0001601046false00016010462024-11-192024-11-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 19, 2024

KEYSIGHT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36334 | | 46-4254555 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| 1400 Fountaingrove Parkway | 95403 |

| Santa Rosa | CA | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (800) 829-4444

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name on each exchange on which registered |

| Common Stock, par value $0.01 per share | KEYS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

The information in this Item 2.02 of Form 8-K and Exhibit 99.1 attached hereto is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

On November 19, 2024, Keysight Technologies, Inc. (the “Company”) issued its press release announcing financial results for the fourth fiscal quarter and fiscal year ended October 31, 2024. A copy of this press release is attached hereto as Exhibit 99.1.

We provide non-GAAP financial information in order to provide meaningful supplemental information regarding our operational performance and to enhance our investors’ overall understanding of our core current financial performance and our prospects for the future. We believe that our investors benefit from seeing our results “through the eyes” of management in addition to the GAAP presentation. Management measures segment and enterprise performance using measures such as those that are disclosed in this release. This information is used to facilitate management’s internal comparisons to the Company’s historical operating results, comparisons to competitors’ operating results and guidance provided to investors. Non-GAAP information allows for greater transparency to supplemental information used by management in its financial and operations decision making. We believe that the inclusion of comparative numbers provides consistency in our financial reporting.

This information is not in accordance with, or an alternative for, generally accepted accounting principles in the United States. It excludes items, such as amortization of acquisition-related balances, share-based compensation, acquisition and integration costs, restructuring and related costs, and others, and any one-time adjustments that may have a material effect on the Company’s expenses and income from operations calculated in accordance with GAAP. Management monitors these items to ensure that expenses are in line with expectations and that our GAAP results are correctly stated but does not use them to measure the ongoing operating performance of the Company. The non-GAAP information we provide may be different from the non-GAAP information provided by other companies.

Additional explanation of non-GAAP information is provided in Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following is furnished as an exhibit to this report and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 101 | | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 | | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | KEYSIGHT TECHNOLOGIES, INC. |

| | |

| | |

| | By: | /s/ JoAnn Juskie |

| | Name: | JoAnn Juskie |

| | Title: | Vice President, Assistant General Counsel and Assistant Secretary |

| | |

Date: November 19, 2024 | |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 101 | | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 | | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

Exhibit 99.1

Keysight Technologies Reports Fourth Quarter and Fiscal Year 2024 Results

Strong execution drives above guidance results

SANTA ROSA, Calif., November 19, 2024 - Keysight Technologies, Inc. (NYSE: KEYS) today reported financial results for the fourth fiscal quarter and fiscal year ended October 31, 2024.

“Keysight executed well and delivered fourth quarter revenue and earnings per share above the high end of guidance under market conditions which remained consistent with our expectations,” said Satish Dhanasekaran, Keysight’s President and CEO. “As we look ahead, the strength of our differentiated portfolio, deep engagement with customers, and the accelerating pace of technology innovation give us confidence in our ability to outperform as markets recover.”

Fourth Quarter Financial Summary

•Revenue was $1.29 billion, compared with $1.31 billion last year.

•GAAP net loss was $73 million, or $0.42 per share, compared with a GAAP net income of $226 million, or $1.28 per share, in the fourth quarter of 2023. This loss reflects a $315 million tax expense related to a new Singapore tax incentive and corresponding decrease in deferred tax assets.

•Non-GAAP net income was $288 million, or $1.65 per share, compared with $352 million, or $1.99 per share in the fourth quarter of 2023.

•Cash flow from operations was $359 million, compared with $378 million last year. Free cash flow was $328 million, compared with $340 million in the fourth quarter of 2023.

•As of October 31, 2024, cash and cash equivalents totaled $1.80 billion.

Fiscal Year 2024 Financial Summary

•Revenue was $4.98 billion, compared with $5.46 billion last year.

•GAAP net income was $0.61 billion, or $3.51 per share, compared with $1.06 billion, or $5.91 per share in fiscal 2023.

