CALGARY, Aug. 5, 2011 /CNW/ -- All financial figures are unaudited

and in Canadian dollars (CDN$) unless noted otherwise. All

financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") including

comparative figures pertaining to Enerplus' 2010 results. A

reconciliation of comparative figures is provided in the notes to

the Unaudited Interim Consolidated Financial Statements for the

period ended June 30, 2011. This news release includes

forward-looking statements and information within the meaning of

applicable securities laws. Readers are advised to review

"Forward-Looking Information and Statements" at the conclusion of

this news release. Readers are also referred to "Information

Regarding Reserves, Resources and Operations", "Notice to U.S.

Readers" and "Non-GAAP Measures" at the end of this news release

for information regarding the presentation of the financial,

reserves, contingent resources and operational information in this

news release. A full copy of our 2011 Second Quarter Financial

Statements and MD&A have been filed on our website at

www.enerplus.com, under our profile on SEDAR at www.sedar.com and

on the EDGAR website at www.sec.gov. CALGARY, Aug. 5, 2011 /CNW/ -

Enerplus Corporation ("Enerplus") (TSX: ERF) (NYSE: ERF) is pleased

to announce operating and financial results for the three months

ended June 30, 2011. Highlights for the quarter include:

Acquisitions and Divestments -- We sold approximately 45% of our

Marcellus acreage position in Pennsylvania, Maryland and West

Virginia, including 24.5 Bcfe of proved plus probable reserves for

approximately $568 million, capturing a pre-tax gain of $272

million. Proceeds from the sale were used to reduce our outstanding

bank debt, leaving our $1 billion credit facility virtually undrawn

at the end of the quarter. -- Subsequent to the sale, we have

retained a significant land position in the Marcellus that is more

balanced consisting of 110,000 net acres, 60% of which is operated.

Our non-operated Marcellus position includes approximately 45,000

net acres concentrated in the prolific Northeast area of

Pennsylvania whereas our 65,000 net operated acres are located in

West Virginia and Maryland. The independent best estimate of

contingent resources associated with our remaining leases is 2.3

Tcfe and 92 Bcfe of proved plus probable natural gas reserves as of

December 31, 2010. -- We continued to add to our undeveloped land

inventory in emerging resource plays in Canada this year.

