| | | | | |

Barings Participation Investors |

| |

| |

Report for the Three Months Ended March 31, 2024 |

| |

| |

| |

Adviser

Barings LLC

300 S Tryon St., Suite 2500

Charlotte, NC 28202

Independent Registered Public Accounting Firm

KPMG LLP

Boston, Massachusetts 02110

Counsel to the Trust

Ropes & Gray LLP

Boston, Massachusetts 02111

Custodian

State Street Bank and Trust Company

Boston, Massachusetts 02110

Transfer Agent & Registrar

SS&C Global Investor & Distribution Solution, Inc., formerly known as DST System, Inc. ("SS&C GIDS")

P.O. Box 219086

Kansas City, Missouri 64121-9086

1-800-647-7374

Internet Website

https://www.barings.com/mpv

| | | | | |

| Barings Participation Investors c/o Barings LLC 300 S Tryon St., Suite 2500 Charlotte, NC 28202 1-866-399-1516 |

Investment Objective and Policy

Barings Participation Investors (the “Trust”) is a closed-end management investment company, first offered to the public in 1988, whose shares are traded on the New York Stock Exchange under the trading symbol “MPV”. The Trust’s share price can be found in the financial section of most newspapers under either the New York Stock Exchange listings or Closed-End Fund Listings.

The Trust’s investment objective is to maintain a portfolio of securities providing a current yield and, when available, an opportunity for capital gains. The Trust’s principal investments are privately placed, below-investment grade, long-term debt obligations including bank loans and mezzanine debt instruments. Such private placement securities may, in some cases, be accompanied by equity features such as common stock, preferred stock, warrants, conversion rights, or other equity features. The Trust typically purchases these investments, which are not publicly tradable, directly from their issuers in private placement transactions. These investments are typically made to small or middle market companies. In addition, the Trust may invest, subject to certain limitations, in marketable debt securities (including high yield and/or investment grade securities) and marketable common stocks. Below-investment grade or high yield securities have predominantly speculative characteristics with respect to the capacity of the issuer to pay interest and repay principal.

The Trust distributes substantially all of its net income to shareholders each year. Accordingly, the Trust pays dividends to shareholders four times per year. The Trust pays dividends to its shareholders in cash, unless the shareholder elects to participate in the Dividend Reinvestment and Share Purchase Plan.

Form N-PORT

The Trust files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on part F of Form N-PORT. This information is available (i) on the SEC’s website at http://www.sec.gov; and (ii) at the SEC’s Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available upon request by calling, toll-free, 866-399-1516.

Proxy Voting Policies & Procedures; Proxy Voting Record

The Trustees of the Trust have delegated proxy voting responsibilities relating to the voting of securities held by the Trust to Barings LLC (“Barings”). A description of Barings’ proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 866-399-1516; (2) on the Trust’s website at https://www.barings.com/mpv; and (3) on the SEC’s website at http://www.sec.gov. Information regarding how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended March 31, 2024 is available (1) on the Trust’s website at https://www.barings.com/mpv; and (2) on the SEC’s website at http://www.sec.gov.

Legal Matters

The Trust has entered into contractual arrangements with an investment adviser, transfer agent and custodian (collectively “service providers”) who each provide services to the Trust. Shareholders are not parties to, or intended beneficiaries of, these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the Trust.

Under the Trust’s Bylaws, any claims asserted against or on behalf of the Trust, including claims against Trustees and officers must be brought in courts located within the Commonwealth of Massachusetts.

The Trust’s registration statement and this shareholder report are not contracts between the Trust and its shareholders and do not give rise to any contractual rights or obligations or any shareholder rights other than any rights conferred explicitly by federal or state securities laws that may not be waived.

Barings Participation Investors

TO OUR SHAREHOLDERS

April 30, 2023

We are pleased to present the March 31, 2024, Quarterly Report of Barings Participation Investors (the “Trust”).

PORTFOLIO PERFORMANCE

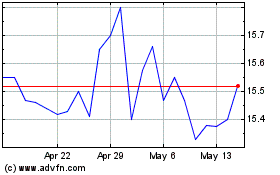

The Board of Trustees declared a quarterly dividend of $0.36 per share, payable on June 14, 2024, to shareholders of record on May 31, 2024. This represents an increase of $0.01 per share or 2.9% over the previous dividend of $0.35 per share and the seventh consecutive quarterly increase. The Trust earned $0.36 per share of net investment income, net of taxes, for the first quarter of 2024, compared to $0.33 per share in the previous quarter. The increase in net investment income was predominantly related to $0.04 per share of excise tax expense in the fourth quarter, while core earnings were flat as base rates leveled off in the first quarter.

| | | | | | | | | | | | | | | | | |

| March 31, 2023(1)(2) | | December 31, 2023(1) | | % Change |

Quarterly Dividend per share(3) | 0.36(3) | | $ | 0.35 | | | 2.9 | % |

Net Investment Income(4) | $ | 3,803,025 | | | $ | 3,529,750 | | | 7.7 | % |

| Net Assets | $ | 168,705,696 | | | $ | 163,366,715 | | | 3.3 | % |

Net Assets per share(5) | $ | 15.88 | | | $ | 15.41 | | | 3.0 | % |

| Share Price | $ | 16.12 | | | $ | 15.60 | | | 3.3 | % |

| Dividend Yield at Share Price | 8.9 | % | | 9.0 | % | | (1.1) | % |

| (Discount) / Premium | 1.5 | % | | 1.2 | % | | |

| | | | | |

(1) Past performance is no guarantee of future results

(2) Figures are unaudited

(3) Payable on June 14, 2024

(4) Figures are shown net of excise tax

(5) Based on shares outstanding at the end of the period of 10,601,700 as of 12/31/2023 and 10,622,422 as of 3/31/2024, respectively.

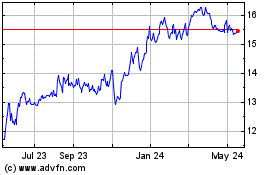

•Quarterly total returns at March 31, 2024, and December 31, 2023, were 3.1% and 2.7%, respectively. Longer term, the Trust returned 11.6%, 10.7%, 10.2%, 9.6%, and 11.0% for the 1, 3, 5, 10, and 25-year periods, respectively, based on the change in the Trust’s net assets assuming the reinvestment of all dividends

•The Trust’s average quarter-end discount for the 1, 3, 5 and 10-year periods was (7.1)%, (11.5)%, (6.5)% and (1.7)%, respectively

•U.S. fixed income markets, as approximated by the Bloomberg Barclays U.S. Corporate High Yield Index and the Credit Suisse Leveraged Loan Index, returned 1.5% and 2.5% for the quarter, respectively

PORTFOLIO BENEFITS

•We believe the Trust benefits from being part of the larger Barings North American Private Finance (“NAPF”) platform, which as of March 31, 2024, has over 30 years of experience and had commitments of over $26 billion to private credit.

•The NAPF platform has provided two primary benefits to the Trust: Direct deal origination and credit underwriting. NAPF has served as the Lead or Co-Lead on over 80% of its originated transactions and has a senior loan loss rate of 0.03% since inception. The benefit of being the Lead or Co-Lead lender is the ability to lead negotiations on terms and have influence over the credit agreement.

•The Trust has continued to benefit from NAPF’s strong origination relationships with private equity sponsors. Every private placement investment in the portfolio was directly originated by Barings via a sponsor (without a financial intermediary), where one hundred percent of the economics are passed through to investors.

•The Trust has consistently generated a stable dividend yield for investors, which to date has been paid exclusively from investment income and capital gains – no return of capital, all while employing a limited amount of leverage 0.10x.

•The Trust continues to invest in what we believe are high-quality companies in defensive sectors and remains well diversified with 33 different industries across 155 assets, where over 65% of those investments are first lien senior secured loans that we believe provide strong risk adjusted returns. The Trust continues to invest in senior subordinated debt when we believe the risk

adjusted return is appropriate. Approximately 13% of the market value of the Trust was equity, generating ~$10.5 million ($0.99 per share) in unrealized appreciation as of March 31, 2024.

(Continued)

PORTFOLIO ACTIVITY

Consistent with the stated investment objective of the Trust, we continued to search for relative value across the capital structure of potential investments that provide current yield with an opportunity for capital gains. The Trust closed eight new private placement investments and add-on investments to 28 existing portfolio companies during the first quarter of 2024. The total amount invested by the Trust in these transactions was $10.7 million.

PORTFOLIO LIQUIDITY

The Trust maintained a liquidity position comprised of a combination of its available cash balance and short-term investments of $4.0 million or 2.1% of total assets, in addition to a low leverage profile at 0.10x as of March 31, 2024. Given the migration of the portfolio towards more senior secured investments, the Trust increased its revolving credit facility with MassMutual to a total commitment of $22.5 million (See Note 4). This increased facility coupled with the current cash balance provides liquidity to support our current portfolio companies as well as invest in new portfolio companies. As always, the Trust continues to benefit from strong relationships with our carefully chosen financial sponsor partners. These relationships provide clear benefits to the portfolio companies including potential access to additional capital if needed and strategic thinking to compliment a company’s management team. High-quality and timely information about portfolio companies, which is only available in a private market setting, allows us to work constructively with financial sponsors and maximize the portfolio companies’ long-term health and value.

