false 0001792580 0001792580 2024-11-13 2024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 13, 2024

Ovintiv Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-39191 |

|

84-4427672 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

| Suite 1700, 370 17th Street Denver, Colorado |

|

|

|

80202 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

(303) 623-2300

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

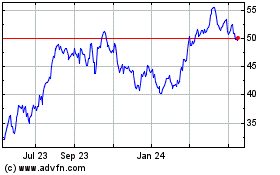

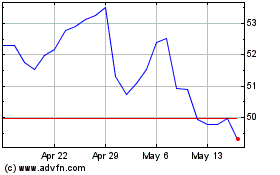

OVV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| ITEM 1.01 |

Entry into a Material Definitive Agreement. |

Montney Acquisition

On November 13, 2024, Ovintiv Inc. (“Ovintiv”) and its wholly-owned subsidiary, Ovintiv Canada ULC (the “OVV Buyer”), entered into an Agreement of Purchase and Sale (the “Purchase Agreement”) with Paramount Resources Ltd. (the “Seller”), pursuant to which the OVV Buyer has agreed to acquire the Seller’s upstream oil and gas assets and midstream gathering and processing assets located in the Grande Prairie and Zama regions of Alberta.

The board of directors of Ovintiv has unanimously approved the Purchase Agreement and the transactions contemplated thereby (the “Acquisition”).

Under the terms and conditions of the Purchase Agreement, which has an economic effective date of October 1, 2024, the aggregate consideration to be paid to the Seller in the Acquisition will consist of CAD$3.325 billion in cash (the “Cash Consideration”) plus the conveyance to the Seller of certain oil and gas assets of the OVV Buyer located in the Horn River basin area in British Columbia, in each case, subject to customary closing adjustments. Pursuant to the Purchase Agreement, the OVV Buyer will deposit CAD$100.0 million (the “Acquisition Deposit”) into an interest-bearing escrow account, which will be credited toward the Cash Consideration payable at the closing of the Acquisition. If the Purchase Agreement is terminated in accordance with its terms and conditions, the Acquisition Deposit and any interest earned thereon will be disbursed to the OVV Buyer or the Seller as provided in the Purchase Agreement, summarized below.

The Purchase Agreement provides that the closing of the Acquisition is subject to the satisfaction or waiver of customary closing conditions, including, among others, (a) the accuracy of the representations and warranties of each party (subject to specified materiality standards and customary qualifications), (b) compliance by each party with their respective covenants (subject to specified materiality standards and customary qualifications) and (c) approval under the Competition Act (Canada), as amended, and the Investment Canada Act (Canada), as amended (collectively, the “Regulatory Approvals”).

The Seller and the OVV Buyer have made customary representations and warranties in the Purchase Agreement. The Purchase Agreement also contains customary covenants and agreements, including, among others, covenants and agreements relating to (a) the maintenance of the assets subject of the Purchase Agreement during the period between the execution of the Purchase Agreement and closing of the Acquisition and (b) the efforts of the parties to cause the Acquisition to be completed, including obtaining the Regulatory Approvals.

The Purchase Agreement also provides for certain termination rights for the OVV Buyer and the Seller, including, among others (and subject to certain exceptions in each case), (a) by mutual written consent of the Seller and the OVV Buyer, (b) by either the Seller or the OVV Buyer, if such party’s respective conditions to closing have not been satisfied or are not capable of being satisfied on or before April 30, 2025 (the “Acquisition Outside Date”), except if such condition has not been satisfied or is not capable of being satisfied due to such party not having performed an obligation or agreement, or complied with a covenant in the Purchase Agreement and (c) by either the Seller or the OVV Buyer, if the Acquisition has not closed by the Acquisition Outside Date, provided however that (i) if either of the Regulatory Approvals have not been granted by the date that is four business days before the Acquisition Outside Date, either party may elect to extend the Acquisition Outside Date by one or more periods of not less than 10 business days and (ii) if the Seller is required to obtain additional corporate approvals, and such additional corporate approvals have not been received by the date that is four business days before the Acquisition Outside Date, either party may elect to extend the Acquisition Outside Date by one or more periods of not less than 10 business days, and in each case such extensions may not exceed 90 days in the aggregate.

Subject to certain further terms, conditions and exceptions, if the Purchase Agreement is terminated, or is terminable, (a) by the Seller, if closing has not occurred due to one or more breaches of the Purchase Agreement by the OVV Buyer and if such breaches are not capable of being cured on or prior to the Acquisition Outside Date, then the Seller will have the right to terminate the Purchase Agreement and receive the Acquisition Deposit and any interest earned thereon as liquidated damages as the Seller’s sole and exclusive remedy; or (b) by the OVV Buyer, if closing has not occurred due to one or more breaches of the Purchase Agreement by the Seller and if such breaches are not capable of being cured on or prior to the Acquisition Outside Date, then the OVV Buyer will have the right, among other things, to terminate the Purchase Agreement, to receive a refund of the Acquisition Deposit

and any interest earned thereon and to seek any other remedies available to the OVV Buyer. If the closing does not occur by the Acquisition Outside Date for any reason or circumstance other than as described in the previous sentence, then the OVV Buyer will be entitled to the return of the Acquisition Deposit and any interest earned thereon.

In connection with, and concurrently with the entry into, the Purchase Agreement, Ovintiv entered into a debt commitment letter, dated November 13, 2024, with JPMorgan Chase Bank, N.A. (“JPM”) and Morgan Stanley Senior Funding, Inc. (together with JPM, the “Commitment Parties”), pursuant to which the Commitment Parties have committed, subject to satisfaction of the conditions set forth therein, to provide Ovintiv with a 364-day senior unsecured bridge loan facility in an aggregate principal amount of $2.5 billion (the “Bridge Loan Facility”). Ovintiv currently intends to fund the Cash Consideration and related transaction fees and expenses with a combination of cash on hand (including cash proceeds received pursuant to the Divestiture (as defined below)), proceeds from new debt financing, and, only to the extent necessary, borrowings under the Bridge Loan Facility.

The representations, warranties and covenants contained in the Purchase Agreement have been made solely for the benefit of the parties thereto. In addition, such representations, warranties and covenants (a) have been made only for purposes of the Purchase Agreement, (b) are subject to materiality qualifications contained in the Purchase Agreement which may differ from what may be viewed as material by investors, (c) were made only as of the date of the Purchase Agreement or such other date as is specified in the Purchase Agreement and (d) have been included in the Purchase Agreement for the purpose of allocating risk between the contracting parties rather than establishing matters as fact. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties to the Purchase Agreement or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in Ovintiv’s public disclosures.

The foregoing description of the Purchase Agreement and the Acquisition does not purport to be complete and is subject to and qualified in its entirety by reference to the copy of the Purchase Agreement, which will be filed as an Exhibit to the Company’s Form 10-K for the year ending December 31, 2024.

| ITEM 7.01 |

Regulation FD Disclosure. |

On November 14, 2024, Ovintiv issued a press release regarding the Transactions (as defined below). A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

On November 14, 2024, Ovintiv posted an investor presentation relating to the Transactions on its website at https://www.ovintiv.com. A copy of the presentation is furnished as Exhibit 99.2 to this report and incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K and Exhibits 99.1 and 99.2 attached hereto are being furnished and, along with information contained on Ovintiv’s website (or linked therein or otherwise connected thereto), shall not be deemed “filed” for purposes of Section 18 of the Exchange Act of 1934, as amended or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Uinta Divestiture

On November 13, 2024, Ovintiv USA Inc. and Ovintiv Royalty Holdings LLC, each a wholly-owned subsidiary of Ovintiv, entered into an agreement with FourPoint Resources, LLC (“FourPoint”) to sell to FourPoint substantially all of their oil and gas assets and properties and related rights and interests located in an agreed sale are covering specified lands in Duchesne and Uinta Counties, Utah along with certain specified interests located in Wasatch County, Utah for aggregate consideration of $2.0 billion in cash, subject to customary closing adjustments (the “Divestiture” and, together with the Acquisition, the “Transactions”). The Divestiture is expected to close January 22, 2025, subject to customary closing conditions.