Year-to-date we have acquired approximately 38,000 net acres in the

liquids-rich Duvernay shale play and 14,000 net acres in two

emerging Canadian oil prospects. We also added over 9,000 net acres

of Montney prospective lands in the Cameron area of British

Columbia, bringing our total Montney undeveloped land position to

approximately 28,000 net acres. In total, we've invested

approximately $75 million in unvdeveloped land to the end of July

2011. Production -- Daily production averaged 75,383 BOE/day

despite challenges relating to wet weather in our key producing

regions and was virtually unchanged compared to the first quarter

of 2011. -- Field conditions have begun to improve in July and we

are ramping up activities with four operated rigs now running in

North Dakota at Fort Berthold and are building to four operated

rigs in Canada focused mainly on our waterflood properties. We

expect to bring on over 60 net wells during the second half of the

year as drilling activity increases. Production volumes are

expected to build throughout the remainder of the year, with the

most significant increases anticipated late in the third quarter

and into the fourth quarter. Financial -- We generated funds flow

of $132.4 million ($0.74/share) during the quarter. Our funds flow

does not reflect the gain of $272 million from the Marcellus asset

sale; however it does reflect a $43 million U.S. tax expense

resulting from the sale of those assets. Funds flow was $0.98 per

share if adjusted for the impact of the tax expense. See "Non-GAAP

Measures" below. -- We invested approximately $145 million in our

assets during the quarter, drilling 14.1 net wells. Approximately

60% of our capital was directed toward oil projects, primarily in

the Bakken and 33% invested in the Marcellus. -- We maintained our

monthly dividend at $0.18/share through the quarter. -- We exited

the quarter in a very strong financial position with a debt to

funds flow ratio of only 0.7x. -- Operating costs of $9.84/BOE and

G&A costs of $3.64/BOE during the quarter were marginally

higher than anticipated mainly due to lower production. -- Our

hedging program generated cash losses of approximately $21 million

($3.03/BOE) during the quarter as crude oil prices were above our

hedge positions. We currently have over 60% of our anticipated

crude oil production for the second half of 2011 hedged at $87.27

per barrel and have over 30% of our forecast 2012 crude oil

production hedged at over $98.00 per barrel. We do not have any

natural gas price hedges in place. Updated Guidance -- We have

adjusted our capital spending guidance for 2011 from $650 million

to $770 million due to an increase in drilling activity in both our

operated and non-operated acreage and as a result of cost

increases. We expect to drill more wells in the Marcellus where

activity is focused on the highly economic northeast area of

Pennsylvania, in the liquids rich Deep Basin region and also in our

oil properties in Canada. Approximately 85% of our total spending

remains focused in our Bakken, Marcellus and waterflood assets. --

Approximately $60 million of the increase in capital spending for

2011 is attributed to transitory cost increases due to the wet

weather, some cost overruns on a few of our delineation projects,

as well as inflationary cost increases for some services in Canada.

-- Delays in production and capital spending due to the weather

during the quarter reduced our expectations for annual average

production by 800 BOE/day. We also sold 900 BOE/day of annual

average production and 3,800 BOE/day of exit 2011 production due to

the Marcellus sale. As a result, we are adjusting our 2011 annual

average production guidance down by 2,000 BOE/day to 76,000 to

78,000 BOE/day. -- Due to the additional capital spending plans in

the second half of the year, we are adjusting our exit production

guidance up slightly to 81,000 - 84,000 BOE/day. -- With regard to

2012, we are evaluating opportunities within our portfolio and the

potential to increase spending and production volumes beyond our

original guidance issued earlier this year. We expect to provide

greater clarity on our 2012 plans in the fourth quarter. SELECTED

FINANCIAL RESULTS Three months ended June Six months ended June 30,

30, 2011 2010((1)) 2011 2010((1)) Financial (000's) Funds Flow(

(2)) $132,441 $174,753 $293,665 $373,035 Dividends to 97,077 95,909

193,763 191,621 Shareholders Net Income/(Loss) 267,982 76,502

297,531 (107,520) Debt Outstanding 460,087 697,817 460,087 697,817

- net of cash Capital Spending 145,165 88,395 319,609 182,556

Property and Land 94,415 310,114 142,633 349,747 Acquisitions

Divestments 571,096 181,238 630,788 182,776 Financial per Weighted

Average Shares Outstanding Funds Flow( (2)) $0.74 $0.99 $1.64 $2.13

Dividends 0.54 0.55 1.08 1.09 Net Income/(Loss) 1.50 0.44 1.66

(0.61) Weighted Average Number of Shares Outstanding 179,583

175,705 179,209 175,099 Debt to Trailing 12 Month Funds Flow 0.7x

0.9x((5)) 0.7x 0.9x((5)) Selected Financial Results per BOE( (3))

Oil & Gas Sales((4) ()) $51.62 $41.18 $49.28 $44.39 Royalties

(9.07) (7.35) (8.85) (7.96) Commodity (3.03) 2.23 (1.30) 1.38

Derivative Instruments Operating Costs (9.86) (10.09) (9.37)

(10.03) General and (3.16) (2.18) (3.21) (2.46) Administrative

Interest and (0.89) (1.12) (1.82) (0.99) Other Expenses Taxes

(6.30) (0.05) (3.22) (0.03) Funds Flow((2)) $19.31 $22.62 $21.51

$24.30 SELECTED OPERATING RESULTS Three months ended June Six

months ended June 30, 30, 2011 2010 2011 2010 Average Daily

Production Natural gas 255,665 296,566 253,584 297,737 (Mcf/day)

Crude oil 29,330 31,559 29,831 31,268 (bbls/day) NGLs (bbls/day)

3,442 3,922 3,337 3,924 Total (BOE/day) 75,383 84,909 75,433 84,815

% Natural gas 57% 58% 56% 59% Average Selling Price((4)) Natural

gas (per $3.86 $3.78 $3.88 $4.44 Mcf) Crude oil (per 90.92 68.72

84.23 71.25 bbl) NGLs (per bbl) 66.20 47.55 63.35 52.49 US$/CDN$

exchange 1.03 0.97 1.02 0.97 rate Net Wells drilled 14.1 19 40.2

158 ((1) ) (2010 comparative amounts have been restated and are

presented in accordance with International Financial Reporting

Standards ("IFRS"). In addition, 2010 comparatives represent the

results of Enerplus Resources Fund which converted into Enerplus

Corporation on January 1, 2011.) ((2))( ) (See "Non-GAAP Measures"

in the Management's Discussion and Analysis of Enerplus Corporation

dated August 4, 2011.) ((3)) (Non-cash amounts have been excluded.)

