(All amounts in US$ unless otherwise

indicated)

Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“Lithium Americas” or the “Company”) announced an

increased mineral resource and mineral reserve estimate for the

Thacker Pass lithium project in Humboldt County, Nevada

(“Thacker Pass” or the “Project”), including the

release of an independent National Instrument 43-101 (“NI

43-101”) technical report (“Technical Report”) entitled

“NI 43-101 Technical Report on the Thacker Pass Project Humboldt

County, Nevada, USA,” and an independent S-K 1300 technical report

(the “S-K 1300 Technical Report”) entitled “S-K 1300

Technical Report on the Thacker Pass Project Humboldt County,

Nevada, USA,” both dated effective December 31, 2024. The Project

is indirectly owned by Lithium Nevada Ventures LLC (“LN”).

LN is a joint venture between the Company, which has a 62%

ownership, and General Motors Holdings LLC (“GM”), which has

a 38% ownership.

Jonathan Evans, President and CEO, commented, “We are excited to

release the results of our Thacker Pass Technical Report that

demonstrates the multigenerational opportunity for transformational

growth the Project creates. Thacker Pass is now the largest

measured lithium reserve and resource in the world and has the

potential to become an unmatched district, generating American jobs

and helping the U.S. regain independence of its energy supply. We

are committed to safely and sustainably developing Thacker Pass

while engaging with our stakeholders to increase domestic

production of critical minerals.”

HIGHLIGHTS

- Proven and Probable (“P&P”) mineral reserve estimate

of 14.3 million tonnes (“Mt”) lithium carbonate equivalent

(“LCE”) at an average grade of 2,540 parts per million

(“ppm”) lithium (“Li”), an increase of 286% since the

November 2022 Feasibility Study1; supports an expansion of up to

five phases with an 85-year mine life.

- Measured and Indicated (“M&I”) mineral resource

estimate of 44.5 Mt LCE at an average grade of 2,230 ppm Li; an

increase of 177% since the November 2022 Feasibility Study.

- Expansion plan targeting 160,000 tonnes per year (“t/y”)

of battery-quality lithium carbonate (“Li2CO3”) production

capacity in four phases of 40,000 t/y each, respectively (“Phase

1,” “Phase 2,” “Phase 3” and “Phase 4”),

with a sulfuric acid plant without an additional Li2CO3 production

circuit as Phases 1-4 are expected to have excess capacity

(“Phase 5”). Phase 4 expansion incorporates a direct rail

line from Winnemucca to Thacker Pass.

- Project economics for an 85-year life of mine (“LOM”)

(“Base Case”) and an optimized production scenario for years

1-25 of the 85-year LOM (“Years 1-25” or “Production

Scenario”). Both the Base Case and Production Scenario use a

price assumption of $24,000 per tonne of Li2CO3.

- Average annual EBITDA2 for the Production Scenario is estimated

at $2.2 billion per year and $2.1 billion per year for the Base

Case.

- Production Scenario after-tax net present value (“NPV”)

of $5.9 billion at 8% discount and 19.6% after-tax internal rate of

return (“IRR”), and Base Case after-tax NPV of $8.7 billion

at 8% discount and 20.0% after-tax IRR.

- Production Scenario operating costs (“OPEX”) of $6,238

per tonne lithium carbonate produced, and Base Case OPEX of $8,039

per tonne lithium carbonate produced.

- Capital cost (“CAPEX”) estimates for Phase 1 of $2.93

billion (as previously disclosed in March 2024), Phase 2 of $2.33

billion, Phase 3 of $2.74 billion, Phase 4 and 5 together of $4.32

billion, based on cost estimates from Q2 2024 and include a 15%

contingency.

- Construction of each of Phases 1 through 4 is expected to be

spaced four years apart, with Phase 5 beginning at the same time as

Phase 4.

- Phase 1 is expected to create nearly 2,000 jobs during

construction and approximately 350 full-time jobs during

operations. Over the LOM, an average of approximately 1,100

full-time employees are expected to support mining and processing

operations. Additional jobs are expected to be created in the local

communities through ancillary and support services, such as

transportation, maintenance and supplies.

- Phase 1 is targeted for completion in late 2027. The Company is

targeting to announce the final investment decision (“FID”)

for Phase 1 in early 2025. Bechtel is the engineering, procurement

and construction management (“EPCM”) contractor for the

construction of Phase 1.

