UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

SECURITIES EXCHANGE

ACT OF 1934

For the month of March,

2024

(Commission File

No. 001-34429),

PAMPA ENERGIA S.A.

(PAMPA ENERGY INC.)

Argentina

(Jurisdiction of

incorporation or organization)

Maipú 1

C1084ABA

City of Buenos Aires

Argentina

(Address of principal

executive offices)

(Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F ___X___ Form 40-F ______

(Indicate

by check mark whether the registrant by furnishing the

information contained in this form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.)

Yes ______ No ___X___

(If "Yes"

is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82- .)

This Form 6-K

for Pampa Energía S.A. (“Pampa” or the “Company”) contains:

Exhibit

1: Earnings Release Q4 23

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: March 4, 2024

| Pampa Energía S.A. |

| |

|

|

| |

|

|

| By: |

/s/ Gustavo Mariani

|

|

| |

Name: Gustavo Mariani

Title: Chief Executive Officer |

|

FORWARD-LOOKING

STATEMENTS

This press release may contain

forward-looking statements. These statements are statements that are not historical facts, and are based on management's current

view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates",

"believes", "estimates", "expects", "plans" and similar expressions, as they relate to

the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends,

the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations

and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee

that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including

general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

Pampa Energía, an independent

company with active participation in the Argentine electricity and gas value chain, announces the results for the fiscal year and quarter

ended on December 31, 2023. |

Buenos Aires, March 6, 2024

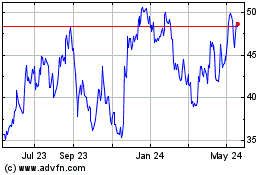

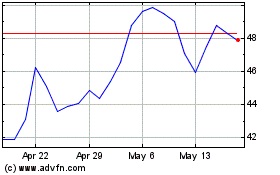

Stock information

Share capital

as of March 5, 2024

1,363.5 million common shares/

54.5 million ADS

Market capitalization

AR$2,330 billion/

US$2,259 million

Information about the videoconference

Date and time

Thursday March 7

10 AM Eastern Standard Time

12 PM Buenos Aires Time

Access link

bit.ly/Pampa4Q2023VC

For further information about Pampa

Email

investor@pampaenergia.com

Website for investors

ri.pampaenergia.com

Argentina’s Securities

and Exchange Commission

www.argentina.gob.ar/cnv

Securities and

Exchange Commission

sec.gov

|

|

Basis of presentation

Pampa’s financial information adopts US$ as functional

currency, converted into AR$ at transactional FX. However, Transener and TGS adjust their figures for inflation as of December 31, 2023,

which are expressed in US$ at the period’s closing FX. The reported figures from previous periods remain unchanged.

The impact of the

local currency depreciation

The steep US$ quote increase from AR$350 to AR$808 on December

13, 2023, mainly affected the tax valuation as it reports under local currency. Despite being adjusted for inflation, it was diluted by

the AR$ depreciation, temporarily diverging from the accounting valuation of PPE and accruing a non-cash deferred income tax. Regarding

Transener and TGS, the 21% average inflation adjustment on Q4 23 flows failed to offset the AR$ devaluation.

Q4 23 main results1

19% year-on-year

sales decrease, recording US$362 million2 in Q4 23, explained by lower gas sales,

thermal and petrochemicals dispatch.

Operating

performance highlighted by CTEB’s CCGT and hydros:

|

| |

Pampa's main operational KPIs |

Q4 23 |

Q4 22 |

Variation |

| |

Power |

Generation (GWh) |

5,017 |

5,175 |

-3% |

| |

|

Gross margin (US$/MWh) |

21.0 |

17.4 |

+21% |

| |

|

|

|

|

|

| |

Oil and gas |

Production (k boe/day) |

56.4 |

61.6 |

-8% |

| |

|

Gas over total production |

92% |

91% |

+2% |

| |

|

Average gas price (US$/MBTU) |

3.2 |

3.9 |

-17% |

| |

|

Average oil price (US$/bbl) |

68.9 |

66.9 |

+3% |

| |

|

|

|

|

|

| |

Petrochemicals |

Volume sold (k ton) |

94 |

120 |

-22% |

| |

|

Average price (US$/ton) |

1,264 |

1,284 |

-2% |

| |

|

|

|

|

|

| |

Adjusted EBITDA3 reached US$129

million, 30% lower than Q4 22, explained by reductions of US$46 million in holding and others,

as the sharp AR$ devaluation significantly diluted the adjusted by inflation results of TGS and Transener, and a 30% drop in oil and gas.

These decreases were partially offset by improvements of 10%

in power generation and 33% in petrochemicals.

|

1 The information

is based on FS prepared according to IFRS in force in Argentina.

2 It does not include

sales from the affiliates CTBSA, Transener and TGS, shown as ‘Results for participation in joint businesses and associates’.

3

Consolidated adjusted EBITDA represents the flows before financial items, income tax, depreciations and amortizations, extraordinary and

non-cash income and expense, equity income, and includes affiliates’ EBITDA at our ownership. Further information on section

3.1.

| |

Pampa Energía ● Earnings release Q4 23 ● 1 |

The net income

attributable to the Company’s shareholders recorded a US$155 million loss, briefly explained before by lower sales and affiliates’

equity income, in addition to US$151 million of higher non-cash deferred income tax charges due to the temporary lag between the accounting

and tax valuation of PPE. It is worth noting that the accounting valuation is based on the US$ as functional currency, while the tax reporting

is in AR$, which inflation adjustment was diluted by the sharp devaluation impact towards the end of Q4 23. Gains from holding financial

securities partially offset these losses.

