarter. Just 85.3 msf of new industrial product

was completed in Q4, down 8% quarter-over-quarter and 48% versus

one year ago. Over 65% of the total was speculative product, much

of which was delivered vacant. For the year, 425.5 msf of

industrial facilities were completed, with 22% (92.6 msf)

build-to-suit (BTS) and 78% (333 msf) speculative; compared to 17%

BTS and 83% speculative in 2023. The total was 31% lower than the

previous year, with annual delivery totals expected to continue to

fall in 2025. Completions continued to be concentrated in the South

and West regions, accounting for 50% and 29% of the 2024 annual

total, respectively. Only four markets saw more than 20 msf of

completions year-to-date, compared to 10 markets in 2023.

Meanwhile, as construction starts remained tempered overall, the

under-development pipeline has continued to thin out, dropping by

36% annually to its lowest level (290.5 msf) since Q3 2018.

One-third of that total is BTS developments, which will likely help

stabilize vacancy in the second half of this year and beyond.

Asking rents ticked higher by another 1% quarterly during Q4 to

$10.13 psf. For the year, asking rents climbed by 4.5%, fueled by

the South region (6%) and Northeast (3.8%). Conversely, markets in

the West region saw rents continue to soften over the last year,

dropping by 2.3% on average. On the market level, 25 markets saw

asking rents fall year-over-year, including five that reported

double-digit decreases; led by Raleigh/Durham (-14%), Inland Empire

(-14%), and Los Angeles (-13%). Still, 69% of the markets yielded

annual asking rent increases, 21 of which saw rents climb by 5% or

more, many of which were concentrated in the South region.

“After a year of hesitancy, logistics is entering a new,

sustained growth phase. Corporate capital is being deployed to

optimize supply chains, diversify networks, and minimize potential

risks. What's particularly encouraging is the proactive approach of

retailers, wholesalers, and 3PLs, who are not just reacting to the

market, but shaping it. 2025 will be a year characterized by this

bias for action,” said Tolliver.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global

commercial real estate services firm for property owners and

occupiers with approximately 52,000 employees in nearly 400 offices

and 60 countries. In 2023, the firm reported revenue of $9.5

billion across its core services of property, facilities and

project management, leasing, capital markets, and valuation and

other services. It also receives numerous industry and business

accolades for its award-winning culture and commitment to

Diversity, Equity and Inclusion (DEI), sustainability and more. For

additional information, visit www.cushmanwakefield.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250110802897/en/

Michael Boonshoft Michael.boonshoft@cushwake.com

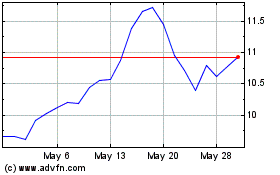

Cushman and Wakefield (NYSE:CWK)

Historical Stock Chart

From Dec 2024 to Jan 2025

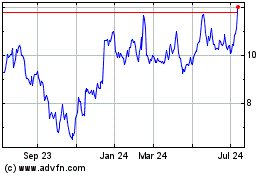

Cushman and Wakefield (NYSE:CWK)

Historical Stock Chart

From Jan 2024 to Jan 2025