- Favorable Hawaii Supreme Court Decision Provides Clarity Needed

to Help Finalize Maui Tort Litigation Settlement

- Strong Execution on Strategic Priorities in a Pivotal Year

- Definitive Settlement Agreements Reached in Maui Wildfire Tort

Litigation

- Sale of 90.1% of American Savings Bank Simplified HEI’s

Strategy and Regulatory Position While Allowing Enhanced Focus on

Utility Business; Proceeds Will Be Used to Reduce Debt

- Rapid Implementation of Utility Wildfire Mitigation Efforts:

Grid Hardening and Redesign, Improved Situational Awareness and

Operational Practices, and Enhanced Stakeholder Engagement Efforts

Implemented to Reduce Risk

- Utility Achieved a 36% Renewable Portfolio Standard in 2024,

Accelerating Progress Toward the 2030 Milestone of 40%

- Typical Residential Bill Decreased 7% in 2024; Utility Returned

$18 Million in Bill Credits to Customers

Hawaiian Electric Industries, Inc. (NYSE - HE) (HEI)

today reported a net loss for the full year 2024 of $1,426 million,

or $11.23 per share, compared to net income of $199 million, or

$1.81 per share in 2023. Excluding the impacts of discontinued

operations, Maui wildfire-related expenses and the Pacific Current

asset impairment recorded in the third quarter, Core1 income from

continuing operations was $124 million, or $0.98 per share,

compared to $152 million, or $1.38 per share in 2023.

The fourth quarter 2024 net loss was $68 million, or $0.40 per

share, compared to net income of $49 million, or $0.44 per share,

in the fourth quarter of 2023. Core income from continuing

operations was $35 million for the fourth quarter of 2024 compared

to $37 million in the fourth quarter of 2023.

“The past year was pivotal in our company’s history, and

I am proud of the significant progress we’ve made to address the

challenges before us and build a foundation for long-term success,”

said Scott Seu, HEI president and CEO.

“Over the course of the year, we achieved numerous milestones in

our efforts to regain HEI’s financial strength and emerge a

stronger, more resilient company best positioned to serve our

communities for the long term. The settlement agreements signed in

November, along with the favorable Hawaii Supreme Court decision

issued earlier this month, allow us to move forward with a clearer

line of sight toward resolution of the Maui wildfire tort

litigation. The sale of over 90% of American Savings Bank in

December simplifies our strategy and regulatory position while

allowing us to reduce holding company debt and focus more on our

core utility business. The utility continued to rapidly progress

its wildfire mitigation efforts throughout the year, and

operational changes, new technology and the Public Safety Power

Shutoff program implemented in 2024 have led to substantial strides

in reducing risk of ignition from utility equipment. We also saw

significant progress on another key strategic initiative, with the

utility reaching a 36% renewable portfolio standard in 2024. This

puts us on track to meet the 40% by 2030 milestone significantly

ahead of schedule. These collective actions position our company

well as we continue our commitment to a stronger, more resilient

and more financially healthy future.”

As previously disclosed, on February 10, 2025 the Hawaii Supreme

Court issued a decision regarding the reserved questions posed to

them by the Second Circuit Court. The Hawaii Supreme Court’s

decision clarifies that, once the settlement becomes final,

insurers seeking to recover amounts paid to settling plaintiffs

cannot separately sue defendants, including for amounts beyond the

settlement agreed to by the plaintiffs and defendants. The Court’s

decision aligns with the Company’s and plaintiffs’ positions on key

questions that arose from insurers’ challenges to the settlement

agreements reached in the Maui wildfire tort litigation.

HAWAIIAN ELECTRIC COMPANY (HAWAIIAN ELECTRIC)

EARNINGS2

Full Year Results:

Hawaiian Electric’s full-year net loss was $1,226 million,

compared to net income of $194 million in 2023, with the decrease

primarily driven by the following items:

- $1,875 million ($1,392 million after-tax) loss due to the

accrual of estimated wildfire liabilities from tort-related legal

claims and cross claims as of December 31, 2024 (net of insurance

recoveries);

- $76 million ($56 million after taxes) in higher operations and

maintenance (O&M) expenses, driven principally by the

settlement of indemnification claims asserted by the state, higher

wildfire mitigation program expenses and higher property and

general liability insurance costs; and

- $7 million ($6 million after taxes) of higher depreciation

expense.

