0001000753FALSE00010007532025-02-102025-02-100001000753us-gaap:CommonStockMember2025-02-102025-02-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 10, 2025

Insperity, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-13998 | | 76-0479645 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

19001 Crescent Springs Drive

Kingwood, Texas 77339

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (281) 358-8986

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value per share | NSP | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under The Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under The Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 10, 2025, Insperity, Inc. issued a press release announcing the company’s financial and operating results for the quarter and year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated by reference.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| INSPERITY, INC. |

| |

| |

| |

| |

| |

| By: | /s/ Christian P. Callens |

| Christian P. Callens |

| Senior Vice President of Legal,

General Counsel & Secretary |

Date: February 10, 2025

Exhibit 99.1

Insperity Announces Fourth Quarter and Full Year 2024 Results

HOUSTON – February 10, 2025 – Insperity, Inc. (NYSE: NSP), a leading provider of human resources and business performance solutions for America’s best businesses, today reported results for the fourth quarter and year ended December 31, 2024. Insperity will be hosting a conference call today at 8:30 a.m. ET to discuss these results and our 2025 outlook and will be posting an accompanying presentation to its investor website at http://ir.insperity.com.

•Q4 average number of WSEEs paid of 309,000 within our expected range

•Q4 net loss of $9 million; adjusted EBITDA of $23 million

•Q4 diluted EPS of $(0.22); adjusted EPS of $0.05

•2024 average number of paid WSEEs of 307,000

•2024 net income of $91 million; adjusted EBITDA of $270 million

•2024 diluted EPS of $2.42; adjusted EPS of $3.58

•Return to shareholders of $152 million during 2024 through the repurchase of 697,000 shares at a cost of $63 million and $89 million in cash dividends

Fourth Quarter Results

The average number of worksite employees (“WSEE”) paid per month decreased 2% from Q4 2023 to 309,093 WSEEs. Revenues in Q4 2024 increased 2% to $1.6 billion on a 4% increase in revenue per WSEE on higher pricing, offset by the 2% decrease in paid WSEEs.

“We are pleased with our fourth quarter and full year 2024 results including an exceptional year-end sales and client retention campaign, accomplishing an important growth inflection point entering the new year,” said Paul J. Sarvadi, Insperity chairman and chief executive officer. “We expect to build on this momentum with growth acceleration in 2025. We are also focused on reaching significant milestones in our Workday strategic partnership this year, with the goal of enhancing our growth trajectory in 2026 and beyond.”

Gross profit decreased 2% from Q4 2023 to $218 million. Q4 2024 gross profit per employee was in line with the prior year period.

Operating expenses increased 17% over Q4 2023, in line with our forecast, and included approximately $19 million associated with the implementation of our Workday strategic partnership.

Reported net loss and diluted EPS were $9 million and $(0.22), respectively. Adjusted EBITDA and adjusted EPS were $23 million and $0.05, respectively.

Full Year Results

The average number of WSEEs paid per month decreased 2% from 2023 to 307,261 WSEEs. Revenues increased by 1% to $6.6 billion on a 3% increase in revenue per WSEE, offset in part by the 2% decrease in paid WSEEs.

Gross profit increased 1% on a 3% increase in gross profit per WSEE per month, primarily due to increased pricing and more favorable results from our benefits costs program and payroll taxes.

Operating expenses increased 14% over 2023. Operating expenses for 2024 include approximately $57 million associated with the implementation of our Workday strategic partnership as well as ongoing investments in our sales, service and technology areas, and the impact of the recent inflationary environment.

Reported net income and diluted EPS were $91 million and $2.42, respectively. Adjusted EBITDA and adjusted EPS were $270 million and $3.58, respectively.

“We are pleased with our 2024 financial results, particularly considering the macroeconomic conditions that impacted our growth,” said James D. Allison, executive vice president of finance, chief financial officer and treasurer. “Our

balance sheet remains strong, as we balance investments in our long-term business strategy and returns to shareholders through dividends and share repurchases.”

Cash outlays in 2024 included the repurchase of approximately 697,000 shares of our common stock at a cost of $63 million, dividends totaling $89 million, and capital expenditures of $38 million. Adjusted cash at December 31, 2024 totaled $134 million and $280 million remains available under our $650 million credit facility.