1 For more details, refer to the Company’s Feasibility Study

entitled “Feasibility Study National Instrument 43-101 Technical

Report for the Thacker Pass Project Humboldt County, Nevada, USA”,

dated effective November 2, 2022, available on SEDAR+. 2 Earnings

before income, taxes, depreciation and amortization

(“EBITDA”) is a non-GAAP financial measure, refer to

Non-GAAP Measures for more information.

PROJECT IMPROVEMENTS

The Thacker Pass Technical Report results reflect continuous

improvement initiatives, including optimizing the mine plan and

incorporating results of test work completed at the Company’s

Lithium Technical Development Center.

The Thacker Pass deposit allows the mine to have multiple grades

of ore exposed at any given time, enabling flexibility to deliver

optimum ore blends as needed to maximize economics. The Company has

developed an optimized mine plan which allows an approximate 25%

increase in recovery for the first 12 years of production,

providing a higher economic return during the years of capital

investment for building Phases 2 through 5.

Process optimizations and engineering development updates

include:

- Beneficiation circuit: the number of decanter centrifuges

reduced from six to four.

- Counter-current Decantation (“CCD”) thickeners: smaller

diameter.

- Filter presses: reduced from eight membrane type to four

recessed chamber type.

- Brine evaporators: reduced from three to two.

- Sulfuric acid plant for Phase 1 through 4: size of plant

reduced from the previous 3,000 tonnes per day (“t/d”)

sulfuric acid to 2,250 t/d sulfuric acid, reducing the

transportation and consumption of liquid sulfur.

- Final polishing step where low levels of calcium and magnesium

are removed: improved reaction parameters in the calcium

precipitation circuit reduce loading on ion exchange.

- Reagents: reduced soda ash consumption in the lithium carbonate

circuit.

To maximize the life of mine, ore control parameters would be

lowered after the construction of Phase 1 through 5 is completed.

Phase 5 would consist of a 3,000 t/d sulfuric acid plant and a

brine plant to supplement feed to the processing plants of Phases 1

through 4, to maintain their nominal production capacity at 40,000

t/y.

Estimated OPEX for Years 1-25 is approximately $500 per tonne

lower (~7%), than the November 2022 Feasibility Study. Lower raw

material (reagent) consumption and costs, decreased maintenance on

less equipment and reduced tailings placement (due to less tailings

produced) were offset by higher mining costs to achieve the

optimized mine plan, power utility costs based on final selection

of power provider and general and administrative costs for

insurance.

TECHNICAL REPORT SUMMARY

December 2024 Thacker Pass Technical

Report Results (US$)

Production Scenario (Years

1-25)

Base Case (85-year

LOM)

Mineral resource (Measured &

Indicated)

44.5 Mt LCE at a grade of 2,230

ppm Li

Mineral reserves (Proven &

Probable)

14.3 Mt LCE at a grade of 2,540

ppm Li

Ore reserve life

85 years

Operational life

25 years

85 years

Nominal production capacity

160,000 t/y Li2CO3 (Phases 1-4 at

40,000 t/y Li2CO3 each, with additional Phase 5 producing brine to

feed to Phases 1-4 lithium processing plants)

Mining method

Continuous open-pit mining

Processing method

Sulfuric acid leaching

Metallurgical Recovery

82.1%

80.4%

Initial capital costs – Phase 1

$2.93 billion

Initial capital costs – Phase 2

$2.33 billion

Initial capital costs – Phase 3

$2.75 billion

Initial capital costs – Phase 4 and 5

(includes rail)

$4.32 billion

Sustaining capital costs

$1.55 billion

$6.92 billion

Operating Costs (average) (per tonne

LCE)

$6,238

$8,039

Lithium carbonate price assumption (per

tonne)

$24,000

Average Annual EBITDA (per year)

$2.2 billion

$2.1 billion

After-tax NPV @ 8% Discount Rate

$5.9 billion

$8.7 billion

After-tax IRR

19.6%

20.0%

CONSTRUCTION TIMELINE

Construction of Thacker Pass to reach total nominal design

capacity of 160,000 t/y of Li2CO3 is planned over five phases. Each

of Phases 1 through 4 are expected to be spaced 4 years apart with

Phase 5 beginning at the same time as Phase 4. Construction of

Phases 2 through 5 is expected to occur over a 13-year period, from

the start of Phase 1 first production. Phase 4 expansion includes a

direct rail line to Thacker Pass for the transportation of raw

materials and finished product. The lithium carbonate production

plants for Phase 1 through 4 is expected to have excess capacity

that would take brine feed from Phase 5 to maintain their nominal

production capacity of 40,000 t/y. Additional required permitting

for Phases 2 through 5 will be initiated following the completion

of Phase 1 construction.

