ICE Introduces Multi-Asset Class Climate Transition Risk Solution

October 08 2024 - 8:00AM

Business Wire

Holistic Emissions Data Now Available for

Municipal Bonds, Mortgage-backed Securities and Real Estate, as

well as Corporate and Sovereign Bonds

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data, today announced the launch of a

multi-asset class climate transition risk solution, which provides

emissions estimates and portfolio analytics across various fixed

income asset classes, covering Scope 1, Scope 2 and Scope 3

emissions for municipal bonds, mortgage-backed securities (MBS),

and real estate. This new solution, combined with ICE’s existing

coverage of sovereign, corporate equity, and private companies, can

enable clients to assess and benchmark their financed emissions

across a comprehensive range of fixed income asset classes in one

integrated offering.

ICE’s new multi-asset class transition risk solution addresses

gaps in emissions data by covering underserved sub-asset classes,

such as RMBS, CMBS, and private corporates. By integrating this

data, ICE can provide a unified portfolio metric that tracks

financed emissions across multiple asset classes, supporting

climate risk reporting, ensuring a holistic portfolio coverage from

a physical and transition risk standpoint.

“Our clients increasingly need quality transition risk data for

underserved segments, particularly mortgage-backed securities,

where we have applied physics-based simulations with building

energy models and ICE’s data to provide emissions insights for RMBS

and CMBS,” said Larry Lawrence, Head of ICE Climate. “Mortgages and

mortgage securities can represent more than 20 percent of bank

balance sheets, leading to a growing need for data to help meet

regulatory disclosure and support stress testing to inform

decision-making.”

ICE’s multi-asset class transition risk solution provides

PCAF-aligned (Partnership for Carbon Accounting Financials)

financed emissions data, encompassing over 110 million US

properties and more than 4.2 million fixed income securities

globally. With this solution, clients can leverage advanced

portfolio analytics to evaluate total emissions across multi-asset

class portfolios, assisting clients in transition risk strategies.

ICE’s methodologies, customized for each asset class, provide

comprehensive emissions tracking, including Scope 1, 2, and 3

estimates, as well as carbon intensity metrics, essential to meet

climate regulatory reporting requirements.

This new solution is part of the company’s climate data

offering, which provides data and analytics that help quantify

investment impacts posed by transition risks as well as physical

climate risks, such as extreme weather events.

For more information, visit

https://www.ice.com/fixed-income-data-services/ice-climate-data-analytics.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges –

including the New York Stock Exchange – and clearing houses help

people invest, raise capital and manage risk. We offer some of the

world’s largest markets to trade and clear energy and environmental

products. Our fixed income, data services and execution

capabilities provide information, analytics and platforms that help

our customers streamline processes and capitalize on opportunities.

At ICE Mortgage Technology , we are transforming U.S. housing

finance, from initial consumer engagement through loan production,

closing, registration and the long-term servicing relationship.

Together, ICE transforms, streamlines and automates industries to

connect our customers to opportunity.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: Fixed Income and Data Services

SOURCE: Intercontinental Exchange

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241008432655/en/

ICE Media Isabella Bezzone +1 212 748 3948

isabella.bezzone@ice.com media@theice.com ICE Investor

Relations Katia Gonzalez +1 678 981 3882 katia.gonzalez@ice.com

investors@ice.com

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Nov 2024 to Dec 2024

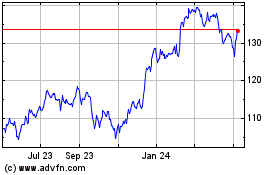

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Dec 2023 to Dec 2024