Company Introduces "Arc by Green Dot" Iterating

Focus on Embedded Finance Market

Green Dot Corporation (NYSE: GDOT), a leading digital bank and

fintech that delivers seamless banking and payment tools for

consumers and businesses, today reported financial results for the

quarter ended September 30, 2024.

“It was a solid quarter of execution, and we are excited about

the launch of our embedded finance brand, Arc by Green Dot,

signifying our commitment to this sizable market where we believe

ample opportunity for long-term growth exists,” said George

Gresham, Chief Executive Officer of Green Dot. “While our GAAP net

loss was larger than last year, we returned to adjusted EBITDA

growth in the quarter, which we believe is evidence of our progress

on efforts to position Green Dot as a market leader with

predictable financial performance and operational excellence.”

Consolidated Results Summary

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

% Change

2024

2023

% Change

(In thousands, except per

share data and percentages)

GAAP financial results

Total operating revenues

$

409,743

$

353,029

16

%

$

1,268,852

$

1,135,285

12

%

Net (loss) income

$

(7,840

)

$

(6,265

)

25

%

$

(31,805

)

$

30,325

(205

)%

Diluted (loss) earnings per common

share

$

(0.15

)

$

(0.12

)

25

%

$

(0.60

)

$

0.58

(203

)%

Non-GAAP financial results1

Non-GAAP total operating revenues1

$

406,019

$

348,571

16

%

$

1,255,998

$

1,122,078

12

%

Adjusted EBITDA1

$

28,315

$

23,735

19

%

$

121,545

$

145,147

(16

)%

Adjusted EBITDA/Non-GAAP total operating

revenues (adjusted EBITDA margin)

7.0

%

6.8

%

0.2

%

9.7

%

12.9

%

(3.2

)%

Non-GAAP net income1

$

6,988

$

7,442

(6

)%

$

51,814

$

77,889

(33

)%

Non-GAAP diluted earnings per share1

$

0.13

$

0.14

(7

)%

$

0.96

$

1.49

(36

)%

Unencumbered cash at the holding company was approximately $75

million as of September 30, 2024.

Key Metrics

The following table shows Green Dot's quarterly key business

metrics for each of the last seven calendar quarters on a

consolidated basis and by each of its reportable segments. Please

refer to Green Dot’s latest Annual Report on Form 10-K for a

description of the key business metrics, as well as additional

information regarding how Green Dot organizes its business by

segment.

2024

2023

Q3

Q2

Q1

Q4

Q3

Q2

Q1

(In millions)

Consolidated *

Gross dollar volume

$

33,473

$

32,130

$

30,755

$

26,355

$

24,836

$

24,724

$

23,289

Number of active accounts

3.46

3.41

3.51

3.57

3.67

3.71

3.84

Purchase volume

$

4,887

$

5,012

$

5,274

$

5,273

$

5,362

$

5,734

$

6,145

Consumer Services

Gross dollar volume

$

3,983

$

4,014

$

4,500

$

4,290

$

4,619

$

5,122

$

5,677

Number of active accounts

1.78

1.76

1.93

2.05

2.16

2.35

2.41

Direct deposit active accounts

0.44

0.45

0.46

0.49

0.52

0.59

0.60

Purchase volume

$

2,904

$

3,036

$

3,339

$

3,312

$

3,553

$

3,984

$

4,344

B2B Services

Gross dollar volume

$

29,490

$

28,116

$

26,255

$

22,065

$

20,217

$

19,602

$

17,612

Number of active accounts

1.68

1.65

1.58

1.52

1.51

1.36

1.43

Purchase volume

$

1,983

$

1,976

$

1,935

$

1,961

$

1,809

$

1,750

$

1,801

Money Movement

Number of cash transfers

8.22

8.15

7.77

8.19

8.31

8.66

8.70

Number of tax refunds processed

0.19

4.20

9.28

0.16

0.20

3.87

9.91

* Represents the sum of Green Dot's Consumer Services and B2B

(as defined herein) Services segments.

“It was a solid quarter and we are seeing the benefits of our

efforts to improve our cost structure, support existing customers

and launch new partners such as PLS,” said Jess Unruh, Chief

Financial Officer of Green Dot. “While our retail division has seen

improved performance, it is falling short of the improvement that

we had expected, which is impacting our guidance for the rest of

the year. Nonetheless, I am encouraged by the fact that our revised

guidance still points to improved momentum as we exit the

year.”

2024 Financial Guidance

Green Dot has updated its most recent financial outlook for

2024. Green Dot’s outlook is based on a number of assumptions that

management believes are reasonable at the time of this earnings

release. In particular, its outlook reflects several

considerations, including but not limited to the current

macro-economic environment, the effect of inflation and interest

rates, the impact of previously disclosed non-renewals of certain

partnerships and programs, the company's decision to wind down many

of its legacy cardholder programs in support of GO2bank, negative

trends within certain channels of its business, investment in

strategic initiatives and compliance programs, and cost reduction

initiatives. Additionally, the civil money penalty and related

expenses associated with Green Dot's consent order previously

disclosed are expressly excluded from its non-GAAP measures and

related financial outlook. Information regarding potential risks

that could cause the actual results to differ from these

forward-looking statements is set forth below and in Green Dot's

filings with the Securities and Exchange Commission.