2025 Guidance

The company also announced its guidance for 2025, including the first quarter of 2025. Please refer to the accompanying financial tables at the end of this press release for the reconciliation of non-GAAP financial measures to the comparable GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2025 | | Full Year 2025 |

| | | | | | | |

| Average WSEEs paid | 306,500 | — | 309,000 | | 313,400 | — | 319,500 |

| Year-over-year increase | 0.9% | — | 1.7% | | 2.0% | — | 4.0% |

| | | | | | | |

Adjusted EPS(1) | $1.89 | — | $2.15 | | $3.10 | — | $3.95 |

| Year-over-year increase (decrease) | (17)% | — | (5)% | | (13)% | — | 10% |

| | | | | | | |

| Adjusted EBITDA (in millions) | $121 | — | $135 | | $240 | — | $285 |

| Year-over-year increase (decrease) | (15)% | — | (5)% | | (11)% | — | 6% |

_______________________________

(1)Adjusted EPS includes an estimated $(0.06) for Q1 2025 and full year 2025 related to a higher effective income tax rate.

Definition of Key Metrics

Average WSEEs paid — Determined by calculating the company’s cumulative WSEEs paid during the period divided by the number of months in the period.

Adjusted EPS — Represents diluted net income per share computed in accordance with GAAP, excluding the impact of non-cash stock-based compensation.

Adjusted EBITDA — Represents net income computed in accordance with GAAP, plus interest expense, income taxes, depreciation and amortization expense, amortization of SaaS implementation costs and non-cash stock-based compensation.

Conference Call and Webcast

Insperity will be hosting a conference call today at 8:30 a.m. ET to discuss these results and the guidance discussed in this press release, and answer questions from investment analysts. To listen in, call 888-506-0062 and use conference i.d. number 405371. The call will also be webcast at http://ir.insperity.com. The conference call script will be available at the same website later today. A replay of the conference call will be available at 877-481-4010, conference i.d. number 51901. The webcast will be archived for one year.

About Insperity

Since 1986, Insperity’s mission has been to help businesses succeed so communities prosper. Offering the most comprehensive suite of scalable HR solutions available in the marketplace, Insperity is defined by an unrivaled breadth and depth of services and level of care. Through an optimal blend of premium HR service and technology, Insperity delivers the administrative relief, reduced liabilities and better benefit solutions that businesses need for sustained growth. With 2024 revenues of $6.6 billion and more than 100 sales offices throughout the U.S., Insperity is currently making a difference in thousands of businesses and communities nationwide. For more information, visit http://www.insperity.com.

Forward-Looking Statements

The statements contained herein that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You can identify such forward-looking statements by the words “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “forecasts,” “likely,” “possibly,” “probably,” “could,” “goal,” “opportunity,” “objective,” “target,” “assume,” “outlook,” “guidance,” “predicts,” “appears,” “indicator” and similar expressions. Forward-looking statements involve a number of risks and uncertainties. In the normal course of business, in an effort to help keep our stockholders and the public informed about our operations, from time to time, we may issue such forward-looking statements, either orally or in writing. Generally, these statements relate to business plans or strategies, including our strategic partnership with Workday, Inc.; projected or anticipated benefits or other consequences of such plans or strategies; or projections involving anticipated revenues, earnings, average number of worksite employees, benefits and workers’ compensation costs, or other operating results. We base these forward-looking statements on our current expectations, estimates and projections. We caution you that these statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In addition, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Therefore, the actual results of the future events described in such forward-looking statements could differ materially from those stated in such forward-looking statements. Among the factors that could cause actual results to differ materially are:

•adverse economic conditions;

•failure to comply with or meet client expectations regarding certain COVID-19 relief programs;

•bank failures or other events affecting financial institutions; labor shortages, increasing competition for highly skilled workers, and evolving employee expectations regarding the workplace;

•impact of inflation;

•vulnerability to regional economic factors because of our geographic market concentration;

•failure to comply with covenants under our credit facility;

•impact of a future outbreak of highly infectious or contagious disease;

•our liability for WSEE payroll, payroll taxes and benefits costs, or other liabilities associated with actions of our client companies or WSEEs, including if our clients fail to pay us;

•increases in health insurance costs and workers’ compensation rates and underlying claims trends, health care reform, financial solvency of workers’ compensation carriers, other insurers or financial institutions, state unemployment tax rates, liabilities for employee and client actions or payroll-related claims;

•an adverse determination regarding our status as the employer of our WSEEs for tax and benefit purposes and an inability to offer alternative benefit plans following such a determination;

•cancellation of client contracts on short notice, or the inability to renew client contracts or attract new clients;