((4) ) (Net of oil and gas transportation costs, but before the

effects of commodity derivative instruments.) ((5))( ) (The 12

months trailing funds flow for June 30, 2010, includes funds flow

for July through December 2009 which was prepared following

previous Canadian GAAP.) Share Trading Summary CDN* - ERF U.S.** -

ERF For the three months ended June 30, (CDN$) (US$) 2011 High

$31.54 $32.86 Low $28.82 $29.61 Close $30.45 $31.60 * TSX and other

Canadian trading data combined. **NYSE and other U.S. trading data

combined. 2011 Cash Dividends Per Share Payment Month CDN$ US$*

First Quarter Total $0.54 $0.55 April $0.18 $0.19 May 0.18 0.18

June 0.18 0.18 Second Quarter Total $0.54 $0.55 Total Year-to-Date

$1.08 $1.10 (*US$ dividends represent CDN$ dividends converted at

the relevant foreign exchange rate on the payment date.) PRODUCTION

AND CAPITAL SPENDING Three months ended Six months ended June 30,

2011 June 30, 2011 Average Capital Average Capital Production

Spending Production Spending Play Type Volumes ($ millions) Volumes

($ millions) Bakken/Tight Oil 12,724 67 13,197 135 (BOE/day) Crude

Oil 13,314 19 13,379 48 Waterfloods (BOE/day) Conventional Oil

6,075 1 6,269 4 (BOE/day) Total Oil (BOE/day) 32,114 87 32,845 187

Marcellus Shale Gas 21,867 47 21,571 89 (Mcfe/day) Other Natural

Gas 237,746 11 233,959 44 (Mcfe/day) Total Gas 259,613 58 255,530

133 (Mcfe/day) Company Total 75,383 145 75,433 320 NET DRILLING

ACTIVITY for the three months ended June 30, 2011 Wells Pending

Wells Dry & Horizontal Vertical Total Completion/ On- Abandoned

Play Type Wells Wells Wells Tie-in* stream Wells Bakken/Tight 7.6 -

7.6 4.6 3.0 - Oil Crude Oil - - - - - - Waterfloods Conventional

1.5 0.1 1.6 1.6 - - Oil Total Oil 9.1 0.1 9.2 6.2 3.0 - Marcellus

4.7 - 4.7 4.7 - - Shale Gas Other 0.2 - 0.2 0.2 - - Natural Gas

Total Gas 4.9 - 4.9 4.9 - - Company 14.0 0.1 14.1 11.1 3.0 - Total

(*Pending potential completion/tie-in or abandonment and on-stream

wells measured as at June 30, 2011) Bakken/Tight Oil As a result of

the unusually wet weather conditions in the Williston Basin, we

experienced a second consecutive quarter of lower than anticipated

activity in our Bakken/tight oil resource play. We managed to keep

two rigs working in Fort Berthold, North Dakota and two rigs

working in Sleeping Giant, Montana throughout the quarter where we

drilled 6 net operated horizontal wells and brought 2.8 net wells

on-stream during the quarter. We also participated in the

drilling of 1.6 net wells at Taylorton, Saskatchewan. Production

volumes for the quarter averaged approximately 12,700 BOE/day, down

900 BOE/day from the first quarter due to weather and timing

delays. At Fort Berthold, we drilled one long and three short

Bakken horizontal wells during the quarter and completed and

brought on a short Three Forks well. We began drilling a long

Three Forks lateral well during the quarter and anticipate testing

the well during the third quarter. We currently have four rigs

working at Fort Berthold and expect to maintain this rig count

through the remainder of 2011. Infrastructure and gathering system

build continues to proceed and we expect to have a majority of our

wells tied in by the end of the third quarter, reducing our

reliance on trucking. Production volumes are also expected to

increase by approximately 10% due to the associated natural gas

volumes which will be captured once the wells are tied into the

gathering system. We expect to drill 26 horizontal wells at Fort

Berthold during the remainder of the year, targeting both the

Bakken and the Three Forks formations and plan to complete and

tie-in 22 wells. We have permits in place for all of our 2011

wells and are currently working to secure 2012 and 2013 drilling

permits. Our 2011 plans include testing downspacing to determine

optimal well density and as a result, we expect approximately 75%

of the wells drilled this year will be short lateral horizontals.