Thacker Pass Expansion by

Phase

Phase 1

Phase 2

Phase 3

Phase 4

Phase 5

Sulfuric Acid Plant Capacity

(t/d)

2,250

2,250

2,250

2,250

3,000

Nominal Design LCE Production

(t/y)

40,000

40,000

40,000

40,000

-

Beneficiation circuit

X

X

X

X

X

Leaching, Neutralization &

CCD circuits

X

X

X

X

X

Magnesium and calcium removal

circuit

X

X

X

X

Partial

Lithium carbonate production

plant

X

X

X

X

-

Construction of Phase 1 commenced in early 2023 and the Company

is targeting to announce FID in early 2025. Bechtel is the EPCM

contractor for the construction of Phase 1. In Q4 2024, the Company

provided Bechtel and other major contractors with limited full

notice to proceed to de-risk the construction schedule and continue

to target completion in late 2027.

Current work at Thacker Pass for Phase 1 includes excavation of

the process plant (now over 75% complete), advancing detailed

engineering (now over 50% complete) and awarding of procurement

packages. At the Workforce Hub, the Company’s full-service housing

facility in Winnemucca for construction workers, the site’s utility

infrastructure is being built out.

CAPITAL COST ESTIMATE

Total estimated CAPEX for the development of Phases 1 through 5

for total nominal production of 160,000 t/y of lithium carbonate is

$12.4 billion. CAPEX estimates are based on Q2 2024 pricing and

include a 15% contingency. CAPEX estimates include early works,

mine development, mining, the process plant, the off-site transload

facility, commissioning and all associated infrastructure.

CAPEX for Phase 2, 3, 4 and 5 is derived from Phase 1 estimates.

CAPEX for Phases 2 and 3 benefits from established mine and plant

infrastructure from Phase 1. CAPEX for Phases 4 and 5 include the

addition of one processing plant, two sulfuric acid plants and a

direct rail line to Thacker Pass.

Thacker Pass CAPEX Estimates ($US

millions)

Phase 1

Phase 2

Phase 3

Phase 4 & 5

Additional LOM

Mine

$88

-

-

-

-

Process & Sulfuric Acid

Plants

$2,842

$2,326

$2,754

$4,074

-

Infrastructure Relocation

-

$2

-

-

$114

Rail expansion

-

-

-

$241

-

Total Development Capital

$2,930

$2,328

$2,754

$4,315

$114

Sustaining capital costs for Years 1 through 25 total $1.55

billion and for LOM total $6.92 billion. Sustaining capital costs

include replacement costs for mining equipment, process plant

equipment, expansions of storage facilities and infrastructure and

capital repayment to third parties for the off-site transload

terminal, mining and limestone quarry. Capital costs for Phases 2

through 5 are not included in sustaining capital costs.

Sustaining Capital Cost Estimate

(US$ millions)

Production Scenario (Years

1-25)

Base Case (85-year

LOM)

Mine including equipment capital

$636

$3,445

Mobile equipment

$28

$93

Process plants and infrastructure

$626

$3,125

Third-party capital repayment

$259

$259

Total sustaining capital cost

$1,549

$6,921

OPERATING COST ESTIMATE

OPEX include raw materials, labor, utilities, maintenance

materials, supplies and outside services and tailings. Reagents for

the sulfuric acid plant and process plant account for approximately

50% of total operating costs for LOM or 56% for Years 1-25. Primary

reagents include liquid sulfur, soda ash, quicklime, caustic soda,

flocculant and limestone.

Summary of Thacker Pass OPEX

(US$)

Production Scenario

(Years 1-25)

Base Case (85-year

LOM)

$ per tonne

Li2CO3

% of Total

$ per tonne

Li2CO3

% of Total

Mine

$904

14%

$1,767

22%

Lithium Processing & Sulfuric Acid

Plants

$5,013

80%

$5,946

74%

General & Administrative

$321

5%

$326

4%

Total Operating Costs

6,238

100%

$8,039

100%

MINERAL RESOURCE ESTIMATE

Thacker Pass Mineral Resource Estimate as of December 31,

2024

Category

In Situ Dry Tonnage

(Mt)

Average Li (ppm)

Lithium Carbonate Equivalent

(Mt)

Measured

560.8

2,680

8.0

Indicated

3,225.2

2,150

36.5

Total Measured & Indicated

3,786.0

2,230

44.5

Inferred

1,981.5

2,070

21.6

Notes for the December 31, 2024 Mineral Resource:

- The independent Qualified Person who supervised the preparation

of and approved disclosure for the estimate is Benson Chow, P.G.,

SME-RM.

- Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability.

- The Mineral Resource model has been generated using Imperial

units. Metric tonnages shown in table are conversions from the

Imperial Block Model.

- Mineral Resources are inclusive of 1,056.7 million metric

tonnes (Mt) of Mineral Reserves

- Mineral Resources are reported using an economic break-even

formula: “Operating Cost per Resource Short Ton”/“Price per

Recovered Short Ton Lithium” * 10^6 = ppm Li Cutoff. “Operating

Cost per Resource Short Ton” = US$86.76, “Price per Recovered Short

Ton Lithium” is estimated: “Lithium Carbonate Equivalent (LCE)

Price” * 5.3228 * (1 – “Royalties”) * “Metallurgical Recovery”.

Variables are “LCE Price” = US$26,308/Short Ton ($29,000/tonne)

Li2CO3, “GRR” = 1.75% and “Metallurgical Recovery” = 73.5%.

- Presented at a cutoff grade of 858 ppm Li. and a maximum ash

content of 85%.

- A mineral resource constraining pit shell has been derived from

performing a pit optimization estimation using Vulcan software and

the same economic inputs as what was used to calculate the cutoff

grade.

- The conversion factor for lithium to LCE is 5.3228.

- Applied density for the mineralization is weighted in the block

model based on clay and ash percentages in each block and the

average density for each lithology (Section 14.1.6.4 of the

Technical Report).

- Measured Mineral Resources are in blocks estimated using at

least 3 drill holes and 10 samples where the closest sample during

estimation is less than or equal to 900 ft. Indicated Mineral

Resources are in blocks estimated using at least 2 drill holes and

10 samples where the closest sample during estimation is less than

or equal to 1,500 ft. Inferred Mineral Resources are in blocks

estimated using at least 2 drill holes and 9 samples where the

closest sample during estimation is less than or equal to 2,500

ft.

- Tonnages and grades have been rounded to accuracy levels deemed

appropriate by the QP. Summation errors due to rounding may

exist.

- Mineral Resources are presented on a 100% basis. LN indirectly

owns the Project. Lithium Americas owns a 62% interest in LN and GM

owns the remaining 38%.

MINERAL RESERVE ESTIMATE

Thacker Pass Mineral Reserve Estimate as of December 31,

2024

Category

Run-of-Mine (ROM) Dry

Tonnage (Mt)

Average Li

(ppm)

Lithium Carbonate Equivalent

(Mt)

Proven

269.5

3,180

4.5

Probable

787.1

2,320

9.7

Total Proven and Probable

1,056.7

2,540

14.3

Notes for the December 31, 2024 Mineral Reserve:

- The independent Qualified Person for the Mineral Reserves

Estimate has been prepared by Kevin Bahe, P.E.

- Mineral Reserves have been converted from measured and

indicated Mineral Resources within the feasibility study and have

demonstrated economic viability.

- Reserves presented in an optimized pit at an 85% maximum ash

content, cutoff grade of 858 ppm Li, and an average cut-off factor

of 13.3 kg of LCE recovered per tonne of leach ore tonne (ranged

from 7.5-26 kg of LCE recovered per tonne of leach ore tonne).

- A sales price of $29,000 US$/tonne of Li2CO3 was utilized in

the pit optimization resulting in the generation of the reserve pit

shell in 2024. An overall slope of 27 degrees was applied. For

bedrock material pit slope was set at 52 degrees. Mining and

processing costs of $95.40 per tonne of ROM feed, a processing

recovery factor based on the block model, and a GRR cost of 1.75%

were additional inputs into the pit optimization.

- A LOM plan was developed based on equipment selection,

equipment rates, labor rates, and plant feed and reagent

parameters. All Mineral Reserves are within the LOM plan. The LOM

plan is the basis for the economic assessment within the Technical

Report, which is used to show the economic viability of the Mineral

Reserves.

- Applied density for the ore is varied by clay type (Table 14-13

of the Technical Report).