These items were partially offset by the following:

- $43 million ($29 million after taxes) higher revenues,

including $25 million from the annual revenue adjustment mechanism,

$7 million from the major project interim recovery mechanism, $6

million of demand response program revenues (offset by expenses

included in O&M) and $5 million from performance incentive

mechanisms;

- $4 million ($3 million after taxes) of lower interest expense;

and

- $3 million ($2 million after taxes) from a gain on sale of

property.

Hawaiian Electric’s Core net income for 2024 was $181 million.

Pre-tax wildfire-related expenses of $2,019 million were partially

offset by $86 million in insurance recoveries and $38 million of

costs deferred pursuant to the Public Utilities Commission’s

decision allowing Hawaiian Electric to defer these costs.

Fourth Quarter Results:

Hawaiian Electric’s net income for the fourth quarter of 2024

was $46 million, compared to $58 million in the fourth quarter of

2023, with the variance driven by the following items: $30 million

($25 million after taxes) of higher O&M, $13 million ($9

million after taxes) in higher revenues, $3 million ($2 million

after taxes) from a gain on sale of property and a $3 million ($2

million after taxes) impact from better heat rate performance.

Hawaiian Electric’s Core net income was approximately $49 million

for both the fourth quarters of 2024 and 2023.

Utility Dividend Update

The utility dividend to HEI continues to be suspended, as

holding company cash needs are limited following HEI’s recent

equity issuance and the continued suspension of the dividend to

HEI’s common equity shareholders.

DISCONTINUED OPERATIONS - AMERICAN SAVINGS BANK (ASB)

As previously announced, on December 31, 2024 HEI, ASB and ASB

Hawaii (ASB’s parent holding company) closed on the sale of 90.1%

of the common stock of ASB to various investors. Accordingly, the

results of ASB are presented as discontinued operations in the

consolidated financial statements. For the full year 2024, the loss

from discontinued operations totaled $103 million, compared to net

income of $53 million in 2023. Excluding wildfire expenses, the

goodwill impairment recorded in the second quarter, and the net

loss recorded in accordance with the December 2024 sale

transaction, Core income for 2024 was $79 million.

HOLDING AND OTHER COMPANIES

The holding and other companies’ net loss was $96 million in

2024 compared to $48 million in 2023. The higher net loss for the

year was primarily due to the Pacific Current asset impairment

recorded in the third quarter, higher wildfire-related expenses and

higher expenses at Pacific Current. Core net loss for the year was

$56 million compared to $43 million in 2023. The fourth quarter

2024 net loss was $17 million compared to $13 million in the fourth

quarter of 2023. The higher net loss compared to the prior year

quarter was primarily due to lower Pacific Current net income. Core

net loss for the fourth quarter of 2024 was $14 million compared to

$12 million in the fourth quarter of 2023.

EARNINGS RELEASE, WEBCAST AND CONFERENCE CALL TO DISCUSS

EARNINGS

HEI will conduct a webcast and conference call to review its

fourth quarter and full year 2024 consolidated financial results

today at 11:30 a.m. Hawaii time (4:30 p.m. Eastern).

To listen to the conference call, dial 1-888-660-6377 (U.S.) or

1-929-203-0797 (international) and enter passcode 2393042. Parties

may also access presentation materials (which include

reconciliation of non-GAAP measures) and/or listen to the

conference call by visiting the conference call link on HEI’s

website at www.hei.com under “Investor Relations,” sub-heading

“News and Events — Events and Presentations.”

A replay will be available online and via phone. The online

replay will be available on HEI’s website about two hours after the

event. The audio replay will also be available about two hours

after the event through March 7, 2025. To access the audio replay,

dial 1-800-770-2030 (U.S.) or 1-647-362-9199 (international) and

enter passcode 2393042.