Forward-Looking Statements

This Form 8-K contains forward-looking statements or information (collectively, “forward-looking statements”) within the meaning of applicable securities legislation, including Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements, except for statements of historical fact, that relate to the anticipated future activities, plans, strategies, objectives or expectations of Ovintiv are forward-looking statements. When used in this Form 8-K, the use of words and phrases including “anticipates,” “believes,” “estimates,” “expects,” “intends,” “maintain,” “may,” “plans,” “potential,” “strategy,” “targets,” “will,” “would” and other similar terminology is intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words or phrases.

The forward-looking statements included in this Form 8-K involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Ovintiv has based these forward-looking statements on current expectations and assumptions about future events, including Ovintiv’s ability to consummate any pending acquisition and divestiture transactions (including the transactions described herein), other risks and uncertainties related to the closing of pending acquisition and divestiture transactions (including the transactions described herein), and the ability of Ovintiv to access credit facilities and capital markets, taking into account all information currently known by Ovintiv. While Ovintiv considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties, many of which are difficult to predict and beyond our control. The risks and uncertainties that may affect the operations, performance and results of Ovintiv’s business and forward-looking statements include, but are not limited to, those set forth in Item 1A. “Risk Factors” of Ovintiv’s most recent Annual Report on Form 10-K, and other risks and uncertainties impacting Ovintiv’s business as described from time to time in Ovintiv’s other periodic filings with the SEC or Canadian securities regulators.

Although Ovintiv believes the expectations represented by its forward-looking statements are reasonable based on the information available to it as of the date such statements are made, forward-looking statements are only predictions and statements of Ovintiv’s current beliefs and there can be no assurance that such expectations will prove to be correct. All forward-looking statements contained in this Form 8-K are made as of the date of this Form 8-K and, except as required by law, Ovintiv undertakes no obligation to update publicly or revise any forward-looking statements. The forward-looking statements contained or incorporated by reference in this Form 8-K, and all subsequent forward-looking statements attributable to Ovintiv, whether written or oral, are expressly qualified by these cautionary statements.

| ITEM 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 14, 2024

|

|

|

| OVINTIV INC. |

| (Registrant) |

|

|

| By: |

|

/s/ Dawna I. Gibb |

| Name: |

|

Dawna I. Gibb |

| Title: |

|

Assistant Corporate Secretary |

Exhibit 99.1

|

|

|

|

|

|

news release |

Ovintiv Strengthens Portfolio with Core Oil-Rich Montney Asset

Acquisition

Transaction to Significantly Expand Existing Montney Premium Oil Inventory,

Company to Exit Uinta Basin with Asset Sale

Highlights:

| |

• |

|

Agreement reached to acquire approximately 109,000 net acres and approximately 70 thousand barrels of oil

equivalent per day (“MBOE/d”) in the core of the Alberta Montney for $2.377 billion (C$3.325 billion) |

| |

• |

|

Acquisition will add approximately 900 total net well locations, including approximately 600 premium(1) return well locations and approximately 300 upside locations, extending premium Montney oil and condensate inventory life to approximately 15 years |

| |

• |

|

Expanded access to additional midstream and downstream infrastructure will enable future oil growth optionality

|

| |

• |

|

Agreement reached to divest Uinta assets for proceeds of $2.0 billion |

| |

• |

|

Combined transactions are immediately and long-term accretive across all key financial metrics, 2025 Non-GAAP Free Cash Flow expected to increase by approximately $300 million(2) at current commodity strip pricing |

| |

• |

|

Annual cost synergies from the combined transactions are expected to total approximately $125 million(2) |

| |

• |

|

Commitment to investment grade balance sheet maintained, ratings agencies expected to affirm investment grade

rating and stable outlook |

| |

• |

|

Non-GAAP Net Debt of approximately $5.65 billion, as of

October 31, 2024 |

DENVER, November 14, 2024 – Ovintiv Inc. (NYSE, TSX: OVV) (“Ovintiv” or the

“Company”) today announced it has entered into a definitive purchase agreement to acquire certain Montney assets (the “assets”) from Paramount Resources Ltd. (“Paramount”), in an

all-cash transaction valued at approximately $2.377 billion (C$3.325 billion). Upon closing, the acquisition will add approximately 70 MBOE/d of production (approximately 25 Mbbls/d of oil and

condensate), 900 net 10,000 foot equivalent well locations, and approximately 109,000 net acres (approximately 80% undeveloped), in the core of the oil-rich Alberta Montney. The assets are strategically

located near the Company’s current operations and have access to midstream infrastructure with available capacity. The transaction has been unanimously approved by Ovintiv’s Board of Directors.

“We are acquiring top decile rate of return assets in the heart of the Montney oil window,” said Ovintiv President and CEO, Brendan McCracken.

“This acquisition is the targeted result of our in-depth technical and commercial analysis of the basin to identify the highest value undeveloped oil resource. The acquired assets have demonstrated

leading well performance and are a natural fit with our operating advantage and our existing acreage. The assets come with ample midstream capacity, unlocking optionality for mid-single digit growth in our

Montney oil and condensate volumes. The Montney is the second largest undeveloped oil resource in North America, and with this acquisition, we have solidified our position as the premier operator in the play.”

Ovintiv has also entered into a definitive agreement to sell substantially all its Uinta Basin assets located in Utah, to FourPoint Resources, LLC, for total

cash proceeds of approximately $2.0 billion.

The Company expects the combined transactions to increase 2025

Non-GAAP Free Cash Flow by approximately $300 million, driving 2025 Non-GAAP Free Cash Flow per share approximately 20% higher than previously expected.

“The combined transactions advance our durable returns strategy,” continued McCracken. “We are high grading our portfolio, significantly

increasing free cash flow, and enhancing our resiliency, enabling us to build on our track record of strong shareholder returns.”

The Montney

acquisition is expected to be funded through a combination of cash proceeds received from the pending sale of the Uinta assets, cash on hand, as well as borrowings under the Company’s credit facility and/or temporary financing.

| |

1) |

Premium return well locations defined as generating a greater than 35% internal rate of return at $55/bbl WTI

oil and $2.75/MMBtu NYMEX natural gas prices. |

| |

2) |

Assumes both the acquisition and the disposition close on January 1, 2025.

|

1

Ovintiv has received fully committed bridge financing from JPMorgan Chase Bank, N.A. and Morgan Stanley Senior Funding, Inc.