•Non-GAAP net income was $1.10 billion, or $6.27 per share, compared with $1.49 billion, or $8.33 per share in fiscal year 2023.

•Cash flow from operations was $1.05 billion, compared with $1.41 billion last year. Free cash flow was $0.91 billion, compared with $1.21 billion in fiscal year 2023.

Reporting Segments

•Communications Solutions Group (CSG)

CSG reported revenue of $894 million in the fourth quarter, flat over last year, reflecting 4 percent growth in commercial communications driven by AI-related investment, while aerospace, defense, and government declined 6 percent versus a record high quarter last year.

•Electronic Industrial Solutions Group (EISG)

EISG reported revenue of $393 million in the fourth quarter, down 6 percent over last year, reflecting ongoing constraint in manufacturing-related customer spending.

Outlook

Keysight’s first fiscal quarter of 2025 revenue is expected to be in the range of $1.265 billion to $1.285 billion. Non-GAAP earnings per share for the first fiscal quarter of 2025 are expected to be in the range of $1.65 to $1.71. Certain items impacting the GAAP tax rate pertain to future events and are not currently estimable with a reasonable degree of accuracy; therefore, no reconciliation of GAAP earnings per share to non-GAAP has been provided. Further information is discussed in the section titled “Use of Non-GAAP Financial Measures” below.

Webcast

Keysight’s management will present more details about its fourth quarter and fiscal year 2024 financial results and its first quarter FY2025 outlook on a conference call with investors today at 1:30 p.m. PT. This event will be webcast in listen-only mode. Listeners may log on to the call at www.investor.keysight.com under the “Upcoming Events” section and select “Q4 2024 Keysight Technologies Inc. Earnings Conference Call” to participate or dial +1 833-470-1428 (Toll-Free) or +1 404-975-4839 (Local) and enter passcode 116445. The webcast will remain on the company site for 90 days.

Forward-Looking Statements

This communication contains forward-looking statements as defined in the Securities Exchange Act of 1934 and is subject to the safe harbors created therein. The words "assume," “expect,” “intend,” “will,” “should,” "outlook" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. These forward-looking statements involve risks and uncertainties that could significantly affect the expected results and are based on certain key assumptions of Keysight’s management and on currently available information. Due to such uncertainties and risks, no assurances can be given that such expectations or assumptions will prove to have been correct, and readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof. Keysight undertakes no responsibility to publicly update or revise any forward-looking statement. The forward-looking statements contained herein include, but are not limited to, predictions, future guidance, projections, beliefs, and expectations about the company’s goals, revenues, financial condition, earnings, and operations that involve risks and uncertainties that could cause Keysight’s results to differ materially from management’s current expectations. Such risks and uncertainties include, but are not limited to, impacts of global economic conditions such as inflation or recession, uncertainty relating to the impact of election results in the U.S. and U.K., slowing demand for products or services, volatility in financial markets, reduced access to credit, changes in interest rates; impacts of geopolitical tension and conflict outside of the U.S., export control regulations and compliance; net zero emissions commitments; customer purchasing decisions and timing; and order cancellations.

In addition to the risks above, other risks that Keysight faces include those detailed in Keysight’s filings with the Securities and Exchange Commission on Keysight’s yearly report on Form 10-K for the period ended October 31, 2023, and Keysight’s quarterly report on Form 10-Q for the period ended July 31, 2024.

Segment Data

Segment data reflects the results of our reportable segments under our management reporting system. Segment data are provided on page 5 of the attached tables.

Use of Non-GAAP Financial Measures

In addition to financial information prepared in accordance with U.S. GAAP (“GAAP”), this document also contains certain non-GAAP financial measures based on management’s view of performance, including:

•Non-GAAP Net Income/Earnings

•Non-GAAP Net Income per share/Earnings per share

•Free Cash Flow

Income per share is based on weighted average diluted share count. See the attached supplemental schedules for reconciliations of each non-GAAP financial measure to its most directly comparable GAAP financial measure for the three months ended October 31, 2024 and fiscal year 2024. Following the reconciliations is a discussion of the items adjusted from our non-GAAP financial measures and the company’s reasons for including or excluding certain categories of income or expenses from our non-GAAP results.

