0000040211false00000402112024-10-222024-10-220000040211exch:XCHI2024-10-222024-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 22, 2024

GATX Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| New York | | 1-2328 | | 36-1124040 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

233 South Wacker Drive

Chicago, Illinois 60606-7147

(Address of principal executive offices, including zip code)

(312) 621-6200

(Registrant’s telephone number, including area code)

__________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock | GATX | New York Stock Exchange |

| | Chicago Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

The following information is furnished pursuant to Item 2.02, "Results of Operations and Financial Condition" and Item 7.01, "Regulation FD Disclosure" and shall not be deemed "filed" for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

On October 22, 2024, GATX Corporation ("GATX") issued a press release that included unaudited financial statements and supplemental financial information for the quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

GATX will host a teleconference to discuss its 2024 third quarter financial results on October 22, 2024, beginning at 11:00 a.m. Eastern Time. Investors may access the conference by dialing 1-800-715-9871 (or 1-646-307-1963 if dialing from outside the United States).

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

|

| GATX CORPORATION |

| (Registrant) |

|

| /s/ Thomas A. Ellman |

| Thomas A. Ellman |

| Executive Vice President and Chief Financial Officer |

October 22, 2024

Exhibit 99.1

NEWS RELEASE

FOR IMMEDIATE RELEASE

GATX CORPORATION REPORTS 2024 THIRD-QUARTER RESULTS

•Demand for railcars across GATX's global fleets remains strong; Rail North America’s fleet utilization remains above 99%

•Aircraft spare engine portfolio continues strong performance

•Investment volume was $504.5 million in the third quarter and totaled over $1.3 billion year to date

•Company updates 2024 full-year earnings guidance to $7.50 – 7.70 per diluted share

CHICAGO, Oct. 22, 2024—GATX Corporation (NYSE: GATX) today reported 2024 third-quarter net income of $89.0 million, or $2.43 per diluted share, compared to net income of $52.5 million, or $1.44 per diluted share, in the third quarter of 2023. The 2024 third-quarter results include a net negative impact of $2.5 million, or $0.07 per diluted share, from Tax Adjustments and Other Items.

Net income for the first nine months of 2024 was $207.7 million, or $5.68 per diluted share, compared to $193.2 million, or $5.30 per diluted share, in the prior year period. The 2024 year-to-date results include a net negative impact of $9.9 million, or $0.27 per diluted share, from Tax Adjustments and Other Items. The 2023 year-to-date results include a net negative impact of $1.1 million, or $0.03 per diluted share, from Tax Adjustments and Other Items. Details related to these items are provided in the attached Supplemental Information under Impact of Tax Adjustments and Other Items.

"Operating conditions across our global markets remain consistent with our expectations coming into the year," said Robert C. Lyons, president and chief executive officer of GATX. "Our commercial and operations teams at Rail North America continue to execute at a high level. GATX Rail North America's fleet utilization was 99.3% at the end of the third quarter and the renewal success rate was over 80%. The renewal lease rate change of GATX’s Lease Price Index was a positive 26.6% with an average renewal term of 59 months.

"At Rail North America, we capitalized on an active secondary railcar market and generated third-quarter remarketing income of over $43 million, bringing year-to-date remarketing income to over $96 million. Furthermore, we identified opportunities to grow our asset base during the quarter, acquiring over 1,000 railcars in addition to those acquired under our supply agreement.

"Rail International performed well as we continue to take delivery of new railcars in Europe and India. GATX Rail Europe's fleet utilization was 95.9% at the end of the quarter. GATX Rail India, where fleet utilization remained at 100%, continues to experience very strong demand for railcars and sees substantial opportunities for new railcar investments.

"In Engine Leasing, third-quarter results were driven by excellent performance at the Rolls-Royce and Partners Finance affiliates, as demand for aircraft spare engines remains robust. We continued to identify attractive opportunities to increase our investment in engines, both directly and through RRPF affiliates. In the third quarter, we added four engines to our wholly owned portfolio for $94.8 million."

Mr. Lyons concluded, "Based on current market conditions and our year-to-date performance, we expect 2024 full-year earnings to be in the range of $7.50–$7.70 per diluted share. This guidance excludes the impact of Tax Benefits and Other Items."

RAIL NORTH AMERICA

Rail North America reported segment profit of $102.4 million in the third quarter of 2024, compared to $66.1 million in the third quarter of 2023. Higher 2024 third-quarter segment profit was driven by higher gains on asset dispositions and higher lease revenue. Year to date 2024, Rail North America reported segment profit of $271.5 million, compared to $240.6 million in the same period of 2023. Higher 2024 year-to-date segment profit was predominately driven by higher lease revenue, partially offset by higher interest expense.

As of Sept. 30, 2024, Rail North America’s wholly owned fleet was composed of over 111,000 cars, including approximately 9,000 boxcars. The following fleet statistics and performance discussion exclude the boxcar fleet.

Fleet utilization was 99.3% at the end of the third quarter of 2024, consistent with the end of the prior quarter and the end of the third quarter of 2023. During the third quarter of 2024, the renewal lease rate change of the LPI was positive 26.6%. This compares to positive 29.4% in the prior quarter and positive 33.4% in the third quarter of 2023. The average lease renewal term for all cars included in the LPI during the third quarter of 2024 was 59 months, compared to 61 months in the prior quarter and 65 months in the third quarter of 2023. The 2024 third-quarter renewal success rate was 82.0%, compared to 84.1% in the prior quarter and 83.6% in the third quarter of 2023. Rail North America’s investment volume during the third quarter of 2024 was $325.9 million.

