0001579877FALSE00015798772025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 4, 2025 (January 31, 2025)

_________________________

OUTFRONT Media Inc.

(Exact name of registrant as specified in its charter)

__________________________

| | | | | | | | | | | | | | |

Maryland | | 001-36367 | | 46-4494703 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | | | | | | | | |

90 Park Avenue, 9th Floor | | |

New York, | New York | | 10016 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 297-6400

__________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01, par value | OUT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On January 31, 2025, the Board of Directors (the “Board”) of OUTFRONT Media Inc. (the “Company”) appointed Nicolas Brien to serve as Interim Chief Executive Officer (“Interim CEO”) of the Company, effective as of February 10, 2025 (the “Effective Date”).

Mr. Brien, age 63, has served on the Board since October 2014, and has held senior leadership roles at some of the most influential global organizations in the advertising, media, advertising technology and digital marketing industries, where he was responsible for leading the organizations through periods of rapid expansion and change. Mr. Brien served as Chief Executive Officer of Enthusiast Gaming Holdings Inc., a gaming media and entertainment company, from March 2023 to January 2024. Previously, he served as Chief Executive Officer of Amobee, Inc., an advertising technology company, from July 2021 to October 2022. He served as Chief Executive Officer, the Americas and U.S., of Dentsu Aegis Network Ltd., one of the world’s largest advertising, media and digital marketing agencies, from August 2017 to December 2019, and as a consultant to Dentsu Aegis Network Ltd. from January 2020 to March 2020. He also served as the Chief Executive Officer of iCrossing, a subsidiary of Hearst Corporation, and as President of Hearst Magazines Marketing Services, a division of Hearst Corporation, from March 2015 to July 2017. Prior to that, he served as Chairman and Chief Executive Officer of McCann Worldgroup from April 2010 through November 2012, and as Chief Executive Officer of IPG Mediabrands from 2008 to 2010. Mr. Brien also served as Chief Executive Officer of Universal McCann from 2005 to 2008.

There is no arrangement or understanding with any person pursuant to which Mr. Brien was appointed as Interim CEO of the Company. In addition, there are no family relationships between Mr. Brien and any director or executive officer of the Company, and there are no transactions between Mr. Brien and the Company requiring disclosure under Item 404 of Regulation S-K.

In connection with Mr. Brien’s appointment, the Company entered into a letter agreement with him, dated as of January 31, 2025 (the “Letter Agreement”), which provides for his employment as the Company’s Interim CEO from the Effective Date until the first to occur of the appointment of another individual as Chief Executive Officer of the Company, Mr. Brien’s voluntary resignation (upon thirty (30) days’ written notice), Mr. Brien’s “termination for cause” (as defined in the Letter Agreement), or due to Mr. Brien’s death or disability. Mr. Brien will receive a monthly base salary of $66,667 and will be eligible to receive an annual cash bonus solely for 2025 (the “2025 Cash Bonus”) with an annual bonus target opportunity equal to 100% of his earned base salary. In addition, Mr. Brien will be granted a one-time award of restricted share units (“RSUs”) under the OUTFRONT Media Inc. Amended and Restated Omnibus Stock Incentive Plan (the “Plan”) with a grant date fair value equal to $1,333,333 that will vest on the one-year anniversary of the grant date (the “One-Time Award”). The terms and conditions of any long-term incentive equity compensation awarded to Mr. Brien are set forth in the Plan and the related equity award terms and conditions. In addition, Mr. Brien will be entitled to participate in arrangements for benefits, business expenses and perquisites generally available to our other senior executives of the Company.

In the event Mr. Brien’s employment is terminated due to the appointment of a new Chief Executive Officer or his death or disability, Mr. Brien will remain eligible to receive the 2025 Cash Bonus and the One-Time Award will remain outstanding and continue to vest based on his service as a member of the Board, provided that if he is no longer serving as a member of the Board at such time or ceases to serve as a member of the Board after such time but before the one-year anniversary of the grant date of the One-Time Award, the One-Time Award will vest pro-rata, based on the number of days elapsed from the grant date through and including the date his role as Interim CEO or as a member of the Board terminates (whichever is later).