The Trust’s recently announced dividend of $0.36 per share is the seventh consecutive quarterly dividend increase. With more than 65% of the Trust in first lien floating rate loans, the Trust's net investment income has increased as interest rates have risen. We believe the increase in interest rates coupled with the overall strong credit quality of the Trusts supports the increase in the quarterly dividend. In determining the quarterly dividend, the Board of Trustees seeks to ensure that the Trust will be able to pay sustainable dividends over the long term.

Thank you for your continued interest in and support of Barings Participation Investors.

Sincerely,

Christina Emery

President

Portfolio Composition as of 03/31/24*

* Based on market value of total investments

Cautionary Notice: Certain statements contained in this report may be “forward looking” statements. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management’s current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that may cause actual results to differ materially. These statements are subject to change at any time based upon economic, market or other conditions and may not be relied upon as investment advice or an indication of the Trust’s trading intent. References to specific securities are not recommendations of such securities, and may not be representative of the Trust’s current or future investments. We undertake no obligation to publicly update forward looking statements, whether as a result of new information, future events, or otherwise.

| | | | | | | | | | | |

Average Annual Returns March 31, 2024 | 1 Year | 5 Year | 10 Year |

| Barings Participation Investors | 38.31 | % | 8.56 | % | 10.06 | % |

| Bloomberg Barclays U.S. Corporate High Yield Index | 11.15 | % | 4.21 | % | 4.44 | % |

Data for Barings Participation Investors (the “Trust”) represents returns based on the change in the Trust’s market price assuming the reinvestment of all dividends and distributions. Past performance is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on distributions from the Trust or the sale of shares.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | |

| Assets: | |

Investments

(See Consolidated Schedule of Investments) | |

| Corporate restricted securities - private placement investments at fair value | $ | 173,828,287 |

(Cost - $ 165,971,201) | |

| Corporate restricted securities - rule 144A securities at fair value | 5,242,655 |

(Cost - $ 5,439,310) | |

| Corporate public securities at fair value | 1,824,582 |

(Cost - $ 2,184,028) | |

| |

Total investments (Cost - $ 173,594,539) | 180,895,524 |

| Cash | 4,005,134 |

Foreign currencies (Cost - $ 6,830) | 6,381 |

| Dividend and interest receivable | 2,008,796 |

| Receivable for investments sold | 407,943 |

| Other assets | 193,635 |

| Total assets | 187,517,413 |

| |

| Liabilities: | |

| Note payable | 15,000,000 |

| Credit facility (net of deferred financing fees) | 2,832,421 |

| Deferred tax liability | 334,789 |

| Investment advisory fee payable | 379,588 |

| Interest payable | 65,332 |

| |

| Accrued expenses | 199,587 |

| Total liabilities | 18,811,717 |

| Commitments and Contingencies (See Note 7) | |

| Total net assets | $ | 168,705,696 |

| Net Assets: | |

Common shares, par value $0.01 per share | $ | 106,224 |

| Additional paid-in capital | 144,491,153 |

| Total distributable earnings | 24,108,319 |

| Total net assets | $ | 168,705,696 |

Common shares issued and outstanding (14,787,750 authorized) | 10,622,422 |

| Net asset value per share | $ | 15.88 |

See Notes to Consolidated Financial Statements 5

CONSOLIDATED STATEMENT OF OPERATIONS Barings Participation Investors

For the three months ended March 31, 2024

(Unaudited)

| | | | | |

| Investment Income: | |

| Interest | $ | 4,816,370 |

| Dividends | 21,012 |

| Other | 56,346 |

| Total investment income | 4,893,728 |

| Expenses: | |

| Interest and other financing fees | 440,427 |

| Investment advisory fees | 379,588 |

| Professional fees | 131,965 |

| Trustees’ fees and expenses | 69,000 |

| Reports to shareholders | 42,000 |

| Custodian fees | 6,000 |

| Other | 21,723 |

| Total expenses | 1,090,703 |

| Investment income - net | 3,803,025 |

| Income tax, including excise tax expense | — |

| Net investment income after taxes | 3,803,025 |

| Net realized and unrealized gain on investments and foreign currency: | |

| Net realized gain on investments before taxes | 895,020 |

| Income tax benefit | 2,786 |

| Net realized gain on investments after taxes | 897,806 |

| Net increase in unrealized appreciation of investments before taxes | 369,978 |

| Net decrease in unrealized appreciation of foreign currency translation before taxes | (168) |

| Deferred income tax benefit (expense) | (52,015) |

| Net increase in unrealized appreciation of investments and foreign currency transactions after taxes | 317,795 |

| Net gain on investments and foreign currency | 1,215,601 |

| Net increase in net assets resulting from operations | $ | 5,018,626 |

See Notes to Consolidated Financial Statements 6

CONSOLIDATED STATEMENT OF CASH FLOWS Barings Participation Investors

For the three months ended March 31, 2024

(Unaudited)

| | | | | |

| Net decrease in cash & foreign currencies: | |

| Cash flows from operating activities: | |

| |

| Purchases of portfolio securities | $ | (12,351,391) |

| Proceeds from disposition of portfolio securities | 13,705,543 |

| Interest, dividends and other income received | 5,291,636 |

| Interest expenses paid | (603,326) |

| Operating expenses paid | (937,347) |

| Income taxes paid | (447,214) |

| Net cash provided by operating activities | 4,657,901 |

| Cash flows from financing activities: | |

| |

| Repayments under credit facility | (3,750,000) |

| Receipts for shares issued on reinvestment of dividends | 320,355 |

| Cash dividends paid from net investment income | (3,710,595) |

| |

| Net cash used for financing activities | (7,131,364) |

| Net decrease in cash & foreign currencies | (2,473,463) |

| Cash & foreign currencies - beginning of period | 6,485,146 |

| Effects of foreign currency exchange rate changes on cash and cash equivalents | (168) |

| Cash & foreign currencies - end of period | $ | 4,011,515 |

Reconciliation of net increase in net assets to

net cash provided by operating activities: | |

| Net increase in net assets resulting from operations | $ | 5,018,626 |

| Increase in investments | (2,031,257) |

| Decrease in interest receivable | 779,499 |

| Increase in receivable for investments sold | (7,429) |

| Decrease in payment-in-kind non-cash income received | 1,274,687 |

| Decrease in amortization | 437,022 |

| Decrease in other assets | 34,540 |

| Increase in deferred tax liability | 52,015 |

| Decrease in investment advisory fee payable | (362,010) |

| Decrease in interest payable | (162,899) |

| |

| Increase in accrued expenses | 74,939 |

| Decrease in tax payable | (450,000) |

| Total adjustments to net assets from operations | (360,893) |

| Effects of foreign currency exchange rate changes on cash and cash equivalents | 168 |

| Net cash provided by operating activities | $ | 4,657,901 |

See Notes to Consolidated Financial Statements 7

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS Barings Participation Investors

| | | | | | | | | | | |

| For the three months ended

03/31/2024

(Unaudited) | | For the

year ended

12/31/2023 |

| Increase in net assets: | | | |

| Operations: | | | |

| Investment income - net | $ | 3,803,025 | | $ | 15,877,015 |

| Net realized gain / (loss) on investments and foreign currency after taxes | 897,806 | | (333,114) |

| Net change in unrealized appreciation / (depreciation) of investments and foreign currency after taxes | 317,795 | | 2,575,432 |

| | | |

| Net increase in net assets resulting from operations | 5,018,626 | | 18,119,333 |

| | | |

| Increase from common shares issued on reinvestment of dividends | | | |

| 320,355 | | — |

| | | |

| Dividends to shareholders from: | | | |

| Distributable earnings to Common Stock Shareholders | | | |

| — | | (13,676,193) |

| | | |

| Total increase / (decrease) in net assets | 5,338,981 | | 4,443,140 |

| | | |

| Net assets, beginning of period/year | 163,366,715 | | 158,923,575 |

| | | |

| Net assets, end of period/year | $ | 168,705,696 | | $ | 163,366,715 |

See Notes to Consolidated Financial Statements 8

CONSOLIDATED SELECTED FINANCIAL HIGHLIGHTS Barings Participation Investors

Selected data for each share of beneficial interest outstanding:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended

03/31/2024

(Unaudited) | | For the years ended December 31, |

| | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Net asset value: Beginning of period/year | $ | 15.41 | | $ | 14.99 | | $ | 15.19 | | $ | 13.60 | | $ | 13.80 | | $ | 13.18 |

| Net investment income (a) | 0.36 | | 1.50 | | 0.97 | | 0.86 | | 1.00 | | 1.00 |

| Net realized and unrealized gain / (loss) on investments | 0.11 | | 0.21 | | (0.31) | | 1.53 | | (0.40) | | 0.69 |

| Total from investment operations | 0.47 | | 1.71 | | 0.66 | | 2.39 | | 0.60 | | 1.69 |

| Dividends from net investment income to common shareholders | — | | (1.29) | | (0.83) | | (0.80) | | (0.80) | | (1.08) |

| Dividends from realized gain on investments to common shareholders | — | | — | | (0.03) | | — | | — | | — |

| Increase from dividends reinvested | 0.00 (b) | | — | | — | | — | | 0.00 (b) | | 0.01 |

| Total dividends | — | | (1.29) | | (0.86) | | (0.80) | | (0.80) | | (1.07) |

| Net asset value: End of period/year | $ | 15.88 | | $ | 15.41 | | $ | 14.99 | | $ | 15.19 | | $ | 13.60 | | $ | 13.80 |

| Per share market value: End of period/year | $ | 16.12 | | $ | 15.60 | | $ | 12.32 | | $ | 14.80 | | $ | 11.88 | | $ | 16.13 |

