Insperity, Inc. (NYSE: NSP), a leading provider of human

resources and business performance solutions for America’s best

businesses, today reported results for the fourth quarter and year

ended December 31, 2024. Insperity will be hosting a conference

call today at 8:30 a.m. ET to discuss these results and our 2025

outlook and will be posting an accompanying presentation to its

investor website at http://ir.insperity.com.

- Q4 average number of WSEEs paid of 309,000 within our expected

range

- Q4 net loss of $9 million; adjusted EBITDA of $23 million

- Q4 diluted EPS of $(0.22); adjusted EPS of $0.05

- 2024 average number of paid WSEEs of 307,000

- 2024 net income of $91 million; adjusted EBITDA of $270

million

- 2024 diluted EPS of $2.42; adjusted EPS of $3.58

- Return to shareholders of $152 million during 2024 through the

repurchase of 697,000 shares at a cost of $63 million and $89

million in cash dividends

Fourth Quarter Results

The average number of worksite employees (“WSEE”) paid per month

decreased 2% from Q4 2023 to 309,093 WSEEs. Revenues in Q4 2024

increased 2% to $1.6 billion on a 4% increase in revenue per WSEE

on higher pricing, offset by the 2% decrease in paid WSEEs.

“We are pleased with our fourth quarter and full year 2024

results including an exceptional year-end sales and client

retention campaign, accomplishing an important growth inflection

point entering the new year,” said Paul J. Sarvadi, Insperity

chairman and chief executive officer. “We expect to build on this

momentum with growth acceleration in 2025. We are also focused on

reaching significant milestones in our Workday strategic

partnership this year, with the goal of enhancing our growth

trajectory in 2026 and beyond.”

Gross profit decreased 2% from Q4 2023 to $218 million. Q4 2024

gross profit per employee was in line with the prior year

period.

Operating expenses increased 17% over Q4 2023, in line with our

forecast, and included approximately $19 million associated with

the implementation of our Workday strategic partnership.

Reported net loss and diluted EPS were $9 million and $(0.22),

respectively. Adjusted EBITDA and adjusted EPS were $23 million and

$0.05, respectively.

Full Year Results

The average number of WSEEs paid per month decreased 2% from

2023 to 307,261 WSEEs. Revenues increased by 1% to $6.6 billion on

a 3% increase in revenue per WSEE, offset in part by the 2%

decrease in paid WSEEs.

Gross profit increased 1% on a 3% increase in gross profit per

WSEE per month, primarily due to increased pricing and more

favorable results from our benefits costs program and payroll

taxes.

Operating expenses increased 14% over 2023. Operating expenses

for 2024 include approximately $57 million associated with the

implementation of our Workday strategic partnership as well as

ongoing investments in our sales, service and technology areas, and

the impact of the recent inflationary environment.

Reported net income and diluted EPS were $91 million and $2.42,

respectively. Adjusted EBITDA and adjusted EPS were $270 million

and $3.58, respectively.

“We are pleased with our 2024 financial results, particularly

considering the macroeconomic conditions that impacted our growth,”

said James D. Allison, executive vice president of finance, chief

financial officer and treasurer. “Our balance sheet remains strong,

as we balance investments in our long-term business strategy and

returns to shareholders through dividends and share

repurchases.”

Cash outlays in 2024 included the repurchase of approximately

697,000 shares of our common stock at a cost of $63 million,

dividends totaling $89 million, and capital expenditures of $38

million. Adjusted cash at December 31, 2024 totaled $134 million

and $280 million remains available under our $650 million credit

facility.

2025 Guidance

The company also announced its guidance for 2025, including the

first quarter of 2025. Please refer to the accompanying financial

tables at the end of this press release for the reconciliation of

non-GAAP financial measures to the comparable GAAP financial

measures.

Q1 2025

Full Year 2025

Average WSEEs paid

306,500

—

309,000

313,400

—

319,500

Year-over-year increase

0.9%

—

1.7%

2.0%

—

4.0%

Adjusted EPS(1)

$1.89

—

$2.15

$3.10

—

$3.95

Year-over-year increase (decrease)

(17)%

—

(5)%

(13)%

—

10%

Adjusted EBITDA (in millions)

$121

—

$135

$240

—

$285

Year-over-year increase (decrease)

(15)%

—

(5)%

(11)%

—

6%

_______________________________

(1) Adjusted EPS includes an estimated $(0.06) for Q1 2025 and

full year 2025 related to a higher effective income tax rate.