Total Non-GAAP Operating Revenues2

- Green Dot now expects its guidance range for its full year

non-GAAP total operating revenues2 to be between $1.65 billion and

$1.70 billion, or up approximately 13% year over year at the

mid-point.

Adjusted EBITDA2

- Green Dot now expects its full year adjusted EBITDA2 range to

be between $164 million and $166 million, or down approximately 3%

year over year at the mid-point.

Non-GAAP EPS2

- Green Dot now expects its full year non-GAAP EPS2 range to be

between $1.33 and $1.36, or down 17% year over year at the

mid-point.

The components of Green Dot's non-GAAP EPS2 guidance range are

as follows:

Range

Low

High

(In millions, except per share

data)

Adjusted EBITDA

$

164.0

$

166.0

Depreciation and amortization*

(63.5

)

(63.5

)

Net interest expense

(5.3

)

(5.3

)

Non-GAAP pre-tax income

$

95.2

$

97.2

Tax impact**

(22.8

)

(23.3

)

Non-GAAP net income

$

72.4

$

73.9

Diluted weighted-average shares issued and

outstanding

54.2

54.2

Non-GAAP earnings per share

$

1.33

$

1.36

*

Excludes the impact of amortization of

acquired intangible assets

**

Assumes a non-GAAP effective tax rate of

approximately 24% for full year.

1

Reconciliations of total operating

revenues to non-GAAP total operating revenues, net income to

adjusted EBITDA, net income to non-GAAP net income, and diluted

earnings per share to non-GAAP diluted earnings per share,

respectively, are provided in the tables immediately following the

unaudited consolidated financial statements. Additional information

about the Company's non-GAAP financial measures can be found under

the caption “About Non-GAAP Financial Measures” below.

2

For additional information, see

reconciliations of forward-looking guidance for these non-GAAP

financial measures to their respective, most directly comparable

projected GAAP financial measures provided in the tables

immediately following the reconciliation of Net Income to Adjusted

EBITDA.

Conference Call

Green Dot's management will host a conference call to discuss

third quarter 2024 financial results today at 5:00 p.m. ET. The

conference call can be accessed live from Green Dot's investor

relations website at http://ir.greendot.com/. Green Dot uses this

website as a tool to disclose important information about the

company to investors and comply with its disclosure obligations

under Regulation Fair Disclosure. A replay of the webcast will be

available at the same website following the call. The replay will

be available until Thursday, November 14, 2024.

Forward-Looking Statements

This earnings release contains forward-looking statements, which

are subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These statements include, among

other things, statements in the quotes of Green Dot's executive

officers and under the heading "2024 Financial Guidance," and other

future events that involve risks and uncertainties. Actual results

may differ materially from those contained in the forward-looking

statements contained in this earnings release, and reported results

should not be considered as an indication of future performance.

The potential risks and uncertainties that could cause actual

results to differ from those projected include, among other things,

Green Dot’s ability to achieve the expected cost savings and other

benefits from its processor conversions, impacts from and changes

in general economic conditions on Green Dot’s business, results of

operations and financial condition, shifts in consumer behavior

towards electronic payments, the timing and impact of revenue

growth activities, Green Dot's dependence on revenues derived from

Walmart or other large partners, the timing and impact of

non-renewals or terminations of agreements with other large

partners, impact of competition, Green Dot's reliance on retail

distributors for the promotion of its products and services, demand

for Green Dot's new and existing products and services, continued

and improving returns from Green Dot's investments in strategic

initiatives, Green Dot's ability to operate in a highly regulated

environment, including with respect to any restrictions imposed on

its business, changes to governmental policies or rulemaking or

enforcement priorities affecting financial institutions or to

existing laws or regulations affecting Green Dot's operating

methods or economics, Green Dot's reliance on third-party vendors,

changes in credit card association or other network rules or

standards, changes in card association and debit network fees or

products or interchange rates, instances of fraud developments in

the financial services industry that impact debit card usage

generally, business interruption or systems failure, economic,

political and other conditions may adversely affect trends in

consumer spending and Green Dot's involvement in litigation or

investigations. These and other risks are discussed in greater

detail in Green Dot's Securities and Exchange Commission filings,

including its most recent annual report on Form 10-K available on

Green Dot's investor relations website at ir.greendot.com and on

the SEC website at www.sec.gov. All information provided in this

release and in the attachments is as of November 7, 2024, and Green

Dot assumes no obligation to update this information as a result of

future events or developments, except as required by law.