The Letter Agreement also contains a covenant that restricts Mr. Brien from solicitating employees during his employment and for one year following the termination of his employment.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the Letter Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

As previously disclosed on December 17, 2024, Jeremy J. Male, will retire from his positions as the Company’s Chief Executive Officer and Chairman and as a member of the Board on the Effective Date and will thereafter serve as an advisor to the Board until March 31, 2025.

Michael J. Dominguez, a current member of the Board, has been appointed to serve as Chairman of the Board to replace Mr. Male, effective as of the Effective Date. Mr. Brien stepped down as a member of the Compensation Committee of the Board, effective January 31, 2025, in connection with his appointment as Interim CEO.

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

A copy of the press release announcing the appointment of Mr. Brien as Interim CEO is attached as Exhibit 99.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

The information contained in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished pursuant to Item 7.01. This information shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed or furnished, as applicable, herewith:

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| |

| 10.1 | | Letter Agreement between OUTFRONT Media Inc. and Nicolas Brien, dated as of January 31, 2025. |

| | |

| 99.1 | | Press release dated February 4, 2025. |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

EXHIBIT INDEX

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| |

| 10.1 | | |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

OUTFRONT MEDIA INC. |

| | |

By: | | /s/ Matthew Siegel |

| | Name: | | Matthew Siegel |

| | Title: | | Executive Vice President and |

| | | | Chief Financial Officer |

| | | | |

Date: February 4, 2025

Execution Version

January 31, 2025

Nicolas Brien

At the address on file with the Company

RE: Interim Chief Executive Officer

Dear Nicolas,

Thank you for your agreement to serve as Interim Chief Executive Officer (“Interim CEO”) of Outfront Media, Inc. (the “Company”). This letter (the “Letter Agreement”) sets forth the terms of your employment as Interim CEO of the Company, which shall commence on February 10, 2025 (the “Effective Date”).

1. Position. As of the Effective Date, you will serve as the Interim CEO of the Company and agree to perform all duties reasonable and consistent with that office and related to the Company’s business, as the Board of Directors of the Company (the “Board”) may assign to you. You will be permitted to work from a home office in California; provided, that (i) you will regularly travel to New York to render services from the Company’s New York office and (ii) from time-to-time you will be required to render services elsewhere as required for business reasons. You will report to the Board, and your service as Interim CEO will not affect your service as a member of the Board.

2. Term. Your position as Interim CEO will commence on the Effective Date and end on the first to occur of the following: (a) the appointment of another individual as Chief Executive Officer of the Company, (b) your voluntary resignation of employment upon thirty (30) days’ written notice to the Company, (c) your “Termination for Cause” (as defined in the Company’s Omnibus Stock Incentive Plan), or (d) the termination of your employment in the event of your death or disability (such period of time, the “Term”). At the end of the Term, you will cease to be the Interim CEO of the Company (but your service as a member of the Board will not be affected).

3. Compensation and Benefits. During the Term, you will be entitled to the following compensation and benefits, which will be lieu of any other compensation to which you may be entitled as a member of the Board:

a. Base Salary. You will receive a base salary at a rate of $66,667 per month, less applicable deductions and withholding taxes, in accordance with the Company’s payroll practices (the “Base Salary”).

