AM Best Comments on Credit Ratings of Kemper Corp. Following Announcement of Acquisition of American Access Casualty Company

November 24 2020 - 9:25AM

Business Wire

AM Best has commented that the Long-Term Issuer Credit

Rating (Long-Term ICR) rating of “bbb-” of Kemper Corporation

(Kemper) (Delaware) [NYSE:KMPR], and the Financial Strength Rating

(FSR) of A- (Excellent) and Long-Term ICRs of “a-” of its

property/casualty operating subsidiaries, referred to as Kemper

Property & Casualty Group, are unchanged by the announcement

that Kemper plans to acquire American Access Casualty Company

(American Access) (Downers Grove, IL) for $370 million in an

all-cash transaction. The outlook of Kemper’s Credit Ratings

(ratings) is positive.

The acquisition is in line with Kemper’s strategy of seeking

growth in niche markets. Based on the most recent 12-month results,

the acquisition will increase Kemper’s specialty auto net premiums

written by over 10%, and will expand its geographic footprint and

presence in Hispanic communities.

Following the close of the transaction, expected in the first

quarter of 2021, Kemper’s financial leverage and coverage metrics

are expected to remain comfortably within AM Best’s guidelines for

the ratings. The transaction will drive an increase in tangible

leverage, but management anticipates earnings over the course of

the first year after the acquisition to neutralize this effect. As

a result, AM Best does not expect that the transaction will have

any adverse rating impact, but will continue to discuss its

progress with management and assess its effects on Kemper’s

operations.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent Rating

Activity web page. For additional information regarding the use and

limitations of Credit Rating opinions, please view Guide to Best’s

Credit Ratings. For information on the proper media use of Best’s

Credit Ratings and AM Best press releases, please view Guide for

Media - Proper Use of Best’s Credit Ratings and AM Best Rating

Action Press Releases.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in New York, London,

Amsterdam, Dubai, Hong Kong, Singapore and Mexico City. For more

information, visit www.ambest.com.

Copyright © 2020 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201124005736/en/

Jennifer Marshall Director +1 908 439 2200,

ext. 5327 jennifer.marshall@ambest.com

Christopher Sharkey Manager, Public Relations

+1 908 439 2200, ext. 5159

christopher.sharkey@ambest.com

Michael Lagomarsino, CFA, FRM Senior Director

+1 908 439 2200, ext. 5810 michael.lagomarsino@ambest.com

Jim Peavy Director, Communications +1 908 439

2200, ext. 5644 james.peavy@ambest.com

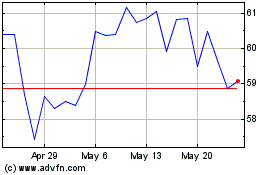

Kemper (NYSE:KMPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

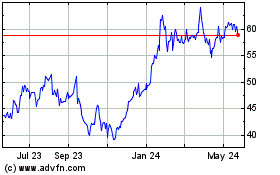

Kemper (NYSE:KMPR)

Historical Stock Chart

From Nov 2023 to Nov 2024