false

0001421461

0001421461

2025-01-14

2025-01-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: January 14, 2025

(Date of earliest event

reported)

Intrepid

Potash, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-34025 |

|

26-1501877 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

707

17th Street, Suite

4200

Denver,

Colorado

80202

(Address of principal executive offices and zip

code)

(303)

296-3006

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

IPI |

|

New

York Stock Exchange |

Indicate by checkmark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

Item 5.02 of this Current Report on Form 8-K contains a description of the material

terms of a Cooperation Agreement, which description is incorporated by reference in this Item 1.01.

| Item 5.02 | Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective as of January 14, 2025, the Board

of Directors (the “Board”) of Intrepid Potash, Inc. (the “Company”) increased the size of the Board from 7

to 8 directors, and the Board appointed Gonzalo Avendano as an additional independent director to fill the vacancy created by the

expansion of the Board and to serve as a Class I director of the Company. The Board also appointed Mr. Avendano to serve on each of

the Board’s Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Environmental, Health,

Safety, and Sustainability Committee, each effective immediately.

Mr. Avendano, age 57, has over 30 years of expertise

in leadership of finance and wealth management companies, including Lehman Brothers, Deutsche Bank AG, UBS AG, and Silver Mills LLC, an

investment advisory group Mr. Avendano founded in 2005 and led as Chief Executive Officer for nearly 10 years. Mr. Avendano currently

serves as an Investment Advisor at Clearway Capital Management LLC (“Clearway”), an investment company incorporated in Florida.

In addition to his position at Clearway, which he has held since 2014, Mr. Avendano owns and operates Haras Patagones SRL, an Argentinian

private company in the agriculture industry. Mr. Avendano holds a bachelor of law studies from the University of Buenos Aires –

Faculta de Derecho y Cliencias Sociales.

The Board determined that Mr. Avendano is independent

as defined in the Company’s governing documents and under applicable law. Mr. Avendano does not have any family relationship with

any officer or director of the Company. Other than as provided under the Cooperation Agreement described below, there are no arrangements

or understandings pursuant to which Mr. Avendano was elected as a director, and Mr. Avendano has not been involved in any related transactions

or relationships with the Company as defined in Item 404(a) of Regulation S-K.

In connection with Mr. Avendano’s appointment

as a member of the Board, Mr. Avendano will be entitled to receive the same compensation as other non-employee directors, which compensation

amount shall reflect the pro rata portion for Mr. Avendano’s partial period of service between the date of his appointment and the

2025 annual meeting of stockholders. In addition, Mr. Avendano will enter into an indemnification agreement with the Company in the form

attached as Exhibit 10.1 to the Company’s annual report on Form 10-K for the year ended December 31, 2023.

In connection with the appointment, the Company

entered into a Cooperation Agreement (the “Cooperation Agreement”) with Clearway and certain other persons and entities listed

on Schedule A thereto (together with Clearway, the “Investor Group”). Pursuant to the Cooperation Agreement, the Investor

Group has agreed not to conduct a proxy contest or engage in any solicitation of proxies regarding the election of directors with respect

to the 2025 and 2026 annual meetings of stockholders.

Under the Cooperation Agreement, the Investor

Group also agreed to abide by certain voting commitments, customary standstill obligations and mutual non-disparagement provisions which

remain in effect 30 calendar days prior to the last day of the advance notice period for the submission by stockholders of non-proxy access

director nominations for the Company’s 2027 annual meeting of stockholders (the “Standstill Period”). The scope of the

Investor Group’s commitments, obligations, provisions and other terms are set forth in full in the Cooperation Agreement.

The foregoing summary of the Cooperation Agreement

does not purport to be complete and is subject to and is qualified in its entirety by the terms of the Cooperation Agreement, a copy of

which is attached hereto as Exhibit 10.1 to this Current Report on Form 8-K, and incorporated by reference herein.

| Item 7.01 | Regulation FD Disclosure. |

On January 15, 2025, the Company issued a press

release announcing the appointment of Mr. Avendano to the Board and related information. A copy of such press release is attached hereto

as Exhibit 99.1 and incorporated herein by reference.

The information furnished under this Item 7.01,

including Exhibit 99.1, will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and will

not be incorporated by reference into any filing under the Securities Act of 1933, except as expressly set forth by specific reference

in that filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INTREPID POTASH, INC. |

| |

|

|

| Dated: January 15,

2025 |

By: |

/s/ Christina C. Sheehan |

| |

|

Christina C. Sheehan |

| |

|

General Counsel and Secretary |

Exhibit 10.1

COOPERATION AGREEMENT

This COOPERATION AGREEMENT

(the “Agreement”), dated as of January 14, 2025, is made and entered into by and among INTREPID POTASH, INC.,

a Delaware corporation (the “Company”), and CLEARWAY CAPITAL MANAGEMENT LLC (“Clearway”) and the

other persons and entities listed on Schedule A hereto (collectively and together with Clearway, the “Investor Group”).

The Company and the Investor Group are each herein referred to as a “party” and collectively, as the “parties”.

WHEREAS, the Company and the

Investor Group have engaged in discussions regarding various matters concerning the Company, including matters concerning the Board of

Directors of the Company (the “Board”); and

WHEREAS, the Company believes

that the best interests of the Company would be served at this time by, among other things, coming to an agreement with the Investor Group

with respect to the matters covered in this Agreement and by the Company and the Investor Group agreeing to the other covenants and obligations

contained herein.

NOW, THEREFORE, in consideration

of the foregoing premises and the mutual covenants and agreements contained in this Agreement, and for other good and valuable consideration,

the receipt and sufficiency of which are acknowledged, the parties to this Agreement, intending to be legally bound by this Agreement,

agree as follows:

1. Representations

and Warranties of the Company. The Company represents and warrants to Clearway that (a) the Company has the corporate power

and authority to execute the Agreement and to bind the Company to this Agreement; (b) this Agreement has been duly and validly authorized,

executed and delivered by the Company, constitutes a valid and binding obligation and agreement of the Company, and is enforceable against

the Company in accordance with its terms, except as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium, fraudulent conveyance or similar laws generally affecting the rights of creditors and subject to general equity principles;

and (c) the execution, delivery and performance of this Agreement by the Company does not violate or conflict with (i) any

law, rule, regulation, order, judgment or decree applicable to it, or (ii) result in any breach or violation of or constitute a

default (or an event which with notice or lapse of time or both could become a default) under or pursuant to, or give any right of termination,

amendment, acceleration or cancellation of, any organizational document, or any material agreement, contract, commitment, understanding

or arrangement to which the Company is a party or by which it is bound.

