Nordstrom's Sales Trend Year to Date - Analyst Blog

September 12 2012 - 12:50PM

Zacks

Amid this unstable retail environment, Nordstrom

Inc. (JWN) has been able to maintain decent sales run so

far in fiscal 2012, and we expect it to carry the same momentum

throughout the year. The company has been relentlessly striving to

keep itself on the growth trajectory, while keeping an upbeat note

amidst the lackluster economy.

Riding on Positive Comps

From February to August 2012, Nordstrom has consistently

registered improvement in comparable-store sales. During this

period, comps growth touched a low of 0.9% and a high of 21%,

thereby recording an average growth of approximately 8%.

In the first seven months of fiscal 2012, comps increased 10.2%

in February, 8.6% in March, 7.1% in April, 5.3% in May, 8.1% in

June, 0.9% in July and 21% in August.

Given the soft economic retrieval, monthly sales data for

Nordstrom also portrayed a decent performance. The company, in the

above mentioned period, registered a minimum sales growth of 1.1%

and a maximum growth of 25.2%, reflecting an average growth of

approximately 12.1%. Sales growth was recorded at 16.2% in

February, 14.7% in March, 10.5% in April, 9.3% in May, 12.6% in

June, 1.1% in July and 25.2% in August.

Let’s Conclude

Nordstrom's expansion into Boston, MA indicates its focus on

expanding the store network in order to drive top-line growth.

Additionally, the company announced the opening of two new

Nordstrom Rack stores – one in The Woodlands Mall in The Woodlands,

Texas, and the other in St. Johns Town Center in Jacksonville,

Florida. The stores are expected to open in fall 2014.

As of September 11, 2012, Nordstrom operated 117 Nordstrom

full-line stores, 110 Nordstrom Rack, 2 Jeffrey boutiques, 1

treasure&bond store and 1 clearance store, thus bringing the

total store count to 231.

Nordstrom is set to continue with its store expansion strategy

in fiscal 2012 with a target of opening 16 new stores – 1 full-line

store and 15 Rack stores. Also, the company plans to add 24 new

Rack stores in fiscal 2013 and intends to operate 230 Rack stores

by the end of 2016.

In addition,the acquisition of HauteLook has helped Nordstrom to

build its multi-channel retail format. It has facilitated the

company to increase its direct business capabilities, implement an

enterprise-wide inventory management system, conduct direct sales

to online customers and enhance customer service.

Amidst all these positive factors, Nordstrom faces intense

competition from other well-established players in the specialty

retail sector such as The Gap Inc. (GPS),

Limited Brands Inc. (LTD), Abercrombie

& Fitch Co. (ANF) and Saks Inc.

(SKS). Competitive pressure within the retail space may force the

company to reduce its sales price, bringing down its margins.

However, the company’s customers remain sensitive to

macroeconomic factors including interest rate hikes, increase in

fuel and energy costs, credit availability, unemployment levels and

high household debt levels, which may negatively impact their

discretionary spending, and in turn the company’s growth and

profitability.

Zacks Rank

Nevertheless, the short-term outlook for Nordstrom remains

positive, based on the encouraging results and the execution of its

store expansion plans. The company retains a Zacks #3 Rank,

implying a short-term Hold rating. Moreover, we maintain our

long-term Neutral recommendation on the stock.

Based in Seattle, Washington, Nordstrom Inc. offers high quality

apparel, shoes, cosmetics and accessories for men, women and kids.

The company offers both branded and private label merchandise as

well as a private label card, two Nordstrom VISA credit cards and

debit cards for Nordstrom purchases.

ABERCROMBIE (ANF): Free Stock Analysis Report

GAP INC (GPS): Free Stock Analysis Report

NORDSTROM INC (JWN): Free Stock Analysis Report

LIMITED BRANDS (LTD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

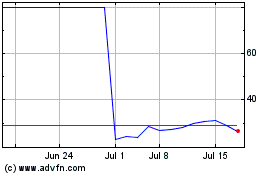

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

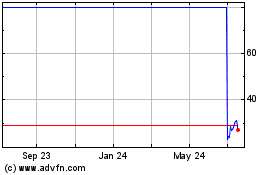

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024