QuickLinks

-- Click here to rapidly navigate through this document

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer pursuant to Rule 13-a-16 or 15d-16

of the Securities Exchange Act of 1934

FOR THE MONTH OF AUGUST, 2015

COMMISSION FILE NUMBER 1-15150

The Dome Tower

Suite 3000, 333 – 7th Avenue S.W.

Calgary, Alberta

Canada T2P 2Z1

(403) 298-2200

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Indicate

by check mark whether, by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the securities Exchange Act of 1934.

EXHIBIT INDEX

EXHIBIT

99.1 — Enerplus Second Quarter Report for the Period Ending June 30, 2015

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

ENERPLUS CORPORATION |

|

|

BY: |

|

/s/ DAVID A. MCCOY

David A. McCoy

Vice President, General Counsel & Corporate Secretary

|

DATE: August 7, 2015

QuickLinks

EXHIBIT INDEX

SIGNATURE

QuickLinks

-- Click here to rapidly navigate through this document

Exhibit 99.1

Selected Financial Results

SELECTED FINANCIAL RESULTS |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

| |

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

| Financial (000's) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Funds Flow(4) |

|

$ |

160,436 |

|

|

|

$ |

213,211 |

|

|

|

$ |

269,600 |

|

|

|

$ |

433,723 |

|

|

| Cash and Stock Dividends |

|

|

30,935 |

|

|

|

|

55,214 |

|

|

|

|

78,294 |

|

|

|

|

110,149 |

|

|

| Net Income/(Loss) |

|

|

(312,544 |

) |

|

|

|

39,957 |

|

|

|

|

(605,750 |

) |

|

|

|

79,994 |

|

|

| Debt Outstanding – net of cash |

|

|

1,120,680 |

|

|

|

|

1,067,590 |

|

|

|

|

1,120,680 |

|

|

|

|

1,067,590 |

|

|

| Capital Spending |

|

|

147,979 |

|

|

|

|

204,427 |

|

|

|

|

314,989 |

|

|

|

|

422,190 |

|

|

| Property Divestments |

|

|

187,801 |

|

|

|

|

(525 |

) |

|

|

|

191,513 |

|

|

|

|

116,700 |

|

|

| Debt to Funds Flow Ratio(4) |

|

|

1.6x |

|

|

|

|

1.3x |

|

|

|

|

1.6x |

|

|

|

|

1.3x |

|

|

Financial per Weighted Average Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Funds Flow |

|

$ |

0.78 |

|

|

|

$ |

1.04 |

|

|

|

$ |

1.31 |

|

|

|

$ |

2.13 |

|

|

| Net Income/(Loss) |

|

|

(1.52 |

) |

|

|

|

0.20 |

|

|

|

|

(2.94 |

) |

|

|

|

0.39 |

|

|

| Weighted Average Number of Shares Outstanding (000's) |

|

|

206,208 |

|

|

|

|

204,158 |

|

|

|

|

206,028 |

|

|

|

|

203,671 |

|

|

Selected Financial Results per BOE(1)(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Oil & Natural Gas Sales(3) |

|

$ |

30.53 |

|

|

|

$ |

53.32 |

|

|

|

$ |

28.78 |

|

|

|

$ |

54.45 |

|

|

| Royalties and Production Taxes |

|

|

(6.23 |

) |

|

|

|

(11.58 |

) |

|

|

|

(5.88 |

) |

|

|

|

(11.81 |

) |

|

| Commodity Derivative Instruments |

|

|

7.47 |

|

|

|

|

(2.60 |

) |

|

|

|

8.48 |

|

|

|

|

(2.17 |

) |

|

| Cash Operating Expenses |

|

|

(8.12 |

) |

|

|

|

(9.12 |

) |

|

|

|

(8.81 |

) |

|

|

|

(9.04 |

) |

|

| Transportation Costs |

|

|

(2.87 |

) |

|

|

|

(2.39 |

) |

|

|

|

(2.89 |

) |

|

|

|

(2.45 |

) |

|

| General and Administrative |

|

|

(2.03 |

) |

|

|

|

(1.97 |

) |

|

|

|

(2.19 |

) |

|

|

|

(2.14 |

) |

|

| Cash Share-Based Compensation |

|

|

0.13 |

|

|

|

|

(1.12 |

) |

|

|

|

(0.32 |

) |

|

|

|

(0.95 |

) |

|

| Interest, Foreign Exchange and Other Expenses |

|

|

(2.48 |

) |

|

|

|

(1.61 |

) |

|

|

|

(2.87 |

) |

|

|

|

(1.63 |

) |

|

| Taxes |

|

|

0.01 |

|

|

|

|

(0.40 |

) |

|

|

|

– |

|

|

|

|

(0.63 |

) |

|

|

|

|

|

|

|

|

| Funds Flow |

|

$ |

16.41 |

|

|

|

$ |

22.53 |

|

|

|

$ |

14.30 |

|

|

|

$ |

23.63 |

|

|

|

|

|

|

|

|

|

| SELECTED OPERATING RESULTS |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

| |

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

|

|

|

|

| Average Daily Production(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Crude Oil (bbls/day) |

|

|

41,122 |

|

|

|

39,863 |

|

|

|

40,243 |

|

|

|

38,817 |

|

| Natural Gas Liquids (bbls/day) |

|

|

5,145 |

|

|

|

3,636 |

|

|

|

4,444 |

|

|

|

3,450 |

|

| Natural Gas (Mcf/day) |

|

|

366,971 |

|

|

|

362,929 |

|

|

|

356,836 |

|

|

|

354,906 |

|

| Total (BOE/day) |

|

|

107,429 |

|

|

|

103,987 |

|

|

|

104,160 |

|

|

|

101,418 |

|

% Crude Oil and Natural Gas Liquids |

|

|

43% |

|

|

|

42% |

|

|

|

43% |

|

|

|

42% |

|

Average Selling Price(2)(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Crude Oil (per bbl) |

|

$ |

58.26 |

|

|

$ |

96.46 |

|

|

$ |

51.35 |

|

|

$ |

93.25 |

|

| Natural Gas Liquids (per bbl) |

|

|

20.88 |

|

|

|

51.80 |

|

|

|

21.55 |

|

|

|

57.66 |

|

| Natural Gas (per Mcf) |

|

|

2.09 |

|

|

|

4.15 |

|

|

|

2.32 |

|

|

|

4.46 |

|

Net Wells Drilled |

|

|

8 |

|

|

|

14 |

|

|

|

36 |

|

|

|

44 |

|

|

|

|

|

|

|

|

- (1)

- Non-cash

amounts have been excluded.

- (2)

- Based

on Company interest production volumes. See "Basis of Presentation" section in the following MD&A.

- (3)

- Before

transportation costs, royalties and commodity derivative instruments.

- (4)

- These

non-GAAP measures may not be directly comparable to similar measures presented by other entities. See "Non-GAAP Measures" section in the following MD&A.