•the ability to secure competitive replacement contracts for health insurance and workers’ compensation insurance at expiration of current contracts;

•regulatory and tax developments and possible adverse application of various federal, state and local regulations;

•failure to manage growth of our operations and the effectiveness of our sales and marketing efforts;

•the impact of the competitive environment and other developments in the human resources services industry, including the PEO industry, on our growth and/or profitability;

•an adverse final judgment or settlement of claims against Insperity;

•disruptions of our information technology systems or failure to enhance our service and technology offerings to address new regulations or client expectations;

•our liability or damage to our reputation relating to disclosure of sensitive or private information as a result of data theft, cyberattacks or security vulnerabilities;

•failure of third-party providers, such as financial institutions, data centers or cloud service providers;

•our ability to fully realize the anticipated benefits of our strategic partnership and plans to develop a joint solution with Workday, Inc.; and

•our ability to integrate or realize expected returns on future product offerings, including through acquisitions, strategic partnerships, and investments.

These factors are discussed in further detail in Insperity’s filings with the U.S. Securities and Exchange Commission. Any of these factors, or a combination of such factors, could materially affect the results of our operations and whether forward-looking statements we make ultimately prove to be accurate.

Any forward-looking statements are made only as of the date hereof and, unless otherwise required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| | |

SUMMARY FINANCIAL INFORMATION |

Insperity, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | |

| | December 31, 2024 | December 31, 2023 |

| (in millions) |

| | |

| Assets | | |

| Cash and cash equivalents | $ | 1,039 | | $ | 693 | |

| Restricted cash | 69 | | 57 | |

| Marketable securities | 16 | | 16 | |

| Accounts receivable, net | 829 | | 694 | |

| Prepaid insurance and related assets | 25 | | 7 | |

| | |

| Other current assets | 107 | | 128 | |

| Total current assets | 2,085 | | 1,595 | |

| Property and equipment, net | 192 | | 197 | |

| Right-of-use leased assets | 65 | | 57 | |

| Deposits and prepaid health insurance | 195 | | 215 | |

| Goodwill and other intangible assets, net | 13 | | 13 | |

| Deferred income taxes, net | 34 | | 20 | |

| Other assets | 13 | | 23 | |

| Total assets | $ | 2,597 | | $ | 2,120 | |

| | |

| Liabilities and stockholders' equity | | |

| Accounts payable | $ | 10 | | $ | 11 | |

| Payroll taxes and other payroll deductions payable | 901 | | 566 | |

| Accrued worksite employee payroll cost | 730 | | 559 | |

| Accrued health insurance costs | 19 | | 46 | |

| Accrued workers’ compensation costs | 71 | | 60 | |

| Accrued corporate payroll and commissions | 82 | | 64 | |

| Other accrued liabilities | 117 | | 130 | |

| Total current liabilities | 1,930 | | 1,436 | |

| Accrued workers’ compensation costs, net of current | 135 | | 163 | |

| Long-term debt | 369 | | 369 | |

| Operating lease liabilities, net of current | 66 | | 58 | |

| | |

| | |

| Total noncurrent liabilities | 570 | | 590 | |

| Stockholders’ equity: | | |

| Common stock | 1 | | 1 | |

| Additional paid-in capital | 222 | | 185 | |

| Treasury stock, at cost | (864) | | (831) | |

| | |

| Retained earnings | 738 | | 739 | |

| Total stockholders' equity | 97 | | 94 | |

| Total liabilities and stockholders’ equity | $ | 2,597 | | $ | 2,120 | |

| | |

SUMMARY FINANCIAL INFORMATION |

Insperity, Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| (in millions, except per share amounts) | 2024 | 2023 | Change | | 2024 | 2023 | Change |

| | | | | | | |

| Operating results: | | | | | | | |

Revenues(1) | $ | 1,613 | | $ | 1,580 | | 2 | % | | $ | 6,581 | | $ | 6,486 | | 1 | % |

| Payroll taxes, benefits and workers’ compensation costs | 1,395 | | 1,358 | | 3 | % | | 5,529 | | 5,449 | | 1 | % |

| Gross profit | 218 | | 222 | | (2) | % | | 1,052 | | 1,037 | | 1 | % |

| Salaries, wages and payroll taxes | 128 | | 112 | | 14 | % | | 521 | | 461 | | 13 | % |