HEI and Hawaiian Electric Company, Inc. (Hawaiian Electric)

intend to continue to use HEI’s website, www.hei.com, as a means of

disclosing additional information; such disclosures will be

included in the Investor Relations section of the website.

Accordingly, investors should routinely monitor the Investor

Relations section of HEI’s website, in addition to following HEI’s

and Hawaiian Electric’s press releases, HEI’s and Hawaiian

Electric’s Securities and Exchange Commission (SEC) filings and

HEI’s public conference calls and webcasts. Investors may sign up

to receive e-mail alerts via the “Investor Relations” section of

the website. The information on HEI’s website is not incorporated

by reference into this document or into HEI’s and Hawaiian

Electric’s SEC filings unless, and except to the extent,

specifically incorporated by reference.

Investors may also wish to refer to the Public Utilities

Commission of the State of Hawaii (PUC) website at

https://hpuc.my.site.com/cdms/s/ to review documents filed with,

and issued by, the PUC. No information on the PUC website is

incorporated by reference into this document or into HEI’s and

Hawaiian Electric’s SEC filings.

ABOUT HEI

The HEI family of companies provides the energy services that

empower much of the economic and community activity of Hawaii.

HEI’s electric utility, Hawaiian Electric, supplies power to

approximately 95% of Hawaii’s population and is undertaking an

ambitious effort to decarbonize its operations and the broader

state economy, and modernize and harden the grid to ensure

resilience and public safety. HEI also helps advance Hawaii’s

sustainability goals through investments by its non-regulated

subsidiary, Pacific Current. For more information, visit

www.hei.com.

NON-GAAP MEASURES

Measures described as “Core” are non-GAAP measures which exclude

Maui wildfire-related costs, the asset impairment taken in

connection with HEI’s ongoing review of strategic options for

Pacific Current and expenses recorded in connection with the review

of strategic options for ASB. See “Explanation of HEI’s Use of

Certain Unaudited Non-GAAP Measures” and the related GAAP

reconciliations at the end of this release.

This release may contain “forward-looking statements,” which

include statements that are predictive in nature, depend upon or

refer to future events or conditions, and usually include words

such as “will,” “expects,” “anticipates,” “intends,” “plans,”

“believes,” “predicts,” “estimates” or similar expressions. In

addition, any statements concerning future financial performance,

ongoing business strategies or prospects or possible future actions

are also forward-looking statements. Forward-looking statements are

based on current expectations and projections about future events

and are subject to risks, uncertainties and the accuracy of

assumptions concerning HEI and its subsidiaries, the performance of

the industries in which they do business and economic, political

and market factors, among other things. These forward-looking

statements are not guarantees of future performance.

Forward-looking statements in this release should be read in

conjunction with the “Cautionary Note Regarding Forward-Looking

Statements” and “Risk Factors” discussions (which are incorporated

by reference herein) set forth in HEI’s Annual Report on Form 10-K

for the year ended December 31, 2023 and HEI’s other SEC periodic

reports and filings that discuss important factors that could cause

HEI’s results to differ materially from those anticipated in such

statements. These forward-looking statements speak only as of the

date of the report, presentation or filing in which they are made.

Except to the extent required by the federal securities laws, HEI,

Hawaiian Electric, and their subsidiaries undertake no obligation

to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

Note: Throughout this release, per share values are calculated

based on diluted shares.

1Measures described as “Core” for the periods in this news

release are non-GAAP measures which exclude Maui wildfire-related

costs, and expenses taken in connection with strategic reviews for

Pacific Current and American Savings Bank. See the “Explanation of

HEI’s Use of Certain Unaudited Non-GAAP Measures” and the related

GAAP reconciliation at the end of this release.

2 Utility amounts indicated as after-tax in this earnings

release are based upon adjusting items using a current year

composite statutory tax rate of 25.75%.