ENERPLUS 2015 Q2

REPORT 1

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

| Average Benchmark Pricing |

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

|

|

|

|

| WTI Crude Oil (US$/bbl) |

|

$ |

57.94 |

|

|

$ |

102.99 |

|

|

$ |

53.29 |

|

|

$ |

100.84 |

|

| AECO – monthly index (CDN$/Mcf) |

|

|

2.67 |

|

|

|

4.68 |

|

|

|

2.81 |

|

|

|

4.72 |

|

| AECO – daily index (CDN$/Mcf) |

|

|

2.64 |

|

|

|

4.69 |

|

|

|

2.70 |

|

|

|

5.20 |

|

| NYMEX – last day (US$/Mcf) |

|

|

2.64 |

|

|

|

4.67 |

|

|

|

2.81 |

|

|

|

4.80 |

|

| US/CDN exchange rate |

|

|

1.23 |

|

|

|

1.09 |

|

|

|

1.24 |

|

|

|

1.10 |

|

|

|

|

|

|

|

|

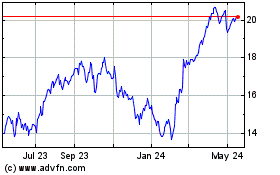

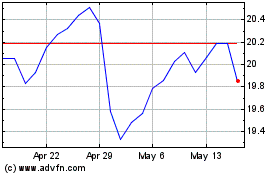

Share Trading Summary

For the three months ended June 30, 2015 |

|

|

CDN* – ERF

(CDN$) |

|

|

U.S.** – ERF

(US$) |

|

|

| High |

|

$ |

16.09 |

|

$ |

13.16 |

|

| Low |

|

|

10.61 |

|

|

8.56 |

|

| Close |

|

|

10.96 |

|

|

8.79 |

|

|

- *

- TSX

and other Canadian trading data combined.

- **

- NYSE

and other U.S. trading data combined.

2015 Dividends per Share

Payment Month |

|

|

CDN$ |

|

|

US$(1) |

|

|

| First Quarter Total |

|

$ |

0.27 |

|

$ |

0.22 |

|

|

| April |

|

$ |

0.05 |

|

$ |

0.04 |

|

| May |

|

|

0.05 |

|

|

0.04 |

|

| June |

|

|

0.05 |

|

|

0.04 |

|

|

| Second Quarter Total |

|

$ |

0.15 |

|

$ |

0.12 |

|

|

| Total Year-to-Date |

|

$ |

0.42 |

|

$ |

0.34 |

|

|

- (1)

- US$

dividends represent CDN$ dividends converted at the relevant foreign exchange rate on the payment date.

2 ENERPLUS 2015 Q2

REPORT

PRESIDENT'S MESSAGE

Through the second quarter of 2015, Enerplus continued to focus on operational execution under a disciplined capital program. We delivered production growth, improved cost

performance and maintained a strong financial position.

Production

volumes grew by 7% quarter over quarter to 107,429 BOE per day. This growth was primarily driven by increased activity in North Dakota, where production averaged approximately

27,100 BOE per day, up over 25% from the first quarter of 2015. We also saw growth from our gas portfolio with our Canadian Deep Basin and Marcellus assets showing production increases over the

first quarter of 2015. Our production mix was essentially unchanged from the previous quarter, with crude oil and natural gas liquids accounting for 43% of production.

As

a result of continued operational outperformance, we are increasing our average annual production guidance for both liquids and gas to 100,000-104,000 BOE per day from

97,000-103,000 BOE per day. We expect approximately 44,000-46,000 barrels per day of crude oil and natural gas liquids. This guidance includes year to date divestments of approximately

1,900 BOE per day.

We

spent $148 million in our core areas during the quarter, and are on track to meet our annual capital spending guidance of $540 million, despite the weak Canadian dollar. Approximately

75% of spending in the quarter was directed to our North Dakota properties. In total we drilled 7.8 net wells and brought 22 net wells on-stream across our portfolio in the

second quarter.

Both

operating costs and G&A expenses for the quarter came in lower than forecast, at $7.85 per BOE and $2.03 per BOE, respectively. Based on our cost savings realized to date and our increased

production target, we are decreasing our annual operating cost guidance to $9.25 per BOE from $9.75 per BOE and our G&A expense guidance to $2.25 per BOE from $2.40 per BOE, representing a combined

decrease of $0.65 per BOE.

Funds

flow increased by 47% to $160 million from the first quarter. This was largely a result of higher production, lower costs and improved crude oil prices, and despite slightly weaker gas

pricing. Funds flow was also supported by our hedging program which generated gains of $73 million during the second quarter.

We

incurred a non-cash asset impairment charge in the quarter of $497 million. Under U.S. GAAP we are required to use twelve month trailing average prices to determine impairment, and

consequently the impairment reflects the low commodity prices in the fourth quarter of 2014 and the first half of 2015.

During

the quarter, we closed our previously announced non-core asset sales, along with the sale of additional minor non-core properties for proceeds of $188 million.

Our

focus on cost control, strong 2015 hedge position, divestment proceeds, and disciplined capital spending have helped preserve our strong financial position. We ended the quarter with an improved

trailing debt to funds flow ratio of 1.6 times, down from 1.7 times in the first quarter of 2015. At June 30, 2015, we were approximately 8% drawn on our $1 billion credit

facility. Following the next scheduled repayment of our senior notes in October 2015 of US$10.8 million, we have no scheduled debt repayments until June of 2017.

ENERPLUS 2015 Q2

REPORT 3

Production and Capital Spending

| |

|

Three months ended June 30, 2015

|

|

Six months ended June 30, 2015

|

| |

|

Average Production

Volumes |

|

Capital Spending

($ millions) |

|

Average Production

Volumes |

|

Capital Spending

($ millions) |

|

|

| Crude Oil & NGLs (bbls/day) |

|

|

|

|

|

|

|

|

|

| Canada |

|

17,598 |

|

17.3 |

|

18,460 |

|

72.4 |

|

| United States |

|

28,669 |

|

110.8 |

|

26,227 |

|

189.2 |

|

|

| Total Crude Oil & NGLs (bbls/day) |

|

46,267 |

|

128.1 |

|

44,687 |

|

261.6 |

|

|

Natural Gas (Mcf/day) |

|

|

|

|

|

|

|

|

|

| Canada |

|

144,788 |

|

7.3 |

|

140,129 |

|

29.1 |

|

| United States |

|

222,183 |

|

12.6 |

|

216,707 |

|

24.3 |

|

|

| Total Natural Gas (Mcf/day) |

|

366,971 |

|

19.9 |

|

356,836 |

|

53.4 |

|

|

| Company Total (BOE/day) |

|

107,429 |

|

148.0 |

|

104,160 |

|

315.0 |

|

|

Net Drilling Activity*** – for the three months ended June 30, 2015

| |

|

Wells Drilled |

|

Wells Pending

Completion/Tie-in* |

|

Wells

On-stream** |

|

Dry & Abandoned

Wells |

|

|

| Crude Oil |

|

|

|

|

|

|

|

|

|

| Canada |

|

1.0 |

|

1.0 |

|

6.6 |

|

– |

|

| United States |

|

5.5 |

|

4.5 |

|

9.2 |

|

– |

|

|

| Total Crude Oil |

|

6.5 |

|

5.5 |

|

15.8 |

|

– |

|

|

Natural Gas |

|

|

|

|

|

|

|

|

|

| Canada |

|

0.7 |

|

0.7 |

|

3.0 |

|

– |

|

| United States |

|

0.7 |

|

0.4 |

|

3.2 |

|

– |

|

|

| Total Natural Gas |

|

1.4 |

|

1.1 |

|

6.2 |

|

– |

|

|

| Company Total |

|

7.8 |

|

6.5 |

|

22.0 |

|

– |

|

|

- *

- Wells

drilled during the quarter that are pending potential completion/tie-in or abandonment as at June 30, 2015.