Additional fleet statistics, including information on the boxcar fleet, and macroeconomic data related to Rail North America’s business are provided on the last page of this press release.

RAIL INTERNATIONAL

Rail International’s segment profit was $33.9 million in the third quarter of 2024, compared to $28.2 million in the third quarter of 2023. Year to date 2024, Rail International reported segment profit of $89.2 million, compared to $79.0 million in the same period of 2023. The 2023 year-to-date results include a net positive impact of $0.3 million from Tax Adjustments and Other Items. Additional details are provided in the attached Supplemental Information under Tax Adjustments and Other Items. Excluding the impact of these items, higher 2024 third-quarter and year-to-date segment profit was driven by more railcars on lease and higher lease rates.

As of Sept. 30, 2024, GATX Rail Europe’s (GRE) fleet consisted of nearly 30,000 cars. 2024 third-quarter fleet utilization was 95.9%, compared to 95.8% at the end of the prior quarter and 96.0% at the end of the third quarter of 2023.

As of Sept. 30, 2024, Rail India's fleet consisted of over 10,300 railcars. 2024 third-quarter fleet utilization was 100%, consistent with the end of the prior quarter and the end of the third quarter of 2023.

Additional fleet statistics for GRE and Rail India are provided on the last page of this press release.

ENGINE LEASING

Engine Leasing reported segment profit of $37.5 million in the third quarter of 2024, compared to segment profit of $20.2 million in the third quarter of 2023. Year to date 2024, segment profit was $81.6 million, compared to segment profit of $75.1 million in the same period of 2023.

2024 and 2023 year-to-date results include a net positive impact of $0.6 million and a net negative impact of $1.4 million, respectively, from Tax Adjustments and Other Items. Additional details are provided in the attached Supplemental Information under Tax Adjustments and Other Items.

Excluding these impacts, higher 2024 third-quarter and year-to-date segment profit was predominately driven by strong performance at the Rolls-Royce and Partners Finance (RRPF) affiliates. Earnings from GATX Engine Leasing, our wholly owned portfolio, were also higher in the comparative periods due to more engines under ownership.

COMPANY DESCRIPTION

At GATX Corporation (NYSE: GATX), we empower our customers to propel the world forward. GATX leases transportation assets including railcars, aircraft spare engines and tank containers to customers worldwide. Our mission is to provide innovative, unparalleled service that enables our customers to transport what matters safely and sustainably while championing the well-being of our employees and communities. Headquartered in Chicago, Illinois since its founding in 1898, GATX has paid a quarterly dividend, uninterrupted, since 1919.

TELECONFERENCE INFORMATION

GATX Corporation will host a teleconference to discuss 2024 third-quarter results. Call details are as follows:

Tuesday, Oct. 22, 2024

11 a.m. Eastern Time

Domestic Dial-In: 1-800-715-9871

International Dial-In: 1-646-307-1963

Replay: 1-800-770-2030 or 1-609-800-9909 / Access Code: 5389470

Call-in details, a copy of this press release and real-time audio access are available at www.gatx.com. Please access the call 15 minutes prior to the start time. A replay will be available on the same site starting at 2 p.m. (Eastern Time), Oct. 22, 2024.

AVAILABILITY OF INFORMATION ON GATX'S WEBSITE

Investors and others should note that GATX routinely announces material information to investors and the marketplace using SEC filings, press releases, public conference calls, webcasts and the GATX Investor Relations website. While not all of the information that the Company posts to the GATX Investor Relations website is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media and others interested in GATX to review the information that it shares on www.gatx.com under the “Investors” tab.

FORWARD-LOOKING STATEMENTS

Statements in this Earnings Release not based on historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and, accordingly, involve known and unknown risks and uncertainties that are difficult to predict and could cause our actual results, performance, or achievements to differ materially from those discussed. These include statements as to our future expectations, beliefs, plans, strategies, objectives, events, conditions, financial performance, prospects, or future events. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “outlook,” “continue,” “likely,” “will,” “would,” and similar words and phrases. Forward-looking statements are necessarily based on estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Accordingly, you should not place undue reliance on forward-looking statements, which speak only as of the date they are made, and are not guarantees of future performance. We do not undertake any obligation to publicly update or revise these forward-looking statements.

The following factors, in addition to those discussed under "Risk Factors" and elsewhere in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2023, and any subsequent reports on Form 10-Q, could cause actual results to differ materially from our current expectations expressed in forward-looking statements:

| | | | | | | | |

•a significant decline in customer demand for our transportation assets or services, including as a result of: ◦prolonged inflation or deflation ◦high interest rates ◦weak macroeconomic conditions and world trade policies ◦weak market conditions in our customers' businesses ◦adverse changes in the price of, or demand for, commodities ◦changes in railroad operations, efficiency, pricing and service offerings, including those related to "precision scheduled railroading" or labor strikes or shortages ◦changes in, or disruptions to, supply chains ◦availability of pipelines, trucks, and other alternative modes of transportation ◦changes in conditions affecting the aviation industry, including global conflicts, geographic exposure and customer concentrations ◦customers' desire to buy, rather than lease, our transportation assets ◦other operational or commercial needs or decisions of our customers •inability to maintain our transportation assets on lease at satisfactory rates due to oversupply of assets in the market or other changes in supply and demand •competitive factors in our primary markets, including competitors with significantly lower costs of capital •higher costs associated with increased assignments of our transportation assets following non-renewal of leases, customer defaults, and compliance maintenance programs or other maintenance initiatives •events having an adverse impact on assets, customers, or regions where we have a concentrated investment exposure •financial and operational risks associated with long-term purchase commitments for transportation assets •reduced opportunities to generate asset remarketing income •inability to successfully consummate and manage ongoing acquisition and divestiture activities •reliance on Rolls-Royce in connection with our aircraft spare engine leasing businesses, and the risks that certain factors that adversely affect Rolls-Royce could have an adverse effect on our businesses •potential obsolescence of our assets | |

