Highlights*

- 2024 orders of $24.2 billion; book-to-bill of 1.14x

- 2024 revenue of $21.3 billion, up 10%, and 4%

organically

- 2024 cash from operations of $2.6 billion, adjusted free

cash flow of $2.3 billion

- 4Q24 revenue of $5.5 billion, up 3%, and 4%

organically

- 4Q24 operating margin of 10.3% and 9.0% for 2024

- 4Q24 adjusted segment operating margin of 15.3% and 15.4%

for 2024

- 4Q24 diluted earnings per share (EPS) of $2.37 and $7.87 for

2024

- 4Q24 non-GAAP diluted EPS of $3.47 and $13.101 for

2024

L3Harris Technologies (NYSE: LHX) reported fourth quarter 2024

diluted EPS of $2.37 on fourth quarter 2024 revenue of $5.5

billion. Fourth quarter 2024 non-GAAP diluted EPS was $3.47. Fourth

quarter results reflect growth in the business and continued

operational efficiencies driving margin improvement.

Reconciliations of non-GAAP results are detailed in tables

beginning on page 13.

"2024 was a year of significant accomplishments as we delivered

on our financial commitments, underscoring our agility and position

as the defense industry’s Trusted Disruptor, and achieved a record

backlog of $34 billion. These results reflect our alignment with

customer priorities, driving strong demand across all domains.

Through our LHX NeXt initiative, we exceeded our cost-savings

target for 2024, achieving $800 million, and are raising our

overall cost-savings goal to $1.2 billion by the end of 2025, a

year ahead of schedule," said Christopher E. Kubasik, Chair and

CEO.

Kubasik added, "As we move into 2025, our momentum remains

strong, driven by strong bookings, a robust pipeline, expanding

international opportunities, and continued transformation and

operational improvements. We are on track to achieve our 2026

financial framework and remain committed to returning excess cash

to shareholders. We are confident in our ability to sustain

profitable growth and drive long-term value for our stakeholders.

We are the agile defense player that is able to rapidly adapt to

changing industry dynamics to deliver mission-critical capabilities

for our customers."

_____ *Organic revenue, adjusted segment operating margin,

non-GAAP diluted EPS and adjusted free cash flow are non-GAAP

financial measures defined on page 19.

SUMMARY FINANCIAL RESULTS*

Fourth Quarter

Full Year

($ millions, except per share data)

2024

2023

Change

2024

2023

Change

Revenue (see Table 4 for organic

revenue)

Space & Airborne Systems

$

1,728

$

1,800

$

6,869

$

6,856

Integrated Mission Systems

1,773

1,627

6,842

6,630

Communication Systems

1,437

1,363

5,459

5,070

Aerojet Rocketdyne

628

597

2,347

1,052

Corporate eliminations

(43

)

(47

)

(192

)

(189

)

Revenue

$

5,523

$

5,340

3%

$

21,325

$

19,419

10%

Operating income

Space & Airborne Systems

$

186

$

191

$

812

$

756

Integrated Mission Systems

238

(75

)

838

459

Communication Systems

326

356

1,324

1,229

Aerojet Rocketdyne

72

66

294

122

Corporate unallocated items

(253

)

(384

)

(1,350

)

(1,140

)

Operating income

$

569

$

154

$

1,918

$

1,426

Adjusted segment operating income

(see Table 5)

$

846

$

807

5%

$

3,292

$

2,874

15%

Margin

Operating margin

10.3

%

2.9

%

9.0

%

7.3

%

Adjusted segment operating margin

15.3

%

15.1

%

20 bps

15.4

%

14.8

%

60 bps

Tax rate

Effective tax rate (GAAP)

6.4

%

(65.8

%)

5.3

%

1.9

%

Effective tax rate (non-GAAP)

12.1

%

12.6

%

12.7

%

13.0

%

EPS

Diluted EPS

$

2.37

$

0.83

$

7.87

$

6.44

Non-GAAP diluted EPS

$

3.47

$

3.35

4%

$

13.10

$

12.36

6%

Pension adjusted non-GAAP diluted EPS

$

3.06

$

2.82

9%

$

11.50

$

10.44

10%

Cash flow

Cash from operations

$

1,129

$

789

43%

$

2,559

$

2,096

22%

Adjusted free cash flow

$

1,033

$

756

37%

$

2,319

$

2,029

14%

* Adjusted segment operating income and

margin, effective tax rate on non-GAAP income, non-GAAP diluted

EPS, pension adjusted non-GAAP diluted EPS, organic revenue and

adjusted free cash flow are non-GAAP financial measures defined on

page 19.

Revenue: Fourth quarter revenue increased 3%, supported

by solid growth in Integrated Mission Systems (IMS) and

Communication Systems (CS) of 9% and 5%, respectively. The

increases were driven by demand for resilient communication

products and night vision devices, higher aircraft missionization

volume, increased volume for advanced electronics for space and

munitions programs and higher volume in our Commercial Aviation

Solutions (CAS) business.

