Fastly, Inc. (NYSE: FSLY), a leader in global edge cloud

platforms, today announced that on December 2, 2024, it entered

into separate, privately negotiated subscription agreements

pursuant to which Fastly will issue (the “Issuance”) $150.0 million

aggregate principal amount of its 7.75% convertible senior notes

due 2028 (the “2028 Notes”). Fastly estimates that the gross

proceeds from the Issuance will be $150.0 million. Fastly intends

to use $150.0 million of the gross proceeds from the Issuance to

repurchase approximately $157.9 million aggregate principal amount

of its existing 0.00% Convertible Senior Notes due 2026 (the

“Existing Convertible Notes”). Additionally, on December 2, 2024,

Fastly entered into separate, privately negotiated repurchase

agreements with a limited number of holders of its Existing

Convertible Notes to repurchase (the “Repurchases” and together

with the Issuance, the “Transactions”) approximately $157.9 million

aggregate principal amount of the Existing Convertible Notes for

aggregate cash consideration of $150.0 million. The Transactions

are expected to settle on or about December 5, 2024, subject to

customary closing conditions.

Upon completion of the Transactions, the aggregate principal

amount of the Existing Convertible Notes outstanding will be

approximately $188.6 million, and the aggregate principal amount of

the 2028 Notes outstanding will be $150.0 million.

The 2028 Notes will be senior, unsecured obligations of Fastly

and will accrue interest at a rate of 7.75% per annum, payable

semi-annually in arrears on June 1 and December 1 of each year,

beginning on June 1, 2025. The 2028 Notes will mature on June 1,

2028, unless earlier converted or repurchased.

The 2028 Notes will be convertible at the option of the

noteholders in certain circumstances. Upon conversion, Fastly will

pay or deliver, as the case may be, cash, shares of Fastly’s Class

A common stock (the “common stock”) or a combination of cash and

shares of common stock, at its election. The initial conversion

rate is 50.6586 shares of common stock per $1,000 principal amount

of 2028 Notes (equivalent to an initial conversion price of

approximately $19.74 per share of common stock, which represents a

conversion premium of approximately 100% to the last reported sale

price of the common stock on The New York Stock Exchange on

December 2, 2024), and will be subject to customary anti-dilution

adjustments.

The 2028 Notes will not be redeemable by Fastly prior to the

maturity date, and no “sinking fund” will be provided for the 2028

Notes.

If Fastly undergoes a “fundamental change” (as defined in the

indenture for the 2028 Notes), subject to certain conditions and

limited exceptions, noteholders may require Fastly to repurchase

for cash all or any portion of their notes at a repurchase price

equal to 100% of the principal amount of the 2028 Notes to be

repurchased, plus accrued and unpaid interest, if any, to, but

excluding, the fundamental change repurchase date. In addition,

following certain corporate events that occur prior to the maturity

date of the 2028 Notes, Fastly will, in certain circumstances,

increase the conversion rate of the notes for a noteholder who

elects to convert its notes in connection with such a corporate

event.

Fastly expects that some or all of the holders of the Existing

Convertible Notes that are repurchased by Fastly in the Repurchases

may purchase shares of Fastly’s common stock in open market

transactions or enter into or unwind various derivatives with

respect to Fastly’s common stock to unwind hedge positions that

they have with respect to their investments in the Existing

Convertible Notes. Fastly also expects that some or all holders of

the 2028 Notes may sell shares of Fastly’s common stock in open

market transactions or enter into various derivatives with respect

to Fastly’s common stock to hedge their investments in the 2028

Notes. These transactions may cause or avoid an increase or

decrease in the market price of Fastly’s common stock, and the

effect of which may be material.