- Lithium Carbonate Equivalent is based on in-situ LCE tonnes

with a 95% mine recovery factor.

- Tonnages and grades have been rounded to accuracy levels deemed

appropriate by the QP. Summation errors due to rounding may

exist.

- The reference point at which the Mineral Reserves are defined

is at the point where the ore is delivered to the run-of-mine

feeder.

- Mineral Reserves are presented on a 100% basis. LN indirectly

owns the Project. Lithium Americas owns a 62% interest in LN and GM

owns the remaining 38%.

Please refer to the Technical Report for full details on the

geology, mining, processing and infrastructure of Thacker Pass.

QUALITY ASSURANCE AND QUALITY CONTROL

Mineral Resources

Sample names, certificate identifications and run

identifications were cross referenced with the laboratory

certificates and sample assay datasheet for spot checking and

verification of data. No data anomalies were discovered during this

check.

Quality Assurance / Quality Control (“QA/QC”) methodology

utilized by Lithium Americas and results of these checks were

discussed between Lithium Americas’ geologists and the Mineral

Resources qualified person, as defined under NI 43-101

(“QP”), who has reviewed and verified the Mineral Resource

estimate (the “Mineral Resources QP”).

Geologic logs, Access databases and Excel spreadsheets were

provided to the Mineral Resources QP for cross validation with the

Excel lithological description file. Spot checks between Excel

lithological description sheets were performed against the source

data with no inconsistencies found with the geologic unit

descriptions.

Verification of the block model was performed by the creation of

a geostatistical model and the review of its various outputs.

Histograms, simulation and swath plots were created and analyzed to

validate the accuracy of the block model.

Based on the various reviews, validation exercises and remedies

outlined above, the Mineral Resources QP concluded that the data is

adequate for use for Mineral Resource estimation.

Mineral Reserves

A QP has reviewed and verified the Mineral Reserve estimate (the

“Mineral Reserves QP”), for the following as part of the

mine planning, cost model and Mineral Reserves data

verification.

- Geotechnical: slope stability study completed by BARR

Engineering in 2019 and 2024 was reviewed.

- Mining Method: open-pit mining with limited blasting has been

reviewed and assessed with geotechnical reports.

- Pit Optimization: was based on the resource pit completed in

2024. The final optimized pit is limited by several physical

features.

- Mine Design: ramp, bench and face angle parameters were

validated by geotechnical reports.

- Production Schedule: the production schedule was validated

based on reasonability.

- Labor and Equipment: estimations for equipment sizes, capacity,

availability and utilization were reviewed for reasonability.

- Economic Model: model was reviewed and demonstrated economic

viability for the Project.

- Facilities and Materials: facilities and materials located

within the reserve pit boundary will be re-located when access to

those areas are required during mining.

QUALIFIED PERSON

The scientific and technical information contained in this news

release has been derived from the Technical Report and has been

reviewed and approved by Rene LeBlanc, RM-SME, Vice President,

Growth and Product Strategy of the Company, a QP as defined under

NI 43-101.

Further information about Thacker Pass, including a description

of the key assumptions, parameters, sampling methods, data

verification and QA/QC programs, methods relating to Mineral

Resources and Mineral Reserves and factors that may affect those

estimates are contained in the Technical Report which is available

under the Company’s profile on SEDAR+, and in the S-K 1300

Technical Report which is available under the Company’s profile on

EDGAR at www.sec.gov and both reports are available on the

Company’s website.

Other than as described in the Company’s continuous disclosure

documents, there are no known legal, political, environmental or

other risks that could materially affect the potential development

of the Mineral Reserves and Mineral Resources at this point in

time.

NON-GAAP MEASURES

This news release contains certain non-GAAP (Generally Accepted

Accounting Principles) measures, including EBITDA. Such measures

have non-standardized meaning under GAAP and may not be comparable

to similar measures used by other issuers. Each of these measures

used are intended to provide additional information to the user and

should not be considered in isolation or as a substitute for

measures prepared in accordance with IFRS. Non-IFRS financial

measures used in this news release are common to the industry. The

prospective non-GAAP financial measures or ratios presented are not

able to be reconciled to the nearest comparable measure under IFRS

and the equivalent historical non-GAAP financial measure for the

prospective non-GAAP financial measure or ratio discussed herein

are not available because the Project is not and has not been in

production. As the Company has provided these measures on a

forward-looking basis, it is unable to present a quantitative

reconciliation to the most directly comparable financial measure

calculated and presented in accordance with GAAP without

unreasonable efforts. This is due to the inherent difficulty of

forecasting the timing or amount of various reconciling items that

would impact the most directly comparable forward-looking GAAP

measure that have not yet occurred, are outside of the Company’s

control and/or cannot be reasonably predicted.

