UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2024

Mistras Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34481 | | 22-3341267 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| 195 Clarksville Road | | |

| Princeton Junction, | New Jersey | | 08550 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (609) 716-4000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d 2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | MG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Mistras Group, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Form 8-K”) on December 5, 2024. In the Original Form 8-K, the Company stated, among other things, that the compensation arrangements for Manuel N. Stamatakis in connection with his continuation as Executive Chairman of the Company had not then been finalized and that the Company would report the compensation arrangements when they were finalized. These compensation arrangements were finalized on December 31, 2024 and, accordingly, the Company is filing this Amendment No. 1 to the Original Form 8-K to report these arrangements.

Employment Agreement with Mr. Stamatakis

The Company and Mr. Stamatakis entered into an employment agreement on December 31, 2024 (the “Employment Agreement”) to reflect the terms of his employment by the Company as its Executive Chairman. The Employment Agreement became effective on January 1, 2025 and, at that time, replaced the employment agreement dated October 9, 2023 between the Company and Mr. Stamatakis.

Pursuant to the Employment Agreement, Mr. Stamatakis has an annual base salary of $725,000 and a target annual bonus opportunity equal to 100% of his base salary (with actual payout ranging between 0% and 200% of target, depending on actual performance). Mr. Stamatakis is also eligible for annual equity awards with a target equity incentive opportunity equal to 200% of his base salary (with the resulting award ranging between 0% and 200% of target, depending on actual performance). The terms of such annual awards will be determined by the Compensation Company of the Company’s Board of Directors, provided that the vesting of such annual awards will accelerate upon any termination of Mr. Stamatakis’ employment other than a termination for Cause.

The Employment Agreement also provides that if Mr. Stamatakis’ employment ceases due to a termination by the Company without cause or his resignation with good reason (as those terms are defined in the Employment Agreement), he will receive the following severance benefits: (i) a lump sum cash payment equal to 200% of his base salary (unless such termination occurs upon or following a change in control of the Company); (ii) a pro rata annual incentive award for the year of his cessation of employment, based on the greater of target or actual performance for the year of termination; (iii) a pro rata portion of performance-based restricted stock units then subject to an open performance period will become earned and vested, based on actual performance through the end of the performance period; and (iv) his time-vested stock options and any previously earned performance-based restricted stock units will vest, to the extent not already vested. Such severance benefits will be conditioned on Mr. Stamatakis’ execution of a release of claims against the Company and its affiliates.

In addition, the Employment Agreement provides that the Company will indemnify Mr. Stamatakis for acts or omissions in his capacity as an officer, director and/or employee of the Company, and advance the expenses of his defense in any proceeding connected to his service as an officer, director and/or employee of the Company, in each case to the maximum extent permitted by applicable law

Stock Option Award to Mr. Stamatakis

Additionally, on December 31, 2024, the Compensation Committee of the Company’s Board of Directors approved the grant to Mr. Stamatakis, of a stock option (the “Stock Option”) for the purchase of 375,000 shares of the Company’s common stock at an exercise price per share equal to the closing price of the common stock, as reported on the New York Stock Exchange, on January 6,2025 ("the Grant Date"). The Stock Option will vest and become exercisable on the first anniversary of the Grant Date, subject to accelerated vesting and exercisability upon termination of Mr. Stamatakis’ employment due to his death or disability. In addition, as noted above, if Mr. Stamatakis’ employment ceases due to his termination by the Company without cause or his resignation with good reason then, pursuant to the Employment Agreement, the vesting and exercisability of the Stock Option will also accelerate. The outside expiration date of the Stock Option is the tenth anniversary of the Grant Date.

The foregoing summaries of the Employment Agreement and the Stock Option are qualified in their entirety by reference to the Employment Agreement and the Form of Option Award Agreement, copies of which are filed as Exhibits 10.1 and 10.2, respectively, to this Amendment No. 1 to the Original Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | |

| | | |

| MISTRAS GROUP, INC. |

| |

Date: January 2, 2025 | By: | /s/ Michael C. Keefe |

| | Name: | Michael C. Keefe |

| | Title: | Executive Vice President, General Counsel and Secretary |

EMPLOYMENT AGREEMENT

This Employment Agreement (the “Agreement”) is entered into on December 31, 2024 between Mistras Group, Inc., a Delaware corporation (such entity or its successor, the “Company”), and Manny N. Stamatakis (“Executive”) and the Agreement shall become effective on January 1, 2025 (the “Effective Date”).

Recital

WHEREAS, Executive is currently employed by the Company as interim President and Chief Executive Officer of the Company under an agreement dated October 9, 2023 (“2023 Letter Agreement”) and serves as Chairman of Board of Directors of the Company (the “Board”); and

WHEREAS, effective as of the Effective Date, this Agreement sets forth the terms and conditions of the Company’s continued employment of Executive as an employee of the Company and appointment of Executive in the position as Executive Chairman of the Board.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties agree as follows:

1. Employment. The Company shall employ Executive as an employee of the Company and appoint Executive to the position of Executive Chairman, upon the terms and conditions set forth in this Agreement.

2. Term. Executive’s employment and appointment pursuant to this Agreement will commence on the Effective Date and will continue until terminated in accordance with Section 10 hereof.

3. Position and Duties.

(a)Executive shall serve as the Executive Chairman of the Company, will report to the Company’s Board of Directors (the “Board”), will carry out such duties and responsibilities as are customarily performed by persons in Executive’s position generally for public companies within the industry, including, but not limited to: the primary responsibility to manage the affairs of the Board; the primary responsibility to manage and direct strategic planning, merger, acquisition, and disposition activities and margin expansion activities of the Company; in coordination with the Board, the reporting accountability for the Company’s Chief Executive Officer (the “CEO”); and the cultivation of external partnerships, alliances, and relationships which benefit the Company, including with investment banks.

(b)Executive is currently serving as a member and Chairman of the Board, and at the annual meeting of shareholders to be held in calendar year 2025, Executive shall be nominated for re-election as a member of the Board, and, upon election to the Board, Executive shall be re-appointed as Chairman of the Board and each annual meeting of shareholders thereafter while

employed hereunder, Executive shall be nominated for re-election as a member of the Board, and, upon election to the Board, Executive shall be re-appointed as Chairman of the Board.

(c)Executive agrees to devote his best efforts to the performance of his duties and responsibility hereunder. However, the Company acknowledges that Executive has other business and non-profit commitments and agrees that Executive may continue to devote a portion of his business time to those other activities, so long as they do not conflict with his duties hereunder.

