MRC Global Announces Closing of $750 Million Asset-Based Loan Facility

November 12 2024 - 3:15PM

MRC Global Inc. (NYSE: MRC), announced today that it has amended

its asset-based revolving loan facility (“ABL”), extending its

maturity to November 2029. The amended ABL has a committed

borrowing capacity of $750 million.

The terms of the ABL are substantially the same

as the previous facility with a borrowing rate of Term SOFR plus a

margin ranging from 1.25% to 1.75%, based on the company’s fixed

charge coverage ratio.

Rob Saltiel, MRC Global President & CEO

stated, “We are pleased to have successfully closed on our amended

ABL credit facility with favorable terms and an extended maturity.

This transaction, along with our new 7-year Term Loan B announced

last week that helped fund the repurchase of our convertible

preferred stock, strengthens our company’s capital structure and

de-risks our dependence on near-term capital markets for credit

support.”

About MRC Global Inc.

Headquartered in Houston, Texas, MRC Global

(NYSE: MRC) is the leading global distributor of pipe,

valves, fittings (PVF) and other infrastructure products

and services to diversified end-markets including the gas

utilities, downstream, industrial and energy transition, and

production and transmission sectors. With over 100 years of

experience, MRC Global has provided customers with innovative

supply chain solutions, technical product expertise and a robust

digital platform from a worldwide network of over 200

locations including valve and engineering centers. The company’s

unmatched quality assurance program offers over 300,000 SKUs from

over 8,500 suppliers, simplifying the supply chain for

approximately 10,000 customers. Find out more at

www.mrcglobal.com.

Contact:Monica BroughtonVP, Investor Relations

& TreasuryMRC Global

Inc.Monica.Broughton@mrcglobal.com832-308-2847

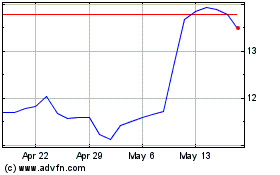

MRC Global (NYSE:MRC)

Historical Stock Chart

From Feb 2025 to Mar 2025

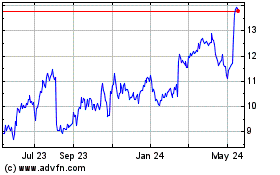

MRC Global (NYSE:MRC)

Historical Stock Chart

From Mar 2024 to Mar 2025