About Non-GAAP Financial Measures

To supplement Green Dot's consolidated financial statements

presented in accordance with accounting principles generally

accepted in the United States of America (GAAP), Green Dot uses

measures of operating results that are adjusted for, among other

things, non-operating net interest income and expense; other

non-interest investment income earned by its bank; income tax

benefit and expense; depreciation and amortization, including

amortization of acquired intangibles; certain legal settlement

gains and charges; stock-based compensation and related employer

payroll taxes; changes in the fair value of contingent

consideration; transaction costs from acquisitions; amortization

attributable to deferred financing costs, impairment charges;

extraordinary severance expenses; earnings or losses from equity

method investments; changes in the fair value of loans held for

sale; commissions and certain processing-related costs associated

with Banking as a Service ("BaaS") products and services where

Green Dot does not control customer acquisition; realized gains on

investment securities; other charges and income not reflective of

ongoing operating results; and income tax effects. This earnings

release includes non-GAAP total operating revenues, adjusted

EBITDA, non-GAAP net income, and non-GAAP diluted earnings per

share. These non-GAAP financial measures are not calculated or

presented in accordance with, and are not alternatives or

substitutes for, financial measures prepared in accordance with

GAAP, and should be read only in conjunction with Green Dot's

financial measures prepared in accordance with GAAP. Green Dot's

non-GAAP financial measures may be different from similarly-titled

non-GAAP financial measures used by other companies. Green Dot

believes that the presentation of non-GAAP financial measures

provides useful information to management and investors regarding

underlying trends in its consolidated financial condition and

results of operations. Green Dot's management regularly uses these

supplemental non-GAAP financial measures internally to understand,

manage and evaluate Green Dot's business and make operating

decisions. For additional information regarding Green Dot's use of

non-GAAP financial measures and the items excluded by Green Dot

from one or more of its historic and projected non-GAAP financial

measures, investors are encouraged to review the reconciliations of

Green Dot's historic and projected non-GAAP financial measures to

the comparable GAAP financial measures, which are attached to this

earnings release, and which can be found by clicking on “Financial

Information” in the Investor Relations section of Green Dot's

website at http://ir.greendot.com/.

About Green Dot

Green Dot Corporation (NYSE: GDOT) is a financial technology and

registered bank holding company committed to giving all people the

power to bank seamlessly, affordably, and with confidence. Green

Dot’s technology platform enables it to build products and features

that address the most pressing financial challenges of consumers

and businesses, transforming the way they manage and move money and

making financial empowerment more accessible for all.

Green Dot offers a broad set of financial products to consumers

and businesses including debit, checking, credit, prepaid, and

payroll cards, as well as robust money processing services, such as

tax refunds, cash deposits and disbursements. Its flagship digital

banking platform GO2bank offers consumers simple and accessible

mobile banking designed to help improve financial health over time.

The company’s banking platform services business enables a growing

list of the world’s largest and most trusted consumer and

technology brands to deploy customized, seamless, value-driven

money management solutions for their customers.

Founded in 1999, Green Dot has served more than 33 million

customers directly and many millions more through its partners. The

Green Dot Network of more than 90,000 retail distribution locations

nationwide, more than all remaining bank branches in the U.S.

combined, enables it to operate primarily as a “branchless bank.”

Green Dot Bank is a subsidiary of Green Dot Corporation and member

of the FDIC. For more information about Green Dot’s products and

services, please visit www.greendot.com.

GREEN DOT CORPORATION

CONSOLIDATED BALANCE

SHEETS

September 30, 2024

December 31, 2023

(unaudited)

Assets

(In thousands, except par

value)

Current assets:

Unrestricted cash and cash equivalents

$

1,453,549

$

682,263

Restricted cash

44

4,239

Investment securities available-for-sale,

at fair value

43,257

33,859

Settlement assets

587,106

737,989

Accounts receivable, net

84,635

110,141

Prepaid expenses and other assets

49,459

69,419

Income tax receivable

1,322

—

Total current assets

2,219,372

1,637,910

Investment securities available-for-sale,

at fair value

2,120,803

2,203,142

Loans to bank customers, net of allowance

for credit losses of $17,778 and $11,383 as of September 30, 2024

and December 31, 2023, respectively

33,380

30,534

Prepaid expenses and other assets

193,791

221,656

Property, equipment, and internal-use

software, net

181,386

179,376

Operating lease right-of-use assets

3,801

5,342

Deferred expenses

1,226

1,546

Net deferred tax assets

128,263

117,139

Goodwill and intangible assets

403,265

420,477

Total assets

$

5,285,287

$

4,817,122

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

95,043

$

119,870

Deposits

3,837,906

3,293,603

Obligations to customers

215,588

314,278

Settlement obligations

50,821

57,001

Amounts due to card issuing banks for

overdrawn accounts

84

225

Other accrued liabilities

94,844

91,239

Operating lease liabilities

2,118

3,369

Deferred revenue

7,181

6,343

Line of credit

—

61,000

Income tax payable

2,497

6,262

Total current liabilities

4,306,082

3,953,190

Other accrued liabilities

1,217

1,895

Operating lease liabilities

2,068

2,687

Notes payable

43,675

—

Total liabilities

4,353,042

3,957,772

Stockholders’ equity:

Class A common stock, $0.001 par value;

100,000 shares authorized as of September 30, 2024 and December 31,

2023; 53,751 and 52,816 shares issued and outstanding as of

September 30, 2024 and December 31, 2023, respectively

54

53

Additional paid-in capital

400,769

375,980

Retained earnings

738,499

770,304

Accumulated other comprehensive loss

(207,077

)

(286,987

)

Total stockholders’ equity

932,245

859,350

Total liabilities and stockholders’

equity

$

5,285,287

$

4,817,122

GREEN DOT CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(UNAUDITED)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In thousands, except per

share data)

Operating revenues:

Card revenues and other fees

$

310,372

$

253,407

$

878,002

$

735,380

Cash processing revenues

34,897

36,256

198,447

191,925

Interchange revenues

48,397

54,968

148,950

178,950

Interest income, net

16,077

8,398

43,453

29,030

Total operating revenues

409,743

353,029

1,268,852

1,135,285

Operating expenses:

Sales and marketing expenses

52,626

56,495

167,948

194,530

Compensation and benefits expenses

61,795

59,168

189,967

192,934

Processing expenses

228,227

162,375

631,789

460,555

Other general and administrative

expenses

70,027

81,830

295,193

238,324

Total operating expenses

412,675

359,868

1,284,897

1,086,343

Operating (loss) income

(2,932

)

(6,839

)

(16,045

)

48,942

Interest expense, net

1,577

239

4,306

2,121

Other expense, net

(3,705

)

(802

)

(10,045

)

(6,050

)

(Loss) income before income taxes

(8,214

)

(7,880

)

(30,396

)

40,771

Income tax (benefit) expense

(374

)

(1,615

)

1,409

10,446

Net (loss) income

$

(7,840

)

$

(6,265

)

$

(31,805

)

$

30,325

Basic (loss) earnings per common

share:

$

(0.15

)

$

(0.12

)

$

(0.60

)

$

0.58

Diluted (loss) earnings per common

share

$

(0.15

)

$

(0.12

)

$

(0.60

)

$

0.58

Basic weighted-average common shares

issued and outstanding:

53,722

52,367

53,373

52,127

Diluted weighted-average common shares

issued and outstanding:

53,722

52,367

53,373

52,436

GREEN DOT CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(UNAUDITED)

Nine Months Ended September

30,

2024

2023

(In thousands)

Operating activities

Net (loss) income

$

(31,805

)

$

30,325

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Depreciation and amortization of property,

equipment and internal-use software

47,732

42,306

Amortization of intangible assets

16,295

18,593

Provision for uncollectible overdrawn

accounts from purchase transactions

15,509

7,356

Provision for loan losses

22,471

21,404

Stock-based compensation

24,059

27,732

Losses in equity method investments

11,931

9,286

Amortization of discount on

available-for-sale investment securities

(1,614

)

(1,724

)

Impairment of long-lived assets

4,944

—

Other

(1,810

)

(3,128

)

Changes in operating assets and

liabilities:

Accounts receivable, net

9,997

1,081

Prepaid expenses and other assets

16,024

8,385

Deferred expenses

320

12,946

Accounts payable and other accrued

liabilities

(24,534

)

(15,505

)

Deferred revenue

157

(19,363

)

Income tax receivable/payable

(4,803

)

(7,859

)

Other, net

(478

)

613

Net cash provided by operating

activities

104,395

132,448

Investing activities

Purchases of available-for-sale investment

securities

(11,845

)

—

Proceeds from maturities of

available-for-sale securities

154,682

131,559

Proceeds from sales and calls of

available-for-sale securities

273

197

Payments for property, equipment and

internal-use software

(52,168

)

(55,501

)

Net changes in loans

(24,366

)

(21,562

)

Investment in TailFin Labs, LLC

(35,000

)

(35,000

)

Proceeds from other investments

55,088

—

Other investing activities

(846

)

(1,273

)

Net cash provided by investing

activities

85,818

18,420

Financing activities

Borrowings on notes payable

44,551

—

Borrowings on revolving line of credit

238,000

153,000

Repayments on revolving line of credit

(299,000

)

(161,000

)

Proceeds from exercise of options and ESPP

purchases

2,719

3,415

Taxes paid related to net share settlement

of equity awards

(1,988

)

(3,500

)

Net changes in deposits

547,477

(238,417

)

Net changes in settlement assets and

obligations to customers

46,013

(8,776

)

Deferred financing costs

(894

)

—

Net cash provided by (used in) financing

activities

576,878

(255,278

)