Hawaiian Electric Industries, Inc. (HEI) and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME DATA (Unaudited)

Three months ended December

31

Years ended December

31

(in thousands, except per share

amounts)

2024

2023

2024

2023

Revenues

Electric utility

$

796,174

$

849,982

$

3,206,700

$

3,269,521

Other

3,006

3,442

13,150

17,982

Total revenues

799,180

853,424

3,219,850

3,287,503

Expenses

Electric utility (includes nil and $1,875

million of provision, net, for Wildfire tort-related claims

recorded in quarter and year ended December 31, 2024,

respectively)

722,383

768,682

4,818,558

2,967,363

Other (includes $35 million of impairment

recorded in third quarter of 2024)

23,135

10,411

108,052

45,148

Total expenses

745,518

779,093

4,926,610

3,012,511

Operating income (loss)

Electric utility

73,791

81,300

(1,611,858

)

302,158

Other

(20,129

)

(6,969

)

(94,902

)

(27,166

)

Total operating income (loss)

53,662

74,331

(1,706,760

)

274,992

Retirement defined benefits credit—other

than service costs

903

1,017

3,754

4,014

Interest expense, net

(31,131

)

(34,273

)

(127,207

)

(125,532

)

Allowance for borrowed funds used during

construction

1,409

1,403

5,470

5,201

Allowance for equity funds used during

construction

3,510

4,091

13,786

15,164

Interest income

9,433

9,105

19,362

9,105

Loss on equity-method investment

—

(644

)

—

(644

)

Income (loss) from continuing

operations before income taxes

37,786

55,030

(1,791,595

)

182,300

Income tax expense (benefit)

8,147

8,999

(470,962

)

34,534

Income (loss) from continuing

operations

29,639

46,031

(1,320,633

)

147,766

Preferred stock dividends of

subsidiaries

473

473

1,890

1,890

Income (loss) from continuing

operations for common stock

29,166

45,558

(1,322,523

)

145,876

Income (loss) from discontinued

operations

(97,411

)

3,231

(103,486

)

53,362

Net income (loss) for common

stock

$

(68,245

)

$

48,789

$

(1,426,009

)

$

199,238

Continuing operations - Basic earnings

(loss) per common share

$

0.17

$

0.41

$

(10.42

)

$

1.33

Discontinued operations - Basic

earnings (loss) per common share

(0.56

)

0.03

(0.81

)

0.49

Basic earnings (loss) per common

share

$

(0.40

)

$

0.44

$

(11.23

)

$

1.82

Continuing operations - Diluted

earnings (loss) per common share

$

0.17

$

0.41

$

(10.42

)

$

1.33

Discontinued operations - Diluted

earnings (loss) per common share

(0.56

)

0.03

(0.81

)

0.48

Diluted earnings (loss) per common

share

$

(0.40

)

$

0.44

$

(11.23

)

$

1.81

Dividends declared per common

share

$

—

$

—

$

—

$

1.08

Weighted-average number of common

shares outstanding

172,466

110,134

126,927

109,739

Weighted-average shares assuming

dilution

172,466

110,301

126,927

110,038

Income (loss) from continuing

operations for common stock by segment

Electric utility

$

46,396

$

58,183

$

(1,226,362

)

$

193,952

Other

(17,230

)

(12,625

)

(96,161

)

(48,076

)

Income (loss) from continuing

operations for common stock

$

29,166

$

45,558

$

(1,322,523

)

$

145,876

Comprehensive income (loss) attributable

to HEI

$

(96,214

)

$

117,463

$

(1,422,825

)

$

245,916

Return on average common equity (%)

(twelve months ended)1

NM

8.8

1 Simple average. NM Not meaningful.

This information should be read in

conjunction with the consolidated financial statements and the

notes thereto in HEI filings with the SEC.

Hawaiian Electric Company, Inc. (Hawaiian Electric) and

Subsidiaries CONSOLIDATED STATEMENTS OF INCOME DATA (Unaudited)

Three months ended December

31

Years ended December

31

($ in thousands, except per barrel

amounts)

2024

2023

2024

2023

Revenues

$

796,174

$

849,982

$

3,206,700

$

3,269,521

Expenses

Fuel oil

256,059

329,728

1,078,045

1,211,420

Purchased power

173,061

172,779

703,371

671,769

Other operation and maintenance

156,024

126,373

609,672

533,557

Wildfire tort-related claims, net

—

—

1,875,000

—

Depreciation

62,706

60,924

251,142

243,705

Taxes, other than income taxes

74,533

78,878

301,328

306,912

Total expenses

722,383

768,682

4,818,558

2,967,363

Operating income (loss)