2. Representations

and Warranties of the Investor Group. The Investor Group, jointly and severally represents and warrants to the Company that (a)(i) as

of the date of this Agreement, the Investor Group and each Related Person (as defined below) beneficially own, directly or indirectly,

only the number of common shares of the Company, par value $0.001 per share (the “Common Shares”) as described opposite

its name on Schedule A to this Agreement and such schedule includes each Investor Group member and all Related Persons that beneficially

own any Common Shares; (a)(ii) as of the date of this Agreement, other than as disclosed opposite its name on Schedule A

to this Agreement, the Investor Group and each Related Person does not currently have, and does not currently have any right to acquire,

any interest in any other equity or debt securities of the Company or its subsidiaries (or any rights, options or other securities convertible

into or exercisable or exchangeable (whether or not convertible, exercisable or exchangeable immediately or only after the passage of

time or the occurrence of a specified event) for such securities or, any Synthetic Position (as defined below), or any other obligations

measured by the price or value of any securities of the Company or any of its controlled Affiliates, including any swaps or other derivative

arrangements designed to produce economic benefits and risks that correspond to the ownership of Common Shares, whether or not any of

the foregoing would give rise to beneficial ownership (as determined under Rule 13d-3 promulgated under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”)), and whether or not to be settled by delivery of Common Shares, payment

of cash or by other consideration, and without regard to any short position under any such contract or arrangement) or any other interest

in the Company or its subsidiaries described in Sections 4(a)(vii) and 4(a)(viii) and such schedule includes

each Investor Group member and all Related Persons that have any interest of the type described in this clause (a)(ii); (b) this

Agreement has been duly and validly authorized, executed and delivered by each member of the Investor Group, and constitutes a valid

and binding obligation and agreement of each such member, enforceable against the such member in accordance with its terms, except as

enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or similar

laws generally affecting the rights of creditors and subject to general equity principles; (c) each member of the Investor Group

has the authority to execute this Agreement on behalf of itself and to bind such member to the terms of this Agreement, including by

virtue of having sole voting and dispositive power over all Common Shares and other interests in the Company and its subsidiaries as

set forth opposite the name of such member of the Investor Group on Schedule A to this Agreement, if applicable; (d) each

member of the Investor Group shall cause each of its Related Persons to comply with the terms of this Agreement; and (e) the execution,

delivery and performance of this Agreement by each member of the Investor Group does not violate or conflict with (i) any law, rule,

regulation, order, judgment or decree applicable to it, or (ii) result in any breach or violation of or constitute a default (or

an event which with notice or lapse of time or both could become a default) under or pursuant to, or give any right of termination, amendment,

acceleration or cancellation of, any organizational document, agreement, contract, commitment, understanding or arrangement to which

such member is a party or by which it is bound. The Investor Group jointly and severally represents and warrants that no member of the

Investor Group and no Related Person has any voting commitments (written or oral) with the New Director (as defined below) as of the

date hereof and agrees that no member of the Investor Group and no Related Person shall compensate or otherwise incentivize the New Director

for service or action on the Board or enter into voting commitments (written or oral) relating to the Company with any director or officer

of the Company. The Investor Group jointly and severally represents and warrants that no member of the Investor Group and no Related

Person has, directly or indirectly, any agreements, arrangements or understandings with any person with respect to its investment in

the Company or its subsidiaries, any strategic, capital, management or other operational matter with respect to the Company or its subsidiaries,

any potential transaction involving the Company or its subsidiaries, or the acquisition, voting or disposition of any securities of the

Company or its subsidiaries. The Investor Group jointly and severally represents and warrants that no member of the Investor Group and

no Related Person has any control or influence over any compensation or other monetary payments to be received by the New Director in

connection with service as a director of the Company and that no member of the Investor Group and no Related Person is aware of any facts

or circumstances that will prevent the New Director from exercising independent judgment with respect to any matter involving the Company

or items that may come before the Board or any of its committees. The Investor Group jointly and severally represents and warrants that

the information previously provided to the Company by any member of the Investor Group or any Related Person is true, accurate and complete

in all material respects.

3. Board

Matters.

(a) Board

Matters. The Company agrees that promptly as practicable following the execution of this Agreement, the Board and the Nominating and

Corporate Governance Committee of the Board shall take all necessary actions to set the size of the Board at eight (8) directors

and, in connection therewith, appoint Gonzalo Avendano (the “New Director”) to the Board as an independent director

to fill the vacancy created by the expansion of the Board and to serve as a director of the Company as a Class I director.

(b) Service

on Board Committees. The Board shall, subject to compliance with all applicable stock exchange rules, consider appropriate appointments

for the New Director to applicable Board committees as it would consider such appointments for other Board candidates, taking into account

the composition of the Board, committee assignments and the needs and independence and eligibility requirements of the committees.

(c) Board

Policies and Procedures. Each party acknowledges that the New Director shall be governed by (i) all applicable laws and regulations,

and (ii) all of the same policies, processes, procedures, codes, rules, standards and guidelines applicable to members of the Board

and shall be required to adhere strictly to the policies on confidentiality, insider trading and conflicts of interest imposed on all

members of the Board. Each party acknowledges that the New Director shall be required to provide the Company with such information and

authorizations as reasonably requested from all members of the Board as is required to be disclosed under applicable law or stock exchange

regulations, in each case as promptly as necessary to enable the timely and accurate filing of the Company’s proxy statement and

other periodic reports or legally required disclosures with the Securities and Exchange Commission (the “SEC”) and

to applicable stock exchanges and regulatory authorities. The Company agrees that the New Director shall receive the same compensation

for service as a director as the compensation received by other non-management directors on the Board. The Company agrees that, upon appointment

to the Board, the New Director shall receive (1) the same benefits of director and officer insurance as all other non-management

directors on the Board, (2) the same compensation for his service as a director as the compensation received by other non-management

directors on the Board and (3) such other benefits on the same basis as all other non-management directors on the Board.