Net increase (decrease) in unrestricted

cash, cash equivalents and restricted cash

767,091

(104,410

)

Unrestricted cash, cash equivalents and

restricted cash, beginning of period

686,502

819,845

Unrestricted cash, cash equivalents and

restricted cash, end of period

$

1,453,593

$

715,435

Cash paid for interest

$

9,896

$

3,615

Cash paid for income taxes

$

6,003

$

17,100

Reconciliation of unrestricted cash,

cash equivalents and restricted cash at end of period:

Unrestricted cash and cash equivalents

$

1,453,549

$

711,399

Restricted cash

44

4,036

Total unrestricted cash, cash equivalents

and restricted cash, end of period

$

1,453,593

$

715,435

GREEN DOT CORPORATION

REPORTABLE SEGMENTS

(UNAUDITED)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Segment Revenue

(In thousands)

Consumer Services

$

98,046

$

118,204

$

295,278

$

387,128

B2B Services

276,402

199,206

769,658

551,150

Money Movement Services

31,854

32,089

187,967

180,304

Corporate and Other

(283

)

(928

)

3,095

3,496

Total segment revenues

406,019

348,571

1,255,998

1,122,078

BaaS commissions and processing expenses

(8)

4,346

5,168

14,492

15,346

Other income (9)

(622

)

(710

)

(1,638

)

(2,139

)

Total operating revenues

$

409,743

$

353,029

$

1,268,852

$

1,135,285

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Segment Profit

(In thousands)

Consumer Services

$

39,389

$

42,426

$

107,097

$

139,450

B2B Services

27,736

18,883

65,097

58,808

Money Movement Services

12,717

12,850

113,855

103,650

Corporate and Other

(51,527

)

(50,424

)

(164,504

)

(156,761

)

Total segment profit *

28,315

23,735

121,545

145,147

Reconciliation to (loss) income before

income taxes

Depreciation and amortization of property,

equipment and internal-use software

15,473

14,720

47,732

42,307

Stock based compensation and related

employer taxes

8,210

7,966

24,429

28,255

Amortization of acquired intangible

assets

5,246

5,648

16,295

18,593

Impairment charges

8

—

8,528

—

Legal settlements and related expenses

869

545

32,896

1,964

Other expense

1,441

1,695

7,710

5,086

Operating (loss) income

(2,932

)

(6,839

)

(16,045

)

48,942

Interest expense, net

1,577

239

4,306

2,121

Other expense, net

(3,705

)

(802

)

(10,045

)

(6,050

)

(Loss) income before income taxes

$

(8,214

)

$

(7,880

)

$

(30,396

)

$

40,771

* Total segment profit is also referred to herein as adjusted

EBITDA in its non-GAAP measures. Additional information about the

Company's non-GAAP financial measures can be found under the

caption “About Non-GAAP Financial Measures."

Green Dot's segment reporting is based on how its Chief

Operating Decision Maker (“CODM”) manages its businesses, including

resource allocation and performance assessment. Its CODM (who is

the Chief Executive Officer) organizes and manages the businesses

primarily on the basis of the channels in which its product and

services are offered and uses net revenue and segment profit to

assess profitability. Segment profit reflects each segment's net

revenue less direct costs, such as sales and marketing expenses,

processing expenses, third-party call center support and

transaction losses. Green Dot’s operations are aggregated amongst

three reportable segments: 1) Consumer Services, 2) Business to

Business ("B2B") Services and 3) Money Movement Services.

The Corporate and Other segment primarily consists of net

interest income, certain other investment income earned by Green

Dot's bank, interest profit sharing arrangements with certain BaaS

partners (a reduction of revenue), eliminations of inter-segment

revenues and expenses, and unallocated corporate expenses, which

include Green Dot's fixed expenses, such as salaries, wages and

related benefits for its employees, professional services fees,

software licenses, telephone and communication costs, rent,

utilities, and insurance that are not considered when Green Dot's

CODM evaluates segment performance. Non-cash expenses such as

stock-based compensation, depreciation and amortization of

long-lived assets, impairment charges and other non-recurring

expenses that are not considered by Green Dot's CODM when it is

evaluating overall consolidated financial results are excluded from

its unallocated corporate expenses. Green Dot does not evaluate

performance or allocate resources based on segment asset data, and

therefore such information is not presented.

