0000882184false00008821842024-08-292024-08-290000882184us-gaap:CommonStockMember2024-08-292024-08-290000882184us-gaap:SeniorNotesMember2024-08-292024-08-29

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

__________________________________________________

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2024

______________________________

D.R. Horton, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-14122 | | 75-2386963 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1341 Horton Circle, Arlington, Texas 76011

(Address of principal executive offices)

(817) 390-8200

(Registrant’s telephone number, including area code)

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $.01 per share | | DHI | | New York Stock Exchange |

| 5.000% Senior Notes due 2034 | | DHI 34 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

Effective August 29, 2024, DHI Mortgage Company, Ltd. ("DHI Mortgage"), a wholly-owned subsidiary of D.R. Horton, Inc., U.S. Bank National Association, as a buyer, and as administrative agent and other buyers listed as a buyer (collectively, the "Buyers") hereto entered into the Third Amendment (the "Amendment") to the Fourth Amended and Restated Master Repurchase Agreement dated as of February 18, 2022 as amended prior to the date hereof (as so amended, the "Amended Repurchase Facility").

The Amendment extends the term of the Amended Repurchase Facility through the earlier of (i) May 9, 2025 or (ii) the date when the Buyers’ commitments are terminated pursuant to the Amended Repurchase Facility, by order of any governmental authority or by operation of law.

The Amended Repurchase Facility provides financing and liquidity to DHI Mortgage by facilitating purchase transactions in which DHI Mortgage transfers eligible loans to Buyers against the transfer of funds by Buyers (thereby becoming purchased loans). The purchase transactions are based on the terms and conditions in the Amended Repurchase Facility and the ancillary or operative agreements attached thereto or referred to therein. Amounts outstanding under the Amended Repurchase Facility are not guaranteed by D.R. Horton, Inc. or any of the subsidiaries that guarantee the debt of its homebuilding, rental or Forestar operations.

The Amendment is filed herewith as Exhibit 10.1 and is incorporated by reference into this Item 1.01. Capitalized terms not defined herein are defined in the Amended Repurchase Facility or as provided therein.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above under Item 1.01. "Entry into a Material Definitive Agreement" is hereby incorporated by reference into this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits | | |

| 10.1 | | Third Amendment to Fourth Amended and Restated Master Repurchase Agreement, dated August 29, 2024, among DHI Mortgage Company, Ltd., U.S. Bank National Association, as Administrative Agent, Sole Book Runner, Lead Arranger, and a Buyer, and all other Buyers. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document contained in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | D.R. Horton, Inc. |

Date: | September 3, 2024 | | By: | /S/ BILL W. WHEAT |

| | | | Bill W. Wheat |

| | | | Executive Vice President and |

| | | | Chief Financial Officer |

THIRD AMENDMENT TO

FOURTH AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT

THIS THIRD AMENDMENT TO FOURTH AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT (this “Amendment”), dated as of August 29, 2024 (the “Amendment Effective Date”), is by and between DHI Mortgage Company, Ltd., a Texas limited partnership (the “Seller”), the Buyers party to the Repurchase Agreement (defined below) (the “Buyers”), and U.S. Bank National Association, a national banking association, as administrative agent for the Buyers (the “Administrative Agent”).

RECITALS

A. The Seller, the Buyers, and the Administrative Agent are parties to a Fourth Amended and Restated Master Repurchase Agreement dated as of February 18, 2022 (as amended by that certain First Amendment to Fourth Amended and Restated Master Repurchase Agreement dated as of February 17, 2023, that certain Second Amendment to Fourth Amended and Restated Master Repurchase Agreement dated as of February 16, 2024, and as further amended, restated, or otherwise modified from time to time, the “Repurchase Agreement”).

B. The parties hereto desire to amend the Repurchase Agreement as provided herein.

AGREEMENT

In consideration of the premises herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

Section 1.Definitions. Capitalized terms used and not otherwise defined in this Amendment have the meanings specified in the Repurchase Agreement.

Section 2.Amendments. Effective as of the Amendment Effective Date, the Repurchase Agreement is hereby amended as follows:

2.1Definitions. Section 1.2 of the Repurchase Agreement is hereby amended by adding or amending and restating, as applicable, the following defined terms to read in their entireties as follows:

“Termination Date” means the earlier of (i) May 9, 2025, and (ii) the date when the Buyers’ Commitments are terminated pursuant to this Agreement, by order of any Governmental Authority or by operation of law.

Section 3.Conditions Precedent and Effectiveness. This Amendment shall become effective as of the Amendment Effective Date upon the occurrence of each of the following:

3.1The Administrative Agent shall have received (or be satisfied that it will receive by such deadline as the Administrative Agent shall specify) the following, all of which must be satisfactory in form and content to the Administrative Agent:

(a)this Amendment, duly executed by the Seller, the Required Buyers, and the Administrative Agent;

(b)a current UCC search report of a UCC filings search in the office of the Secretary of State of the State of Texas;

(c)a certificate of the General Partner’s corporate secretary or assistant secretary or other authorized officer dated as of the date hereof as to (i) the incumbency of the officers of the Seller executing this Amendment and all other Repurchase Documents executed or to be executed by or on behalf of the Seller, (ii) the authenticity of their signatures, and specimens of their signatures shall be included in such certificate or set forth on an exhibit attached to it (the Administrative Agent, the Buyers and the Custodian shall be entitled to rely on that certificate until the Seller has furnished a new certificate to the Administrative Agent), (iii)

resolutions of the General Partner’s board of directors, authorizing the execution, delivery and performance by the Seller of this Amendment and all other Repurchase Documents to be delivered by the Seller pursuant to this Amendment and (iv) copies of the Seller’s (1) limited partnership agreement, (2) certificate of limited partnership issued by the state of Texas, (3) articles of incorporation certified by the Secretary of State of the State of the General Partner, and (4) bylaws and all amendments, or certification that there have been no changes to such documents since a true and correct copy thereof was delivered to the Administrative Agent and that such documents are in full force and effect.