| Stock-based compensation | 14 | | 11 | | 27 | % | | 61 | | 53 | | 15 | % |

| Commissions | 13 | | 13 | | — | | | 47 | | 47 | | — | |

| Advertising | 10 | | 7 | | 43 | % | | 38 | | 37 | | 3 | % |

| General and administrative expenses | 57 | | 45 | | 27 | % | | 224 | | 177 | | 27 | % |

| | | | | | | |

| Depreciation and amortization | 11 | | 11 | | — | | | 44 | | 43 | | 2 | % |

| Total operating expenses | 233 | | 199 | | 17 | % | | 935 | | 818 | | 14 | % |

| Operating income (loss) | (15) | | 23 | | (165) | % | | 117 | | 219 | | (47) | % |

| Other income (expense): | | | | | | | |

| Interest income | 9 | | 8 | | 13 | % | | 37 | | 33 | | 12 | % |

| Interest expense | (7) | | (7) | | — | | | (28) | | (27) | | 4 | % |

| Income (loss) before income tax expense | (13) | | 24 | | (154) | % | | 126 | | 225 | | (44) | % |

| Income tax (benefit) expense | (4) | | 5 | | (180) | % | | 35 | | 54 | | (35) | % |

| Net income (loss) | $ | (9) | | $ | 19 | | (147) | % | | $ | 91 | | $ | 171 | | (47) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income (loss) per share of common stock | | | | | | |

| Basic | $ | (0.22) | | $ | 0.52 | | (142) | % | | $ | 2.44 | | $ | 4.53 | | (46) | % |

| Diluted | $ | (0.22) | | $ | 0.52 | | (142) | % | | $ | 2.42 | | $ | 4.47 | | (46) | % |

____________________________________

(1)Revenues are comprised of gross billings less WSEE payroll costs as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

(in millions) | 2024 | 2023 | | 2024 | 2023 |

| | | | | |

Gross billings | $ | 11,617 | | $ | 11,378 | | | $ | 43,752 | | $ | 43,141 | |

Less: WSEE payroll cost | 10,004 | | 9,798 | | | 37,171 | | 36,655 | |

Revenues | $ | 1,613 | | $ | 1,580 | | | $ | 6,581 | | $ | 6,486 | |

| | |

SUMMARY FINANCIAL INFORMATION |

Insperity, Inc.

KEY FINANCIAL AND STATISTICAL DATA

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | 2023 | Change | | 2024 | 2023 | Change |

| | | | | | | |

| Average WSEEs paid | 309,093 | | 315,072 | | (2) | % | | 307,261 | | 312,102 | | (2) | % |

| | | | | | | |

Statistical data (per WSEE per month): | | | | | | | |

Revenues(1) | $ | 1,739 | | $ | 1,672 | | 4 | % | | $ | 1,785 | | $ | 1,732 | | 3 | % |

| Gross profit | 235 | | 235 | | — | | | 285 | | 277 | | 3 | % |

| Operating expenses | 251 | | 211 | | 19 | % | | 253 | | 219 | | 16 | % |

| Operating income | (16) | | 24 | | (167) | % | | 32 | | 58 | | (45) | % |

| Net income | (10) | | 20 | | (150) | % | | 25 | | 46 | | (46) | % |

____________________________________

(1)Revenues per WSEE per month are comprised of gross billings per WSEE per month less WSEE payroll costs per WSEE per month follows:

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, | |

| (per WSEE per month) | 2024 | 2023 | | 2024 | 2023 | |

| | | | | | |

| Gross billings | $ | 12,528 | | $ | 12,037 | | | $ | 11,866 | | $ | 11,519 | | |

Less: WSEE payroll cost | 10,789 | | 10,365 | | | 10,081 | | 9,787 | | |

| Revenues | $ | 1,739 | | $ | 1,672 | | | $ | 1,785 | | $ | 1,732 | | |

| | |

SUMMARY FINANCIAL INFORMATION |

Insperity, Inc.

Non-GAAP FINANCIAL MEASURES

(Unaudited)

Non-GAAP financial measures are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of the non-GAAP financial measures used to their most directly comparable GAAP financial measures as provided in the tables below.

| | | | | | | | |

| Non-GAAP Measure | Definition | Benefit of Non-GAAP Measure |

| Non-bonus payroll cost | Non-bonus payroll cost is a non-GAAP financial measure that excludes the impact of bonus payrolls paid to our WSEEs.

Bonus payroll cost varies from period to period, but has no direct impact to our ultimate workers’ compensation costs under the current program. | Our management refers to non-bonus payroll cost in analyzing, reporting and forecasting our workers’ compensation costs.

