October 16, 2024FALSE000169402800016940282024-10-162024-10-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 16, 2024

Liberty Energy Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-38081 | | 81-4891595 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

950 17th Street, Suite 2400

Denver, Colorado 80202

(Address and Zip Code of Principal Executive Offices)

(303) 515-2800

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | | | | | | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | |

| Securities registered pursuant to Section 12(b) of the Act |

| | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| | | | | | |

| Class A Common Stock, par value $0.01 | | LBRT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On October 16, 2024, Liberty Energy Inc., a Delaware corporation (the “Company”), issued a press release announcing its results for the third quarter ended September 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

This information is not deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 and is not incorporated by reference into any Securities Act of 1933 registration statements.

Item 9.01. Financial Statements and Exhibits

(d)Exhibits. | | | | | | | | |

| | |

Exhibit

No. | | Description |

| |

| 99.1 | | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | LIBERTY ENERGY INC. |

| | | |

Dated: October 16, 2024 | | | | By: | | /s/ R. Sean Elliott |

| | | | | | R. Sean Elliott |

| | | | | | Chief Legal Officer and Corporate Secretary |

Liberty Energy Inc. Announces Third Quarter 2024 Financial and Operational Results

October 16, 2024

Liberty Energy Inc. (NYSE: LBRT; “Liberty” or the “Company”) announced today third quarter 2024 financial and operational results.

Summary Results and Highlights

•Revenue of $1.1 billion, a 2% sequential decrease

•Net income of $74 million, or $0.44 fully diluted earnings per share (“EPS”)

•Adjusted EBITDA1 of $248 million

•Delivered 22% TTM Adjusted Pre-Tax Return on Capital Employed (“ROCE”)2

•Distributed $51 million to shareholders through share repurchases and cash dividends

•Repurchased and retired 1.2% of shares outstanding during the third quarter, and a cumulative 14.3% of shares outstanding since reinstatement of the repurchase program in July 2022

•Increased quarterly cash dividend by 14% to $0.08 per share beginning fourth quarter of 2024

•Liberty’s multi-year fleet technology transition on track to start 2025 with 90% of fleets primarily powered by natural gas

•A digiPrime fleet completed the highest number of monthly hours pumped of any crew in Liberty history

•Quarterly record for company pumping efficiency

•Shipped Liberty fleet to Australia, with completions activity commencing during the fourth quarter

“Liberty delivered a solid quarter with revenue of $1.1 billion and Adjusted EBITDA1 of $248 million. We again reached new heights in efficiencies, pumping more hours in a quarter than ever before, amidst a backdrop of a slowing demand environment. A Liberty digiPrime fleet set the company record for number of monthly hours pumped by any crew in company history. I’m proud of our team for executing at the highest operating levels, generating strong financial performance and value for our customers,” commented Chris Wright, Chief Executive Officer.

“Our strategic investments in digiFleets and power generation are expanding our competitive advantage and market opportunities, while enabling a robust return of capital program. Since July 2022, we have distributed $509 million to shareholders through the retirement of 14% of shares outstanding and quarterly cash dividends. This week we announced a 14% increase in our quarterly cash dividend to $0.08 per share. The compounding effect of share buybacks and dividends is driving higher total shareholder returns over cycles,” continued Mr. Wright.

“Focused investments have allowed us to develop new markets and lead technology innovation and operational efficiency in the industry. Over the past year, Liberty entered partnerships to develop the new gas-rich Beetaloo Basin in Australia. We have taken a significant step forward with the arrival of a Liberty fleet in country,” continued Mr. Wright. “During the third quarter, the Liberty Advanced Equipment Technologies (LAET) manufacturing and assembly division delivered its first digiPrime pumps. Additionally, Liberty Power Innovations’ (LPI) expanded operations in the DJ Basin are off to a strong start, helping bring our frac fleet CNG fueling services to critical mass.”

“Today, the rising demand for power in commercial and industrial applications offers compelling opportunities for LPI. We are excited to leverage the expertise that we have built constructing and managing power plants for frac fleets to additional opportunities both inside and outside the oilfield.”