GREEN DOT CORPORATION

Reconciliation of Total

Operating Revenues to Non-GAAP Total Operating Revenues (1)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In thousands)

Total operating revenues

$

409,743

$

353,029

$

1,268,852

$

1,135,285

BaaS commissions and processing expenses

(8)

(4,346

)

(5,168

)

(14,492

)

(15,346

)

Other income (9)

622

710

1,638

2,139

Non-GAAP total operating revenues

$

406,019

$

348,571

$

1,255,998

$

1,122,078

Reconciliation of Net (Loss)

Income to Non-GAAP Net Income (1)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In thousands, except per

share data)

Net (loss) income

$

(7,840

)

$

(6,265

)

$

(31,805

)

$

30,325

Stock-based compensation and related

employer payroll taxes (3)

8,210

7,966

24,429

28,255

Amortization of acquired intangible assets

(4)

5,246

5,648

16,295

18,593

Transaction and related acquisition costs

(4)

—

—

—

(3

)

Amortization of deferred financing costs

(5)

54

36

126

108

Impairment charges (5)

8

—

8,528

—

Legal settlements and related expenses

(5)

869

545

32,896

1,964

Losses in equity method investments

(5)

4,472

1,675

11,931

9,286

Change in fair value of loans held for

sale (5)

(9

)

(172

)

(244

)

(1,101

)

Extraordinary severance expenses (6)

635

984

6,072

3,415

Other income, net (5)

48

10

(4

)

(461

)

Income tax effect (7)

(4,705

)

(2,985

)

(16,410

)

(12,492

)

Non-GAAP net income

$

6,988

$

7,442

$

51,814

$

77,889

Diluted (loss) earnings per common

share

GAAP

$

(0.15

)

$

(0.12

)

$

(0.60

)

$

0.58

Non-GAAP

$

0.13

$

0.14

$

0.96

$

1.49

Diluted weighted-average common shares

issued and outstanding

GAAP

53,722

52,367

53,373

52,436

Non-GAAP

54,690

52,736

53,931

52,436

Reconciliation of GAAP to

Non-GAAP Diluted Weighted-Average

Shares Issued and

Outstanding

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In thousands)

Diluted weighted-average shares issued and

outstanding

53,722

52,367

53,373

52,436

Anti-dilutive shares due to GAAP net

loss

968

369

558

—

Non-GAAP diluted weighted-average shares

issued and outstanding

54,690

52,736

53,931

52,436

GREEN DOT CORPORATION

Supplemental Detail on Diluted

Weighted-Average Common Shares Issued and Outstanding

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In thousands)

Class A common stock outstanding as of

September 30:

53,751

52,415

53,751

52,415

Weighting adjustment

(29

)

(48

)

(378

)

(288

)

Dilutive potential shares:

Service based restricted stock units

913

246

530

173

Performance-based restricted stock

units

10

67

4

75

Employee stock purchase plan

45

56

24

61

Diluted weighted-average shares issued and

outstanding

54,690

52,736

53,931

52,436

Reconciliation of Net (Loss)

Income to Adjusted EBITDA (1)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In thousands)

Net (loss) income

$

(7,840

)

$

(6,265

)

$

(31,805

)

$

30,325

Interest expense, net (2)

1,577

239

4,306

2,121

Income tax expense

(374

)

(1,615

)

1,409

10,446

Depreciation and amortization of property,

equipment and internal-use software (2)

15,473

14,720

47,732

42,307

Stock-based compensation and related

employer payroll taxes (2)(3)

8,210

7,966

24,429

28,255

Amortization of acquired intangible assets

(2)(4)

5,246

5,648

16,295

18,593

Transaction and related acquisition costs

(2)(4)

—

—

—

(3

)

Impairment charges (2)(5)

8

—

8,528

—

Legal settlements and related expenses

(2)(5)

869

545

32,896

1,964

Losses in equity method investments

(2)(5)

4,472

1,675

11,931

9,286

Change in fair value of loans held for

sale (2)(5)

(9

)

(172

)

(244

)

(1,101

)

Extraordinary severance expenses

(2)(6)

635

984

6,072

3,415

Other income, net (2)(5)

48

10

(4

)

(461

)

Adjusted EBITDA

$

28,315

$

23,735

$

121,545

$

145,147

Non-GAAP total operating revenues

$

406,019

$

348,571

$

1,255,998

$

1,122,078

Adjusted EBITDA/Non-GAAP total operating

revenues (adjusted EBITDA margin)

7.0

%

6.8

%

9.7

%

12.9

%

GREEN DOT CORPORATION

Reconciliation of Forward

Looking Guidance for Non-GAAP Financial Measures to

Projected GAAP Total Operating

Revenues (1)

(Unaudited)

FY 2024

Range

Low

High

(In millions)

Total operating revenues

$

1,669

$

1,719

Adjustments (8)(9)

(19

)

(19

)

Non-GAAP total operating revenues

$

1,650

$

1,700

Reconciliation of Forward

Looking Guidance for Non-GAAP Financial Measures to

Projected GAAP Net Loss

(1)

(Unaudited)

FY 2024

Range

Low

High

(In millions)

Net loss

$

(27.3

)

$

(24.9

)

Adjustments (10)

191.3

190.9

Adjusted EBITDA

$

164.0

$

166.0

Non-GAAP total operating revenues

$

1,700

$

1,650

Adjusted EBITDA/Non-GAAP total operating

revenues (adjusted EBITDA margin)