- **

- Total

wells brought on-stream during the quarter regardless of when they were drilled.

- ***

- Table

may not add due to rounding.

Asset Activity

We re-established production growth in North Dakota in the second quarter of 2015. Production from Fort Berthold averaged approximately 27,100 BOE per

day during the quarter, up over 25% from the first quarter of 2015. We drilled 5.5 net wells in Fort Berthold with 9.2 net wells brought on-stream during the quarter for a total capital

outlay of $111 million.

We

continue to run a one-rig drilling program as we work through our inventory of drilled uncompleted wells at Fort Berthold and expect to drill approximately 8 net wells in the second half of

the year. We are ahead of schedule on our 2015 completions activity. During the first six months of 2015 we brought approximately 13 net wells on stream. We expect to bring up to

10 additional net wells on stream during the second half of the year. This activity is broadly weighted towards the third quarter and we expect production growth through the remainder of the

year. Our high intensity completion design continues to yield excellent results. The average initial 30 day production rate (IP30) of our operated on-stream wells in the quarter was over

2,000 BOE per day, exceeding our high end type curve. We continue to see improved well costs with current costs down over 20% from 2014 levels.

In

the Marcellus, continued low levels of spending ($12.6 million in the second quarter) led to 0.7 net wells drilled and 3.2 net wells on-stream. Despite the reduced activity,

well outperformance resulted in production of 201 MMcf per day during the second quarter, a modest increase from the previous quarter.

In

the Deep Basin, we drilled three excellent wells at our Ansell pad. The average peak 30 day production rate for a well on the pad was approximately 10 MMcf per day, on trend with our

high end type curve.

4 ENERPLUS 2015 Q2

REPORT

Crude Oil & Natural Gas Pricing

The West Texas Intermediate (WTI) benchmark price for crude oil increased by 19% quarter-over-quarter to average US$57.94 per barrel in the second quarter. The

strength in WTI prices combined with the narrowing of crude oil differentials in both Canada and the U.S. resulted in a 32% improvement in the selling price for our crude oil compared to the

previous quarter. The average realized sales price for our crude oil was $58.26 per barrel during the quarter with crude oil properties generating approximately 90% of our corporate netback.

On

the natural gas side, both AECO and NYMEX weakened from the previous quarter due to continued high production and increased storage levels across the continent. In the Marcellus, our realized

differential widened US$0.07 per Mcf from the previous quarter to average US$1.39 per Mcf. Overall, as a result of lower benchmark pricing and continued pricing weakness in the Marcellus producing

region, our realized sales price for gas fell by 19% compared to the previous quarter to average $2.09 per Mcf.

We

continued to add to our commodity hedge position for both 2015 and 2016. For the second half of 2015, we have an average of 11,250 barrels per day of crude oil hedged (representing

approximately 35% of our expected crude oil production net of royalties) at an average floor price of US$84.58 per barrel through a combination of swaps and three way collar structures. For 2016, we

have an average of 11,000 barrels per day of crude oil hedged (representing approximately 34% of our expected crude oil production net of royalties) at an average floor price of US$64.35 per

barrel through a combination of swaps and three way collar structures.

We

have also added to our NYMEX gas hedging position. For the second half of 2015, we are swapped on an average of 128 MMcf per day at an average price of US$3.82 per Mcf, representing

approximately 47% of our forecasted natural gas production after royalties. For 2016, we have 25 MMcf per day, or 9% of our forecasted natural gas production after royalties, hedged through

three-way collars with an average floor price of US$3.00 per Mcf.

Outlook

We delivered another quarter of strong operating results. On the back of this operational momentum and improved cost efficiencies, we are increasing our 2015

production guidance and reducing our operating and G&A expense guidance.

We

continue to navigate through this challenging commodity price environment with a strong balance sheet and hedging program that will support our funds flow. We remain focused on driving improvement

in our operational efficiencies through both reducing our cost structures and optimizing well performance. Above all, the low commodity prices have not stopped us from committing the time and

resources to ensure safe, responsible and sustainable operations across our business.

Ian

C. Dundas

President & Chief Executive Officer

Enerplus Corporation

ENERPLUS 2015 Q2

REPORT 5

MD&A

MANAGEMENT'S DISCUSSION AND ANALYSIS ("MD&A")

The following discussion and analysis of financial results is dated August 6, 2015 and is to be read in conjunction with:

- •

- the

unaudited interim consolidated financial statements of Enerplus Corporation ("Enerplus" or the "Company") as at and for the three and six months ended

June 30, 2015 and 2014 (the "Interim Financial Statements");

- •

- the

audited consolidated financial statements of Enerplus as at December 31, 2014 and 2013 and for the years ended December 31, 2014, 2013

and 2012; and

- •

- our

MD&A for the year ended December 31, 2014 (the "Annual MD&A").

The

following MD&A contains forward-looking information and statements. We refer you to the end of the MD&A under "Forward-Looking Information and Statements" for further information. The following

MD&A also contains financial measures that do not have a standardized meaning as prescribed by accounting principles generally accepted in the United States of America ("U.S. GAAP"). See

"Non-GAAP Measures" below for further information.

BASIS OF PRESENTATION

The Interim Financial Statements and notes have been prepared in accordance with U.S. GAAP including the prior period comparatives. All amounts are

stated in Canadian dollars unless otherwise specified and all other references relate to the notes included in the Interim Financial Statements.

Where

applicable, natural gas has been converted to barrels of oil equivalent ("BOE") based on 6 Mcf:1 BOE and oil and natural gas liquids ("NGL") have been converted to

thousand cubic feet of gas equivalent ("Mcfe") based on 0.167 bbl:1 Mcfe. BOE and Mcfe measures are based on an energy equivalent conversion method primarily applicable at the

burner tip and do not represent a value equivalent at the wellhead. Given that the value ratio based on the current price of natural gas as compared to crude oil is significantly different from the

energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value. Use of BOE and Mcfe in isolation may be misleading. All production volumes are

presented on a Company interest basis, being the Company's working interest share before deduction of any royalties paid to others, plus the Company's royalty interest unless otherwise stated. Company

interest is not a term defined in Canadian National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities and may not be comparable to

information produced by other entities.

In

accordance with U.S. GAAP, oil and gas sales are presented net of royalties in our Interim Financial Statements. Under International Financial Reporting Standards, industry standard is to

present oil and gas sales before deduction of royalties and as such this MD&A presents production, oil and gas sales, and BOE measures on this basis to remain comparable with our peers.

NON-GAAP MEASURES

The Company utilizes the following terms for measurement within the MD&A that do not have a standardized meaning or definition as prescribed by U.S. GAAP

and therefore may not be comparable with the calculation of similar measures by other entities:

"Netback" is used by Enerplus and is useful to investors and securities analysts in evaluating operating performance of our crude oil and natural gas

assets. The term netback is calculated as oil and natural gas sales less royalties, production taxes, cash operating costs and transportation.