Outlook

Oil markets reflect significant uncertainty across the global economy, OPEC+ production plans, Chinese economic growth and Middle East geopolitical dynamics. Global demand for oil will grow by approximately one million barrels of oil per day this year and is expected to exceed this next year. While global oil production may be in surplus in 2025, oil prices are expected to remain relatively rangebound and supportive of North American activity.

Natural gas prices rose in recent weeks after storage congestion concerns eased due to producer curtailments and strong domestic power generation demand, but higher prices may incentivize reversal of curtailments and prove to be transitory. The commissioning of LNG export facilities in the U.S. and Canada is expected to stimulate gas activity in 2025 and support higher sustained natural gas demand.

Frac markets are navigating the slowing of E&P operators’ 2024 development programs in response to the strong first-half 2024 efficiency gains from factors including consolidation, longer laterals, and concentration in high-graded acreage. Elevated uncertainty in energy markets has further left operators reluctant to accelerate completions activity in advance of the new year. We now expect a low double-digit percentage reduction in Q4 activity, a bit more than the typical Q4 softening. Completions activity likely increases in early 2025 to support flattish E&P oil & gas production targets. Since late 2023, U.S. crude oil production has been relatively flat and would likely decline if current completions activity levels persist.

Frac industry dynamics are poised to improve in 2025 from today’s levels. E&Ps brought wells to production faster this year, in part due to completion efficiencies and increased frac intensity with higher pump rates. Efficiencies were aided by a mix shift towards larger producers benefiting from consolidation and partnership with top tier frac service providers. Industry-wide frac efficiency is at its highest levels, but we expect the rate of improvement will slow going forward. Higher intensity fracs require more horsepower. Softer activity has been a catalyst for attrition, equipment cannibalization, and idling of fleets. Together, these imply that the supply and demand balance of frac fleets is tighter than headline fleet counts suggest.

Large, well-capitalized E&Ps are enjoying attractive economics across a wide range of oil prices. To maintain efficiency gains and further support the increasing complexity of E&P needs, investment is necessary in leading edge service technologies. Soft year end frac activity levels are pressuring prices in the near term to levels that are inconsistent with the anticipated market demand and supply of horsepower in 2025. It is important that service prices support investment, especially given aging equipment, industry underinvestment in next generation technologies, and growing fleet sizes.

“Few service providers are positioned to manage the growing complexities of completion demands with quality services and next generation technologies. We are significantly advantaged with our deep customer relationships, leading edge digiTechnologies offering, and the integrated services that enable strong efficiencies for our customers and returns for our shareholders,” commented Mr. Wright.

“We remain disciplined in investing and asset deployment as we seek to drive superior long-term financial results. Over the last two years we have maintained a roughly flat deployed fleet count. However, amidst near term reductions in customer activity and market pressures, we are planning to temporarily and modestly reduce our deployed fleet count while continuing to support our long-term partners.”

“Looking ahead, we expect to deliver healthy free cash flow generation in 2025. Our investment cadence within frac slows following an accelerated technology transition push in the last few years. Our strategic investment is expected to shift in support of our growing opportunities for power generation services. We are well-positioned to deliver on our dual priorities of strategic investment and return of capital to shareholders, creating value over the long-term,” continued Mr. Wright.

Share Repurchase Program

During the quarter ended September 30, 2024, Liberty repurchased and retired 1,939,072 shares of Class A common stock at an average of $20.27 per share, representing 1.2% of shares outstanding, for approximately $39 million. Liberty has cumulatively repurchased and retired 14.3% of shares outstanding at program

commencement on July 25, 2022. Total remaining authorization for future common share repurchases is approximately $323 million.

The shares may be repurchased from time to time in open market transactions, through block trades, in privately negotiated transactions, through derivative transactions or by other means in accordance with federal securities laws. The timing, as well as the number and value of shares repurchased under the program, will be determined by the Company at its discretion and will depend on a variety of factors, including management’s assessment of the intrinsic value of the Company’s common stock, the market price of the Company’s common stock, general market and economic conditions, available liquidity, compliance with the Company’s debt and other agreements, applicable legal requirements, and other considerations. The exact number of shares to be repurchased by the Company is not guaranteed, and the program may be suspended, modified, or discontinued at any time without prior notice. The Company expects to fund the repurchases by using cash on hand, borrowings under its revolving credit facility and expected free cash flow to be generated through the authorization period.