The Company has temporarily paused its share buyback program until the cash borrowed under the temporary financing, totalling approximately $377 million,

has been recovered. This represents the net difference between the purchase price for the Montney assets and the expected divestiture proceeds from the Uinta assets. In the fourth quarter, approximately $181 million has been redirected to debt

reduction from the buyback pause. Ovintiv estimates that share buybacks will resume in the second quarter of 2025. The Company’s bolt-on acquisition activity has effectively been paused until the share

buyback program has resumed. The base dividend is expected to remain unchanged.

Combined Transaction Overview:

| |

• |

|

Immediately Accretive – The combined transactions are expected to be immediately and long-term

accretive across key operational and financial metrics including Return on Capital Employed, Non-GAAP Cash Flow Per Share, and Non-GAAP Free Cash Flow Per Share.

|

| |

• |

|

Increases Montney Scale and Extends Inventory Life – The Montney transaction will expand

Ovintiv’s premium oil and condensate inventory in the play to approximately 15 years with the addition of approximately 600 premium return locations, acquired for less than $1 million each, and approximately 300 upside locations.

Ovintiv’s core land position in the Montney is expected to increase to approximately 369 thousand net acres. At closing, the Company’s pro forma Montney oil and condensate production is expected to be approximately 55 Mbbls/d.

|

| |

• |

|

Synergies – The combined transactions are expected to generate cost synergies of approximately

$125 million annually, comprised primarily of well cost savings, overhead reductions and Canadian cash tax savings. Per well cost savings are estimated at greater than $1.5 million across the acquired assets, consistent with Ovintiv’s

current Montney well costs of about $550 per foot, resulting from optimized operations and economies of scale. |

| |

• |

|

Streamlines Portfolio and Operations – Following the transactions, Ovintiv’s portfolio will

consist of anchor positions in the Montney and Permian, supported by the strong operating cash flows generated from its low decline, multi-product Anadarko asset. As part of the Montney transaction, ownership of Ovintiv’s Horn River asset,

located in British Columbia, will be transferred to Paramount and ownership of Paramount’s Zama asset, located in Alberta, will be transferred to Ovintiv. |

| |

• |

|

Maintains Strong Balance Sheet – Ovintiv’s leverage metrics are expected to remain

strong. As of October 31st, the Company’s Non-GAAP Net Debt was $5.65 billion, approximately $220 million less than the end of the third

quarter. Going forward, Ovintiv will continue to steward towards $4.0 billion of total debt. The Company remains committed to an investment grade balance sheet and expects the ratings agencies to affirm its investment grade rating and stable

outlook. |

Refer to Note 1 for information regarding Non-GAAP Measures in this release.

Pro Forma Montney Position expected at closing:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Ovintiv Standalone |

|

|

Acquisition |

|

|

Pro Forma |

|

| Core Acreage (000s of net acres) |

|

|

260 |

|

|

|

109 |

|

|

|

369 |

|

| Oil & C5+ Production (Mbbls/d) |

|

|

30 |

|

|

|

25 |

|

|

|

55 |

|

| Total Production (MBOE/d) |

|

|

240 |

|

|

|

70 |

|

|

|

310 |

|

| Assumes transaction closes in Q1 2025 |

|

Uinta Disposition

Ovintiv has entered into a definitive agreement to sell substantially all its Uinta Basin assets for total cash proceeds of approximately $2.0 billion.

The divestiture includes approximately 126 thousand net acres of largely undeveloped land. Ovintiv’s third quarter 2024 Uinta oil and condensate production was approximately 29 Mbbls/d.

McCracken added, “The sale of our Uinta position is aligned with our track record of unlocking significant value from our assets while focusing our

portfolio and extending inventory runway in our core areas. We are grateful for the hard work and dedication of our Uinta team.”

2

2025 Outlook(2)

Following the closing of the transactions, Ovintiv plans to run an average of three rigs across its combined Montney acreage, five rigs on its Permian acreage

and one to two rigs on its Anadarko acreage. Approximately 85% to 90% of 2025 total capital is expected to be allocated to the Permian and the Montney. The Company expects to deliver 2025 total average oil and condensate production volumes of

approximately 205 Mbbls/d and total volumes of approximately 620 MBOE/d, with capital investment of approximately $2.2 billion, or about $100 million less than previously expected.

Timing and Approvals

The effective date of the

acquisition of the Montney assets and the Uinta disposition is October 1, 2024. The transactions, which are expected to close by the end of the first quarter of 2025, are subject to the satisfaction of customary closing conditions and customary

closing adjustments.

Advisors

J.P. Morgan

Securities LLC and Morgan Stanley & Co. LLC are serving as financial advisors to Ovintiv on the Montney transaction and Jefferies LLC (lead) and BofA Securities, Inc. are serving as financial advisors on the Uinta transaction. Blake,

Cassels & Graydon LLP is serving as Ovintiv’s legal counsel on the Montney transaction, Kirkland & Ellis LLP is serving as Ovintiv’s legal counsel on the Uinta sale and Gibson, Dunn & Crutcher LLP is serving as

Ovintiv’s legal counsel on financing matters related to the transactions.

Conference Call Information

A conference call and webcast to discuss the transactions will be held on November 14, 2024, at 6:30 a.m. MT (8:30 a.m. ET).

To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/3CoCWXD to receive an

instant automated call back. You can also dial direct to be entered to the call by an Operator. Please dial 888-510-2154 (toll-free in North America) or 437-900-0527 (international) approximately 15 minutes prior to the call.

The

live audio webcast of the conference call, including presentation slides, will be available on Ovintiv’s website, www.ovintiv.com under Investors/Presentations and Events. The webcast will be archived for approximately 90 days.

Important information

Unless otherwise noted, Ovintiv

reports in U.S. dollars and production and sales estimates are reported on an after-royalties basis. Unless otherwise specified or the context otherwise requires, references to Ovintiv or to the Company includes reference to subsidiaries of and

partnership interests held by Ovintiv Inc. and its subsidiaries.

NI 51-101 Exemption

The Canadian securities regulatory authorities have issued a decision document (the “Decision”) granting Ovintiv exemptive relief from the

requirements contained in Canada’s National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities (“NI 51-101”). As a result of the

Decision, and provided that certain conditions set out in the Decision are met on an on-going basis, Ovintiv will not be required to comply with the Canadian requirements of NI

51-101 and the Canadian Oil and Gas Evaluation Handbook. The Decision permits Ovintiv to provide disclosure in respect of its oil and gas activities in the form permitted by, and in accordance with, the legal

requirements imposed by the U.S. Securities and Exchange Commission (“SEC”), the Securities Act of 1933, the Securities and Exchange Act of 1934, the Sarbanes-Oxley Act of 2002 and the rules of the NYSE. The Decision also provides that

Ovintiv is required to file all such oil and gas disclosures with the Canadian securities regulatory authorities on www.sedarplus.ca as soon as practicable after such disclosure is filed with the SEC.