6 ENERPLUS 2015 Q2

REPORT

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

Calculation of Netback

($ millions) |

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

| Oil and natural gas sales |

|

$ |

298.4 |

|

|

|

$ |

504.5 |

|

|

|

$ |

542.5 |

|

|

|

$ |

999.6 |

|

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Royalties |

|

|

(46.7 |

) |

|

|

|

(89.6 |

) |

|

|

|

(85.8 |

) |

|

|

|

(176.9 |

) |

|

| |

Production taxes |

|

|

(14.2 |

) |

|

|

|

(20.0 |

) |

|

|

|

(25.0 |

) |

|

|

|

(39.8 |

) |

|

| |

Cash operating costs(1) |

|

|

(79.3 |

) |

|

|

|

(86.2 |

) |

|

|

|

(166.2 |

) |

|

|

|

(166.1 |

) |

|

| |

Transportation |

|

|

(28.0 |

) |

|

|

|

(22.6 |

) |

|

|

|

(54.5 |

) |

|

|

|

(45.0 |

) |

|

|

|

|

|

|

|

|

| Netback before hedging |

|

$ |

130.2 |

|

|

|

$ |

286.1 |

|

|

|

$ |

211.0 |

|

|

|

$ |

571.8 |

|

|

| |

Cash gains/(losses) on derivative instruments |

|

|

73.1 |

|

|

|

|

(24.5 |

) |

|

|

|

159.9 |

|

|

|

|

(39.9 |

) |

|

|

|

|

|

|

|

|

| Netback after hedging |

|

$ |

203.3 |

|

|

|

$ |

261.6 |

|

|

|

$ |

370.9 |

|

|

|

$ |

531.9 |

|

|

|

|

|

|

|

|

|

- (1)

- Operating

costs adjusted to exclude non-cash gains on fixed price electricity swaps of $2.6 million and $1.7 million in the three and six months ended

June 30, 2015 and $0.2 million in both the three and six months ended June 30, 2014.

"Funds Flow" is used by Enerplus and useful to investors and securities analysts in analyzing operating

performance, leverage and liquidity. Funds flow is calculated as net cash provided by operating activities before asset retirement obligation expenditures and changes in non-cash operating working

capital.

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

Reconciliation of Cash Flow from Operating Activities to Funds Flow

($ millions) |

|

|

2015 |

|

|

|

2014 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

| Cash flow from operating activities |

|

$ |

135.0 |

|

|

$ |

228.5 |

|

|

|

$ |

266.2 |

|

|

|

$ |

368.9 |

|

| Asset retirement obligation expenditures |

|

|

2.6 |

|

|

|

4.2 |

|

|

|

|

6.5 |

|

|

|

|

8.5 |

|

| Changes in non-cash operating working capital |

|

|

22.8 |

|

|

|

(19.5 |

) |

|

|

|

(3.1 |

) |

|

|

|

56.3 |

|

|

|

|

|

|

|

|

| Funds Flow |

|

$ |

160.4 |

|

|

$ |

213.2 |

|

|

|

$ |

269.6 |

|

|

|

$ |

433.7 |

|

|

|

|

|

|

|

|

"Debt to Funds Flow Ratio" is used by Enerplus and is useful to investors and securities analysts in analyzing

leverage and liquidity. The debt to funds flow ratio is calculated as total debt net of cash, divided by a trailing 12 months of funds flow. This measure is not equivalent to Debt to Earnings

before Interest, Taxes, Depreciation and Amortization and other non-cash charges ("EBITDA") and is not a debt covenant.

"Adjusted Payout Ratio" is used by Enerplus and is useful to investors and securities analysts in analyzing operating performance, leverage and

liquidity. We calculate our adjusted payout ratio as cash dividends plus capital and office expenditures divided by funds flow.

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

Calculation of Adjusted Payout Ratio

($ millions) |

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

|

|

|

|

| Cash dividends(1) |

|

$ |

30.9 |

|

|

$ |

50.5 |

|

|

$ |

78.3 |

|

|

$ |

92.7 |

|

| Capital and office expenditures |

|

|

149.4 |

|

|

|

205.6 |

|

|

|

317.3 |

|

|

|

423.8 |

|

|

|

|

|

|

|

|

| |

|

$ |

180.3 |

|

|

$ |

256.1 |

|

|

$ |

395.6 |

|

|

$ |

516.5 |

|

| Funds flow |

|

|

160.4 |

|

|

|

213.2 |

|

|

|

269.6 |

|

|

|

433.7 |

|

|

|

|

|

|

|

|

| Adjusted payout ratio (%) |

|

|

112% |

|

|

|

120% |

|

|

|

147% |

|

|

|

119% |

|

|

|

|

|

|

|

|

- (1)

- Cash

dividends exclude stock dividend plan proceeds in 2014.

In addition, the Company uses certain financial measures within the "Overview" and "Liquidity and Capital Resources" sections of this MD&A that do not have a

standardized meaning or definition as prescribed by U.S. GAAP and, therefore, may not be comparable with the calculation of similar measures by other entities. Such measures include "Senior

Debt to EBITDA", "Total Debt to EBITDA", "Total Debt to Capitalization", "maximum debt to consolidated present value of total proven reserves" and "EBITDA to Interest" and are used to determine the

Company's compliance with financial covenants under its bank credit facility and outstanding senior notes. Calculation of such terms is described under the "Liquidity and Capital Resources" section of

this MD&A.

ENERPLUS 2015 Q2

REPORT 7

OVERVIEW

Our strong operational performance continued in the second quarter as we delivered production growth and met or exceeded all our guidance targets. As a result,

we are increasing our 2015 production guidance and lowering our operating cost and general and administrative ("G&A") expense guidance by $0.65/BOE, combined. All other guidance targets

are maintained.

Average

daily production for the second quarter was 107,429 BOE/day, exceeding our annual average production guidance range of 97,000-103,000 BOE/day. Production increased approximately

6,600 BOE/day or 7% from the first quarter of 2015. The majority of the production growth was driven by our ongoing development in Fort Berthold, North Dakota, where production increased 26% or

approximately 5,600 BOE/day compared to the first quarter. Natural gas production increased 6% from the prior quarter due to the ongoing development of our Canadian deep gas properties and well

outperformance in the Marcellus. Based on our continued operational success, we are increasing our production guidance range to 100,000-104,000 BOE/day and expect approximately

44,000-46,000 bbls/day of crude oil and natural gas liquids.

We

maintained a disciplined capital program with spending of $148.0 million in our core areas during the quarter and are on track to meet our annual capital spending guidance of

$540.0 million.

Both

operating costs and G&A expenses came in below guidance, at $76.7 million or $7.85/BOE and $19.9 million or $2.03/BOE, respectively. As a result of our continued focus on cost

control and increased production target, we are decreasing our operating cost guidance to $9.25/BOE from $9.75/BOE and our G&A expense guidance to $2.25/BOE from $2.40/BOE, representing a combined

decrease of $0.65/BOE.

