false

0000702165

0000702165

2024-10-22

2024-10-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

October 22, 2024 (October

22, 2024)

________________________________

NORFOLK

SOUTHERN CORPORATION

(Exact name of registrant as specified in its

charter)

______________________________________

| Virginia |

1-8339 |

52-1188014 |

| (State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS

Employer Identification Number) |

| 650 West Peachtree Street NW |

|

Atlanta, Georgia

30308-1925 |

(855) 667-3655 |

| (Address of principal

executive offices, including zip code) |

(Registrant’s telephone

number, including area code) |

No Change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange

on which registered |

Norfolk Southern Corporation

Common Stock (Par Value $1.00) |

|

NSC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial

Condition

Item 7.01. Regulation FD Disclosure

On October 22, 2024, Norfolk Southern Corporation (the “Company”)

issued a press release and its Quarterly Financial Data for the third quarter of 2024. A copy of the press release is attached as Exhibit

99.1 and a copy of the Quarterly Financial Data is attached as Exhibit 99.2, each of which is incorporated by reference herein. These

documents are also available on the Company’s website, www.norfolksouthern.com.* This unaudited financial information and summary

of certain notes to the consolidated financial statements should be read in conjunction with: (a) the consolidated financial statements

and notes included in the Company's latest Annual Report on Form 10-K and in subsequent Quarterly Reports on Form 10-Q; and (b) any Current

Reports on Form 8-K.

The information contained in this Current Report shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by

reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibits are furnished as part of this Current Report on

Form 8-K:

* Internet addresses are provided for informational purposes only and are

not intended to be hyperlinks.

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant

has caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

SIGNATURES |

| |

NORFOLK SOUTHERN CORPORATION |

| |

(Registrant) |

| |

|

|

| |

|

|

| |

/s/ Jason M. Morris |

| |

Name: Jason M. Morris |

| |

Title: SVP, CLO & Corporate Secretary |

Date: October 22, 2024

Exhibit 99.1

FOR IMMEDIATE RELEASE

Norfolk Southern reports strong third quarter 2024

results

Productivity initiatives drive further margin improvement

On track to meet adjusted operating ratio targets

for second half and full year 2024

ATLANTA, October

22, 2024 – Norfolk Southern Corporation (NYSE: NSC) announced Tuesday its third quarter 2024 financial results. For the

quarter, income from railway operations was $1.6 billion, the operating ratio was

47.7%, and diluted earnings per share were $4.85.

After adjusting the results to

exclude the impact of railway line sales, the Eastern Ohio incident as well as restructuring and

other charges, railway operating income was $1.1 billion, the operating ratio was 63.4%, and diluted earnings per share were $3.25.

During

the quarter, the company closed two railway line sales resulting in cash proceeds of nearly $400 million and gains of $380 million. For

the second consecutive quarter, insurance recoveries related to the Eastern Ohio incident exceeded incremental costs.

"The Norfolk Southern team continues to build

momentum, producing strong results for our shareholders and customers, and delivering on our safety culture for our employees" said

Norfolk Southern President and CEO Mark R. George. “Working together, our team drove productivity and grew volumes while demonstrating

resiliency in dealing with weather challenges. Thanks to our team’s hard work, we delivered sequential and year-over-year margin

improvement putting us on track to achieve our adjusted operating ratio targets for the second half and full year 2024, and we are well

positioned for long-term value creation.”