73,791

81,300

(1,611,858

)

302,158

Allowance for equity funds used during

construction

3,510

4,091

13,786

15,164

Retirement defined benefits credit—other

than service costs

1,034

1,076

4,137

4,303

Interest expense and other charges,

net

(20,457

)

(22,575

)

(82,082

)

(86,140

)

Allowance for borrowed funds used during

construction

1,409

1,403

5,470

5,201

Interest income

2,078

6,454

6,633

6,454

Income (loss) before income

taxes

61,365

71,749

(1,663,914

)

247,140

Income tax expense (benefit)

14,470

13,067

(439,547

)

51,193

Net income (loss)

46,895

58,682

(1,224,367

)

195,947

Preferred stock dividends of

subsidiaries

229

229

915

915

Net income (loss) attributable to

Hawaiian Electric

46,666

58,453

(1,225,282

)

195,032

Preferred stock dividends of Hawaiian

Electric

270

270

1,080

1,080

Net income (loss) for common

stock

$

46,396

$

58,183

$

(1,226,362

)

$

193,952

Comprehensive income (loss)

attributable to Hawaiian Electric

$

46,426

$

58,337

$

(1,226,425

)

$

193,940

OTHER ELECTRIC UTILITY INFORMATION

Kilowatthour sales (millions)

Hawaiian Electric

1,608

1,604

6,134

6,138

Hawaii Electric Light

267

272

1,047

1,043

Maui Electric

276

264

1,038

1,046

2,151

2,140

8,219

8,227

Average fuel oil cost per barrel

$

104.38

$

132.47

$

115.00

$

126.73

Return on average common equity (%)

(twelve months ended)1

NM

8.2

1 Simple average. NM Not meaningful. This

information should be read in conjunction with the consolidated

financial statements and the notes thereto in Hawaiian Electric

filings with the SEC.

Explanation of HEI’s Use of Certain Unaudited Non-GAAP

Measures

HEI management uses certain non-GAAP measures to evaluate the

performance of HEI. Management believes these non-GAAP measures

provide useful information and are a better indicator of the

companies’ core operating activities. Core earnings and other

financial measures as presented here may not be comparable to

similarly titled measures used by other companies. The accompanying

tables provide a reconciliation of reported GAAP1 earnings to

non-GAAP Core earnings.

The reconciling adjustments from GAAP earnings to Core earnings

are limited to the costs related to the Maui wildfires, costs

related to the strategic review and majority sale of ASB, and the

asset impairment taken in connection with HEI’s ongoing review of

strategic options for Pacific Current. Management does not consider

these items to be representative of the company’s fundamental core

earnings.

Reconciliation of GAAP to non-GAAP Measures Hawaiian

Electric Industries, Inc. (HEI) and Subsidiaries Unaudited

Three months ended December

31

Years ended December

31

(in thousands)

2024

2023

2024

2023

Maui

wildfire-related costs2

Pretax expenses:

Legal expenses

$

13,449

$

23,768

$

69,779

$

33,969

Outside services expenses

7,541

6,640

11,014

12,024

Wildfire tort-related claims

—

—

1,915,000

75,000

Other expenses

8,281

1,034

35,403

3,519

Interest expense

3,185

1,645

14,834

2,600

Pretax expenses

32,456

33,087

2,046,030

127,112

Insurance recoveries

(11,089

)

(29,580

)

(94,699

)

(104,580

)

Deferral of cost

(13,817

)

(14,692

)

(37,960

)

(14,692

)

Wildfire-related expenses, net of

insurance recoveries and approved deferral treatment

7,550

(11,185

)

1,913,371

7,840

Pretax asset impairment

—

—

35,216

—

Income tax (benefits) expense3

(1,945

)

2,880

(501,763

)

(2,019

)

After-tax adjustments

$

5,605

$

(8,305

)

$

1,446,824

$

5,821

1 Accounting principles generally accepted

in the United States of America. 2 Excludes Maui wildfire-related

costs of our discontinued operations. 3 Current year composite

statutory tax rate of 25.75% is used for Utility and Other amounts.