NATIONAL INSTRUMENT 43-101 DISCLOSURE

Readers are cautioned that the conclusions, projections and

estimates set out in this news release are subject to important

qualifications, assumptions and exclusions, all of which are

detailed in the Technical Report. To fully understand the summary

information set out above, the Technical Report is available on

SEDAR+ at www.sedarplus.ca should be read in its entirety.

ABOUT LITHIUM AMERICAS

Lithium Americas is committed to responsibly developing Thacker

Pass located in Humboldt County in northern Nevada, which hosts the

largest known lithium M&I resource and P&P reserve in the

world. Thacker Pass is owned by a joint venture between Lithium

Americas (holding a 62% interest and is the manager of the

Project), and GM (holding a 38% interest). The Company is focused

on advancing Thacker Pass Phase 1 toward production, targeting

nominal design capacity of 40,000 t/y of battery-quality lithium

carbonate. The Company and its EPCM contractor, Bechtel, entered

into a National Construction Agreement (Project Labor Agreement)

with North America’s Building Trades Unions for construction of

Thacker Pass. The three-year construction build is expected to

create nearly 2,000 direct jobs, including 1,800 skilled

contractors. Lithium Americas’ shares are listed on the Toronto

Stock Exchange and New York Stock Exchange under the symbol LAC. To

learn more, visit www.lithiumamericas.com or follow

@LithiumAmericas on social media.

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities legislation, and

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995

(collectively referred to as “forward-looking information”

(“FLI”)). All statements, other than statements of historical fact,

are FLI and can be identified by the use of statements that

include, but are not limited to, words, such as “anticipate,”

“plan,” “continues,” “estimate,” “expect,” “may,” “will,”

“projects,” “predict,” “proposes,” “potential,” “target,”

“implement,” “scheduled,” “forecast,” “intend,” “would,” “could,”

“might,” “should,” “believe” and similar terminology, or statements

that certain actions, events or results “may,” “could,” “would,”

“might” or “will” be taken, occur or be achieved. FLI in this news

release includes, but is not limited to expectations relating to

performance and execution of business plans; expectations related

to current or future joint venture relationships; expectations

relating to financial management, controls and project funding;

expectations relating to the timing and ability to advance to a

final investment decision for major construction of the Project;

expectations relating to delivering shareholder value; expectations

relating to contributions to the development of a North American

lithium supply chain and the resulting beneficial impacts on local

communities proximate to the Project; expectations and timing on

the commencement of major construction and first production;

project de-risking initiatives; expectations related to the

construction build and phases of Thacker Pass and nameplate

capacity (as well as expansion potential) and mine life;

expectations relating to the estimated completion and performance

of the Project, including estimates of operating and capital costs;

statements with respect to the expected economics of Thacker Pass,

including production expectations, EBITDA, NPV, IRR, pricing

assumptions, life of mine, OPEX and sustaining capital; other

statements with respect to the Company’s future objectives and

strategies to achieve these objectives, and management’s beliefs,

plans, estimates and intentions, and similar statements concerning

anticipated future events, results, circumstances, performance of

the Project or expectations that are not historical facts.

FLI involves known and unknown risks, assumptions and other

factors that may cause actual results or performance to differ

materially. FLI reflects the Company’s current views about future

events, and while considered reasonable by the Company as of the

date of this news release, are inherently subject to significant

uncertainties and contingencies. Accordingly, there can be no

certainty that they will accurately reflect actual results.

Assumptions upon which such FLI is based include, without

limitation, the absence of material adverse events affecting the

Company during the construction of the Project; the ability to

perform conditions and meet expectations of agreements with GM;

confidence that development, construction and operations at Thacker

Pass will proceed as anticipated, including the impact of potential

supply chain disruptions and the availability of equipment and

facilities necessary to complete development and construction at

Thacker Pass and produce battery grade lithium; the Company’s

ability to operate in a safe and effective manner, and without

material adverse impact from the effects of climate change or

severe weather conditions; expectations regarding the Company’s

financial resources and future prospects, including the ability to

obtain additional financing on satisfactory terms; expectations

regarding future pricing of lithium and the supplies necessary to

operate Thacker Pass; the ability to meet future objectives and

priorities; a cordial business relationship between the Company and

third party strategic and contractual partners; general business

and economic uncertainties and adverse market conditions;

