The economy is struggling, and so is J. C. Penney

Company Inc. (JCP). The company’s lackluster performance has set it

back while many of its peers have walked away with impressive

numbers. But is this enough for an investment decision?

Superficially, a stock may look weak but this should not be the

criterion for ones judgment. What looks good from the outside may

not actually hold promises in the long run. In short, looks can be

deceptive.

What else do we look for before investing in a stock? For a

comprehensive answer, we must dig deeper to find whether the

company is actually trying to address its problems, and what

measures or remedies it is taking to lift itself. The steps may not

immediately lead the company on a growth path immediately, but slow

and steady wins the race.

Rising stocks are always lucrative for investors. In a growing

economy, everything appears to be on the rise, and vice versa. But

that is where an investor must act prudently. Instead of being

influenced by market sentiments, one must carefully analyze one's

portfolio of stocks.

A close look will give a brief idea of whether the risks in a

stock are systematic or unsystematic. A dismal economy will

definitely make the stock look less attractive, but that doesn't

necessarily indicate that the stock is devoid of growth

propositions.

A SWOT analysis of the stock will certainly make our task much

simpler. A diligent use of the tool will help in assessing and

scrutinizing equity investments. Every stock has its own strengths

and weaknesses that need to be evaluated. And it is also true that

every opportunity carries a risk factor. Our approach through this

write up is to analyze J. C. Penney on this platform.

Let’s start with…..

Counting the Strength

We believe J. C. Penney’s well diversified supplier base,

compelling private and national brands, marketing campaigns,

point-of-sale technology initiatives as well as effective cost and

inventory management should augur well over the long term. The

company is leaving no stone unturned to become cost resilient, and

is focusing on closing underperforming stores and exiting its

catalog business.

In order to enhance customers’ shopping experience, J. C. Penney

is also focusing on remodeling, renovating and refurbishing stores

as well as refreshing its website functionality, considering the

steady migration to online shopping. The launch of compelling new

merchandise and the JCP Rewards program should also bode well.

The in-store Sephora departments continue to draw younger and more

affluent customers. J. C. Penney has also incorporated stores of

MNG by Mango

and Call It Spring by The ALDO Group in its store suite.

Where Lies the Weakness?

J. C. Penney has been witnessing falling comparable-store sales

since the last four months. Comps declined 1.9% in August, 0.6% in

September, 2.6% in October and 2% in November.

Between January and November 2011, comparable-store sales fell

as low as 2.6% (in October) and rose as high as 6.4% (in February

and April) recording an average growth of a meager 0.8%. The last

time J. C. Penney registered positive growth was in July, when

comparable-store sales increased 3.3%. Since then, the company has

seen a downtrend.

Monthly sales data has also not been encouraging for J. C.

Penney, which has been falling persistently in the last four months

– 4.5% in August, 3.6% in September, 6.6% in October and 5.9% in

November. July was the last month when sales inched up 1%. J. C.

Penney experienced a steep decline of 6.6% (in October) and

recorded a highest increase of 3.4% (in April) in sales between

January and November 2011.

J. C. Penney also could not make the most of the Black Friday

weekend sales, when retailers such as Macy’s Inc.

(M), Saks Incorporated (SKS), Ross Stores

Inc. (ROST) and Limited Brands Inc. (LTD)

posted better-than-expected November comparable-store sales growth

of 4.8%, 9.3%, 5% and 7%, respectively.

Seeking Opportunities

An economy plagued by financial crisis and high unemployment

remains a bitter truth but relentless efforts to emerge from the

doldrums cannot be ignored. Even J. C. Penney is trying every means

to tide over a distressed economy.

Its latest move of acquiring a 16.6% stake in Martha

Stewart Living Omnimedia Inc. (MSO) is just an another step towards

uplifting itself. The company is betting hard on Martha Stewart to

be a fortune changer. The alliance between the two took place on

December 7.

In October, J. C. Penney entered into an asset buyout agreement

with Liz Claiborne Inc. (LIZ). Per the deal, J. C.

Penney acquired the global rights for the Liz Claiborne portfolio

of brands and the U.S. and Puerto Rico rights for Monet, a fashion

jewelry brand, for $267.5 million.

Will these acquisitions prove to be a game changer for J. C.

Penney? We can only wait and watch how the retailer moves ahead –

whether it walks the growth trajectory or continues to trail.

Threats

The economy still looks gloomy, and whether 2012 will mark the

resurrection is tough to say, unless some concrete steps are taken

to avoid another cliff fall. Cuts are deep and wounds are not

healed.

Each and every company is vying to survive the downturn, and

eventually be at the helm. J. C. Penney, which does not remain

immune to economic upheavals, is no exception. The company has been

losing its foothold in the market as it struggles against retail

chains such as Macy’s and Kohl’s Corporation

(KSS).

Given the pros and cons embedded in J. C. Penney, it might be

difficult for an investor to decide whether to Buy, Hold or Sell

the company’s stock. That’s where we come in with the

Zacks Rank.

Currently, J. C. Penney holds a Zacks #3 Rank that translates into a

short-term Hold rating.

PENNEY (JC) INC (JCP): Free Stock Analysis Report

KOHLS CORP (KSS): Free Stock Analysis Report

LIZ CLAIBORNE (LIZ): Free Stock Analysis Report

LIMITED BRANDS (LTD): Free Stock Analysis Report

MACYS INC (M): Free Stock Analysis Report

MARTHA STWT LIV (MSO): Free Stock Analysis Report

ROSS STORES (ROST): Free Stock Analysis Report

SAKS INC (SKS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

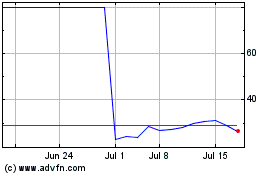

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

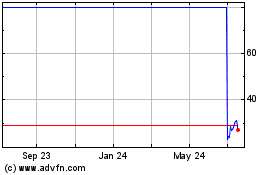

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024