Net debt

decreased to US$613 million, reaching the lowest in the last 5 years. This substantial decrease

was mainly explained by an interannual reduction of US$165 million in gross debt, due to principal cancellations and dilution of the AR$

debt. Moreover, a US$135 million increase in cash and cash equivalents was recorded, resulting in a net leverage ratio of 0.9x and accomplishing

a solid balance sheet.

| |

Pampa Energía ● Earnings release Q4 23 ● 2 |

| 1.1 | Declaration of emergency

in the national electricity sector |

On December

18, 2023, through DNU No. 55/23, the National Government declared a state of emergency for the national electricity sector until December

31, 2024. The emergency comprises power generation, transmission and distribution, as well as natural gas transportation and distribution.

To ensure

the proper provision of public utilities, the SE was instructed to implement measures that procure free competition and low barrier pricing

and maintain regulated income in real terms. Also, RTI processes were initiated for electricity and natural gas transportation and distribution.

RTI implementation cannot be extended beyond the end of 2024.

The

ENRE and ENARGAS held public hearings regarding tariff adjustments and the monthly updating index. ENRE established 179.7% and 191.1%

increases over Transener and Transba’s November 2023 tariff schedules, respectively, applicable as of February 2024. Also, from

May 2024, an index combining wages, wholesale and consumer prices was determined to update tariffs monthly (Res. ENRE No. 104/24 and 105/24).

As of today, the tariff schemes for TGS have not been published yet.

Additionally,

the DNU orders the intervention of ENRE and ENARGAS from January 1, 2024, and its Board of Directors members to be appointed by the SE.

Also, the DNU seeks to create a single National Regulatory Authority for Gas and Electricity (Ente Nacional Regulador del Gas y la

Electricidad), which would eventually replace ENRE and ENARGAS.

| 1.2 | Power generation segment |

Tender to install

thermal power capacity

In November

2023, a total of 29 projects for 3,340 MW were awarded to install and improve the system’s reliability and efficiency, among them

Pampa’s CTGEBA and CTEB expansion projects for 300 MW and 11 MW, respectively (Res. SE No. 961/23). However, on December 28, 2023,

the SE instructed CAMMESA to temporarily hold the issuance of commercial documentation corresponding to the guarantee’s payment

for maintaining the bid. Therefore, the PPAs were not executed.

Incident at

CTLL’s GT05

On July

20, 2023, an incident occurred in the LDLATG05 gas turbine at CTLL, manufactured by General Electric. The necessary work to dismantle

and repair the failure was completed, and commercial operations resumed on January 26, 2024.

Updates for

the legacy or spot pricing scheme

On February

7, 2024, the SE granted a 74% increase to the spot energy remuneration in AR$, as of February 2024 (Res. No. 9/24).

| |

Pampa Energía ● Earnings release Q4 23 ● 3 |

Permits to export

gas

In November

2023, the SE approved additional gas export volumes to Chile on a ToP basis for 0.6 million m3/day, to be delivered during

the winter months of May to September 2024. Currently, Pampa is authorized to export a ToP volume of 1.5 million m3/day until

April 2024.

Shareholding

in OCP

On January

16, 2024, Pampa acquired 29.66% share capital in OCP from Repsol. Hence, Pampa holds 63.74% of the OCP’s share capital and maintains

the company’s co-control.

| 1.4 | Export Growth Program (Programa

de Incremento Exportador, PIE) |

To encourage

oil and gas exports and strengthen BCRA’s reserves, on October 3, 2023, the SE through Res. No. 808/23 allowed hydrocarbon exporters

to settle transactions under the Export Growth Program (DNU No. 576/22). PIE partially recognizes exports under a differential FX at CCL

and the remaining at the official FX. Pampa adhered to this scheme. The evolution of the percentages is summarized below:

| Res./DNU |

Export period |

% of settlement under higher FX |

| Res. SE No. 808/23 |

From October 2 to November 20, 2023 |

25% |

| DNU No. 549/23 |

From October 23 to November 17, 2023 |

30% |

| DNU No. 597/23 |

From November 20 to December 10, 2023 |

50% |

| DNU No. 28/23 |

From December 13, 2023 |

20% |

| 1.5 | TGS: Commissioning of the

Mercedes–Cardales gas pipeline |

In December

2023, the Mercedes–Cardales gas pipeline was commissioned. Conducted by ENARSA and complementary to the GPNK, this major infrastructure

allows more flexibility in the transfer between natural gas transportation systems operated by TGS and TGN in the Greater Buenos Aires

area. ENARSA contracted TGS to operate and maintain the said gas pipeline.

On November

22, 2023, the Board accepted the resignation of Diana Mondino as an alternate independent member. Moreover, on November 29, 2023, the

Board accepted the resignation of Emilse Juárez as an alternate independent member and Renata Scafati as an independent member.