4. Standstill.

(a) Except

as otherwise set forth in or permitted by this Agreement, from the date of this Agreement until the expiration of the Standstill Period

(as defined below), each member of the Investor Group shall not, and shall cause its respective Affiliates, Associates, principals, directors,

general partners, officers, employees and, to the extent acting on behalf or at the direction of any of the foregoing, agents and other

representatives (collectively, the “Related Persons” and each a “Related Person”) not to, directly

or indirectly, without the prior written approval of the Board:

| (i) | engage in any solicitation of proxies or written consents to vote (or withhold the vote of) any voting

securities of the Company, or conduct any binding or nonbinding referendum with respect to any voting securities of the Company, or assist

or participate in any other way, directly or indirectly, in any solicitation of proxies (or written consents) with respect to any voting

securities of the Company, or otherwise become a “participant” in a “solicitation,” as such terms are defined

in Instruction 3 of Item 4 of Schedule 14A and Rule 14a-1 of Regulation 14A, respectively, under the Exchange Act, to vote (or withhold

the vote of) any securities of the Company; |

| (ii) | grant any proxy, consent or other authority to vote with respect to any matters (other than to the named

proxies included in the Company’s proxy card for any annual meeting or special meeting of stockholders) or deposit any voting securities

of the Company in a voting trust or subject them to a voting agreement or other arrangement of similar effect (excluding customary brokerage

accounts, margin accounts, prime brokerage accounts and the like); |

| (iii) | engage in any course of conduct with the purpose of causing stockholders of the Company to vote contrary

to the recommendation of the Board on any matter presented to the Company’s stockholders for their vote at any meeting of the Company’s

stockholders or by written consent; |

| (iv) | call or seek to call, or request the call of, alone or in concert with others, any meeting of stockholders,

or action by consent resolutions, whether or not such a meeting or consent is permitted by the Restated Certificate of Incorporation of

the Company, as amended (the “Charter”) or the Amended and Restated Bylaws of the Company (the “Bylaws”),

including any “town hall meeting”; |

| (v) | act, seek, facilitate or encourage any person to submit nominations or proposals, whether in furtherance

of a “contested solicitation” or otherwise, for the appointment, election or removal of directors or otherwise with respect

to the Company or seek, facilitate, encourage or take any other action with respect to the appointment, election or removal of any directors; |

| (vi) | make any announcement or proposal with respect to, or offer, seek, propose or indicate an interest in,

separately or in conjunction with any other person in which it is or proposes to be either a principal, partner or financing source or

is acting or proposes to act as broker or agent for compensation submit a proposal or offer for, or make any communication in opposition

to (A) any form of business combination or acquisition or other transaction relating to assets or securities of the Company or any

of its subsidiaries, (B) any form of restructuring, recapitalization or similar transaction with respect to the Company or any of

its subsidiaries, (C) any form of tender or exchange offer for the Common Shares, whether or not such transaction involves a change

of control of the Company, or any securities or debt of any of the Company’s subsidiaries, (D) any financing transaction involving

the Company or any of its subsidiaries, or (E) any liquidation or dissolution of the Company or any of its subsidiaries; |

| (vii) | (A) purchase or otherwise acquire, or offer, seek, propose or agree to acquire, through swap or hedging

transactions or other Synthetic Position, or otherwise (the taking of any such action, an “Acquisition”), any ownership

(including beneficial ownership as defined in Rule 13d-3 under the Exchange Act) of, or interest in, any securities or assets of

the Company such that after giving effect to any such Acquisition, the Investor Group or any of its Related Persons holds, directly or

indirectly, in excess of a 13.1% interest in the then-outstanding securities of the Company, (B) purchase or otherwise acquire, or

offer, seek, propose or agree to acquire, any interest in any indebtedness of the Company, or (C) purchase or otherwise acquire,

or offer, seek, propose or agree to acquire, ownership (including beneficial ownership) of any assets or liabilities of the Company or

any right or option to acquire any such asset or liabilities from any person, in each case in this clause (C) other than securities

of the Company, and in each case in this paragraph (vii), other than by way of distributions or offerings made available to holders

of Common Shares generally on a pro rata basis or pursuant to a Voting Exempt Matter (as defined in Section 5); |

| (viii) | engage in any short sale, forward contract or any purchase, sale or grant of any option, warrant, convertible

security, stock appreciation right or other similar right (including any put or call option or “swap” transaction) with respect

to any security (other than a broad-based market basket or index) that includes, relates to or derives any significant part of its value

from a decline in the market price or value of the securities of the Company; |

| (ix) | seek to advise, encourage, support or influence any person with respect to the voting of (or execution

of a written consent in respect of), acquisition of or disposition of any securities of the Company or its subsidiaries; |

| (x) | other than in open market sale transactions whereby the identity of the purchaser is not known, sell,

offer or agree to sell, directly or indirectly, through swap or hedging transactions or otherwise, the securities of the Company or any

rights decoupled from the underlying securities of the Company held by the Investor Group or any Related Person to any Third Party that,

to the Investor Group’s knowledge (after due inquiry, it being understood that such knowledge shall be deemed to exist with respect

to any publicly available information, including, but not limited to, information in documents filed with the SEC), would result in such

Third Party, together with its Affiliates and Associates, owning, controlling or otherwise having any beneficial or other ownership of,

in the aggregate, more than 4.9% of the shares of voting securities of the Company outstanding at such time or would increase the beneficial

ownership interest of any Third Party who, collectively with its Affiliates and Associates, has a beneficial or other ownership interest

of, in the aggregate, more than 4.9% of the shares of voting securities of the Company outstanding at such time, except for Schedule 13G

filers that are mutual funds, pension funds, index funds or investment fund managers; |

| (xi) | take any action in support of or make any proposal or request that constitutes (or would constitute if

taken), or make any statement or have a discussion with any known stockholder of the Company concerning or with the effect of: (A) advising,

controlling, changing or influencing the Board or management of the Company and its subsidiaries, including any plans or proposals to

change the voting standard with respect to director elections, number or term of directors or to fill any vacancies on the Board, (B) any

change in the capitalization, stock repurchase programs and practices, capital allocation programs and practices, or dividend policy of

the Company or its subsidiaries, (C) any other change in the Company’s or its subsidiaries’ management, business, or

corporate structure, (D) seeking to have the Company waive or make amendments or modifications to the Charter or Bylaws, or other

actions that may impede or facilitate the acquisition of control of the Company by any person, (E) causing a class of securities

of the Company to be delisted from, or to cease to be authorized to be quoted on, any securities exchange, or (F) causing a class

of securities of the Company to become eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange

Act; |

| (xii) | pursuant to Rule 14a-1(l)(2)(iv) under the Exchange Act, communicate with stockholders of the

Company or others; |

| (xiii) | form, join or in any other way participate in any partnership, limited partnership, syndicate or “group”

(within the meaning of Section 13(d)(3) of the Exchange Act or otherwise) with respect to the Company or its securities (other

than with members of the Investor Group); |

| (xiv) | demand a copy of the Company’s list of stockholders or its other books and records or make any request

under Section 220 of the General Corporation Law of the State of Delaware or other applicable legal provisions regarding inspection

of books and records or other materials (including stocklist materials) of the Company or any of its subsidiaries; |

| (xv) | commence, encourage, join as a party, solicit or support any litigation, arbitration, derivative action

in the name of the Company or any class action or other proceeding against or involving the Company or any of its current or former Company

Related Persons (as defined below); |

| (xvi) | make or publicly advance any request or submit any proposal, directly or indirectly, to amend, modify

or waive the terms of this Section 4 other than through non-public communications with the Company, which the Company may

accept or reject in its sole and absolute discretion, that would not trigger public disclosure obligations for any member of the Investor

Group or its Related Persons or reasonably be expected to trigger public disclosure obligations for the Company or any Company Related

Persons; or |

| (xvii) | enter into any discussions, negotiations, agreements or understandings with any person or entity with

respect to any action the Investor Group is prohibited from taking pursuant to this Section 4, or advise, assist, knowingly

encourage or seek to persuade any person or entity to take any action or make any statement with respect to any such action, or otherwise

take or cause any action or make any statement inconsistent with any of the foregoing. |

Notwithstanding the foregoing,

nothing in this Section 4 or elsewhere in this Agreement shall prohibit or restrict the Investor Group or its Related Persons

from communicating privately with members of the Board or executive officers of the Company regarding any matter, so long as such communications

are not intended to and would not require any public disclosure of such communications. The Investor Group shall not, and shall cause

its Related Persons not to, seek to do, directly or indirectly, through any director of the Company or other individual, anything that

would be prohibited under this Agreement if done by the Investor Group or any Related Person.

(b) For

purposes of this Agreement:

| (i) | “Affiliate” shall mean any “Affiliate” as defined in Rule 12b-2 promulgated

by the SEC under the Exchange Act; |

| (ii) | “Associate” shall mean any “Associate” as defined in Rule 12b-2 promulgated

by the SEC under the Exchange Act; |

| (iii) | “beneficial owner” and “beneficial ownership” shall have the same

meanings as set forth in Rule 13d-3 promulgated by the SEC under the Exchange Act; |

| (iv) | “person” or “persons” shall mean any individual, corporation (including

not-for-profit), general or limited partnership, limited liability company, joint venture, estate, trust, association, organization or

other entity of any kind or nature; |

| (v) | “Standstill Period” shall mean the period commencing on the date of this Agreement

and ending on the date that is thirty (30) calendar days prior to the last day of the advance notice period for the submission by stockholders

of non-proxy access director nominations for the Company’s 2027 annual meeting of stockholders of the Company pursuant to the Bylaws; |

| (vi) | “Synthetic Position” shall mean any derivative, swap or other transaction or series

of transactions engaged in, directly or indirectly, by such person, the purpose or effect of which is to give such person economic risk

similar to ownership of equity securities of any class or series of the Company, including due to the fact that the value of such derivative,

swap or other transactions are determined by reference to the price, value or volatility of any shares of any class or series of the Company’s

equity securities, or which derivative, swap or other transactions provide the opportunity to profit from any increase in the price or

value of shares of any class or series of the Company’s equity securities, without regard to whether (i) the derivative, swap

or other transactions convey any voting rights in such equity securities to such person; (ii) the derivative, swap or other transactions

are required to be, or are capable of being, settled through delivery of such equity securities; or (iii) such person may have entered

into other transactions that hedge or mitigate the economic effect of such derivative, swap or other transactions; and |

| (vii) | “Third Party” shall mean any person that is not (A) a party to this Agreement,

(B) a member of the Board, (C) an officer of the Company or (D) an Affiliate or Associate of the Investor Group who has

previously executed a joinder to this Agreement agreeing to all obligations of the Investor Group hereunder and providing all the representations

and warranties and corresponding disclosure of the Investor Group hereunder. |

(c) Within

five (5) business days of the end of each fiscal quarter during the Standstill Period and at any time during the Standstill Period

within five (5) business days of a written request from the Company to the Investor Group, the Investor Group will provide the Company

with information (including the date of acquisition or disposition) regarding the amount of any debt and equity securities of the Company

and its subsidiaries beneficially owned by each member of the Investor Group and each Related Person or any other interest in the Company

or its subsidiaries described in Section 4(a)(vii).