NOTE 1: Non-GAAP Measures

Certain measures in this news release do not have any standardized meaning as prescribed by U.S. GAAP and, therefore, are considered non-GAAP measures. These measures may not be comparable to similar measures presented by other companies and should not be viewed as a substitute for measures reported under U.S. GAAP. These measures are commonly

used in the oil and gas industry and/or by Ovintiv to provide shareholders and potential investors with additional information regarding the Company’s liquidity and its ability to generate funds to finance its operations. For additional

information regarding non-GAAP measures, see the Company’s website. This news release contains references to non-GAAP measures as follows:

| |

• |

|

Non-GAAP Cash Flow and

Non-GAAP Cash Flow per Share are non-GAAP measures. Non-GAAP Cash Flow is defined as cash from (used in) operating activities

excluding net change in other assets and liabilities, and net change in non-cash working capital. Non-GAAP Cash Flow per Share is

Non-GAAP Cash Flow divided by the weighted average number of shares of common stock outstanding. |

3

| |

• |

|

Non-GAAP Free Cash Flow and

Non-GAAP Free Cash Flow per Share are non-GAAP measures. Non-GAAP Free Cash Flow is defined as Non-GAAP Cash Flow in excess of capital expenditures, excluding net acquisitions and divestitures. Non-GAAP Free Cash Flow per Share is

Non-GAAP Free Cash Flow divided by the weighted average number of shares of common stock outstanding. Forecasted Non-GAAP Free Cash Flow assumes forecasted Non-GAAP Cash Flow based on price sensitivity of $67 WTI, $3.15 NYMEX and ($1.50) AECO differential. The scenario utilizes the midpoint of the expected asset production and capital. Due to its forward-looking

nature, management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure, such as changes in operating assets and liabilities. Accordingly, Ovintiv is unable to present a

quantitative reconciliation of such forward-looking non-GAAP financial measure to its most directly comparable forward-looking GAAP financial measure. Amounts excluded from this non-GAAP measure in future periods could be significant. |

| |

• |

|

Net Debt is a non-GAAP measure defined as long-term debt,

including the current portion, less cash and cash equivalents. At October 31, 2024, Net Debt of $5.65 billion comprised long-term debt of approximately $5.89 billion, less cash and cash equivalents of approximately $240 million.

|

| |

• |

|

Return on Capital Employed (ROCE) is a non-GAAP measure. ROCE is

defined as Adjusted Earnings divided by Capital Employed. Adjusted Earnings is defined as trailing 12-month Non-GAAP Adjusted Earnings plus after-tax interest expense. Non-GAAP Adjusted Earnings is defined as Net Earnings (Loss) excluding non-cash items that management

believes reduces the comparability of the Company’s financial performance between periods. These items may include, but are not limited to, unrealized gains/losses on risk management, impairments,

non-operating foreign exchange gains/losses, and gains/losses on divestitures. Income taxes includes adjustments to normalize the effect of income taxes calculated using the estimated annual effective income

tax rate. In addition, any valuation allowances are excluded in the calculation of income taxes. Capital Employed is defined as average debt plus average shareholders’ equity. |

ADVISORY REGARDING OIL AND GAS INFORMATION – The conversion of natural gas volumes to barrels of oil equivalent (“BOE”) is on the basis

of six thousand cubic feet to one barrel. BOE is based on a generic energy equivalency conversion method primarily applicable at the burner tip and does not represent economic value equivalency at the wellhead. Readers are cautioned that BOE may be

misleading, particularly if used in isolation. The term “liquids” is used to represent oil, NGLs and condensate. The term “condensate” refers to plant condensate.

ADVISORY REGARDING FORWARD-LOOKING STATEMENTS – This news release contains forward-looking statements or information (collectively,

“forward-looking statements”) within the meaning of applicable securities legislation, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All

statements, except for statements of historical fact, that relate to the anticipated future activities, plans, strategies, objectives or expectations of the Company, including timing and expected benefits of the acquisition, timing of the

disposition and expected 2025 guidance, are forward-looking statements. When used in this news release, the use of words and phrases including “anticipates,” “believes,” “continue,” “could,”

“estimates,” “expects,” “focused on,” “forecast,” “guidance,” “intends,” “maintain,” “may,” “opportunities,” “outlook,” “plans,”

“potential,” “strategy,” “targets,” “will,” “would” and other similar terminology is intended to identify forward-looking statements, although not all forward-looking statements contain such

identifying words or phrases. Readers are cautioned against unduly relying on forward-looking statements, which are based on current expectations and, by their nature, involve numerous assumptions that are subject to both known and unknown risks and

uncertainties (many of which are beyond our control) that may cause such statements not to occur, or actual results to differ materially and/or adversely from those expressed or implied. These assumptions include, without limitation: future

commodity prices and basis differentials; the Company’s ability to consummate any pending acquisition or divestment transactions (including the transactions described herein); the ability of the Company to access credit facilities, debt and

equity markets and other sources of liquidity to fund operations or acquisitions and manage debt; the availability of attractive commodity or financial hedges and the enforceability of risk management programs; the Company’s ability to capture

and maintain gains in productivity and efficiency; the ability for the Company to generate cash returns and execute on its share buyback plan; expectations of plans, strategies and objectives of the Company, including anticipated production volumes

and capital investment; the Company’s ability to manage cost inflation and expected cost structures, including expected operating, transportation, processing and labor expenses; the outlook of the oil and natural gas industry generally,

including impacts from changes to the geopolitical environment; and projections made in light of, and generally consistent with, the Company’s historical experience and its perception of historical industry trends; and the other assumptions

contained herein. Although the Company believes the expectations represented by its forward-looking statements are reasonable based on the information available to it as of the date such statements are made, forward-looking statements are only

predictions and statements of our current beliefs and there can be no assurance that such expectations will prove to be correct. Unless otherwise stated herein, all statements, including forward looking statements, contained in this news

4

release are made as of the date of this news release and, except as required by law, the Company undertakes no obligation to update publicly, revise or keep current any such statements The

forward-looking statements contained in this news release and all subsequent forward-looking statements attributable to the Company, whether written or oral, are expressly qualified by these cautionary statements.

The reader should carefully read the risk factors described in the “Risk Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” sections of the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and in other filings with

the SEC or Canadian securities regulators, for a description of certain risks that could, among other things, cause actual results to differ from these forward-looking statements. Other unpredictable or unknown factors not discussed in this news

release could also have material adverse effects on forward-looking statements.

Further information on Ovintiv Inc. is available on the Company’s

website, www.ovintiv.com, or by contacting:

|

|

|

| Investor contact: (888) 525-0304 |

|

Media contact: (403) 645-2252 |

SOURCE: Ovintiv Inc.

5

Permian & Montney Oil Powerhouse

November 14, 2024 Exhibit 99.2

Cautionary Statements For convenience,

references in this presentation to “Ovintiv”, “OVV”, the “Company”, “we”, “us” and “our” may, where applicable, refer only to or include any relevant direct and indirect

subsidiary entities and partnerships (“Subsidiaries”) of Ovintiv Inc., and the assets, activities and initiatives of such Subsidiaries. The terms “include”, “includes”, “including” and

“included” are to be construed as if they were immediately followed by the words “without limitation”, except where explicitly stated otherwise. The term “liquids” is used to represent oil, NGLs and condensate.

