L Brands Raises Profit Outlook Despite Soft January Sales -- Update

February 04 2016 - 11:13AM

Dow Jones News

By Chelsey Dulaney

L Brands Inc. on Thursday raised its profit outlook for the

recently ended fourth quarter, though the parent of retailers such

as Victoria's Secret reported a surprise decline in a key sales

metric in January.

Shares fell 5.3% to $90.10 a share in late morning trading.

L Brands, which also owns mall stalwart Bath & Body Works,

said it now expects earnings of $2.05 a share, above its earlier

guidance for earnings of $1.85 to $1.95. That would also top the $2

a share analysts polled by Thomson Reuters are forecasting for the

quarter.

L Brands also said it has boosted its annual dividend by 20% to

$2.40 and announced a $2 special dividend, payable March 4. The

company added that it has authorized a $500 million share-buyback

program.

But the company said comparable sales, which exclude newly

opened and closed stores, fell 2% in January, while analysts had

expected a 2.4% increase, according to Consensus Metrix. L Brands

cited the shift of the Victoria's Secret semiannual sale into

December for the decline.

Excluding the impact of that shift, L Brands said comparable

sales would have been up 1%.

Victoria's Secret sales fell 4% in January, due to the

semiannual sale shift and a decline in the beauty business, while

analysts had expected 3.3% growth. Bath & Body Works sales were

up 2%, better than the 1.1% growth analysts had forecast.

L Brands said its merchandise margin rate declined compared with

the prior year due to a sports event and foreign-exchange impacts

from its Canadian business.

Despite the softer-than-expected month, L Brands reported

overall sales for the fourth quarter, which ended Jan. 30, that

topped expectations. L Brands said net sales rose to $4.4 billion

from $4.07 billion a year earlier. Analysts had forecast $4.37

billion in sales.

Comparable sales rose 6% for the period.

L Brands had a strong showing during the holiday selling season,

including what it described as its "best December ever," as

consumers didn't pull back as much as feared. Still, foot traffic

to stores fell across the retail industry as shopping continues to

shift online. L Brands will report its fourth-quarter earnings and

give guidance for 2016 on Feb. 25. Meanwhile, L Brands said it

expects 2016 profit to be hurt by $1 billion in debt issuance last

year and pressure from foreign exchange.

Looking to February, L Brands said it expects its comparable

sales to be up in the low-single digits.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

February 04, 2016 11:58 ET (16:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

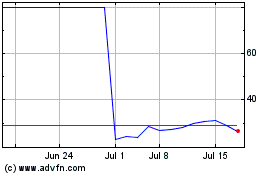

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024