Kayne Anderson Energy Infrastructure Fund Announces Change to Monthly Distributions and Announces Distributions

October 10 2024 - 3:20PM

Kayne Anderson Energy Infrastructure Fund, Inc. (the “Company”)

announced today its distribution payment frequency will change from

quarterly to monthly payments beginning in November 2024.

As outlined in the table below, the Company

declared a monthly distribution of $0.08 per share payable in

November 2024, December 2024 and January 2025. This monthly

distribution amount is equivalent to the $0.24 per share quarterly

distribution paid by KYN on October 7, 2024.

The Board of Directors and management understand

how important distributions are to the Company’s investors and

believe this change to KYN’s distribution policy will make it an

attractive choice for investors who desire more frequent

distribution payments.

Payment of future distributions is subject to

the approval of the Company’s Board of Directors. It is the

Company’s intention to declare monthly payments each month

beginning with the monthly distribution payment expected to be made

in February 2025.

|

Record Date / Ex-Date |

Payment Date |

Distribution Amount |

Return of

Capital Estimate |

|

11/15/24 |

11/29/24 |

$0.08 |

0%(1) |

|

12/16/24 |

12/31/24 |

$0.08 |

75%(2) |

|

1/15/25 |

1/31/25 |

$0.08 |

75%(2) |

(1) This estimate is based on the Company’s

anticipated earnings and profits. The final determination of the

tax character of distributions will not be determinable until after

the end of fiscal 2024 and may differ substantially from this

preliminary information.(2) This estimate is based on the Company’s

anticipated earnings and profits. The final determination of the

tax character of distributions will not be determinable until after

the end of fiscal 2025 and may differ substantially from this

preliminary information.

Kayne Anderson Energy Infrastructure Fund, Inc.

(NYSE: KYN) is a non-diversified, closed-end management investment

company registered under the Investment Company Act of 1940, as

amended, whose common stock is traded on the NYSE. The Company’s

investment objective is to provide a high after-tax total return

with an emphasis on making cash distributions to stockholders. KYN

intends to achieve this objective by investing at least 80% of its

total assets in securities of Energy Infrastructure Companies. See

Glossary of Key Terms in the Company’s most recent quarterly report

for a description of these investment categories and the meaning of

capitalized terms.

The Company pays cash distributions to common

stockholders at a rate that may be adjusted from time to time.

Distribution amounts are not guaranteed and may vary depending on a

number of factors, including changes in portfolio holdings and

market conditions.

This press release shall not constitute an offer

to sell or a solicitation to buy, nor shall there be any sale of

any securities in any jurisdiction in which such offer or sale is

not permitted. Nothing contained in this press release is intended

to recommend any investment policy or investment strategy or

consider any investor’s specific objectives or circumstances.

Before investing, please consult with your investment, tax, or

legal adviser regarding your individual circumstances.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS: This communication contains statements reflecting

assumptions, expectations, projections, intentions, or beliefs

about future events. These and other statements not relating

strictly to historical or current facts constitute forward-looking

statements as defined under the U.S. federal securities laws.

Forward-looking statements involve a variety of risks and

uncertainties. These risks include but are not limited to changes

in economic and political conditions; regulatory and legal changes;

energy industry risk; leverage risk; valuation risk; interest rate

risk; tax risk; and other risks discussed in detail in the

Company’s filings with the SEC, available

at www.kaynefunds.com or www.sec.gov. Actual events

could differ materially from these statements or our present

expectations or projections. You should not place undue reliance on

these forward-looking statements, which speak only as of the date

they are made. Kayne Anderson undertakes no obligation to publicly

update or revise any forward-looking statements made herein. There

is no assurance that the Company’s investment objectives will be

attained.

Contact investor relations at 877-657-3863 or

cef@kayneanderson.com.

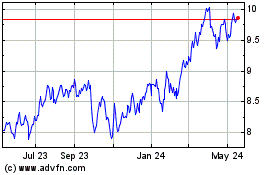

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Nov 2024 to Dec 2024

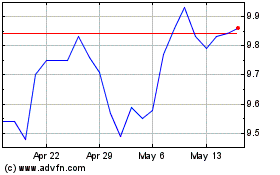

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Dec 2023 to Dec 2024