Cash Dividend

During the quarter ended September 30, 2024, the Company paid a quarterly cash dividend of $0.07 per share of Class A common stock, or approximately $11 million in aggregate to shareholders.

On October 15, 2024, the Board declared a cash dividend of $0.08 per share of Class A common stock, to be paid on December 20, 2024 to holders of record as of December 6, 2024.

Future declarations of quarterly cash dividends are subject to approval by the Board of Directors and to the Board’s continuing determination that the declarations of dividends are in the best interests of Liberty and its stockholders. Future dividends may be adjusted at the Board’s discretion based on market conditions and capital availability.

Third Quarter Results

For the third quarter of 2024, revenue was $1.1 billion, compared to $1.2 billion in each of the third quarter of 2023 and the second quarter of 2024.

Net income (after taxes) totaled $74 million for the third quarter of 2024 compared to $149 million in the third quarter of 2023 and $108 million in the second quarter of 2024.

Adjusted Net Income3 (after taxes) totaled $76 million for the third quarter of 2024 compared to $149 million in the third quarter of 2023 and $103 million in the second quarter of 2024.

Adjusted EBITDA1 was $248 million in the third quarter of 2024 compared to $319 million in the third quarter of 2023 and $273 million in the second quarter of 2024.

Fully diluted earnings per share of $0.44 for the third quarter of 2024 compared to $0.85 for the third quarter of 2023 and $0.64 for the second quarter of 2024.

Adjusted Net Income per Diluted Share3 of $0.45 for the third quarter of 2024 compared to $0.86 for the third quarter of 2023 and $0.61 for the second quarter of 2024.

Please refer to the tables at the end of this earnings release for a reconciliation of Adjusted EBITDA, Adjusted Net Income, and Adjusted Net Income per Diluted Share (each, a non-GAAP financial measure) to the most directly comparable GAAP financial measures.

Balance Sheet and Liquidity

As of September 30, 2024, Liberty had cash on hand of $23 million, a decrease from second quarter levels, and total debt of $123 million, drawn on the secured asset-based revolving credit facility. Total liquidity, including availability under the credit facility, was $352 million as of September 30, 2024.

Conference Call

Liberty will host a conference call to discuss the results at 8:00 a.m. Mountain Time (10:00 a.m. Eastern Time) on Thursday, October 17, 2024. Presenting Liberty’s results will be Chris Wright, Chief Executive Officer, Ron Gusek, President, and Michael Stock, Chief Financial Officer.

Individuals wishing to participate in the conference call should dial (833) 255-2827, or for international callers (412) 902-6704. Participants should ask to join the Liberty Energy call. A live webcast will be available at http://investors.libertyenergy.com. The webcast can be accessed for 90 days following the call. A telephone replay will be available shortly after the call and can be accessed by dialing (877) 344-7529, or for international callers (412) 317-0088. The passcode for the replay is 5442952. The replay will be available until October 24, 2024.

About Liberty

Liberty is a leading North American energy services firm that offers one of the most innovative suites of completion services and technologies to onshore oil and natural gas exploration and production companies. Liberty was founded in 2011 with a relentless focus on developing and delivering next generation technology for the sustainable development of unconventional energy resources in partnership with our customers. Liberty is headquartered in Denver, Colorado. For more information about Liberty, please contact Investor Relations at IR@libertyenergy.com.

1 “Adjusted EBITDA” is not presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). Please see the supplemental financial information in the table under “Reconciliation of Net Income to EBITDA and Adjusted EBITDA” at the end of this earnings release for a reconciliation of the non-GAAP financial measure of Adjusted EBITDA to its most directly comparable GAAP financial measure.