| Total investment return | | | | | | | | | | | |

| Net asset value (c) | 3.05% | | 12.46% | | 4.42% | | 17.84% | | 4.66% | | 13.21% |

| Market value (c) | 3.33% | | 38.51% | | (10.57%) | | 32.09% | | (21.11%) | | 14.72% |

| Net assets (in millions): End of period/year | $ | 168.71 | | $ | 163.37 | | $ | 158.92 | | $ | 161.08 | | $ | 144.18 | | $ | 146.08 |

| Ratio of total expenses to average net assets (d) | 2.64% (e) | | 2.66% | | 2.35% | | 2.66% | | 1.47% | | 2.26% |

| Ratio of operating expenses to average net assets | 1.58% (e) | | 1.56% | | 1.46% | | 1.46% | | 1.38% | | 1.45% |

| Ratio of interest expense to average net assets | 1.07% (e) | | 0.76% | | 0.63% | | 0.41% | | 0.43% | | 0.42% |

| Ratio of income tax expense to average net assets | (0.01)% (e) | | 0.34% | | 0.26% | | 0.79% | | (0.34)% | | 0.39% |

| Ratio of net investment income to average net assets | 9.23% (e) | | 9.69% | | 6.39% | | 5.99% | | 7.52% | | 7.30% |

| Portfolio turnover | 7% | | 12% | | 12% | | 43% | | 34% | | 22% |

(a) Calculated using average shares.

(b) Rounds to less than $0.01 per share.

(c) Net asset value return represents portfolio returns based on change in the Trust’s net asset value assuming the reinvestment of all dividends and distributions which differs from the total investment return based on the Trust’s market value due to the difference distributions which differs from the total investment return based on the Trust’s market value due to the difference between the Trust’s net asset value and the market value of its shares outstanding; past performance is no guarantee of future results.

(d) Total expenses include income tax expense.

(e) Annualized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended

03/31/2024

(Unaudited) | | For the years ended December 31, |

| Senior borrowings: | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| Total principal amount (in millions) | $ | 18 | | $ | 22 | | $ | 24 | | $ | 21 | | $ | 15 | | $ | 15 |

| Asset coverage per $1,000 of indebtedness | $ | 10,373 | | $ | 8,511 | | $ | 7,763 | | $ | 8,670 | | $ | 10,612 | | $ | 10,739 |

See Notes to Consolidated Financial Statements 9

Consolidated Schedule of Investments Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| 1WorldSync, Inc. | | | | | | | | |

| A product information sharing platform that connects manufacturers/suppliers and key retailers via the Global Data Synchronization Network. |

| 10.18% Term Loan due 06/24/2025 (SOFR + 4.750%) | | $ | 2,384,283 | | | * | | $ | 2,373,248 | | | $ | 2,384,282 | |

| * 07/01/19 and 12/09/20. | | | | | | | | |

| | | | | | | | |

| Accurus Aerospace | | | | | | | | |

| A supplier of highly engineered metallic parts, kits and assemblies, and processing services. |

| 10.72% First Lien Term Loan due 03/31/2028 (SOFR + 5.250%) (G) | | $ | 485,953 | | | 04/05/22 | | 468,889 | | | 461,122 | |

| Limited Liability Company Unit (B) | | 8,752 uts. | | 10/14/21 | | 8,752 | | | 8,577 | |

| | | | | | 477,641 | | | 469,699 | |

| AdaCore Inc | | | | | | | | |

| AdaCore is a provider of a software development toolkit that helps software developers to write code for embedded systems using a number of programming languages, including Ada, C/C++, Rust, and SPARK. |

| 11.56% First Lien Term Loan due 03/13/2030 (SOFR + 6.250%) (G) | | $ | 1,173,376 | | | 03/13/24 | | 766,864 | | 766,609 |

| | | | | | | | |

| Advanced Manufacturing Enterprises LLC | | | | | | | | |

| A designer and manufacturer of large, custom gearing products for a number of critical customer applications. |

| Limited Liability Company Unit (B) | | 1,945 uts. | | * | | 207,911 | | | — | |

| * 12/07/12, 07/11/13 and 06/30/15. | | | | | | | | |

| | | | | | | | |

| Advantage Software | | | | | | | | |

| A provider of enterprise resource planning (ERP) software built for advertising and marketing agencies. |

| Limited Liability Company Unit Class A (B) (F) | | 766 uts. | | 10/01/21 | | 24,353 | | | 61,231 | |

| Limited Liability Company Unit Class A (B) (F) | | 197 uts. | | 10/01/21 | | 6,320 | | | 15,793 | |

| Limited Liability Company Unit Class B (B) (F) | | 766 uts. | | 10/01/21 | | 784 | | | — | |

| Limited Liability Company Unit Class B (B) (F) | | 197 uts. | | 10/01/21 | | 202 | | | — | |

| | | | | | 31,659 | | | 77,024 | |

| AIT Worldwide Logistics, Inc. | | | | | | | | |

| A provider of domestic and international third-party logistics services. |

| 12.93% Second Lien Term Loan due 04/06/2029 (SOFR+ 7.500%) | | $ | 1,669,355 | | | 04/06/21 | | 1,645,818 | | | 1,659,840 | |

| Limited Liability Company Unit (B) | | 56 uts. | | 04/06/21 | | 55,645 | | | 85,754 | |

| | | | | | 1,701,463 | | | 1,745,594 | |

| Americo Chemical Products | | | | | | | | |

| A provider of customized specialty chemical solutions and services for pretreatment of metal surfaces and related applications. |

| 10.83% First Lien Term Loan due 04/28/2029 (SOFR + 5.500%) (G) | | $ | 612,489 | | | 04/28/23 | | 479,504 | | | 492,448 | |

| Limited Liability Company Unit (B) (F) | | 22,480 uts. | | 04/28/23 | | 22,480 | | | 23,829 | |

| | | | | | 501,984 | | | 516,277 | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 10

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| AMS Holding LLC | | | | | | | | |

| A leading multi-channel direct marketer of high-value collectible coins and proprietary-branded jewelry and watches. |

Limited Liability Company Unit Class A

Preferred (B) (F) | | 114 uts. | | 10/04/12 | | $ | 113,636 | | | $ | 211,506 | |

| | | | | | | | |

| Amtech Software | | | | | | | | |

| A provider of enterprise resource planning software and technology solutions for packaging manufacturers. |

| 11.06% First Lien Term Loan due 11/02/2027 (SOFR + 5.750%) (G) | | $ | 993,182 | | | 11/02/21 | | 523,442 | | | 528,134 | |

| | | | | | | | |

| Applied Aerospace Structures Corp. | | | | | | | | |

| A leading provider of specialized large-scale composite and metal-bonded structures for platforms in the aircraft, space, and land/sea end markets. |

| 11.59% Term Loan due 11/22/2028 (SOFR + 6.250%) (G) | | $ | 191,452.00 | | | 12/01/22 | | 161,182 | | | 167,302 | |

| Limited Liability Company Unit (B) | | 8 uts. | | 12/01/22 | | 8,000 | | | 10,856 | |

| | | | | | 169,182 | | | 178,158 | |

| ASC Communications, LLC (Becker's Healthcare) | | | | | | | | |

| An operator of trade shows and controlled circulation publications targeting the healthcare market. |

| 10.18% Term Loan due 07/15/2027 (SOFR + 4.750%) (G) | | $ | 390,448 | | | 07/15/22 | | 363,652 | | | 367,783 | |

| Limited Liability Company Unit (B) (F) | | 535 uts. | | 07/15/22 | | 11,221 | | | 15,661 | |

| | | | | | 374,873 | | | 383,444 | |

| ASC Holdings, Inc. | | | | | | | | |

| A manufacturer of capital equipment used by corrugated box manufacturers. |

| 13.00% (1.00% PIK) Senior Subordinated Note due 12/31/2024 | | $ | 911,281 | | | 11/19/15 | | 911,178 | | | 829,266 | |

| Limited Liability Company Unit (B) | | 111,100 uts. | | 11/18/15 | | 111,100 | | | 15,554 | |

| | | | | | 1,022,278 | | | 844,820 | |

| Audio Precision | | | | | | | | |

| A provider of high-end audio test and measurement sensing instrumentation software and accessories. |

| 11.46% Term Loan due 10/31/2024 (SOFR + 6.000%) | | $ | 1,705,500 | | | 10/30/18 | | 1,702,185 | | | 1,654,335 | |

| | | | | | | | |

| Aurora Parts & Accessories LLC (d.b.a Hoosier) | | | | | | | | |

| A distributor of aftermarket over-the-road semi-trailer parts and accessories sold to customers across North America. |

| Preferred Stock (B) | | 210 shs. | | 08/17/15 | | 209,390 | | | 209,390 | |

| Common Stock (B) | | 210 shs. | | 08/17/15 | | 210 | | | 264,377 | |

| | | | | | 209,600 | | | 473,767 | |

| BBB Industries LLC - DBA (GC EOS Buyer Inc.) | | | | | | | | |

| A supplier of remanufactured and new parts to the North American automotive aftermarket. |

| 14.31% Second Lien Term Loan due 07/25/2030 (SOFR + 9.000%) | | $ | 454,545 | | | 07/25/22 | | 440,182 | | | 448,182 | |

| Limited Liability Company Unit (B) | | 45 uts. | | 07/25/22 | | 45,000 | | | 48,012 | |

| | | | | | 485,182 | | | 496,194 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 11