2024 revenue increased 10% due to the inclusion of a full year

of results for our Aerojet Rocketdyne (AR) segment and 4%

organically due to continued strong demand for our resilient

communication products, higher volume for advanced electronics and

higher volume in our CAS business.

Operating Margin:

GAAP Operating Margin: Fourth

quarter increased 740 bps to 10.3% and 2024 increased 170 bps to

9.0%.

Adjusted Segment Operating Margin:

Fourth quarter expanded 20 bps to 15.3% and 2024 expanded 60 bps to

15.4%.

Fourth quarter operating margin increase was primarily driven by

improved program performance at IMS, the absence of a prior year

goodwill impairment associated with CAS and the monetization of

certain legacy end of life assets, aligned with our transformation

and value creation priorities. Such increases were partially offset

by mix at CS, challenges on classified development programs at SAS

and an impairment of other assets related to the Tactical Data

Links acquisition. Adjusted segment operating margin excludes the

impact of a prior year goodwill impairment associated with CAS and

an impairment of other assets related to the Tactical Data Links

acquisition in 2024.

2024 operating margin increased driven by the absence of a prior

year goodwill impairment associated with CAS. Adjusted segment

operating margin increased, with all four segments contributing to

margin improvement; IMS in particular increased 100 bps versus

prior year.

Diluted EPS:

GAAP Diluted EPS: Fourth quarter

increased 186% to $2.37 and 2024 increased 22% to $7.87.

Non-GAAP Diluted EPS: Fourth

quarter non-GAAP diluted EPS increased 4% to $3.47 and 2024

non-GAAP diluted EPS increased 6% to $13.10.

Pension Adjusted Non-GAAP Diluted

EPS: Fourth quarter pension adjusted non-GAAP diluted EPS

increased 9% to $3.06 and 2024 pension adjusted non-GAAP diluted

EPS increased 10% to $11.50.

Fourth quarter and 2024 diluted EPS increase was driven by

higher operating income, partially offset by a lower Financial

Accounting Standards/U.S. Government Cost Accounting Standards

(FAS/CAS) operating adjustment and higher income taxes. Non-GAAP

diluted EPS increased due to higher adjusted segment operating

income, partially offset by a lower FAS/CAS operating adjustment.

Over the same period, pension adjusted non-GAAP diluted EPS

increased due to higher adjusted segment operating income.

Cash Flow:

Cash from Operations: Fourth

quarter increased 43% to $1.1 billion and 2024 increased 22% to

$2.6 billion.

Adjusted Free Cash Flow: Fourth

quarter increased 37% to $1.0 billion and 2024 increased 14% to

$2.3 billion.

Fourth quarter cash from operations increased due to tax

planning strategies, less cash used to fund working capital and

less cash used for merger, acquisition and severance payments.

Adjusted free cash flow excludes the impact of cash used for

merger, acquisition and severance payments.

2024 cash from operations increased due to tax planning

strategies and a decrease in transaction costs related to the AJRD

acquisition, partially offset by more cash used to fund working

capital. Adjusted free cash flow excludes the impact of cash used

for merger, acquisition and severance payments.

SEGMENT RESULTS*

SAS

Fourth Quarter

Full Year

($ millions)

2024

2023

Change

2024

2023

Change

Revenue

$

1,728

$

1,800

(4)%

$

6,869

$

6,856

—%

Operating margin

10.8%

10.6%

20 bps

11.8%

11.0%

80 bps

Adjusted segment operating margin

10.8%

10.6%

20 bps

11.8%

11.4%

40 bps

Revenue: Fourth quarter revenue decreased 4%, reflecting

the divestiture of our antenna business in the second quarter.

Excluding the divestiture impact, organic revenue decreased 1%,

primarily due to lower F-35 related volume as TR-3 transitions from

development to a more gradual production ramp in our Airborne

Combat Systems business, partially offset by increased volume in

our FAA safety of flight networks business and growth of classified

programs in Intel & Cyber.

2024 revenue was flat, reflecting the divestiture of the antenna

business. Excluding the divestiture impact, organic revenue

increased 2% primarily due to program growth in Intel & Cyber

and higher volume in our FAA safety of flight networks business,

partially offset by lower F-35 related volume.

Operating Margin:

GAAP Operating Margin: Fourth

quarter increased 20 bps to 10.8% and 2024 increased 80 bps to

11.8%.

Adjusted Segment Operating Margin:

Fourth quarter increased 20 bps to 10.8% and 2024 increased 40 bps

to 11.8%.

Fourth quarter operating margin and adjusted segment operating

margin increased primarily due to LHX NeXt cost savings, growth in

our FAA safety of flight networks business and the monetization of

certain legacy end of life assets, aligned with our transformation

and value creation priorities; increase was partially offset by

challenges on classified fixed price development programs in Space

Systems that are in later stages of completion.