•risks related to our international operations and expansion into new geographic markets, including laws, regulations, tariffs, taxes, treaties or trade barriers affecting our activities in the countries where we do business •failure to successfully negotiate collective bargaining agreements with the unions representing a substantial portion of our employees •inability to attract, retain, and motivate qualified personnel, including key management personnel •inability to maintain and secure our information technology infrastructure from cybersecurity threats and related disruption of our business •exposure to damages, fines, criminal and civil penalties, and reputational harm arising from a negative outcome in litigation, including claims arising from an accident involving transportation assets •changes in, or failure to comply with, laws, rules, and regulations •environmental liabilities and remediation costs •operational, functional and regulatory risks associated with climate change, severe weather events and natural disasters, and other environmental, social and governance matters •U.S. and global political conditions and the impact of increased geopolitical tension and wars, including the ongoing war between Russia and Ukraine and resulting sanctions and countermeasures, on domestic and global economic conditions in general, including supply chain challenges and disruptions •prolonged inflation or deflation •fluctuations in foreign exchange rates •deterioration of conditions in the capital markets, reductions in our credit ratings, or increases in our financing costs •the emergence of new variants of COVID-19 or the occurrence of another widespread health crisis and the impact of measures taken in response •inability to obtain cost-effective insurance •changes in assumptions, increases in funding requirements or investment losses in our pension and post-retirement plans •inadequate allowances to cover credit losses in our portfolio •asset impairment charges we may be required to recognize •inability to maintain effective internal control over financial reporting and disclosure controls and procedures |

FOR FURTHER INFORMATION CONTACT:

GATX Corporation

Shari Hellerman

Senior Director, Investor Relations, ESG, and External Communications

312-621-4285

shari.hellerman@gatx.com

(10/22/2024)

GATX CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| 2024 | | 2023 | | 2024 | | 2023 |

Revenues | | | | | | | |

Lease revenue | $ | 351.7 | | | $ | 317.2 | | | $ | 1,024.6 | | | $ | 927.8 | |

Non-dedicated engine revenue | 18.1 | | | 13.6 | | | 45.0 | | | 24.5 | |

Marine operating revenue | — | | | 0.6 | | | — | | | 6.1 | |

Other revenue | 35.6 | | | 28.7 | | | 102.4 | | | 83.8 | |

Total Revenues | 405.4 | | | 360.1 | | | 1,172.0 | | | 1,042.2 | |

Expenses | | | | | | | |

Maintenance expense | 95.9 | | | 87.9 | | | 283.9 | | | 254.1 | |

Marine operating expense | — | | | 1.0 | | | — | | | 5.4 | |

Depreciation expense | 103.4 | | | 96.2 | | | 297.9 | | | 278.1 | |

Operating lease expense | 8.0 | | | 9.0 | | | 26.0 | | | 27.0 | |

Other operating expense | 14.1 | | | 12.0 | | | 41.5 | | | 34.0 | |

Selling, general and administrative expense | 57.2 | | | 51.0 | | | 171.7 | | | 153.4 | |

Total Expenses | 278.6 | | | 257.1 | | | 821.0 | | | 752.0 | |

Other Income (Expense) | | | | | | | |

Net gain on asset dispositions | 48.5 | | | 16.9 | | | 110.3 | | | 105.1 | |

Interest expense, net | (88.9) | | | (68.1) | | | (249.5) | | | (190.8) | |

Other (expense) income | (0.9) | | | 1.8 | | | (10.9) | | | (7.1) | |

Income before Income Taxes and Share of Affiliates’ Earnings | 85.5 | | | 53.6 | | | 200.9 | | | 197.4 | |

Income taxes | (22.9) | | | (14.5) | | | (51.9) | | | (52.3) | |

Share of affiliates’ earnings, net of taxes | 26.4 | | | 13.4 | | | 58.7 | | | 48.1 | |

Net Income | $ | 89.0 | | | $ | 52.5 | | | $ | 207.7 | | | $ | 193.2 | |

| | | | | | | |

Share Data | | | | | | | |

Basic earnings per share | $ | 2.44 | | | $ | 1.44 | | | $ | 5.70 | | | $ | 5.32 | |

Average number of common shares | 35.8 | | | 35.7 | | | 35.8 | | | 35.6 | |

| | | | | | | |

Diluted earnings per share | $ | 2.43 | | | $ | 1.44 | | | $ | 5.68 | | | $ | 5.30 | |

Average number of common shares and common share equivalents | 35.9 | | | 35.8 | | | 35.9 | | | 35.7 | |

| | | | | | | |

Dividends declared per common share | $ | 0.58 | | | $ | 0.55 | | | $ | 1.74 | | | $ | 1.65 | |