In connection with the Transactions, Fastly has been advised

that J. Wood Capital Advisors LLC (“JWCA”), Fastly’s financial

advisor with respect to the Transactions, intends to purchase

approximately 1.3 million shares of Fastly’s common stock

concurrently with the Transactions in privately negotiated

transactions from certain purchasers of the 2028 Notes through a

financial intermediary at a discount to the last reported sale

price of Fastly’s common stock on December 2, 2024. JWCA has also

agreed not to sell such shares of common stock for 60 days. Such

concurrent purchases by JWCA of Fastly’s common stock could

increase (or reduce the size of any decrease in) the market price

of Fastly’s common stock or the 2028 Notes.

The Issuance and any common stock issuable upon conversion of

the 2028 Notes have not been, and will not be, registered under the

Securities Act of 1933, as amended (the “Securities Act”), or any

other securities laws, and the 2028 Notes and any such common stock

cannot be offered or sold except pursuant to an exemption from, or

in a transaction not subject to, the registration requirements of

the Securities Act and any other applicable securities laws. This

press release does not constitute an offer to sell, or the

solicitation of an offer to buy, the Existing Convertible Notes,

the 2028 Notes or any common stock issuable upon conversion of the

2028 Notes, nor will there be any sale of the 2028 Notes or any

such common stock, in any state or other jurisdiction in which such

offer, sale or solicitation would be unlawful.

About Fastly, Inc.

Fastly’s powerful and programmable edge cloud platform helps the

world’s top brands deliver online experiences that are fast, safe,

and engaging through edge compute, delivery, security, and

observability offerings that improve site performance, enhance

security, and empower innovation at global scale. Compared to other

providers, Fastly’s powerful, high-performance, and modern platform

architecture empowers developers to deliver secure websites and

apps with rapid time-to-market and demonstrated, industry-leading

cost savings. Organizations around the world trust Fastly to help

them upgrade the internet experience, including Reddit, Neiman

Marcus, Universal Music Group, and SeatGeek.

Forward-Looking Statements

This press release contains “forward-looking” statements that

are based on our beliefs and assumptions and on information

currently available to us on the date of this press release.

Forward-looking statements may involve known and unknown risks,

uncertainties, and other factors that may cause our actual results,

performance, or achievements to be materially different from those

expressed or implied by the forward-looking statements. These

statements include, but are not limited to, statements related to

the 2028 Notes to be issued and the Existing Convertible Notes to

be repurchased, the completion, timing and size of the Issuance

and/or the Repurchases, the impact of the Issuance and/or the

Repurchases on the market price of the common stock, and JWCA’s

expected purchase of Fastly’s common stock and the effects of such

purchase. Among the factors that could cause actual results to

differ materially from those indicated in the forward-looking

statements are the satisfaction of the closing conditions related

to the Issuance and/or the Repurchases and market conditions.

Except as required by law, we assume no obligation to update these

forward-looking statements publicly or to update the reasons actual

results could differ materially from those anticipated in the

forward-looking statements, even if new information becomes

available in the future. Important factors that could cause our

actual results to differ materially are detailed from time to time

in the reports Fastly files with the Securities and Exchange

Commission (“SEC”), including without limitation Fastly’s Annual

Report on Form 10-K for the year ended December 31, 2023 and our

Quarterly Reports on Form 10-Q for the quarters ended June 30, 2024

and September 30, 2024. Copies of reports filed with the SEC are

posted on Fastly’s website and are available from Fastly without

charge.

Source: Fastly, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202598767/en/

Investor Contact Vernon Essi, Jr. ir@fastly.com Media Contact

Spring Harris press@fastly.com

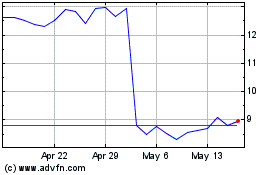

Fastly (NYSE:FSLY)

Historical Stock Chart

From Nov 2024 to Dec 2024

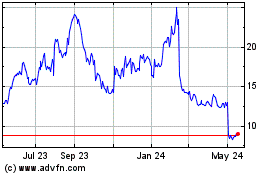

Fastly (NYSE:FSLY)

Historical Stock Chart

From Dec 2023 to Dec 2024