What Taxpayers Should Know About Big Changes to Form 1099-K Reporting

January 22 2025 - 7:00AM

The millions of Americans with revenue-generating side hustles and

casual sellers may be in for a big surprise this January—an

unexpected tax form called the 1099-K. Payment platforms, apps and

online marketplaces must issue a Form 1099-K to anyone who received

$5,000 or more in payments on any single platform in 2024 to

include with their tax return this tax season.

This is a substantial change from the prior threshold, in which

1099-Ks were only sent to individuals who received more than

$20,000 and had more than 200 transactions on any platform. The IRS

also announced that the reporting threshold will continue to

decrease in subsequent years and anticipates it will impact roughly

20 million people over the next two years.

Implications for Side-Hustlers and Casual

Sellers

What does this mean for taxpayers and the explosive growth of

the side-hustle economy? Many Americans are supplementing their

incomes to cover necessities and fund their dreams. Some resell

highly coveted concert tickets or used designer merchandise. Others

sell handmade goods on online marketplaces or drive for a rideshare

company. The 1099-K change means these casual online sellers, gig

workers, freelancers and small business owners whose online

transactions met the new reporting threshold for the first time in

2024 could have a more complex tax filing experience.

Recent data from H&R Block’s Outlook on American Life report

found that GenZ is the generation most likely to rely on multiple

income streams from a patchwork of revenue-generating activities,

and most often online. These individuals must now account for and

report their income more diligently to ensure compliance with the

IRS regulations.

Many people are surprised that as gig workers they actually own

a small business in the eyes of the Internal Revenue Service. And

small businesses have extra tax rules—and potentially more IRS

audits and notices—making filing taxes complicated. Whether gig

revenue is the primary source of income or a side hustle, these

individuals have more requirements and responsibilities that may

lead them to interact more with the IRS and state revenue

offices.

“Although these changes could result in more paperwork at tax

time, the bigger concern is about accuracy,” said Carl Breedlove, a

leading expert at H&R Block’s The Tax Institute. “Block

Advisors and H&R Block small business certified tax pros have

the expertise to help cut through the confusion, ensure you file

accurately, and get you every possible deduction so you can keep

more of your hard-earned money.”

While these new tax requirements may seem daunting, taxpayers

filing as self-employed or small business owners also have more

opportunities to offset their tax burden. Tax deductions, such as

expenses you incur during your gig or side hustle, can help lower

your income and overall tax bill. Self-employed and gig workers can

often take advantage of small business tax deductions that

individuals can’t.

Recommendations to Minimize Tax Liability

- Create separate business

and personal profiles: Using the same account for business

and personal transactions, such as splitting rent or sending gifts,

may make distinguishing business income and expenses

difficult.

- Maintain detailed

records: Keep thorough records of all transactions,

including the amount received, the date, and the nature of the

transaction. This includes sales receipts, invoices, and any

relevant correspondence.

- Track expenses:

Document any expenses related to your side hustle or casual selling

activities. This includes costs for materials, shipping,

advertising, and any platform fees, as these can often be deducted

from your income when filing your taxes.

- Consider professional

assistance: If managing these new requirements feels

overwhelming, consider seeking help from a tax professional. They

can provide personalized advice and ensure you meet all IRS

requirements accurately.

- Utilize tax preparation

software: For DIYers, utilize reliable tax preparation

software that can help you track income and expenses, generate

necessary forms, and ensure compliance with the new 1099K

requirements.

- Plan for taxes: Set

aside a portion of your income to cover potential tax liabilities.

This proactive approach can prevent unexpected financial burdens

when it comes time to file your tax return.

Individuals who receive a 1099-K for the first time this year

should keep in mind that they may be able to deduct against their

reported business income in several ways. Home office expenses,

business meals and travel, advertising expenses, retirement

contributions, and even the cost of tax prep can often be deducted.

Furthermore, if their business activities continue to expand, they

may want to consider forming an LLC and filing taxes as an S Corp.

This tax strategy often saves small business owners hundreds or

even thousands at tax time.

While tallying up potential business deductions, individuals

should consider that reporting a loss for multiple years can also

threaten their new self-employed business owner status. Walking the

line between hobby and business can be tricky, but a primary

indicator is seeking to make a profit. If your expenses outweigh

your revenue, the IRS may eventually wonder if your activity is

more of a hobby.

Entering the world of self-employment brings a new level of

complexity to taxes. The Block Advisors Resource Center has

articles to help navigate the ins and outs of 1099-Ks and

self-employed tax deductions. For professional help, Block

Advisors’ small business certified tax pros provide support

tailored to unique situations. To learn more, visit

www.blockadvisors.com.

Editor’s Note:For additional

assets, please visit the 1099-K Media Kit at

https://www.hrblock.com/tax-center/media-kit/1099-k/

About H&R BlockH&R Block, Inc. (NYSE:

HRB) provides help and inspires confidence in its clients and

communities everywhere through global tax preparation services,

financial products, and small-business solutions. The company

blends digital innovation with human expertise and care as it helps

people get the best outcome at tax time and also be better with

money using its mobile banking app, Spruce. Through Block Advisors

and Wave, the company helps small-business owners thrive with

year-round bookkeeping, payroll, advisory, and payment processing

solutions. For more information, visit H&R Block News.

|

Media Contacts |

|

|

|

|

|

Media Relations: |

Erika O’Shea, (816) 585-6058,

erika.oshea@hrblock.comMedia Desk: mediadesk@hrblock.com |

|

Investor Relations: |

Jordyn Eskijian, (816) 854-5674,

jordyn.eskijian@hrblock.com |

|

|

|

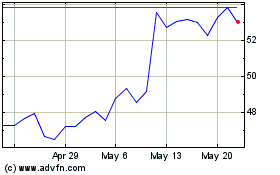

H and R Block (NYSE:HRB)

Historical Stock Chart

From Dec 2024 to Jan 2025

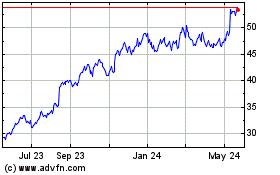

H and R Block (NYSE:HRB)

Historical Stock Chart

From Jan 2024 to Jan 2025