Gabelli Dividend & Income Trust Trustees Have Approved Spin-Off of Gabelli Preferred Securities Trust Focusing on Preferred Securities

February 24 2025 - 7:30AM

The Board of Trustees of The Gabelli Dividend & Income Trust

(NYSE: GDV) (the “Fund” or “GDV”) has approved the spin off a newly

created closed-end fund (Gabelli Preferred Securities Trust or

“GPS”) whose investment objective will be to seek income and

capital appreciation by investing in preferred securities. As

investor preferences change and vary across portions of the capital

structure, the Fund, which has focused on common equity, is

considering additional allocation to preferred securities.

The Fund would contribute approximately $150

million of its cash and/or securities to GPS and would then

distribute all of the shares of GPS pro rata to the common

shareholders of GDV. GPS will seek to have its shares listed on the

New York Stock Exchange. Following the spin off, GPS is expected to

deploy leverage, the amount of which is to be determined.

It is expected that GDV’s distribution policy

will remain unchanged. The Board of Trustees of GPS will determine

the distribution rate of the new closed-end fund at the time of the

spin-off.

The transaction is expected to be voted upon at

a meeting of shareholders of the Fund following requisite

regulatory approvals. There are no assurances that such shareholder

and regulatory approvals will be received.

The Board of Trustees of the Fund will determine

the amount of cash and/or securities to be contributed, the number

of shares to be distributed, and the record and distribution dates,

which will be announced at a later time.

For more information regarding this press

release, call:

Investor Relations TeamCarter Austin, Laurissa Martire, David

Schachter, and Bethany Uhlein(914) 921-5070

This press release is not intended to, and does

not constitute an offer to purchase or sell any securities; nor is

this press release intended to solicit a proxy from any

shareholder. The solicitation of proxies in connection with the

special meeting of shareholders to effect the transaction will only

be made by a final, effective Registration Statement on Form N-14,

which includes a definitive Proxy Statement/Prospectus, after the

Registration Statement is declared effective by the Securities and

Exchange Commission (the “SEC”). This Registration Statement has

yet to be filed with the SEC. After the Registration Statement is

filed with the SEC, it may be amended or withdrawn and the Proxy

Statement/Prospectus will not be distributed to shareholders unless

and until the Registration Statement is declared effective by the

SEC.

The Fund and its trustees, officers and

employees and the Fund’s investment adviser and its officers and

employees and other persons may be deemed to be participants in the

solicitation of proxies in connection with the special meeting of

shareholders. Investors and shareholders may obtain more detailed

information regarding the direct and indirect interests of the

Fund’s trustees, officers and employees and other persons by

reading the Proxy Statement/Prospectus relating to the special

meeting of shareholders when it is filed with the SEC.

Investors and security holders of the

Fund are urged to read the Proxy Statement/Prospectus and other

documents filed with the SEC carefully and in their entirety when

they become available because these documents will contain

important information about the transaction. Investors should

consider the investment objective, risks, charges and expenses of

the Fund carefully. The Proxy Statement/Prospectus will contain

information with respect to the investment objective, risks,

charges and expenses of the Fund and other important information

about the Fund.

Security holders may obtain free copies of the

Registration Statement and Proxy Statement/Prospectus and other

documents (when they become available) filed with the SEC at the

SEC’s web site at www.sec.gov. In addition, free copies of the

Proxy Statement/Prospectus and other documents filed with the SEC

may also be obtained after the Registration Statement becomes

effective by calling the Fund at (914) 921-5070.

|

THE GABELLI DIVIDEND & INCOME TRUSTInvestor Relations

Team:Carter AustinLaurissa MartireDavid SchachterBethany

Uhlein(914) 921-5070ClosedEnd@gabelli.com |

The Fund also files annual and semi-annual

reports and other information with the SEC. You may request a free

copy of our annual and semiannual reports or request other

information about us and make shareholder inquiries by calling

(914) 921-5070. You may also obtain copies of the Fund’s annual and

semi-annual reports (and other information regarding the Fund) from

the SEC’s website (http://www.sec.gov).

About The Gabelli Dividend & Income

Trust

The Gabelli Dividend & Income Trust is a

diversified, closed-end management investment company with $3.0

billion in total net assets whose primary investment objective is

to provide a high level of total return with an emphasis on

dividends and income. The Fund is managed by Gabelli Funds, LLC, a

subsidiary of GAMCO Investors, Inc. (OTCQX: GAMI).

NYSE – GDVCUSIP – 36242H104

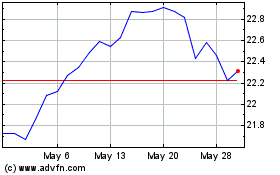

Gabelli Dividend and Inc... (NYSE:GDV)

Historical Stock Chart

From Feb 2025 to Mar 2025

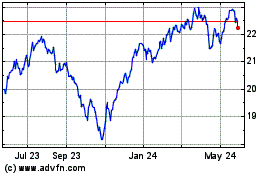

Gabelli Dividend and Inc... (NYSE:GDV)

Historical Stock Chart

From Mar 2024 to Mar 2025