9.6

%

10.1

%

Reconciliation of Forward

Looking Guidance for Non-GAAP Financial Measures to

Projected GAAP Net

Loss(1)

(Unaudited)

FY 2024

Range

Low

High

(In millions, except per share

data)

Net loss

$

(27.3

)

$

(24.9

)

Adjustments (10)

99.7

98.8

Non-GAAP net income

$

72.4

$

73.9

Diluted earnings (loss) per share

GAAP

$

(0.51

)

$

(0.46

)

Non-GAAP

$

1.33

$

1.36

Diluted weighted-average shares issued and

outstanding

GAAP

53.6

53.6

Anti-dilutive shares due to GAAP net

loss

0.6

0.6

Non-GAAP

54.2

54.2

(1)

To supplement Green Dot’s consolidated financial statements

presented in accordance with GAAP, Green Dot uses measures of

operating results that are adjusted to exclude various, primarily

non-cash, expenses and charges. These financial measures are not

calculated or presented in accordance with GAAP and should not be

considered as alternatives to or substitutes for operating

revenues, operating income, net income or any other measure of

financial performance calculated and presented in accordance with

GAAP. These financial measures may not be comparable to

similarly-titled measures of other organizations because other

organizations may not calculate their measures in the same manner

as Green Dot does. These financial measures are adjusted to

eliminate the impact of items that Green Dot does not consider

indicative of its core operating performance. You are encouraged to

evaluate these adjustments and the reasons Green Dot considers them

appropriate.

Green Dot believes that the non-GAAP financial measures it

presents are useful to investors in evaluating Green Dot’s

operating performance for the following reasons:

- adjusted EBITDA is widely used by investors to measure a

company’s operating performance without regard to items, such as

non-operating net interest income and expense, income tax benefit

and expense, depreciation and amortization, stock-based

compensation and related employer payroll taxes, changes in the

fair value of contingent consideration, transaction costs,

impairment charges, extraordinary severance expenses, certain legal

settlement and related expenses, earnings or losses from equity

method investments, changes in the fair value of loans held for

sale, and other charges and income that can vary substantially from

company to company depending upon their respective financing

structures and accounting policies, the book values of their

assets, their capital structures and the methods by which their

assets were acquired;

- securities analysts use adjusted EBITDA as a supplemental

measure to evaluate the overall operating performance of companies;

and

- Green Dot records stock-based compensation from period to

period, and recorded stock-based compensation expenses and related

employer payroll taxes, net of forfeitures, of approximately $8.2

million and $8.0 million for the three months ended September 30,

2024 and 2023, respectively. By comparing Green Dot’s adjusted

EBITDA, non-GAAP net income and non-GAAP diluted earnings per share

in different historical periods, investors can evaluate Green Dot’s

operating results without the additional variations caused by

stock-based compensation expense and related employer payroll

taxes, which may not be comparable from period to period due to

changes in the fair market value of Green Dot’s Class A common

stock (which is influenced by external factors like the volatility

of the public markets and the financial performance of Green Dot’s

peers) and is not a key measure of Green Dot’s operations.

Green Dot’s management uses the non-GAAP financial measures:

- as measures of operating performance, because they exclude the

impact of items not directly resulting from Green Dot’s core

operations;

- for planning purposes, including the preparation of Green Dot’s

annual operating budget;

- to allocate resources to enhance the financial performance of

Green Dot’s business;

- to evaluate the effectiveness of Green Dot’s business

strategies;

- to establish metrics for variable compensation; and

- in communications with Green Dot’s board of directors

concerning Green Dot’s financial performance.

Green Dot understands that, although adjusted EBITDA and other

non-GAAP financial measures are frequently used by investors and

securities analysts in their evaluations of companies, these

measures have limitations as an analytical tool, and you should not

consider them in isolation or as substitutes for an analysis of

Green Dot’s results of operations as reported under GAAP. Some of

these limitations are:

- that these measures do not reflect Green Dot’s capital

expenditures or future requirements for capital expenditures or

other contractual commitments;

- that these measures do not reflect changes in, or cash

requirements for, Green Dot’s working capital needs;

- that these measures do not reflect non-operating interest

expense or interest income;

- that these measures do not reflect cash requirements for income

taxes;

- that, although depreciation and amortization are non-cash

charges, the assets being depreciated or amortized will often have

to be replaced in the future, and these measures do not reflect any

cash requirements for these replacements; and

- that other companies in Green Dot’s industry may calculate

these measures differently than Green Dot does, limiting their

usefulness as comparative measures.

(2)

Green Dot does not include any income tax

impact of the associated non-GAAP adjustment to adjusted EBITDA, as

the case may be, because each of these adjustments to the non-GAAP

financial measure is provided before income tax expense.

(3)

This expense consists primarily of

expenses for restricted stock units (including performance-based

restricted stock units) and related employer payroll taxes.