We include these non-GAAP financial measures because we believe they are useful to investors in allowing for greater transparency related to the costs incurred under our current workers’ compensation program. |

| Adjusted cash, cash equivalents and marketable securities | Excludes funds associated with: • federal and state income tax withholdings, • employment taxes, • other payroll deductions, and • client prepayments. | We believe that the exclusion of the identified items helps us reflect the fundamentals of our underlying business model and analyze results against our expectations, against prior periods, and to plan for future periods by focusing on our underlying operations. We believe that the adjusted results provide relevant and useful information for investors because they allow investors to view performance in a manner similar to the method used by management and improves their ability to understand and assess our operating performance. Adjusted EBITDA is used by our lenders to assess our leverage and ability to make interest payments. |

| |

| |

| |

| EBITDA | Represents net income computed in accordance with GAAP, plus: • interest expense, • income tax expense, • depreciation and amortization expense, and • amortization of SaaS implementation costs. |

| |

| Adjusted EBITDA | Represents EBITDA plus: • non-cash stock-based compensation. |

| |

| Adjusted net income | Represents net income computed in accordance with GAAP, excluding: • non-cash stock-based compensation. |

| |

| Adjusted EPS | Represents diluted net income per share computed in accordance with GAAP, excluding: • non-cash stock-based compensation. |

Following is a reconciliation of payroll cost (GAAP) to non-bonus payroll costs (non-GAAP):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in millions, except per WSEE per month) | 2024 | | 2023 | | 2024 | | 2023 |

| Per WSEE | | | Per WSEE | | | Per WSEE | | | Per WSEE |

| | | | | | | | | | | |

Payroll cost | $ | 10,004 | | $ | 10,789 | | | $ | 9,798 | | $ | 10,365 | | | $ | 37,171 | | $ | 10,081 | | | $ | 36,655 | | $ | 9,787 | |

Less: Bonus payroll cost | 1,690 | | 1,823 | | | 1,634 | | 1,728 | | | 5,101 | | 1,383 | | | 4,978 | | 1,329 | |

Non-bonus payroll cost | $ | 8,314 | | $ | 8,966 | | | $ | 8,164 | | $ | 8,637 | | | $ | 32,070 | | $ | 8,698 | | | $ | 31,677 | | $ | 8,458 | |

Payroll cost % change period over period | 2 | % | 4 | % | | 3 | % | — | | | 1 | % | 3 | % | | 7 | % | 1 | % |

Non-bonus payroll cost % change period over period | 2 | % | 4 | % | | 5 | % | 2 | % | | 1 | % | 3 | % | | 8 | % | 2 | % |

| | |

SUMMARY FINANCIAL INFORMATION |

Following is a reconciliation of cash, cash equivalents and marketable securities (GAAP) to adjusted cash, cash equivalents and marketable securities (non-GAAP):

| | | | | | | | | | | |

| (in millions) | December 31,

2024 | | December 31,

2023 |

| |

Cash, cash equivalents and marketable securities | $ | 1,055 | | | $ | 709 | |

Less: | | | |

Amounts payable for withheld federal and state income taxes, employment taxes and other payroll deductions | 830 | | | 510 | |

| Client prepayments | 91 | | | 28 | |

Adjusted cash, cash equivalents and marketable securities | $ | 134 | | | $ | 171 | |

Following is a reconciliation of net income (GAAP) to EBITDA (non-GAAP) and adjusted EBITDA (non-GAAP):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per WSEE per month) | Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Per WSEE | | | Per WSEE | | | Per WSEE | | | Per WSEE |

| | | | | | | | | | | |

| Net income (loss) | $ | (9) | | $ | (10) | | | $ | 19 | | $ | 20 | | | $ | 91 | | $ | 25 | | | $ | 171 | | $ | 46 | |

| Income tax (benefit) expense | (4) | | (4) | | | 5 | | 5 | | | 35 | | 8 | | | 54 | | 14 | |

Interest expense | 7 | | 8 | | | 7 | | 7 | | | 28 | | 8 | | | 27 | | 7 | |

| Amortization of SaaS implementation costs | 4 | | 4 | | | 3 | | 3 | | | 11 | | 3 | | | 6 | | 2 | |

Depreciation and amortization | 11 | | 12 | | | 11 | | 12 | | | 44 | | 12 | | | 43 | | 11 | |