GATX CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(In millions)

| | | | | | | | | | | |

| September 30 | | December 31 |

| 2024 | | 2023 |

Assets | | | |

Cash and Cash Equivalents | $ | 503.7 | | | $ | 450.7 | |

Restricted Cash | 0.1 | | | 0.1 | |

| | | |

Receivables | | | |

Rent and other receivables | 93.9 | | | 87.9 | |

| | | |

Finance leases (as lessor) | 124.8 | | | 136.4 | |

Less: allowance for losses | (5.3) | | | (5.9) | |

| 213.4 | | | 218.4 | |

| | | |

Operating Assets and Facilities | 14,243.1 | | | 13,081.9 | |

Less: allowance for depreciation | (3,866.7) | | | (3,670.7) | |

| 10,376.4 | | | 9,411.2 | |

Lease Assets (as lessee) | | | |

Right-of-use assets, net of accumulated depreciation | 173.5 | | | 212.0 | |

| | | |

| 173.5 | | | 212.0 | |

| | | |

Investments in Affiliated Companies | 690.3 | | | 627.0 | |

Goodwill | 120.9 | | | 120.0 | |

Other Assets ($0.4 and $0.8 related to assets held for sale) | 301.6 | | | 286.6 | |

| | | |

Total Assets | $ | 12,379.9 | | | $ | 11,326.0 | |

| | | |

Liabilities and Shareholders’ Equity | | | |

Accounts Payable and Accrued Expenses | $ | 210.1 | | | $ | 239.6 | |

Debt | | | |

Commercial paper and borrowings under bank credit facilities | 11.1 | | | 11.0 | |

Recourse | 8,293.5 | | | 7,388.1 | |

| 8,304.6 | | | 7,399.1 | |

Lease Obligations (as lessee) | | | |

Operating leases | 187.5 | | | 226.8 | |

| | | |

| 187.5 | | | 226.8 | |

| | | |

Deferred Income Taxes | 1,132.2 | | | 1,081.1 | |

Other Liabilities | 108.8 | | | 106.4 | |

| | | |

Total Liabilities | 9,943.2 | | | 9,053.0 | |

Total Shareholders’ Equity | 2,436.7 | | | 2,273.0 | |

Total Liabilities and Shareholders’ Equity | $ | 12,379.9 | | | $ | 11,326.0 | |

GATX CORPORATION AND SUBSIDIARIES

SEGMENT DATA (UNAUDITED)

Three Months Ended September 30, 2024

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Rail North America | |

Rail International | | Engine Leasing | | Other | | GATX Consolidated |

Revenues | | | | | | | | | |

Lease revenue | $ | 249.2 | | | $ | 86.3 | | | $ | 8.1 | | | $ | 8.1 | | | $ | 351.7 | |

Non-dedicated engine revenue | — | | | — | | | 18.1 | | | — | | | 18.1 | |

| | | | | | | | | |

Other revenue | 29.3 | | | 4.3 | | | — | | | 2.0 | | | 35.6 | |

Total Revenues | 278.5 | | | 90.6 | | | 26.2 | | | 10.1 | | | 405.4 | |

| Expenses | | | | | | | | | |

Maintenance expense | 77.7 | | | 17.0 | | | — | | | 1.2 | | | 95.9 | |

| | | | | | | | | |

Depreciation expense | 69.2 | | | 20.3 | | | 10.1 | | | 3.8 | | | 103.4 | |

Operating lease expense | 8.0 | | | — | | | — | | | — | | | 8.0 | |

Other operating expense | 7.0 | | | 3.7 | | | 2.6 | | | 0.8 | | | 14.1 | |

Total Expenses | 161.9 | | | 41.0 | | | 12.7 | | | 5.8 | | | 221.4 | |

Other Income (Expense) | | | | | | | | | |

Net gain on asset dispositions | 46.7 | | | 1.7 | | | — | | | 0.1 | | | 48.5 | |

Interest (expense) income, net | (60.2) | | | (18.5) | | | (11.3) | | | 1.1 | | | (88.9) | |

Other (expense) income | (0.8) | | | 1.1 | | | 0.1 | | | (1.3) | | | (0.9) | |

Share of affiliates' pre-tax earnings | 0.1 | | | — | | | 35.2 | | | — | | | 35.3 | |

| Segment profit | $ | 102.4 | | | $ | 33.9 | | | $ | 37.5 | | | $ | 4.2 | | | $ | 178.0 | |

Less: | | | | | | | | | |

Selling, general and administrative expense | 57.2 | |

Income taxes (includes $8.9 related to affiliates' earnings) | 31.8 | |

Net income | $ | 89.0 | |

| | | | | | | | | |

Selected Data: | | | | | | | | | |

Investment volume | $ | 325.9 | | | $ | 80.6 | | | $ | 94.8 | | | $ | 3.2 | | | $ | 504.5 | |

| | | | | | | | | |

Net Gain on Asset Dispositions | | | | | | | | | |

Asset Remarketing Income: | | | | | | | | | |

Net gains on disposition of owned assets | $ | 43.6 | | | $ | 1.2 | | | $ | — | | | $ | 0.1 | | | $ | 44.9 | |

Residual sharing income | 0.1 | | | — | | | — | | | — | | | 0.1 | |

Non-remarketing net gains (1) | 3.0 | | | 0.5 | | | — | | | — | | | 3.5 | |

| | | | | | | | | |

| $ | 46.7 | | | $ | 1.7 | | | $ | — | | | $ | 0.1 | | | $ | 48.5 | |

__________

(1) Includes net gains from scrapping of railcars.