Stock-based compensation expense is not comparable from period to

period due to changes in the fair market value of Green Dot’s Class

A common stock (which is influenced by external factors like the

volatility of public markets and the financial performance of Green

Dot’s peers) and is not a key measure of Green Dot’s operations.

Green Dot excludes stock-based compensation expense from its

non-GAAP financial measures primarily because it consists of

non-cash expenses that Green Dot does not believe are reflective of

ongoing operating results. Green Dot also believes that it is not

useful to investors to understand the impact of stock-based

compensation to its results of operations. Further, the related

employer payroll taxes are dependent upon volatility in Green Dot's

stock price, as well as the timing and size of option exercises and

vesting of restricted stock units, over which Green Dot has limited

to no control. This expense is included as a component of

compensation and benefits expenses on Green Dot's consolidated

statements of operations.

(4)

Green Dot excludes certain income and

expenses that are the result of acquisitions. These

acquisition-related adjustments include items such as transaction

costs, the amortization of acquired intangible assets, changes in

the fair value of contingent consideration, settlements of

contingencies established at time of acquisition and other

acquisition related charges, such as integration charges and

professional and legal fees, which result in Green Dot recording

expenses or fair value adjustments in its GAAP financial

statements. Green Dot analyzes the performance of its operations

without regard to these adjustments. In determining whether any

acquisition-related adjustment is appropriate, Green Dot takes into

consideration, among other things, how such adjustments would or

would not aid in the understanding of the performance of its

operations. These items are included as a component of other

general and administrative expenses on Green Dot's consolidated

statements of operations, as applicable for the periods

presented.

(5)

Green Dot excludes certain income and

expenses that are not reflective of ongoing operating results. It

is difficult to estimate the amount or timing of these items in

advance. Although these events are reflected in Green Dot's GAAP

financial statements, Green Dot excludes them in its non-GAAP

financial measures because Green Dot believes these items may limit

the comparability of ongoing operations with prior and future

periods. These adjustments include items such as amortization

attributable to deferred financing costs, impairment charges

related to long-lived assets, earnings or losses from equity method

investments, legal settlements and related expenses, changes in the

fair value of loans held for sale, realized gains on investment

securities and other income and expenses, as applicable for the

periods presented. In determining whether any such adjustment is

appropriate, Green Dot takes into consideration, among other

things, how such adjustments would or would not aid in the

understanding of the performance of its operations. Each of these

adjustments, except for amortization of deferred financing costs,

earnings and losses from equity method investments, fair value

changes on loans held for sale, and realized gains on investment

securities, which are all included below operating income, are

included within other general and administrative expenses on Green

Dot's consolidated statements of operations.

(6)

During the three and nine months ended

September 30, 2024, Green Dot recorded charges of $0.6 million and

$6.1 million, respectively, related to extraordinary severance

expenses, which were paid out in connection with reductions in

force and other extraordinary involuntary terminations of

employment. Although severance expenses may arise throughout the

fiscal year, Green Dot believes the nature of these extraordinary

costs are not indicative of its core operating performance. This

expense is included as a component of compensation and benefits

expenses on Green Dot's consolidated statements of operations.

(7)

Represents the tax effect for the related

non-GAAP measure adjustments using Green Dot's year to date

non-GAAP effective tax rate. It also excludes both the impact of

excess tax benefits related to stock-based compensation and the IRC

§162(m) limitation that applies to performance-based restricted

stock units expense as of September 30, 2024.

(8)

Represents commissions and certain

processing-related costs associated with BaaS products and services

where Green Dot does not control customer acquisition. This

adjustment is netted against Green Dot's B2B Services revenues when

evaluating segment performance.

(9)

Represents other non-interest investment

income earned by Green Dot Bank. This amount is included along with

operating interest income in Green Dot's Corporate and Other

segment since the yield earned on these investments are generated

on a recurring basis and earned similarly to its investment

securities available for sale.

(10)

These amounts represent estimated

adjustments for items such as income taxes, depreciation and

amortization, employee stock-based compensation and related

employer taxes, amortization attributable to deferred financing

costs, impairment charges, extraordinary severance expenses,

earnings and losses from equity method investments, changes in the

fair value of loans held for sale, legal settlements and related

expenses and other income and expenses. Employee stock-based

compensation expense includes assumptions about the future fair

value of the Company’s Class A common stock (which is influenced by

external factors like the volatility of public markets and the

financial performance of the Company’s peers).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107073773/en/

Investor Relations: IR@greendot.com Media

Relations: PR@greendotcorp.com

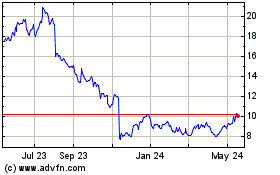

Green Dot (NYSE:GDOT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Green Dot (NYSE:GDOT)

Historical Stock Chart

From Dec 2023 to Dec 2024