Funds

flow increased by 47% to $160.4 million from $109.2 million in the first quarter as a result of production growth and higher oil prices, along with the impact of one-time expenses

experienced in the first quarter. Compared to the same period in 2014, funds flow decreased by

approximately $52.8 million or 25% as oil and natural gas sales reflected the significant decline in commodity prices. Our hedging program provided additional revenue, generating gains of

$73.1 million in the quarter compared to losses of $24.5 million in the same period of 2014.

Under

U.S. GAAP, we recorded a net loss of $312.5 million for the quarter compared to net income of $40.0 million in the second quarter of 2014. The continued decline in the

twelve month trailing average commodity price resulted in an asset impairment of $497.2 million in the quarter. Year to date, we have recorded cumulative asset impairments of

$764.9 million. We expect the twelve month trailing prices used to calculate impairment charges in accordance with U.S. GAAP to decline further, which may lead to additional write-downs

of our oil and natural gas properties in the second half of 2015.

Despite

a decline in commodity prices during the first half of 2015 we remain in a strong financial position. At June 30, 2015 we were approximately 8% drawn on our $1.0 billion

credit facility and had a conservative debt to funds flow ratio of 1.6x and senior debt to EBITDA ratio of 1.5x. After a US$10.8 million senior note repayment due in the fourth quarter of 2015

we will have no term debt principal repayments due until June of 2017. We have added significantly to our hedging program during the quarter and continue to expect our risk management program to

protect our balance sheet and a portion of our funds flow in the second half of 2015 and into 2016.

RESULTS OF OPERATIONS

Production

Production for the second quarter totaled 107,429 BOE/day, exceeding our guidance range of 97,000-103,000 BOE/day and increasing 7% compared to

100,855 BOE/day in the first quarter of 2015. This increase was driven primarily by growth in our Fort Berthold production, which increased 26% or 5,600 BOE/day compared to the prior

quarter. We brought on 9.2 net wells in Fort Berthold during the quarter compared to 3.6 net wells in the first quarter. Based on our decision to accelerate the completion of eight

additional wells during the second half of 2015 we expect modest production growth in the region. Natural gas production increased by 6% from the prior quarter due to our ongoing development program

in the Canadian Deep Basin as well as continued well outperformance in the Marcellus.

Production

in the second quarter of 2015 increased by 3% from 103,987 BOE/day in the same period of 2014 primarily due to an increase in Fort Berthold crude oil production. Natural gas

production remained relatively flat compared to the second quarter of 2014, with growth in our Marcellus and Canadian Deep Basin production offset by the divestment of non-core Canadian natural gas

properties in the second half of 2014.

8 ENERPLUS 2015 Q2

REPORT

Our

production mix was unchanged from the previous quarter with crude oil and natural gas liquids accounting for 43% of our total average daily production.

Average

daily production volumes for the three and six months ended June 30, 2015 and 2014 are outlined below:

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

| Average Daily Production Volumes |

|

2015 |

|

|

2014 |

|

% Change |

|

|

2015 |

|

|

2014 |

|

% Change |

|

|

|

|

|

|

|

|

| Crude oil (bbls/day) |

|

41,122 |

|

|

39,863 |

|

3% |

|

|

40,243 |

|

|

38,817 |

|

4% |

|

| Natural gas liquids (bbls/day) |

|

5,145 |

|

|

3,636 |

|

42% |

|

|

4,444 |

|

|

3,450 |

|

29% |

|

| Natural gas (Mcf/day) |

|

366,971 |

|

|

362,929 |

|

1% |

|

|

356,836 |

|

|

354,906 |

|

1% |

|

|

|

|

|

|

|

|

| Total daily sales (BOE/day) |

|

107,429 |

|

|

103,987 |

|

3% |

|

|

104,160 |

|

|

101,418 |

|

3% |

|

|

|

|

|

|

|

|

As a result of continued outperformance we are revising our average annual production guidance upwards to 100,000-104,000 BOE/day from our guidance of

97,000-103,000 BOE/day provided in June. We expect annual production to include 44,000-46,000 bbls/day of crude oil and natural gas liquids.

Pricing

The prices received for our crude oil and natural gas production directly impact our earnings, funds flow and financial condition. The following table compares

quarterly average prices from the second quarter of 2015 to the second quarter of 2014:

| |

|

Six months ended

June 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pricing (average for the period) |

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

Q2 2015 |

|

|

|

|

Q1 2015 |

|

|

Q4 2014 |

|

|

Q3 2014 |

|

|

Q2 2014 |

|

|

|

|

|

|

|

|

|

| Benchmarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

WTI crude oil (US$/bbl) |

|

$ |

53.29 |

|

|

|

$ |

100.84 |

|

|

|

$ |

57.94 |

|

|

|

$ |

48.64 |

|

$ |

73.15 |

|

$ |

97.17 |

|

$ |

102.99 |

|

|

| |

AECO natural gas – monthly index (CDN$/Mcf) |

|

|

2.81 |

|

|

|

|

4.72 |

|

|

|

|

2.67 |

|

|

|

|

2.95 |

|

|

4.01 |

|

|

4.22 |

|

|

4.68 |

|

|

| |

AECO natural gas – daily index (CDN$/Mcf) |

|

|

2.70 |

|

|

|

|

5.20 |

|

|

|

|

2.64 |

|

|

|

|

2.75 |

|

|

3.60 |

|

|

4.02 |

|

|

4.69 |

|

|

| |

NYMEX natural gas – last day (US$/Mcf) |

|

|

2.81 |

|

|

|

|

4.80 |

|

|

|

|

2.64 |

|

|

|

|

2.98 |

|

|

4.00 |

|

|

4.06 |

|

|

4.67 |

|

|

| |

US/CDN exchange rate |

|

|

1.24 |

|

|

|

|

1.10 |

|

|

|

|

1.23 |

|

|

|

|

1.24 |

|

|

1.14 |

|

|

1.09 |

|

|

1.09 |

|

|

Enerplus Selling Price(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Crude oil (CDN$/bbl) |

|

$ |

51.35 |

|

|

|

$ |

94.80 |

|

|

|

$ |

58.26 |

|

|

|

$ |

44.04 |

|

$ |

69.17 |

|

$ |

88.28 |

|

$ |

96.46 |

|

|

| |

Natural gas liquids (CDN$/bbl) |

|

|

21.55 |

|

|

|

|

59.37 |

|

|

|

|

20.88 |

|

|

|

|

22.48 |

|

|

42.34 |

|

|

46.76 |

|

|

51.80 |

|

|

| |

Natural gas (CDN$/Mcf) |

|

|

2.32 |

|

|

|

|

4.60 |

|

|

|

|

2.09 |

|

|

|

|

2.58 |

|

|

3.25 |

|

|

3.36 |

|

|

4.15 |

|

|

|

|

|

|

|

|

|

Average differentials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

MSW Edmonton – WTI (US$/bbl) |

|

$ |

(4.93 |

) |

|

|

$ |

(7.19 |

) |

|

|

$ |

(3.06 |

) |

|

|

$ |

(6.80 |

) |

$ |

(6.36 |

) |

$ |

(7.93 |

) |

$ |

(6.13 |

) |

|

| |

WCS Hardisty – WTI (US$/bbl) |

|

|

(13.16 |

) |

|

|

|

(21.59 |

) |

|

|

|

(11.59 |

) |

|

|

|

(14.73 |

) |

|

(14.24 |

) |

|

(20.18 |

) |

|

(20.04 |

) |

|

| |

Brent Futures (ICE) – WTI (US$/bbl) |

|

|

6.10 |

|

|

|

|

7.97 |

|

|

|

|

5.63 |

|

|

|

|

6.58 |

|

|

3.85 |

|

|

6.26 |

|

|

6.75 |

|

|

| |

AECO monthly – NYMEX (US$/Mcf) |

|

|

(0.54 |

) |

|

|

|

(0.50 |

) |

|

|

|

(0.47 |

) |

|

|

|

(0.60 |

) |

|

(0.47 |

) |

|

(0.18 |

) |

|

(0.38 |

) |

|

Enerplus realized differentials(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Canada crude oil – WTI (US$/bbl) |