4. Company Policies. Executive will comply with Company policies regarding ethics, personal conduct, stock ownership, securities trading, compensation claw backs, and hedging and pledging of securities.

5. Place of Performance. Executive may perform Executive’s duties at any location. While employed by the Company, the Company will provide Executive with such computer and other electronic equipment and services as are reasonably required to enable Executive to tend to the business of the Company. During Executive’s employment with the Company, the Company shall hire for Executive with Executive’s approval a direct report, full-time business analyst employee with at least five years relevant experience and at a compensation level commensurate with similar positions with the Company.

6. Salary. The Company will pay Executive a salary (the “Base Salary”) at an initial annual rate of $725,000, payable in accordance with the Company’s standard payroll schedule and subject to applicable deductions and withholdings. The amount of the Base Salary shall be reviewed on an annual basis and may be increased from time to time by the Board or the Compensation Committee of the Board (the “Compensation Committee”). During Executive’s employment with the Company pursuant to this Agreement, Executive shall not be eligible to receive any fees or stock awards generally payable to members of the Board for their service as members of the Board, by reason of Executive’s service as a member of the Board, as Chairman of the Board, or as a member of any Committee of the Board; provided that equity-based awards previously granted to Executive will remain in effect in accordance with their terms.

7. Annual Incentive Awards.

(d)(a) For each calendar year of Executive’s employment hereunder (beginning with the 2025 calendar year), Executive will have the opportunity to earn an annual incentive award under the Company’s “executive annual incentive plan” (sometimes referred to as the “bonus plan”) applicable to senior executives generally, with Executive’s annual incentive target opportunity amount for each calendar year to be 100% of Base Salary (the “Target Bonus Opportunity”) and with the actual incentive award ranging from 0% to 200% of target based on actual performance results. Any annual incentive award that is earned by Executive will be payable consistent with the Company’s regular payroll practices applicable to annual incentive awards for senior executives generally, but in no event will it be paid later than March 15 of the calendar year that immediately follows the calendar year to which the annual incentive award relates. The actual amount that will be earned will depend upon the extent to which performance targets established by the Compensation Committee under the bonus plan are or are not achieved. Except as otherwise expressly provided in Section 11(b), payment of any otherwise earned

annual incentive award will be conditioned on Executive’s continued employment with the Company through the end of the calendar year for which such payment was earned.

(e)(b) Nothing in this Agreement shall affect Executive’s entitlement to an annual incentive bonus for 2024 as provided in paragraph 3 of the 2023 Letter Agreement.

8. Long-Term Equity Incentive Grants. For each calendar year of the Executive’s employment hereunder, Executive will be eligible to receive a grant of performance-based equity at the target opportunity amount of 200% of Base Salary, with the actual incentive award ranging from 0% to 200% of target based on actual performance results, which, as of the Effective Date, is contemplated to be in the form of performance-based Restricted Stock Unit Awards (“Performance-Based RSUs”) under the Company’s Long-Term Incentive Plan as in effect from time to time. The terms of each such equity award will be determined by the administrator of the applicable equity plan and memorialized in a separate award agreement. Upon termination of Executive’s employment under this Agreement for any reason other than for “Cause,” the service condition with respect such outstanding unvested Performance-Based RSUs shall be deemed satisfied in full upon such termination and will be paid out in accordance with the formula in Section 11(b)(iii).

9. Benefits; Business Expenses.

(a) Executive shall be entitled to participate in Company benefit plans that are generally available to the CEO and other executive-level employees of the Company, in accordance with and subject to the terms and conditions of such plans, as in effect from time to time. Notwithstanding the foregoing, Executive will not participate in the Company’s Executive Severance Plan or any other severance plan, policy or arrangement maintained by the Company or its affiliates (other than the terms of Section 11(b) below).

(f)(b) Company shall reimburse you for all travel, entertainment and other expenses reasonably incurred or paid by you in connection with, or related to, the performance of your duties and responsibilities to the Company.

10. Termination.

(g)(a) Executive’s employment hereunder shall terminate on the earliest of: (i) on the date set forth in a written notice to Executive from the Board that Executive’s employment with the Company has been or will be terminated, (ii) on the date not less than thirty (30) days following written notice from Executive to the Board that Executive is resigning from the Company, (iii) on the date of Executive’s death, or (iv) on the date set forth in a written notice to Executive from the Board that Executive’s employment is terminated on account of Executive’s Disability (as defined in Section 14). Notwithstanding the foregoing, in the event that Executive gives notice of termination to the Board, the Board may unilaterally accelerate the

date of termination and such acceleration shall not constitute a termination by the Board for purposes of this Agreement.

(h)(b) Upon cessation of Executive’s employment for any reason, unless otherwise consented to in writing by the Board, Executive will resign immediately from any and all officer, director and other positions Executive then holds with the Company and its affiliates and agrees to execute such documents as may be requested by the Company to confirm that resignation.

(i)(c) Upon any cessation of Executive’s employment with the Company, Executive will be entitled only to such compensation and benefits as described in Section 11 below.

(j)(d) Executive agrees that, following any cessation of Executive’s employment and subject to reimbursement of Executive’s reasonable expenses, Executive will cooperate with the Company and its counsel with respect to any matter (including litigation, investigations, or governmental proceedings) in which Executive was in any way involved during Executive’s employment with the Company. Executive agrees to render such cooperation in a timely manner on reasonable notice from the Company, provided the Company exercises reasonable efforts to limit and schedule the need for Executive’s cooperation so as not to materially interfere with Executive’s other professional obligations.

(k)(e) Executive agrees that, upon any cessation of Executive’s employment, Executive will deliver to the Company (and will not retain in Executive’s possession or control, or deliver to anyone else) all property and equity of the Company, including without limitation (i) all keys, books, records, access cards, credit cards and identification, and (ii) all other Company materials (and copies thereof), including any Company records, data, notes, reports, proposals, lists or correspondence; provided that Executive may retain his Company supplied laptop computer after the removal of all Company data and files.