Third Quarter Summary

| • |

Railway operating revenues of $3.1 billion, up $80 million, or 3%, compared to the third quarter 2023. |

| |

|

| • |

Income from railway operations was $1.6 billion, an increase of $840 million, or 111%, compared to the third quarter 2023. |

| |

|

| |

° |

Adjusting for the impact of railway line sales, restructuring and other charges, and the Eastern Ohio incident, income from railway operations was $1.1 billion, up $198 million, or 22%, compared to adjusted third quarter 2023. |

| • |

Operating ratio in the quarter was 47.7% compared to 74.6% in third quarter 2023. |

| |

|

| |

° |

On an adjusted basis, the operating ratio for third quarter 2024 was 63.4%. This represents 570 basis points of improvement from adjusted third quarter 2023 which was 69.1%. |

| |

|

| • |

Diluted earnings per share were $4.85, an increase of 131% compared to third quarter 2023. |

| |

|

| |

° |

Adjusted diluted earnings per share were $3.25, up $0.60, or 23%, compared to adjusted third quarter 2023. |

###

About Norfolk Southern

Since 1827, Norfolk Southern Corporation (NYSE: NSC) and its predecessor

companies have safely moved the goods and materials that drive the U.S. economy. Today, it operates a customer-centric and operations-driven

freight transportation network. Committed to furthering sustainability, Norfolk Southern helps its customers avoid approximately 15 million

tons of yearly carbon emissions by shipping via rail. Its dedicated team members deliver more than 7 million carloads annually, from agriculture

to consumer goods, and Norfolk Southern originates more automotive traffic than any other Class I Railroad. Norfolk Southern also has

the most extensive intermodal network in the eastern U.S. It serves a majority of the country's population and manufacturing base, with

connections to every major container port on the Atlantic coast as well as major ports in the Gulf of Mexico and Great Lakes. Learn more

by visiting www.NorfolkSouthern.com.

Media Inquiries:

Media Relations

Investor Inquiries:

Investor Relations

Cautionary Statement

on Forward-Looking Statements

Certain statements in this press release are "forward-looking statements" within the meaning of the "safe harbor"

provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements relate to future events or our future

financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels

of activity, performance, or our achievements or those of our industry to be materially different from those expressed or implied by any

forward-looking statements. In some cases, forward-looking statements may be identified by the use of words like "may," "will,"

"could," "would," "should," "expect," "anticipate," "believe," "project,"

or other comparable terminology. While the Company has based these forward-looking statements on those expectations, assumptions, estimates,

beliefs, and projections it views as reasonable, such forward-looking statements are only predictions and involve known and unknown risks

and uncertainties, many of which involve factors or circumstances that are beyond the Company's control, including but not limited to:

(i) the Company's ability to successfully implement its operational and productivity initiatives; (ii) changes in domestic or international

economic, political or business conditions, including those affecting the transportation industry; (iii) natural events such as severe

weather conditions; (iv) the outcome of claims, litigation, and governmental proceedings involving or affecting the Company, including

those with respect to the Eastern Ohio incident; and (v) the nature and extent of the Company’s environmental remediation obligations

with respect to the Eastern Ohio incident. These and other important factors, including

those discussed under "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2023, as well as

the Company's subsequent filings with the SEC, may cause actual results, performance, or achievements to differ materially from those

expressed or implied by these forward-looking statements. The forward-looking statements herein are made only as of the date they were

first issued, and unless otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update

or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measures

Information included within this press release contains non-GAAP financial

measures, including adjusted income from railway operations, adjusted operating ratio, and adjusted diluted earnings per share. Non-GAAP

financial measures should be considered in addition to, not as a substitute for, the financial measures reported in accordance with U.S.

generally accepted accounting principles (GAAP).

Our third quarter 2024 non-GAAP financial

results exclude the effects of certain expenses related to the impact of railway line sales, the Eastern Ohio incident, and restructuring

and other charges. The following table adjusts our third quarter 2024 GAAP financial results to exclude the effects of those items. The

income tax effects of the non-GAAP adjustments were calculated based on the applicable tax rates to which the non-GAAP adjustments related.