EBITDA | 9 | | 10 | | | 45 | | 47 | | | 209 | | 56 | | | 301 | | 80 | |

Stock-based compensation | 14 | | 15 | | | 11 | | 12 | | | 61 | | 17 | | | 53 | | 14 | |

Adjusted EBITDA | $ | 23 | | $ | 25 | | | $ | 56 | | $ | 59 | | | $ | 270 | | $ | 73 | | | $ | 354 | | $ | 94 | |

| Net income % change period over period | (147) | % | (150) | % | | (50) | % | (51) | % | | (47) | % | (46) | % | | (4) | % | (10) | % |

| Adjusted EBITDA % change period over period | (59) | % | (58) | % | | (29) | % | (31) | % | | (24) | % | (22) | % | | 1 | % | (6) | % |

Following is a reconciliation of net income (GAAP) to adjusted net income (non-GAAP):

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (in millions) | 2024 | 2023 | | 2024 | 2023 |

| | | | | |

| Net income (loss) | $ | (9) | | $ | 19 | | | $ | 91 | | $ | 171 | |

| Non-GAAP adjustments: | | | | | |

| Stock-based compensation | 14 | | 11 | | | 61 | | 53 | |

| Tax effect | (4) | | (1) | | | (17) | | (12) | |

| Total non-GAAP adjustments, net | 10 | | 10 | | | 44 | | 41 | |

| Adjusted net income | $ | 1 | | $ | 29 | | | $ | 135 | | $ | 212 | |

| Net income % change period over period | (147) | % | (50) | % | | (47) | % | (4) | % |

| Adjusted net income % change period over period | (97) | % | (38) | % | | (36) | % | (2) | % |

| | |

SUMMARY FINANCIAL INFORMATION |

Following is a reconciliation of diluted EPS (GAAP) to adjusted EPS (non-GAAP):

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2024 | 2023 | | 2024 | 2023 |

| | | | | |

Diluted EPS | $ | (0.22) | | $ | 0.52 | | | $ | 2.42 | | $ | 4.47 | |

Non-GAAP adjustments: | | | | | |

| Stock-based compensation | 0.37 | | 0.30 | | | 1.61 | | 1.38 | |

| | | | | |

| Tax effect | (0.10) | | (0.07) | | | (0.45) | | (0.33) | |

| Total non-GAAP adjustments, net | 0.27 | | 0.23 | | | 1.16 | | 1.05 | |

| Adjusted EPS | $ | 0.05 | | $ | 0.75 | | | $ | 3.58 | | $ | 5.52 | |

| Diluted EPS % change period over period | (142) | % | (47) | % | | (46) | % | (4) | % |

| Adjusted EPS % change period over period | (93) | % | (38) | % | | (35) | % | (1) | % |

| | |

SUMMARY FINANCIAL INFORMATION |

The following is a reconciliation of GAAP to non-GAAP financial measures for first quarter and full year 2025 guidance:

| | | | | | | | | | | |

| Q1 2025 | | Full Year 2025 |

| (in millions, except per share amounts) | Guidance | | Guidance |

| | | |

Net income | $61 - $70 | | $71 - $102 |

Income tax expense | 26 - 31 | | 30 - 44 |

Interest expense | 6 | | | 25 | |

| SaaS implementation amortization | 2 | | | 4 | |

Depreciation and amortization | 11 | | 44 |

EBITDA | 106 - 120 | | 174 - 219 |

Stock-based compensation | 15 | | 66 |

Adjusted EBITDA | $121 - $135 | | $240 - $285 |

| | | |

Diluted EPS | $1.61 - $1.87 | | $1.87 - $2.72 |

Non-GAAP adjustments: | | | |

Stock-based compensation | 0.40 | | 1.75 |

| Tax effect | (0.12) | | (0.52) |

| Total non-GAAP adjustments, net | 0.28 | | 1.23 |

Adjusted EPS | $1.89 - $2.15 | | $3.10 - $3.95 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

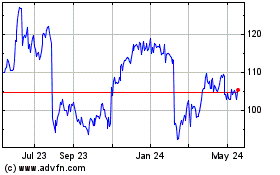

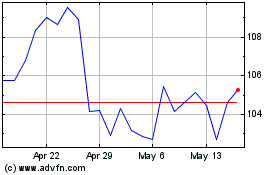

Insperity (NYSE:NSP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Insperity (NYSE:NSP)

Historical Stock Chart

From Feb 2024 to Feb 2025