5. Voting.

At each annual and special meeting of stockholders held prior to the expiration of the Standstill Period (and at any action taken

by consent of stockholders during such period), the Investor Group agrees to (i) appear at such stockholders’ meeting or otherwise

cause all Common Shares beneficially owned by the Investor Group and its Related Persons to be counted as present for purposes of establishing

a quorum; (ii) vote, or cause to be voted, all Common Shares beneficially owned by the Investor Group and its Related Persons on

the Company’s proxy card or voting instruction form (a) in favor of each of the directors nominated by the Board and recommended

by the Board in the election of directors and against any proposals to remove any such members of the Board, (b) against any nominees

to serve on the Board that have not been recommended by the Board, and (c) with respect to all other matters other than a Voting

Exempt Matter, in accordance with the Board’s recommendations as identified in the Company’s proxy statement; and (iii) not

execute any proxy card or voting instruction form in respect of such stockholders’ meeting other than the proxy card and related

voting instruction form being solicited by or on behalf of the Board (such proxy card and/or form, the “Company’s Card”);

provided, that with respect to any Voting Exempt Matter, Investor Group shall have the ability to vote freely on the Company’s

Card, so long as the Investor Group does not publicly disclose such vote. For purposes of this Section 5, a “Voting

Exempt Matter” means any tender offer, exchange offer, merger, consolidation, acquisition, business combination, sale, recapitalization,

restructuring, or other transaction with a person that, in each case, results in a change in control of the Company or the sale of substantially

all of the Company’s and its subsidiaries’ aggregate assets. During the Standstill Period, not later than five (5) business

days prior to each of the Company’s meetings of stockholders, the Investor Group shall vote in accordance with this Section 5

and shall not revoke or change any such vote. For the avoidance of doubt, nothing in this Section 5 or this Agreement

shall prohibit the New Director in acting in accordance with his fiduciary duties at any Board meeting of directors.

6. Mutual

Non-Disparagement.

(a) The

Investor Group agrees that, until the expiration of the Standstill Period, the Investor Group will not, and the Investor Group will cause

each of its Related Persons not to, directly or indirectly, in any capacity or manner, make, express, transmit, speak, write, verbalize

or otherwise communicate in any way (or cause, further, assist, solicit, encourage, support or participate in any of the foregoing), any

remark, comment, message, information, declaration, communication or other statement of any kind, whether verbal, in writing, electronically

transferred or otherwise, that might reasonably be construed to be derogatory towards, or critical of, the Company or any of its past

or present directors, officers, Affiliates, subsidiaries, employees, agents or representatives (collectively, the “Company Related

Persons”), or that reveals, discloses, incorporates, is based upon, discusses, includes or otherwise involves any confidential

or proprietary information of the Company or the Company Related Persons, or to malign, harm, disparage, defame or damage the reputation

or good name of the Company, any Company Related Person or the Company’s business; provided, however, that the foregoing

shall not prevent the Investor Group or its Related Persons from privately communicating to the Board factual information based on publicly

available information.

(b) The

Company agrees that, until the expiration of the Standstill Period, it will not, and it will cause the Company Related Persons not to,

directly or indirectly, in any capacity or manner, make, express, transmit, speak, write, verbalize or otherwise communicate in any way

(or cause, further, assist, solicit, encourage, support or participate in any of the foregoing), any remark, comment, message, information,

declaration, communication or other statement of any kind, whether verbal, in writing, electronically transferred or otherwise, or take

any action that is intended to result in a public statement of any kind, that might reasonably be construed to be derogatory towards,

or critical of, the Investor Group or any of its Related Persons, or that reveals, discloses, incorporates, is based upon, discusses,

includes or otherwise involves any confidential or proprietary information of the Investor Group or its Related Persons, or to malign,

harm, disparage, defame or damage the reputation or good name of the Investor Group, any Related Person or the Investor Group’s

or its Related Persons’ businesses; provided, however, that the foregoing shall not prevent private communications

to the Investor Group or its Related Persons of factual information based on publicly available information.

(c) Notwithstanding

the foregoing, nothing in Section 4, this Section 6, or elsewhere in this Agreement shall prohibit any party to

this Agreement from making any statement or disclosure required under the federal securities laws or other applicable laws, rules or

regulations so long as such requirement is not due to a breach by any party of this Agreement or to comply with any subpoena or other

legal process or respond to a request for information from any governmental authority with jurisdiction over the party from whom information

is sought; provided, that (i) such party must, to the extent legally permissible, (x) provide written notice to

the other party at least five (5) business days prior to making any such statement or disclosure, (y) shall reasonably consider

any comments of the other party and (ii) the disclosing party may in its sole discretion (and at its cost) seek a protective order

or other appropriate remedy and/or waive compliance with the provisions of this Agreement, and the other party will reasonably cooperate

with the Company to obtain any such protective order or other remedy. The limitations set forth in Sections 6(a) and

6(b) shall not prevent any party to this Agreement from responding to any public statement made by the other party of the

nature described in Sections 6(a) and 6(b) if such statement by the other party was made in breach of this Agreement.

(d) The

Investor Group shall not, and the Investor Group shall cause its Related Persons not to, during the Standstill Period, (i) issue

a press release regarding the Company or in connection with this Agreement or the actions contemplated by this Agreement or (ii) otherwise

make any public disclosure or announcement with respect to the Company or this Agreement or the actions contemplated by this Agreement

that is inconsistent with the terms of this Agreement or in violation of the obligations set forth in Section 4 or this Section 6,

in each case without the prior written consent of the Company, which may be withheld at the Company’s sole discretion. Notwithstanding

anything to the contrary, the Company acknowledges that the Investor Group intends to file this Agreement as an exhibit to an amendment

to the Investor Group’s Schedule 13D filed with the SEC on November 4, 2024 (the “Investor Group 13D”) and

will provide the Company an opportunity to review the amendment in advance of such filing. During the Standstill Period, the Company shall

have an opportunity to review in advance any other amendment to the Investor Group 13D to be filed with the SEC by the Investor Group

on or after the date of this Agreement.

7. Specific

Performance. It is understood and agreed that money damages would not be an adequate remedy for any breach of this Agreement by any

party to this Agreement and the non-breaching party to this Agreement shall be entitled to equitable relief, including, without limitation,

injunction and specific performance, as a remedy for any such actual or potential breach. Such remedies shall not be deemed to be the

exclusive remedies for a breach by the non-breaching parties, but shall be in addition to all other remedies available at law or equity

to the non-breaching party. The parties to this Agreement further agree not to raise as a defense or objection to the request or granting

of such relief that any breach of this Agreement is or would be compensable by an award of money damages, and the parties to this Agreement

agree to waive any requirements for the securing or posting of any bond in connection with such remedy.