|

$ |

(14.13 |

) |

|

|

$ |

(18.36 |

) |

|

|

$ |

(12.50 |

) |

|

|

$ |

(15.22 |

) |

$ |

(12.17 |

) |

$ |

(20.51 |

) |

$ |

(16.77 |

) |

|

| |

Canada natural gas – NYMEX (US$/Mcf) |

|

|

(0.46 |

) |

|

|

|

(0.25 |

) |

|

|

|

(0.46 |

) |

|

|

|

(0.46 |

) |

|

(0.62 |

) |

|

(0.29 |

) |

|

(0.46 |

) |

|

| |

Bakken crude oil – WTI (US$/bbl) |

|

|

(10.05 |

) |

|

|

|

(11.29 |

) |

|

|

|

(9.30 |

) |

|

|

|

(11.65 |

) |

|

(12.15 |

) |

|

(12.81 |

) |

|

(12.81 |

) |

|

| |

Marcellus natural gas – NYMEX (US$/Mcf) |

|

|

(1.35 |

) |

|

|

|

(1.19 |

) |

|

|

|

(1.39 |

) |

|

|

|

(1.32 |

) |

|

(1.62 |

) |

|

(1.70 |

) |

|

(1.48 |

) |

|

|

|

|

|

|

|

|

- (1)

- Before

transportation costs, royalties and commodity derivative instruments.

Crude Oil and Natural Gas Liquids

WTI crude oil prices increased by 19% versus the previous quarter to average US$57.94/bbl during the second quarter of 2015. Although crude oil inventories in

the U.S. reached record levels of 491 million barrels in April, strong seasonal demand for gasoline and early indications of slowing crude oil production growth in the

U.S. resulted in inventory levels falling and WTI prices trading over US$60/bbl. However, increasing concerns over the Chinese economy and its potential negative impact on crude oil demand

growth, the nuclear agreement with Iran that will

ENERPLUS 2015 Q2

REPORT 9

eventually

allow increased Iranian production to return to the market and the ongoing debt crisis in Greece all contributed to the decline of WTI to under US$50/bbl by mid-July.

The

strength in WTI prices during the second quarter combined with improved realized crude oil differentials resulted in a 32% improvement in selling price for our crude oil compared to the previous

quarter. Crude oil differentials in Canada strengthened considerably during the second quarter, due largely to scheduled oil sands maintenance and other unplanned outages from forest fires in Northern

Alberta reducing production. As a result, WCS differentials to WTI narrowed by US$3.14/bbl to average US$11.59/bbl below WTI and light sweet crude oil differentials in Canada narrowed by US$3.74/bbl

to average US$3.06/bbl below WTI. The strength in light sweet differentials helped support our Bakken differentials as well, which narrowed by US$2.35/bbl quarter over quarter to average US$9.30/bbl

below WTI during the second quarter. We expect both heavy and light oil differentials in Canada and the U.S. to widen for the rest of the year relative to the second quarter, as production is

stabilizing in the affected regions.

The

decline in crude oil prices over the past twelve months and the level of natural gas liquids production across the continent continues to depress North American natural gas liquids prices,

specifically propane. As propane production and inventories in Canada and the U.S. grow, it has resulted in negative benchmark prices for propane during May and June. However, stronger WTI

prices during the quarter helped stabilize market prices for butanes and condensate, partially offsetting the weakness in propane prices. Our realized price for our natural gas liquids production fell

by 7% quarter over quarter to average $20.88/bbl.

Natural

Gas

Both AECO monthly index and NYMEX natural gas prices fell by 9% and 11%, respectively, versus the previous quarter due to continued high production and

increased storage levels across the continent. U.S. dry gas production in June was approximately 3.0 Bcf/day higher than last year while U.S. storage levels ended the quarter in

line with the five year average. Although production remains high, demand for natural gas fired power generation increased relative to previous years as natural gas prices were low enough to

incentivize generators to switch from coal to natural gas as a fuel for power generation. This increased power demand, combined with higher than expected exports from the U.S. to Mexico,

provided some price support by offsetting the continued strong North American production. However, even with the extra demand and normal weather, the strong production may push storage inventories to

test the upper end of capacity levels by the end of October.

In

Western Canada, there were ongoing service interruptions and restrictions in certain areas of the NOVA Gas Transmission Ltd. ("NGTL") pipeline system as TransCanada was

required by the National Energy Board to carry out thorough safety inspections of smaller diameter pipelines. These restrictions, combined with other unplanned maintenance issues across the system,

have caused many producers in Western Canada to curtail natural gas production. Overall, we have been able to limit the impact on Enerplus through holding firm transportation in our key areas and

actively managing transportation shortfalls at affected locations. We had on average roughly 5 MMcfe/day of natural gas production temporarily curtailed during the quarter due to these

restrictions. We anticipate the curtailment of transportation services to ease somewhat before the end of the year, however, the issue may persist into 2016 as further NGTL safety inspections

are required.

Our

overall realized sales price for natural gas fell by 19% compared to the previous quarter to average $2.09/Mcf. This is in line with the combination of weaker NYMEX pricing and continued weakness

in the Marcellus producing region. While the average of spot market prices in Northeast Pennsylvania at the Transco Leidy and TGP Zone 4 Marcellus were roughly unchanged from the first quarter,

outside of the northeast Pennsylvania producing region prices at Dominion South Point fell by 24% to average US$1.40/Mcf in the quarter. With approximately 37% of our Marcellus production tied to

markets outside the northeast Pennsylvania producing region that all realized wider differentials to NYMEX versus the previous quarter, our overall realized discount to NYMEX for our Marcellus

production widened by 5% or US$0.07/Mcf versus the first quarter to average US$1.39/Mcf.

Foreign

Exchange

The Canadian dollar strengthened during the second quarter, increasing a modest 2% as a result of higher crude oil prices. Subsequent to the quarter, we saw the

Canadian dollar fall to a six year low USD/CDN exchange rate of 1.30 following the Bank of Canada's decision to cut interest rates by 25 basis points and lower their forecasted economic

growth for 2015. The majority of our oil and natural gas sales are based on U.S. dollar denominated indices and therefore a weaker Canadian dollar relative to the U.S. dollar increases

the amount of our realized sales. Because we report in Canadian dollars, the weaker Canadian dollar also increases our U.S. dollar denominated operating costs, capital spending and the

principal and interest on our U.S. dollar denominated senior notes.