Under the full development scenario, approximately 75% of the wells

are expected to be long horizontals. With four rigs working and our

frac services agreement in place, drilling and completions activity

should accelerate and we expect to remain on schedule for the

balance of the year, drilling and completing three to four wells

per month. We continue to expect to spend approximately $250

million in North Dakota and Montana in 2011. Waterfloods Activity

during the second quarter was mainly focused on our two enhanced

oil recovery projects at Giltedge and Medicine Hat. Our polymer

pilot at Giltedge is now fully operational and we are seeing

indications that the polymer is moving through the project area.

Assessment of oil production performance is expected by year end.

At Medicine Hat, we continued to work on facility build-out to

support our polymer project and plan to be injecting polymer early

in 2012. Despite nominal tie-ins during the quarter, production

volumes were unchanged from the first quarter at 13,300 BOE/day,

emphasizing the benefits of these low decline properties. Marcellus

High activity levels in the Marcellus continued through the second

quarter of 2011 as our partners drilled wells to retain and develop

leases. On our non-operated land, we participated in drilling

59 gross wells (approximately 5.3 net) with the majority of this

activity in northeastern Pennsylvania where production rates and

expected ultimate recoveries have been generally above our type

curve. Although none of the wells drilled during the quarter were

completed or tied-in due to wet weather, 1.2 net wells previously

drilled were brought on stream during the quarter. There are

currently 169 gross wells (12.5 net wells) drilled by our partners

that are waiting on completion and/or tie-in. Production volumes

during the quarter averaged 21.9 MMcfe/day, slightly above our

first quarter average of 21.3 MMcfe/day. Current production is

approximately 12 MMcf/day. UPDATING 2011 GUIDANCE

_____________________________________________________________________

|2011 Estimates | |

|_____________________________________________________|_______________|

|Capital Expenditures ($millions) | |

|_____________________________________________________|_______________|

| Original Capital Expenditure Estimate | $650|

|_____________________________________________________|_______________|

| Capital Reduction Due to Marcellus Disposition | ($50)|

|_____________________________________________________|_______________|

| Increased Spending | $170|

|_____________________________________________________|_______________|

| Revised Capital Expenditure Estimate | $770|

|_____________________________________________________|_______________|

| | |

|_____________________________________________________|_______________|

|Revised Capital Expenditures By Resource Play | |

|_____________________________________________________|_______________|

| Bakken/Tight Oil | $325|

|_____________________________________________________|_______________|

| Waterfloods | $145|

|_____________________________________________________|_______________|

| Marcellus | $195|

|_____________________________________________________|_______________|

| Deep Basin | $55|

|_____________________________________________________|_______________|

|% of Total | 94%|

|_____________________________________________________|_______________|

| | |

|_____________________________________________________|_______________|

|Original Annual Average Production Estimate (BOE/day)|78,000 -

80,000|

|_____________________________________________________|_______________|

|Oil & Liquids Weighting | 47%|

|_____________________________________________________|_______________|

| | |

|_____________________________________________________|_______________|

|Less Marcellus Production Sold & Weather Impacts | (1,700)|

|(BOE/day) | |

|_____________________________________________________|_______________|

|Revised Annual Average Production (BOE/day) |76,000 - 78,000|

|_____________________________________________________|_______________|

|Oil & Liquids Weighting | 45%|

|_____________________________________________________|_______________|

| | |

|_____________________________________________________|_______________|

|Original Exit Production Estimate (BOE/day) |80,000 - 84,000|

|_____________________________________________________|_______________|

|Less Marcellus Production Sold (BOE/day) | (3,800)|

|_____________________________________________________|_______________|

|Revised Exit Production Estimate (BOE/day) |81,000 - 84,000|

|_____________________________________________________|_______________|

|Oil & Liquids Weighting | 47%|

|_____________________________________________________|_______________|

ADDITIONS TO THE BOARD OF DIRECTORS We are pleased to announce that

Ms. Sue MacKenzie and Mr. David Barr joined the board of directors

of Enerplus effective July 1, 2011. Ms. MacKenzie has over 25 years

of energy sector experience, having served as Chief Operating

Officer with Oilsands Quest Inc. and Vice-President of Human

Resources and Vice President of In Situ Development and Operations

for Petro-Canada. Mr. Barr has 36 years of experience in the

oil and gas industry, and is President and Chief Executive Officer

of Logan International Inc. He was formerly Chairman of the Board