We use these non-GAAP financial measures internally and believe this information provides useful supplemental information to investors

to facilitate making period-to-period comparisons by excluding these costs. While we believe that these non-GAAP financial measures are

useful in evaluating our business, this information should be considered as supplemental in nature and is not meant to be considered in

isolation from, or as a substitute for, the related financial information prepared in accordance with GAAP. In addition, these non-GAAP

financial measures may not be the same as similar measures presented by other companies. With respect to our full year 2024 adjusted operating

ratio guidance, we are unable to predict or estimate with reasonable certainty the ultimate outcome of certain items required for the

GAAP measure without unreasonable effort. Information about the adjustments that are not currently available to us could have a potentially

unpredictable and significant impact on future GAAP results.

| ($ in millions, except per share amounts) | |

Third |

| | |

Quarter 2024 |

| Income from railway operations | |

$ | 1,596 | |

| Effect of railway line sales | |

| (380 | ) |

| Effect of Eastern Ohio incident | |

| (159 | ) |

| Effect of restructuring and other charges | |

| 60 | |

| Adjusted income from railway operations | |

$ | 1,117 | |

| | |

| | |

| Operating ratio | |

| 47.7 | % |

| Effect of railway line sales | |

| 12.5 | % |

| Effect of Eastern Ohio incident | |

| 5.2 | % |

| Effect of restructuring and other charges | |

| (2.0 | %) |

| Adjusted operating ratio | |

| 63.4 | % |

| | |

| | |

| Diluted earnings per share | |

$ | 4.85 | |

| Effect of railway line sales | |

| (1.27 | ) |

| Effect of Eastern Ohio incident | |

| (0.53 | ) |

| Effect of restructuring and other charges | |

| 0.20 | |

| Adjusted diluted earnings per share | |

$ | 3.25 | |

Exhibit 99.2

Norfolk Southern Corporation and Subsidiaries

Consolidated Statements of Income

(Unaudited)

| | |

Third Quarter | |

First Nine Months |

| | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

(in millions, except per share amounts) |

| Railway operating revenues | |

| | | |

| | | |

| | | |

| | |

| Merchandise | |

$ | 1,861 | | |

$ | 1,800 | | |

$ | 5,628 | | |

$ | 5,504 | |

| Intermodal | |

| 763 | | |

| 737 | | |

| 2,250 | | |

| 2,296 | |

| Coal | |

| 427 | | |

| 434 | | |

| 1,221 | | |

| 1,283 | |

| Total railway operating revenues | |

| 3,051 | | |

| 2,971 | | |

| 9,099 | | |

| 9,083 | |

| | |

| | | |

| | | |

| | | |

| | |

| Railway operating expenses | |

| | | |

| | | |

| | | |

| | |

| Compensation and benefits | |

| 690 | | |

| 715 | | |

| 2,126 | | |

| 2,098 | |

| Purchased services and rents | |

| 497 | | |

| 517 | | |

| 1,541 | | |

| 1,519 | |

| Fuel | |

| 216 | | |

| 289 | | |

| 757 | | |

| 867 | |

| Depreciation | |

| 339 | | |

| 326 | | |

| 1,011 | | |

| 968 | |

| Materials and other | |

| (188 | ) | |

| 205 | | |

| 200 | | |

| 622 | |

| Restructuring and other charges | |

| 60 | | |

| — | | |

| 156 | | |

| — | |

| Eastern Ohio incident | |

| (159 | ) | |

| 163 | | |

| 368 | | |

| 966 | |

| Total railway operating expenses | |

| 1,455 | | |

| 2,215 | | |

| 6,159 | | |

| 7,040 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income from railway operations | |

| 1,596 | | |

| 756 | | |

| 2,940 | | |

| 2,043 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income – net | |

| 34 | | |

| 40 | | |

| 69 | | |

| 153 | |

| Interest expense on debt | |

| 203 | | |

| 182 | | |

| 608 | | |

| 527 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income before income taxes | |

| 1,427 | | |

| 614 | | |

| 2,401 | | |

| 1,669 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income taxes | |

| 328 | | |

| 136 | | |

| 512 | | |

| 369 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 1,099 | | |

$ | 478 | | |

$ | 1,889 | | |

$ | 1,300 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share – diluted | |

$ | 4.85 | | |

$ | 2.10 | | |

$ | 8.34 | | |

$ | 5.70 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding – diluted | |

| 226.5 | | |

| 227.0 | | |

| 226.3 | | |

| 227.8 | |

See accompanying notes to consolidated financial statements.

