Ellington Credit Declares Monthly Common Dividend

December 06 2024 - 7:00AM

Business Wire

Ellington Credit Company (NYSE: EARN) (the "Company") today

announced that its Board of Trustees has declared a monthly common

dividend of $0.08 per share, payable on January 27, 2025 to

shareholders of record as of December 31, 2024.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are not

historical in nature and can be identified by words such as

"anticipate," "estimate," "will," "should," "may," "expect,"

"project," "believe," "intend," "seek," "plan" and similar

expressions or their negative forms, or by references to strategy,

plans, or intentions. Forward-looking statements are based on our

beliefs, assumptions and expectations of our future operations,

business strategies, performance, financial condition, liquidity

and prospects, taking into account information currently available

to us. These beliefs, assumptions, and expectations are subject to

numerous risks and uncertainties and can change as a result of many

possible events or factors, not all of which are known to us. If a

change occurs, our business, financial condition, liquidity,

results of operations and strategies may vary materially from those

expressed or implied in our forward-looking statements. The

following factors are examples of those that could cause actual

results to vary from those stated or implied by our forward-looking

statements: changes in interest rates and the market value of the

Company's investments, market volatility, changes in the default

rates on corporate loans, the Company's ability to borrow to

finance its assets, changes in government regulations affecting the

Company's business, the Company's ability to maintain its exclusion

from registration under the Investment Company Act of 1940, our

ability to pivot our investment strategy to focus on collateralized

loan obligations ("CLOs"), a deterioration in the CLO market, our

ability to utilize our net operating loss carryforwards, our

ability to convert to a closed end fund/RIC, including our ability

to obtain shareholder approval of our conversion to a closed end

fund/RIC, and other changes in market conditions and economic

trends, such as changes to fiscal or monetary policy, heightened

inflation, slower growth or recession, and currency fluctuations.

Furthermore, as stated above, forward-looking statements are

subject to numerous risks and uncertainties, including, among other

things, those described under Item 1A of the Company's Annual

Report on Form 10-K, which can be accessed through the link to the

Company's SEC filings under "For Investors" on the Company's

website (at www.ellingtoncredit.com) or at the SEC's website

(www.sec.gov). Other risks, uncertainties, and factors that could

cause actual results to differ materially from those projected or

implied may be described from time to time in reports the Company

files with the SEC, including reports on Forms 10-Q, 10-K and 8-K.

The Company undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

This release and the information contained herein do not

constitute an offer of any securities or solicitation of an offer

to purchase securities.

About Ellington Credit Company

Ellington Credit Company, formerly known as Ellington

Residential Mortgage REIT, was initially formed as a real estate

investment trust ("REIT") that invested primarily in residential

mortgage-backed securities ("MBS"). On March 29, 2024, the

Company’s Board of Trustees approved a strategic transformation of

its investment strategy to focus on corporate CLOs, with an

emphasis on mezzanine debt and equity tranches. In connection with

this transformation, the Company revoked its election to be taxed

as a REIT effective January 1, 2024, and rebranded to Ellington

Credit Company. The Company intends, subject to shareholder

approval of certain matters, to convert to a closed-end fund and

complete its transition from an MBS-focused company to a

CLO-focused company.

Ellington Credit Company is externally managed and advised by

Ellington Credit Company Management LLC, an affiliate of Ellington

Management Group, L.L.C.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205678932/en/

Investors: Ellington Credit Company Investor Relations (203)

409-3773 info@ellingtoncredit.com

or

Media: Amanda Shpiner/Grace Cartwright Gasthalter & Co. for

Ellington Credit Company (212) 257-4170

Ellington@gasthalter.com

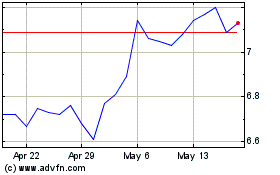

Ellington Credit (NYSE:EARN)

Historical Stock Chart

From Dec 2024 to Jan 2025

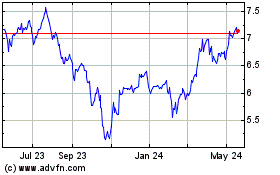

Ellington Credit (NYSE:EARN)

Historical Stock Chart

From Jan 2024 to Jan 2025