2 Adjusted Pre-Tax Return on Capital Employed is a non-U.S. GAAP operational measure. Please see the supplemental financial information in the table under “Calculation of Adjusted Pre-Tax Return on Capital Employed” at the end of this earnings release for a calculation of this measure.

3 “Adjusted Net Income” and “Adjusted Net Income per Diluted Share” are not presented in accordance with U.S. GAAP. Please see the supplemental financial information in the table under “Reconciliation of Net Income and Net Income per Diluted Share to Adjusted Net Income and Adjusted Net Income per Diluted Share” at the end of this earnings release for a reconciliation of the non-GAAP financial measures of Adjusted Net Income and Adjusted Net Income per Diluted Share to the most directly comparable GAAP financial measures.

Non-GAAP Financial Measures

This earnings release includes unaudited non-GAAP financial and operational measures, including EBITDA, Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Diluted Share, and Adjusted Pre-Tax Return on Capital Employed (“ROCE”). We believe that the presentation of these non-GAAP financial and operational measures provides useful information about our financial performance and results of operations. We define Adjusted EBITDA as EBITDA adjusted to eliminate the effects of items such as non-cash stock-based compensation, new fleet or new basin start-up costs, fleet lay-down costs, gain or loss on the disposal of assets, unrealized gain or loss on investments, net, bad debt reserves, transaction and other costs, the loss or gain on remeasurement of liability under our tax receivable agreements, and other non-recurring expenses that management does not consider in assessing ongoing performance.

Our board of directors, management, investors, and lenders use EBITDA and Adjusted EBITDA to assess our financial performance because it allows them to compare our operating performance on a consistent basis across periods by removing the effects of our capital structure (such as varying levels of interest expense), asset base (such as depreciation, depletion, and amortization) and other items that impact the comparability of financial results from period to period. We present EBITDA and Adjusted EBITDA because we believe they provide useful information regarding the factors and trends affecting our business in addition to measures calculated under U.S. GAAP.

We present Adjusted Net Income and Adjusted Net Income per Diluted Share because we believe such measures provide useful information to investors regarding our operating performance by excluding the after-tax impacts of unusual or one-time benefits or costs, including items such as unrealized gain or loss on investments, net, transaction and other costs, and the loss or gain on remeasurement of liability under our tax receivable agreements, primarily because management views the excluded items to be outside of our normal operating results. We define Adjusted Net Income as net income after eliminating the effects of such excluded items and Adjusted Net Income per Diluted Share as Adjusted Net Income divided by the number of weighted average diluted shares outstanding. Management analyzes net income without the impact of these items as an indicator of performance to identify underlying trends in our business.

We define ROCE as the ratio of adjusted pre-tax net income (adding back income tax and certain adjustments that include tax receivable agreement impacts, unrealized gain or loss on investments, net, and transaction and other costs, when

applicable) for the twelve months ended September 30, 2024 to Average Capital Employed. Average Capital Employed is the simple average of total capital employed (both debt and equity) as of September 30, 2024 and September 30, 2023. ROCE is presented based on our management’s belief that these non-GAAP measures are useful information to investors when evaluating our profitability and the efficiency with which management has employed capital over time. Our management uses ROCE for that purpose. ROCE is not a measure of financial performance under U.S. GAAP and should not be considered an alternative to net income, as defined by U.S. GAAP.

Non-GAAP financial and operational measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial and operational measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with U.S. GAAP. See the tables entitled Reconciliation and Calculation of Non-GAAP Financial and Operational Measures for a reconciliation or calculation of the non-GAAP financial or operational measures to the most directly comparable GAAP measure.