GATX CORPORATION AND SUBSIDIARIES

SEGMENT DATA (UNAUDITED)

Three Months Ended September 30, 2023

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Rail North America | |

Rail International | | Engine Leasing | | Other | | GATX Consolidated |

Revenues | | | | | | | | | |

Lease revenue | $ | 225.2 | | | $ | 75.6 | | | $ | 8.1 | | | $ | 8.3 | | | $ | 317.2 | |

Non-dedicated engine revenue | — | | | — | | | 13.6 | | | — | | | 13.6 | |

Marine operating revenue | — | | | — | | | 0.6 | | | — | | | 0.6 | |

Other revenue | 22.7 | | | 3.6 | | | 0.1 | | | 2.3 | | | 28.7 | |

Total Revenues | 247.9 | | | 79.2 | | | 22.4 | | | 10.6 | | | 360.1 | |

| Expenses | | | | | | | | | |

Maintenance expense | 69.4 | | | 17.1 | | | — | | | 1.4 | | | 87.9 | |

Marine operating expense | — | | | — | | | 1.0 | | | — | | | 1.0 | |

Depreciation expense | 66.9 | | | 17.5 | | | 8.4 | | | 3.4 | | | 96.2 | |

Operating lease expense | 9.0 | | | — | | | — | | | — | | | 9.0 | |

Other operating expense | 6.5 | | | 2.7 | | | 2.1 | | | 0.7 | | | 12.0 | |

Total Expenses | 151.8 | | | 37.3 | | | 11.5 | | | 5.5 | | | 206.1 | |

Other Income (Expense) | | | | | | | | | |

Net gain on asset dispositions | 15.5 | | | 0.9 | | | 0.2 | | | 0.3 | | | 16.9 | |

Interest (expense) income, net | (46.6) | | | (14.5) | | | (8.7) | | | 1.7 | | | (68.1) | |

Other income (expense) | 1.2 | | | (0.1) | | | (0.2) | | | 0.9 | | | 1.8 | |

Share of affiliates' pre-tax (loss) earnings | (0.1) | | | — | | | 18.0 | | | — | | | 17.9 | |

Segment profit | $ | 66.1 | | | $ | 28.2 | | | $ | 20.2 | | | $ | 8.0 | | | $ | 122.5 | |

Less: | | | | | | | | | |

Selling, general and administrative expense | 51.0 | |

Income taxes (includes $4.5 related to affiliates' earnings) | 19.0 | |

Net income | $ | 52.5 | |

| | | | | | | | | |

Selected Data: | | | | | | | | | |

Investment volume | $ | 197.0 | | | $ | 129.6 | | | $ | 28.3 | | | $ | 9.0 | | | $ | 363.9 | |

| | | | | | | | | |

Net Gain on Asset Dispositions | | | | | | | | | |

Asset Remarketing Income: | | | | | | | | | |

Net gains on disposition of owned assets | $ | 13.0 | | | $ | — | | | $ | — | | | $ | 0.1 | | | $ | 13.1 | |

Residual sharing income | 0.1 | | | — | | | 0.2 | | | — | | | 0.3 | |

Non-remarketing net gains (1) | 2.4 | | | 0.9 | | | — | | | 0.2 | | | 3.5 | |

| | | | | | | | | |

| $ | 15.5 | | | $ | 0.9 | | | $ | 0.2 | | | $ | 0.3 | | | $ | 16.9 | |

__________

(1) Includes net gains from scrapping of railcars.

GATX CORPORATION AND SUBSIDIARIES

SEGMENT DATA (UNAUDITED)

Nine Months Ended September 30, 2024

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Rail North America | |

Rail International | | Engine Leasing | | Other | | GATX Consolidated |

Revenues | | | | | | | | | |

Lease revenue | $ | 727.8 | | | $ | 248.9 | | | $ | 24.3 | | | $ | 23.6 | | | $ | 1,024.6 | |

Non-dedicated engine revenue | — | | | — | | | 45.0 | | | — | | | 45.0 | |

| | | | | | | | | |

Other revenue | 86.1 | | | 10.6 | | | — | | | 5.7 | | | 102.4 | |

Total Revenues | 813.9 | | | 259.5 | | | 69.3 | | | 29.3 | | | 1,172.0 | |

| Expenses | | | | | | | | | |

Maintenance expense | 228.0 | | | 52.7 | | | — | | | 3.2 | | | 283.9 | |

| | | | | | | | | |

Depreciation expense | 201.1 | | | 58.6 | | | 27.1 | | | 11.1 | | | 297.9 | |

Operating lease expense | 26.0 | | | — | | | — | | | — | | | 26.0 | |

Other operating expense | 20.1 | | | 10.8 | | | 7.0 | | | 3.6 | | | 41.5 | |

Total Expenses | 475.2 | | | 122.1 | | | 34.1 | | | 17.9 | | | 649.3 | |

Other Income (Expense) | | | | | | | | | |

Net gain on asset dispositions | 105.8 | | | 3.7 | | | 0.6 | | | 0.2 | | | 110.3 | |

Interest (expense) income, net | (169.9) | | | (52.7) | | | (30.3) | | | 3.4 | | | (249.5) | |

Other (expense) income | (3.2) | | | 0.8 | | | 0.3 | | | (8.8) | | | (10.9) | |

Share of affiliates' pre-tax earnings | 0.1 | | | — | | | 75.8 | | | — | | | 75.9 | |

Segment profit | $ | 271.5 | | | $ | 89.2 | | | $ | 81.6 | | | $ | 6.2 | | | $ | 448.5 | |

Less: | | | | | | | | | |

Selling, general and administrative expense | 171.7 | |

Income taxes (includes $17.2 related to affiliates' earnings) | 69.1 | |

Net income | $ | 207.7 | |

| | | | | | | | | |

Selected Data: | | | | | | | | | |

Investment volume | $ | 955.7 | | | $ | 190.1 | | | $ | 166.1 | | | $ | 13.2 | | | $ | 1,325.1 | |

| | | | | | | | | |

Net Gain on Asset Dispositions | | | | | | | | | |

Asset Remarketing Income: | | | | | | | | | |

Net gains on disposition of owned assets | $ | 96.3 | | | $ | 1.3 | | | $ | 0.6 | | | $ | 0.2 | | | $ | 98.4 | |

Residual sharing income | 0.3 | | | — | | | — | | | — | | | 0.3 | |

Non-remarketing net gains (1) | 9.2 | | | 2.4 | | | — | | | — | | | 11.6 | |

| | | | | | | | | |

| $ | 105.8 | | | $ | 3.7 | | | $ | 0.6 | | | $ | 0.2 | | | $ | 110.3 | |

__________

(1) Includes net gains from scrapping of railcars.