Definition of Key Metrics

Average WSEEs paid — Determined by calculating the company’s

cumulative WSEEs paid during the period divided by the number of

months in the period.

Adjusted EPS — Represents diluted net income per share computed

in accordance with GAAP, excluding the impact of non-cash

stock-based compensation.

Adjusted EBITDA — Represents net income computed in accordance

with GAAP, plus interest expense, income taxes, depreciation and

amortization expense, amortization of SaaS implementation costs and

non-cash stock-based compensation.

Conference Call and Webcast

Insperity will be hosting a conference call today at 8:30 a.m.

ET to discuss these results and the guidance discussed in this

press release, and answer questions from investment analysts. To

listen in, call 888-506-0062 and use conference i.d. number 405371.

The call will also be webcast at http://ir.insperity.com. The

conference call script will be available at the same website later

today. A replay of the conference call will be available at

877-481-4010, conference i.d. number 51901. The webcast will be

archived for one year.

About Insperity

Since 1986, Insperity’s mission has been to help businesses

succeed so communities prosper. Offering the most comprehensive

suite of scalable HR solutions available in the marketplace,

Insperity is defined by an unrivaled breadth and depth of services

and level of care. Through an optimal blend of premium HR service

and technology, Insperity delivers the administrative relief,

reduced liabilities and better benefit solutions that businesses

need for sustained growth. With 2024 revenues of $6.6 billion and

more than 100 sales offices throughout the U.S., Insperity is

currently making a difference in thousands of businesses and

communities nationwide. For more information, visit

http://www.insperity.com.

Forward-Looking Statements

The statements contained herein that are not historical facts

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. You can identify such forward-looking

statements by the words “anticipates,” “expects,” “intends,”

“plans,” “projects,” “believes,” “estimates,” “forecasts,”

“likely,” “possibly,” “probably,” “could,” “goal,” “opportunity,”

“objective,” “target,” “assume,” “outlook,” “guidance,” “predicts,”

“appears,” “indicator” and similar expressions. Forward-looking

statements involve a number of risks and uncertainties. In the

normal course of business, in an effort to help keep our

stockholders and the public informed about our operations, from

time to time, we may issue such forward-looking statements, either

orally or in writing. Generally, these statements relate to

business plans or strategies, including our strategic partnership

with Workday, Inc.; projected or anticipated benefits or other

consequences of such plans or strategies; or projections involving

anticipated revenues, earnings, average number of worksite

employees, benefits and workers’ compensation costs, or other

operating results. We base these forward-looking statements on our

current expectations, estimates and projections. We caution you

that these statements are not guarantees of future performance and

involve risks, uncertainties and assumptions that we cannot

predict. In addition, we have based many of these forward-looking

statements on assumptions about future events that may prove to be

inaccurate. Therefore, the actual results of the future events

described in such forward-looking statements could differ

materially from those stated in such forward-looking statements.

Among the factors that could cause actual results to differ

materially are:

- adverse economic conditions;

- failure to comply with or meet client expectations regarding

certain COVID-19 relief programs;

- bank failures or other events affecting financial institutions;

labor shortages, increasing competition for highly skilled workers,

and evolving employee expectations regarding the workplace;

- impact of inflation;

- vulnerability to regional economic factors because of our

geographic market concentration;

- failure to comply with covenants under our credit

facility;

- impact of a future outbreak of highly infectious or contagious

disease;

- our liability for WSEE payroll, payroll taxes and benefits

costs, or other liabilities associated with actions of our client

companies or WSEEs, including if our clients fail to pay us;

- increases in health insurance costs and workers’ compensation

rates and underlying claims trends, health care reform, financial

solvency of workers’ compensation carriers, other insurers or

financial institutions, state unemployment tax rates, liabilities

for employee and client actions or payroll-related claims;

- an adverse determination regarding our status as the employer

of our WSEEs for tax and benefit purposes and an inability to offer

alternative benefit plans following such a determination;

- cancellation of client contracts on short notice, or the

inability to renew client contracts or attract new clients;

- the ability to secure competitive replacement contracts for

health insurance and workers’ compensation insurance at expiration

of current contracts;

- regulatory and tax developments and possible adverse

application of various federal, state and local regulations;

- failure to manage growth of our operations and the

effectiveness of our sales and marketing efforts;

- the impact of the competitive environment and other

developments in the human resources services industry, including

the PEO industry, on our growth and/or profitability;

- an adverse final judgment or settlement of claims against

Insperity;

- disruptions of our information technology systems or failure to

enhance our service and technology offerings to address new

regulations or client expectations;

- our liability or damage to our reputation relating to

disclosure of sensitive or private information as a result of data

theft, cyberattacks or security vulnerabilities;

- failure of third-party providers, such as financial

institutions, data centers or cloud service providers;

- our ability to fully realize the anticipated benefits of our

strategic partnership and plans to develop a joint solution with

Workday, Inc.; and

- our ability to integrate or realize expected returns on future

product offerings, including through acquisitions, strategic

partnerships, and investments.