2024 operating margin increased 80 bps, primarily due to LHX

NeXt cost savings, growth in our FAA safety of flight networks

business, the monetization of certain end of life assets, aligned

with our transformation and value creation priorities, and the

impact of a non-cash charge for impairment of other assets which

occurred during FY23. Such increases were partially offset by

challenges on classified fixed price development programs in Space

Systems. 2023 adjusted segment operating margin excludes the impact

of the non-cash charge.

*Organic revenue and adjusted segment operating margin are

non-GAAP financial measures defined on page 19.

IMS

Fourth Quarter

Full Year

($ millions)

2024

2023

Change

2024

2023

Change

Revenue

$

1,773

$

1,627

9%

$

6,842

$

6,630

3%

Operating margin

13.4%

(4.6%)

1,800 bps

12.2%

6.9%

530 bps

Adjusted segment operating margin

13.4%

11.9%

150 bps

12.2%

11.2%

100 bps

Revenue: Fourth quarter revenue increased 9.0% primarily

due to higher aircraft missionization volume, higher volume in our

CAS business, the divestiture of which is pending closure, and

increased advanced electronics demand for space and munitions

programs.

2024 increased due to higher revenue for advanced electronics,

higher aircraft missionization volume, higher volume in CAS and

Maritime, and higher commercial revenue for airborne

electro-optical sensors.

Operating Margin:

GAAP Operating Margin: Fourth

quarter operating margin increased to 13.4% and 2024 increased 530

bps 12.2%.

Adjusted Segment Operating Margin:

Fourth quarter adjusted segment operating margin increased 150 bps

to 13.4% and 2024 increased 100 bps to 12.2%.

Fourth quarter operating margin increased primarily due to

improved program performance across the segment, including LHX NeXt

cost savings, absence of a prior year goodwill impairment

associated with CAS, and the monetization of certain end of life

assets, aligned with our transformation and value creation

priorities. Adjusted segment operating margin increase excludes the

prior year goodwill impairment.

2024 operating margin increased primarily due to improved

program performance across the segment, including LHX NeXt cost

savings, and the absence of a prior year goodwill impairment

associated with CAS that is not included in adjusted segment

operating margin.

CS

Fourth Quarter

Full Year

($ millions)

2024

2023

Change

2024

2023

Change

Revenue

$

1,437

$

1,363

5%

$

5,459

$

5,070

8%

Operating margin

22.7%

26.1%

(340) bps

24.3%

24.2%

10 bps

Adjusted segment operating margin

24.4%

26.1%

(170) bps

24.7%

24.2%

50 bps

Revenue: Fourth quarter and 2024 revenue increased 5% and

8%, respectively, primarily driven by robust demand for our

resilient communication equipment, related waveforms, and night

vision devices. Growth for software defined tactical radios was

especially strong across international markets, in particular from

NATO countries, reflecting demand for our superior capabilities for

critical battlefield communication equipment and waveforms.

Operating Margin:

GAAP Operating Margin: Fourth

quarter decreased 340 bps to 22.7% and 2024 increased 10 bps to

24.3%.

Adjusted Segment Operating Margin:

Fourth quarter decreased 170 bps to 24.4% and 2024 increased 50 bps

to 24.7%.

Fourth quarter operating margin decreased due to higher mix of

domestic radios related to competitive IDIQ contracts and a

non-cash impairment of other assets related to the Tactical Data

Links acquisition, partially offset by LHX NeXt cost savings.

Adjusted segment operating margin decrease excludes the impact of

the non-cash impairment of other assets.

2024 operating margin increased due to LHX NeXt cost savings,

partially offset by a higher mix of domestic radios related to

competitive IDIQ contracts and the non-cash impairment of other

assets. Adjusted segment operating margin increase excludes the

impact of the non-cash impairment of other assets.

AR

Fourth Quarter

Full Year

($ millions)

2024

2023

Change

2024

2023

Change

Revenue

$

628

$

597

5%

$

2,347

$

1,052

123%

Operating margin

11.5%

11.1%

40 bps

12.5%

11.6%

90 bps

Revenue: Fourth quarter revenue increased 5%, primarily

from increased production volume across key missile programs,

partially offset by a reduction in space propulsion revenue due to

program related delays and lower volume of in-space propulsion

work.

2024 results are attributed to program execution across both

sectors, Missile Solutions and Space Propulsion and Power Systems,

relative to the 5 months of AR results in 2023.

Operating Margin: Fourth quarter and 2024 operating

margin increased, primarily from the benefit of increased

production volumes and strong program execution.

2025 GUIDANCE

Beginning in 1Q25 and reflected in our 2025 guidance, we are

revising our Non-GAAP diluted EPS metric to exclude an adjustment

for amortization of acquisition-related intangible assets that are

in full year results for both years. We believe this better aligns

to industry standard presentation of Non-GAAP diluted EPS and

provides our investors with a more appropriate metric that better

reflects our performance. In this press release, 4Q24 and 2024

"Non-GAAP diluted EPS" and "Pension adjusted non-GAAP diluted EPS"

include an adjustment for amortization of acquisition-related

intangible assets, and "Non-GAAP diluted EPS (New)" does not

include an adjustment for amortization of acquisition-related

intangible assets.