GATX CORPORATION AND SUBSIDIARIES

SEGMENT DATA (UNAUDITED)

Nine Months Ended September 30, 2023

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Rail North America | |

Rail International | | Engine Leasing | | Other | | GATX Consolidated |

Revenues | | | | | | | | | |

Lease revenue | $ | 659.2 | | | $ | 219.1 | | | $ | 24.5 | | | $ | 25.0 | | | $ | 927.8 | |

Non-dedicated engine revenue | — | | | — | | | 24.5 | | | — | | | 24.5 | |

Marine operating revenue | — | | | — | | | 6.1 | | | — | | | 6.1 | |

Other revenue | 68.0 | | | 9.6 | | | 0.1 | | | 6.1 | | | 83.8 | |

Total Revenues | 727.2 | | | 228.7 | | | 55.2 | | | 31.1 | | | 1,042.2 | |

| Expenses | | | | | | | | | |

Maintenance expense | 203.1 | | | 47.6 | | | — | | | 3.4 | | | 254.1 | |

Marine operating expense | — | | | — | | | 5.4 | | | — | | | 5.4 | |

Depreciation expense | 198.5 | | | 49.8 | | | 19.9 | | | 9.9 | | | 278.1 | |

Operating lease expense | 27.0 | | | — | | | — | | | — | | | 27.0 | |

Other operating expense | 20.2 | | | 7.2 | | | 4.4 | | | 2.2 | | | 34.0 | |

Total Expenses | 448.8 | | | 104.6 | | | 29.7 | | | 15.5 | | | 598.6 | |

Other Income (Expense) | | | | | | | | | |

Net gain on asset dispositions | 97.4 | | | 2.4 | | | 4.7 | | | 0.6 | | | 105.1 | |

Interest (expense) income, net | (133.4) | | | (40.5) | | | (20.9) | | | 4.0 | | | (190.8) | |

Other (expense) income | (1.3) | | | (7.0) | | | (0.5) | | | 1.7 | | | (7.1) | |

Share of affiliates' pre-tax (losses) earnings | (0.5) | | | — | | | 66.3 | | | — | | | 65.8 | |

Segment profit | $ | 240.6 | | | $ | 79.0 | | | $ | 75.1 | | | $ | 21.9 | | | $ | 416.6 | |

Less: | | | | | | | | | |

Selling, general and administrative expense | 153.4 | |

Income taxes (includes $17.7 related to affiliates' earnings) | 70.0 | |

Net income | $ | 193.2 | |

| | | | | | | | | |

Selected Data: | | | | | | | | | |

Investment volume | $ | 654.8 | | | $ | 288.0 | | | $ | 267.3 | | | $ | 27.4 | | | $ | 1,237.5 | |

| | | | | | | | | |

Net Gain on Asset Dispositions | | | | | | | | | |

Asset Remarketing Income: | | | | | | | | | |

Net gains on disposition of owned assets | $ | 88.4 | | | $ | 0.5 | | | $ | 5.5 | | | $ | 0.3 | | | $ | 94.7 | |

Residual sharing income | 0.3 | | | — | | | 0.4 | | | — | | | 0.7 | |

Non-remarketing net gains (1) | 8.7 | | | 1.9 | | | — | | | 0.3 | | | 10.9 | |

Asset impairments | — | | | — | | | (1.2) | | | — | | | (1.2) | |

| $ | 97.4 | | | $ | 2.4 | | | $ | 4.7 | | | $ | 0.6 | | | $ | 105.1 | |

__________

(1) Includes net gains from scrapping of railcars.

GATX CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION (UNAUDITED)

(In millions, except per share data)

Impact of Tax Adjustments and Other Items on Net Income (1)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (GAAP) | $ | 89.0 | | | $ | 52.5 | | | $ | 207.7 | | | $ | 193.2 | |

| Adjustments attributable to consolidated pre-tax income: | | | | | | | |

| Litigation claims settlements (2) | 3.3 | | | — | | | 3.3 | | | — | |

| Environmental reserves (3) | $ | — | | | $ | — | | | $ | 10.7 | | | $ | — | |

| Net (gain) loss on Specialized Gas Vessels at Engine Leasing (4) | — | | | — | | | (0.6) | | | 1.4 | |

| Net gain on Rail Russia at Rail International (5) | — | | | — | | | — | | | (0.3) | |

| | | | | | | |

| | | | | | | |

| Total adjustments attributable to consolidated pre-tax income | $ | 3.3 | | | $ | — | | | $ | 13.4 | | | $ | 1.1 | |

| Income taxes thereon, based on applicable effective tax rate | (0.8) | | | — | | | (3.5) | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income, excluding tax adjustments and other items (non-GAAP) | $ | 91.5 | | | $ | 52.5 | | | $ | 217.6 | | | $ | 194.3 | |

Impact of Tax Adjustments and Other Items on Diluted Earnings per Share (1)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30 | | Nine Months Ended