The term “condensate” refers to plant condensate. The conversion of natural gas volumes to barrels of oil equivalent (“BOE”) is on the basis of six thousand cubic feet to one barrel. BOE is based on a generic energy

equivalency conversion method primarily applicable at the burner tip and does not represent economic value equivalency at the wellhead. Readers are cautioned that BOE may be misleading, particularly if used in isolation. There is no certainty that

Ovintiv will drill all gross premium well inventory locations and if drilled there is no certainty that such locations will result in additional oil and gas reserves or production. The locations on which Ovintiv will actually drill wells, including

the number and timing thereof, is ultimately dependent upon the availability of capital, regulatory and partner approvals, seasonal restrictions, equipment and personnel, oil and natural gas prices, costs, actual drilling results, transportation

constraints and other factors. Certain measures in this presentation do not have any standardized meaning as prescribed by U.S. GAAP and, therefore, are considered non-GAAP measures. These measures may not be comparable to similar measures

presented by other companies and should not be viewed as a substitute for measures reported under U.S. GAAP These measures are commonly used in the oil and gas industry and/or by Ovintiv to provide shareholders and potential investors with

additional information regarding the Company’s liquidity and its ability to generate funds to finance its operations. For additional information regarding non-GAAP measures, including reconciliations, see the Company’s website and

Ovintiv’s most recent Annual Report on Form 10-K. This presentation contains references to non-GAAP measures as follows: Non-GAAP Cash Flow and Non-GAAP Cash Flow per Share are non-GAAP measures. Non-GAAP Cash Flow is defined as cash from

(used in) operating activities excluding net change in other assets and liabilities, and net change in non-cash working capital. Non-GAAP Cash Flow per Share is Non-GAAP Cash Flow divided by the weighted average number of shares of common stock

outstanding. Non-GAAP Free Cash Flow and Non-GAAP Free Cash Flow per Share are non-GAAP measures. Non-GAAP Free Cash Flow is defined as Non-GAAP Cash Flow in excess of capital expenditures, excluding net acquisitions and divestitures. Non-GAAP Free

Cash Flow per Share is Non-GAAP Free Cash Flow divided by the weighted average number of shares of common stock outstanding. Forecasted Non-GAAP Free Cash Flow assumes forecasted Non-GAAP Cash Flow based on price sensitivity of $67 WTI, $3.15 NYMEX

and ($1.50) AECO differential. The scenario utilizes the midpoint of the expected asset production and capital. Due to its forward-looking nature, management cannot reliably predict certain of the necessary components of the most directly comparable

forward-looking GAAP measure, such as changes in operating assets and liabilities. Accordingly, Ovintiv is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to its most directly comparable

forward-looking GAAP financial measure. Amounts excluded from this non-GAAP measure in future periods could be significant. Non-GAAP Free Cash Flow Yield is a non-GAAP measure defined as annualized Non-GAAP Free Cash Flow compared to current

market capitalization. Net Debt is a non-GAAP measure defined as long-term debt, including the current portion, less cash and cash equivalents. At October 31, 2024, Net Debt of $5.65 B comprised long-term debt of approximately $5.89B, less cash and

cash equivalents of approximately $240 MM. Return on Capital Employed (ROCE) is a non-GAAP measure. ROCE is defined as Adjusted Earnings divided by Capital Employed. Adjusted Earnings is defined as trailing 12-month Non-GAAP Adjusted Earnings plus

after-tax interest expense. Non-GAAP Adjusted Earnings is defined as Net Earnings (Loss) excluding non-cash items that management believes reduces the comparability of the Company’s financial performance between periods. These items may

include, but are not limited to, unrealized gains/losses on risk management, impairments, non-operating foreign exchange gains/losses, and gains/losses on divestitures. Income taxes, includes adjustments to normalize the effect of income taxes

calculated using the estimated annual effective income tax rate. In addition, any valuation allowances are excluded in the calculation of income taxes. Capital Employed is defined as average debt plus average shareholders’ equity.

Forward Looking Statements This

presentation contains forward-looking statements or information (collectively, “forward-looking statements”) within the meaning of applicable securities legislation, including Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. All statements, except for statements of historical fact, that relate to the anticipated future activities, plans, strategies, objectives or expectations of the Company, including

guidance and expected free cash flow, the expectation of delivering sustainable durable returns to shareholders in future years, plans regarding share buybacks and debt reduction, the anticipated success of, and benefits from, technology and

innovation, the ability of the Company to meet and maintain certain targets, timing and expectations regarding capital efficiencies and well completion and performance, are forward-looking statements. When used in this presentation, the use of words

and phrases including “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “focused on,” “forecast,” “guidance,”

“intends,” “maintain,” “may,” “opportunities,” “outlook,” “plans,” “potential,” “strategy,” “targets,” “will,”

“would” and other similar terminology are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words or phrases. Readers are cautioned against unduly relying on

forward-looking statements which, are based on current expectations and by their nature, involve numerous assumptions that are subject to both known and unknown risks and uncertainties (many of which are beyond our control) that may cause such

statements not to occur, or actual results to differ materially and/or adversely from those expressed or implied. These assumptions include, without limitation: future commodity prices and basis differentials; future foreign exchange rates; the

ability of the Company to access credit facilities and capital markets; data contained in key modeling statistics; the availability of attractive commodity or financial hedges and the enforceability of risk management programs; the Company’s

ability to capture and maintain gains in productivity and efficiency; the ability for the Company to generate cash returns and execute on its share buyback plan; expectations of plans, strategies and objectives of the Company, including anticipated

production volumes and capital investment; benefits from technology and innovations; expectations that counterparties will fulfill their obligations pursuant to gathering, processing, transportation and marketing agreements; access to adequate

gathering, transportation, processing and storage facilities; assumed tax, royalty and regulatory regimes; the outlook of the oil and natural gas industry generally, including impacts from changes to the geopolitical environment; expectations and

projections made in light of, and generally consistent with, the Company’s historical experience and its perception of historical industry trends, including with respect to the pace of technological development; and the other assumptions

contained herein. Risks and uncertainties that may affect the Company’s financial or operating performance include: market and commodity price volatility, including widening price or basis differentials, and the associated impact to the

Company’s stock price, credit rating, financial condition, oil and natural gas reserves and access to liquidity; uncertainties, costs and risks involved in our operations, including hazards and risks incidental to both the drilling and

completion of wells and the production, transportation, marketing and sale of oil, condensate, NGL and natural gas; availability of equipment, services, resources and personnel required to perform the Company’s operating activities; service or

material cost inflation; our ability to generate sufficient cash flow to meet our obligations and reduce debt; the impact of a pandemic, epidemic or other widespread outbreak of an infectious disease on commodity prices and the Company’s

operations; our ability to secure adequate transportation and storage for oil, condensate, NGL and natural gas, as well as access to end markets or physical sales locations; interruptions to oil, condensate, NGL and natural gas production, including

potential curtailments of gathering, transportation or refining operations; variability and discretion of the Company’s board of directors to declare and pay dividends, if any; the timing and costs associated with drilling and completing

wells, and the construction of well facilities and gathering and transportation pipelines; business interruption, property and casualty losses (including weather related losses) or unexpected technical difficulties and the extent to which insurance

covers any such losses; counterparty and credit risk; the actions of members of OPEC and other state-controlled oil companies with respect to oil, condensate, NGLs and natural gas production and the resulting impacts on oil, condensate, NGLs and

natural gas prices; the impact of changes in our credit rating and access to liquidity, including costs thereof; changes in political or economic conditions in the United States and Canada, including fluctuations in foreign exchange rates, tariffs,

taxes, interest rates and inflation rates; failure to achieve or maintain our cost and efficiency initiatives; risks associated with technology, including electronic, cyber and physical security breaches; changes in royalty, tax, environmental,

greenhouse gas, carbon, accounting and other laws or regulations or the interpretations thereof; our ability to timely obtain environmental or other necessary government permits or approvals; the Company’s ability to utilize U.S. net operating

loss carryforwards and other tax attributes; risks associated with existing and potential lawsuits and regulatory actions made against the Company, including with respect to environmental liabilities and other liabilities that are not adequately

covered by an effective indemnity or insurance; risks related to the purported causes and impact of climate change, and the costs therefrom; the impact of disputes arising with our partners, including suspension of certain obligations and inability

to dispose of assets or interests in certain arrangements; the Company’s ability to acquire or find additional oil and natural gas reserves; imprecision of oil and natural gas reserves estimates and estimates of recoverable quantities,

including the impact to future net revenue estimates; land, legal, regulatory and ownership complexities inherent in the U.S., Canada and other applicable jurisdictions; risks associated with past and future acquisitions or divestitures of oil and

natural gas assets, including the receipt of any contingent amounts contemplated in the transaction agreements (such transactions may include third-party capital investments, farm-ins, farm-outs or partnerships); our ability to repurchase the