b. Annual Bonus. You will be eligible to receive an annual cash bonus solely for fiscal year 2025 (“2025 Cash Bonus”) in accordance with the Executive Bonus Plan and will have an annual bonus target equal to 100% of earned Base Salary (the “Target Bonus”) with a maximum bonus opportunity equal to 200% of the Target Bonus,. Your 2025 Cash Bonus, if any, will be paid to you based on actual performance when such bonuses are generally paid to similarly situated employees of the Company. In the event of your termination of employment for the reasons set forth in Paragraph 2(a) or 2(d) of this Letter Agreement, you will remain eligible to receive a 2025 Cash Bonus, but, if your employment terminates for the reasons set forth in Paragraph 2(b) or 2(c) before the end of calendar year 2025, you will cease to be eligible.

c. Long-Term Incentive Award. In connection with your appointment as Interim CEO, you will be granted a one-time award of restricted stock units (“RSUs”) under the Company’s Omnibus Stock Incentive Plan with a grant date fair value equal to $1,333,333, which award will be approved on February 20, 2025 and granted to you in accordance with the Company’s standard equity award grant practices and at the same time as annual awards are granted to other senior executives of the Company. The RSUs will vest (and deliver) in full on the one year anniversary of the grant date, subject to your continued employment through such date. Notwithstanding the foregoing sentence, in the event of your termination of employment for the reasons set forth in Paragraph 2(a) or 2(d) of this Letter Agreement, the RSUs will remain outstanding and continue to vest based on your service as a member of the Board, provided, that if you are no longer serving as a member of the Board at such time or cease to serve as a member of the Board after such time but before the one-year anniversary of the grant date, the RSUs will vest pro-rata, based on the number of days elapsed from the grant date through and including the date your role as Interim CEO or member of the Board terminates (whichever is later). The terms of the RSUs, including the applicable vesting provisions, will be set forth in a separate award agreement.

d. Benefits. You will be eligible to participate in the Company’s benefit plans made available to senior executives of the Company to the extent you meet the eligibility requirements of such plans and you do not waive your participation rights or coverage.

e. Business Expenses. The Company will reimburse you for such reasonable travel (including business class travel) and other expenses in the performance of your duties as are customarily reimbursed to the Company’s executives at comparable levels.

4. Legal Fees. Upon presentation of reasonable documentation, the Company will reimburse you for reasonable and customary attorneys’ fees incurred in connection with the review of this Letter Agreement, up to a maximum amount of $25,000.

5. Employee Non-Solicitation Covenant. You agree that, while employed by Company and for twelve (12) months thereafter, you will not, directly or indirectly, employ or solicit the employment of any person who is then or has been within twelve (12) months prior thereto, an employee of the Company or any of any entity in which the Company directly or indirectly owns at least 20% of the voting power.

3

6. Section 409A. It is intended that any amounts payable under this Letter Agreement shall be exempt from or comply with Section 409A of the Internal Revenue Code and the regulations promulgated thereunder (“Section 409A”) and, accordingly, all provisions of this Letter Agreement shall be construed in a manner consistent with the requirements for avoiding taxes or penalties under Section 409A. If and to the extent that any payment or benefit hereunder, or any plan, award or arrangement of the Company or its affiliates, is determined by the Company to constitute “non-qualified deferred compensation” subject to Section 409A and is payable to you by reason of your termination of employment, then (a) such payment or benefit shall be made or provided to you only upon a “separation from service” as defined for purposes of Section 409A under applicable regulations and (b) if you are a “specified employee” (within the meaning of Section 409A and as determined by the Company), such payment or benefit shall not be made or provided before the date that is six months after the date of your separation from service (or your earlier death). Any amount not paid or benefit not provided in respect of the six- month period specified in the preceding sentence will be paid to you in a lump sum or provided to you as soon as practicable after the expiration of such six-month period. Each payment or benefit hereunder shall be treated as a separate payment for purposes of Section 409A to the extent Section 409A applies to such payments or benefits.

7. Governing Law. This Letter Agreement will be governed by and construed in accordance with the laws of the state of New York without reference to principles of conflict of laws.