8. Related

Persons. The Investor Group shall cause any Related Persons to comply with the terms of this Agreement and shall be responsible for

any breach of this Agreement by any such Related Person. A breach of this Agreement by any Related Person, if such Related Person is not

a party to this Agreement, shall be deemed to occur if such Related Person engages in conduct that would constitute a breach of this Agreement

if such Related Person was a party to the same extent as any member of the Investor Group. The Investor Group shall cause the applicable

parties thereto to execute Exhibit A no later than two (2) days after the date of this Agreement.

9. Termination.

(a) Unless

otherwise mutually agreed in writing by each party, this Agreement shall terminate on the earliest to occur of (i) the termination

of the Standstill Period and (ii) the consummation of a Voting Exempt Matter.

(b) If

this Agreement is terminated in accordance with this Section 9, this Agreement shall forthwith become null and void, but no

termination shall relieve a party from liability for any breach of this Agreement prior to such termination.

(c) Notwithstanding

the foregoing terms of this Section 9, Section 7 and Section 10 through Section 24 shall

survive the termination of this Agreement.

10. Notice.

Any notices, consents, determinations, waivers or other communications required or permitted to be given under the terms of this

Agreement must be in writing and will be deemed to have been delivered: (i) upon receipt, when delivered personally; (ii) upon

receipt, when sent by email (provided confirmation of transmission is mechanically or electronically generated and kept on file by the

sending party), provided that such email notice is accompanied by a notice delivered pursuant to either clause (i) or (iii) within

twenty-four (24) hours of email receipt; or (iii) one (1) business day after deposit with a nationally recognized overnight

delivery service, in each case properly addressed to the party to receive the same. The addresses and email addresses for such communications

shall be:

| |

If to the Company: |

| |

|

| |

Intrepid Potash, Inc. |

| |

707 17th Street, Suite 4200 |

| |

Denver, CO 80202 |

| |

Attention: Christina Sheehan |

| |

Email: christina.sheehan@intrepidpotash.com |

| |

|

| |

with copies (which shall not constitute notice) to: |

| |

|

| |

Latham & Watkins |

| |

330 North Wabash Avenue, Suite 2800 |

| |

Chicago, IL 60611 |

| |

Attention: Christopher R. Drewry, Justin T. Stolte |

| |

Email: christopher.drewry@lw.com, justin.stolte@lw.com |

| |

|

| |

If to the Investor Group: |

| |

|

| |

Clearway Capital Management LLC |

| |

240 Crandon Blvd., Suite 250. |

| |

Key Biscayne, FL 33149 |

| |

Attention: Gonzalo Avendano |

| |

Email: gonzalo.avendano@mac.com |

| |

|

| |

with copies (which shall not constitute notice) to: |

| |

|

| |

Whisenand & Turner, P.A. |

| |

240 Crandon Blvd., Suite250 |

| |

Key Biscayne, FL 33149 |

| |

Attention: James D. Whisenand |

| |

Email: jdw@w-tgroup.com |

11. Governing

Law. This Agreement and any claim, controversy or dispute arising under or related to this Agreement, the relationship of the parties,

and/or the interpretation and enforcement of the rights and duties of the parties shall be governed by and construed and enforced in

accordance with the laws of the State of Delaware, without regard to any conflict of laws provisions thereof.

12. Jurisdiction.

Each party to this Agreement agrees, on behalf of itself and its Affiliates and Associates, that any actions, suits or proceedings

arising out of or relating to this Agreement or the transactions contemplated by this Agreement will be brought solely and exclusively

in the Delaware Court of Chancery or other federal or state courts of the State of Delaware (and the parties agree not to commence any

action, suit or proceeding relating to this Agreement or the transactions contemplated by this Agreement except in such courts), and

further agrees that service of any process, summons, notice or document by U.S. registered mail to the respective addresses set forth

in Section 10 will be effective service of process for any such action, suit or proceeding brought against any party in any

such Delaware court. Each party, on behalf of itself and its Affiliates and Associates, irrevocably and unconditionally waives any objection

to the laying of venue of any action, suit or proceeding arising out of this Agreement or the transactions contemplated by this Agreement,

in the Delaware Court of Chancery or other federal or state court in the State of Delaware, and further irrevocably and unconditionally

waives and agrees not to plead or claim in any such Delaware court that any such action, suit or proceeding brought in any such Delaware

court has been brought in an improper or inconvenient forum.

13. Waiver

of Jury Trial. EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO INVOLVE

COMPLICATED AND DIFFICULT ISSUES AND, THEREFORE, EACH SUCH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT IT MAY HAVE TO

A TRIAL BY JURY IN RESPECT OF ANY LEGAL ACTION ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS

AGREEMENT. EACH PARTY TO THIS AGREEMENT CERTIFIES AND ACKNOWLEDGES THAT (A) NO REPRESENTATIVE OF ANY OTHER PARTY HAS REPRESENTED,

EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT SEEK TO ENFORCE THE FOREGOING WAIVER IN THE EVENT OF A LEGAL ACTION, (B) SUCH

PARTY HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER, (C) SUCH PARTY MAKES THIS WAIVER VOLUNTARILY, AND (D) SUCH PARTY HAS

BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 13.

14. Entire

Agreement. This Agreement constitutes the full and entire understanding and agreement among the parties with regard to the subject

matter of this Agreement, and supersedes all prior and contemporaneous agreements, understandings and representations, whether oral or

written, of the parties with respect to the subject matter of this Agreement. There are no restrictions, agreements, promises, representations,

warranties, covenants or undertakings, oral or written, between the parties other than those expressly set forth in this Agreement.

15. Headings.

The section headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation

of this Agreement.

16. Waiver.

No failure on the part of any party to exercise, and no delay in exercising, any right, power or remedy under this Agreement shall

operate as a waiver of such right, power or remedy, nor shall any single or partial exercise of such right, power or remedy by such party

preclude any other or further exercise of such right, power or remedy or the exercise of any other right, power or remedy.

17. Remedies.

All remedies under this Agreement are cumulative and are not exclusive of any other remedies provided by law or equity.