September 30 |

| 2024 | | 2023 | | 2024 | | 2023 |

| Diluted earnings per share (GAAP) | $ | 2.43 | | | $ | 1.44 | | | $ | 5.68 | | | $ | 5.30 | |

| Diluted earnings per share, excluding tax adjustments and other items (non-GAAP) | $ | 2.50 | | | $ | 1.44 | | | $ | 5.95 | | | $ | 5.33 | |

_________

(1) In addition to financial results reported in accordance with GAAP, we compute certain financial measures using non-GAAP components. Specifically, we exclude the effects of certain tax adjustments and other items for purposes of presenting net income and diluted earnings per share because we believe these items are not attributable to our business operations. Management utilizes net income, excluding tax adjustments and other items, when analyzing financial performance because such amounts reflect the underlying operating results that are within management’s ability to influence. Accordingly, we believe presenting this information provides investors and other users of our financial statements with meaningful supplemental information for purposes of analyzing year-to-year financial performance on a comparable basis and assessing trends.

(2) Expenses recorded for the settlement of litigation claims arising out of legacy business operations.

(3) Reserves recorded for our share of anticipated environmental remediation costs arising out of prior operations and legacy businesses.

(4) In 2022, we made the decision to sell the Specialized Gas Vessels. We have recorded gains and losses associated with the subsequent impairments and sales of these assets. As of December 31, 2023, all vessels had been sold.

(5) In 2022, we made the decision to exit our rail business in Russia ("Rail Russia"). In the first quarter of 2023, we sold Rail Russia and recorded a gain on the final sale of this business.

GATX CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION (UNAUDITED)

(In millions, except leverage)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 9/30/2024 | | 6/30/2024 | | 3/31/2024 | | 12/31/2023 | | 9/30/2023 |

| Total Assets, Excluding Cash, by Segment |

| Rail North America | | $ | 7,643.7 | | | $ | 7,416.0 | | | $ | 7,214.1 | | | $ | 6,984.9 | | | $ | 6,760.5 | |

| Rail International | | 2,298.6 | | | 2,168.3 | | | 2,142.1 | | | 2,150.8 | | | 1,951.5 | |

| Engine Leasing | | 1,544.7 | | | 1,431.7 | | | 1,354.4 | | | 1,343.2 | | | 1,363.8 | |

| Other | | 389.1 | | | 382.8 | | | 389.3 | | | 396.3 | | | 368.5 | |

| Total Assets, excluding cash | | $ | 11,876.1 | | | $ | 11,398.8 | | | $ | 11,099.9 | | | $ | 10,875.2 | | | $ | 10,444.3 | |

| Debt and Lease Obligations, Net of Unrestricted Cash |

| Unrestricted cash | | $ | (503.7) | | | $ | (823.6) | | | $ | (479.1) | | | $ | (450.7) | | | $ | (203.1) | |

| Commercial paper and bank credit facilities | | 11.1 | | | 10.7 | | | 10.8 | | | 11.0 | | | 12.3 | |

| Recourse debt | | 8,293.5 | | | 8,235.7 | | | 7,624.5 | | | 7,388.1 | | | 6,835.6 | |

| Operating lease obligations | | 187.5 | | | 209.3 | | | 215.2 | | | 226.8 | | | 233.2 | |

| | | | | | | | | | |

| Total debt and lease obligations, net of unrestricted cash | | $ | 7,988.4 | | | $ | 7,632.1 | | | $ | 7,371.4 | | | $ | 7,175.2 | | | $ | 6,878.0 | |

| Total recourse debt (1) | | $ | 7,988.4 | | | $ | 7,632.1 | | | $ | 7,371.4 | | | $ | 7,175.2 | | | $ | 6,878.0 | |

| Shareholders’ Equity | | $ | 2,436.7 | | | $ | 2,343.4 | | | $ | 2,324.3 | | | $ | 2,273.0 | | | $ | 2,174.5 | |

| Recourse Leverage (2) | | 3.3 | | | 3.3 | | | 3.2 | | | 3.2 | | | 3.2 | |

_________

(1) Includes recourse debt, commercial paper and bank credit facilities, and operating and finance lease obligations, net of unrestricted cash.

(2) Calculated as total recourse debt / shareholder's equity.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Total Assets to Total Assets, Excluding Cash |

| Total Assets | | $ | 12,379.9 | | | $ | 12,222.6 | | | $ | 11,579.1 | | | $ | 11,326.0 | | | $ | 10,647.5 | |

| Less: cash | | (503.8) | | | (823.8) | | | (479.2) | | | (450.8) | | | (203.2) | |

| Total Assets, excluding cash | | $ | 11,876.1 | | | $ | 11,398.8 | | | $ | 11,099.9 | | | $ | 10,875.2 | | | $ | 10,444.3 | |

GATX CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION (UNAUDITED)

(Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 9/30/2024 | | 6/30/2024 | | 3/31/2024 | | 12/31/2023 | | 9/30/2023 |

| Rail North America Statistics | | | | | | | | | |

| Lease Price Index (LPI) (1) | | | | | | | | | |

| Average renewal lease rate change | 26.6 | % | | 29.4 | % | | 33.0 | % | | 33.5 | % | | 33.4 | % |

| Average renewal term (months) | 59 | | | 61 | | | 64 | | | 65 | | | 65 | |

| Renewal Success Rate (2) | 82.0 | % | | 84.1 | % | | 83.4 | % | | 87.1 | % | | 83.6 | % |

| Fleet Rollforward (3) | | | | | | | | | |

| Beginning balance | 102,086 | | | 101,687 | | | 101,167 | | | 100,656 | | | 100,585 | |