Forward-Looking and Cautionary Statements

The information above includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included herein concerning, among other things, statements about our expected growth from recent acquisitions, expected performance, future operating results, oil and natural gas demand and prices and the outlook for the oil and gas industry, future global economic conditions, the impact of worldwide political, military and armed conflict, the impact of announcements and changes in oil production quotas by oil exporting countries, improvements in operating procedures and technology, our business strategy and the business strategies of our customers, the deployment of fleets in the future, planned capital expenditures, future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, return of capital to stockholders, business strategy and objectives for future operations, are forward-looking statements. These forward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “outlook,” “project,” “plan,” “position,” “believe,” “intend,” “achievable,” “forecast,” “assume,” “anticipate,” “will,” “continue,” “potential,” “likely,” “should,” “could,” and similar terms and phrases. However, the absence of these words does not mean that the statements are not forward-looking. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties. The outlook presented herein is subject to change by Liberty without notice and Liberty has no obligation to affirm or update such information, except as required by law. These forward-looking statements represent our current expectations or beliefs concerning future events, and it is possible that the results described in this earnings release will not be achieved. These forward-looking statements are subject to certain risks, uncertainties and assumptions identified above or as disclosed from time to time in Liberty's filings with the Securities and Exchange Commission. As a result of these factors, many of which are beyond our control, actual results may differ materially from those indicated or implied by such forward-looking statements.

Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, we do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for us to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in “Item 1A. Risk Factors” included in our most recent Annual Report on Form 10-K, any subsequent Quarterly Reports on Form 10-Q, and in our other public filings with the SEC. These and other factors could cause our actual results to differ materially from those contained in any forward-looking statements.

Contact:

Michael Stock

Chief Financial Officer

Anjali Voria, CFA

Director of Investor Relations

303-515-2851

IR@libertyenergy.com

Liberty Energy Inc.

Selected Financial Data

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | June 30, | | September 30, | | September 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Statement of Operations Data: | | (amounts in thousands, except for per share data) |

| Revenue | | $ | 1,138,578 | | | $ | 1,159,884 | | | $ | 1,215,905 | | | $ | 3,371,587 | | | $ | 3,672,970 | |

| Costs of services, excluding depreciation, depletion, and amortization shown separately | | 840,274 | | | 835,798 | | | 850,247 | | | 2,458,752 | | | 2,572,119 | |

| General and administrative | | 58,614 | | | 57,700 | | | 55,040 | | | 169,300 | | | 166,110 | |

| Transaction and other costs | | — | | | — | | | 202 | | | — | | | 1,804 | |

| Depreciation, depletion, and amortization | | 126,395 | | | 123,305 | | | 108,997 | | | 372,886 | | | 303,093 | |

| Loss (gain) on disposal of assets | | 6,017 | | | 1,248 | | | (3,808) | | | 6,105 | | | (6,981) | |

| Total operating expenses | | 1,031,300 | | | 1,018,051 | | | 1,010,678 | | | 3,007,043 | | | 3,036,145 | |

| Operating income | | 107,278 | | | 141,833 | | | 205,227 | | | 364,544 | | | 636,825 | |

| Unrealized loss (gain) on investments, net | | 2,727 | | | (7,201) | | | — | | | (4,474) | | | — | |

| Interest expense, net | | 8,589 | | | 8,063 | | | 6,776 | | | 23,715 | | | 21,142 | |

| Net income before taxes | | 95,962 | | | 140,971 | | | 198,451 | | | 345,303 | | | 615,683 | |

| Income tax expense | | 22,158 | | | 32,550 | | | 49,843 | | | 81,186 | | | 151,658 | |

| Net income | | 73,804 | | | 108,421 | | | 148,608 | | | 264,117 | | | 464,025 | |

| Less: Net income attributable to non-controlling interests | | — | | | — | | | — | | | — | | | 91 | |

| Net income attributable to Liberty Energy Inc. stockholders | | $ | 73,804 | | | $ | 108,421 | | | $ | 148,608 | | | $ | 264,117 | | | $ | 463,934 | |

| Net income attributable to Liberty Energy Inc. stockholders per common share: | | | | | | | | | | |

| Basic | | $ | 0.45 | | | $ | 0.65 | | | $ | 0.88 | | | $ | 1.59 | | | $ | 2.68 | |

| Diluted | | $ | 0.44 | | | $ | 0.64 | | | $ | 0.85 | | | $ | 1.55 | | | $ | 2.62 | |