10 ENERPLUS 2015 Q2

REPORT

Price Risk Management

We have a price risk management program that considers our overall financial position, the economics of our capital program and potential acquisitions. We

continued to add to our commodity hedge position in both 2015 and 2016 as a result of the modest improvement in crude oil prices during the quarter along with our decision to accelerate the

completions of eight additional North Dakota wells. For the second half of 2015 we have an average of 11,250 bbls/day of crude oil (approximately 35% of our expected crude oil production, net

of royalties) hedged at an average floor price of US$84.58/bbl through a combination of swaps and three-way collar structures. In 2016 we have an average of 11,000 bbls/day of crude oil

(approximately 34% of our expected crude oil production, net of royalties) hedged at an average floor price of US$64.35/bbl through a combination of swaps and three-way collar structures.

We

continued to add to our NYMEX gas hedging program for 2015 and began hedging our 2016 gas production during the quarter. In the second half of 2015 we are swapped on an average of

128,370 Mcf/day (approximately 47% of our forecasted natural gas production, net of royalties) at an average price of US$3.82/Mcf. In 2016 we have 25,000 Mcf/day (approximately 9% of our

forecasted natural gas production, net of royalties) hedged through three-way collars with an average floor price of US$3.00/Mcf.

The

following is a summary of our financial contracts in place at July 22, 2015 expressed as a percentage of our anticipated net production volumes:

| |

|

WTI Crude Oil (US$/bbl)(1)

|

|

NYMEX Natural Gas (US$/Mcf)(1)

|

|

| |

|

|

Jul 1,

2015 –

Sept 30,

2015 |

|

|

Oct 1,

2015 –

Dec 31,

2015 |

|

|

Jan 1,

2016 –

Jun 30,

2016 |

|

|

Jul 1,

2016 –

Dec 31,

2016 |

|

|

Jul 1,

2015 –

Sept 30,

2015 |

|

|

Oct 1,

2015 –

Oct 31,

2015 |

|

|

Nov 1,

2015 –

Dec 31,

2015 |

|

|

Jan 1,

2016 –

Dec 31,

2016 |

|

|

| Downside Protection – Swaps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sold Swaps |

|

$ |

93.86 |

|

$ |

82.10 |

|

$ |

64.28 |

|

|

– |

|

$ |

3.73 |

|

$ |

3.85 |

|

$ |

4.04 |

|

|

– |

|

| % |

|

|

25% |

|

|

39% |

|

|

9% |

|

|

– |

|

|

57% |

|

|

42% |

|

|

35% |

|

|

– |

|

Downside Protection – Collars |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sold Puts |

|

|

– |

|

$ |

48.00 |

|

$ |

50.13 |

|

$ |

49.34 |

|

|

– |

|

|

– |

|

|

– |

|

$ |

2.50 |

|

| % |

|

|

– |

|

|

6% |

|

|

25% |

|

|

34% |

|

|

– |

|

|

– |

|

|

– |

|

|

9% |

|

| Purchased Puts |

|

|

– |

|

$ |

63.00 |

|

$ |

64.38 |

|

$ |

64.35 |

|

|

– |

|

|

– |

|

|

– |

|

$ |

3.00 |

|

| % |

|

|

– |

|

|

6% |

|

|

25% |

|

|

34% |

|

|

– |

|

|

– |

|

|

– |

|

|

9% |

|

| Sold Calls |

|

|

– |

|

$ |

70.00 |

|

$ |

79.38 |

|

$ |

80.09 |

|

|

– |

|

|

– |

|

|

– |

|

$ |

3.75 |

|

| % |

|

|

– |

|

|

6% |

|

|

25% |

|

|

34% |

|

|

– |

|

|

– |

|

|

– |

|

|

9% |

|

Upside Participation Collars |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sold Puts |

|

$ |

62.23 |

|

$ |

62.23 |

|

|

– |

|

|

– |

|

$ |

3.25 |

|

$ |

3.25 |

|

$ |

3.25 |

|

|

– |

|

| % |

|

|

13% |

|

|

13% |

|

|

– |

|

|

– |

|

|

2% |

|

|

2% |

|

|

2% |

|

|

– |

|

| Purchased Calls |

|

$ |

93.00 |

|

$ |

93.00 |

|

|

– |

|

|

– |

|

$ |

4.29 |

|

$ |

4.29 |

|

$ |

4.29 |

|

|

– |

|

| % |

|

|

13% |

|

|

13% |

|

|

– |

|

|

– |

|

|

2% |

|

|

2% |

|

|

2% |

|

|

– |

|

| Sold Calls |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

$ |

5.00 |

|

$ |

5.00 |

|

$ |

5.00 |

|

|

– |

|

| % |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

2% |

|

|

2% |

|

|

2% |

|

|

– |

|

|

- (1)

- Based

on weighted average price (before premiums), assumed average annual production of 100,000 – 104,000 BOE/day for 2015 and 2016, less

royalties and production taxes of 21.0% in aggregate.

We have also entered into WCS and MSW differential swap positions to manage our exposure to Canadian crude oil differentials. At July 22, 2015, we

have 4,000 bbls/day of WCS swapped at US$(16.61)/bbl and 1,000 bbls/day of MSW swapped at US$(3.50)/bbl in the second half of 2015 and 2,000 bbls/day of WCS swapped at

US$(14.50)/bbl in 2016.

We

have physically hedged a portion of our exposure to AECO differentials versus NYMEX prices through to October 2019. These basis transactions are intended to protect against weakening natural

gas prices in Alberta as increased production from the Marcellus is expected to flow into Ontario and the U.S. Midwest over the coming years. There is also a risk of weaker AECO prices as a

result of continued growth in natural gas production in advance of potential Canadian west coast liquefied natural gas exports.

ENERPLUS 2015 Q2

REPORT 11

The

following table provides a summary of the physical AECO-NYMEX basis contracts we have in place at July 22, 2015:

| |

|

MMcf/day |

|

|

US$/Mcf |

|

|

|

| Jul 1, 2015 – Oct 31, 2015 |

|

60.0 |

|

$ |

(0.65 |

) |

|

| AECO-NYMEX Basis |

|

|

|

|

|

|

|

Nov 1, 2015 – Oct 31, 2016 |

|

60.0 |

|

$ |

(0.67 |

) |

|

| AECO-NYMEX Basis |

|

|

|

|

|

|

|

Nov 1, 2016 – Oct 31, 2017 |

|

80.0 |

|

$ |

(0.65 |

) |

|

| AECO-NYMEX Basis |

|

|

|

|

|

|

|

Nov 1, 2017 – Oct 31, 2018 |

|

80.0 |

|

$ |

(0.65 |

) |

|

| AECO-NYMEX Basis |

|

|

|

|

|

|

|

Nov 1, 2018 – Oct 31, 2019 |

|

80.0 |

|

$ |

(0.64 |

) |

|

| AECO-NYMEX Basis |

|

|

|

|

|

|

|

|

In 2014 we entered into foreign exchange collars on US$24 million per month to hedge a floor exchange rate on a portion of our U.S. dollar

denominated oil and natural gas sales with upside participation in the event the Canadian dollar weakened. During the second quarter of 2015 we entered into U.S. dollar forward exchange

contracts on US$6 million per month at an exchange rate of USD/CDN 1.20 to partially mitigate our losses on these collars. As of July 22, 2015, we effectively have

US$18 million per month hedged for 2015 at an average USD/CDN floor of 1.1088, a ceiling of 1.1845 and a conditional ceiling of 1.1263. Under these contracts, if the monthly foreign exchange

rate settles above the ceiling rate the conditional celling is used to determine the settlement amount.