About Keysight Technologies

At Keysight (NYSE: KEYS), we inspire and empower innovators to bring world-changing technologies to life. As an S&P 500 company, we're delivering market-leading design, emulation, and test solutions to help engineers develop and deploy faster, with less risk, throughout the entire product lifecycle. We're a global innovation partner enabling customers in communications, industrial automation, aerospace and defense, automotive, semiconductor, and general electronics markets to accelerate innovation to connect and secure the world. Learn more at Keysight Newsroom and www.keysight.com.

# # #

INVESTOR CONTACT:

Paulenier Sims

+1 707-577-2310

paulenier.sims@keysight.com

MEDIA CONTACT:

Claire Rowberry

+ 1 339-200-9518

claire.rowberry@non.keysight.com

Source: IR-KEYS

| | | | | | | | | | | | | | | | | | | | | | | |

| KEYSIGHT TECHNOLOGIES, INC. |

| CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS |

| (In millions, except per share data) |

| (Unaudited) |

| PRELIMINARY |

| | | | | | | |

| | | | | | | |

| Three months ended | | Year ended |

| October 31, | | October 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Orders | $ | 1,345 | | | $ | 1,327 | | | $ | 5,033 | | | $ | 5,190 | |

| | | | | | | |

| Revenue | $ | 1,287 | | | $ | 1,311 | | | $ | 4,979 | | | $ | 5,464 | |

| | | | | | | |

| Costs and expenses: | | | | | | | |

| Cost of products and services | 485 | | | 467 | | | 1,846 | | | 1,932 | |

| Research and development | 233 | | | 218 | | | 919 | | | 882 | |

| Selling, general and administrative | 343 | | | 313 | | | 1,395 | | | 1,307 | |

| Other operating expense (income), net | (4) | | | (4) | | | (14) | | | (15) | |

| Total costs and expenses | 1,057 | | | 994 | | | 4,146 | | | 4,106 | |

| | | | | | | |

| Income from operations | 230 | | | 317 | | | 833 | | | 1,358 | |

| | | | | | | |

| Interest income | 21 | | | 32 | | | 81 | | | 102 | |

| Interest expense | (23) | | | (20) | | | (84) | | | (78) | |

| Other income (expense), net | 20 | | | (53) | | | 35 | | | (25) | |

| | | | | | | |

| Income before taxes | 248 | | | 276 | | | 865 | | | 1,357 | |

| | | | | | | |

| Provision for income taxes | 321 | | | 50 | | | 251 | | | 300 | |

| | | | | | | |

| Net income (loss) | $ | (73) | | | $ | 226 | | | $ | 614 | | | $ | 1,057 | |

| | | | | | | |

| | | | | | | |

| Net income (loss) per share: | | | | | | | |

| Basic | $ | (0.42) | | | $ | 1.28 | | | $ | 3.53 | | | $ | 5.95 | |

| Diluted | $ | (0.42) | | | $ | 1.28 | | | $ | 3.51 | | | $ | 5.91 | |

| | | | | | | |

| Weighted average shares used in computing net income (loss) per share: | | | | |

| Basic | 173 | | | 176 | | | 174 | | | 178 | |

| Diluted | 173 | | | 177 | | | 175 | | | 179 | |

| | | | | | | | | | | |

| KEYSIGHT TECHNOLOGIES, INC. |

| CONDENSED CONSOLIDATED BALANCE SHEET |

| (In millions, except par value and share data) |

| (Unaudited) |

| PRELIMINARY |

| | | |

| | | |

| October 31, | | October 31, |

| 2024 | | 2023 |

| | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,796 | | | $ | 2,472 | |

| Accounts receivable, net | 857 | | | 900 | |

| Inventory | 1,022 | | | 985 | |

| Other current assets | 582 | | | 452 | |

| Total current assets | 4,257 | | | 4,809 | |

| | | |

| Property, plant and equipment, net | 774 | | | 761 | |

| Operating lease right-of-use assets | 234 | | | 226 | |

| Goodwill | 2,388 | | | 1,640 | |

| Other intangible assets, net | 607 | | | 155 | |

| Long-term investments | 110 | | | 81 | |

| Long-term deferred tax assets | 378 | | | 671 | |

| Other assets | 521 | | | 340 | |

| Total assets | $ | 9,269 | | | $ | 8,683 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | — | | | $ | 599 | |