| |

Pampa Energía ● Earnings release Q4 23 ● 4 |

| 2.1 | Consolidated balance sheet |

| Figures in million |

|

As of 12.31.2023 |

|

As of 12.31.2022 |

| |

AR$ |

US$ FX 808,45 |

|

AR$ |

US$ FX 177,16 |

| ASSETS |

|

|

|

|

|

|

| Property, plant and equipment |

|

2,056,974 |

2,544 |

|

383,464 |

2,165 |

| Intangible assets |

|

77,898 |

96 |

|

24,364 |

138 |

| Right-of-use assets |

|

17,259 |

21 |

|

1,521 |

9 |

| Deferred tax asset |

|

2 |

0 |

|

6,326 |

36 |

| Investments in joint ventures and associates |

|

542,978 |

672 |

|

159,833 |

902 |

| Financial assets at amortized cost |

|

- |

- |

|

18,000 |

102 |

| Financial assets at fair value through profit and loss |

|

28,040 |

35 |

|

4,867 |

27 |

| Other assets |

|

349 |

0 |

|

91 |

1 |

| Trade and other receivables |

|

14,524 |

18 |

|

3,415 |

19 |

| Total non-current assets |

|

2,738,024 |

3,387 |

|

601,881 |

3,397 |

| |

|

|

|

|

|

|

| Inventories |

|

166,023 |

205 |

|

30,724 |

173 |

| Financial assets at amortized cost |

|

84,749 |

105 |

|

1,357 |

8 |

| Financial assets at fair value through profit and loss |

|

451,883 |

559 |

|

103,856 |

586 |

| Derivative financial instruments |

|

250 |

0 |

|

161 |

1 |

| Trade and other receivables |

|

238,294 |

295 |

|

83,328 |

470 |

| Cash and cash equivalents |

|

137,973 |

171 |

|

18,757 |

106 |

| Total current assets |

|

1,079,172 |

1,335 |

|

238,183 |

1,344 |

| |

|

|

|

|

|

|

| Total assets |

|

3,817,196 |

4,722 |

|

840,064 |

4,742 |

| |

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

| Equity attributable to owners of the company |

|

1,943,736 |

2,404 |

|

403,463 |

2,277 |

| |

|

|

|

|

|

|

| Non-controlling interest |

|

6,960 |

9 |

|

1,157 |

7 |

| |

|

|

|

|

|

|

| Total equity |

|

1,950,696 |

2,413 |

|

404,620 |

2,284 |

| |

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

| Provisions |

|

119,863 |

148 |

|

26,062 |

147 |

| Income tax and presumed minimum income tax liabilities |

|

44,614 |

55 |

|

31,728 |

179 |

| Deferred tax liabilities |

|

240,686 |

298 |

|

19,854 |

112 |

| Defined benefit plans |

|

13,172 |

16 |

|

4,908 |

28 |

| Borrowings |

|

989,182 |

1,224 |

|

237,437 |

1,340 |

| Trade and other payables |

|

37,301 |

46 |

|

3,757 |

21 |

| Total non-current liabilities |

|

1,444,818 |

1,787 |

|

323,746 |

1,827 |

| |

|

|

|

|

|

|

| Provisions |

|

4,649 |

6 |

|

779 |

4 |

| Income tax liabilities |

|

14,026 |

17 |

|

927 |

5 |

| Taxes payables |

|

11,427 |

14 |

|

4,966 |

28 |

| Defined benefit plans |

|

2,695 |

3 |

|

1,021 |

6 |

| Salaries and social security payable |

|

15,537 |

19 |

|

5,627 |

32 |

| Derivative financial instruments |

|

191 |

0 |

|

318 |

2 |

| Borrowings |

|

181,357 |

224 |

|

48,329 |

273 |

| Trade and other payables |

|

191,800 |

237 |

|

49,731 |

281 |

| Total current liabilities |

|

421,682 |

522 |

|

111,698 |

630 |

| |

|

|

|

|

|

|

| Total liabilities |

|

1,866,500 |

2,309 |

|

435,444 |

2,458 |

| |

|

|

|

|

|

|

| Total liabilities and equity |

|

3,817,196 |

4,722 |

|

840,064 |

4,742 |

| |

Pampa Energía ● Earnings release Q4 23 ● 5 |

| 2.2 | Consolidated income statement |

| |

|

Fiscal year |

|

Fourth quarter |

| Figures in million |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

AR$ |

US$ |

|

AR$ |

US$ |

|

AR$ |

US$ |

|

AR$ |

US$ |

| Sales revenue |

|

513,727 |

1,732 |

|

242,182 |

1,829 |

|

166,770 |

362 |

|

73,434 |

448 |

| Domestic sales |

|

429,205 |

1,423 |

|

196,723 |

1,478 |

|

143,313 |

306 |

|

59,861 |

364 |

| Foreign market sales |

|

84,522 |

309 |

|

45,459 |

351 |

|

23,457 |

56 |

|

13,573 |

84 |

| Cost of sales |

|

(320,124) |

(1,107) |

|

(149,661) |

(1,139) |

|

(110,171) |

(257) |

|

(45,638) |

(280) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

193,603 |

625 |

|

92,521 |

690 |

|

56,599 |

105 |

|

27,796 |

168 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling expenses |

|

(19,338) |

(66) |

|

(8,448) |

(65) |

|

(6,005) |

(15) |

|

(2,729) |

(18) |

| Administrative expenses |

|

(62,721) |

(185) |

|

(19,373) |

(142) |

|

(29,167) |

(52) |

|

(6,984) |

(39) |

| Exploration expenses |

|

(1,859) |

(7) |

|

(50) |

- |

|

(87) |

- |

|

(27) |

- |

| Other operating income |

|

57,141 |

177 |

|

19,066 |

131 |

|

25,514 |

62 |

|

8,721 |

52 |

| Other operating expenses |

|

(29,374) |

(88) |

|

(5,952) |

(46) |

|

(11,295) |

(20) |

|

(1,743) |

(13) |

| Impairment of financial assets |

|

283 |

- |

|

(477) |

(4) |

|

1,773 |

4 |

|

195 |

(1) |

| Rec. of imp. (impairm.) of int. assets & inventories |

|

(30,784) |

(39) |

|

(4,925) |

(38) |

|

(30,460) |

(38) |

|

(665) |

(4) |

| Results for part. in joint businesses & associates |

|

4,541 |

(2) |

|

16,089 |

105 |

|

(9,503) |

(44) |

|

2,479 |

5 |

| Income from the sale of associates |

|

6,262 |

9 |

|

- |

- |

|

5,776 |

8 |

|

- |

- |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

117,754 |

424 |

|

88,451 |

631 |

|

3,145 |

10 |