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Best Lawyers (Azalea Investment Holdings, LLC) | | | | | | |

| A global digital media company that provides ranking and marketing services to the legal community. |

| 10.69% First Lien Term Loan due 11/19/2027 (SOFR + 5.250%) (G) | | $ | 1,367,223 | | | 11/30/21 | | $ | 1,091,828 | | | $ | 1,108,473 | |

| 12.00% HoldCo PIK Note due 05/19/2028 | | $ | 381,476 | | | 11/30/21 | | 377,774 | | | 374,228 | |

| Limited Liability Company Unit (B) | | 44,231 uts. | | 11/30/21 | | 44,231 | | | 69,000 | |

| | | | | | 1,513,833 | | | 1,551,701 | |

| Blue Wave Products, Inc. | | | | | | | | |

| A distributor of pool supplies. |

| Common Stock (B) | | 51,064 shs. | | 10/12/12 | | 51,064 | | | 60,766 | |

| Warrant, exercisable until 2024, to purchase common stock at $.01 per share (B) | | 20,216 shs. | | 10/12/12 | | 20,216 | | | 23,855 | |

| | | | | | 71,280 | | | 84,621 | |

| Bridger Aerospace | | | | | | | | |

| A provider of comprehensive solutions to combat wildfires in the United States including fire suppression, air attack and unmanned aircraft systems. |

| Series C Convertible Preferred Equity (7.00% PIK) (B) | | 183 shs. | | 08/12/22 | | 194,454 | | | 177,462 | |

| | | | | | | | |

| BrightSign | | | | | | | | |

| A provider of digital signage hardware and software solutions, serving a variety of end markets, including retail, restaurants, government, sports, and entertainment. |

| 11.21% Term Loan due 10/14/2027 (SOFR + 5.750%) (G) | | $ | 1,398,769 | | | 10/14/21 | | 1,363,668 | | | 1,359,340 | |

| Limited Liability Company Unit (B) (F) | | 111,835 uts. | | 10/14/21 | | 111,835 | | | 101,770 | |

| | | | | | 1,475,503 | | | 1,461,110 | |

| Brown Machine LLC | | | | | | | | |

| A designer and manufacturer of thermoforming equipment used in the production of plastic packaging containers within the food and beverage industry. |

| 11.08% Term Loan due 10/04/2024 (SOFR + 5.750%) | | $ | 784,104 | | | 10/03/18 | | 781,756 | | | 773,127 | |

| | | | | | | | |

| Cadence, Inc. | | | | | | | | |

| A full-service contract manufacturer (“CMO”) and supplier of advanced products, technologies, and services to medical device, life science, and industrial companies. |

| 10.21% First Lien Term Loan due 04/30/2025 (SOFR+ 4.750%) | | $ | 858,986 | | | 5/14/2018 | | 854,393 | | | 843,524 | |

| 10.72% Incremental Term Loan due 05/26/2026 (LIBOR + 5.250%) | | $ | 366,151 | | | 10/2/2023 | | 358,729 | | | 363,221 | |

| | | | | | 1,213,122 | | | 1,206,745 | |

| CAi Software | | | | | | | | |

| A vendor of mission-critical, production-oriented software to niche manufacturing and distribution sectors. |

| 11.82% Term Loan due 12/10/2028 (SOFR + 6.250%) (G) | | $ | 2,454,715 | | | 12/13/21 | | 2,186,021 | | | 2,169,874 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 12

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| California Custom Fruits & Flavors | | | | | | | | |

| Develops and manufactures value-added, custom-formulated processed fruit and flavor bases for various customers across the Private Label, Branded, Direct Grocery, and Food-Service channels. |

| 10.75% First Lien Term Loan due 02/11/2030 (SOFR + 5.750% (G) | | $ | 440,741 | | | 02/26/24 | | $ | 193,333 | | | $ | 193,191 | |

| Limited Liability Company Unit (B) (F) | | 12 uts. | | 02/26/24 | | 12,000 | | | 12,000 | |

| | | | | | 205,333 | | | 205,191 | |

| Cascade Services | | | | | | | | |

| A residential services platform that provides HVAC repair and replacement work for single-family homes in southern geographies. |

| 10.58% First Lien Term Loan due 09/30/2029 (SOFR + 5.250%) (G) | | $ | 998,658 | | | 10/04/23 | | 607,804 | | | 628,720 | |

| | | | | | | | |

| Cash Flow Management | | | | | | | | |

| A software provider that integrates core banking systems with branch technology and creates modern retail banking experiences for financial institutions. |

| 11.65% Term Loan due 12/27/2027 (LIBOR + 6.000%) (G) | | $ | 977,843 | | | 12/28/21 | | 910,146 | | | 896,269 | |

| Limited Liability Company Unit (B) (F) | | 24,016 uts. | | | | 25,331 | | | 24,857 | |

| | | | | | 935,477 | | | 921,126 | |

| CJS Global | | | | | | | | |

| A janitorial services provider focused on high end restaurants in NYC, Florida, and Texas. |

| 11.16% Term Loan due 03/10/2029 (SOFR + 5.500%) (G) | | $ | 848,485 | | | 03/20/23 | | 580,746 | | | 580,606 | |

| Limited Liability Company Unit Common (B) | | 303,180 uts. | | 03/20/23 | | 147,469 | | | 147,560 | |

| | | | | | 728,215 | | | 728,166 | |

| Cleaver-Brooks, Inc. | | | | | | | | |

| A manufacturer of full suite boiler room solutions. |

| 10.83% Term Loan due 07/14/2028 (SOFR + 5.500%) (G) | | $ | 624,395 | | | 07/18/22 | | 544,177 | | | 545,636 | |

| 11.00% HoldCo PIK Note due 07/14/2029 | | 128095 | | | 07/18/22 | | 125,696 | | | 125,888 | |

| | | | | | 669,873 | | | 671,524 | |

| Cloudbreak | | | | | | | | |

| A language translation and interpretation services provider to approximately 970 hospitals and outpatient clinics across the U.S. |

| 11.07% Term Loan due 03/15/2030 (SOFR + 5.750%) (G) | | $ | 952,381 | | | 03/15/24 | | 611,296 | | | 611,111 | |

| Limited Liability Company Unit Class A (B) (F) | | 59 uts. | | 03/15/24 | | 59,000 | | | 59,000 | |

| Limited Liability Company Unit Class B (B) (F) (I) | | 59 uts. | | 03/15/24 | | — | | | — | |

| | | | | | 670,296 | | | 670,111 | |

| CloudWave | | | | | | | | |

| A provider of managed cloud hosting and IT services for hospitals. |

| 10.96% Term Loan due 01/04/2027 (SOFR + 6.000%) | | $ | 1,619,274 | | | 01/29/21 | | 1,602,097 | | | 1,619,274 | |

| Limited Liability Company Unit (B) (F) | | 55,645 uts. | | 01/29/21 | | 55,645 | | | 102,387 | |

| | | | | | 1,657,742 | | | 1,721,661 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 13

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Cogency Global | | | | | | | | |

| A provider of statutory representation and compliance services for corporate and professional services clients. |

| 10.66% Term Loan due 12/28/2027 (SOFR + 5.250%) (G) | | $ | 872,002 | | | 02/14/22 | | $ | 778,107 | | | $ | 771,561 | |

| 10.66% Term Loan due 02/14/2028 (SOFR + 5.250%) (G) | | $ | 765,069 | | | 09/13/23 | | 748,241 | | | 749,461 | |

| Preferred Stock (B) | | 33 shs. | | 02/14/22 | | 36,108 | | | 62,195 | |

| | | | | | 1,562,456 | | | 1,583,217 | |

| Command Alkon | | | | | | | | |

| A vertical-market software and technology provider to the heavy building materials industry delivering purpose-built, mission critical products that serve as the core operating & production systems for ready-mix concrete producers, asphalt producers, and aggregate suppliers. |

| 12.08% Term Loan due 04/17/2027 (SOFR + 6.750%) | | $ | 2,011,782 | | | * | | 1,984,995 | | | 1,998,907 | |

| Limited Liability Company Unit Class B (B) (I) | | 6,629 uts. | | 04/23/20 | | — | | | 35,264 | |

| * 04/23/20, 10/30/20 and 11/18/20. | | | | | | 1,984,995 | | | 2,034,171 | |

| | | | | | | | |

| Compass Precision | | | | | | | | |

| A manufacturer of custom metal precision components. | | | | | | | | |

| 11.00% (1.00% PIK) Senior Subordinated Note due 10/16/2025 | | $ | 1,319,076 | | | 04/15/22 | | 1,307,660 | | | 1,272,909 | |

| Limited Liability Company Unit (B) (F) | | 158,995 uts. | | 10/14/21 | | 431,250 | | | 500,835 | |

| | | | | | 1,738,910 | | | 1,773,744 | |

| Comply365 | | | | | | | | |

| A provider of proprietary enterprise SaaS and mobile solutions for content management and document distribution in highly regulated industries, including Aviation and Rail. |

| 10.43% Term Loan due 04/19/2028 (SOFR + 5.000%) (G) | | $ | 685,187 | | | 04/15/22 | | 623,192 | | | 619,968 | |

| | | | | | | | |

| Concept Machine Tool Sales, LLC | | | | | | | | |

| A full-service distributor of high-end machine tools and metrology equipment, exclusively representing a variety of global manufacturers in the Upper Midwest. |

| 10.54% Term Loan due 01/31/2025 (LIBOR + 5.000%) | | $ | 578,137 | | | 01/30/20 | | 573,890 | | | 556,746 | |

| Limited Liability Company Unit (B) (F) | | 1,237 shs. | | * | | 49,559 | | | 14,671 | |

| * 01/30/20 and 03/05/21 | | | | | | 623,449 | | | 571,417 | |

| | | | | | | | |

| CTS Engines | | | | | | | | |

| A provider of maintenance, repair and overhaul services within the aerospace & defense market. |

| 11.07% Term Loan due 12/22/2026 (SOFR + 5.750%) (G) | | $ | 1,448,352 | | | 12/22/20 | | 1,390,745 | | | 1,329,434 | |

| | | | | | | | |

| DataServ | | | | | | | | |

| A managed IT services provider serving Ohio’s state, local, and education (“SLED”) market (79% of FY21 Revenue), as well as small and medium-sized businesses (“SMB”, 8%) and enterprise clients (13%). |

| 10.97% First Lien Term Loan due 09/30/2028 (SOFR + 5.500%) (G) | | $ | 237,488 | | | 11/02/22 | | 185,398 | | | 186,585 | |

| Preferred Stock (B) | | 9,615 shs. | | 11/02/22 | | 9,615 | | | 9,712 | |

| | | | | | 195,013 | | | 196,297 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 14