of Logan International. He also spent close to 20 years with Baker

Hughes in various executive roles, including Group President

of numerous divisions and President of Baker Atlas. OUTLOOK The

unusual weather experienced during the first half of 2011 has

presented a number of operational challenges for Enerplus. However,

through the hard work and dedication of our employees, particularly

in the field, we were successful in mitigating any significant

impacts to our business and maintaining our production volumes at

similar levels to the first quarter. We have once again delivered a

significant gain to shareholders with the Marcellus sale and

increased our financial strength and ability to deliver on our

growth plans. The second half of 2011 is expected to be very

active due to the increase in capital spending and the number of

wells we plan to drill and tie-in. We will be focused on executing

our capital program and achieving our production targets through

the remainder of the year. For further information, please contact

our Investor Relations Department at 1-800-319-6462 or email

investorrelations@enerplus.com. - 30 - Gordon J. Kerr President

& Chief Executive Officer Enerplus Corporation NOTICE TO U.S.

READERS The oil and natural gas reserves information contained in

this news release has generally been prepared in accordance with

Canadian disclosure standards, which are not comparable in all

respects to United States or other foreign disclosure standards.

Reserves categories such as "proved reserves" and "probable

reserves" may be defined differently under Canadian requirements

than the definitions contained in the United States Securities and

Exchange Commission (the "SEC") rules. In addition, under Canadian

disclosure requirements and industry practice, reserves and

production are reported using volumes prior to deduction of royalty

and similar payments. The practice in the United States is to

report reserves and production using net volumes, after deduction

of applicable royalties and similar payments. Canadian disclosure

requirements require that forecasted commodity prices be used for

reserves evaluations, while the SEC mandates the use of an average

of first day of the month price for the 12 months prior to the end

of the reporting period. Additionally, the SEC prohibits

disclosure of oil and gas resources, whereas Canadian issuers may

disclose oil and gas resources. Resources are different than, and

should not be construed as reserves. For a description of the

definition of, and the risks and uncertainties surrounding the

disclosure of, contingent resources, see "Information Regarding

Reserves, Resources and Operations" below. INFORMATION REGARDING

RESERVES, RESOURCES AND OPERATIONS Barrels of Oil Equivalent and

Cubic Feet of Gas Equivalent This news release also contains

references to "BOE" (barrels of oil equivalent) and "cfe" (cubic

feet of gas equivalent). Enerplus has adopted the standard of six

thousand cubic feet of gas to one barrel of oil (6 Mcf: 1 bbl) when

converting natural gas to BOEs, and one barrel of oil to six

thousand cubic feet of gas (1 bbl: 6 Mcf) when converting oil to

cfes. BOEs and cfes may be misleading, particularly if used in

isolation. The foregoing conversion ratios are based on an

energy equivalency conversion method primarily applicable at the

burner tip and do not represent a value equivalency at the

wellhead. Contingent Resource Estimates This news release contains

estimates of "contingent resources". "Contingent resources" are

not, and should not be confused with, oil and gas reserves.

"Contingent resources" are defined in the Canadian Oil and Gas

Evaluation Handbook (the "COGE Handbook") as "those quantities of

petroleum estimated, as of a given date, to be potentially

recoverable from known accumulations using established technology

or technology under development, but which are not currently

considered to be commercially recoverable due to one or more

contingencies. Contingencies may include factors such as economic,

legal, environmental, political and regulatory matters or a lack of

markets. It is also appropriate to classify as "contingent

resources" the estimated discovered recoverable quantities

associated with a project in the early evaluation stage." There is

no certainty that we will produce any portion of the volumes

currently classified as "contingent resources". The "contingent

resource" estimates contained herein are presented as the "best

estimate" of the quantity that will actually be recovered,

effective as of December 31, 2010. A "best estimate" of

contingent resources means that it is equally likely that the

actual remaining quantities recovered will be greater or less than

the best estimate, and if probabilistic methods are used, there

should be at least a 50% probability that the quantities actually

recovered will equal or exceed the best estimate. For information

regarding the primary contingencies which currently prevent the

classification of our disclosed "contingent resources" associated

with our Marcellus shale gas assets as reserves and the positive

and negative factors relevant to the "contingent resource"

estimate, see our Annual Information Form for the year ended

December 31, 2010 (and corresponding Form 40-F), a copy of which is

available on our SEDAR profile at www.sedar.com and a copy of the

Form 40-F which is available on our EDGAR profile at www.sec.gov.