ACCOUNTING

FOR PRICE RISK MANAGEMENT

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

Commodity Risk Management Gains/(Losses)

($ millions) |

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

| Cash gains/(losses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Crude oil |

|

$ |

56.7 |

|

|

|

$ |

(21.2 |

) |

|

|

$ |

127.2 |

|

|

|

$ |

(32.0 |

) |

|

| |

Natural gas |

|

|

16.4 |

|

|

|

|

(3.3 |

) |

|

|

|

32.7 |

|

|

|

|

(7.9 |

) |

|

|

|

|

|

|

|

|

| Total cash gains/(losses) |

|

$ |

73.1 |

|

|

|

$ |

(24.5 |

) |

|

|

$ |

159.9 |

|

|

|

$ |

(39.9 |

) |

|

Non-cash gains/(losses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Change in fair value – crude oil |

|

$ |

(71.1 |

) |

|

|

$ |

(24.8 |

) |

|

|

$ |

(107.1 |

) |

|

|

$ |

(34.2 |

) |

|

| |

Change in fair value – natural gas |

|

|

(21.8 |

) |

|

|

|

5.3 |

|

|

|

|

(22.2 |

) |

|

|

|

(2.6 |

) |

|

|

|

|

|

|

|

|

| Total non-cash gains/(losses) |

|

$ |

(92.9 |

) |

|

|

$ |

(19.5 |

) |

|

|

$ |

(129.3 |

) |

|

|

$ |

(36.8 |

) |

|

|

|

|

|

|

|

|

| Total gains/(losses) |

|

$ |

(19.8 |

) |

|

|

$ |

(44.0 |

) |

|

|

$ |

30.6 |

|

|

|

$ |

(76.7 |

) |

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

| (Per BOE) |

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

| Total cash gains/(losses) |

|

$ |

7.47 |

|

|

|

$ |

(2.60 |

) |

|

|

$ |

8.48 |

|

|

|

$ |

(2.17 |

) |

|

| Total non-cash gains/(losses) |

|

|

(9.49 |

) |

|

|

|

(2.06 |

) |

|

|

|

(6.85 |

) |

|

|

|

(2.01 |

) |

|

|

|

|

|

|

|

|

| Total gains/(losses) |

|

$ |

(2.02 |

) |

|

|

$ |

(4.66 |

) |

|

|

$ |

1.63 |

|

|

|

$ |

(4.18 |

) |

|

|

|

|

|

|

|

|

During the second quarter of 2015 we realized cash gains of $56.7 million on our crude oil contracts and $16.4 million on our natural gas

contracts. In comparison, during the second quarter of 2014 we realized cash losses of $21.2 million on our crude oil contracts and $3.3 million on our natural gas contracts. The cash

gains in 2015 were due to contracts which provided floor protection above market prices, while cash losses in 2014 were a result of prices rising above our fixed price swap positions.

As

the forward markets for crude oil and natural gas fluctuate and new contracts are executed and existing contracts are realized, changes in fair value are reflected as either a non-cash charge or

gain to earnings. At the end of the second quarter of 2015 the fair value of our crude oil and

12 ENERPLUS 2015 Q2

REPORT

natural

gas contracts represented net gain positions of $60.1 million and $27.1 million, respectively. For the three and six months ended June 30, 2015 the change in the

fair value of our crude oil contracts represented losses of $71.1 million and $107.1 million, respectively, and our natural gas contracts represented losses of $21.8 million and

$22.2 million, respectively.

During

the three and six months ended June 30, 2015 we recorded total cash losses on our foreign exchange collars of $7.1 million and $15.7 million, respectively. At

June 30, 2015 the fair value of foreign exchange derivatives was a net loss of $12.5 million. See Note 15 for further information.

Revenues

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

| ($ millions) |

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

| Oil and natural gas |

|

$ |

298.4 |

|

|

|

$ |

504.5 |

|

|

|

$ |

542.5 |

|

|

|

$ |

999.6 |

|

|

| Royalties |

|

|

(46.7 |

) |

|

|

|

(89.6 |

) |

|

|

|

(85.8 |

) |

|

|

|

(176.9 |

) |

|

|

|

|

|

|

|

|

| Oil and natural gas sales, net of royalties |

|

$ |

251.7 |

|

|

|

$ |

414.9 |

|

|

|

$ |

456.7 |

|

|

|

$ |

822.7 |

|

|

|

|

|

|

|

|

|

Oil and natural gas revenues for the three and six months ended June 30, 2015 were $298.4 million and $542.5 million, respectively,

compared to $504.5 million and $999.6 million for the same periods in 2014. The decrease in revenue was driven by the weak commodity price environment, which saw benchmark prices decline

between 40% and 48% in the first half of 2015 compared to the same period in 2014.

Royalties and Production Taxes

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

| ($ millions, except per BOE amounts) |

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

|

|

|

|

| Royalties |

|

$ |

46.7 |

|

|

$ |

89.6 |

|

|

$ |

85.8 |

|

|

$ |

176.9 |

|

| Per BOE |

|

$ |

4.78 |

|

|

$ |

9.47 |

|

|

$ |

4.55 |

|

|

$ |

9.64 |

|

Production taxes |

|

$ |

14.2 |

|

|

$ |

20.0 |

|

|

$ |

25.0 |

|

|

$ |

39.8 |

|

| Per BOE |

|

$ |

1.45 |

|

|

$ |

2.11 |

|

|

$ |

1.33 |

|

|

$ |

2.17 |

|

|

|

|

|

|

|

|

| Royalties and production taxes |

|

$ |

60.9 |

|

|

$ |

109.6 |

|

|

$ |

110.8 |

|

|

$ |

216.7 |

|

| Per BOE |

|

$ |

6.23 |

|

|

$ |

11.58 |

|

|

$ |

5.88 |

|

|

$ |

11.81 |

|

Royalties and production taxes

(% of oil and natural gas sales, before transportation) |

|

|

20% |

|

|

|

22% |

|

|

|

20% |

|

|

|

22% |

|

|

|

|

|

|

|

|

Royalties are paid to government entities, land owners and mineral rights owners. Production taxes include state production taxes, Pennsylvania impact fees,

freehold mineral taxes and Saskatchewan resource surcharges. During the three and six months ended June 30, 2015 royalties and production taxes decreased to $60.9 million and

$110.8 million, respectively, from $109.6 million and $216.7 million for the same periods in 2014, primarily due to lower realized prices. Royalties and production taxes averaged

20% of oil and natural gas sales before transportation in the first half of 2015 compared to 22% for the same period in 2014.

We

continue to expect an average royalty and production tax rate of 21% in 2015.

Operating Expenses

| |

|

Three months ended June 30,

|

|

Six months ended June 30,

|

| ($ millions, except per BOE amounts) |

|

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

|

|

|

|