These factors are discussed in further detail in Insperity’s

filings with the U.S. Securities and Exchange Commission. Any of

these factors, or a combination of such factors, could materially

affect the results of our operations and whether forward-looking

statements we make ultimately prove to be accurate.

Any forward-looking statements are made only as of the date

hereof and, unless otherwise required by applicable securities

laws, we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Insperity, Inc. CONDENSED CONSOLIDATED

BALANCE SHEETS

December 31, 2024

December 31, 2023

(in millions)

Assets

Cash and cash equivalents

$

1,039

$

693

Restricted cash

69

57

Marketable securities

16

16

Accounts receivable, net

829

694

Prepaid insurance and related assets

25

7

Other current assets

107

128

Total current assets

2,085

1,595

Property and equipment, net

192

197

Right-of-use leased assets

65

57

Deposits and prepaid health insurance

195

215

Goodwill and other intangible assets,

net

13

13

Deferred income taxes, net

34

20

Other assets

13

23

Total assets

$

2,597

$

2,120

Liabilities and stockholders'

equity

Accounts payable

$

10

$

11

Payroll taxes and other payroll deductions

payable

901

566

Accrued worksite employee payroll cost

730

559

Accrued health insurance costs

19

46

Accrued workers’ compensation costs

71

60

Accrued corporate payroll and

commissions

82

64

Other accrued liabilities

117

130

Total current liabilities

1,930

1,436

Accrued workers’ compensation costs, net

of current

135

163

Long-term debt

369

369

Operating lease liabilities, net of

current

66

58

Total noncurrent liabilities

570

590

Stockholders’ equity:

Common stock

1

1

Additional paid-in capital

222

185

Treasury stock, at cost

(864

)

(831

)

Retained earnings

738

739

Total stockholders' equity

97

94

Total liabilities and stockholders’

equity

$

2,597

$

2,120

Insperity, Inc.

CONSOLIDATED STATEMENTS OF

OPERATIONS

Three Months Ended

December 31,

Year Ended

December 31,

(in millions, except per share

amounts)

2024

2023

Change

2024

2023

Change

Operating results:

Revenues(1)

$

1,613

$

1,580

2

%

$

6,581

$

6,486

1

%

Payroll taxes, benefits and workers’

compensation costs

1,395

1,358

3

%

5,529

5,449

1

%

Gross profit

218

222

(2

)%

1,052

1,037

1

%

Salaries, wages and payroll taxes

128

112

14

%

521

461

13

%

Stock-based compensation

14

11

27

%

61

53

15

%

Commissions

13

13

—

47

47

—

Advertising

10

7

43

%

38

37

3

%

General and administrative expenses

57

45

27

%

224

177

27

%

Depreciation and amortization

11

11

—

44

43

2

%

Total operating expenses

233

199

17

%

935

818

14

%

Operating income (loss)

(15

)

23

(165

)%

117

219

(47

)%

Other income (expense):

Interest income

9

8

13

%

37

33

12

%

Interest expense

(7

)

(7

)

—

(28

)

(27

)

4

%

Income (loss) before income tax

expense

(13

)

24

(154

)%

126

225

(44

)%

Income tax (benefit) expense

(4

)

5

(180

)%

35

54

(35

)%

Net income (loss)

$

(9

)

$

19

(147

)%

$

91

$

171

(47

)%

Net income (loss) per share of common

stock

Basic

$

(0.22

)

$

0.52

(142

)%

$

2.44

$

4.53

(46

)%

Diluted

$

(0.22

)

$

0.52

(142

)%

$

2.42

$

4.47

(46

)%

____________________________________

(1) Revenues are comprised of

gross billings less WSEE payroll costs as follows:

Three Months Ended

December 31,

Year Ended

December 31,

(in millions)

2024

2023

2024

2023

Gross billings

$

11,617

$

11,378

$

43,752

$

43,141

Less: WSEE payroll cost

10,004

9,798

37,171

36,655

Revenues

$

1,613

$

1,580

$

6,581

$

6,486

Insperity, Inc.