Note: Other segment (Holding and Other Companies) wildfire-related

expenses (legal, outside services and other) are included in

“Expenses-Other” and interest expense is included in “Interest

expense, net” on the HEI and subsidiaries’ Consolidated Statements

of Income Data. See Electric Utilities tables below for more

detail.

Reconciliation of GAAP to non-GAAP Measures (continued)

Hawaiian Electric Industries, Inc. (HEI) and Subsidiaries

Unaudited

Three months ended December

31

Years ended December

31

(in thousands)

2024

2023

2024

2023

HEI Consolidated

- Continuing Operations

GAAP income (loss) - continuing

operations (as reported)

$

29,166

$

45,558

$

(1,322,523

)

$

145,876

Excluding special items related to the

Maui wildfire (after tax):

Legal expenses

9,987

17,648

51,811

25,222

Outside services expenses

5,599

4,931

8,178

8,928

Wildfire tort-related claims

—

—

1,421,887

55,688

Other expenses

6,147

766

26,286

2,612

Interest expense

2,365

1,222

11,014

1,931

After tax expenses

24,098

24,567

1,519,176

94,381

Insurance recoveries

(8,234

)

(21,963

)

(70,314

)

(77,651

)

Deferral of cost

(10,259

)

(10,909

)

(28,185

)

(10,909

)

Maui wildfire-related expenses, net of

insurance recoveries and approved deferral treatment (after

tax)

5,605

(8,305

)

1,420,677

5,821

Asset impairment (after tax)

—

—

26,147

—

Non-GAAP (core) income - continuing

operations

$

34,771

$

37,253

$

124,301

$

151,697

GAAP Diluted earnings (loss) per share

- continuing operations (as reported)

$

0.17

$

0.41

$

(10.42

)

$

1.33

Non-GAAP (Core) Diluted earnings per

share - continuing operations

$

0.20

$

0.34

$

0.98

$

1.38

Three months ended December

31

Years ended December

31

(in thousands)

2024

2023

2024

2023

HEI Consolidated

- Discontinued Operations

GAAP income (loss) - discontinued

operations (as reported)

$

(97,411

)

$

3,231

$

(103,486

)

$

53,362

Less: Net loss from the sale of ASB

115,803

—

115,803

—

Excluding special items:

Goodwill impairment

—

—

66,130

—

Loss on sale of investment securities

—

10,954

—

10,954

Wildfire expenses

59

1,987

963

8,251

Non-GAAP (Core) income - discontinued

operations

$

18,451

$

16,172

$

79,410

$

72,567

Reconciliation of GAAP to non-GAAP Measures (continued)

Hawaiian Electric Company, Inc. and Subsidiaries Unaudited

Three months ended December

31

Years ended December

31

(in thousands)

2024

2023

2024

2023

Maui windstorm

and wildfires related costs

Pretax expenses:

Legal expenses

$

11,237

$

18,486

$

51,406

$

24,737

Outside services expenses

6,080

5,826

8,500

10,532

Wildfire tort-related claims

—

—

1,915,000

75,000

Other expenses

7,614

834

32,753

3,316

Interest expenses

2,204

720

11,168

1,223

Pretax expenses

27,135

25,866

2,018,827

114,808

Insurance recoveries

(9,808

)

(23,613

)

(85,781

)

(98,613

)

Deferral of cost

(13,817

)

(14,692

)

(37,960

)

(14,692

)

Total Maui windstorm and wildfires

related expenses, net of insurance recoveries and approved deferral

treatment

3,510

(12,439

)

1,895,086

1,503

Income tax expense (benefits)1

(904

)

3,203

(487,985

)

(387

)

After-tax adjustments

$

2,606

$

(9,236

)

$

1,407,101

$

1,116

Hawaiian Electric

consolidated net income (loss)

GAAP2 net income (loss) (as reported)

$

46,396

$

58,183

$

(1,226,362

)