3.2Payment to the Administrative Agent or the Custodian, as applicable, of all fees and expenses (including the disbursements and reasonable fees of the Administrative Agent’s attorneys) of the Administrative Agent and the Buyers payable by Seller pursuant to Section 9 of the Repurchase Agreement accrued and billed for to the date of the Seller’s execution and delivery of this Agreement, and, in the case of expenses, invoiced at least two Business Days prior to the Amendment Effective Date.

Section 4.Miscellaneous.

4.1Ratifications. This Amendment shall modify and supersede all terms and provisions set forth in the Repurchase Documents that are inconsistent with this Amendment, and the terms and provisions of the Repurchase Documents are ratified and confirmed and shall continue in full force and effect.

4.2Seller Representations and Warranties. The Seller hereby represents and warrants that the representations and warranties set forth in Section 15 of the Repurchase Agreement are true and correct in all material respects with the same force and effect on and as of the date hereof as though made as of the date hereof.

4.3Survival. The representations and warranties made by the Seller in this Amendment shall survive the execution and delivery of this Amendment.

4.4Reference to Repurchase Agreement. Each of the Repurchase Documents, including the Repurchase Agreement and any and all other agreements, documents, or instruments now or hereafter executed and delivered pursuant to the terms hereof or pursuant to the terms of the Repurchase Agreement as amended hereby, is hereby amended so that any reference in such Repurchase Document to the Repurchase Agreement shall refer to the Repurchase Agreement as amended and modified hereby.

4.5Applicable Law. This Amendment shall be governed by and construed in accordance with the laws of the State of New York as applicable to the Repurchase Agreement.

4.6Successors and Assigns. This Amendment is binding upon and shall inure to the benefit of the Seller, the Buyers, the Administrative Agent, and their respective successors and assigns, except that the Seller may not assign or transfer any of its rights or obligations hereunder without the prior written consent of the Administrative Agent and, to the extent required by the Repurchase Agreement, the Buyers.

4.7Counterparts. This Amendment may be executed in one or more counterparts, each of which when so executed shall be deemed an original, but all of which when taken together shall constitute one and the same instrument.

4.8Headings. The headings, captions, and arrangements used in this Amendment are for convenience only and shall not affect the interpretation of this Amendment.

4.9ENTIRE AGREEMENT. THIS AMENDMENT AND THE OTHER REPURCHASE DOCUMENTS REPRESENT THE FINAL AGREEMENT BETWEEN THE PARTIES THERETO AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG THE PARTIES.

[Signature Pages Follow]

IN WITNESS WHEREOF the parties have caused this Amendment to be executed as of the date first set forth above.

DHI MORTGAGE COMPANY, LTD., as Seller and Servicer

By: DHI Mortgage Company GP, Inc.

Its General Partner

By: /s/ MARK C. WINTER

Name: Mark C. Winter

Title: Executive Vice President

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

U.S. BANK NATIONAL ASSOCIATION, as Administrative Agent and a Buyer

By: /s/ RODNEY S. DAVIS

Name: Rodney S. Davis

Title: Senior Vice President

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

EVERBANK, N.A. f/k/a TIAA, FSB, as a Buyer

By: /s/ ELIZABETH MOORE

Name: Elizabeth Moore

Title: Vice President

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

TRUIST BANK, f/k/a BRANCH BANKING & TRUST COMPANY, as a Buyer

By: /s/ SAMUEL W. BRYAN

Name: Samuel W. Bryan

Title: Senior Vice President

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

ASSOCIATED BANK, N.A., as a Buyer

By: /s/ VĂN T. PHAM

Name: Văn T. Pham

Title: Senior Vice President

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

MERCHANTS BANK OF INDIANA, as a Buyer

By: /s/ KELLY HORVATH

Name: Kelly Horvath

Title: Senior Vice President, Warehouse Lending

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

TEXAS CAPITAL BANK, as a Buyer

By: /s/ LAKEISHA BINNS-WILLIS

Name: Lakeisha Binns-Willis

Title: Vice President

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

THE HUNTINGTON NATIONAL BANK, as a Buyer

By: /s/ ROCHELLE THOMAS

Name: Rochelle Thomas

Title: Authorized Signer

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

VERITEX COMMUNITY BANK, as a Buyer

By: /s/ AMY SATSKY

Name: Amy Satsky

Title: Executive Vice President

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

HINSDALE BANK & TRUST COMPANY, N.A., as a Buyer

By: /s/ KEVIN MITZIT

Name: Kevin Mitzit

Title: Executive Vice President

Third Amendment to Fourth Amended and Restated Master Repurchase Agreement

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeniorNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

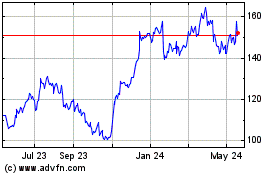

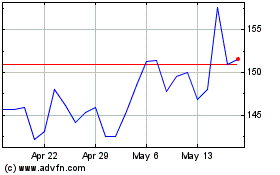

D R Horton (NYSE:DHI)

Historical Stock Chart

From Nov 2024 to Dec 2024

D R Horton (NYSE:DHI)

Historical Stock Chart

From Dec 2023 to Dec 2024