| Accounts payable | 313 | | | 286 | |

| Employee compensation and benefits | 295 | | | 304 | |

| Deferred revenue | 561 | | | 541 | |

| Income and other taxes payable | 90 | | | 90 | |

| Operating lease liabilities | 43 | | | 40 | |

| Other accrued liabilities | 125 | | | 189 | |

| Total current liabilities | 1,427 | | | 2,049 | |

| | | |

| Long-term debt | 1,790 | | | 1,195 | |

| Retirement and post-retirement benefits | 72 | | | 64 | |

| Long-term deferred revenue | 206 | | | 216 | |

| Long-term operating lease liabilities | 197 | | | 192 | |

| Other long-term liabilities | 472 | | | 313 | |

| Total liabilities | 4,164 | | | 4,029 | |

| | | |

| Stockholders' equity: | | | |

| | | |

| Preferred stock; $0.01 par value; 100 million shares authorized; none issued and outstanding | — | | | — | |

| | | |

| | | |

| Common stock; $0.01 par value; 1 billion shares authorized; issued shares: 201 million and 200 million, respectively | 2 | | | 2 | |

| | | |

| Treasury stock, at cost; 28.4 million shares and 25.4 million shares, respectively | (3,422) | | | (2,980) | |

| Additional paid-in-capital | 2,664 | | | 2,487 | |

| Retained earnings | 6,225 | | | 5,611 | |

| Accumulated other comprehensive loss | (364) | | | (466) | |

| Total stockholders' equity | 5,105 | | | 4,654 | |

| Total liabilities and equity | $ | 9,269 | | | $ | 8,683 | |

| | | | | | | | | | | |

| KEYSIGHT TECHNOLOGIES, INC. |

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS |

| (In millions) |

| (Unaudited) |

| PRELIMINARY |

| | | |

| Year ended |

| October 31, |

| 2024 | | 2023 |

| | | |

| Cash flows from operating activities: | | | |

| Net income | $ | 614 | | | $ | 1,057 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation | 126 | | | 120 | |

| Amortization | 144 | | | 92 | |

| Share-based compensation | 137 | | | 135 | |

| Deferred tax expense (benefit) | 268 | | | (3) | |

| Excess and obsolete inventory-related charges | 35 | | | 27 | |

| Other non-cash expenses (income), net | (1) | | | (1) | |

| Changes in assets and liabilities, net of effects of businesses acquired: | | | |

| Accounts receivable | 71 | | | 14 | |

| Inventory | (49) | | | (148) | |

| Accounts payable | 26 | | | (62) | |

| Employee compensation and benefits | (36) | | | (43) | |

| Deferred revenue | (12) | | | 61 | |

| Income taxes payable | 30 | | | (40) | |

| Interest rate swap agreement termination proceeds | — | | | 107 | |

| Prepaid assets | 14 | | | 7 | |

| Tax receivables | (202) | | | (4) | |

| Other assets and liabilities | (113) | | | 89 | |

Net cash provided by operating activities(a) | 1,052 | | | 1,408 | |

| | | |

| Cash flows from investing activities: | | | |

| Investments in property, plant and equipment | (154) | | | (197) | |

| Proceeds from government incentives | 7 | | | 1 | |

| Acquisitions of businesses and intangible assets, net of cash acquired | (681) | | | (85) | |

| Purchase of investments | (11) | | | (7) | |

| Others Investing activities | 20 | | | — | |

| Net cash used in investing activities | (819) | | | (288) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of common stock under employee stock plans | 66 | | | 67 | |

| Payment of taxes related to net share settlement of equity awards | (31) | | | (49) | |