settlement of agreements related to the operation and sale of

mineral production as well as contracts in respect of operations

and inputs required in the course of production; the Company’s

ability to complete construction of each Phase of the Project on

time and on budget; the respective benefits and impacts of Thacker

Pass when production operations commence; the availability of

equipment and facilities necessary to complete development and

construction at the Project; unforeseen technological, engineering

and operational problems; political factors, including the impact

of the results of the 2024 U.S. presidential election on, among

other things, the extractive resource industry, the green energy

transition and the electric vehicle market; accuracy of development

budgets and construction estimates; uncertainties inherent to

feasibility studies and mineral resource and mineral reserve

estimates; reliability of technical data; uncertainties relating to

receiving and maintaining mining, exploration, environmental and

other permits or approvals in Nevada; government regulation of

mining operations and changes to regulatory or governmental royalty

or tax rates; delays in obtaining governmental approvals or

financing or in the completion of development or construction

activities; demand for lithium, including that such demand is

supported by growth in the electric vehicle market; current

technological trends; the impact of increasing competition in the

lithium business, and the Company’s competitive position in the

industry; changes to costs of production due to general economic

factors such as: recession, inflation, deflation, and financial

instability; compliance by joint venture partners with terms of

agreements; continuing support of local communities and the Fort

McDermitt Paiute and Shoshone Tribe for Thacker Pass, and

continuing constructive engagement with these and other

stakeholders, and any expected benefits of such engagement; risks

related to cost, funding and regulatory authoritarians to develop a

workforce housing facility; the stable and supportive legislative,

regulatory and community environment in the jurisdictions where the

Company operates; ability to realize expected benefits from

investments in or partnerships with third parties; availability of

technology, including low carbon energy sources and water rights,

on acceptable terms to advance Thacker Pass; the impact of unknown

financial contingencies, including litigation costs, title dispute

or claims, environmental compliance costs and costs associated with

the impacts of climate change, on the Company’s operations;

increased attention to environmental, social, governance and safety

(“ESG-S”) and sustainability-related matters, risks related to the

Company’s public statements with respect to such matters that may

be subject to heightened scrutiny from public and governmental

authorities related to the risk of potential “greenwashing,” (i.e.,

misleading information or false claims overstating potential

sustainability-related benefits), risks that the Company may face

regarding potentially conflicting anti-ESG-S initiatives from

certain U.S. state or other governments; estimates of and

unpredictable changes to the market prices for lithium products, as

well as assumptions concerning general economic and industry growth

rates, commodity prices, resource estimates, currency exchange and

interest rates and competitive conditions. Although the Company

believes that the assumptions and expectations reflected in such

FLI are reasonable, the Company can give no assurance that these

assumptions and expectations will prove to be correct.

Readers are cautioned that the foregoing lists of factors are

not exhaustive. There can be no assurance that FLI will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. As such,

readers are cautioned not to place undue reliance on this

information, and that this information may not be appropriate for

any other purpose, including investment purposes. The Company’s

actual results could differ materially from those anticipated in

any FLI as a result of the risk factors set out herein and in the

Company’s filings with securities regulators.

The FLI contained in this news release is expressly qualified by

these cautionary statements. All FLI in this news release speaks as

of the date of this news release. The Company does not undertake

any obligation to update or revise any FLI, whether as a result of

new information, future events or otherwise, except as required by

law. Additional information about these assumptions and risks and

uncertainties is contained in the Company’s filings with securities

regulators, including the Company’s most recent Annual Report on

Form 20-F and most recent management’s discussion and analysis for

our most recently completed financial year and, if applicable,

interim financial period, which are available on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov. All FLI contained in

this news release is expressly qualified by the risk factors set

out in the aforementioned documents.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250107373175/en/

INVESTOR CONTACT Virginia Morgan, VP, IR and ESG

+1-778-726-4070 ir@lithiumamericas.com

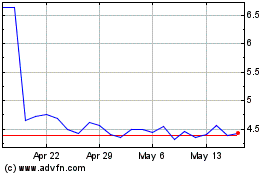

Lithium Americas (NYSE:LAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Lithium Americas (NYSE:LAC)

Historical Stock Chart

From Jan 2024 to Jan 2025