KEY FINANCIAL AND STATISTICAL

DATA

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

Change

2024

2023

Change

Average WSEEs paid

309,093

315,072

(2

)%

307,261

312,102

(2

)%

Statistical data (per WSEE per

month):

Revenues(1)

$

1,739

$

1,672

4

%

$

1,785

$

1,732

3

%

Gross profit

235

235

—

285

277

3

%

Operating expenses

251

211

19

%

253

219

16

%

Operating income

(16

)

24

(167

)%

32

58

(45

)%

Net income

(10

)

20

(150

)%

25

46

(46

)%

____________________________________

(1) Revenues per WSEE per month are comprised of gross billings

per WSEE per month less WSEE payroll costs per WSEE per month

follows:

Three Months Ended

December 31,

Year Ended

December 31,

(per WSEE per month)

2024

2023

2024

2023

Gross billings

$

12,528

$

12,037

$

11,866

$

11,519

Less: WSEE payroll cost

10,789

10,365

10,081

9,787

Revenues

$

1,739

$

1,672

$

1,785

$

1,732

Insperity, Inc. Non-GAAP FINANCIAL MEASURES

(Unaudited)

Non-GAAP financial measures are not prepared in accordance with

GAAP and may be different from non-GAAP financial measures used by

other companies. Non-GAAP financial measures should not be

considered as a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP. Investors

are encouraged to review the reconciliation of the non-GAAP

financial measures used to their most directly comparable GAAP

financial measures as provided in the tables below.

Non-GAAP Measure

Definition

Benefit of Non-GAAP Measure

Non-bonus payroll cost

Non-bonus payroll cost is a non-GAAP

financial measure that excludes the impact of bonus payrolls paid

to our WSEEs.

Bonus payroll cost varies from period to

period, but has no direct impact to our ultimate workers’

compensation costs under the current program.

Our management refers to non-bonus payroll

cost in analyzing, reporting and forecasting our workers’

compensation costs.

We include these non-GAAP financial

measures because we believe they are useful to investors in

allowing for greater transparency related to the costs incurred

under our current workers’ compensation program.

Adjusted cash, cash equivalents and

marketable securities

Excludes funds associated with:

• federal and state income tax

withholdings,

• employment taxes,

• other payroll deductions, and

• client prepayments.

We believe that the exclusion of the

identified items helps us reflect the fundamentals of our

underlying business model and analyze results against our

expectations, against prior periods, and to plan for future periods

by focusing on our underlying operations. We believe that the

adjusted results provide relevant and useful information for

investors because they allow investors to view performance in a

manner similar to the method used by management and improves their

ability to understand and assess our operating performance.

Adjusted EBITDA is used by our lenders to assess our leverage and

ability to make interest payments.

EBITDA

Represents net income computed in

accordance with GAAP, plus:

• interest expense,

• income tax expense,

• depreciation and amortization expense,

and

• amortization of SaaS implementation

costs.

Adjusted EBITDA

Represents EBITDA plus:

• non-cash stock-based compensation.

Adjusted net income

Represents net income computed in

accordance with GAAP, excluding:

• non-cash stock-based compensation.

Adjusted EPS

Represents diluted net income per share

computed in accordance with GAAP, excluding:

• non-cash stock-based compensation.

Following is a reconciliation of payroll cost (GAAP) to

non-bonus payroll costs (non-GAAP):

Three Months Ended December

31,

Year Ended December

31,

(in millions, except per WSEE per

month)

2024

2023

2024

2023

Per WSEE

Per WSEE

Per WSEE

Per WSEE

Payroll cost

$

10,004

$

10,789

$

9,798

$

10,365

$

37,171

$

10,081

$

36,655

$

9,787

Less: Bonus payroll cost

1,690

1,823

1,634

1,728

5,101

1,383

4,978

1,329

Non-bonus payroll cost

$

8,314

$

8,966

$

8,164

$

8,637

$

32,070

$

8,698

$

31,677

$

8,458

Payroll cost % change period over

period

2

%

4

%

3

%

—

1

%

3

%

7

%

1

%

Non-bonus payroll cost % change period

over period

2

%

4

%

5

%

2

%

1

%

3

%

8

%

2

%

Following is a reconciliation of cash, cash equivalents and

marketable securities (GAAP) to adjusted cash, cash equivalents and

marketable securities (non-GAAP):

(in millions)

December 31,

2024

December 31,

2023

Cash, cash equivalents and marketable

securities

$

1,055

$

709

Less:

Amounts payable for withheld federal and

state income taxes, employment taxes and other payroll

deductions

830

510

Client prepayments

91

28

Adjusted cash, cash equivalents and

marketable securities

$

134

$

171

Following is a reconciliation of net income (GAAP) to EBITDA

(non-GAAP) and adjusted EBITDA (non-GAAP):

(in millions, except per WSEE per

month)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Per WSEE

Per WSEE

Per WSEE

Per WSEE

Net income (loss)

$

(9

)

$

(10

)

$

19

$

20

$

91

$

25

$

171

$

46

Income tax (benefit) expense

(4

)

(4

)

5

5

35

8

54

14

Interest expense

7

8

7

7

28

8

27

7

Amortization of SaaS implementation

costs

4

4

3

3

11

3

6

2

Depreciation and amortization

11

12

11

12

44

12

43

11

EBITDA

9

10

45

47

209

56

301

80

Stock-based compensation

14

15

11

12

61

17

53

14

Adjusted EBITDA

$

23

$

25

$

56

$

59

$

270

$

73

$

354

$

94

Net income % change period over

period

(147

)%

(150

)%

(50

)%

(51

)%

(47

)%

(46

)%

(4

)%

(10

)%

Adjusted EBITDA % change period over

period

(59

)%

(58

)%

(29

)%

(31

)%

(24

)%

(22

)%

1

%

(6

)%

Following is a reconciliation of net income (GAAP) to adjusted

net income (non-GAAP):

Three Months Ended December

31,

Year Ended December

31,

(in millions)

2024

2023

2024

2023

Net income (loss)

$

(9

)

$

19

$

91

$

171

Non-GAAP adjustments:

Stock-based compensation

14

11

61

53

Tax effect

(4

)

(1

)

(17

)

(12

)

Total non-GAAP adjustments, net

10

10

44

41

Adjusted net income

$

1

$

29

$

135

$

212

Net income % change period over

period

(147

)%

(50

)%

(47

)%

(4

)%

Adjusted net income % change period

over period

(97

)%

(38

)%

(36

)%

(2

)%

Following is a reconciliation of diluted EPS (GAAP) to adjusted

EPS (non-GAAP):

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Diluted EPS

$

(0.22

)

$

0.52

$

2.42

$

4.47

Non-GAAP adjustments:

Stock-based compensation

0.37

0.30

1.61

1.38

Tax effect

(0.10

)

(0.07

)

(0.45

)

(0.33

)

Total non-GAAP adjustments, net

0.27

0.23

1.16

1.05

Adjusted EPS

$

0.05

$

0.75

$

3.58

$

5.52

Diluted EPS % change period over

period

(142

)%

(47

)%

(46

)%

(4

)%

Adjusted EPS % change period over

period

(93

)%

(38

)%

(35

)%

(1

)%

The following is a reconciliation of GAAP to non-GAAP financial

measures for first quarter and full year 2025 guidance:

Q1 2025

Full Year 2025

(in millions, except per share

amounts)

Guidance

Guidance

Net income

$61 - $70

$71 - $102

Income tax expense

26 - 31

30 - 44

Interest expense

6

25

SaaS implementation amortization

2

4

Depreciation and amortization

11

44

EBITDA

106 - 120

174 - 219

Stock-based compensation

15

66

Adjusted EBITDA

$121 - $135

$240 - $285

Diluted EPS

$1.61 - $1.87

$1.87 - $2.72

Non-GAAP adjustments:

Stock-based compensation

0.40

1.75

Tax effect

(0.12

)

(0.52

)

Total non-GAAP adjustments, net

0.28

1.23

Adjusted EPS

$1.89 - $2.15

$3.10 - $3.95

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210607210/en/

Investor Relations Contact: James D. Allison Executive

Vice President of Finance, Chief Financial Officer and Treasurer

281-348-3140 Investor.Relations@Insperity.com

News Media Contact: Cynthia Murga Director, Public

Relations 713-324-1414 Media@insperity.com

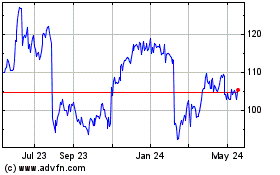

Insperity (NYSE:NSP)

Historical Stock Chart

From Jan 2025 to Feb 2025

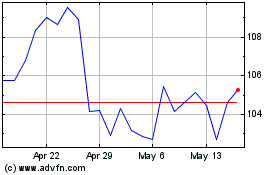

Insperity (NYSE:NSP)

Historical Stock Chart

From Feb 2024 to Feb 2025