$

193,952

Excluding special items related to the

Maui windstorm and wildfires (after tax):

Legal expenses

8,344

13,726

38,169

18,367

Outside services expenses

4,514

4,326

6,311

7,820

Wildfire tort-related claims

—

—

1,421,887

55,688

Other expenses

5,654

619

24,320

2,462

Interest expenses

1,636

534

8,292

908

Maui windstorm and wildfires related

expenses (after tax)

20,148

19,205

1,498,979

85,245

Insurance recoveries (after tax)

(7,283

)

(17,532

)

(63,693

)

(73,220

)

Deferral of cost (after tax)

(10,259

)

(10,909

)

(28,185

)

(10,909

)

Total Maui windstorm and wildfires

related expenses, net of insurance recoveries and approved deferral

treatment (after tax)

2,606

(9,236

)

1,407,101

1,116

Non-GAAP (Core) net income

$

49,002

$

48,947

$

180,739

$

195,068

1 Current year composite statutory tax

rate of 25.75% is used for Utility amounts. 2 Accounting principles

generally accepted in the United States of America. Note: Legal,

outside services and other are included in “Other operation and

maintenance” and interest expense is included in “Interest expense

and other charges, net” on the Hawaiian Electric and subsidiaries’

Consolidated Statements of Income Data.

Reconciliation of GAAP to non-GAAP Measures (continued)

Holding and Other Companies Unaudited

Three months ended December

31

Years ended December

31

(in thousands)

2024

2023

2024

2023

Maui windstorm

and wildfires related costs

Pretax expenses:

Legal expenses

$

2,212

$

5,282

$

18,373

$

9,232

Outside services expenses

1,461

814

2,514

1,492

Other expenses

667

200

2,650

203

Interest expenses

981

925

3,666

1,377

Pretax expenses

5,321

7,221

27,203

12,304

Insurance recoveries

(1,281

)

(5,967

)

(8,918

)

(5,967

)

Total Maui windstorm and wildfires

related expenses, net of insurance recoveries

4,040

1,254

18,285

6,337

Income tax benefits1

(1,041

)

(323

)

(4,709

)

(1,632

)

After-tax adjustments

$

2,999

$

931

$

13,576

$

4,705

Holding and Other

Companies net loss

GAAP2 net loss (as reported)

$

(17,230

)

$

(12,625

)

$

(96,161

)

$

(48,076

)

Excluding special items related to the

Maui windstorm and wildfires (after tax):

Legal expenses

1,643

3,922

13,642

6,855

Outside services expenses

1,085

605

1,867

1,108

Other expenses

493

147

1,966

150

Interest expenses

729

688

2,722

1,023

Maui windstorm and wildfires related

expenses (after tax)

3,950

5,362

20,197

9,136

Insurance recoveries (after tax)

(951

)

(4,431

)

(6,621

)

(4,431

)

Total Maui windstorm and wildfires

related expenses, net of insurance recoveries (after tax)

2,999

931

13,576

4,705

Asset impairment (after tax)

—

—

26,147

—

Non-GAAP (Core) net loss

$

(14,231

)

$

(11,694

)

$

(56,438

)

$

(43,371

)

1 Current year composite statutory tax

rate of 25.75% is used for Holding and Other Companies’ amounts. 2

Accounting principles generally accepted in the United States of

America. Note: Holding and Other Companies wildfire-related

expenses (legal, outside services and other) are included in

“Expenses-Other” and interest expense is included in “Interest

expense, net” on the HEI and subsidiaries’ Consolidated Statements

of Income Data.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250221176474/en/

Mateo Garcia Telephone: (808) 543-7300 Director, Investor

Relations E-mail: ir@hei.com

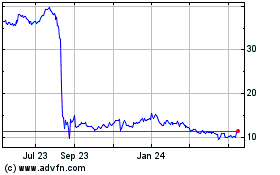

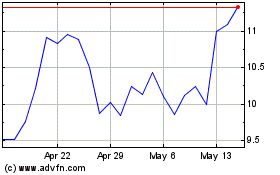

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Feb 2024 to Feb 2025