8. Complete Agreement. This Letter Agreement and the award agreement referred to in Section 3(c) herein embody the complete agreement and understanding between the parties with respect to the subject matter hereof and effective as of its date supersedes and preempts any prior understandings, agreements or representations by or between the parties, written or oral, which may have related to the subject matter hereof in any way.

[Signature Page Follows]

Please confirm, by returning to the Company the enclosed copy of this letter, signed where indicated, that you have knowingly and voluntarily decided to accept and agree to the foregoing.

We truly appreciate your assistance during this transition.

| | | | | |

| Very truly yours, |

| |

| |

| |

| /s/ Michael J. Dominguez |

| Name: Michael J. Dominguez |

| Title: Member of the Board |

| |

| |

| |

| |

| ACCEPTED AND AGREED, | |

| as of the date first written above | |

| |

| |

| |

| /s/ Nicolas Brien | |

| Nicolas Brien | |

| |

[Signature Page to Letter Agreement]

Exhibit 99.1

OUTFRONT Media Names Industry Veteran Nick Brien Interim CEO to Guide the Company’s Next Chapter of Strategic Growth and Innovation

New York, February 4, 2025 — OUTFRONT Media Inc. (NYSE: OUT) today announced the appointment of Nick Brien as Interim Chief Executive Officer, effective February 10, 2025. With a dynamic blend of industry expertise and decades of leadership experience, Brien is uniquely positioned to lead OUTFRONT Media into its next chapter of innovation and growth. Having served on the company’s Board of Directors for many years (which service will continue during his tenure as the Interim Chief Executive Officer), Brien brings deep insights into the company’s operations, partnerships, and the evolving out-of-home industry. This foundation empowers him to chart an ambitious path forward, unlocking new opportunities for OUTFRONT Media to be a driving force as a leading media brand.

“Nick brings a perfect balance of marketing strategy, business acumen, and expertise in ad tech and digital innovation, making him the ideal leader for OUTFRONT during this important transition. When the Board initiated the search for new leadership, Nick stepped forward with a bold vision for the company. It was clear he could immediately step in as Interim CEO to spearhead an ambitious set of initiatives, driving continued momentum and progress in the company’s transformation and growth,” said Michael Dominguez, who was named Chairman of the Board as of February 10, 2025.

A seasoned Chief Executive Officer, Brien has held senior leadership positions at some of the world’s most influential organizations, including advertising industry powerhouses Publicis, Dentsu, McCann Worldgroup, and IPG Mediabrands. He also comes to OUTFRONT with deep experience in ad technology from his time as CEO at Amobee. He successfully led these companies through periods of rapid expansion and change, redefining their influence on the global media landscape.

“The out-of-home medium is bold, impactful, and is quickly evolving into a significant digital channel. Our unmissable creative canvases spark conversations and enable advertisers to engage consumers in ways that drive superior campaign performance while building brand loyalty,” said Mr. Brien. “By operating as a tech-enabled, data-driven, and ideas-led company, we have the opportunity to elevate OUTFRONT’s strategic importance for brands and partners while unlocking new avenues for growth.”

This leadership transition follows the previously announced retirement of Jeremy Male, who leaves behind a lasting legacy at OUTFRONT Media. Most notably, Male oversaw the transformation of CBS Outdoor Americas into OUTFRONT Media and led the company through a successful initial public offering. Under his leadership, OUTFRONT Media established itself as a leader in the out-of-home advertising industry, resulting in significant growth throughout his tenure.

As Interim CEO, Brien joins an industry-leading team renowned for their exceptional sales expertise, innovative design teams, and client-focused consultative approach. With his established relationships across the executive management team, Brien will work closely with leaders to ensure a seamless transition while the Board considers him alongside other candidates for the permanent role as part of a global search. To further strengthen the company’s leadership during this pivotal period, Chief Financial Officer, Matthew Siegel, will take on expanded operational responsibilities.

