Current Report Filing (8-k)

April 18 2019 - 4:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):April

18, 2019

L

Brands, Inc.

(Exact Name of Registrant as Specified in

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

1-8344

|

|

31-1029810

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

Three Limited Parkway

Columbus, OH

|

|

43230

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(614) 415-7000

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01. Entry Into a Material Definitive Agreement.

On April 18, 2019, L Brands, Inc. (the “Company”)

entered into an agreement (the “Agreement”) with Barington Companies Equity Partners, L.P. (“Barington Equity”)

and Barington Capital Group, L.P. (“Barington Capital” and, together with Barington Equity, “Barington”),

pursuant to which the Company agreed to appoint Barington Capital as a special advisor to the Company for the term of the Agreement

(the “Term”) and Barington agreed to withdraw its proposed nominees for election to the Company’s Board of Directors

(the “Board”) at the Company’s 2019 annual meeting of stockholders. The term of the Agreement is until the date

that is 15 business days prior to the nomination deadline for the Company’s 2020 annual meeting of stockholders, provided,

however, that the Company and Barington may elect to extend such term.

As a special advisor, Barington will provide consulting and

advisory services to the Company from time to time with respect to the Company’s business, operations, strategic and financial

matters, the composition of the Board and potential candidates for nomination to the Board. Pursuant to the Agreement, during the

Term, Barington will vote all of its shares of Company common stock (i) in favor of the election of directors nominated by the

Board, (ii) to ratify the appointment of the Company’s independent registered public accounting firm, (iii) in any manner

Barington desires with respect to proposals pertaining to a merger, consolidation, business combination or other extraordinary

transaction, an amendment to the Company’s certificate of incorporation or bylaws or other fundamental change to the Company

and (iv) otherwise in accordance with the Board’s recommendation, subject to certain exceptions. Barington also agreed to

certain restrictions during the Term, including, among other things, restrictions on soliciting proxies, making shareholder proposals,

and nominating directors for election to the Board.

The foregoing summary does not purport to be complete and is

qualified in its entirety by reference to the Agreement, a copy of which is attached as Exhibit 10.1 and is incorporated herein

by reference.

Item 8.01. Other Events.

On April 18, 2019, the Company issued a press release announcing

the Agreement with Barington. A copy of the press release is attached as Exhibit 99.1 to this Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

L Brands, Inc.

|

|

|

|

|

|

|

Date: April 18, 2019

|

|

By:

|

/s/ Stuart B. Burgdoerfer

|

|

|

|

|

Name: Stuart B. Burgdoerfer

|

|

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

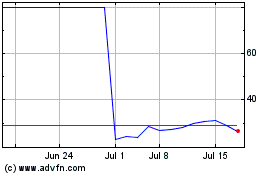

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

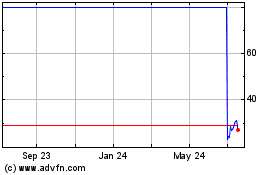

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024