Company’s outstanding shares of common stock, including risks associated with obtaining any necessary stock exchange approvals; the existence of alternative uses for the Company’s cash resources which may be superior to the payment of

dividends or effecting repurchases of the Company’s outstanding shares of common stock; risks associated with decommissioning activities, including the timing and cost thereof; risks and uncertainties described in Item the “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q; and other risks

and uncertainties impacting the Company’s business as described from time to time in the Company’s filings with the SEC or Canadian securities regulators. Readers are cautioned that the assumptions, risks and uncertainties

referenced above are not exhaustive. Although the Company believes the expectations represented by its forward-looking statements are reasonable based on the information available to it as of the date such statements are made, forward-looking

statements are only predictions and statements of our current beliefs and there can be no assurance that such expectations will prove to be correct. Unless otherwise stated herein, all statements, including forward-looking statements, contained in

this presentation are made as of the date of this presentation and, except as required by law, the Company undertakes no obligation to update publicly, revise or keep current any such statements. The forward-looking statements contained or

incorporated by reference in this presentation and all subsequent forward-looking statements attributable to the Company, whether written or oral, are expressly qualified by these cautionary statements.

High-Grading The Portfolio Acquiring

Core Montney oil ~80% undeveloped acreage in high-return oil window For $2.377 B1 Divesting Uinta For $2.00 B A Permian & Montney Oil Powerhouse Note: throughout this presentation, “oil” when referring to Montney oil includes both

oil & condensate given the near-parity pricing between Montney oil & condensate and WTI. Ŧ Non-GAAP measures defined in advisories. For additional information please see advisories contained within this document. 1) C$3.325 B, assumes a

0.7150 CAD to USD FX rate per Bloomberg, Noon Rate, November 13, 2024. Significant Basin Scale In the two largest remaining oil resource basins in North America 85-90% of pro forma capital to Permian & Montney Permian Strong oil mix, deep

inventory & proven well results Anadarko Low decline & High Free Cash FlowŦ Montney High-return oil & deep multi-product inventory Underpinned by Free Cash FlowŦ Engine in the Anadarko ~100 MBOE/d of low-decline

production

Remaining Undrilled Resource (Ovintiv

Internal North American Resource Assessment) Undeveloped Bbbls ~80% of remaining sub-$50/bbl breakeven oil locations in North America are in the Permian & Montney (Enverus, PV10 breakeven at 20:1 conversion) Focused in the Top North American Oil

Basins The Permian & Montney are the two largest remaining oil resource basins in North America

Advancing Our Durable Returns Strategy

Ŧ Non-GAAP measures defined in advisories. For additional information please see advisories contained within this document. 1) Pro-forma estimates and per share metric increases are for FY25E and assume both the acquisition and disposition

close January 1, 2025, and strip pricing as of October 31, 2024: ~$67/bbl WTI, ~$3.15 NYMEX & ~($1.50)/MMBtu AECO differential. Transactions are immediately & long-term accretive on all key financial metrics ~20% increase in Free Cash

FlowŦ per Share, low-single digit increase in Cash FlowŦ per Share & ~$125 MM in expected annual synergies1 Substantially boosts Free Cash FlowŦ & capital efficiency $300 MM more Free Cash FlowŦ for the same oil

production, more BOE & less capital1 High-grades the portfolio Higher return, higher Free Cash FlowŦ asset with a lower FY25E capital requirement & a mid-single-digit oil growth option Enhances our Montney oil position & expands

Montney oil inventory to ~15 years Adds ~900 net 10k locations in the core Montney oil window Leverages our industry-leading innovation & execution in Montney oil Applies our best-in-class operations, capital efficiency & DCFT to additional

core acreage Expect credit ratings & stable outlook to be reaffirmed No new equity or long-term debt; net cash requirement funded by temporary buyback pause with expected resumption in 2Q25 P P P P P P

Asset Profile 70 MBOE/d expected at

close1 25 Mbbls/d oil & condensate1, 230 MMcf/d natural gas1 Anticipate load-leveled pro forma activity of 3 rigs & 1 frac crew Inventory & Operational Details 109k contiguous net acres proximate to existing Pipestone position ~80%

undeveloped ~900 net 10k locations (~600 Premium2 & ~300 upside) <$1 MM / Premium2 location (assuming ~$26k/BOE PDP value) 96% operated, 92% average WI Acreage held indefinitely / no HBP3 requirements Acquired Montney Asset Overview 1) NRI.

2) Premium reflects >35% IRR at $55/bbl WTI oil and $2.75/MMBtu NYMEX. 3) Held by production. 4) Reflects approximate metrics in 1Q25. OVV Montney at Close4 OVV Acquisition Pro Forma Net Core Acres (000s) 260 109 369 Oil & C5+ (Mbbls/d) 30 25

55 Total (MBOE/d) 240 70 310 *Oil productivity is ~20% higher in the over-pressured window vs. the normally pressured window (12-month cume)

Conservative Transaction Funding

Expect agencies to reaffirm investment grade ratings & stable outlooks Committed to maintaining IG rating $4.0B debt target reaffirmed Temporary buyback pause funds net cash requirement of $377 MM Pause began with 3Q24 Free Cash FlowŦ that

would have been used for repurchases in 4Q24 ($181 MM) Bolt-on activity effectively paused while share buybacks are paused No change to base dividend expected1 Anticipate buyback restart in 2Q252 Aligned timing for both transactions Effective Date:

Oct 1, 2024 / Estimated Close: 1Q25 Ŧ Non-GAAP measures defined in advisories. For additional information please see advisories contained within this document. 1) Subject to Board discretion. 2) At strip pricing as of October 31, 2024: ~$67/bbl

WTI, ~$3.15 NYMEX & ~($1.50)/MMBtu AECO differential. 3) Subject to customary adjustments. 4) Includes $50 MM of the $150 MM asset legal settlement, with the balance expected prior to YE24 Sources ($MM) Uinta Sale Proceeds3 $2,000 Cash and

Short-Term Borrowings (recovered through buyback pause) $377 Total $2,377 Uses ($MM) Acquisition Purchase Price3 $2,377 $3,125/$2,500 Total $2,377 $2,500 Transaction Sources and Uses Net DebtŦ at Oct 31, 2024 $6,079 $MM $211 Net DebtŦ @

6/30 3Q24 Net DebtŦ Paydown Net DebtŦ @ 9/30 Oct ’24 Net DebtŦ Paydown4 $5,868 ~$220 Net DebtŦ @ 10/31 ~$5,650