Norfolk Southern Corporation and Subsidiaries

Consolidated Balance Sheets

(Unaudited)

| | |

September 30, | |

December 31, |

| | |

2024 | |

2023 |

| | |

($ in millions) |

| Assets | |

| |

|

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 975 | | |

$ | 1,568 | |

| Accounts receivable – net | |

| 1,302 | | |

| 1,147 | |

| Materials and supplies | |

| 288 | | |

| 264 | |

| Other current assets | |

| 125 | | |

| 292 | |

| Total current assets | |

| 2,690 | | |

| 3,271 | |

| | |

| | | |

| | |

| Investments | |

| 3,968 | | |

| 3,839 | |

| Properties less accumulated depreciation of $13,855 and $13,265, respectively | |

| 35,390 | | |

| 33,326 | |

| Other assets | |

| 1,207 | | |

| 1,216 | |

| | |

| | | |

| | |

| Total assets | |

$ | 43,255 | | |

$ | 41,652 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,614 | | |

$ | 1,638 | |

| Income and other taxes | |

| 179 | | |

| 262 | |

| Other current liabilities | |

| 1,329 | | |

| 728 | |

| Current maturities of long-term debt | |

| 555 | | |

| 4 | |

| Total current liabilities | |

| 3,677 | | |

| 2,632 | |

| | |

| | | |

| | |

| Long-term debt | |

| 16,644 | | |

| 17,175 | |

| Other liabilities | |

| 1,786 | | |

| 1,839 | |

| Deferred income taxes | |

| 7,363 | | |

| 7,225 | |

| | |

| | | |

| | |

| Total liabilities | |

| 29,470 | | |

| 28,871 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock $1.00 per share par value, 1,350,000,000 shares authorized;

outstanding 226,239,662 and 225,681,254 shares, respectively, net of treasury shares | |

| 228 | | |

| 227 | |

| Additional paid-in capital | |

| 2,223 | | |

| 2,179 | |

| Accumulated other comprehensive loss | |

| (332 | ) | |

| (320 | ) |

| Retained income | |

| 11,666 | | |

| 10,695 | |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 13,785 | | |

| 12,781 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 43,255 | | |

$ | 41,652 | |

See accompanying notes to consolidated financial statements.

Norfolk Southern Corporation and Subsidiaries

Consolidated Statements of Cash Flows

(Unaudited)

| | |

First Nine Months |

| | |

2024 | |

2023 |

| | |

($ in millions) |

| Cash flows from operating activities | |

| | | |

| | |

| Net income | |

$ | 1,889 | | |

$ | 1,300 | |

| Reconciliation of net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation | |

| 1,011 | | |

| 968 | |

| Deferred income taxes | |

| 141 | | |

| (53 | ) |

| Gains and losses on properties | |

| (425 | ) | |

| (34 | ) |

| Changes in assets and liabilities affecting operations: | |

| | | |

| | |

| Accounts receivable | |

| (156 | ) | |

| (65 | ) |

| Materials and supplies | |

| (24 | ) | |

| (50 | ) |

| Other current assets | |

| 80 | | |

| 37 | |

| Current liabilities other than debt | |

| 774 | | |

| 538 | |

| Other – net | |

| (189 | ) | |

| (135 | ) |

| | |

| | | |

| | |

| Net cash provided by operating activities | |

| 3,101 | | |

| 2,506 | |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Property additions | |

