GATX Corporation Announces Quarterly Dividend Increase

January 31 2025 - 10:20AM

Business Wire

The board of directors of GATX Corporation (NYSE: GATX) today

declared a quarterly dividend of $0.61 per common share, payable

Mar. 31, 2025, to shareholders of record on Feb. 28, 2025. GATX has

paid quarterly dividends without interruption since 1919, and the

dividend amount announced today represents a 5.2% increase from the

prior year’s dividend.

“2025 marks our 107th consecutive year of paying a dividend, a

track record few companies can match,” said Robert C. Lyons,

president and chief executive officer of GATX. “In the past decade

alone, GATX has invested over $10.3 billion in our business while

also returning over $1.4 billion to shareholders through dividends

and share repurchases. We have done so while maintaining a strong

balance sheet and solid investment grade credit ratings. This

dividend increase reflects the board’s positive view of GATX’s

long-term outlook, the strength and quality of our cash flows, and

the Company’s ongoing commitment to our shareholders.”

COMPANY DESCRIPTION

At GATX Corporation (NYSE: GATX), we empower our customers to

propel the world forward. GATX leases transportation assets

including railcars, aircraft spare engines and tank containers to

customers worldwide. Our mission is to provide innovative,

unparalleled service that enables our customers to transport what

matters safely and sustainably while championing the well-being of

our employees and communities. Headquartered in Chicago, Illinois

since its founding in 1898, GATX has paid a quarterly dividend,

uninterrupted, since 1919.

AVAILABILITY OF INFORMATION ON GATX'S

WEBSITE

Investors and others should note that GATX routinely announces

material information to investors and the marketplace using SEC

filings, press releases, public conference calls, webcasts and the

GATX Investor Relations website. While not all of the information

that the Company posts to the GATX Investor Relations website is of

a material nature, some information could be deemed to be material.

Accordingly, the Company encourages investors, the media and others

interested in GATX to review the information that it shares on

www.gatx.com under the “Investors” tab.

FORWARD-LOOKING

STATEMENTS

Statements in this Earnings Release not based on historical

facts are “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 and, accordingly,

involve known and unknown risks and uncertainties that are

difficult to predict and could cause our actual results,

performance, or achievements to differ materially from those

discussed. These include statements as to our future expectations,

beliefs, plans, strategies, objectives, events, conditions,

financial performance, prospects, or future events. In some cases,

forward-looking statements can be identified by the use of words

such as “may,” “could,” “expect,” “intend,” “plan,” “seek,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“outlook,” “continue,” “likely,” “will,” “would”, and similar words

and phrases. Forward-looking statements are necessarily based on

estimates and assumptions that, while considered reasonable by us

and our management, are inherently uncertain. Accordingly, you

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made, and are not

guarantees of future performance. We do not undertake any

obligation to publicly update or revise these forward-looking

statements.

The following factors, in addition to those discussed in our

other filings with the SEC, including our Form 10-K for the year

ended December 31, 2023, could cause actual results to differ

materially from our current expectations expressed in

forward-looking statements:

- a significant decline in customer demand for our transportation

assets or services, including as a result of:

- prolonged inflation or deflation

- high interest rates

- weak macroeconomic conditions and world trade policies

- weak market conditions in our customers' businesses

- adverse changes in the price of, or demand for,

commodities

- changes in railroad operations, efficiency, pricing and service

offerings, including those related to "precision scheduled

railroading" or labor strikes or shortages

- changes in, or disruptions to, supply chains

- availability of pipelines, trucks, and other alternative modes

of transportation

- changes in conditions affecting the aviation industry,

including global conflicts, geographic exposure and customer

concentrations

- customers' desire to buy, rather than lease, our transportation

assets

- other operational or commercial needs or decisions of our

customers

- inability to maintain our transportation

assets on lease at satisfactory rates and term length due to

oversupply of assets in the market or other changes in supply and

demand

- competitive factors in our primary

markets, including existing or new competitors with significantly

lower costs of capital

- higher costs associated with increased

assignments of our transportation assets following non-renewal of

leases, customer defaults, and compliance maintenance programs or

other maintenance initiatives

- events having an adverse impact on

assets, customers, or regions where we have a concentrated

investment exposure

- financial and operational risks

associated with long-term purchase commitments for transportation

assets

- reduced opportunities to generate asset

remarketing income

- inability to successfully consummate and

manage ongoing acquisition and divestiture activities

- reliance on Rolls-Royce in connection

with our aircraft spare engine leasing businesses, and the risks

that certain factors that adversely affect Rolls-Royce could have

an adverse effect on our businesses

- potential obsolescence of our assets

- risks related to our international

operations and expansion into new geographic markets, including

laws, regulations, tariffs, taxes, treaties or trade barriers

affecting our activities in the countries where we do business

- failure to successfully negotiate

collective bargaining agreements with the unions representing a

substantial portion of our employees

- inability to attract, retain, and

motivate qualified personnel, including key management

personnel

- inability to maintain and secure our

information technology infrastructure from cybersecurity threats

and related disruption of our business

- exposure to damages, fines, criminal and

civil penalties, and reputational harm arising from a negative

outcome in litigation, including claims arising from an accident

involving transportation assets

- changes in, or failure to comply with,

laws, rules, and regulations

- environmental liabilities and remediation

costs

- operational, functional and regulatory

risks associated with climate change, severe weather events and

natural disasters

- U.S. and global political conditions and

the impact of increased geopolitical tension and wars, including

the ongoing war between Russia and Ukraine on domestic and global

economic conditions in general, including supply chain challenges

and disruptions

- prolonged inflation or deflation

- fluctuations in foreign exchange

rates

- deterioration of conditions in the

capital markets, reductions in our credit ratings, or increases in

our financing costs

- inability to obtain cost-effective

insurance

- changes in assumptions, increases in

funding requirements or investment losses in our pension and

post-retirement plans

- inadequate allowances to cover credit

losses in our portfolio

- asset impairment charges we may be

required to recognize

- inability to maintain effective internal

control over financial reporting and disclosure controls and

procedures

- the occurrence of a widespread health

crisis and the impact of measures taken in response.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250131531602/en/

GATX Corporation Shari Hellerman Senior Director Investor

Relations, ESG, and External Communications 312-621-4285

shari.hellerman@gatx.com

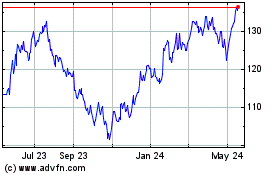

GATX (NYSE:GATX)

Historical Stock Chart

From Jan 2025 to Feb 2025

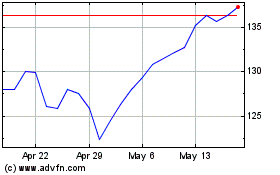

GATX (NYSE:GATX)

Historical Stock Chart

From Feb 2024 to Feb 2025