| Weighted average common shares outstanding: | | | | | | | | | | |

| Basic | | 164,741 | | | 166,210 | | | 169,781 | | | 165,755 | | | 173,135 | |

| Diluted | | 168,595 | | | 169,669 | | | 173,984 | | | 169,947 | | | 177,284 | |

| | | | | | | | | | |

| Other Financial and Operational Data | | | | | | | | |

| Capital expenditures (1) | | $ | 162,835 | | | $ | 134,081 | | | $ | 161,379 | | | $ | 438,909 | | | $ | 442,779 | |

| Adjusted EBITDA (2) | | $ | 247,811 | | | $ | 273,256 | | | $ | 319,213 | | | $ | 765,853 | | | $ | 960,561 | |

(1)Net capital expenditures presented above include investing cash flows from purchase of property and equipment, excluding acquisitions, net of proceeds from the sales of assets.

(2)Adjusted EBITDA is a non-GAAP financial measure. See the tables entitled “Reconciliation and Calculation of Non-GAAP Financial and Operational Measures” below.

| | | | | | | | | | | |

| Liberty Energy Inc. |

| Condensed Consolidated Balance Sheets |

| (unaudited, amounts in thousands) |

| September 30, | | December 31, |

| 2024 | | 2023 |

| Assets | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 23,012 | | | $ | 36,784 | |

| Accounts receivable and unbilled revenue | 594,056 | | | 587,470 | |

| Inventories | 197,563 | | | 205,865 | |

| Prepaids and other current assets | 107,889 | | | 124,135 | |

| Total current assets | 922,520 | | | 954,254 | |

| Property and equipment, net | 1,834,214 | | | 1,645,368 | |

| Operating and finance lease right-of-use assets | 357,757 | | | 274,959 | |

| Other assets | 158,393 | | | 158,976 | |

| Total assets | $ | 3,272,884 | | | $ | 3,033,557 | |

| Liabilities and Equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 655,519 | | | $ | 572,029 | |

| Current portion of operating and finance lease liabilities | 93,052 | | | 67,395 | |

| | | |

| Total current liabilities | 748,571 | | | 639,424 | |

| Long-term debt | 123,000 | | | 140,000 | |

| Long-term operating and finance lease liabilities | 255,020 | | | 197,914 | |

| Deferred tax liability | 102,287 | | | 102,340 | |

| Payable pursuant to tax receivable agreements | 75,008 | | | 112,471 | |

| Total liabilities | 1,303,886 | | | 1,192,149 | |

| | | |

| Stockholders' equity: | | | |

| Common Stock | 1,634 | | | 1,666 | |

| Additional paid in capital | 996,336 | | | 1,093,498 | |

| Retained earnings | 980,914 | | | 752,328 | |

| Accumulated other comprehensive loss | (9,886) | | | (6,084) | |

Total stockholders’ equity | 1,968,998 | | | 1,841,408 | |

| | | |

| | | |

| Total liabilities and equity | $ | 3,272,884 | | | $ | 3,033,557 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liberty Energy Inc. |

| Reconciliation and Calculation of Non-GAAP Financial and Operational Measures |

| (unaudited, amounts in thousands, except per share data) |

| Reconciliation of Net Income to EBITDA and Adjusted EBITDA |

| Three Months Ended | | Nine Months Ended |

| September 30, | | June 30, | | September 30, | | September 30, |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 73,804 | | | $ | 108,421 | | | $ | 148,608 | | | $ | 264,117 | | | $ | 464,025 | |

| Depreciation, depletion, and amortization | 126,395 | | | 123,305 | | | 108,997 | | | 372,886 | | | 303,093 | |

| Interest expense, net | 8,589 | | | 8,063 | | | 6,776 | | | 23,715 | | | 21,142 | |

| Income tax expense | 22,158 | | | 32,550 | | | 49,843 | | | 81,186 | | | 151,658 | |

| EBITDA | $ | 230,946 | | | $ | 272,339 | | | $ | 314,224 | | | $ | 741,904 | | | $ | 939,918 | |

| Stock-based compensation expense | 8,121 | | | 6,870 | | | 8,595 | | | 22,318 | | | 23,738 | |