11. Rights Upon Termination.

(l)(a) Termination without Cause, Death, Disability, or Resignation for Good Reason. If Executive’s employment by the Company ceases due to a termination by the Board without Cause (as defined in Section 14), Executive’s death or Disability, or a resignation by Executive for Good Reason (as defined in Section 14):

(i)(i) the Company shall pay to Executive all accrued and unpaid Base Salary through the date of such cessation of employment at the time such Base Salary would otherwise be paid according to the Company’s usual payroll practices;

(ii)(ii) the Company shall pay to Executive any business expenses that were incurred prior to the date of such cessation of employment but not reimbursed and that are otherwise eligible for reimbursement, within 30 days following Executive’s termination of employment;

(iii)(iii) to the extent then unpaid, the Company shall pay to Executive the annual incentive award (if any) earned with respect to the calendar year ended on or immediately prior to the date of such cessation of employment, paid at the time such bonus would normally be paid to Executive as provided in Section 7(a); and

(iv)(iv) any vested benefits under any Company benefit plan in which Executive participated and any other benefits for which Executive is entitled to from the Company for periods after cessation of employment, in each case payable as provided under the applicable plan.

(m)(b) Termination without Cause or Resignation for Good Reason. In addition to the payments set forth in subparagraph (a), if Executive’s employment by the Company ceases due to a termination by the Board without Cause or a resignation by Executive for Good Reason, the Executive shall be entitled to the following severance benefits:

(i)a total of 200% of the Base Salary as in effect immediately prior to such cessation of employment (or, if such cessation is due to the Good Reason described in clause (i) of that definition, 200% of the Base Salary in effect immediately prior to such material diminution), which amount will be paid in a lump sum on the 35th day following such cessation of employment (the “Settlement Date”); provided, however, if Executive’s employment by the Company ceases due to a termination by the Board without Cause or a resignation by Executive for Good Reason upon or following a Change in Control, Executive shall not receive the payment described in this subsection 11(b)(i);

(ii)a lump sum cash payment equal to a pro rata portion of the annual incentive award, at the higher of the Target Bonus Opportunity or the actual award that Executive would have earned for the calendar year of Executive’s termination based on actual performance results for such year (the “Terminal Award”). The pro-rated portion of the Terminal Award shall be determined by multiplying the Terminal Award by a fraction, the numerator of which is the number of days during which Executive was employed by the Company in the calendar year of Executive’s termination of employment and the denominator of which is three hundred sixty-five (365). Any payment due under this subsection shall be paid at the time that an annual bonus would normally be paid to Executive for such year, as provided in Section 7(a) (or if later, on the Settlement Date);

(iii)Executive will remain eligible to earn a pro-rata portion of any Performance-Based RSUs outstanding and subject to an open performance period as of the date of his termination. For each such award, the Performance-Based RSUs earned under this paragraph will be determined by multiplying (A) the number of such RSUs that would otherwise have been earned (but for Executive’s termination), based on actual performance results through the end of the applicable performance period, by (B) a fraction, the numerator of which is the number of days Executive was employed by the Company in the applicable performance period, and the denominator of which is the total number of days in the applicable performance period. Any Performance-Based RSUs earned under this paragraph will be immediately vested and paid out following the end of the performance period for such Performance-Based RSU; and

(iv)Executive will vest in any outstanding (A) time-vested stock options, and (B) Performance-Based RSUs earned on or prior to the date of Executive’s termination of employment, in each case to the extent such awards were not then otherwise vested.

(v)Except as and solely to the extent otherwise provided in this Section 11(a) and (b), all compensation and benefits will cease at the time of Executive’s cessation of employment and the Company will have no further liability or obligation by reason of such cessation of employment. The payments and benefits described in this Section 11(a) and (b) are in lieu of, and are not in addition to, any other severance plans, policies or arrangements maintained by the Company, including but not limited to severance plans applicable to other Company executives. Notwithstanding any other provision of this Agreement, the payments and benefits described in Section 11(b) are conditioned on Executive’s execution and delivery to the Company and the expiration of all applicable statutory revocation periods, by the 30th day following the effective date of Executive’s cessation of employment, of a general release of claims against the Company and its affiliates in substantially the form attached hereto as Exhibit A (but subject to such revisions as may be required, in the judgment of Company counsel, to reflect then applicable legal or regulatory requirements) (the “Release”).

(c) Other Terminations. If Executive’s employment with the Company ceases for any reason other than as described in Sections 11(a) and (b) above (including but not limited to termination by the Board for Cause or resignation by Executive without Good Reason), then the Company will provide to Executive:

(i) the payment of accrued and unpaid Base Salary through the date of such cessation of employment, paid at the time such Base Salary would otherwise be paid according to the Company’s usual payroll practices;

(ii) payment of any business expenses that were previously incurred but not reimbursed and are otherwise eligible for reimbursement, paid within 30 days following Executive’s termination of employment;

(iii) to the extent then unpaid, and solely with respect to resignation by Executive without Good Reason, the Company shall pay to Executive the annual incentive award (if any) earned with respect to the calendar year ended on or immediately prior to the date of such cessation of employment, paid at the time such bonus would normally be paid to Executive as provided in Section 7(a); and

(iv) to the extent not forfeited as a result of termination of Executive’s employment for Cause or resignation by Executive without Good Reason, any vested benefits under any Company benefit plan in which Executive participated and any other benefits for which Executive is entitled to from the Company for periods after cessation of employment, in each case payable as provided under the applicable plan.

Except as otherwise provided by COBRA, all compensation and benefits will cease at the time of such cessation of employment and the Company will have no further liability or obligation by reason of such termination; and, unless otherwise determined by the Committee at or after the time of the grant, all unvested and/or unearned equity and equity-based awards then held by Executive will be forfeited. The foregoing will not be construed to limit Executive’s right to payment or reimbursement for claims incurred prior to the date of such termination under any

insurance contract funding an employee benefit plan or arrangement of the Company in accordance with the terms of such insurance contract.

12. Section 409A.

(n)(a) The parties intend for this Agreement to comply with or be exempt from Section 409A of the Code, and all provisions of this Agreement will be interpreted and applied accordingly. Nonetheless, the Company does not guaranty the tax treatment of any compensation payable to Executive.

(o)(b) Notwithstanding anything to the contrary in this Agreement, to the extent necessary to facilitate compliance with Section 409A of the Code, no portion of the benefits or payments to be made under Section 11 above will be payable until Executive has a “separation from service” from the Company within the meaning of Section 409A of the Code. In addition, to the extent compliance with the requirements of Treas. Reg. § 1.409A-3(i)(2) (or any successor provision) is necessary to avoid the application of an additional tax under Section 409A of the Code to payments due to Executive upon or following Executive’s “separation from service,” then notwithstanding any other provision of this Agreement (or any otherwise applicable plan, policy, agreement or arrangement), any such payments that are otherwise due within six (6) months following Executive’s “separation from service” (taking into account the preceding sentence of this paragraph) will be deferred without interest and paid to Executive in a lump sum immediately following that six (6) month period. This paragraph should not be construed to prevent the application of Treas. Reg. § 1.409A-1(b)(9)(iii) (or any successor provision) to amounts payable hereunder. For purposes of the application of Section 409A of the Code, each payment under this Agreement is a separate payment and each installment payment will be deemed a separate payment.

