SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2019

(Commission File No. 001-32221) ,

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of Registrant's name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of Regristrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

|

Material Fact

|

São Paulo, April 3, 2019 - GOL Linhas Aéreas Inteligentes S.A. (“GOL” or “Company”), (NYSE: GOL and B3: GOLL4)

, in compliance with the provisions in §4 of article 157 of Law no. 6404, dated December 15, 1976, as amended and in CVM Instruction no. 358/2002 (“ICVM 358”), hereby informs its shareholders and the market in general that it has decided, on March 27, 2019, to engage in negotiations initiated by Manchester Securities Corp. (“Manchester”), Elliott Associates, L.P. (“EA”) and Elliott International, L.P. (“EI” and jointly with EA and Manchester, “Elliott”), with the objective of developing an alternative proposal related to the competitive sale process of certain of the assets of Oceanair Linhas Aéreas S.A. and AVB Holding S.A. (together, “

Oceanair

”), currently under judicial restructuring (“

Judicial Restructuring

”). Elliott is the main creditor in the restructuring.

As a result of the negotiations, GOL and Elliott, on this date, entered into a binding agreement (“

Agreement

”) that establishes the following:

1.

Elliott will present a revised judicial restructuring plan for Oceanair, which will be submitted for approval of Oceanair’s creditors in the Judicial Restructuring (“

Revised Judicial Restructuring Plan

”) and will provide for, among others:

(a) establishment of seven special purpose entities (

unidades produtivas isoladas

) (“

UPIs

”) for Oceanair, to be auctioned as part of the Revised Judicial Restructuring Plan, of which (i) six will hold the right to use Oceanair’s landing and takeoff times in the airports of Congonhas, Santos Dumont and Guarulhos as well as airline operator certificates (“

Airline UPIs

”); and (ii) one will hold assets related to Oceanair’s mileage program

Amigo

; and

(b) submission of the UPIs for an auction, permitting any interested bidder to submit offers for one or more of the UPIs.

2.

GOL will (i) provide Oceanair with short-term post-petition financings, of US$5.0 million and US$3.0 million in principal amounts to be provided on April 9, 2019 and April 16, 2019, respectively, subject to satisfactory conclusion of its due diligence process; and (ii) acquire from Elliot up to US$5.0 million in short-term post-petition financings, to the extent those are provided by Elliot to Oceanair between on April 2 and 5, 2019, at par value.

3.

GOL will make a minimum offer of US$70.0 million for one of the Airline UPIs to be auctioned as part of the Revised Judicial Restructuring Plan, subject to certain conditions of the Revised Judicial Restructuring Plan. The financings described in item 2 above or any other post-petition financings by GOL may be used to offset the acquisition price for any of the UPIs in the auction.

4.

Simultaneously, GOL has agreed to advance US$35mm to Elliott in four monthly installments. Subject to certain conditions, this amount will be returned by Elliott to GOL if (i) after GOL having complied with its obligation under item 3 above, GOL or by any third party acquires the respective UPI, or (ii) another judicial restructuring plan involving the sale of Oceanair’s landing and takeoff times is considered valid by the competent court, and such slot sale transaction is successfully concluded. In exchange for the payment of the advance and subject to certain conditions, Elliott will pay to GOL a portion of the amounts recovered by Elliott as part of the Judicial Restructuring.

In case GOL acquires any Airline UPI, it will offer employment, pursuant to new employment agreements, to Oceanair’s employees that participate in the activities of the acquired UPI.

|

1

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

|

Material Fact

|

The Revised Judicial Restructuring Plan will be submitted to the approval of Oceanair’s creditors in the Judicial Restructuring.

GOL will maintain its shareholders and the market in general informed regarding any material development related to the facts described above.

GOL Investor Relations

ri@voegol.com.br

www.voegol.com.br/ir

+55(11) 2128-4700

About GOL Linhas Aéreas Inteligentes S.A

GOL

serves more than 33 million passengers annually. With Brazil's largest network,

GOL

offers customers more than 750 daily flights to 73 destinations in Brazil and in South America, the Caribbean and the United States.

GOLLOG

’s cargo transportation and logistics business serves more than 3,400 Brazilian municipalities and more than 200 international destinations in 95 countries.

SMILES

allows over 15 million registered clients to accumulate miles and redeem tickets to more than 700 destinations worldwide on the GOL partner network. Headquartered in São Paulo, GOL has a team of more than 15,000 highly skilled aviation professionals and operates a fleet of 120 Boeing 737 aircraft, delivering Brazil's top on-time performance and an industry leading 18 year safety record. GOL has invested billions of Reais in facilities, products and services and technology to enhance the customer experience in the air and on the ground. GOL's shares are traded on the NYSE (GOL) and the B3 (GOLL4). For further information, visit www.voegol.com.br/ir.

This report on Form 6-K shall be deemed TO BE incorporated by reference in the registration statement on Form F-3 (File No. 333-224546), filed with the Securities and Exchange Commission on April 30, 2018, and to be a part thereof from the date on which this report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

****

|

2

|

|

GOL Linhas Aéreas Inteligentes S.A

.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date:

April

3, 2019

|

GOL LINHAS AÉREAS INTELIGENTES S.A.

|

|

|

|

|

|

|

|

By:

|

/S/ Richard Freeman Lark Junior

|

|

|

Name: Richard Freeman Lark Junior

Title: Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

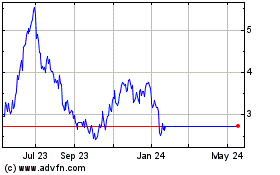

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Nov 2023 to Nov 2024