Immediately & Long-Term Accretive

Accretive on all key financial metrics including Cash FlowŦ & Free Cash FlowŦ ~$300 MM higher Free Cash FlowŦ in FY25E1 ~$200 MM more Cash Flow,Ŧ ~$100 MM less capital Additional Free Cash FlowŦ supports higher

shareholder returns, debt paydown acceleration & lower leverage Capital efficiency driven by execution excellence ~$125 MM in expected annual synergies >$1.5 MM / well in capital savings Additional synergies from Canadian cash tax savings

& lower overhead Infrastructure in place unlocks mid-single-digit Montney oil growth option Enables more load-leveled development Cost & royalty advantaged Ŧ Non-GAAP measures defined in advisories. For additional information please see

advisories contained within this document. 1) FY25E pro-forma vs. FY25E stand-alone Ovintiv. Pro-forma estimates assume both the acquisition and disposition close January 1, 2025, and strip pricing as of October 31, 2024: ~$67/bbl WTI, ~$3.15 NYMEX

& ($1.50)/MMBtu AECO differential. Per share metrics include impact of temporary share buyback pause. ~20% More FY25E Free Cash Flow per ShareŦ1 P ~$125 MM Expected Annual Synergies P Higher ROCEŦ P

Acquiring the Best Rock in the

Montney 1) Enverus. Horizontal wells online since ’22 with 10%+ liquids. Alberta Montney peers include AAV, ARX, BIR, CNQ, KEL, NVA, SCR, VRN & WCP. 2) Premium reflects >35% IRR at $55/bbl WTI oil and $2.75/MMBtu NYMEX. 3) Enverus.

Horizontal wells online since ’22 with 10%+ liquids. Alberta Montney Avg. Oil Productivity1 12-Month Cume. bbls/ft >40% More Productive than the Peer Avg. Acquired Oil Productivity vs. Midland Basin3 12-Month Cume. bbls/ft Attractive

acquisition cost (<$1MM / Premium2 location) Lowest D&C cost ($550/ft) Higher net royalty interest Strong oil price realizations (~97% of WTI) P P P Montney Oil Returns Advantage P Highest oil productivity in the Alberta

Montney Enhances legacy Montney position High confidence in repeatability P P P 15.4 County Average Core-of-the Core Montney Oil

~600 Premium Locations1 12-16 WPS,

two benches across position + 3rd bench in highest oil-in-place acreage ~300 Upside Locations1 3rd bench across position & add’l infill opportunities Enhancing Our Montney Oil Position 1) Premium reflects >35% IRR at $55/bbl WTI oil and

$2.75/MMBtu NYMEX. Locations are net 10k. 2) Expected to close in 1Q25. 3) Mid-cycle prices: $55/bbl WTI, $2.75/MMBtu NYMEX. Well IRR at Mid-Cycle Prices3 Premium1 Well Count Legacy Montney Acquired Premium Locations1 IRR 35% ~15 years of Premium1

Montney oil inventory Legacy Montney & acquired Premium locations1 Transaction expands our leading Montney scale Returns driven by oil >60% FY25E pro-forma IRR at October 31 strip Economics do not require high NYMEX or AECO Improved oil

realizations Montney oil receives ~97% of WTI Structurally short condensate market provides durable support for Montney oil pricing Acquisition immediately competes for capital Today’s Transactions2 100% ~900 Added Premium & Upside

Locations1 Typical Development Program Three bench development is typical by OVV & others offsetting acquired acreage

OVV Spud-Rig Release vs. Peers2

Ovintiv is the Best-in-Class Montney Operator 1) OVV capital efficiency reflects FY24E Montney capex guidance and 2Q24 Montney production. Peer capital efficiency reflects FY24 total company capex guidance converted to USD at 0.75 CAD/US FX and

total company 2Q24 production actuals. For comparison purposes, capital efficiency calculations for peers also include an assumed 10% royalty rate across all products – Montney peers report pre-royalty production, OVV reports after-royalty

production. Peers include AAV, ARX, BIR, NVA and TOU. 2) Enverus 2024 YTD as of October 16, 2024. Spud-rig release timing normalized to 10k ft lateral. Peer Average includes AAV, ARX, BIR, CNQ, COP, KEL, NVA, POU, PRQ, SRC, TOU and VRN. OVV Montney

Oil Capital Efficiency1 Days >8days Faster than Peers ’24 YTD ‘000 ft >1.5k ft Longer than Peers ’24 YTD Peer Average OVV <10 ~18 >11 ~9.5 OVV Lateral Length vs. Peers2 ~60% Better than Peer Avg. FY24E Capex / Oil &

Condensate ($MM USD / Mbbls/d) Peer Average OVV Industry-Leading Montney Operator Decades of experience in the Montney Execution leadership drives top tier capital efficiency Real-time frac optimization maximizes productivity per foot & lowers

costs Digital operations control center maximizes production & lowers costs Integrated learnings and best practices from Lower 48 operations Peers

Speed Driving Montney Efficiencies

Drilled Ft/Day Completed Ft/Day <$500/ft Pacesetter D&C $525-$575/ft FY24 D&C Guidance ~1,700 ~1,725 ~3,300 ~4,100 6% faster drilling in 3Q24 vs. FY23 Longest industry lateral in Montney history at 18,110 ft1 Ovintiv has drilled 14 of the

20 longest Montney laterals1 P P P 3Q24 OVV Drilling 24% faster completions in 3Q24 vs. FY23 Pacesetter completion of >5,400 ft/d Completions speed on par with Permian Trimulfrac P P P 3Q24 OVV Completions Montney D&C

1) Geoscout. ~1,700 ~1,800 ~1,820 ~4,100 ~4,450 ~5,100 6% Faster 3Q24 vs. FY23 24% Faster 3Q24 vs. FY23

Builds on strong year-to-date

company wide performance Immediately & long-term accretive Drives capital efficiency gain & ROCEŦ boost High-grades portfolio & enhances Montney oil position Leverages industry-leading innovation & execution in Montney oil

Expect credit ratings & stable outlook to be reaffirmed Advancing Our Durable Returns Strategy ~620MBOE/d Total Production P P P P P ~$2.2B Capex ~205Mbbls/d Oil & Condensate Production 2025 Pro-Forma Guidance1 Ŧ

Non-GAAP measures defined in advisories. For additional information please see advisories contained within this document. 1) Assumes both the acquisition and disposition close January 1, 2025. P

Appendix

Focused & Efficient Portfolio

Pairing the top two oil basins with stable, low-decline Free Cash FlowŦ Substantial basin scale in each asset Innovations transferred across the assets to drive returns Operational Excellence Drives Efficiencies Proven operational flexibility

and margin enhancement Optimized development programs across asset base Multi-Product Commodity Exposure Premium return options across both oil & condensate and gas Maximizing price realizations through market diversification Deep Premium1

Inventory 10-15 yrs of oil & condensate & >20 yrs of natural gas Premium inventory Proven organic assessment and appraisal program Oil Inventory Powerhouse P P P Permian Strong oil mix, deep inventory & proven well results

Anadarko Low decline & High Free Cash FlowŦ Montney High-return oil & deep multi-product inventory P Premium Multi-Basin Portfolio & Resource Expertise & Culture to Convert Resource to Free Cash FlowŦ Disciplined

Capital Allocation Durable Return on Invested Capital & Return of Cash to Shareholders Durable Returns Recipe = Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s

website. 1) Premium reflects >35% IRR at $55/bbl WTI oil and $2.75/MMBtu NYMEX.