FORWARD-LOOKING INFORMATION AND STATEMENTS This news release

contains certain forward-looking information and statements

("forward-looking information") within the meaning of applicable

securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "guidance", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans",

"intends", "budget", "strategy" and similar expressions are

intended to identify forward-looking information. In particular,

but without limiting the foregoing, this news release contains

forward-looking information pertaining to the following: Enerplus'

strategy to deliver both income and growth to investors and

Enerplus' related asset portfolio; future capital and development

expenditures and the timing and allocation thereof among our

resource plays and assets; future development and drilling

locations and plans; the performance of and future results from

Enerplus' assets and operations, including anticipated production

levels and decline rates; future growth prospects, acquisitions and

dispositions; the volumes and estimated value of Enerplus' oil and

gas reserves and contingent resource volumes and future commodity

price and foreign exchange rate assumptions related thereto; the

life of Enerplus' reserves; the volume and product mix of Enerplus'

oil and gas production; securing necessary infrastructure and third

party services; future cash flows and debt-to-cash flow levels;

returns on Enerplus' capital program; and future costs and

expenses. The forward-looking information contained in this news

release reflect several material factors and expectations and

assumptions of Enerplus including, without limitation: that

Enerplus will conduct its operations and achieve results of

operations as anticipated; that Enerplus' development plans will

achieve the expected results; the general continuance of current

or, where applicable, assumed industry conditions; the continuation

of assumed tax, royalty and regulatory regimes; the accuracy of the

estimates of Enerplus' reserve and resource volumes; commodity

price and cost assumptions; the continued availability of adequate

debt and/or equity financing and cash flow to fund Enerplus'

capital and operating requirements as needed; and the extent of its

liabilities. Enerplus believes the material factors, expectations

and assumptions reflected in the forward-looking information are

reasonable but no assurance can be given that these factors,

expectations and assumptions will prove to be correct. The

forward-looking information included in this news release is not a

guarantee of future performance and should not be unduly relied

upon. Such information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information including, without limitation: changes

in commodity prices; changes in the demand for or supply of

Enerplus' products; unanticipated operating results, results from

development plans or production declines; changes in tax or

environmental laws, royalty rates or other regulatory matters;

changes in development plans by Enerplus or by third party

operators of Enerplus' properties; increased debt levels or debt

service requirements; inaccurate estimation of Enerplus' oil and

gas reserve and resource volumes; limited, unfavourable or a lack

of access to capital markets; increased costs; a lack of adequate

insurance coverage; the impact of competitors; reliance on industry

partners; and certain other risks detailed from time to time in

Enerplus' public disclosure documents (including, without

limitation, those risks identified in Enerplus' Annual Information

Form and Form 40-F described above). The forward-looking

information contained in this news release speak only as of the

date of this news release, and none of Enerplus or its subsidiaries

assumes any obligation to publicly update or revise them to reflect

new events or circumstances, except as may be required pursuant to

applicable laws. NON-GAAP MEASURES In this news release, we use the

terms "funds flow" to analyze operating performance, leverage and

liquidity. We calculate funds flow based on cash flow from

operating activities before changes in non-cash operating working

capital and decommissioning liabilities settled, all of which are

measures prescribed by International Financial Reporting Standards

("IFRS") and which appear in our Consolidated Statements of Cash

Flows. Enerplus believes that, in addition to net earnings and

other measures prescribed by IFRS, the term "funds flow", is a

useful supplemental measure as it provides an indication of the

results generated by Enerplus' principal business activities.

However, this measure is not recognized by IFRS and does not have a

standardized meaning prescribed by IFRS. Therefore, this measure,

as defined by Enerplus, may not be comparable to similar measures

presented by other issuers. To view this news release

in HTML formatting, please use the following URL:

http://www.newswire.ca/en/releases/archive/August2011/05/c9300.html

p Investor Relations Department at 1-800-319-6462 or email a

href="mailto:investorrelations@enerplus.com"investorrelations@enerplus.com/a.

/p

Copyright

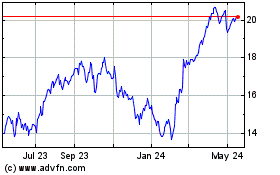

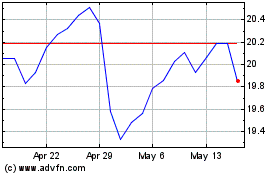

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024