(p)(c) Notwithstanding anything in this Agreement to the contrary, to the extent an expense, reimbursement or in-kind benefit provided to Executive pursuant to this Agreement or otherwise constitutes a “deferral of compensation” within the meaning of Section 409A of the Code: (i) the amount of expenses eligible for reimbursement or in-kind benefits provided to Executive during any calendar year will not affect the amount of expenses eligible for reimbursement or in-kind benefits provided to Executive in any other calendar year, (ii) the reimbursements for expenses for which Executive is entitled to be reimbursed shall be made on or before the last day of the calendar year following the calendar year in which the applicable expense is incurred, and (iii) the right to payment or reimbursement or in-kind benefits hereunder may not be liquidated or exchanged for any other benefit.

13. Section 280G. Notwithstanding any contrary provision of this Agreement (or any plan, policy, agreement or other arrangement covering Executive), if any payment, right or benefit paid, provided or due to Executive, whether pursuant to this Agreement or otherwise (each, a “Payment,” and collectively, the “Total Payments”), would subject Executive to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then the Total Payments will be reduced to the minimum extent necessary to avoid the imposition of the Excise Tax, but only if the amount of such Total Payments, as so reduced, is greater than or equal to the amount of such Total Payments without reduction (in each case, determined by the Company on an after-tax

basis). Any reduction of the Total Payments required by this paragraph will be implemented by determining the Parachute Ratio (as defined below and determined by the Company) for each Payment and then by reducing the Payments in order, beginning with the Payment with the highest Parachute Ratio. For Payments with the same Parachute Ratio, later Payments will be reduced before earlier Payments. For Payments with the same Parachute Ratio and the same time of payment, each Payment will be reduced proportionately. For purposes of this paragraph, “Parachute Ratio” means a fraction, (x) the numerator of which is the value of the applicable Payment, as calculated for purposes of Section 280G of the Code, and (y) the denominator of which is the economic value of the applicable Payment. All determinations pursuant to this paragraph shall be determined by an independent accounting firm engaged by the Company for this purpose.

14. Certain Definitions. For purposes of this Agreement:

(q)(a) “Cause” means any of the following: (i) gross misconduct by Executive in connection with the performance of Executive’s duties and responsibilities to the Company, including, without limitation, a breach of fiduciary duties or a misappropriation of funds or property; (ii) the conviction of Executive of any felony; (iii) a material breach by Executive of any agreement with or duty owed to the Company or its affiliates, which breach is not cured within fifteen (15) days after the delivery of written notice thereof; (iv) a material violation by Executive of the Company’s written employment policies, which violation is not cured within fifteen (15) days after the delivery of written notice thereof; or (v) Executive’s material failure to cooperate with a bona fide internal investigation or an investigation by regulatory or law enforcement authorities, after being instructed by the Company to cooperate, or the willful destruction or failure to preserve documents or other materials known to be relevant to such investigation or the inducement of others to fail to cooperate or to produce documents or other materials in connection with such investigation.

(r)(b) “Change in Control” has the meaning given to this term in the Company’s 2016 Long-Term Incentive Plan, as in effect on the Effective Date.

(s)(c) “Code” means the Internal Revenue Code of 1986, as amended.

(t)(d) “Disability” means a condition entitling Executive to benefits under the Company’s long term disability plan, policy or arrangement; provided, however, that if no such plan, policy or arrangement is then maintained by the Company and applicable to Executive, “Disability” will mean Executive’s inability to perform Executive’s duties under this Agreement due to a mental or physical condition that can be expected to result in death or that can be expected to last (or has already lasted) for a continuous period of 180 days or more, or for 180 days in any 240 consecutive-day period.

(u)(e) “Good Reason” means: (i) a material diminution in Executive’s authority, duties or responsibilities; (ii) if Executive is not re-elected to and/or appointed as Executive Chairman of the Board in 2025 or thereafter in any year in which Executive is still employed under the Agreement; (iii) a reduction in the Base Salary that exceeds ten percent (10%) of the Base Salary as in effect immediately prior to the reduction (excluding, however, the impact of

across-the-board salary reductions similarly affecting other senior executives of the Company); or (iv) the material breach of this Agreement by the Company; provided, however, that no such event will constitute Good Reason unless (x) Executive provides the Company with written objection to such event within ninety (90) days after the initial occurrence thereof, and (y) such event is not reversed or corrected by the Company within thirty (30) days of its receipt of such written objection, in which case Executive’s employment with the Company shall terminate at Executive’s election at the end of such thirty (30) day cure period.

15.Restrictive Covenants.

(v)(a) Restrictive Covenants. It is agreed and understood by the parties hereto that the Board appointed Executive as Executive Chairman to lead and manage a total reorganization of the Company’s business operations and recruit and recommend named officers in the aftermath of challenges following the COVID-19 pandemic. It is agreed and understood by and between the parties that the Executive Chairman shall not solicit Company customers or employees to engage in a competing business with the Company, compete with the Company, nor disclose confidential information or proprietary intellectual property of the Company following separation of Executive; provided, however, that this Section 15(a) shall not apply if Executive’s employment ceases due to a termination by the Board without Cause or a resignation by Executive for Good Reason.

(w)(b) Whistleblower Activities. Notwithstanding anything herein to the contrary, Executive understands that this Agreement will not (i) prohibit him from making reports of possible violations of federal law or regulation to any governmental agency or entity in accordance with the provisions of and rules promulgated under Section 21F of the Securities Exchange Act of 1934, as amended, or Section 806 of the Sarbanes-Oxley Act of 2002, or of any other whistleblower protection provisions of federal law or regulation, or (ii) require notification or prior approval by the Company of any such report; provided that, Executive is not authorized to disclose communications with counsel that were made for the purpose of receiving legal advice or that contain legal advice or that are protected by the attorney work product or similar privilege.

16.No Duty to Mitigate. Except as otherwise specifically provided herein, Executive’s entitlement to payments or benefits upon or following the termination of his or her employment will not be subject to mitigation or a duty to mitigate by Executive.

