Ellington Credit Company Announces the Income Tax Treatment of its 2024 Distributions

January 31 2025 - 3:19PM

Business Wire

Ellington Credit Company (NYSE: EARN) (the "Company") today

announced that information regarding the federal income tax

treatment of the distributions deemed paid in 2024 on the Company's

common shares has been posted to the Company’s website, at

https://www.ellingtoncredit.com/dividend-and-tax-information. The

Company operated as a taxable C-Corp throughout all of 2024.

About Ellington Credit Company

Ellington Credit Company, formerly known as Ellington

Residential Mortgage REIT, was initially formed as a real estate

investment trust ("REIT") that invested primarily in residential

mortgage-backed securities ("MBS"). On March 29, 2024, the

Company’s Board of Trustees approved a strategic transformation of

its investment strategy to focus on corporate CLOs, with an

emphasis on mezzanine debt and equity tranches. In connection with

this transformation, the Company revoked its election to be taxed

as a REIT (and therefore to be taxed as a C-Corp) effective January

1, 2024, and rebranded to Ellington Credit Company. At a special

meeting of shareholders held on January 17, 2025, shareholders

approved the Company's conversion to a Delaware registered

closed-end fund to be treated as a regulated investment company

under the Internal Revenue Code (the “Conversion”). The Company

intends to complete the Conversion in early 2025.

Ellington Credit Company is externally managed and advised by

Ellington Credit Company Management LLC, an affiliate of Ellington

Management Group, L.L.C.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250131627658/en/

Investors:

Ellington Credit Company Investor Relations (203) 409-3773

info@earnreit.com

or

Media:

Amanda Shpiner/Grace Cartwright Gasthalter & Co. for

Ellington Credit Company (212) 257-4170

Ellington@gasthalter.com

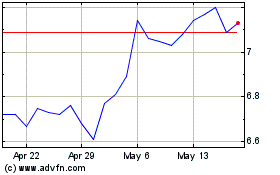

Ellington Credit (NYSE:EARN)

Historical Stock Chart

From Jan 2025 to Feb 2025

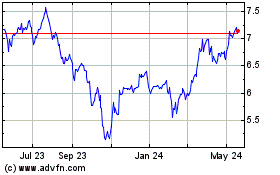

Ellington Credit (NYSE:EARN)

Historical Stock Chart

From Feb 2024 to Feb 2025