| (1,706 | ) | |

| (1,491 | ) |

| Acquisition of assets of CSR | |

| (1,643 | ) | |

| (5 | ) |

| Property sales and other transactions | |

| 527 | | |

| 62 | |

| Investment purchases | |

| (318 | ) | |

| (120 | ) |

| Investment sales and other transactions | |

| 349 | | |

| 160 | |

| | |

| | | |

| | |

| Net cash used in investing activities | |

| (2,791 | ) | |

| (1,394 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Dividends | |

| (915 | ) | |

| (920 | ) |

| Common stock transactions | |

| 15 | | |

| (9 | ) |

| Purchase and retirement of common stock | |

| — | | |

| (503 | ) |

| Proceeds from borrowings | |

| 1,051 | | |

| 2,303 | |

| Debt repayments | |

| (1,054 | ) | |

| (933 | ) |

| | |

| | | |

| | |

| Net cash used in financing activities | |

| (903 | ) | |

| (62 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

| (593 | ) | |

| 1,050 | |

| | |

| | | |

| | |

| Cash and cash equivalents | |

| | | |

| | |

| At beginning of year | |

| 1,568 | | |

| 456 | |

| | |

| | | |

| | |

| At end of period | |

$ | 975 | | |

$ | 1,506 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest (net of amounts capitalized) | |

$ | 571 | | |

$ | 451 | |

| Income taxes (net of refunds) | |

| 284 | | |

| 521 | |

See accompanying notes to consolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Sales of Railway Lines

During the third quarter of 2024, we completed

sales of two railway lines in the states of Virginia and North Carolina resulting in gains of $380 million on operating property sales

included in “Materials and other” expense. The gains from these transactions are reflected in “Gains and losses on properties”

and cash proceeds of $389 million are included in “Property sales and other transactions” on the Consolidated Statement of

Cash Flows.

2. Restructuring and Other Charges

We recognized $60 million in the third quarter

of 2024 related to expenses associated with the rationalization of certain software development projects that had not been placed into

service and reflecting certain equipment at its net realizable value in advance of the planned disposition of that asset class. The $156

million recognized during first nine months of 2024, also includes $96 million of costs associated with our voluntary and involuntary

separation programs that reduced our management workforce and costs associated with the appointment of our chief operating officer. Additionally,

“Other income – net” for the first nine months includes a $20 million curtailment gain on our other postretirement benefit

plan resulting from the restructuring, recorded in the second quarter of 2024.

3. Eastern Ohio Incident

On February 3, 2023, a train operated by us derailed

in East Palestine, Ohio (the Incident). We recognized expenses of $368 million and $966 million during the first nine months of 2024 and

2023, respectively, for costs related to the Incident. Insurance recoveries exceeded expenses by $159 million in the third quarter of

2024 compared to expenses of $163 million in the third quarter of 2023. The total expense recognized in the first nine months of 2024

includes the impact of $552 million in insurance recoveries, of which $288 million was recognized in the third quarter 2024. During the

first nine months of 2023, $25 million in recoveries were recorded. Any additional amounts recoverable under our insurance policies or

from third parties will be reflected in future periods in which recovery is considered probable. No amounts have been recorded related

to potential third-party recoveries, which may reduce amounts payable by our insurers under applicable insurance coverage.

4. Shareholder Advisory Costs

“Other income – net” includes

costs associated with shareholder advisory matters, which amounted to $1 million and $51 million during the third quarter and first nine

months of 2024, respectively.

5. Deferred Income Taxes

During the first nine months of 2024, we recorded

a $27 million reduction to deferred income taxes, the result of a subsidiary restructuring that reduced our estimated deferred state income

tax rate.

6. Stock Repurchase Program

We did not repurchase shares of common stock under

our stock repurchase program in the first nine months of 2024, while we repurchased and retired 2.2 million shares of common stock at

a cost of $508 million in the first nine months of 2023, inclusive of excise taxes.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

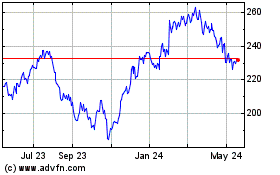

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Dec 2024 to Jan 2025

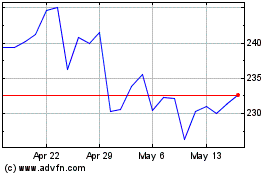

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Jan 2024 to Jan 2025