| Unrealized loss (gain) on investments, net | 2,727 | | | (7,201) | | | — | | | (4,474) | | | — | |

| Fleet start-up and lay-down costs | — | | | — | | | — | | | — | | | 2,082 | |

| Transaction and other costs | — | | | — | | | 202 | | | — | | | 1,804 | |

| Loss (gain) on disposal of assets | 6,017 | | | 1,248 | | | (3,808) | | | 6,105 | | | (6,981) | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted EBITDA | $ | 247,811 | | | $ | 273,256 | | | $ | 319,213 | | | $ | 765,853 | | | $ | 960,561 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income and Net Income per Diluted Share to Adjusted Net Income and Adjusted Net Income per Diluted Share |

| Three Months Ended | | Nine Months Ended |

| September 30, | | June 30, | | September 30, | | September 30, |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 73,804 | | | $ | 108,421 | | | $ | 148,608 | | | $ | 264,117 | | | $ | 464,025 | |

| Adjustments: | | | | | | | | | |

| Less: Unrealized loss (gain) on investments, net | 2,727 | | | (7,201) | | | — | | | (4,474) | | | — | |

| Add back: Transaction and other costs | — | | | — | | | 202 | | | — | | | 1,804 | |

| Total adjustments, before taxes | 2,727 | | | (7,201) | | | 202 | | | (4,474) | | | 1,804 | |

| Income tax expense (benefit) of adjustments | 656 | | | (1,707) | | | 53 | | | (1,051) | | | 444 | |

| Adjusted Net Income | $ | 75,875 | | | $ | 102,927 | | | $ | 148,757 | | | $ | 260,694 | | | $ | 465,385 | |

| | | | | | | | | |

| Diluted weighted average common shares outstanding | 168,595 | | | 169,669 | | | 173,984 | | | 169,947 | | | 177,284 | |

| Net income per diluted share | $ | 0.44 | | | $ | 0.64 | | | $ | 0.85 | | | $ | 1.55 | | | $ | 2.62 | |

| Adjusted Net Income per Diluted Share | $ | 0.45 | | | $ | 0.61 | | | $ | 0.86 | | | $ | 1.53 | | | $ | 2.63 | |

| | | | | | | | | | | |

| Calculation of Adjusted Pre-Tax Return on Capital Employed |

| Twelve Months Ended |

| September 30, |

| 2024 | | 2023 |

| Net income | $ | 356,500 | | | |

| Add back: Income tax expense | 108,010 | | | |

| Less: Gain on remeasurement of liability under tax receivable agreements (1) | (1,817) | | | |

| Less: Unrealized gain on investments, net | (4,474) | | | |

| Add back: Transaction and other costs | 249 | | | |

| Adjusted Pre-tax net income | $ | 458,468 | | | |

| Capital Employed | | | |

| Total debt | $ | 123,000 | | | $ | 223,000 | |

| Total equity | 1,968,998 | | | 1,788,562 | |

| Total Capital Employed | $ | 2,091,998 | | | $ | 2,011,562 | |

| | | |

| Average Capital Employed (2) | $ | 2,051,780 | | | |

| Adjusted Pre-Tax Return on Capital Employed (3) | 22 | % | | |

(1)Gain on remeasurement of the liability under tax receivable agreements is calculated using the Company’s effective tax rates and payments expected to be made under the agreements and should be excluded in the determination of adjusted pre-tax return on capital employed.

(2)Average Capital Employed is the simple average of Total Capital Employed as of September 30, 2024 and 2023.

(3)Adjusted Pre-tax Return on Capital Employed is the ratio of adjusted pre-tax net income for the twelve months ended September 30, 2024 to Average Capital Employed.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

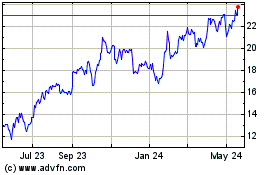

Liberty Energy (NYSE:LBRT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Liberty Energy (NYSE:LBRT)

Historical Stock Chart

From Mar 2024 to Mar 2025