| Acquisition of non-controlling interests | (458) | | | — | |

| Treasury stock repurchases, including excise tax payments | (443) | | | (702) | |

| Proceeds from issuance of long-term debt | 599 | | | — | |

| Repayment of debt | (624) | | | — | |

| Debt issuance costs | (12) | | | — | |

| Other financing activities | (10) | | | (3) | |

| Net cash used in financing activities | (913) | | | (687) | |

| | | |

| Effect of exchange rate movements | 6 | | | (2) | |

| | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | (674) | | | 431 | |

| Cash, cash equivalents, and restricted cash at beginning of year | 2,488 | | | 2,057 | |

| Cash, cash equivalents, and restricted cash at end of year | $ | 1,814 | | | $ | 2,488 | |

(a) Cash payments included in operating activities:

| | | | | | | | | | | |

| Interest payments | $ | 75 | | | $ | 75 | |

| Income tax paid, net | $ | 146 | | | $ | 343 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| KEYSIGHT TECHNOLOGIES, INC. |

| NET INCOME AND DILUTED EPS RECONCILIATION |

| (In millions, except per share data) |

| (Unaudited) |

| PRELIMINARY |

| | | | | | |

| Three months ended | | Year ended |

| October 31, | | October 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net Income | Diluted EPS (a) | | Net Income | Diluted EPS | | Net Income | Diluted EPS | | Net Income | Diluted EPS |

| | | | | | | | | | | |

| Net income (loss), as reported | $ | (73) | | $ | (0.42) | | | $ | 226 | | $ | 1.28 | | | $ | 614 | | $ | 3.51 | | | $ | 1,057 | | $ | 5.91 | |

| Non-GAAP adjustments: | | | | | | | | | | | |

| Amortization of acquisition-related balances | 33 | | 0.19 | | | 19 | | 0.11 | | | 139 | | 0.80 | | | 90 | | 0.50 | |

| Share-based compensation | 27 | | 0.15 | | | 25 | | 0.14 | | | 145 | | 0.83 | | | 136 | | 0.76 | |

| Acquisition and integration costs | 19 | | 0.11 | | | 48 | | 0.27 | | | 75 | | 0.43 | | | 60 | | 0.34 | |

| Restructuring and others | 8 | | 0.05 | | | 32 | | 0.18 | | | 52 | | 0.30 | | | 48 | | 0.27 | |

Adjustment for taxes(b) | 274 | | 1.57 | | | 2 | | 0.01 | | | 71 | | 0.40 | | | 97 | | 0.55 | |

| Non-GAAP Net income | $ | 288 | | $ | 1.65 | | | $ | 352 | | $ | 1.99 | | | $ | 1,096 | | $ | 6.27 | | | $ | 1,488 | | $ | 8.33 | |

| | | | | | | | | | | |

| Weighted average shares outstanding - diluted | 173 | | | | 177 | | | | 175 | | | | 179 | |

(a) EPS impact on non-GAAP adjustments and non-GAAP net income is based on an adjusted shares outstanding of 174 million for three months ended October 31, 2024.

(b) Q4'24 GAAP net loss reflects a $315 million tax expense related to a new Singapore tax incentive and corresponding decrease in deferred tax assets. For both the three and twelve months ended October 31, 2024, management uses a non-GAAP effective tax rate of 14%. For both the three and twelve months ended October 31, 2023, management uses a non-GAAP effective tax rate of 12%.

Please refer to the last page for details on the use of non-GAAP financial measures.

| | | | | | | | | | | | | | | | | |

| KEYSIGHT TECHNOLOGIES, INC. |

| SEGMENT RESULTS INFORMATION |

| (In millions, except where noted) |

| (Unaudited) |

| PRELIMINARY |

| | | | | |

| | | | | |

| | | | | |

| Communications Solutions Group | | | | | Percent |

| Q4'24 | | Q4'23 | | Inc/(Dec) |

| Revenue | $ | 894 | | | $ | 891 | | | —% |

| Gross margin, % | 67 | % | | 68 | % | | |

| Income from operations | $ | 249 | | | $ | 257 | | | |

| Operating margin, % | 28 | % | | 29 | % | | |

| | | | | |

| | | | | |

| Electronic Industrial Solutions Group | | | | | Percent |

| Q4'24 | | Q4'23 | | Inc/(Dec) |

| Revenue | $ | 393 | | | $ | 420 | | | (6)% |

| Gross margin, % | 58 | % | | 61 | % | | |

| Income from operations | $ | 83 | | | $ | 127 | | | |

| Operating margin, % | 21 | % | | 30 | % | | |

Segment revenue and income from operations are consistent with the respective non-GAAP financial measures as discussed on last page.