| Railcars added | 1,474 | | | 1,337 | | | 1,422 | | | 1,688 | | | 791 | |

| Railcars scrapped | (360) | | | (389) | | | (375) | | | (354) | | | (292) | |

| Railcars sold | (503) | | | (549) | | | (527) | | | (823) | | | (428) | |

| Ending balance | 102,697 | | | 102,086 | | | 101,687 | | | 101,167 | | | 100,656 | |

| Utilization | 99.3 | % | | 99.3 | % | | 99.4 | % | | 99.3 | % | | 99.3 | % |

| Average active railcars | 101,629 | | | 101,181 | | | 100,677 | | | 100,197 | | | 99,796 | |

| Boxcar Fleet Rollforward | | | | | | | | | |

| Beginning balance | 8,990 | | | 9,670 | | | 9,311 | | | 9,087 | | | 8,959 | |

| Boxcars added | — | | | — | | | 587 | | | 424 | | | 316 | |

| Boxcars scrapped | (211) | | | (555) | | | (228) | | | (152) | | | (95) | |

| Boxcars sold | — | | | (125) | | | — | | | (48) | | | (93) | |

| Ending balance | 8,779 | | | 8,990 | | | 9,670 | | | 9,311 | | | 9,087 | |

| Utilization | 99.8 | % | | 99.8 | % | | 99.8 | % | | 100.0 | % | | 99.7 | % |

| Average active railcars | 8,848 | | | 9,304 | | | 9,583 | | | 9,207 | | | 8,985 | |

| Rail North America Industry Statistics | | | | | | | | | |

| Manufacturing Capacity Utilization Index (4) | 77.5 | % | | 78.2 | % | | 77.8 | % | | 78.7 | % | | 79.5 | % |

| Year-over-year Change in U.S. Carloadings (excl. intermodal) (5) | (3.3) | % | | (4.5) | % | | (4.2) | % | | 0.7 | % | | 30.0 | % |

| Year-over-year Change in U.S. Carloadings (chemical) (5) | 4.2 | % | | 4.3 | % | | 4.5 | % | | (0.3) | % | | (2.6) | % |

| Year-over-year Change in U.S. Carloadings (petroleum) (5) | 10.4 | % | | 11.1 | % | | 7.7 | % | | 11.1 | % | | 10.5 | % |

| Production Backlog at Railcar Manufacturers (6) | n/a (7) | | 45,238 | | | 46,413 | | | 51,836 | | | 58,680 | |

_________

(1) GATX's Lease Price Index (LPI) is an internally-generated business indicator that measures renewal activity for our North American railcar fleet, excluding boxcars. The LPI calculation includes all renewal activity based on a 12-month trailing average, and the renewals are weighted by the count of all renewals over the 12 month period. The average renewal lease rate change is reported as the percentage change between the average renewal lease rate and the average expiring lease rate. The average renewal lease term is reported in months and reflects the average renewal lease term in the LPI.

(2) The renewal success rate represents the percentage of railcars on expiring leases that were renewed with the existing lessee. The renewal success rate is an important metric because railcars returned by our customers may remain idle or incur additional maintenance and freight costs prior to being leased to new customers.

(3) Excludes boxcar fleet.

(4) As reported and revised by the Federal Reserve.

(5) As reported by the Association of American Railroads (AAR).

(6) As reported by the Railway Supply Institute (RSI).

(7) Not available, not published as of the date of this release.

GATX CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION (UNAUDITED)

(Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 9/30/2024 | | 6/30/2024 | | 3/31/2024 | | 12/31/2023 | | 9/30/2023 |

| Rail Europe Statistics | | | | | | | | | |

| Fleet Rollforward | | | | | | | | | |

| Beginning balance | 29,649 | | | 29,371 | | | 29,216 | | | 29,102 | | | 28,759 | |

| Railcars added | 410 | | | 388 | | | 322 | | | 371 | | | 446 | |

| Railcars scrapped or sold | (106) | | | (110) | | | (167) | | | (257) | | | (103) | |

| Ending balance | 29,953 | | | 29,649 | | | 29,371 | | | 29,216 | | | 29,102 | |

| Utilization | 95.9 | % | | 95.8 | % | | 95.3 | % | | 95.9 | % | | 96.0 | % |

| Average active railcars | 28,626 | | | 28,198 | | | 27,984 | | | 28,003 | | | 27,884 | |

| | | | | | | | | |

| Rail India Statistics | | | | | | | | | |

| Fleet Rollforward | | | | | | | | | |

| Beginning balance | 9,904 | | | 9,501 | | | 8,805 | | | 7,884 | | | 6,927 | |

| Railcars added | 457 | | | 408 | | | 696 | | | 921 | | | 957 | |

| Railcars scrapped or sold | — | | | (5) | | | — | | | — | | | — | |

| Ending balance | 10,361 | | | 9,904 | | | 9,501 | | | 8,805 | | | 7,884 | |

| Utilization | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Average active railcars | 10,165 | | | 9,711 | | | 9,089 | | | 8,321 | | | 7,366 | |

| | | | | | | | | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

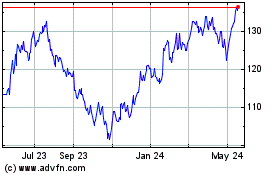

GATX (NYSE:GATX)

Historical Stock Chart

From Oct 2024 to Nov 2024

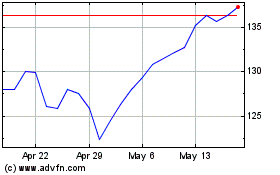

GATX (NYSE:GATX)

Historical Stock Chart

From Nov 2023 to Nov 2024