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Decks Direct | | | | | | | | |

| An eCommerce direct-to-consumer seller of specialty residential decking products in the United States. |

| 11.68% Term Loan due 12/28/2026 (SOFR + 6.250%) (G) | | $ | 1,484,624 | | | 12/29/21 | | $ | 1,283,857 | | | $ | 1,270,202 | |

| 11.68% Term Loan due 12/28/2026 (SOFR + 6.250%) | | $ | 118,373 | | | 07/31/23 | | 115,996 | | | 115,958 | |

| 11.68% Term Loan due 12/28/2026 (SOFR + 6.250%) | | $ | 290,220 | | | 12/21/23 | | 284,289 | | | 284,300 | |

| Limited Liability Company Unit (B) | | 2,209 uts. | | 12/29/21 | | 94,091 | | | 82,145 | |

| | | | | | | | |

| Del Real LLC | | | | | | | | |

| A manufacturer and distributor of fully-prepared fresh refrigerated Hispanic entrees as well as side dishes that are typically sold on a heat-and-serve basis at retail grocers. |

| Limited Liability Company Unit (B) (F) | | 368,799 uts. | | * | | 368,928 | | | 346,671 | |

| * 10/07/16, 07/25/18, 03/13/19 and 06/17/19. | | | | | | | | |

| | | | | | | | |

| DistroKid (IVP XII DKCo-Invest,LP) | | | | | | | | |

| A subscription-based music distribution platform that allows artists to easily distribute, promote, and monetize their music across digital service providers, such as Spotify and Apple Music. |

| 10.96% Term Loan due 09/30/2027 (SOFR + 5.500%) | | $ | 1,610,306 | | | 10/01/21 | | 1,591,526 | | | 1,607,085 | |

| Limited Liability Company Unit (B) (F) | | 73,333 uts. | | 10/01/21 | | 73,404 | | | 69,666 | |

| | | | | | 1,664,930 | | | 1,676,751 | |

| Dwyer Instruments, Inc. | | | | | | | | |

| A designer and manufacturer of precision measurement and control products for use with solids, liquids and gases. |

| 11.15% Term Loan due 07/01/2027 (SOFR + 5.750%) | | $ | 1,700,741 | | | 07/20/21 | | 1,680,539 | | | 1,700,741 | |

| | | | | | | | |

| Echo Logistics | | | | | | | | |

| A provider of tech-enabled freight brokerage across various modes including Truckload, Less-than-Truckload, Parcel, and Intermodal, as well as managed (contracted) transportation services. |

| 12.43% Second Lien Term Loan due 11/05/2029 (SOFR + 7.000%) | | $ | 1,679,204 | | | 11/22/21 | | 1,658,473 | | | 1,640,582 | |

| Limited Liability Company Unit (B) | | 46 uts. | | 11/22/21 | | 45,796 | | | 40,999 | |

| | | | | | 1,704,269 | | | 1,681,581 | |

| EFC International | | | | | | | | |

| A St. Louis-based global distributor (40% of revenue ex-US) of branded, highly engineered fasteners and specialty components. |

| 11.00% (2.5% PIK) Term Loan due 02/28/2030 | | $ | 982,264 | | | 03/01/23 | | 957,898 | | | 963,404 | |

| Limited Liability Company Unit (B) (F) | | 205 uts. | | 03/01/23 | | 288,462 | | | 423,934 | |

| | | | | | 1,246,360 | | | 1,387,338 | |

| EFI Productivity Software | | | | | | | | |

| A provider of ERP software solutions purpose-built for the print and packaging industry. |

| 10.94% Term Loan due 12/30/2027 (SOFR + 5.500%) (G) | | $ | 979,143 | | | 12/30/21 | | 912,157 | | | 919,488 | |

| | | | | | | | |

| Electric Power Systems International, Inc. | | | | | | | | |

| A provider of electrical testing services for apparatus equipment and protection & controls infrastructure. |

| 11.21% Term Loan due 04/19/2028 (SOFR + 5.750%) (G) | | $ | 1,173,249 | | | 04/19/21 | | 1,159,676 | | | 1,132,185 | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 15

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Elite Sportswear Holding, LLC | | | | | | | | |

| A designer and manufacturer of gymnastics, competitive cheerleading and swimwear apparel in the U.S. and internationally. |

| Limited Liability Company Unit (B) (F) | | 1,218,266 uts. | | 10/14/16 | | $ | 159,722 | | | $ | 328,932 | |

| | | | | | | | |

| Ellkay | | | | | | | | |

| A provider of data interoperability solutions for labs, hospitals and healthcare providers. |

| 12.96% Term Loan due 09/14/2027 (SOFR + 7.250%) | | $ | 689,751 | | | 09/14/21 | | 681,779 | | | 614,568 | |

| | | | | | | | |

| ENTACT Environmental Services, Inc. | | | | | | | | |

| A provider of environmental remediation and geotechnical services for blue-chip companies with regulatory-driven liability enforcement needs. |

| 11.07% Term Loan due 12/15/2025 (SOFR + 5.500%) | | $ | 1,077,639 | | | 02/09/21 | | 1,072,055 | | | 1,064,708 | |

| | | | | | | | |

| eShipping | | | | | | | | |

| An asset-life third party logistics Company that serves a broad variety of end markets and offers service across all major transportation modes. |

| 10.44% Term Loan due 11/05/2027 (SOFR + 5.000%) (G) | | $ | 1,189,339 | | | 11/05/21 | | $ | 1,035,292 | | | $ | 1,049,547 | |

| | | | | | | | |

| E.S.P. Associates, P.A. | | | | | | | | |

| A professional services firm providing engineering, surveying and planning services to infrastructure projects. |

| Limited Liability Company Unit (B) | | 273 uts. | | * | | 295,518 | | | 294,601 | |

| * 06/29/18 and 12/29/20. | | | | | | | | |

| | | | | | | | |

| F G I Equity LLC | | | | | | | | |

| A manufacturer of a broad range of filters and related products that are used in commercial, light industrial, healthcare, gas turbine, nuclear, laboratory, clean room, hotel, educational system, and food processing settings. |

| Limited Liability Company Unit Class B-1 (B) | | 49,342 uts. | | 12/15/10 | | 42,343 | | | 601,476 | |

| | | | | | | | |

| Five Star Holding, LLC | | | | | | | | |

| A fully integrated platform of specialty packaging brands that manufactures flexible packaging solutions. |

| 12.54% Second Lien Term Loan due 04/27/2030 (SOFR + 7.250%) | | $ | 476,190 | | | 05/04/22 | | 468,945 | | | 470,000 | |

| Limited Liability Company Unit Common (B) (F) | | 34 uts. | | 10/14/21 | | 33,631 | | | 26,942 | |

| | | | | | 502,576 | | | 496,942 | |

| Follett School Solutions | | | | | | | | |

| A provider of software for K-12 school libraries. |

| 11.08% First Lien Term Loan due 08/31/2028 (SOFR + 5.750%) | | $ | 1,671,338 | | | 08/31/21 | | 1,650,251 | | | 1,671,338 | |

| LP Units (B) (F) | | 881 uts. | | 08/30/21 | | 8,805 | | | 11,112 | |

| LP Interest (B) (F) | | 200 shs. | | 08/30/21 | | 2,003 | | | 2,527 | |

| | | | | | 1,661,059 | | | 1,684,977 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 16