|

27,043 |

150 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Financial income |

|

1,764 |

5 |

|

768 |

5 |

|

674 |

1 |

|

171 |

(1) |

| Financial costs |

|

(105,359) |

(364) |

|

(30,488) |

(221) |

|

(34,263) |

(81) |

|

(12,361) |

(73) |

| Other financial results |

|

155,089 |

558 |

|

25,558 |

166 |

|

59,295 |

166 |

|

21,450 |

133 |

| Financial results, net |

|

51,494 |

199 |

|

(4,162) |

(50) |

|

25,706 |

86 |

|

9,260 |

59 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Profit before tax |

|

169,248 |

623 |

|

84,289 |

581 |

|

28,851 |

96 |

|

36,303 |

209 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax |

|

(132,557) |

(318) |

|

(19,389) |

(124) |

|

(112,120) |

(249) |

|

(14,165) |

(98) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income for the period |

|

36,691 |

305 |

|

64,900 |

457 |

|

(83,269) |

(153) |

|

22,138 |

111 |

| Attributable to the owners of the Company |

|

34,488 |

302 |

|

64,859 |

456 |

|

(85,220) |

(155) |

|

22,411 |

113 |

| Attributable to the non-controlling interests |

|

2,203 |

3 |

|

41 |

1 |

|

1,951 |

2.0 |

|

(273) |

(2) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share to shareholders |

|

25.25 |

0.22 |

|

46.97 |

0.33 |

|

(62.66) |

(0.11) |

|

16.24 |

0.08 |

| Net income per ADR to shareholders |

|

631.19 |

5.53 |

|

1,174.13 |

8.26 |

|

(1,566.55) |

(2.85) |

|

406.00 |

2.05 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average outstanding common shares1 |

|

1,366 |

1,366 |

|

1,381 |

1,381 |

|

1,360 |

1,360 |

|

1,380 |

1,380.0 |

| Outstanding shares by the end of period1 |

|

1,360 |

1,360 |

|

1,380 |

1,380 |

|

1,360 |

1,360 |

|

1,380 |

1,380.0 |

Note:

1 It considers the Employee stock-based compensation plan shares, which amounted to 3.9 million common shares as of December 31,

2022 and 2023.

| |

Pampa Energía ● Earnings release Q4 23 ● 6 |

| 2.3 | Cash and financial borrowings |

As of December 31, 2023,

in US$ million |

|

Cash1 |

|

Financial debt |

|

Net debt |

| |

Consolidated

in FS |

Ownership adjusted |

|

Consolidated

in FS |

Ownership adjusted |

|

Consolidated

in FS |

Ownership adjusted |

| Power generation |

|

805 |

802 |

|

535 |

535 |

|

(270) |

(267) |

| Petrochemicals |

|

- |

- |

|

- |

- |

|

- |

- |

| Holding and others |

|

0 |

0 |

|

- |

- |

|

(0) |

(0) |

| Oil and gas |

|

29 |

29 |

|

913 |

913 |

|

884 |

884 |

| Total under IFRS/Restricted Group |

|

834 |

832 |

|

1,448 |

1,448 |

|

613 |

616 |

| Affiliates at O/S2 |

|

123 |

123 |

|

217 |

217 |

|

94 |

94 |

| Total with affiliates |

|

957 |

954 |

|

1,664 |

1,664 |

|

708 |

710 |

Note:

Financial debt includes accrued interest. 1 It includes cash and cash equivalents, financial assets at fair value with changing

results, and investments at amortized cost. 2 Under IFRS, the affiliates CTBSA, Transener and TGS are not consolidated in Pampa.

Debt transactions

As

of December 31, 2023, Pampa’s financial debt at the consolidated level under IFRS amounted to US$1,448 million, 10% and 12% lower

than the end of 2022 and quarter-on-quarter, respectively. This decrease is mainly explained by the de-consolidation of PEMC’s associated

financial debt, debt payments, and devaluation, which dilutes the AR$ debt. Thanks to the increased liquidity, the net debt continued

to drop by 33% and 9% vs. December 2022 and September 2023, respectively, reaching US$613 million.

The

total US$ debt accounted for 88% of the Company’s gross debt. 79% of the total was denominated in US$, with an average interest

rate of 8.4%, primarily at a fixed rate, while the US$-MEP indebtedness rate was 5%. On the other hand, US$-link debt accounted for 7%

of the gross debt with no coupon, and the average interest rate for AR$ debt was 95.7%. The financial debt had an average life of 3.2

years.

The chart below shows the

principal maturity profile, net of repurchases, in US$ million by the end of the 2023 fiscal year:

Note: The chart

only considers Pampa consolidated under IFRS. It does not include affiliates TGS, Transener, and CTBSA.

On

December 21, 2023, Pampa redeemed the outstanding Series 11 CB for AR$21,655 million at a Private Badlar rate, originally due on January

15, 2024. During Q4 23, Pampa paid short-term bank borrowings for AR$11,568 million, the FINNVERA loan amortization for US$4 million and

took import financing for US$16 million. After Q4 23, on February 5, 2024, Pampa redeemed the Series 17 CB (the second Green Bond) for AR$5,980 million

at a Private Badlar plus 2%, which was initially due on May 4, 2023, and, on February 29, 2023, issued the Series 19 CB for AR$17,131

million at a Private Badlar rate minus 1%, maturing on February 28, 2025. Moreover, Pampa took net import financing for US$1 million

and paid net short-term bank debt for AR$100 million.

| |

Pampa Energía ● Earnings release Q4 23 ● 7 |

Regarding

our affiliates, in Q4 23, TGS took net import financing for US$16 million and bank borrowings for US$3 million, while Transener paid borrowings

for AR$83 million. CTEB paid Series 7 CB for AR$1,754 million and borrowed import financing for US$1 million.

