KKR Raises Over $850 Million for Opportunistic Real Estate Credit Strategy

February 14 2025 - 6:15AM

Business Wire

KKR, a leading global investment firm, today announced the final

close of the KKR Opportunistic Real Estate Credit Fund II (“ROX

II”), a strategy dedicated to opportunistic investments in senior

loans and real estate securities in the U.S. and Western Europe.

Closed commitments to the comingled fund and separate accounts

pursuing KKR’s Opportunistic Real Estate Credit Strategy total over

$850 million.

ROX II is KKR’s flagship private fund investing across the full

breadth of KKR Real Estate Credit’s opportunistic capabilities. The

strategy has a flexible mandate to pursue attractive risk-adjusted

returns across both loans and securities. Loan originations will

focus on first mortgages secured by high-quality properties owned

by institutional sponsors and located in major markets within the

United States and Western Europe. KKR has established a leading

franchise over the past decade as a mortgage lender of choice to

top sponsors. Securities investments will leverage KKR’s position

as the largest third-party purchaser of risk retention CMBS

B-Pieces, as well as K-Star, KKR’s dedicated special servicer.1

“We believe it is a great time to invest real estate credit. The

asset class offers attractive absolute and relative returns,

underpinned by the opportunity to lend on high-quality,

well-located assets at conservative leverage levels on re-set

property values,” said Matt Salem, Partner and Head of Real Estate

Credit at KKR. “We have designed our ROX II strategy with a

flexible mandate to participate in what we view as the best

risk-adjusted opportunities we see across our platform, with the

objective of delivering attractive returns coupled with significant

current income and a focus on downside protection.”

“Our extensive borrower relationships, built over the past

decade, have enabled us to continue our disciplined deployment into

an attractive market,” said Joel Traut, Partner and Head of

Originations for Real Estate Credit at KKR. “We believe private

capital will play an increasingly important role in the commercial

real estate market as loan demand continues to climb, and this

positions us very well to deliver attractive risk-adjusted

opportunities for our investors.”

KKR’s global real estate business invests thematically in

high-quality real estate through a full range of scaled equity and

debt strategies. KKR’s more than 140 dedicated real estate

investment and asset management professionals across 16 offices

apply the capabilities and knowledge of KKR’s global platform to

deliver outcomes for clients and investors. Since 2015, KKR’s real

estate credit strategy has originated $43.4 billion of loans and

invested $14 billion in commercial mortgage-backed securities

(CMBS).2

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

1 Based on the face amount retained on conduit and SASB CMBS

deals from January 1, 2017 – September 30, 2024; Source: Commercial

Mortgage Alert (accessed October 2024).

2 As of September 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250214912583/en/

Media Miles Radcliffe-Trenner or Lauren McCranie (212)

750-8300 media@kkr.com

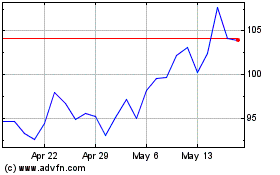

KKR (NYSE:KKR)

Historical Stock Chart

From Jan 2025 to Feb 2025

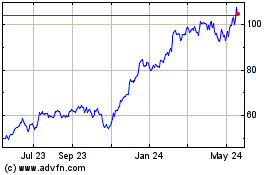

KKR (NYSE:KKR)

Historical Stock Chart

From Feb 2024 to Feb 2025