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Fortis Payments, LLC | | | | | | | | |

| A payment service provider operating in the payments industry. |

| 11.15% First Lien Term Loan due 05/31/2026 (SOFR + 5.750%) | | $ | 495,068 | | | 10/31/22 | | $ | 489,280 | | | $ | 485,166 | |

| 13.25% First Lien Term Loan due 02/13/2026 (SOFR + 4.750%) (G) | | $ | 754,094 | | | 01/31/24 | | 608,005 | | | 606,768 | |

| | | | | | 1,097,285 | | | 1,091,934 | |

| | | | | | | | |

| FragilePAK | | | | | | | | |

| A provider of third-party logistics services focused on the full delivery life-cycle for big and bulky products. |

| 11.32% Term Loan due 05/24/2027 (SOFR + 5.750%) | | $ | 1,051,172 | | | 05/21/21 | | 1,035,998 | | | 956,566 | |

| Limited Liability Company Unit (B) (F) | | 108 uts. | | 05/21/21 | | 107,813 | | | 47,398 | |

| | | | | | 1,143,811 | | | 1,003,964 | |

| GD Dental Services LLC | | | | | | | | |

| A provider of convenient "onestop" general, specialty, and cosmetic dental services with 21 offices located throughout South and Central Florida. |

| Limited Liability Company Unit Preferred (B) | | 76 uts. | | 10/05/12 | | 75,920 | | | 107,066 | |

| Limited Liability Company Unit Common (B) | | 767 uts. | | 10/05/12 | | 767 | | | — | |

| | | | | | 76,687 | | | 107,066 | |

| gloProfessional Holdings, Inc. | | | | | | | | |

| A marketer and distributor of premium mineral-based cosmetics, cosmeceuticals and professional hair care products to the professional spa and physician's office channels. |

| Preferred Stock (B) | | 650 shs. | | 03/29/19 | | 649,606 | | | 530,754 | |

| Common Stock (B) | | 1,181 shs. | | 03/27/13 | | 118,110 | | | — | |

| | | | | | 767,716 | | | 530,754 | |

| Gojo Industries | | | | | | | | |

| A manufacturer of hand hygiene and skin health products. | | | | | | | | |

| 10.33% Term Loan due 10/20/2028 (SOFR + 5.000%) | | $ | 628,862 | | | 10/24/23 | | 611,897 | | | 611,632 | |

| | | | | | | | |

| GraphPad Software, Inc. | | | | | | | | |

| A provider of data analysis, statistics and graphing software solution for scientific research applications, with a focus on the life sciences and academic end-markets. |

| 11.32% Term Loan due 04/27/2027 (SOFR + 6.000%) | | $ | 2,341,184 | | | * | | 2,325,829 | | | 2,341,183 | |

| 11.19% Term Loan due 04/27/2027 (SOFR + 5.500%) | | $ | 82,412 | | | 04/27/21 | | 81,569 | | | 82,206 | |

| Preferred Stock (B) (F) | | 3,737 shs. | | 04/27/21 | | 103,147 | | | 151,133 | |

| * 12/19/17 and 04/16/19. | | | | | | 2,510,545 | | | 2,574,522 | |

| | | | | | | | |

| Handi Quilter Holding Company (Premier Needle Arts) | | | | | | | | |

| A designer and manufacturer of long-arm quilting machines and related components for the consumer quilting market. |

| Limited Liability Company Unit Preferred (B) | | 372 uts. | | * | | 371,644 | | | 145,401 | |

| Limited Liability Company Unit Common Class A (B) (I) | | 3,716 uts. | | 12/19/14 | | — | | | — | |

| *12/19/14 and 04/29/16. | | | | | | 371,644 | | | 145,401 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 17

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Heartland Veterinary Partners | | | | | | | | |

| A veterinary support organization that provides a comprehensive set of general veterinary services as well as ancillary services such as boarding and grooming. |

| 11.00% Opco PIK Note due 11/09/2028 (G) | | $ | 2,163,154 | | | 11/17/21 | | $ | 2,134,656 | | | $ | 1,944,676 | |

| | | | | | | | |

| HemaSource, Inc. | | | | | | | | |

| A technology-enabled distributor of consumable medical products to plasma collection centers. |

| 11.31% Term Loan due 08/31/2029 (SOFR + 6.000%) (G) | | $ | 1,017,435 | | | 08/31/23 | | 827,525 | | | 840,303 | |

| Limited Liability Company Unit Common (B) | | 11,337 uts. | | 08/31/23 | | 11,337 | | | 11,904 | |

| | | | | | 838,862 | | | 852,207 | |

| | | | | | | | |

| Home Care Assistance, LLC | | | | | | | | |

| A provider of private pay non-medical home care assistance services. |

| 10.41% Term Loan due 03/30/2027 (SOFR + 5.000%) | | $ | 833,751 | | | 03/26/21 | | 825,433 | | | 762,883 | |

| | | | | | | | |

| HOP Entertainment LLC | | | | | | | | |

| A provider of post production equipment and services to producers of television shows and motion pictures. |

| Limited Liability Company Unit Class F (B) (F) | | 47 uts. | | 10/14/11 | | — | | | — | |

| Limited Liability Company Unit Class G (B) (F) | | 114 uts. | | 10/14/11 | | — | | | — | |

| Limited Liability Company Unit Class H (B) (F) | | 47 uts. | | 10/14/11 | | — | | | — | |

| Limited Liability Company Unit Class I (B) (F) | | 47 uts. | | 10/14/11 | | — | | | — | |

| | | | | | — | | | — | |

| | | | | | | | |

| HTI Technology & Industries Inc. | | | | | | | | |

| A designer and manufacturer of powered motion solutions to industrial customers. |

| 13.94% Term Loan due 07/07/2025 (SOFR + 8.500%) (G) | | $ | 896,408 | | | 07/27/22 | | 718,670 | | | 707,127 | |

| 13.94% Term Loan due 07/27/2025 (SOFR + 8.500%) | | $ | 97,063 | | | 02/15/23 | | 95,492 | | | 95,025 | |

| | | | | | 814,162 | | | 802,152 | |

| Ice House America | | | | | | | | |

| A manufacturer and operator of automated ice and water vending units with an installed base of 4,200+ units in service (including Company-owned fleet of 165 units) primarily located in the Southeastern United States. |

| 10.83% Term Loan due 12/28/2029 (SOFR + 5.500%) (G) | | $ | 945,946 | | | 01/12/24 | | 818,173 | | | 817,477 | |

| Limited Liability Company Unit (B) (F) | | 541 uts. | | 01/12/24 | | 54,100 | | | 54,100 | |

| | | | | | 872,273 | | | 871,577 | |

| Illumifin | | | | | | | | |

| A leading provider of third-party administrator (“TPA”) services and software for life and annuity insurance providers. |

| 12.57% Term Loan due 02/04/2028 (SOFR + 1.000% Cash, 5.000% PIK) | | $ | 402,305 | | | 04/05/22 | | 397,265 | | | 344,374 | |

| | | | | | | | |

| ISTO Biologics | | | | | | | | |

| In the orthobioligic space, providing solutions in autologous therapies and bone grafts for spine, orthopedics and sports medicine. |

| 11.56% Term Loan due 10/17/2028 (SOFR + 6.250%) (G) | | $ | 639,730 | | | 10/18/23 | | 564,258 | | | 565,236 | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 18

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| JF Petroleum Group | | | | | | | | |

| A provider of repair, maintenance, installation and projection management services to the US fueling infrastructure industry. |

| 10.91% Term Loan due 04/20/2026 (SOFR + 5.500%) | | $ | 667,661 | | | 05/04/21 | | $ | 659,292 | | | $ | 646,296 | |

| | | | | | | | |

| Jones Fish | | | | | | | | |

| A provider of lake management services, fish stocking and pond aeration sales and services. |

| 10.99% First Lien Term Loan due 12/20/2027 (SOFR + 5.500%) (G) | | $ | 1,559,551 | | | 02/28/22 | | 1,112,859 | | | 1,116,890 | |

| 10.86% First Lien Term Loan due 02/28/2029 (SOFR + 5.600%) | | $ | 274,262 | | | 03/16/23 | | 267,478 | | | 270,971 | |

| 10.82% First Lien Term Loan due 02/28/2028 (SOFR + 5.500%) | | $ | 143,646 | | | 04/28/23 | | 140,744 | | | 141,922 | |

| 10.83% First Lien Term Loan due 02/28/2028 (SOFR + 5.500%) | | $ | 35,053 | | | 09/29/23 | | 34,277 | | | 34,632 | |

| Common Stock (B) (F) | | 401 shs. | | 02/28/22 | | 41,971 | | | 95,494 | |

| | | | | | 1,597,329 | | | 1,659,909 | |

| Kano Laboratories LLC | | | | | | | | |

| A producer of industrial strength penetrating oils and lubricants. |

| 10.47% Term Loan due 09/30/2026 (SOFR + 5.000%) (G) | | $ | 1,225,791 | | | 11/18/20 | | 1,215,341 | | | 1,201,275 | |

| 10.47% First Lien Term Loan due 10/31/2027 (SOFR + 5.000%) (G) | | $ | 438,992 | | | 11/08/21 | | 433,995 | | | 430,213 | |

| Limited Liability Company Unit Class (B) | | 20 uts. | | 11/19/20 | | 19,757 | | | 21,066 | |

| | | | | | 1,669,093 | | | 1,652,554 | |

| Kings III | | | | | | | | |

| A provider of emergency phones and monitoring services. |

| 11.34% First Lien Term Loan due 07/07/2028 (SOFR + 6.000%) (G) | | $ | 496,265 | | | 08/31/22 | | 399,984 | | | 402,307 | |

| 11.33% First Lien Term Loan due 08/31/2028 (SOFR + 6.000%) (G) | | $ | 503,735 | | | 02/16/24 | | 373,260 | | | 373,078 | |

| | | | | | 773,244 | | | 775,385 | |

| LeadsOnline | | | | | | | | |

| A nationwide provider of data, technology and intelligence tools used by law enforcement agencies, investigators, and businesses. |

| 10.82% Term Loan due 12/23/2027 (SOFR + 5.500%) (G) | | $ | 1,695,358 | | | 02/07/22 | | 1,451,995 | | | 1,453,893 | |

| Limited Liability Company Unit (B) (F) | | 7,050 uts. | | 02/07/22 | | 7,302 | | | 14,876 | |

| | | | | | 1,459,297 | | | 1,468,769 | |

| LYNX Franchising | | | | | | | | |

| A global franchisor of B2B services including commercial janitorial services, shared office space solutions, and textile and electronics restoration services. |

| 12.23% Incremental Term Loan due 12/18/2026 (SOFR + 6.750%) | | $ | 2,432,972 | | | * | | 2,409,959 | | | 2,425,672 | |

| * 12/22/20 and 09/09/21 | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 19

