ICE Launches MSCI® MarketAxess Tradable Corporate Bond Index Futures to Help Investors Hedge Corporate Bond Exposure

December 12 2024 - 7:30AM

Business Wire

Intercontinental Exchange, Inc. (NYSE: ICE), a leading global

provider of technology and data, and home to the most liquid

markets for trading MSCI® futures, today announced the launch of

MSCI® MarketAxess Tradable Corporate Bond Index futures.

The futures contracts will be based on MSCI and MarketAxess’

newly created corporate bond indices. These tradable indices aim to

provide a benchmark for the performance of the corporate bond

market, incorporating sector and credit allocation to ensure low

tracking error to the MSCI parent indices and reliable replication

of the credit market.

“The introduction of ICE MSCI MarketAxess Corporate Bond futures

are a welcome addition to the existing suite of credit futures,”

said Antony Harden, Executive Director, Goldman Sachs. “Timing

couldn’t be better as client adoption hits an all-time high as

credit futures find their way into investors toolkits.”

ICE’s four futures contracts offer a way for institutional

investors to integrate corporate bond hedges into their investment

process and are based on the following indices: MSCI MarketAxess

USD IG Tradable Corporate Bond Index, MSCI MarketAxess USD HY

Tradable Corporate Bond Index, MSCI MarketAxess EUR IG Tradable

Corporate Bond Index and MSCI MarketAxess EUR HY Tradable Corporate

Bond Index.

The MSCI MarketAxess Tradable Corporate bond indices methodology

uses MarketAxess’ Relative Liquidity Scores to identify and measure

the performance of a selection of liquid fixed income securities

from MSCI’s broader Corporate Bond Indices.

“ICE’s markets account for over 70% of global MSCI futures

trading by volume in equity markets, and we are pleased to expand

our relationship to the corporate bond futures market,” said

Caterina Caramaschi, Vice President, Financial Derivatives, ICE.

“The launch reflects growing investor demand for products that

allow better management of corporate bond portfolios, and we thank

MSCI and MarketAxess for their collaboration.”

"We are excited to be working with ICE and MarketAxess to

provide investors with innovative tools designed to manage credit

exposures more efficiently,” said George Harrington, Managing

Director, MSCI. “By leveraging MSCI's index methodologies,

MarketAxess' unique liquidity metrics and ICE's leading trading

platform, clients can efficiently trade and achieve enhanced

liquidity.”

“Credit futures are an important tool for a healthy market and

our institutional clients—one that will generate more liquidity in

the cash markets,” said Kat Sweeney, Global Head of Data and ETF

Solutions at MarketAxess. “We are proud to have introduced these

tradable indices with MSCI and are equally excited to be expanding

on our data and trading relationship with ICE with the launch of

these futures.”

ICE’s MSCI MarketAxess Tradable Corporate Bond Index Futures

will join ICE’s existing suite of liquid futures based on MSCI

ACWI, MSCI EAFE, MSCI Emerging Markets, MSCI ESG and MSCI Climate

indices, providing participants around the world with a set of

tools to manage equity risk. So far in 2024, the average daily

volume for ICE’s MSCI complex is over 190,000 contracts, equal to

an estimated $13.6 billion of notional value. Approximately 45

million ICE MSCI futures contracts have traded year-to-date.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges –

including the New York Stock Exchange – and clearing houses help

people invest, raise capital and manage risk. We offer some of the

world’s largest markets to trade and clear energy and environmental

products. Our fixed income, data services and execution

capabilities provide information, analytics and platforms that help

our customers streamline processes and capitalize on opportunities.

At ICE Mortgage Technology , we are transforming U.S. housing

finance, from initial consumer engagement through loan production,

closing, registration and the long-term servicing relationship.

Together, ICE transforms, streamlines and automates industries to

connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here . Key Information Documents for certain

products covered by the EU Packaged Retail and Insurance-based

Investment Products Regulation can be accessed on the relevant

exchange website under the heading “Key Information Documents

(KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: EXCHANGES

ICE-CORP

Source: Intercontinental Exchange

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210684314/en/

ICE Media: Jess Tatham jess.tatham@ice.com +44 7377

947136 ICE Investor: Katia Gonzalez katia.gonzalez@ice.com

(678) 981-3882

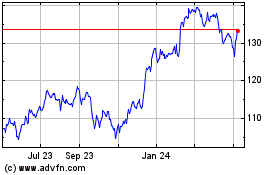

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Dec 2023 to Dec 2024