18. Construction. Each

of the parties to this Agreement acknowledges that it has been represented by counsel of its choice throughout all negotiations that

have preceded the execution of this Agreement, and that it has executed the same with the advice of said independent counsel. Each

party and its counsel cooperated and participated in the drafting and preparation of this Agreement and the documents referred to

herein, and any and all drafts relating thereto exchanged among the parties shall be deemed the work product of all of the parties

and may not be construed against any party by reason of its drafting or preparation. Accordingly, any rule of law or any legal

decision that would require interpretation of any ambiguities in this Agreement against any party that drafted or prepared it is of

no application and is hereby expressly waived by each of the parties hereto, and any controversy over interpretations of this

Agreement shall be decided without regards to events of drafting or preparation. When a reference is made in this Agreement to a

Section, such reference shall be to a Section of this Agreement, unless otherwise indicated. The headings contained in this

Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement. Whenever

the words “include,” “includes” and “including” are used in this Agreement, they shall be deemed

to be followed by the words “without limitation.” The words “hereof,” “herein” and

“hereunder” and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to

any particular provision of this Agreement. The word “will” shall be construed to have the same meaning as the word

“shall.” The words “dates hereof” will refer to the date of this Agreement. The word “or” is not

exclusive. The definitions contained in this Agreement are applicable to the singular as well as the plural forms of such terms. Any

agreement, instrument, law, rule or statute defined or referred to herein means, unless otherwise indicated, such agreement,

instrument, law, rule or statute as from time to time amended, modified or supplemented.

19. Severability.

If any provision of this Agreement is held invalid or unenforceable by any court of competent jurisdiction, the other provisions

of this Agreement shall remain in full force and effect. Any provision of this Agreement held invalid or unenforceable only in part or

degree shall remain in full force and effect to the extent not held invalid or unenforceable. The parties further agree to replace such

invalid or unenforceable provision of this Agreement with a valid and enforceable provision that will achieve, to the extent possible,

the purposes of such invalid or unenforceable provision.

20. Amendment.

This Agreement may be modified, amended or otherwise changed only in a writing signed by the Company, on the one hand, and Clearway,

on the other hand.

21. Successors

and Assigns. The terms and conditions of this Agreement shall be binding upon and be enforceable solely by the parties hereto and

successors thereto. No party may assign (by operation of law or otherwise) this Agreement or any rights or obligations hereunder

without, with respect to any member of the Investor Group, the express prior written consent of the Company, and with respect to the

Company, the prior written consent of Clearway, and any assignment in contravention of the foregoing shall be null and avoid. Prior

to entering into any agreement, arrangement or understanding with respect to, or effecting, any form of business combination or

acquisition or other transaction relating to assets or securities of any member of the Investor Group, any form of restructuring,

recapitalization or similar transaction with respect to any member of the Investor Group, any form of tender or exchange offer of

any member of the Investor Group, or any liquidation of dissolution of any member of the Investor Group, in each case in one or a

series of transactions, that does not directly result in the assumption of the obligations of the Investor Group under this

Agreement, Clearway will notify the Company and will arrange in connection therewith alternative means of providing for the

obligations of the Investor Group in this Agreement, including by the assumption of such obligations by another party.

22. No

Third-Party Beneficiaries. The representations, warranties and agreements of the parties contained herein are intended solely for

the benefit of the party to whom such representations, warranties or agreements are made, and shall confer no rights, benefits, remedies,

obligations, or liabilities hereunder, whether legal or equitable, in any other person or entity, and no other person or entity shall

be entitled to rely thereon.

23. Counterparts;

Facsimile / Electronic Signatures. This Agreement and any amendments hereto may be signed in any number of counterparts, each of

which shall be an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. The words “execution,”

“execute”, “signed,” “signature,” and words of like import in or related to this Agreement and/or

any document to be signed in connection with this Agreement and the transactions contemplated hereby shall be deemed to include electronic

signatures, the electronic matching of assignment terms and contract formations on electronic platforms, or the keeping of records in

electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the

use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the

Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other

similar state laws based on the Uniform Electronic Transactions Act.

24. Expenses.

Each of the Company and the Investor Group shall be responsible for its own fees and expenses incurred in connection with the negotiation,

execution, and effectuation of this Agreement and the matters contemplated hereby, including, but not limited to attorneys’ fees

incurred in connection with the negotiation and execution of this Agreement and all other activities related to the foregoing; provided,

however, that the Company shall reimburse the Investor Group for its reasonable documented out-of-pocket fees and expenses incurred

in connection with the Investor Group’s involvement with the Company prior to the date hereof and the negotiation and execution

of this Agreement in an amount not to exceed $125,000.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties

have duly executed and delivered this Agreement as of the date first above written.

| |

INTREPID POTASH, INC. |

| |

|

| |

By: |

/s/ Kevin S. Crutchfield |

| |

Name: Kevin S. Crutchfield |

| |

Title: Chief Executive Officer |

| |

CLEARWAY CAPITAL MANAGEMENT LLC |

| |

|

| |

By: |

/s/ Gonzalo Avendano |

| |

Name: Gonzalo Avendano |

| |

Title: |

| |

|

| |

GENOVA USVI COMPANY, LLC |

| |

|

| |

By: |

/s/ Luis Oscar Merlotti |

| |

Name: Luis Oscar Merlotti |

| |

Title: |

| |

|

| |

/s/ Gonzalo Avendano |

| |

Gonzalo Avendano |

Schedule

A

INVESTOR GROUP PARTIES

| Party |

Beneficial Ownership |

| |

|

Clearway Capital Management LLC

|

1,203,222 Common Shares beneficially owned |

| |

|

Genova USVI Company, LLC

|

120,000 Common Shares beneficially owned |

| |

|

Gonzalo Avendano

|

0 Common Shares beneficially owned |

EXHIBIT A

Contingent Joinder

January 14, 2025

Reference is made to that

certain Cooperation Agreement (the “Cooperation Agreement”), dated as of January 14, 2025, by and among INTREPID

POTASH, INC., a Delaware corporation (the “Company”), and CLEARWAY CAPITAL MANAGEMENT LLC (“Clearway”)

and the other persons and entities listed on Schedule A hereto (collectively and together with Clearway, the “Investor

Group”). All terms used but not otherwise defined herein have the meanings set forth in the Cooperation Agreement.