Guidance assumes a Continuing Resolution through March of 2025

and no other funding delays or impacts. The administration has

issued several Executive Orders that are still being assessed but

are not expected to have a significant impact on our 2025 results.

However, as US Government contracting officers assess the impact of

Executive Orders on new contracts, we could see an effect on our Q1

2025 bookings and revenue.

Revenue

Adjusted Segment Operating

Margin

Space & Airborne Systems

$6.9B - $7.1B

low 12%

Integrated Mission Systems

$7.0B - $7.2B

low 12%

Communication Systems

$5.6B - $5.7B

high 24%

Aerojet Rocketdyne

~$2.5B

mid 12%

Total Company

$21.8B - $22.2B

mid - high 15%

2025

2024

Earning per share

Guidance1

Actuals

Non-GAAP diluted EPS (Prior)

$13.70 - $14.00

$13.10

Intangible amortization, net of income

taxes

~(3.15)

(3.40)

Non-GAAP diluted EPS (New)

$10.55 - $10.85

$9.70

Growth

10%*

5%

Adjusted free cash flow

$2.4B - $2.5B

$2.3B

1A reconciliation of adjusted segment operating income and

margin, effective tax rate on non-GAAP income, non-GAAP diluted EPS

(prior and new) and adjusted free cash flow on a forward-looking

basis to GAAP is not available without unreasonable effort due to

the unavailability of items for exclusion from the GAAP measure. We

are unable to address the probable significance of this

information, the variability of which may have a significant impact

on future GAAP results. See Non-GAAP Financial Measures on page 9

for more information.

*Based on mid-point

SUPPLEMENTAL INFORMATION

2025

2024

Other Information

Current

Actuals

FAS/CAS operating adjustment

~$15 million

$28 million

Non-service FAS pension income1

~$260 million

$322 million

Net interest expense

~$630 million

$675 million

Effective tax rate on GAAP income

5.3%

Effective tax rate on non-GAAP income

(New)2

11.0% - 12.0%

Average diluted shares

~190

190.7

Capital expenditures

~2% sales

2% sales

1Includes the reduction in non-service FAS

pension income resulting from the anticipated transfer of ~$1.2

billion of pension assets and liabilities to a third party in Q1

2025.

2Effective tax rate on non-GAAP income is

a non-GAAP financial measure defined on page 19. A reconciliation

of effective tax rate on non-GAAP income guidance is not available.

See Non-GAAP Financial Measures on page 10 for more information.

Excludes the adjustment for amortization of acquisition-related

intangible assets.

Forward-Looking Statements

This earnings release contains forward-looking statements within

the meaning of federal securities laws made in reliance on the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. Examples include, but are not limited to: share

repurchases; potential divestitures and their timing; 2024

guidance; 2026 financial framework; anticipated LHX NeXt initiative

costs and savings targets; 2026 margins; supplemental information

for 2024; projection of other financial items; and assumptions

underlying any of the foregoing. Investors should not place undue

reliance on forward-looking statements, which reflect management’s

current expectations, estimates, projections, assumptions and

information currently available to management, and are not

guarantees of future performance or actual results. Important risks

that could cause our results to differ materially from those

expressed in or implied by these forward-looking statements or from

our historical results include, but are not limited to, risks

arising from: competitive markets; U.S. Government spending

priorities; changes in contract mix; inflation; unilateral contract

action by the U.S. Government; uncertain economic conditions;

future geo-political events; supply chain disruptions; impacts of

LHX NeXt; indebtedness; defined benefit plan liabilities and

returns; interest rates and other market factors; changes in

effective tax rate or additional tax exposures; pending and

contemplated divestitures. These and other important risks that

could impact forward-looking statements are described more fully in

the "Risk Factors" in our Form 10-K for fiscal 2023 filed with the

SEC. All subsequent written and oral forward-looking statements

attributable to us or any person acting on our behalf are qualified

by the cautionary statements in this section, and we have no duty

to and disclaim any intention or obligation, other than imposed by

law, to update or revise any forward-looking statements, whether as

a result of new information, future events or developments or

otherwise.

Non-GAAP Financial Measures

Management believes the adjustments to non-GAAP Financial

Measures ("NGFMs") in the tables beginning on page 13 are useful to

investors because the excluded costs do not reflect our ongoing

operating performance. Such adjustments, considered together with

the unadjusted GAAP financial measures, provide information that

management believes is useful to investors to understand

period-over-period operating results separate from items that

management believes may disproportionately impact operating results

in any particular period; however there is no guarantee that items

excluded from NGFMs will not reoccur in future periods. Management

also believes that NGFMs enhance the ability of investors to

analyze business trends, understand performance and evaluate our

initiatives to drive improved financial performance. Management

utilizes NGFMs to guide forecasting and long-term planning and for

compensation purposes. NGFMs should be considered in addition to,

and not as a substitute for, financial measures presented in

accordance with GAAP. A reconciliation of forward-looking NGFMs to

GAAP is not available without unreasonable effort because of

inherent difficulty in forecasting and quantifying comparable GAAP

measures and applicable adjustments and other amounts necessary for

a reconciliation because of potentially high variability,

complexity and low visibility of applicable adjustments and other

unusual amounts that could disproportionately impact future GAAP

results, such as the impact of defined benefit plan performance,

LHX NeXt, potential divestitures and their timing, and the extent

of tax deductibility.