| | | | | | | | | | | | | | | | | | | | | | | |

| KEYSIGHT TECHNOLOGIES, INC. |

| FREE CASH FLOW |

| (In millions) |

| (Unaudited) |

| PRELIMINARY |

| | | | | | | |

| Three months ended | | Year ended |

| October 31, | | October 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | $ | 359 | | | $ | 378 | | | $ | 1,052 | | | $ | 1,408 | |

| Adjustments: | | | | | | | |

| Investments in property, plant and equipment | (38) | | | (39) | | | (154) | | | (197) | |

| Proceeds from government incentives | 7 | | | 1 | | | 7 | | | 1 | |

| Free cash flow | $ | 328 | | | $ | 340 | | | $ | 905 | | | $ | 1,212 | |

Please refer to the last page for details on the use of non-GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| KEYSIGHT TECHNOLOGIES, INC. |

| REVENUE BY END MARKETS |

| (In millions) |

| (Unaudited) |

| PRELIMINARY |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | Percent | | | | | | Percent |

| Q4'24 | | Q4'23 | | Inc/(Dec) | | FY24 | | FY23 | | Inc/(Dec) |

| | | | | | | | | | | |

| Aerospace, Defense and Government | $ | 303 | | | $ | 323 | | | (6)% | | $ | 1,149 | | | $ | 1,250 | | | (8)% |

| Commercial Communications | 591 | | | 568 | | | 4% | | 2,271 | | | 2,435 | | | (7)% |

| Electronic Industrial | 393 | | | 420 | | | (6)% | | 1,559 | | | 1,779 | | | (12)% |

| Total Revenue | $ | 1,287 | | | $ | 1,311 | | | (2)% | | $ | 4,979 | | | $ | 5,464 | | | (9)% |

KEYSIGHT TECHNOLOGIES, INC.

Non-GAAP Financial Measures

Management uses both GAAP and non-GAAP financial measures to analyze and assess the overall performance of the business, to make operating decisions and to forecast and plan for future periods. We believe that our investors benefit from seeing our results “through the eyes of management” in addition to seeing our GAAP results. This information enhances investors’ understanding of the continuing performance of our business and facilitates comparison of performance to our historical and future periods.

Our non-GAAP financial measures may not be comparable to similarly titled measures used by other companies, including industry peer companies, limiting the usefulness of these measures for comparative purposes.

These non-GAAP measures should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The discussion below presents information about each of the non-GAAP financial measures and the company’s reasons for including or excluding certain categories of income or expenses from our non-GAAP results. In future periods, we may exclude such items and may incur income and expenses similar to these excluded items. Accordingly, adjustments for these items and other similar items in our non-GAAP presentation should not be interpreted as implying that these items are non-recurring, infrequent or unusual.

Core Revenue is GAAP/non-GAAP revenue (as applicable) excluding the impact of foreign currency changes and revenue associated with material acquisitions or divestitures completed within the last twelve months. We exclude the impact of foreign currency changes as currency rates can fluctuate based on factors that are not within our control and can obscure revenue growth trends. As the nature, size and number of acquisitions can vary significantly from period to period and as compared to our peers, we exclude revenue associated with recently acquired businesses to facilitate comparisons of revenue growth and analysis of underlying business trends.

Free cash flow includes cash provided by operating activities adjusted for net investments in property, plant & equipment.