17.No Conflicting Agreements. Executive represents and warrants that Executive is not a party to or otherwise bound by any restrictive covenant or similar agreement that will conflict with, or be violated by, the performance of his duties to the Company or his obligations under this Agreement. Executive will not use or misappropriate any intellectual property, trade secrets or confidential information belonging to any third party.

18.Taxes. All compensation payable to Executive is subject to reduction to reflect applicable withholding and payroll taxes and other deductions required by law. Executive hereby acknowledges that the Company does not have a duty to design its compensation policies in a

manner that minimizes Executive’s tax liabilities, and Executive not make any claim against the Company or its board of directors related to tax liabilities arising from his or her compensation.

19.Counsel and Other Fees. Within 14 days of presentment of an invoice following the Effective Date, the Company will pay directly to Executive’s counsel the actual out-of-pocket costs and expenses, including but not limited to attorneys’ fees, reasonably incurred by Executive in connection with the preparation and negotiation of this Agreement and related matters.

20.Indemnification. In addition to, and without limiting, any and all indemnification rights provided to officers, directors, and/or employees of the Company pursuant to the Company’s Certificate of Incorporation and/or Bylaws, the Company shall indemnify and hold Executive harmless to the maximum extent permitted under applicable law for acts and omissions in Executive’s capacity as an officer, director, and/or employee of the Company. To the fullest extent not prohibited by applicable law and subject to Executive’s execution of any repayment undertaking required by applicable law, expenses incurred by Executive in defending any civil, criminal, administrative or investigative action, suit or proceeding in connection with Executive’s service as an officer, director, and/or employee of the Company shall be paid by the Company in advance of the final disposition of such action, suit or proceeding.

21.Entire Agreement; Assignment; Amendment.

(x)(a) This Agreement, including the exhibits, schedules and other documents referred to herein, constitutes the final and entire agreement of the parties with respect to the matters covered hereby and supersedes any prior and/or contemporaneous agreements, arrangements discussions, negotiations, representations or understandings (whether written, oral or implied) relating to the subject matter hereof; and, for the avoidance of doubt, Executive confirms there are no agreements, arrangements, discussions, negotiations, representations or understandings between Executive and the Company, or any affiliates of the Company, not referred to herein.

(y)(b) The rights and obligations of Executive hereunder are personal and may not be assigned. The Company shall assign this Agreement, and its rights and obligations hereunder, to any entity to which the Company transfers substantially all of its assets (or an affiliate thereof).

(z)(c) This Agreement may be amended or modified only by a written instrument signed by a duly authorized officer of the Company and Executive.

(aa)(d) For avoidance of doubt, the 2023 Letter Agreement will remain in effect until the Effective Date.

22.Arbitration. In the event of any dispute under the provisions of this Agreement or otherwise regarding Executive’s employment or compensation (other than a dispute in which the primary relief sought is an injunction or other equitable remedy, such as an action to enforce compliance with Section 15), the parties shall be required to have the dispute, controversy or claim settled by arbitration in Princeton Junction, New Jersey in accordance with the National

Rules for the Resolution of Employment Disputes then in effect of the American Arbitration Association (“AAA”), by one arbitrator mutually agreed upon by the parties (or, if no agreement can be reached within thirty (30) days after names of potential arbitrators have been proposed by the AAA, then by one arbitrator having relevant experience who is chosen by the AAA). Any award or finding will be confidential. The arbitrator may not award attorneys’ fees to either party unless a statute or contract at issue specifically authorizes such an award. Any award entered by the arbitrators will be final, binding and non-appealable and judgment may be entered thereon by either party in accordance with applicable law in any court of competent jurisdiction. This arbitration provision will be specifically enforceable. Each party will be responsible for its own expenses relating to the conduct of the arbitration (including reasonable attorneys’ fees and expenses) and will share equally the fees of the arbitrator.

23.Notices. All notices, demands or other communications hereunder shall be in writing and shall be deemed to have been duly given if delivered in person, by e-mail or fax, by United States mail, certified or registered with return receipt requested, or by a nationally recognized overnight courier service: (a) if to Executive, at the most recent address contained in the Company’s personnel files; (b) if to the Company, to the attention of its Legal Department at the address of its principal executive office; or (c) or at such other address as may have been furnished by such person in writing to the other party. Any such notice, demand or communication shall be deemed given on the date given, if delivered in person, e-mailed or faxed, on the date received, if given by registered or certified mail, return receipt requested or by overnight delivery service.

24.Headings. The headings of the sections of this Agreement are inserted for convenience only and shall not affect the meaning of this Agreement.

25.Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of New Jersey, without regard to its choice of law provisions.

26.Counterparts. This Agreement may be executed in separate counterparts, any one of which need not contain signatures of more than one party, but all of which taken together will constitute one and the same Agreement. Execution and delivery of signatures to this Agreement by electronic mail or DocuSign shall constitute effective delivery in the same manner as delivery of original signatures.

[Signature Page Follows]

This Agreement has been executed and delivered on the date first above written.

MISTRAS GROUP, INC.

By:

Name: Michael C. Keefe

Title: Executive Vice President, General Counsel and Secretary

EXECUTIVE

Manuel N. Stamatakis

Exhibit A

GENERAL RELEASE

This General Release (this “Release”) is executed by _____________ (“Employee”) on this _____, 20__.

WHEREAS, Employee’s employment with MISTRAS GROUP, INC. (“Mistras”) terminated on __________, ___; and

WHEREAS, in connection with the termination of Employee’s employment with Mistras, Employee is entitled to certain severance benefits described in Section 11(b) of the Employment Agreement by and between Mistras and Employee dated December 31, 2024 (the “Employment Agreement”), subject to the execution of this Release (the “Severance Benefits”).

NOW THEREFORE, in consideration of these premises and intending to be legally bound hereby:

1. Employee acknowledges that, in the absence of his/her execution of this Release, the Severance Benefits would not otherwise be due to him/her. Employee further acknowledges and agrees that (a) other than the Severance Benefits, Employee has no entitlement under any other severance or similar arrangement maintained by Mistras, and (b) except as otherwise provided specifically in this Release, the Released Parties (as defined below) do not and will not have any other liability or obligation to Employee.