After

the quarter’s closing, TGS took short-term bank borrowings for US$20 million and import financing for US$1 million. Transener settled

borrowings for AR$56 million, and CTEB took short-term bank debt for AR$31,786 million and redeemed its Series 2 CB for AR$31,760 million.

As

of today, the Company complies with the covenants established in its debt agreements.

Summary of debt

securities

Company

In million |

Security |

Maturity |

Amount issued |

Amount

net of repurchases |

Coupon |

| In US$ |

|

|

|

|

|

| Pampa |

CB Series 9 at par & fixed rate |

2026 |

293 |

179 |

9.5% |

| CB Series 1 at discount & fixed rate |

2027 |

750 |

597 |

7.5% |

| CB Series 3 at discount & fixed rate |

2029 |

300 |

293 |

9.125% |

| TGS1 |

CB at discount at fixed rate |

2025 |

500 |

470 |

6.75% |

| |

|

|

|

|

|

| In US$-link |

|

|

|

|

|

| Pampa |

CB Series 13 |

2027 |

98 |

98 |

0% |

| CTEB1 |

CB Series 4 |

2024 |

96 |

96 |

0% |

| CB Series 6 |

2025 |

84 |

84 |

0% |

| CB Series 9 |

2026 |

50 |

50 |

0% |

| |

|

|

|

|

|

| In US$-MEP |

|

|

|

|

|

| Pampa |

CB Series 16 |

2025 |

56 |

56 |

4.99% |

| CB Series 18 |

2025 |

72 |

72 |

5.00% |

| |

|

|

|

|

|

| In AR$ |

|

|

|

|

|

| Pampa |

CB Series 15 |

2024 |

18,264 |

18,264 |

Badlar Privada +2% |

| CB Series 17 (Green Bond)2 |

2024 |

5,980 |

5,980 |

Badlar Privada +2% |

| CTEB1 |

CB Series 8 |

2024 |

4,236 |

4,236 |

Badlar Privada +1% |

| |

|

|

|

|

|

| In UVA |

|

|

|

|

|

| CTEB1 |

CB Series 23 |

2024 |

65 |

65 |

4% |

Notes:

1 According to IFRS, affiliates are not consolidated in Pampa’s FS. 2 Redeemed on February 5, 2024. 3 Redeemed

on January 18, 2024.

| |

Pampa Energía ● Earnings release Q4 23 ● 8 |

Credit

rating of Pampa and subsidiaries

| |

|

|

|

| Company |

Agency |

Rating |

| Global |

Local |

| Pampa |

S&P |

b-1 |

na |

| Moody's |

Caa3 |

na |

| FitchRatings2 |

B- |

AA+ (long-term)

A1+ (short-term) |

| TGS |

S&P |

CCC- |

na |

| Moody's |

Caa3 |

na |

| Transener |

FitchRatings2 |

na |

A+ (long-term) |

| CTEB |

FitchRatings2 |

na |

A+ |

Note:

1 Stand-alone. 2 Local ratings issued by FIX SCR.

| |

Pampa Energía ● Earnings release Q4 23 ● 9 |

| 3. | Analysis of the Q4 23 results |

| |

|

|

|

|

|

|

|

|

|

Breakdown by segment

Figures in US$ million |

Q4 23 |

Q4 22 |

Variation |

| Sales |

Adjusted EBITDA |

Net Income |

Sales |

Adjusted EBITDA |

Net Income |

Sales |

Adjusted EBITDA |

Net Income |

| |

|

|

|

|

|

|

|

|

|

| Power generation |

141 |

94 |

(103) |

163 |

86 |

55 |

-13% |

+10% |

NA |

| Oil and Gas |

118 |

50 |

(63) |

155 |

72 |

(8) |

-24% |

-30% |

NA |

| Petrochemicals |

118 |

20 |

4 |

154 |

15 |

2 |

-23% |

+33% |

+100% |

| Holding and Others |

3 |

(36) |

7 |

4 |

10 |

63 |

-25% |

NA |

-89% |

| Eliminations |

(18) |

- |

- |

(28) |

1 |

1 |

-36% |

-100% |

-100% |

| |

|

|

|

|

|

|

|

|

|

| Total |

362 |

129 |

(155) |

448 |

183 |

113 |

-19% |

-30% |

NA |

Note:

Net income attributable to the Company’s shareholders.