Conference Call and Webcast

L3Harris Technologies will host an earnings call on January 30,

2025, at 10:30 a.m. Eastern Time (ET). Participants are encouraged

to listen via webcast, which will be broadcast live at

L3Harris.com/investors. The dial-in numbers for the teleconference

are (U.S.) 800-549-8228 and (International) 289-819-1520, and

participants will be directed to an operator. A recording of the

call will be available on the L3Harris website, beginning at

approximately 12 p.m. ET on January 30, 2025.

Table 1 - Condensed Consolidated

Statement of Operations (Unaudited)

Fourth Quarter

Full Year

(In millions, except per share

amounts)

2024

2023

2024

2023

Revenue

$

5,523

$

5,340

$

21,325

$

19,419

Cost of revenue

(4,126

)

(3,935

)

(15,801

)

(14,306

)

General and administrative expenses

(804

)

(955

)

(3,568

)

(3,313

)

Impairment of goodwill and other

assets

(24

)

(296

)

(38

)

(374

)

Operating income

569

154

1,918

1,426

Non-service FAS pension income and other,

net

79

93

354

338

Interest expense, net

(161

)

(171

)

(675

)

(543

)

Income before income taxes

487

76

1,597

1,221

Income taxes

(31

)

50

(85

)

(23

)

Net income

456

126

1,512

1,198

Noncontrolling interests, net of income

taxes

(3

)

32

(10

)

29

Net income attributable to L3Harris

Technologies, Inc.

$

453

$

158

$

1,502

$

1,227

Net income per common share attributable

to L3Harris Technologies, Inc. common shareholders

Basic

$

2.38

$

0.83

$

7.91

$

6.47

Diluted

$

2.37

$

0.83

$

7.87

$

6.44

Basic weighted-average common shares

outstanding

189.7

189.6

189.8

189.6

Diluted weighted-average common shares

outstanding

190.6

190.6

190.7

190.6

Table 2 - Consolidated Statement of

Cash Flow (Unaudited)

Full Year

(In millions)

2024

2023

Operating Activities

Net income

$

1,512

$

1,198

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

1,289

1,166

Share-based compensation

97

89

Net periodic benefit income

(286

)

(275

)

Share-based matching contributions under

defined contribution plans

264

231

Impairment of goodwill and other

assets

38

374

Deferred income taxes

174

(423

)

(Increase) decrease in:

Receivables, net

128

124

Contract assets

(194

)

62

Inventories, net

96

(182

)

Other current assets

(29

)

(55

)

Increase (decrease) in:

Accounts payable

(90

)

87

Contract liabilities

126

195

Compensation and benefits

(128

)

38

Other current liabilities

155

(88

)

Income taxes

(383

)

(333

)

Other operating activities

(210

)

(112

)

Net cash provided by operating

activities

2,559

2,096

Investing Activities

Net cash paid for acquired businesses

—

(6,688

)

Capital expenditures

(408

)

(449

)

Proceeds from sale of property, plant and

equipment, net

1

56

Proceeds from sales of businesses

273

71

Other investing activities

(129

)

(11

)

Net cash used in investing activities

(263

)

(7,021

)

Financing Activities

Proceeds from issuances of long-term debt,

net

2,827

7,568

Repayments of long-term debt

(2,620

)

(3,170

)

Change in commercial paper, maturities

under 90 days, net

(567

)

623

Proceeds from commercial paper, maturities

over 90 days

688

1,181

Repayments of commercial paper, maturities

over 90 days

(1,205

)

(205

)

Proceeds from exercises of employee stock

options

133

24

Repurchases of common stock

(554

)

(518

)

Dividends paid

(886

)

(868

)

Other financing activities

(40

)

(41

)

Net cash (used in) provided by financing

activities

(2,224

)

4,594

Effect of exchange rate changes on cash

and cash equivalents

(17

)

11

Net increase (decrease) in cash and

cash equivalents

55

(320

)

Cash and cash equivalents, beginning of

period

560

880

Cash and cash equivalents, end of

period

$

615

$

560

Table 3 - Condensed Consolidated

Balance Sheet (Unaudited)

(In millions)

January 3, 2025

December 29, 2023

Assets

Current assets

Cash and cash equivalents

$

615

$

560

Receivables, net

1,072

1,230

Contract assets

3,230

3,196

Inventories, net

1,330

1,472

Income taxes receivable

379

61

Other current assets

461

430

Assets of business held for sale

1,131

1,106

Total current assets

8,218

8,055

Non-current assets

Property, plant and equipment, net

2,806

2,862

Goodwill

20,325

19,979

Intangible assets, net

7,639

8,540

Deferred income taxes

120

91

Other non-current assets

2,893

2,160

Total assets

$

42,001

$

41,687

Liabilities and equity

Current liabilities

Short-term debt

$

515

$

1,602

Current portion of long-term debt, net

640

363

Accounts payable

2,005

2,106

Contract liabilities

2,142

1,900

Compensation and benefits

419

544

Income taxes payable

29

88

Other current liabilities

1,648

1,129

Liabilities of business held for sale

235

272

Total current liabilities

7,633

8,004

Non-current liabilities

Long-term debt, net

11,081

11,160

Deferred income taxes

942

815

Other long-term liabilities

2,766

2,879

Total liabilities

22,422

22,858

Total equity

19,579

18,829

Total liabilities and equity

$

42,001

$

41,687

Reconciliation of Non-GAAP Financial

Measures

Table 4 - Organic Revenue

Reconciliation (Unaudited)

Fourth Quarter

2024

2023

(In millions)

GAAP

Adjustments

Organic

GAAP

Adjustments1

Organic

SAS

$

1,728

$

—

$

1,728

$

1,800

$

(54

)

$

1,746

IMS

1,773

—

1,773

1,627

—

1,627

CS

1,437

—

1,437

1,363

—

1,363

AR

628

—

628

597

—

597

Corporate eliminations

(43

)

—

(43

)

(47

)

—

(47

)

Revenue

$

5,523

$

—

$

5,523

$

5,340

$

(54

)

$

5,286

Full Year

2024

2023

(In millions)

GAAP

Adjustments2

Organic

GAAP

Adjustments1

Organic

SAS

$

6,869

$

—

$

6,869

$

6,856

$

(124

)

$

6,732

IMS

6,842

—

6,842

6,630

—

6,630

CS

5,459

—

5,459

5,070

—

5,070

AR

2,347

(1,282

)

1,065

1,052

—

1,052

Corporate eliminations

(192

)

—

(192

)

(189

)

—

(189

)

Revenue

$

21,325

$

(1,282

)

$

20,043

$

19,419

$

(124

)

$

19,295

1Adjustment to exclude amounts

attributable to divested businesses.

2Adjustment to exclude amounts

attributable to AR through the date of acquisition.

Table 5 - Reconciliation of Operating

Income to Adjusted Segment Operating Income (Unaudited)

Fourth Quarter

Full Year

(In millions)

2024

2023

2024

2023

Operating income

$

569

$

154

$

1,918

$

1,426

Unallocated corporate items1

9

(3

)

95

(48

)

Significant and/or non-recurring

items:

Amortization of acquisition-related

intangibles and additional cost of revenue related to the fair

value step-up in inventory sold2

211

233

853

809

Merger, acquisition, and

divestiture-related expenses2

16

30

102

174

Business divestiture-related (gains)

losses, net and impairment of goodwill and other assets2

(10

)

373

57

425

LHX NeXt implementation costs2

51

47

267

115

Gain on sale of property, plant and

equipment2

—

(27

)

—

(27

)

Total significant and/or non-recurring

items

268

656

1,279

1,496

Unallocated items

277

653

1,374

1,448

Adjusted segment operating income

$

846

$

807

$

3,292

$

2,874

1Includes unallocated corporate department

expense of $17M and $123M for the fourth quarter and year to date

2024, respectively, and $35M and $62M for the fourth quarter 2023

and year to date 2023, respectively. Additionally, includes the

FAS/CAS operating adjustment of $8M and $28M for the fourth quarter

and year to date 2024, respectively, and $38M and $110M for the

fourth quarter and year to date 2023, respectively. The FAS/CAS

operating adjustment represents the difference between the service

cost component of Financial Accounting Standards net periodic

benefit income and total U.S. Government Cost Accounting Standards

pension cost.

2Refer to Key Terms and Non-GAAP

Definitions on page 19.

Table 6 - Reconciliation of Operating

Income to Adjusted Segment Operating Income by Segment

(Unaudited)

Fourth Quarter

2024

2023

(In millions)

SAS

IMS

CS

AR

SAS

IMS

CS

AR

Operating income

186

238

326

72

191

(75

)

356

66

Segment impairment of goodwill and other

assets1

—

—

24

—

—

296

—

—

Gain on sale of property, plant and

equipment1

—

—

—

—

—

(27

)

—

—

Adjusted segment operating income

$

186

$

238

$

350

$

72

$

191

$

194

$

356

$

66

Full Year

2024

2023

(In millions)

SAS

IMS

CS

AR

SAS

IMS

CS

AR

Operating income

812

838

1,324

294

756

459

1,229

122

Segment impairment of goodwill and other

assets1

—

—

24

—

27

308

—

—

Gain on sale of property, plant and

equipment1

—

—

—

—

—

(27

)

—

—

Adjusted segment operating income

$

812

$

838

$

1,348

$

294

$

783

$

740

$

1,229

$

122

1Refer to Key Terms and Non-GAAP

Definitions on page 19.