Maria

Bernarda Arencedo, Santiago Avendano, Benjamin Avendano and Joaquin Avendano (collectively, the “Avendano Parties”)

hereby agree to provide the Company within five (5) business days of the end of each fiscal quarter during the Standstill Period,

and at any time during the Standstill Period within five (5) business days of a written request from the Company to the Avendano

Parties, with information regarding the aggregate amount of any shares of Common Stock, par value $0.001 per share, of the Company (the

“Common Stock”) beneficially owned by each member of the Avendano Parties.

The

Avendano Parties also hereby acknowledge and agree that if the Avendano Parties own, control or otherwise have any beneficial or

other ownership of, in the aggregate, more than 2.5% of the Common Stock (excluding, for the avoidance of doubt, any beneficial ownership

by Clearway and Genova USVI Company, LLC) outstanding at any time, then the Avendano Parties shall automatically become parties to the

Cooperation Agreement and shall be fully bound by, and subject to, all of the covenants, terms and conditions of the Cooperation Agreement

applicable to the Investor Group as though an original party thereto.

The provisions of Sections

11 (Governing Law), 12 (Jurisdiction), 13 (Waiver of Jury Trial), 14 (Entire Agreement), 16 (Waiver),

17 (Remedies), 18 (Construction), 19 (Severability), 21 (Successors and Assigns) and 23 (Counterparts;

Facsimile / Electronic Signatures) of the Cooperation Agreement shall each apply hereto mutatis mutandis.

| |

Sincerely, |

| |

|

|

| |

|

/s/ Maria Bernarda Arencedo |

| |

|

Maria Bernarda Arencedo |

| |

|

|

| |

|

/s/ Santiago Arencedo |

| |

|

Santiago Avendano |

| |

|

|

| |

|

/s/ Benjamin Avendano |

| |

|

Benjamin Avendano |

| |

|

|

| |

|

/s/ Joaquin Avendano |

| |

|

Joaquin Avendano |

| |

|

|

Exhibit 99.1

Intrepid Announces Appointment of Gonzalo Avendano

to Board of Directors

Accomplished business leader with deep understanding

of capital markets and investments

Denver – January 15, 2025 – Intrepid Potash, Inc. (“Intrepid”

or “the Company”) (NYSE: IPI), announced today the appointment of Gonzalo Avendano as a new independent director to Intrepid’s

Board of Directors (the “Board”), effective January 14, 2025. Mr. Avendano has over 30 years of experience in leadership of

finance and wealth management companies and brings extensive experience in capital markets and business strategy to the Board. This appointment

increases the size of the Board from seven to eight directors, seven of whom, including Mr. Avendano, are independent.

“We are pleased to welcome Gonzalo to our Board,” said

Barth Whitham, Chair of the Board. “He is a seasoned business leader with extensive knowledge of global investment markets. His

industry experience along with his unique perspective as an investor will make him a valuable addition to our Board.”

Kevin Crutchfield, Chief Executive Officer of Intrepid Potash, added:

“Gonzalo’s insights into evolving market dynamics and his commitment to driving value creation will play a crucial role as

we continue to enhance our operations. I look forward to working closely with him as we execute our strategic initiatives to deliver long-term

value for our shareholders.”

In connection with this announcement, Intrepid has entered into a cooperation

agreement with Clearway Capital Management LLC (“Clearway”) and certain other persons and entities referenced in the agreement,

which includes customary standstill, voting, and other provisions. Gonzalo Avendano, an Investment Advisor of Clearway, said, “I

appreciate the positive and constructive discussions with the Company and I am pleased to join the Intrepid Board. Clearway owns approximately

9.1% of Intrepid and first purchased shares in Intrepid nearly a decade ago. As one of the Company’s largest shareholders, Clearway

is focused on the long-term value of the Company and I look forward to working constructively with my fellow Board members and the management

team to grow shareholder value.”

About Gonzalo Avendano

Gonzalo Avendano serves as an Investment Advisor of Clearway, an investment

company based in Florida that specializes in managing a diversified portfolio of liquid assets and private equity investments. In addition,

Gonzalo owns and operates Haras Patagones SRL, an Argentinian private company in the agriculture industry. He previously held positions

at Lehman Brothers, Deutsche Bank AG, and UBS AG.

About Intrepid

Intrepid is a diversified mineral company that delivers potassium,

magnesium, sulfur, salt, and water products essential for customer success in agriculture, animal feed and the oil and gas industry. Intrepid

is the only U.S. producer of muriate of potash, which is applied as an essential nutrient for healthy crop development, utilized in several

industrial applications and used as an ingredient in animal feed. In addition, Intrepid produces a specialty fertilizer, Trio®,

which delivers three key nutrients, potassium, magnesium, and sulfate, in a single particle. Intrepid also provides water, magnesium chloride,

brine, and various oilfield services. Intrepid serves diverse customers in markets where a logistical advantage exists and is a leader

in the use of solar evaporation for potash production, resulting in lower cost and more environmentally friendly production. Intrepid’s

mineral production comes from three solar solution potash facilities and one conventional underground Trio® mine.

Intrepid routinely posts important information, including information

about upcoming investor presentations and press releases, on its website under the Investor Relations tab. Investors and other interested

parties are encouraged to enroll at intrepidpotash.com, to receive automatic email alerts or RSS feeds for new postings.

Contact

Evan Mapes, CFA, Investor Relations Manager

Phone: 303-996-3042

Email: evan.mapes@intrepidpotash.com

v3.24.4

Cover

|

Jan. 14, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 14, 2025

|

| Entity File Number |

001-34025

|

| Entity Registrant Name |

Intrepid

Potash, Inc.

|

| Entity Central Index Key |

0001421461

|

| Entity Tax Identification Number |

26-1501877

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

707

17th Street

|

| Entity Address, Address Line Two |

Suite

4200

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| City Area Code |

303

|

| Local Phone Number |

296-3006

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

IPI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

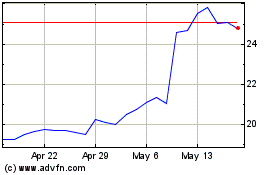

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Jan 2025 to Feb 2025

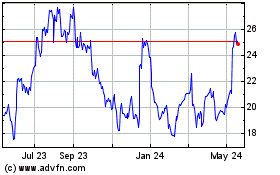

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Feb 2024 to Feb 2025