| 3.1 | Reconciliation of consolidated

adjusted EBITDA |

| |

|

|

|

|

|

|

Reconciliation of adjusted EBITDA,

in US$ million |

|

Fiscal year |

|

Fourth quarter |

| |

2023 |

2022 |

|

2023 |

2022 |

| Consolidated operating income |

|

424 |

631 |

|

10 |

150 |

| Consolidated depreciations and amortizations |

|

267 |

212 |

|

64 |

52 |

| EBITDA |

|

691 |

843 |

|

74 |

202 |

| |

|

|

|

|

|

|

| Adjustments from generation segment |

|

24 |

(23) |

|

28 |

2 |

| Deletion of equity income |

|

18 |

(65) |

|

27 |

2 |

| Deletion of gain from commercial interests |

|

(59) |

(24) |

|

(18) |

(7) |

| Deletion of provision in outages |

|

- |

6 |

|

- |

- |

| Deletion of PPE activation in operating expenses |

|

6 |

21 |

|

2 |

5 |

| Deletion of provision in hydros |

|

6 |

- |

|

1 |

- |

| Greenwind's EBITDA adjusted by ownership |

|

- |

7 |

|

- |

- |

| CTBSA's EBITDA adjusted by ownership |

|

53 |

33 |

|

16 |

2 |

| Adjustments from oil and gas segment |

|

35 |

28 |

|

35 |

1 |

| Deletion of PPE & inventories' impairment |

|

38 |

30 |

|

38 |

1 |

| Deletion of gain from commercial interests |

|

(11) |

(2) |

|

(4) |

(0) |

| Deletion of Río Atuel's reversal losses |

|

8 |

- |

|

1 |

- |

| Adjustments from petrochemicals segment |

|

3 |

2 |

|

(0) |

2 |

| Deletion of inventory impairment |

|

3 |

2 |

|

- |

2 |

| Adjustments from holding & others segment |

|

49 |

58 |

|

(9) |

(23) |

| Deletion of equity income |

|

(16) |

(40) |

|

17 |

(7) |

| Deletion of gain from commercial interests |

|

(0) |

(1) |

|

(0) |

(0) |

| Deletion of intang. assets' impairment/(recovery) |

|

(2) |

6 |

|

- |

1 |

| Deletion of Arbitration Award in Ecuador |

|

- |

(37) |

|

- |

(37) |

| Deletion of the sale of associates |

|

(9) |

- |

|

(8) |

- |

| TGS's EBITDA adjusted by ownership |

|

63 |

119 |

|

(10) |

22 |

| Transener's EBITDA adjusted by ownership |

|

13 |

11 |

|

(8) |

(2) |

| |

|

|

|

|

|

|

| Consolidated adjusted EBITDA |

|

802 |

908 |

|

129 |

183 |

| At our ownership |

|

770 |

906 |

|

136 |

183 |

| |

Pampa Energía ● Earnings release Q4 23 ● 10 |

| 3.2 | Analysis of the power generation

segment |

| |

|

|

|

|

|

|

|

|

Power generation segment, consolidated

Figures in US$ million |

|

Fiscal year |

|

Fourth quarter |

| |

2023 |

2022 |

∆% |

|

2023 |

2022 |

∆% |

| Sales revenue |

|

648 |

663 |

-2% |

|

141 |

163 |

-13% |

| Domestic sales |

|

648 |

663 |

-2% |

|

141 |

163 |

-13% |

| Cost of sales |

|

(354) |

(370) |

-4% |

|

(79) |

(92) |

-14% |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

294 |

293 |

+0% |

|

62 |

71 |

-13% |

| |

|

|

|

|

|

|

|

|

| Selling expenses |

|

(2) |

(3) |

-33% |

|

(1) |

(1) |

- |

| Administrative expenses |

|

(50) |

(39) |

+28% |

|

(12) |

(10) |

+20% |

| Other operating income |

|

75 |

25 |

+200% |

|

25 |

7 |

+257% |

| Other operating expenses |

|

(27) |

(5) |

NA |

|

(3) |

(2) |

+50% |

| Results for participation in joint businesses |

|

(18) |

65 |

NA |

|

(27) |

(2) |

NA |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

272 |

336 |

-19% |

|

44 |

63 |

-30% |

| |

|

|

|

|

|

|

|

|

| Finance income |

|

2 |

1 |

+100% |

|

- |

- |

NA |

| Finance costs |

|

(119) |

(82) |

+45% |

|

(27) |

(35) |

-23% |

| Other financial results |

|

280 |

72 |

+289% |

|

59 |

83 |

-29% |

| Financial results, net |

|

163 |

(9) |

NA |

|

32 |

48 |

-33% |

| |

|

|

|

|

|

|

|

|

| Profit before tax |

|

435 |

327 |

+33% |

|

76 |

111 |

-32% |

| |

|

|

|

|

|

|

|

|

| Income tax |

|

(225) |

(73) |

+208% |

|

(177) |

(58) |

+205% |

| |

|

|

|

|

|

|

|

|

| Net income for the period |

|

210 |

254 |

-17% |

|

(101) |

53 |

NA |

| Attributable to owners of the Company |

|

207 |

253 |

-18% |

|

(103) |

55 |

NA |

| Attributable to non-controlling interests |

|

3 |

1 |

+200% |

|

2 |

(2) |

NA |

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

392 |

395 |

-1% |

|

94 |

86 |

+10% |

| Adjusted EBITDA at our share ownership |

|

361 |

394 |

-8% |

|

102 |

86 |

+19% |

| |

|

|

|

|

|

|

|

|

| Increases in PPE |

|

259 |

115 |

+125% |

|

66 |

16 |

NA |

| Depreciation and amortization |

|

96 |

82 |

+17% |

|

22 |

21 |

+5% |

Power

generation sales during Q4 23 recorded a decrease of 13%,

mainly explained by lower thermal dispatch, in line with the soft electricity demand and programmed overhauls, mainly in the legacy energy,

in addition to the incident at CTLL’s GT05 dated from July. Moreover, the lower power generation resulted in lesser fuel income

from CAMMESA, which is procured by our E&P business with a breakeven margin for the power generation segment. These effects were partially

offset by PEA’s acquisition in December 2022 and the commissioning of PEPE IV.

Regarding

legacy energy, the 28% increase received in November 2023 failed to offset the 57% AR$ devaluation impact on thermal conventional units

(GT and ST), where the capacity was priced at US$3.7 thousand per MW-month (-9% vs. Q4 22 and -5% vs. Q3 23), and US$2.0 thousand per

MW-month for hydro (-6% vs. Q4 22 but +11% vs. Q3 23). However, capacity remuneration for CCGTs remained similar quarter-on-quarter at

US$4.6 thousand per MW-month (+14% year-on-year) due to differential income for CCGTs (Res. No. 59/2023). In Q4 23, legacy energy represented

69% of the 5,332 MW operated by Pampa but comprised only 32% of the segment’s sales.

