Record Quarterly Revenues of $3.70 billion,

15.3% Increase Year-over-Year

Record Quarterly Diluted EPS of

$5.80, 62.5% Increase Year-over-Year

Record Remaining Performance

Obligations of $9.79 billion, 13.4% Increase Year-over-Year

2024 Revenue Guidance of at least

$14.5 billion (previously $14.5 billion - $15.0 billion)

2024 Diluted EPS Guidance Range

Increased to $20.50 - $21.00 (previously $19.00 - $20.00)

EMCOR Group, Inc. (NYSE: EME) today reported results for the

quarter ended September 30, 2024.

Third Quarter 2024 Results of

Operations

For the third quarter of 2024, revenues totaled $3.70 billion,

up 15.3% from the third quarter of 2023. Net income for the third

quarter of 2024 was $270.3 million, or $5.80 per diluted share,

compared to net income of $169.4 million, or $3.57 per diluted

share, for the third quarter of 2023. Net income for the third

quarter of 2023 included a long-lived asset impairment charge of

$2.4 million, or $1.7 million net of tax. Excluding this impairment

charge, non-GAAP net income for the third quarter of 2023 was

$171.1 million, or $3.61 per diluted share.

Operating income for the third quarter of 2024 was $363.5

million, or 9.8% of revenues, compared to operating income of

$235.0 million, or 7.3% of revenues, for the third quarter of 2023.

Excluding the previously referenced impairment charge, non-GAAP

operating income for the third quarter of 2023 was $237.3 million,

or 7.4% of revenues. Operating income included depreciation and

amortization expense, inclusive of amortization of identifiable

intangible assets, of $34.5 million and $30.3 million for the third

quarter of 2024 and 2023, respectively.

Refer to the attached tables for a reconciliation of non-GAAP

operating income, non-GAAP operating margin, non-GAAP net income,

and non-GAAP diluted earnings per share to the comparable GAAP

measures.

Selling, general and administrative expenses for the third

quarter of 2024 totaled $371.2 million, or 10.0% of revenues,

compared to $308.1 million, or 9.6% of revenues, for the third

quarter of 2023.

The Company's income tax rate for the third quarter of 2024 was

27.4%, compared to 27.7% for the third quarter of 2023.

Remaining performance obligations (“RPO”) as of September 30,

2024 were a record $9.79 billion compared to $8.64 billion as of

September 30, 2023, an increase of $1.15 billion

year-over-year.

Tony Guzzi, Chairman, President, and Chief Executive Officer of

EMCOR, commented, “Our team continued to perform exceptionally well

and delivered another great quarter, maintaining our momentum and

again setting new records across key financial and operational

metrics. Record RPOs of $9.8 billion, along with a robust and

diverse pipeline of future opportunities, demonstrates the

continued demand for our services. Our record operating cash flow

and strong and liquid balance sheet enable us to compete and win on

sophisticated projects, and support our organic growth and balanced

capital allocation strategy.”

First Nine Months 2024 Results of

Operations

Revenues for the first nine months of 2024 totaled $10.80

billion, an increase of 18.1%, compared to $9.14 billion for the

first nine months of 2023. Net income for the first nine months of

2024 was $715.0 million, or $15.21 per diluted share, compared to

net income of $421.5 million, or $8.85 per diluted share, for the

first nine months of 2023. Excluding the impact of the previously

referenced impairment charge recorded in the third quarter of 2023,

non-GAAP net income for the first nine months of 2023 was $423.2

million, or $8.88 per diluted share.

Operating income for the first nine months of 2024 was $956.3

million, or 8.9% of revenues, compared to operating income of

$586.6 million, or 6.4% of revenues, for the first nine months of

2023. Excluding the previously referenced impairment charge,

non-GAAP operating income for the first nine months of 2023 was

$588.9 million. Operating income included depreciation and

amortization expense, inclusive of amortization of identifiable

intangible assets, of $98.4 million and $87.8 million for the first

nine months of 2024 and 2023, respectively.

Refer to the attached tables for a reconciliation of non-GAAP

operating income, non-GAAP operating margin, non-GAAP net income,

and non-GAAP diluted earnings per share to the comparable GAAP

measures.

Selling, general and administrative expenses totaled $1.05

billion, or 9.7% of revenues, for the first nine months of 2024,

compared to $882.7 million, or 9.7% of revenues, for the first nine

months of 2023.

Mr. Guzzi continued, “Our Electrical and Mechanical

Construction segments continued their very strong performance,

with combined third quarter revenue growth of nearly 24% and a

combined operating margin of 13.3%. With quarterly and year-to-date

revenue growth of 25% and 32%, respectively, our Mechanical

Construction segment again generated record revenues, and

achieved record operating margins of 12.9% in the quarter and 12.2%

year-to-date. Our Electrical Construction segment also

posted record revenues, with growth of 21% on a quarterly basis and

19% for the year-to-date period, and achieved record operating

margins of 14.1% in the quarter and 12.4% year-to-date. Our

impressive execution and performance were driven by excellent field

leadership and a commitment to continuous innovation, coupled with

a favorable mix of work including data centers and semi-conductor

plants, other high-tech and traditional manufacturing projects, and

growing demand within the institutional, healthcare, and water and

wastewater sectors. Our U.S. Building Services

segment performed as expected, with our mechanical services

business benefiting from strong performance across its portfolio of

work, including HVAC retrofits, repair service, building controls

upgrades, and service maintenance agreements. This segment

continues to experience quality aftermarket opportunities across

most sectors. Our Industrial Services segment continues to

experience a gradual resumption of demand, performing well in both

the field and our shops as we execute against a more typical fall

turnaround season. Our U.K. Building Services segment also

continues to perform well in a difficult market, winning new work

and poised to secure additional opportunities with customers that

demand a strong technical solution for their facilities.”

Full Year 2024 Guidance

Based on year-to-date 2024 performance, current operating

conditions, and near-term visibility, the Company is:

- Adjusting its full-year 2024 revenue guidance to at least $14.5

billion, from the prior guidance range of $14.5 billion - $15.0

billion.

- Increasing its full-year 2024 diluted earnings per share

guidance range to $20.50 - $21.00, from the prior guidance range of

$19.00 - $20.00.

Mr. Guzzi concluded, “Given our momentum and execution to date,

in addition to our record RPOs and strong and diverse project

pipeline, we are again raising our 2024 diluted earnings per share

guidance. We remain confident in our strategic positioning within

growth-oriented sectors and geographies and believe our dedication

to operational excellence and prudent capital allocation will

deliver continued value for our customers and shareholders."

Third Quarter Earnings Conference Call

Information

EMCOR Group's third quarter conference call will be broadcast

live via internet today, Thursday, October 31, at 10:30 AM Eastern

Daylight Time and can be accessed through the Company's website at

www.emcorgroup.com.

About EMCOR

EMCOR Group, Inc. is a Fortune 500 leader in mechanical and

electrical construction services, industrial and energy

infrastructure and building services. This press release and other

press releases may be viewed at the Company’s website at

www.emcorgroup.com. EMCOR routinely posts information that may be

important to investors in the “Investor Relations” section of our

website at www.emcorgroup.com. Investors and potential investors

are encouraged to consult the EMCOR website regularly for important

information about EMCOR.

Forward Looking Statements:

This release and related presentation contain forward-looking

statements. Such statements speak only as of October 31, 2024, and

EMCOR assumes no obligation to update any such forward-looking

statements, unless required by law. These forward-looking

statements include statements regarding anticipated future

operating and financial performance, including financial guidance

and projections underlying that guidance; the nature and impact of

our remaining performance obligations and timing of future

projects; our ability to support organic growth and balanced

capital allocation; market opportunities; market growth prospects;

customer trends; and project mix. These forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from those anticipated (whether expressly or

implied) by the forward-looking statements. Accordingly, these

statements do not guarantee future performance or events.

Applicable risks and uncertainties include, but are not limited to,

adverse effects of general economic conditions; domestic and

international political developments; changes in the specific

markets for EMCOR’s services; adverse business conditions,

including labor market tightness and/or disruption, productivity

challenges, the impact of claims and litigation, the nature and

extent of supply chain disruptions impacting availability and

pricing of materials, global conflicts, and inflationary trends

more generally, including fluctuations in energy costs; the impact

of legislation and/or government regulations; changes in interest

rates; the availability of adequate levels of surety bonding;

increased competition; and unfavorable developments in the mix of

our business. Certain of the risk factors associated with EMCOR’s

business are also discussed in Part I, Item 1A “Risk Factors,” of

the Company’s 2023 Form 10-K, and in other reports filed from time

to time with the Securities and Exchange Commission and available

at www.sec.gov and www.emcorgroup.com. Such risk factors should be

taken into account in evaluating our business, including any

forward-looking statements.

Non-GAAP Measures:

This release and related presentation also include certain

financial measures that were not prepared in accordance with U.S.

generally accepted accounting principles (GAAP). Reconciliations of

those non-GAAP financial measures to the most directly comparable

GAAP financial measures are included in this release. The Company

uses these non-GAAP measures as key performance indicators for the

purpose of evaluating performance internally. We also believe that

these non-GAAP measures provide investors with useful information

with respect to our ongoing operations. Any non-GAAP financial

measures presented are not, and should not be viewed as,

substitutes for financial measures required by GAAP, have no

standardized meaning prescribed by GAAP, and may not be comparable

to the calculation of similar measures of other companies.

EMCOR GROUP, INC. FINANCIAL

HIGHLIGHTS

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share and

per share information)

(Unaudited)

For the quarters ended

September 30,

For the nine months ended

September 30,

2024

2023

2024

2023

Revenues

$

3,696,924

$

3,207,598

$

10,796,097

$

9,143,652

Cost of sales

2,962,198

2,662,126

8,788,061

7,672,058

Gross profit

734,726

545,472

2,008,036

1,471,594

Selling, general and administrative

expenses

371,188

308,139

1,051,737

882,684

Impairment loss on long-lived assets

—

2,350

—

2,350

Operating income

363,538

234,983

956,299

586,560

Net periodic pension income (cost)

227

(284)

670

(840)

Interest income (expense), net

8,312

(90)

21,959

(4,614)

Income before income taxes

372,077

234,609

978,928

581,106

Income tax provision

101,814

64,863

263,944

159,292

Net income including noncontrolling

interests

270,263

169,746

714,984

421,814

Net income attributable to noncontrolling

interests

—

337

—

337

Net income attributable to EMCOR Group,

Inc.

$

270,263

$

169,409

$

714,984

$

421,477

Basic earnings per common share

$

5.83

$

3.59

$

15.27

$

8.88

Diluted earnings per common share

$

5.80

$

3.57

$

15.21

$

8.85

Weighted average shares of common stock

outstanding:

Basic

46,394,857

47,173,974

46,829,458

47,446,298

Diluted

46,588,760

47,398,197

47,016,072

47,642,763

Dividends declared per common share

$

0.25

$

0.18

$

0.68

$

0.51

EMCOR GROUP, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited) September

30, 2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,035,534

$

789,750

Accounts receivable, net

3,509,202

3,203,490

Contract assets

296,523

269,885

Inventories

94,475

110,774

Prepaid expenses and other

70,681

73,072

Total current assets

5,006,415

4,446,971

Property, plant, and equipment, net

204,547

179,378

Operating lease right-of-use assets

322,912

310,498

Goodwill

1,002,218

956,549

Identifiable intangible assets, net

648,123

586,032

Other assets

137,737

130,293

Total assets

$

7,321,952

$

6,609,721

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

897,059

$

935,967

Contract liabilities

1,881,444

1,595,109

Accrued payroll and benefits

753,680

596,936

Other accrued expenses and liabilities

312,799

315,107

Operating lease liabilities, current

80,245

75,236

Total current liabilities

3,925,227

3,518,355

Operating lease liabilities, long-term

269,517

259,430

Other long-term obligations

368,089

361,121

Total liabilities

4,562,833

4,138,906

Equity:

Total EMCOR Group, Inc. stockholders’

equity

2,758,082

2,469,778

Noncontrolling interests

1,037

1,037

Total equity

2,759,119

2,470,815

Total liabilities and equity

$

7,321,952

$

6,609,721

EMCOR GROUP, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

For the Nine Months Ended

September 30, 2024 and 2023

(In thousands) (Unaudited)

2024

2023

Cash flows - operating activities:

Net income including noncontrolling

interests

$

714,984

$

421,814

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

41,799

38,444

Amortization of identifiable intangible

assets

56,559

49,335

Provision for credit losses

12,585

5,256

Non-cash expense for impairment of

long-lived assets

—

2,350

Non-cash share-based compensation

expense

16,170

10,703

Other reconciling items

(7,893)

(9,121)

Changes in operating assets and

liabilities, excluding the effect of businesses acquired

104,198

(42,884)

Net cash provided by operating

activities

938,402

475,897

Cash flows - investing activities:

Payments for acquisitions of businesses,

net of cash acquired

(189,208)

(89,741)

Proceeds from sale or disposal of

property, plant, and equipment

2,765

12,015

Purchases of property, plant, and

equipment

(57,244)

(56,306)

Net cash used in investing

activities

(243,687)

(134,032)

Cash flows - financing activities:

Proceeds from revolving credit

facility

—

100,000

Repayments of revolving credit

facility

—

(100,000)

Repayments of long-term debt

—

(142,813)

Repayments of finance lease

liabilities

(2,144)

(2,138)

Dividends paid to stockholders

(31,884)

(24,198)

Repurchases of common stock

(405,425)

(105,299)

Taxes paid related to net share

settlements of equity awards

(12,095)

(5,365)

Issuances of common stock under employee

stock purchase plan

943

6,769

Payments for contingent consideration

arrangements

(4,427)

(3,113)

Net cash used in financing

activities

(455,032)

(276,157)

Effect of exchange rate changes on

cash, cash equivalents, and restricted cash

7,377

856

Increase in cash, cash equivalents, and

restricted cash

247,060

66,564

Cash, cash equivalents, and restricted

cash at beginning of year (1)

789,750

457,068

Cash, cash equivalents, and restricted

cash at end of period (2)

$

1,036,810

$

523,632

_____________

(1) Includes $0.6 million of restricted cash classified as

“Prepaid expenses and other” in the Consolidated Balance Sheet as

of December 31, 2022. (2) Includes $1.3 million of restricted cash

classified as “Prepaid expenses and other” in the Consolidated

Balance Sheet as of September 30, 2024.

EMCOR GROUP, INC.

SEGMENT INFORMATION

(In thousands, except for

percentages) (Unaudited)

For the quarters ended

September 30,

2024

% of Total

2023

% of Total

Revenues from unrelated

entities:

United States electrical construction and

facilities services

$

845,030

23 %

$

697,406

22 %

United States mechanical construction and

facilities services

1,662,211

45 %

1,329,600

41 %

United States building services

796,923

21 %

817,718

26 %

United States industrial services

286,410

8 %

252,148

8 %

Total United States operations

3,590,574

97 %

3,096,872

97 %

United Kingdom building services

106,350

3 %

110,726

3 %

Total operations

$

3,696,924

100 %

$

3,207,598

100 %

For the nine months ended

September 30,

2024

% of Total

2023

% of Total

Revenues from unrelated

entities:

United States electrical construction and

facilities services

$

2,409,735

22 %

$

2,020,319

22 %

United States mechanical construction and

facilities services

4,745,057

44 %

3,602,271

39 %

United States building services

2,359,191

22 %

2,318,105

25 %

United States industrial services

964,510

9 %

875,314

10 %

Total United States operations

10,478,493

97 %

8,816,009

96 %

United Kingdom building services

317,604

3 %

327,643

4 %

Total operations

$

10,796,097

100 %

$

9,143,652

100 %

EMCOR GROUP, INC.

SEGMENT INFORMATION

(In thousands, except for

percentages) (Unaudited)

For the quarters ended

September 30,

2024

% of Segment Revenues

2023

% of Segment Revenues

Operating income (loss):

United States electrical construction and

facilities services

$

119,118

14.1 %

$

63,127

9.1 %

United States mechanical construction and

facilities services

214,831

12.9 %

138,476

10.4 %

United States building services

55,562

7.0 %

57,156

7.0 %

United States industrial services

3,292

1.1 %

(174)

(0.1) %

Total United States operations

392,803

10.9 %

258,585

8.3 %

United Kingdom building services

5,497

5.2 %

8,869

8.0 %

Corporate administration

(34,762)

—

(30,121)

—

Impairment loss on long-lived assets

—

—

(2,350)

—

Total operations

363,538

9.8 %

234,983

7.3 %

Other items:

Net periodic pension income (cost)

227

(284)

Interest income (expense), net

8,312

(90)

Income before income taxes

$

372,077

$

234,609

For the nine months ended

September 30,

2024

% of Segment Revenues

2023

% of Segment Revenues

Operating income (loss):

United States electrical construction and

facilities services

$

299,284

12.4 %

$

154,365

7.6 %

United States mechanical construction and

facilities services

578,991

12.2 %

344,550

9.6 %

United States building services

135,860

5.8 %

140,943

6.1 %

United States industrial services

34,004

3.5 %

22,733

2.6 %

Total United States operations

1,048,139

10.0 %

662,591

7.5 %

United Kingdom building services

16,651

5.2 %

20,220

6.2 %

Corporate administration

(108,491)

—

(93,901)

—

Impairment loss on long-lived assets

—

—

(2,350)

—

Total operations

956,299

8.9 %

586,560

6.4 %

Other items:

Net periodic pension income (cost)

670

(840)

Interest income (expense), net

21,959

(4,614)

Income before income taxes

$

978,928

$

581,106

EMCOR GROUP, INC. RECONCILIATION OF

ORGANIC REVENUE GROWTH (In thousands, except for percentages)

(Unaudited)

The following table provides a reconciliation between organic

revenue growth, a non-GAAP measure, and total revenue growth for

the quarter and nine months ended September 30, 2024.

For the quarter ended

September 30, 2024

For the nine months ended

September 30, 2024

$

%

$

%

GAAP revenue growth

$

489,326

15.3 %

$

1,652,445

18.1 %

Incremental revenues from acquisitions

(84,935)

(2.7) %

(173,738)

(1.9) %

Organic revenue growth, a non-GAAP

measure

$

404,391

12.6 %

$

1,478,707

16.2 %

EMCOR GROUP, INC. RECONCILIATION OF

2024 AND 2023 NON-GAAP MEASURES (In thousands, except for

percentages and per share data) (Unaudited)

In our press release, we provide non-GAAP operating income,

non-GAAP operating margin, non-GAAP net income, and non-GAAP

diluted earnings per common share for the quarter and nine months

ended September 30, 2023. The following tables provide a

reconciliation between these amounts determined on a non-GAAP basis

and the most directly comparable GAAP measures.

For the quarter ended

September 30,

For the nine months ended

September 30,

2024

2023

2024

2023

GAAP operating income

$

363,538

$

234,983

$

956,299

$

586,560

Impairment loss on long-lived assets

—

2,350

—

2,350

Non-GAAP operating income

$

363,538

$

237,333

$

956,299

$

588,910

For the quarter ended

September 30,

For the nine months ended

September 30,

2024

2023

2024

2023

GAAP operating margin

9.8 %

7.3 %

8.9 %

6.4 %

Impairment loss on long-lived assets

— %

0.1 %

— %

0.0 %

Non-GAAP operating margin

9.8 %

7.4 %

8.9 %

6.4 %

For the quarter ended

September 30,

For the nine months ended

September 30,

2024

2023

2024

2023

GAAP net income

$

270,263

$

169,409

$

714,984

$

421,477

Impairment loss on long-lived assets

—

2,350

—

2,350

Tax effect of impairment loss on

long-lived assets

—

(651)

—

(651)

Non-GAAP net income

$

270,263

$

171,108

$

714,984

$

423,176

For the quarter ended

September 30,

For the nine months ended

September 30,

2024

2023

2024

2023

GAAP diluted earnings per common share

$

5.80

$

3.57

$

15.21

$

8.85

Impairment loss on long-lived assets

—

0.05

—

0.05

Tax effect of impairment loss on

long-lived assets

—

(0.01)

—

(0.01)

Non-GAAP diluted earnings per common

share

$

5.80

$

3.61

$

15.21

$

8.88

_________

Amounts presented in this table may not

foot due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031893772/en/

EMCOR GROUP, INC.

Andrew G. Backman Vice President Investor Relations (203)

849-7938

FTI Consulting, Inc. Investors: Blake Mueller (718) 578-3706

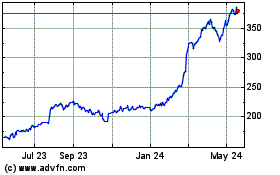

EMCOR (NYSE:EME)

Historical Stock Chart

From Jan 2025 to Feb 2025

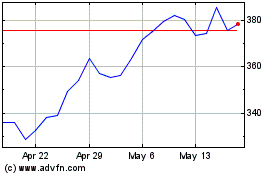

EMCOR (NYSE:EME)

Historical Stock Chart

From Feb 2024 to Feb 2025