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Madison Indoor Air Solutions | | | | | | | | |

| A manufacturer and distributor of heating, dehumidification and other air quality solutions. |

| Limited Liability Company Unit (B) | | 726,845 uts. | | 02/20/19 | | $ | 2,298,574 | | | $ | 12,625,302 | |

| | | | | | | | |

| Magnolia Wash Holdings (Express Wash Acquisition Company, LLC) |

| An express car wash consolidator primarily in the Southeastern US. |

| 12.09% Term Loan due 07/08/2028 (SOFR + 6.500%) (G) | | $ | 533,253 | | | 07/14/22 | | 516,393 | | | 526,571 | |

| | | | | | | | |

| Marshall Excelsior Co. | | | | | | | | |

| A designer, manufacturer and supplier of mission critical, highly engineered flow control products used in the transportation, storage and consumption of liquified petroleum gas, liquified anhydrous ammonia, refined industrial and cryogenic gases. |

| 10.95% Term Loan due 02/18/2028 (SOFR + 5.500%) (G) | | $ | 622,349 | | | 02/24/22 | | 607,064 | | | 611,934 | |

| | | | | | | | |

| Master Cutlery LLC | | | | | | | | |

| A designer and marketer of a wide assortment of knives and swords. |

| 13.00% Senior Subordinated Note due 07/20/2022 (D) | | $ | 868,102 | | | 04/17/15 | | 867,581 | | | — | |

| Limited Liability Company Unit (B) | | 5 uts. | | 04/17/15 | | 678,329 | | | — | |

| | | | | | 1,545,910 | | | — | |

| Media Recovery, Inc. | | | | | | | | |

| A global manufacturer and developer of shock, temperature, vibration, and other condition indicators and monitors for in-transit and storage applications. |

| 11.56% First Lien Term Loan due 11/22/2025 (SOFR + 6.000%) | | $ | 477,457 | | | 11/25/19 | | 474,786 | | | 464,566 | |

| | | | | | | | |

| Mission Microwave | | | | | | | | |

| A leading provider of high-performance solid-state power amplifiers and block upconverters to support ground-based, maritime, airborne, and space-based satellite communication applications. |

| 10.58% Senior Lien Term Loan due 01/15/2030 (SOFR + 5.250%) (G) | | $ | 728,444 | | | 03/01/24 | | 614,352 | | | 614,141 | |

| Limited Liability Company Unit (B) | | 307 uts. | | 03/01/24 | | 30,700 | | | 30,700 | |

| | | | | | 645,052 | | | 644,841 | |

| MNS Engineers, Inc. | | | | | | | | |

| A consulting firm that provides civil engineering, construction management and land surveying services. |

| 10.93% First Lien Term Loan due 07/30/2027 (SOFR + 5.500%) | | $ | 1,170,000 | | | 08/09/21 | | 1,156,940 | | | 1,170,000 | |

| Limited Liability Company Unit (B) | | 100,000 uts. | | 08/09/21 | | 100,000 | | | 114,000 | |

| | | | | | 1,256,940 | | | 1,284,000 | |

| Mobile Pro Systems | | | | | | | | |

| A manufacturer of creative mobile surveillance systems for real-time monitoring in nearly any environment. |

| 11.00% Second Lien Term Loan due 06/23/2027 | | $ | 609,612 | | | 06/27/22 | | 603,071 | | | 604,553 | |

| Common Stock (B) (F) | | 4,118 shs. | | 02/28/22 | | 411,765 | | | 593,889 | |

| | | | | | 1,014,836 | | | 1,198,442 | |

| | | | | | | | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 20

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Music Reports, Inc. | | | | | | | | |

| An administrator of comprehensive offering of rights and royalties solutions for music and cue sheet copyrights to music and entertainment customers. |

| 11.48% Incremental Term Loan due 08/21/2026 (SOFR + 6.000%) | | $ | 783,584 | | | 11/05/21 | | $ | 775,775 | | | $ | 750,673 | |

| 11.48% Term Loan due 08/21/2026 (SOFR + 6.000%) | | $ | 548,682 | | | 08/25/20 | | 543,195 | | | 525,637 | |

| | | | | | 1,318,970 | | | 1,276,310 | |

| Narda-MITEQ (JFL-Narda Partners, LLC) |

| A manufacturer of radio frequency and microwave components and assemblies. |

| 10.41% First Lien Term Loan due 11/30/2027 (SOFR + 5.000%) | | $ | 503,278 | | | 12/06/21 | | 497,885 | | | 503,278 | |

| 10.41% Incremental Term Loan due 12/06/2027 (SOFR + 5.000%) (G) | | $ | 1,063,944 | | | 12/28/21 | | 844,740 | | | 856,263 | |

| Limited Liability Company Unit Class A Preferred (B) | | 790 uts. | | 12/06/21 | | 79,043 | | | 94,037 | |

| Limited Liability Company Unit Class B Common (B) | | 88 uts. | | 12/06/21 | | 8,783 | | | 56,846 | |

| | | | | | 1,430,451 | | | 1,510,424 | |

| Navia Benefit Solutions, Inc. | | | | | | | | |

| A third-party administrator of employee-directed healthcare benefits. |

| 10.33% Term Loan due 02/01/2026 (SOFR + 5.000%) | | $ | 1,149,892 | | | 02/10/21 | | 1,140,285 | | | 1,139,083 | |

| 7.43% Incremental Term Loan due 02/01/2027 (SOFR + 2.250%) | | $ | 511,031 | | | 11/14/22 | | 502,543 | | | 503,059 | |

| | | | | | 1,642,828 | | | 1,642,142 | |

| Net at Work | | | | | | | | |

| An SMB-focused IT service provider specializing in software sales, implementation, managed services and hosting services. |

| 11.07% Term Loan due 09/13/2029 (SOFR + 5.750%) (G) | | $ | 1,696,250 | | | 09/13/23 | | 1,017,395 | | | 1,043,385 | |

| Limited Liability Company Unit Class (B) (F) | | 32,603 uts. | | 09/13/23 | | 32,603 | | | 29,669 | |

| | | | | | 1,049,998 | | | 1,073,054 | |

| Newforma | | | | | | | | |

| A leader in Project Information Management software for the construction industry. |

| 11.81% Term Loan due 04/02/2029 (SOFR + 6.500%) (G) | | $ | 743,605 | | | 03/31/23 | | 636,636 | | | 648,882 | |

| Limited Liability Company Unit (B) | | 81,722 shs. | | * | | 84,194 | | | 92,346 | |

| | | | | | 720,830 | | | 741,228 | |

| Northstar Recycling | | | | | | | | |

| A managed service provider for waste and recycling services, primarily targeting food and beverage end markets. |

| 10.11% Term Loan due 09/30/2027 (SOFR + 4.650%) | | $ | 732,453 | | | 10/01/21 | | 723,908 | | | 732,453 | |

| | | | | | | | |

| Ocelot Holdco | | | | | | | | |

| An electric power services provider that focuses on construction and maintenance services, installing electrical distribution systems and substation infrastructure. |

| 10.00% Takeback Term Loan due 10/20/2027 | | $ | 217,651 | | | 10/24/23 | | 217,651 | | | 217,651 | |

| Preferred Stock (B) | | 15 shs. | | 10/24/23 | | 97,615 | | | 128,316 | |

| Common Stock (B) (I) | | 12 shs. | | 10/24/23 | | - | | - |

| Office Ally (OA TOPCO, LP) | | | | | | | | |

| | | | | | 315,266 | | | 345,967 | |

See Notes to Consolidated Financial Statements 21

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Office Ally (OA TOPCO, LP) | | | | | | | | |

| A provider of medical claims clearinghouse software to office-based physician providers and healthcare insurance payers. |

| 11.19% Term Loan due 12/10/2028 (SOFR + 5.500%) (G) | | $ | 966,175 | | | 12/20/21 | | $ | 837,796 | | | $ | 850,800 | |

| 10.83% Term Loan due 12/20/2028 (SOFR + 5.500%) (G) | | $ | 111,670 | | | 04/29/22 | | 110,079 | | | 111,670 | |

| Limited Liability Company Unit (B) | | 21,092 uts. | | 12/20/21 | | 21,092 | | | 31,849 | |

| | | | | | 968,967 | | | 994,319 | |

| Omega Holdings | | | | | | | | |

| A distributor of aftermarket automotive air conditioning products. |

| 10.32% Term Loan due 03/31/2029 (SOFR + 5.000%) (G) | | $ | 638,673 | | | 03/31/22 | | 490,707 | | | 490,714 | |

| | | | | | | | |

| | | | | | | | |

| Options Technology Ltd | | | | | | | | |

| A provider of vertically focused financial technology managed services and IT infrastructure products for the financial services industry. |