In

operating terms, Pampa’s operated power generation

slightly decreased by 3% vs. Q4 22, while the Argentine power grid remained stable. This is mainly explained by the forced outage of CTLL’s

GT05 from the end of July and programmed overhauls in GT02 and GT04 (-585 GWh). The mild weather and increased water input affected CPB

and CTGEBA’s dispatch as required by CAMMESA (-551 GWh), offset by higher generation at all our hydros (+165 GWh). It is worth highlighting

the contribution from CTEB’s CCGT, commissioned in February 2023 (+717 GWh), PEPE IV and PEA (+114 GWh).

| |

Pampa Energía ● Earnings release Q4 23 ● 11 |

The

availability of Pampa’s operated units reached 93.4%

in Q4 23 (-323 basis points vs. Q4 22’s 96.6%, similar to Q3 23), mainly due to CTLL GT05’s outage and programmed overhauls

mentioned above. Therefore, a 92.4% thermal availability rate was registered in Q4 23 (-375 basis points vs. 96.1% from Q4 22, slightly

higher than Q3 23).

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Power generation's

key performance indicators |

|

2023 |

|

2022 |

|

Variation |

| Hydro |

Wind |

Thermal |

Total |

Hydro |

Wind |

Thermal |

Total |

Hydro |

Wind |

Thermal |

Total |

| Installed capacity (MW) |

|

938 |

287 |

4,107 |

5,332 |

|

938 |

324 |

3,826 |

5,088 |

|

- |

-11% |

+7% |

+5% |

| New capacity (%) |

|

- |

100% |

33% |

31% |

|

- |

100% |

28% |

27% |

|

- |

- |

+5% |

+3% |

| Market share (%) |

|

2.1% |

0.7% |

9.4% |

12.2% |

|

2.2% |

0.8% |

8.9% |

11.9% |

|

-0% |

-0% |

+0% |

+0% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net generation (GWh) |

|

1,964 |

1,206 |

17,809 |

20,979 |

|

1,438 |

888 |

15,985 |

18,311 |

|

+37% |

+36% |

+11% |

+15% |

| Volume sold (GWh) |

|

1,964 |

1,223 |

18,842 |

22,029 |

|

1,438 |

897 |

17,133 |

19,468 |

|

+37% |

+36% |

+10% |

+13% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average price (US$/MWh) |

|

16 |

71 |

35 |

35 |

|

23 |

70 |

39 |

39 |

|

-27% |

+2% |

-11% |

-10% |

| Average gross margin (US$/MWh) |

4 |

61 |

21 |

22 |

|

6 |

58 |

23 |

23 |

|

-39% |

+6% |

-7% |

-5% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fourth quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net generation (GWh) |

|

715 |

293 |

4,009 |

5,017 |

|

550 |

233 |

4,391 |

5,175 |

|

+30% |

+26% |

-9% |

-3% |

| Volume sold (GWh) |

|

715 |

310 |

4,187 |

5,211 |

|

550 |

223 |

4,696 |

5,470 |

|

+30% |

+39% |

-11% |

-5% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average price (US$/MWh) |

|

12 |

69 |

35 |

34 |

|

16 |

69 |

31 |

31 |

|

-25% |

-1% |

+11% |

+7% |

| Average gross margin (US$/MWh) |

1 |

58 |

22 |

21 |

|

3 |

58 |

17 |

17 |

|

-51% |

+0% |

+26% |

+21% |

Note: Gross margin before

amortization and depreciation. It includes CTEB, operated by Pampa (50% equity stake). PEMC was de-consolidated in August 2023.

Without

depreciation and amortizations, net operating costs decreased

to US$48 million, 38% lower than Q4 22, mainly explained by lower gas purchases due to CAMMESA’s lesser thermal demand, lesser electricity

purchases to cover contracts and higher accrued commercial interests, in line with a rise in rates and delays from CAMMESA. Increased

insurance, local taxes and labor costs offset these effects.

Financial

results from Q4 23 reached a net profit of US$32 million, 33% lower than in Q4 22, mainly due

to losses generated by the AR$ devaluation over the segment’s net monetary active position, partially offset by lower financial

interests, mainly from the AR$-debt, and larger gains from holding financial instruments.

Adjusted

EBITDA from the power generation segment reached US$94 million, a 10% increase year-on-year, mainly

due to lower operating costs and the renewable PPAs. These effects were offset by lesser thermal dispatch and programmed overhauls, mainly

in legacy energy, the AR$ devaluation impact over spot prices, in addition to the incident in CTLL’s GT05 and the de-consolidation

of PEMC. In addition, adjusted EBITDA considers CTEB’s 50% ownership, which improvement is associated with the CCGT’s PPA

(US$16 million in Q4 23 vs. US$2 million in Q4 22). It excludes items such as the commercial interests for delayed collections, accrual

of PPE’s expenses as operating expenditures and contingency provisions for the concession’s termination at Mendoza hydros.