Non-GAAP Income from Operations, Non-GAAP Net Income and Non-GAAP Diluted EPS may include the following types of adjustments:

•Acquisition-related Items: We exclude the impact of certain items recorded in connection with business combinations from our non-GAAP financial measures that are either non-cash or not normal, recurring operating expenses due to their nature, variability of amounts and lack of predictability as to occurrence or timing. These amounts may include non-cash items such as the amortization of acquired intangible assets and amortization of items associated with fair value purchase accounting adjustments. We also exclude other acquisition and integration costs associated with business acquisitions that are not normal recurring operating expenses and legal, accounting and due diligence costs. We exclude these charges to facilitate a more meaningful evaluation of our current operating performance and comparisons to our past operating performance.

•Share-based Compensation Expense: We exclude share-based compensation expense from our non-GAAP financial measures because share-based compensation expense can vary significantly from period to period based on the company’s share price, as well as the timing, size and nature of equity awards granted. Management believes the exclusion of this expense facilitates the ability of investors to compare the company’s operating results with those of other companies, many of which also exclude share-based compensation expense in determining their non-GAAP financial measures.

•Restructuring and others: We exclude incremental expenses associated with restructuring initiatives, usually aimed at material changes in the business or cost structure. Such costs may include employee separation costs, asset impairments, facility-related costs, contract termination fees, and costs to move operations from one location to another. These activities can vary significantly from period to period based on the timing, size and nature of restructuring plans; therefore, we do not consider such costs to be normal, recurring operating expenses.

We also exclude “others”, not normal, recurring, cash operating income/expenses from our non-GAAP financial measures. Such items are evaluated on an individual basis, based on both quantitative and qualitative factors and generally represent items that we do not anticipate occurring as part of our normal business. While not all-inclusive, examples of such items would include net unrealized gains on equity investments still held, significant non-recurring events like realized gains or losses associated with our employee benefit plans, costs and recoveries related to unusual events, gain on sale of assets/divestitures, adjustment attributable to non-controlling interest, etc. We believe that these costs do not reflect expected future operating expenses and do not contribute to a meaningful evaluation of the company’s current operating performance or comparisons to our operating performance in other periods

•Estimated Tax Rate: We utilize a consistent methodology for long-term projected non-GAAP tax rate. When projecting this long-term rate, we exclude any tax benefits or expenses that are not directly related to ongoing operations and which are either isolated or cannot be expected to occur again with any regularity or predictability. Additionally, we evaluate our current long-term projections, current tax structure and other factors, such as existing tax positions in various jurisdictions and key tax holidays in major jurisdictions where Keysight operates. This tax rate could change in the future for a variety of reasons, including but not limited to significant changes in geographic earnings mix including acquisition activity, or fundamental tax law changes in major jurisdictions where Keysight operates. The above reasons also limit our ability to reasonably estimate the future GAAP tax rate and provide a reconciliation of the expected non-GAAP earnings per share for the first quarter of fiscal 2025 to the GAAP equivalent.

Management recognizes these items can have a material impact on our cash flows and/or our net income. Our GAAP financial statements, including our Condensed Consolidated Statement of Cash Flows, portray those effects. Although we believe it is useful for investors to see core performance free of special items, investors should understand that the excluded costs are actual expenses that may impact the cash available to us for other uses. To gain a complete picture of all effects on the company’s profit and loss from any and all events, management does (and investors should) rely upon the Condensed Consolidated Statement of Operations prepared in accordance with GAAP. The non-GAAP measures focus instead upon the core business of the company, which is only a subset, albeit a critical one, of the company’s performance.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

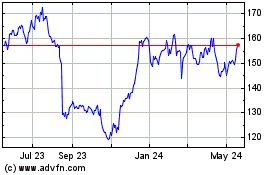

Keysight Technologies (NYSE:KEYS)

Historical Stock Chart

From Oct 2024 to Nov 2024

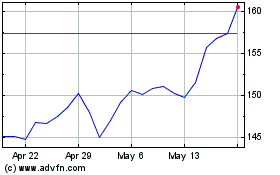

Keysight Technologies (NYSE:KEYS)

Historical Stock Chart

From Nov 2023 to Nov 2024