2. Employee, for himself/herself and his/her estate, heirs, legal representatives, and assigns, releases and forever discharges Mistras and its related entities, parent companies, subsidiaries, and affiliates, and each of their respective current and former officers, directors, stockholders, members or other equity holders, agents, representatives, insurers, plan administrators, employees, predecessors, successors, and assigns (collectively, the “Released Parties”) from any and all claims, liabilities, obligations, promises, agreements, demands, damages, actions, and causes of action of every kind which Employee ever had, now has, hereafter shall or may have or assert against Released Parties for any matter, cause, or thing which may have occurred before and up to the date of the execution of this Release. This Release specifically includes, but is not limited to:

(a) any and all claims and matters which arose or otherwise relate to Employee’s employment with Mistras or the terms, conditions, circumstances and/or termination of that employment;

(b) any and all claims for wages or benefits (including, without limitation, salary, stock, commissions, bonuses, severance pay, health and welfare benefits, vacation pay and any other fringe-type benefits), including but not limited to claims under the Employee Retirement Income Security Act of 1974;

(c) any and all claims for employment discrimination, harassment or retaliation on the basis of any protected category, including but not limited to age, race, color, religion, sex, pregnancy, national origin, ancestry, veteran status, disability, medical condition and/or handicap, or genetics, in violation of any federal, state or local statute, ordinance, judicial precedent or executive order, including but not limited to claims for discrimination under the following statutes (as amended): Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e et seq., the Civil Rights Act of 1866, 42 U.S.C. § 1981 et seq., the Equal Pay Act, 29 U.S.C. § 206(d), et seq., the Age Discrimination in Employment Act, 29 U.S.C. § 621 et seq., the Older Workers Benefit Protection Act, 29 U.S.C. § 626(f), the Americans with Disabilities Act, 42 U.S.C. § 12101 et seq., the Pregnancy Discrimination Act, 42 U.S.C. Ch. 21, § 701(k), the Rehabilitation Act of 1973, the Immigration Reform Control Act, the Occupational Safety and Health Act, the Family and Medical Leave Act, 29 U.S.C. § 2601 et seq., the Genetic Information Nondiscrimination Act, 42 U.S.C. § 2000ff, et seq., New Jersey Law Against Discrimination, New Jersey Family Leave Act, New Jersey Paid Sick Leave Law, New Jersey Conscientious Employee Protection Act, the New Jersey Wage Payment Law, the New Jersey Wage and Hour Law, and all other applicable statutes of any state, county, or locality;

(d) any and all claims for breach of contract;

(e) any and all claims in tort (including but not limited to any claims for misrepresentation, defamation, interference with contract or prospective economic advantage, intentional infliction of emotional distress and negligence);

(f) any and all claims arising under any federal, state or local statute, ordinance, rule, regulation or common law principle;

(g) any and all claims for additional compensation or damages of any kind including, but not limited to, compensatory and punitive damages; and

(h) any and all claims for attorney’s fees and costs.

Employee understands that the general release of claims set forth herein covers claims that Employee knows about and those that he/she may not know about. Employee expressly accepts and assumes the risk that additional or different facts or claims may be discovered after execution of this Release, and Employee agrees that this Release shall remain effective notwithstanding such discovery.

3. This Release does not apply to any claim: (a) that cannot be waived by law; (b) that arose after the date Employee signs this Release; (c) to challenge the validity of this Release and the knowing and voluntary nature of Employee’s release under the Age Discrimination in Employment Act and/or the Older Workers’ Benefit Protection Act; (d) to elect COBRA continuation coverage; or (e) for indemnification under the By-Laws of Mistras, any agreement with Mistras for indemnification, or applicable law for Employee’s acts or omissions as an officer or director of Mistras, or for the benefit of any applicable directors and officers insurance policy.

4. Employee expressly warrants that he/she has no charges, complaints, lawsuits, actions, summons or other legal proceedings pending in any court or administrative or investigative body against any Released Party. Except as otherwise permitted by Sections 5(b) and 5(c) below, Employee: (a) promises not to file any lawsuit or claim asserting any cause of action released by this Release, and (b) agrees to not initiate, cause, encourage, induce, suggest, or threaten the filing of any claims, complaints, charges, or lawsuits against Mistras, by or on behalf of another person.

5. Notwithstanding the foregoing or any other provision hereof, this Release does not:

(a) prohibit Employee from providing truthful testimony in response to a subpoena or in defense of any claim against him/her;

(b) prohibit or restrict Employee’s ability to file a charge or complaint with or participate, testify, or assist in any investigation, hearing or other proceeding before the Equal Employment Opportunity Commission, Occupational Safety and Health Administration, National Labor Relations Board, or similar state or local agency (but does preclude his/her ability to obtain personal relief in connection with such activities); or

(c) prohibit Employee from (i) communicating with the U.S. Department of Justice, the U.S. Securities and Exchange Commission, the Commodity Futures Trading Commission, the Financial Industry Regulatory Authority or any similar state or federal government or regulatory authority; (ii) making any other disclosures that are protected under the whistleblower provisions of federal or other law or regulation; (iii) participating in any investigation or proceeding that may be conducted by an such agency or authority, in connection with reporting a possible securities law violation without notice to Mistras; and (iv) receiving an individual monetary award or other individual relief by virtue of participating in such governmental whistleblower program.

6. All remedies at law and equity shall be available for the enforcement of this Release and this Release may be pled as a full bar to the enforcement of any claim that Employee brings against any Released Party that, either in form or substance, is covered by this Release.

7. Employee acknowledges that his/her obligations under the Employment Agreement survive the termination of his/her employment, including (without limitation) his/her obligations under Sections 10(b), 10(d), 10(e) and 15 of the Employment Agreement. Employee affirms that the restrictive covenants contained in Section 15 of the Employment Agreement are reasonable and necessary to protect the legitimate interests of Mistras, that he/she received adequate consideration in exchange for agreeing to those provisions and that he/she will abide by those provisions.

8. Employee expressly acknowledges and recites that: (a) he/she has read and understands the terms of this Release in its entirety; (b) he/she has entered into this Release knowingly and voluntarily, without any duress or coercion; (c) he/she has been advised orally and is hereby advised in writing to consult with an attorney with respect to this

Release before signing it; (d) he/she was provided 21 calendar days after receipt of the Release to consider its terms before signing it, which 21 day period may be waived; (e) he/she is provided an unwaivable seven calendar days from the date of signing this Release to terminate and revoke this Release; and (f) in the case of a written revocation during those seven days, this Release shall be unenforceable, null and void. Employee may revoke this Release during those seven days by providing written notice of revocation to Mistras at the following address:

Mistras Group, Inc.

ATTN: General Counsel

195 Clarksville Road

Princeton Junction, New Jersey 08550

Any such notice of revocation will be deemed provided on the date actually received by Mistras. If Employee revokes this Release, he/she will forfeit the Separation Benefits and will not be entitled to any other severance benefits.

9. Employee agrees that this Release should not be construed as evidence of any wrongdoing by any Released Party.

10. Sections 22 and 25 of the Employment Agreement (regarding governing law and arbitration) are incorporated herein by reference and will govern any dispute regarding this Release.

IN WITNESS WHEREOF, Employee has executed this Release on the day and year first above written.

[EMPLOYEE]

MISTRAS GROUP, INC.

OPTION AWARD AGREEMENT

This Option Award Agreement (this “Award Agreement”), effective as of the Date of Grant set forth below, represents the grant of an option (the “Option”) to purchase shares of common stock, par value $.01 per share (“Common Stock”), of Mistras Group, Inc. (the “Company”) to Manuel N. Stamatakis (the “Participant”), subject to the terms and conditions set forth below. The grant of the Option has been made by the Board of Directors (the “Board”) of the Company and the Compensation Committee (the “Committee”) of the Board. The number of shares of Common Stock that may be purchased pursuant to the Option, and the per share exercise price (the “Exercise Price”) payable for shares of Common Stock upon exercise of the Option, are set forth in Article I of this Award Agreement.

The grant of the Option pursuant to this Award Agreement is being made pursuant to the terms and provisions of the Mistras Group, Inc. Amended and Restated 2016 Long-Term Incentive Plan (the “Plan”) relating to Options (as the term “Options” is defined in the Plan), which terms and provisions are hereby incorporated into this Award Agreement by this reference, as though fully set forth herein, except as and to the extent expressly provided to the contrary in this Award Agreement. Unless the context herein otherwise requires, the terms defined in the Plan shall have the same meanings herein. A copy of the Plan has been provided to the Participant along with this Award Agreement.

I. STOCK OPTION GRANT AWARD TERMS

| | | | | |

The Participant has been granted, for service as Executive Chairman of the Board of the Company, the Option to purchase shares of Common Stock, subject to the terms and conditions of this Award Agreement, as set forth above and as follows: |

Date of Grant: | [January __], 2025 1 |

Vesting Date: | [January __] 20262 |

Exercise Price per Share: | $[_____]3 |

Total Number of Shares Granted: | 375,000 shares of Common Stock (the “Shares”) |

Total Exercise Price: | $[_____]4 |

Type of Option: | Non-Qualified Stock Option (“NSO”) |

Expiration Date: | Ten (10) years from Date of Grant |

1 To be second business day after filing Form 8-K disclosing employment terms, employment agreement and option agreement.

2 To be on the one year anniversary of the Date of Grant.

3 To be closing price on date of grant

4 Exercise price per share time 375,000

The Option shall become fully vested and exercisable on the Vesting Date set forth above, provided the Participant remains in continuous employment or service with the Company from the Date of Grant through the Vesting Date. In addition, the vesting and exercisability of the Option shall fully accelerate so that the Option is fully vested and exercisable upon termination of the Participant’s employment or service with the Company due to his death or Disability, if such occurs prior to the Vesting Date. The vesting and exercisability of the Option will also fully accelerate so that the Option is fully vested and exercisable in connection with termination of Participant’s employment to the extent, and subject to the conditions, described in Section 11(b) of that certain employment agreement between the Company and the Participant dated December 31, 2024.

Exercise Period:

The Option shall be exercisable by the Participant (or the Participant’s estate or legal representative upon the Participant’s death) at any time from and after the Vesting Date (or earlier, if pursuant to the terms of this Award Agreement or the Plan, the Option is exercisable earlier) up to and including the earliest of (i) the Expiration Date set forth above, (ii) one year following the date on which Participant’s employment or service terminates, (iii) the date the Participant’s employment is terminated by the Company for Cause (or the date the Participant’s service ceases, if at such time there exist grounds for a termination for Cause); and (iv) immediately prior to the effective time of a Change in Control, to the extent Section 9.2 of the Plan is implicated. For the avoidance of doubt, for so long as the Participant is an employee and/or a director of the Company, the Participant’s employment or service to the Company shall not be deemed to have ceased.

II. ADDITIONAL TERMS

1.Exercise of Option.

(a)Method of Exercise. The Option shall be exercisable by delivery of an exercise notice or in a manner and pursuant to such procedures as the Committee may determine (the “Exercise Notice”), which shall state the election to exercise the Option, the number of Shares with respect to which the Option is being exercised (the “Exercised Shares”), and such other representations as may be required by the Company. The Exercise Notice shall be accompanied by payment of the aggregate Exercise Price as to all Exercised Shares, together with any applicable tax withholding. The Option shall be deemed to be exercised upon receipt by the Company of the Exercise Notice accompanied by the aggregate Exercise Price, together with any applicable tax withholding.

(b)Compliance with Law. No Shares shall be issued pursuant to the exercise of the Option unless such issuance and such exercise comply with applicable laws.

2.Method of Payment. Payment of the aggregate Exercise Price shall be by any of the following, or a combination thereof, at the election of the Participant:

(i)cash, check, bank draft, electronic funds transfer or money order payable to the Company;

(ii)by delivery to the Company (either by actual delivery or attestation) of already-owned shares of Common Stock provided that such shares (x) shall be valued at Fair Market Value on the date of exercise, and (y) must be owned free and clear of any liens, claims, encumbrances or security interests;

(iii)by payment to the Company pursuant to a broker-assisted cashless exercise program established and maintained by the Company in connection with the Plan; or

(iv)by a “net exercise” pursuant to which the Company will reduce the number of shares of Common Stock issued upon exercise of the Option by the largest whole number of shares necessary to satisfy the Exercise Price, with such shares of Common Stock being valued at Fair Market Value as of the date of exercise, provided, that the Participant must pay any remaining balance of the aggregate Exercise Price not satisfied by the “net exercise” in another form of payment set forth herein.

3.Transferability of Option. Section 12.1 of the Plan shall be applicable to the Options and, consistent with Section 12.1 of the Plan, the Committee has determined that the Option may be transferred inter vivos by the Participant to any “family member” (within the meaning of Item A(1)(a)(5) of the General Instructions to SEC Form S-8 or a successor), including, without limitation, to one or more trusts, partnerships, limited liability companies or other entities which qualify as family members, provided that (i) such transfer is not a transfer for value; or (ii) such transfer is a transfer for value that the Committee determines is for estate planning purposes. Upon the Participant’s death, the Option will pass to the “beneficiary” designated by the Participant in accordance with Section 12.1 of the Plan (or, in the absence of such a designation, or if no designated beneficiary survives the Participant, to the Participant’s estate). Subject to the foregoing, the terms of this Award Agreement shall be binding upon the executors, administrators, heirs, successors and permitted assigns of the Participant.

4.Eligible Retirement.

(a) The following terms shall govern if Participant retires pursuant to an Eligible Retirement. As used in this Section 4 “Eligible Retirement” means that Participant has reached the age of 65. If Participant meets the Eligible Retirement terms, and Participant retires or resigns (other than on account of Good Reason) from providing service to the Company and its subsidiaries prior to the Vesting Date, Participant will be a “Retiree.” If Participant is a Retiree, the Option hereunder shall remain outstanding and shall become vested and fully exercisable on the original Vesting Date and such Option shall remain exercisable for the period as provided below under the Exercise Period, but only on the condition that Participant continuously complies with the restrictive covenants set forth below in (b) from the date Participant becomes a Retiree until the expiration of six (6) months following the Vesting Date of the Option.

(b) In consideration of Participant becoming a Retiree and the benefit of post-retirement vesting and exercisability of the Option on account of Participant becoming a Retiree, Participant agrees that continuously until 6 months following the Vesting Date (such period being the “Restricted Period”), Participant shall not, directly or indirectly, on his own behalf or on behalf of any person other than the Company (i) engage in, have an equity or profit interest in,

or lend money to, or manage, operate, or work for any person, firm, corporation, partnership, or business (whether as a director, officer, employee, agent, representative, partner, security holder, consultant, or otherwise) that engages in any business which competes in any respect with the Company or any of its Subsidiaries, or (ii) recruit or otherwise solicit or induce any employee, consultant, customer, client, or supplier of the Company or any of its Subsidiaries to (A) terminate its employment or other business arrangement or relationship with the Company or any of its Subsidiaries, (B) otherwise change its relationship with the Company or any of its Subsidiaries or (C) establish any business relationship with him or person controlled by or related to him for any business purpose competitive with the Company or any of its Subsidiaries. A passive investment by Participant in a publicly traded company in which Participant exercises no operational or strategic control and which constitutes less than 2% of the outstanding shares of such entity shall not constitute a breach of this covenant.

(c) If Participant fails to meet the restrictive covenants set forth in (b) above continuously during the Restricted Period, then (i) any portion of the Option that is outstanding shall automatically be cancelled and forfeited, and (ii) Participant shall repay to the Company the value, if any, realized by him from an exercise of the Option where such Option is exercised during the Restricted Period without any reduction for taxes paid by or withheld on his behalf on account of any such value realized.

5.Tax Withholding. The Company reserves the right to withhold, in accordance with applicable laws, from any consideration payable or property transferable to the Participant (including any Shares issuable to the Participant upon the exercise of the Option), any taxes required to be withheld by federal, state or local law as a result of the grant or exercise of the Option or the sale or other disposition of the Shares. If the amount of any consideration payable to the Participant is insufficient to pay such taxes or if no consideration is payable to the Participant, upon the request of the Company, the Participant will pay to the Company an amount sufficient for the Company to satisfy any federal, state or local tax withholding requirements applicable to and as a condition to the exercise of the Option. The minimum withholding obligations may be settled with the Shares.

6.Entire Agreement; Governing Law. This Award Agreement constitutes the entire agreement of the parties with respect to the subject matter hereof and supersedes any and all prior undertakings and agreements of the Company and the Participant with respect to the subject matter hereof. This Award Agreement may not be amended except by means of a writing signed by the Company and the Participant, and, for the avoidance of doubt, if any provision of the Plan that is incorporated by reference herein and applicable to the Option is amended, and such amendment would adversely affect the Participant’s interest, then such amended provision shall not be given effect hereunder unless reflected in a writing signed by the Company and the Participant. This Award Agreement is governed by the internal substantive laws but not the choice of law rules of the State of Delaware.

7.No Guarantee of Continued Service. THE PARTICIPANT ACKNOWLEDGES AND AGREES THAT THIS AWARD AGREEMENT AND THE TRANSACTIONS CONTEMPLATED HEREUNDER DO NOT CONSTITUTE AN EXPRESS OR IMPLIED PROMISE OF CONTINUED ENGAGEMENT FOR ANY PERIOD, OR AT ALL, AND SHALL NOT INTERFERE IN ANY WAY WITH THE PARTICIPANT’S RIGHT OR THE

RIGHT OF THE COMPANY TO TERMINATE THE PARTICIPANT’S RELATIONSHIP WITH THE COMPANY AT ANY TIME, WITH OR WITHOUT CAUSE.

8.Administration. The Option, this Award Agreement and the rights of the Participant hereunder are subject to such rules and regulations as the Committee may adopt for administration of the Plan. Consistent with Section 3 of the Plan, it is expressly understood that the Committee is authorized to administer, construe, and make all determinations necessary or appropriate to the administration of the Option and this Award Agreement, all of which shall be binding upon the Participant and his successors.

9.Electronic Delivery of Documents. The Participant authorizes the Company and its affiliates to deliver electronically any prospectuses or other documentation related to the Option and any other compensation or benefit plan or arrangement in effect from time to time (including, without limitation, periodic reports, proxy statements or other documents that are required to be delivered to participants in such arrangements pursuant to federal or state laws, rules or regulations). For this purpose, electronic delivery will include, without limitation, delivery by means of e-mail or e-mail notification that such documentation is available on the Company’s intranet site or the website of a third-party administrator designated by the Company. Upon written request, the Company will provide to the Participant a paper copy of any document also delivered to the Participant electronically. The authorization described in this paragraph may be revoked by the Participant at any time by written notice to the Company.

[Signature Page Follows]

The Participant hereby accepts the Option subject to all of the terms and provisions of this Award Agreement.

PARTICIPANT MISTRAS GROUP, INC.

___________________________ ___________________________

Manuel N. Stamatakis By: Michael Keefe

Title: EVP and General Counsel

Signature Page to Award Agreement – Manuel N. Stamatakis

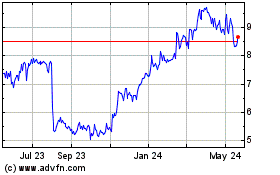

Mistras (NYSE:MG)

Historical Stock Chart

From Dec 2024 to Jan 2025

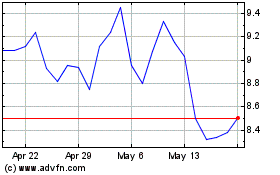

Mistras (NYSE:MG)

Historical Stock Chart

From Jan 2024 to Jan 2025