Table 7 - Reconciliation of Effective

Tax Rate to Effective Tax Rate on Non-GAAP Income

(unaudited)

Fourth Quarter

2024

2023

(In millions)

Earnings Before Tax

Tax Expense

(Benefit)

Effective Tax Rate

Earnings Before Tax

Tax Expense

Effective Tax Rate

Income before income taxes

$

487

$

31

6.4

%

$

76

$

(50

)

(65.8

)%

Amortization of acquisition-related

intangibles and additional cost of revenue related to the fair

value step-up in inventory sold1

211

40

233

53

Merger, acquisition, and

divestiture-related expenses1

16

3

30

7

Business divestiture-related (gains)

losses, net and impairment of goodwill and other assets1

(10

)

4

346

72

LHX NeXt implementation costs1

51

13

47

10

Non-GAAP income before income taxes

$

755

$

91

12.1

%

$

732

$

92

12.6

%

Full Year

2024

2023

(In millions)

Earnings Before Tax

Tax Expense

(Benefit)

Effective Tax Rate

Earnings Before Tax

Tax Expense

Effective Tax Rate

Income before income taxes

$

1,597

$

85

5.3

%

$

1,221

$

23

1.9

%

Amortization of acquisition-related

intangibles and additional cost of revenue related to the fair

value step-up in inventory sold1

853

205

809

191

Merger, acquisition, and

divestiture-related expenses1

102

22

174

31

Business divestiture-related (gains)

losses, net and impairment of goodwill and other assets1

57

(13

)

398

83

LHX NeXt implementation costs1

267

67

115

26

Non-GAAP income before income taxes

$

2,876

$

366

12.7

%

$

2,717

$

354

13.0

%

1Refer to Key Terms and Non-GAAP

Definitions on page 19.

Table 8 - Reconciliation of Diluted EPS

to Non-GAAP Diluted EPS and Pension Adjusted Non-GAAP Diluted EPS

(unaudited)

Fourth Quarter

Full Year

(In millions, except per share

data)

2024

2023

2024

2023

Diluted weighted-average common shares

outstanding

190.6

190.6

190.7

190.6

Diluted EPS

$

2.37

$

0.83

$

7.87

$

6.44

Significant and/or non-recurring items

included in diluted EPS above:

Amortization of acquisition-related

intangibles and additional cost of revenue related to the fair

value step-up in inventory sold1

1.11

1.22

4.47

4.25

Merger, acquisition, and

divestiture-related expenses1

0.08

0.16

0.53

0.91

Business divestiture-related (gains)

losses, net and impairment of goodwill and other assets1

(0.05

)

1.95

0.30

2.23

LHX NeXt implementation costs1

0.27

0.25

1.40

0.60

Gain on sale of property, plant and

equipment1

—

(0.14

)

—

(0.14

)

Income taxes on above adjustments

(0.31

)

(0.75

)

(1.47

)

(1.74

)

Noncontrolling interests portion of

adjustment

—

(0.17

)

—

(0.19

)

Non-GAAP diluted EPS

$

3.47

$

3.35

$

13.10

$

12.36

Less: per share impact of:

FAS/CAS operating adjustment2

(0.04

)

(0.17

)

(0.13

)

(0.50

)

Non-service FAS pension income2

(0.37

)

(0.36

)

(1.47

)

(1.42

)

Pension adjusted non-GAAP diluted EPS

$

3.06

$

2.82

$

11.50

$

10.44

1Refer to Key Terms and Non-GAAP

Definitions on page 19.

2Net of tax effect.

Table 9 - Reconciliation of Net Cash

Provided by Operating Activities to Adjusted Free Cash Flow

(unaudited)

Fourth Quarter

Full Year

(In millions)

2024

2023

2024

2023

Net cash provided by operating

activities

$

1,129

$

789

$

2,559

$

2,096

Capital expenditures

(118

)

(137

)

(408

)

(449

)

Proceeds from sale of property, plant and

equipment, net

1

56

1

56

Free cash flow

1,012

708

2,152

1,703

Cash used for merger, acquisition and

severance1,2

21

48

167

326

Adjusted free cash flow

$

1,033

$

756

$

2,319

$

2,029

1Refer to Key Terms and Non-GAAP

Definitions on page 19.

22023 amounts reclassified to include cash

paid for severance.

Key Terms and Non-GAAP

Definitions

Description

Definition

Amortization of acquisition-related

intangibles and additional cost of revenue related to the fair

value step-up in inventory sold

Amortization of identifiable intangible

assets acquired in connection with business combinations.

Additional cost of revenue related to the fair value step-up in

inventory is the difference between the balance sheet value of

inventory from the acquiree and the acquisition date fair

value.

Merger, acquisition, and

divestiture-related expenses

Transaction and integration expenses

associated with Tactical Data Links and AR acquisitions; external

costs related to pursuing acquisition and divestiture portfolio

optimization; non-transaction costs related to divestitures; and

salaries of employees in roles dedicated to planned divestiture and

acquisition activity.