| 10.47% Term Loan due 12/18/2025 (SOFR + 4.750%) | | $ | 1,550,738 | | | 12/23/19 | | 1,541,768 | | | 1,544,690 | |

| | | | | | | | |

| PANOS Brands LLC | | | | | | | | |

| A marketer and distributor of branded consumer foods in the specialty, natural, better-for-you, “free from” healthy and gluten-free categories. |

| 12.00% (1.00% PIK) Senior Subordinated Note due 06/30/2025 | | $ | 1,902,180 | | | 02/17/17 | | 1,609,039 | | | 1,902,180 | |

| Common Stock Class A (B) | | 380,545 shs. | | * | | 380,545 | | | 449,043 | |

| * 01/29/16 and 02/17/17. | | | | | | 1,989,584 | | | 2,351,223 | |

| | | | | | | | |

| Parkview Dental Partners | | | | | | | | |

| A dental service organization focused in the southwest Florida market. |

| 13.61% Term Loan due 10/12/2029 (SOFR + 8.300%) (G) | | $ | 933,333 | | | 10/20/23 | | 594,568 | | | 596,247 | |

| Limited Liability Company Unit (B) (F) | | 29,166 | | 10/20/23 | | 291,660 | | | 286,702 | |

| | | | | | 886,228 | | | 882,949 | |

| | | | | | | | |

| Pearl Holding Group | | | | | | | | |

| A managing general agent that originates, underwrites, and administers non-standard auto insurance policies for carriers in Florida. |

| 11.61% First Lien Term Loan due 12/16/2026 (SOFR + 6.000%) | | $ | 1,872,846 | | | 12/20/21 | | $ | 1,847,271 | | | $ | 1,845,128 | |

| Warrant-Class A, to purchase common stock at $.01 per share (B) | | 924 shs. | | 12/22/21 | | — | | | 46,911 | |

| Warrant-Class B, to purchase common stock at $.01 per share (B) | | 312 shs. | | 12/22/21 | | — | | | 15,840 | |

| Warrant-Class CC, to purchase common stock at $.01 per share (B) | | 32 shs. | | 12/22/21 | | — | | | — | |

| Warrant-Class D, to purchase common stock at $.01 per share (B) | | 89 shs. | | 12/22/21 | | — | | | 4,519 | |

| | | | | | 1,847,271 | | | 1,912,398 | |

| | | | | | | | |

See Notes to Consolidated Financial Statements 22

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Pegasus Transtech Corporation | | | | | | | | |

| A provider of end-to-end document, driver and logistics management solutions, which enable its customers (carriers, brokers, and drivers) to operate more efficiently, reduce manual overhead, enhance compliance, and shorten cash conversion cycles. |

| 11.33% Term Loan due 11/17/2024 (SOFR + 6.000%) | | $ | 1,440,404 | | | 11/14/17 | | $ | 1,429,887 | | | $ | 1,440,404 | |

| 11.33% Term Loan due 08/31/2026 (SOFR + 6.000%) | | $ | 290,754 | | | 09/29/20 | | 286,598 | | | 290,754 | |

| | | | | | 1,716,485 | | | 1,731,158 | |

| Polara (VSC Polara LLC) | | | | | | | | |

| A manufacturer of pedestrian traffic management and safety systems, including accessible pedestrian signals, “push to walk” buttons, and related “traffic” control units. |

| 10.18% First Lien Term Loan due 12/03/2027 (SOFR + 4.750%) (G) | | $ | 864,362 | | | 12/03/21 | | 745,516 | | | 756,096 | |

| Limited Liability Company Unit (B) (F) | | 1,471 uts. | | 12/03/21 | | 147,110 | | | 240,216 | |

| | | | | | 892,626 | | | 996,312 | |

| Polytex Holdings LLC | | | | | | | | |

| A manufacturer of water based inks and related products serving primarily the wall covering market. |

| 13.90% (7.90% PIK) Senior Subordinated Note due 12/31/2024 (D) | | $ | 2,303,571 | | | 07/31/14 | | 1,064,183 | | | 624,268 | |

| Limited Liability Company Unit (B) | | 148,096 uts. | | 07/31/14 | | 148,096 | | | — | |

| Limited Liability Company Unit Class F (B) | | 36,976 uts. | | * | | 24,802 | | | — | |

| * 09/28/17 and 02/15/18. | | | | | | 1,237,081 | | | 624,268 | |

| | | | | | | | |

| Portfolio Group | | | | | | | | |

| A provider of professional finance and insurance products to automobile dealerships, delivering a suite of offerings that supplement earnings derived from vehicle transactions. |

| 11.46% First Lien Term Loan due 12/02/2025 (SOFR + 6.000%) (G) | | $ | 1,283,659 | | | 11/15/21 | | 1,273,033 | | | 1,237,447 | |

| | | | | | | | |

| Process Insights Acquisition, Inc. | | | | | | | | |

| A designer and assembler of highly engineered, mission critical instruments and sensors that provide compositional analyses to measure contaminants and impurities within gases and liquids. |

| 11.57% Term Loan due 06/30/2029 (SOFR + 6.250%) (G) | | $ | 822,606 | | | 07/18/23 | | 601,645 | | | 606,874 | |

| Limited Liability Company Unit (B) | | 32 shs. | | 07/18/23 | | 32,000 | | | 56,567 | |

| | | | | | 633,645 | | | 663,441 | |

| PB Holdings, LLC | | | | | | | | |

| Specializes in the design, manufacturing, installation, maintenance and repair of parts and equipment for blue chip industrial customers in the Southern US. |

| 10.56% Term Loan due 03/06/2025 (SOFR +5.250%) | | $ | 698,506 | | | 03/06/19 | | 696,346 | | | 690,823 | |

| | | | | | | | |

| ProfitOptics | | | | | | | | |

| A software development and consulting company that delivers solutions via its proprietary software development platform, Catalyst. |

| 11.18% Term Loan due 02/15/2028 (SOFR + 5.750%) (G) | | $ | 843,871 | | | 03/15/22 | | 797,286 | | | 808,388 | |

| 8.00% Senior Subordinated Note due 02/15/2029 | | $ | 32,258 | | | 03/15/22 | | 32,258 | | | 29,194 | |

| Limited Liability Company Unit (B) | | 96,774 uts. | | 03/15/22 | | 64,516 | | | 88,065 | |

| | | | | | 894,060 | | | 925,647 | |

See Notes to Consolidated Financial Statements 23

Consolidated Schedule of Investments (Continued) Barings Participation Investors

March 31, 2024

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Restricted Securities - 106.15%: (A) | | Principal Amount,

Shares, Units or

Ownership Percentage | | Acquisition

Date | | Cost | | Fair Value |

| | | | | | | | |

| Private Placement Investments - 103.04%: (C) | | | | | | | | |

| | | | | | | | |

| Randy's Worldwide | | | | | | | | |

| A designer and distributor of automotive aftermarket parts serving the repair/replacement, off-road and racing/performance segments. |

| 11.82% First Lien Term Loan due 10/31/2028 (SOFR + 6.500%) (G) | | $ | 193,657 | | | 11/01/22 | | $ | 136,658 | | | $ | 140,048 | |

| Limited Liability Company Unit Class A (B) | | 54 uts. | | 11/01/22 | | 5,400 | | | 5,408 | |

| | | | | | 142,058 | | | 145,456 | |

| Recovery Point Systems, Inc. | | | | | | | | |

| A provider of IT infrastructure, colocation and cloud based resiliency services. |

| 11.98% Term Loan due 07/31/2026 (SOFR + 6.500%) | | $ | 1,309,036 | | | 08/12/20 | | 1,298,724 | | | 1,309,036 | |

| Limited Liability Company Unit (B) (F) | | 21,532 uts. | | 03/05/21 | | 21,532 | | | 11,197 | |

| | | | | | 1,320,256 | | | 1,320,233 | |

| RedSail Technologies | | | | | | | | |

| A provider of pharmacy management software solutions for independent pharmacies and long-term care facilities. |

| 10.06% Term Loan due 10/27/2026 (SOFR + 4.750%) | | $ | 1,522,357 | | | 12/09/20 | | 1,502,277 | | 1,499,521 |

| | | | | | | | |

| | | | | | | | |

| Renovation Brands (Renovation Parent Holdings, LLC) |

| A portfolio of seven proprietary brands that sell various home improvement products primarily through the e-Commerce channel. |

| 10.95% Term Loan due 08/16/2027 (SOFR + 5.500%) | | $ | 951,456 | | | 11/15/21 | | 937,502 | | | 838,233 | |

| Limited Liability Company Unit (B) | | 39,474 uts. | | 09/29/17 | | 39,474 | | | 11,842 | |

| | | | | | 976,976 | | | 850,075 | |

| | | | | | | | |

| Resonetics, LLC | | | | | | | | |

| A provider of laser micro-machining manufacturing services for medical device and diagnostic companies. |

| 12.59% Second Lien Term Loan due 04/28/2029 (SOFR + 7.000%) | | $ | 1,725,000 | | | 04/28/21 | | 1,703,122 | | | 1,725,000 | |

| 12.59% Incremental Second Lien Term Loan due 04/28/2029 (SOFR + 7.000%) | | $ | 552,000 | | | 11/15/21 | | 544,482 | | | 552,000 | |

| | | | | | 2,247,604 | | | 2,277,000 | |

| | | | | | | | |

| RoadOne IntermodaLogistics | | | | | | | | |