Under Brien’s leadership, the company is focused on amplifying the power of out-of-home to drive brand awareness and measurable performance, accelerating its technological evolution, and building on its strong foundation of creativity and innovation—all while continuing to deliver exceptional value to agencies, brands, key stakeholders, and stockholders.

About OUTFRONT Media Inc.

OUTFRONT leverages the power of technology, location, and creativity to connect brands with consumers outside of their homes through one of the largest and most diverse sets of billboard, transit, and mobile assets in the United States. Through its technology platform, OUTFRONT will fundamentally change the ways advertisers engage audiences on-the-go.

Cautionary Statement Regarding Forward-Looking Statements

We have made statements in this document that are forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by the use of forward-looking terminology such as “will,” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions related to our capital resources, portfolio performance and results of operations. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and may not be able to be realized. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: declines in advertising and general economic conditions; the severity and duration of pandemics, and the impact on our business, financial condition and results of operations; competition; government regulation; our ability to operate our digital display platform; losses and costs resulting from recalls and product liability, warranty and intellectual property claims; our ability to obtain and renew key municipal contracts on favorable terms; taxes, fees and registration requirements; decreased government compensation for the removal of lawful billboards; content-based restrictions on outdoor advertising; seasonal variations; acquisitions and other strategic transactions that we may pursue could have a negative effect on our results of operations; dependence on our management team and other key employees; experiencing a cybersecurity incident; changes in regulations and consumer concerns regarding privacy, information security and data, or any failure or perceived failure to comply with these regulations or our internal policies; asset impairment charges for our long-lived assets and goodwill; environmental, health and safety laws and regulations; expectations relating to environmental, social and governance considerations; our

substantial indebtedness; restrictions in the agreements governing our indebtedness; incurrence of additional debt; interest rate risk exposure from our variable-rate indebtedness; our ability to generate cash to service our indebtedness; cash available for distributions; hedging transactions; the ability of our board of directors to cause us to issue additional shares of stock without common stockholder approval; certain provisions of Maryland law may limit the ability of a third party to acquire control of us; our rights and the rights of our stockholders to take action against our directors and officers are limited; our failure to remain qualified to be taxed as a real estate investment trust (“REIT”); REIT distribution requirements; availability of external sources of capital; we may face other tax liabilities even if we remain qualified to be taxed as a REIT; complying with REIT requirements may cause us to liquidate investments or forgo otherwise attractive investments or business opportunities; our ability to contribute certain contracts to a taxable REIT subsidiary (“TRS”); our planned use of TRSs may cause us to fail to remain qualified to be taxed as a REIT; REIT ownership limits; complying with REIT requirements may limit our ability to hedge effectively; failure to meet the REIT income tests as a result of receiving non-qualifying income; the Internal Revenue Service may deem the gains from sales of our outdoor advertising assets to be subject to a 100% prohibited transaction tax; establishing operating partnerships as part of our REIT structure; and other factors described in our filings with the Securities and Exchange Commission (the "SEC"), including but not limited to the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 22, 2024. All forward-looking statements in this document apply as of the date of this document or as of the date they were made and, except as required by applicable law, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.

| | | | | |

| Contacts: | |

| Investors | Media |

| Stephan Bisson | Courtney Richards |

| Investor Relations | PR & Events Specialist |

| (212) 297-6573 | (646) 876-9404 |

| stephan.bisson@outfront.com | courtney.richards@outfront.com |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

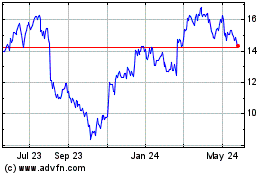

OUTFRONT Media (NYSE:OUT)

Historical Stock Chart

From Jan 2025 to Feb 2025

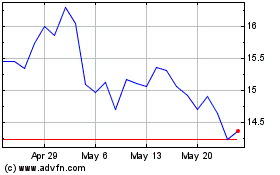

OUTFRONT Media (NYSE:OUT)

Historical Stock Chart

From Feb 2024 to Feb 2025