Business divestiture-related (gains)

losses, net and impairment of goodwill and other assets

Inclusive of segment impairment of

goodwill and other assets noted below. 2023, includes a gain on

sale of our Visual Information Solutions business, impairment of

contract assets and other assets related to the restructuring of a

customer contract and impairment of in-process research and

development associated with a facility closure. In 2024, includes

valuation allowance increase related to the pending sale of our CAS

business (QTD and YTD) and impairment of goodwill and loss on sale

recognized in connection with the sale of our antenna and related

businesses (YTD).

Segment impairment of goodwill and other

assets

In 2023, charges for goodwill impairment

recorded at our IMS segment related to the pending divestiture of

our CAS business and charges at our IMS and SAS segment related to

restructuring of a customer contract impacting both segments and

facility closures in IMS. In 2024, charges for an impairment of

other assets recorded at our CS segment related to the Tactical

Data Links acquisition.

Gain on sale of property, plant and

equipment

In 2023, related to the sale of a building

in our IMS segment.

LHX NeXt implementation costs

Costs related to the LHX NeXt initiative

are expected to continue through 2025 and are expected to include

workforce optimization costs and incremental IT expenses for

implementation of new systems, third-party consulting expenses and

other related costs, including costs related to personnel dedicated

to this project.

LHX NeXt cost savings

Represents annual gross run rate savings

driven by the LHX NeXt transformation initiative. It is an

operational measure that includes savings from initiatives related

to labor and function optimization, direct and indirect

procurement, and infrastructure expected to recur on an ongoing

basis.

Orders

Total value of funded and unfunded

contract awards received from the U.S. Government and other

customers, including incremental funding and adjustments to

previous awards, excluding unexercised contract options and

potential orders under ordering-type contracts, such as indefinite

delivery, indefinite quantity (IDIQ) contracts.

Organic revenue*

Excludes the impact of completed

divestitures and first year revenue associated with acquisitions

and is reconciled in Table 4.

Adjusted segment operating income and

margin*

On a consolidated basis represents

operating income and margin, excluding the FAS/CAS operating

adjustment, corporate unallocated items and items reconciled in

Table 5.

Segment operating income and margin for

each segment represents each such segment's operating income and

margin (GAAP measures), excluding impairment of goodwill and other

assets and gain on sale of property, plant and equipment, as

reconciled in table 6.

Non-GAAP diluted EPS*1

Represents EPS (net income per diluted

common share attributable to L3Harris Technologies, Inc. common

shareholders) adjusted for items reconciled in Table 8.

Pension adjusted non-GAAP diluted

EPS*1

Represents Non-GAAP diluted EPS, described

above, adjusted for the after tax per share impact of the FAS/CAS

operating adjustment and Non-service FAS pension income reconciled

in Table 8.

Adjusted Free Cash Flow*

Net cash provided by operating activities

less capital expenditures, plus proceeds from sale of property,

plant and equipment, cash used for merger, acquisition, and

severance reconciled in Table 9.

Cash used for merger, acquisition, and

severance*

Cash related to merger and acquisition

expenses (described above) and severance costs included in LHX NeXt

implementation costs.

Non-GAAP income before income taxes*

Represents income before income taxes

adjusted for items reconciled in Table 7.

Effective tax rate on non-GAAP income*

Represents the effective tax rate (tax

expense as a percentage of income before income taxes) adjusted for

the tax effect of items reconciled in Table 7.

_____

*Refer to Non-GAAP Financial Measures on

page 7 for more information.

1 Beginning in 1Q25 and reflected in our

2025 guidance, we are revising our Non-GAAP diluted EPS metric to

exclude an adjustment for amortization of acquisition-related

intangible assets. We believe this better aligns to industry

standard presentation of Non-GAAP diluted EPS and provides our

investors with a more appropriate metric that better reflects our

performance. In this press release, "Non-GAAP diluted EPS" and

"Pension adjusted non-GAAP diluted EPS" include an adjustment for

amortization of acquisition-related intangible assets, and

"Non-GAAP diluted EPS (New)" and "Pension adjusted non-GAAP diluted

EPS (New)" does not include an adjustment for amortization of

acquisition-related intangible assets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130388384/en/

Investor Relations Contact: Daniel Gittsovich,

321-724-3170 investorrelations@l3harris.com

Media Relations Contact: Sara Banda, 321-306-8927

media@l3harris.com

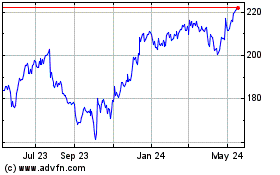

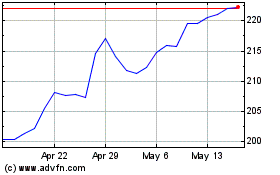

L3Harris Technologies (NYSE:LHX)

Historical Stock Chart

From Jan 2025 to Feb 2025

L3Harris Technologies (NYSE:LHX)

Historical Stock Chart

From Feb 2024 to Feb 2025