Details on Uinta Basin Exit All

Cash Proceeds $2.00 $B Funds Significant Portion of Montney Acquisition Production Profile 29 Mbbls/d 3Q24 Oil & Condensate Production Key Dates October 1, 2024 Effective Date 1Q25 Estimated Close

Acquired acreage among the highest

oil productivity in the Montney Proven Montney Oil Well Performance Note: Production data based on wells with 12 months of production brought on production January 2020 or later. Acquisition 46 Wells 14.5 bo/ft -12mo OVV Acreage Acquired Acreage

(109k acres) Overpressured Oil Gas Window Montney well Acquisition 60 Wells 17.5 bo/ft -12mo Over-Pressured* Normally Pressured* ~106k Acquired Net Core Acres ~80% Undeveloped ~900 Acquired Net 10k Locations *Oil productivity is ~20% higher in the

over-pressured window vs. the normally pressured window (12-month cume) Pipestone Wapiti Karr Kakwa

Midstream & Marketing Overview

Sufficient Access to Processing & Transportation Capacity Scaled with near-term development plans Option for mid-single-digit oil growth Leverages & Builds on Existing Relationships Ongoing business with midstream providers Plants operated

by CSV & Keyera Manageable Increase in AECO Exposure Continue to diversify exposure through physical transport & AECO hedges P P P Midstream Infrastructure

Condy Fundamentals Support Parity

to WTI 1) Canada Energy Regulator, December 2023 (Current Policies case). 2) Montney Condensate: ICE C5 1a + NYMEX Calendar Basis Swap. WTI: WTI Calendar Basis Swap. 3) Unhedged. 2024 YTD is through September 2024. Montney Condensate Competes with

WTI ($/bbl)2 Captive Demand Growth (Mbbls/d)1 Canadian condensate demand expected to continue to be met with imports from the U.S. Even with domestic condensate production growth in Canada Required Condensate Imports to Meet Demand Domestic

Condensate Production ~4% 5-yr Import Demand CAGR WTI Montney Condensate 97% OVV Montney Condensate Realizations vs. WTI, 2021-2024 YTD3

WCSB Supply & Demand Balance

(Bcf/d) In-Basin WCSB Demand Exports Out of the WCSB WCSB Production Note: WCSB: Western Canadian Sedimentary Basin. 1) YTD 2024. ~18Bcf/d Natural Gas Production ~10Bcf/d Pipeline Exports ~8Bcf/d Local, In-Basin Demand WCSB Natural Gas Balance by

the Numbers1 WCSB Gas Market Balances on Exports

Station 2 Malin Sumas Emerson

Chicago Dawn Empress Montney / WCSB Gas Export Infrastructure NGTL System TC Energy 1) Unhedged through 2Q24. 2) BBtu/d. Montney firm transport values are calculated from AECO. Northern Border TC Energy Alliance Pembina GTN TC Energy BC (Westcoast)

Enbridge Ovintiv’s Montney Gas Gets Near NYMEX Pricing Long-term Firm Transport to premium US & Canadian Markets Renewal rights on all long-term Firm Transport agreements Physical price protection supplemented by financial hedges to NYMEX

Consistent history of above AECO realized pricing P P P P Canadian Mainline TC Energy Montney Firm Transport2 2024 – 2025+ Dawn 330 Sumas 21 Malin 113 Chicago 245 Total 709 Diversified & ex AECO Pricing

LNG Canada WCSB LNG Infrastructure

Note: ISD: In-service date. FID: Final investment decision. Cedar Ksi Lisims Woodfibre Prince Rupert Gas Transmission Western & Nisga’a LNG Canada Phases 1 (2.0 Bcf/d) & 2 (2.0 Bcf/d) Phase 1: ISD: ~2025 (has taken FID) Phase 2: ISD:

~2030 Owner/Supplier: Shell (40%), Petronas (25%), PetroChina (15%), Mitsubishi (15%), Kogas (5%) Access: Coastal Gas Link (TC) Cedar LNG (0.4 Bcf/d) ISD: ~2028 (has taken FID) Owner: Pembina/Haisla partnership Supplier: ARC (50%) / Pembina (50%)

Access: Coastal Gas Link (TC) Woodfibre LNG (0.3 Bcf/d) ISD: ~2027 (has taken FID) Owner: Pacific Energy (70%) / Enbridge (30%) Supplier: Pacific Canbriam Access: To link to Westcoast system Ksi Lisims LNG (1.7 Bcf/d) ISD: ~2030 Owner: Western LNG

Supplier: Rockies LNG (WCSB Producers) Access: Pipeline under construction (Nisga’a) West Coast LNG Projects Coastal Gas Link connected to Sunrise Plant BC Montney Partner (Mitsubishi) is an Owner Participant in Rockies LNG Ovintiv Optionality

>6 Bcf/d of potential LNG exports before 2030 Coastal Gas Link connected to Sunrise Plant Coastal GasLink TC Energy BC (Westcoast) Enbridge Well-Positioned for West Coast LNG

Note: Royalty calculations assume

AECO benchmark prices of approximately 80% of NYMEX. Royalties reflect “Net Effective Royalties to OVV” after incentives. 1) Total BOE Production. Canadian Royalty Sensitivity Royalty Rates Vary Based on Commodity Prices OVV Reports

“NRI” volumes after royalties across its US and Canadian assets Changes in royalty rates seen in changes to reported net production Observed Montney Rates at or Below US Basins US royalties are traditionally a “fixed”

percentage Even in a “high” scenario Montney royalties screen in-line with US basins Incentives Programs Exist to Lower Realized Royalties Upfront & early life royalty incentives derived from development costs Additional royalty

incentives from infrastructure and facility cost credits 6 – 8% 13 – 15% Royalty Sensitivity1 US Basin Average (20 – 25%) 24 – 26% WTI / Condensate $55 / $54 $70 / $69 $135 / $134 NYMEX / AECO $2.75 / $2.15 $5.00 / $4.00

$9.00 / $7.00 MAX Effective Royalties

Durable Cash Return Framework

Ŧ Non-GAAP measures defined in advisories. For additional information regarding non-GAAP measures see the Company’s website. Note: Future dividends are subject to Board approval. 1) $78 MM base dividend in 4Q24, held flat to 3Q24 for

illustrative purposes. 4Q24 Free Cash FlowŦ Allocation ($ MM) 3Q24 Results $978 Non-GAAP Cash FlowŦ ($538) Capex $440 Non-GAAP Free Cash FlowŦ ($78) 3Q24 Base Dividend $362 Available for Allocation 4Q24 Capital Allocation $181 50%

Allocated to Balance Sheet $181 50% Add’l Allocation to Balance Sheet (from buyback pause to fund net cash requirement) $362 4Q24 Balance Sheet Allocation $78 4Q24 Shareholder Return (Base Dividend)1 Uses of Post-Base Dividend Free Cash

FlowŦ Buybacks temporarily paused to fund transaction net cash requirement Net Cash Requirement 4Q24 Buyback Pause Remaining Net Cash Requirement $377 $181 Funded with Buyback pause (expected restart in 2Q25) Buyback Pause & Restart $MM

Shareholder Return Framework Shareholder Returns At least 50% Share Buybacks Variable Dividend Balance Sheet Up to 50% Debt Paydown Low-cost Bolt-Ons $196

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef