ENERPLUS CLOSES SALE OF KIRBY AND OTHER NON-CORE ASSETS

October 01 2010 - 5:03PM

PR Newswire (Canada)

CALGARY, Oct. 1 /CNW/ -- CALGARY, Oct. 1 /CNW/ - Enerplus Resources

Fund ("Enerplus") has closed the previously announced sale of our

100% working interest in the Kirby oil sands lease for proceeds of

$405 million. TD Securities Inc. acted as exclusive advisor to

Enerplus on this transaction. Enerplus has also closed the

previously announced sale of 2,500 BOE/day of non-core production

and 9.3 million BOE of proved plus probable reserves for proceeds

of $158.5 million ($153 million after closing adjustments). This

production was comprised of 54% crude oil and natural gas liquids

and 46% natural gas located primarily in British Columbia and

Alberta from approximately 70 properties. RBC Rundle acted as

exclusive advisor to Enerplus on this divestment package. The

proceeds of these sales will be used to reduce outstanding bank

debt resulting from our previously announced Bakken/tight oil and

Marcellus property acquisitions. Electronic copies of our financial

statements, press releases, and other public information are

available on our website at www.enerplus.com. INFORMATION REGARDING

DISCLOSURE IN THIS NEWS RELEASE All amounts in this news release

are stated in Canadian dollars unless otherwise specified. Where

applicable, natural gas has been converted to barrels of oil

equivalent ("BOE") based on 6 Mcf:1 BOE. The BOE rate is based on

an energy equivalent conversion method primarily applicable at the

burner tip and does not represent a value equivalent at the

wellhead. Use of BOE in isolation may be misleading. In accordance

with Canadian practice, production volumes and revenues are

reported on a gross basis, before deduction of Crown and other

royalties, unless otherwise stated. Unless otherwise specified, all

reserves volumes in this news release (and all information derived

therefrom) are based on "company interest reserves" using forecast

prices and costs. "Company interest reserves" consist of "gross

reserves" (as defined in National Instrument 51-101 adopted by the

Canadian securities regulators ("NI 51-101")) plus Enerplus'

royalty interests in reserves. "Company interest reserves" are not

a measure defined in NI 51-101 and do not have a standardized

meaning under NI 51-101. Accordingly, our company interest reserves

may not be comparable to reserves presented or disclosed by other

issuers. NOTICE TO U.S. READERS The oil and natural gas reserves

information contained in this news release has generally been

prepared in accordance with Canadian disclosure standards, which

are not comparable in all respects to United States or other

foreign disclosure standards. Reserves categories such as "proved

reserves" and "probable reserves" may be defined differently under

Canadian requirements than the definitions contained in the United

States Securities and Exchange Commission rules. In addition, under

Canadian disclosure requirements and industry practice, reserves

and production are reported using gross (or, as noted above,

"company interest") volumes, which are volumes prior to deduction

of royalty and similar payments. The practice in the United States

is to report reserves and production using net volumes, after

deduction of applicable royalties and similar payments. Gordon J.

Kerr President & Chief Executive Officer Enerplus Resources

Fund %CIK: 0001126874 please contact our Investor Relations

department at 1-800-319-6462 or email

investorrelations@enerplus.com

Copyright

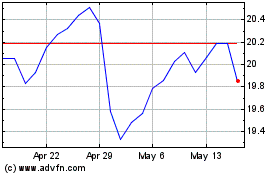

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

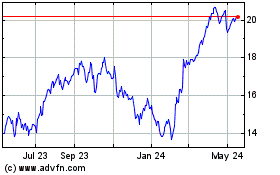

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024