Finally,

without including CTEB, capital expenditures registered

US$66 million in Q4 23 vs. US$16 million in Q4 22, explained by the PEPE VI expansion project, which started at the end of 2022.

| |

Pampa Energía ● Earnings release Q4 23 ● 12 |

The following table shows

the expansion projects in power generation:

| |

|

|

|

|

|

|

|

|

|

|

| Project |

MW |

Marketing |

Currency |

Awarded price |

|

Estimated capex in

US$ million1 |

Date of

commissioning |

Capacity per

MW-month |

Variable

per MWh |

Total

per MWh |

|

Budget |

% Executed

@12/31/23 |

| Thermal |

|

|

|

|

|

|

|

|

|

|

| Closing to CC Ensenada |

279 |

PPA for 10 years |

US$ |

23,962 |

10.5 |

43 |

|

253 |

99% |

22-Feb-23 |

| |

|

|

|

|

|

|

|

|

|

|

| Renewable |

|

|

|

|

|

|

|

|

|

|

| Pampa Energía IV |

81 |

MAT ER |

US$ |

na |

na |

58(2) |

|

128 |

97% |

17-Jun-23 |

| Pampa Energía VI |

139.5 |

MAT ER |

US$ |

na |

na |

62(2) |

|

269 |

52% |

Q4 2024 (est.) |

Note: 1 Without

value-added tax. 2 Estimated average.

| 3.3 | Analysis of the oil and

gas segment |

Oil & gas segment, consolidated

Figures in US$ million |

|

Fiscal year |

|

Fourth quarter |

| |

2023 |

2022 |

∆% |

|

2023 |

2022 |

∆% |

| Sales revenue |

|

666 |

646 |

+3% |

|

118 |

155 |

-24% |

| Domestic sales |

|

505 |

487 |

+4% |

|

95 |

107 |

-12% |

| Foreign market sales |

|

161 |

159 |

+1% |

|

24 |

47 |

-50% |

| Cost of sales |

|

(412) |

(350) |

+18% |

|

(93) |

(86) |

+8% |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

254 |

296 |

-14% |

|

25 |

69 |

-64% |

| |

|

|

|

|

|

|

|

|

| Selling expenses |

|

(49) |

(45) |

+9% |

|

(11) |

(12) |

-8% |

| Administrative expenses |

|

(74) |

(60) |

+23% |

|

(18) |

(16) |

+13% |

| Exploration expenses |

|

(7) |

- |

NA |

|

- |

- |

NA |

| Other operating income |

|

86 |

61 |

+41% |

|

22 |

6 |

+267% |

| Other operating expenses |

|

(32) |

(26) |

+23% |

|

(6) |

(4) |

+50% |

| Impairment of financial assets |

|

- |

(2) |

-100% |

|

- |

(1) |

-100% |

| Impairment of PPE |

|

(38) |

(30) |

+27% |

|

(38) |

(1) |

NA |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

140 |

194 |

-28% |

|

(26) |

41 |

NA |

| |

|

|

|

|

|

|

|

|

| Finance income |

|

2 |

2 |

- |

|

- |

- |

NA |

| Finance costs |

|

(203) |

(107) |

+90% |

|

(46) |

(24) |

+92% |

| Other financial results |

|

(15) |

(28) |

-46% |

|

(22) |

(9) |

+144% |

| Financial results, net |

|

(216) |

(133) |

+62% |

|

(68) |

(33) |

+106% |

| |

|

|

|

|

|

|

|

|

| Loss before tax |

|

(76) |

61 |

NA |

|

(94) |

8 |

NA |

| |

|

|

|

|

|

|

|

|

| Income tax |

|

29 |

(16) |

NA |

|

31 |

(16) |

NA |

| |

|

|

|

|

|

|

|

|

| Net loss for the period |

|

(47) |

45 |

NA |

|

(63) |

(8) |

NA |

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

341 |

347 |

-2% |

|

50 |

72 |

-30% |

| |

|

|

|

|

|

|

|

|

| Increases in PPE and right-of-use assets |

|

556 |

324 |

+72% |

|

172 |

114 |

+51% |

| Depreciation and amortization |

|

166 |

125 |

+33% |

|

41 |

30 |

+37% |

In

Q4 23, sales from the oil and gas segment decreased by

24% vs. Q4 22, mainly due to lower gas prices driven by soft local and foreign demand and, to a lesser extent, the lower oil and gas production.

| |

Pampa Energía ● Earnings release Q4 23 ● 13 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Oil and gas'

key performance indicators |

|

2023 |

|

2022 |

|

Variation |

| Oil |

Gas |

Total |

Oil |

Gas |

Total |

Oil |

Gas |

Total |

| Fiscal year |

|

|

|

|

|

|

|

|

|

|

|

|

| Volume |

|

|

|

|

|

|

|

|

|

|

|

|

| Production |

|

|

|

|

|

|

|

|

|

|

|

|

| In thousand m3/day |

|

0.8 |

10,296 |

|

|

0.8 |

9,811 |

|

|

-10% |

+5% |

+4% |

| In million cubic feet/day |

|

|

364 |

|

|

|

346 |

|

|

| In thousand boe/day |

|

4.8 |

60.6 |

65.4 |

|

5.3 |

57.7 |

63.1 |

|

| Sales |

|

|

|

|

|

|

|

|

|

|

|

|

| In thousand m3/day |

|

0.8 |

10,274 |

|

|

0.8 |

9,842 |

|

|

-6% |

+4% |

+3% |

| In million cubic feet/day |

|

|

363 |

|

|

|

348 |

|

|

| In thousand boe/day |

|

5.0 |

60.5 |

65.5 |

|

5.3 |

57.9 |

63.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average Price |

|

|

|

|

|

|

|

|

|

|

|

|

| In US$/bbl |

|

66.2 |

|

|

|

69.6 |

|

|

|

-5% |

+1% |

|

| In US$/MBTU |

|

|

4.2 |

|

|

|

4.2 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Fourth quarter |

|

|

|

|

|

|

|

|

|

|

|

|

| Volume |

|

|

|

|

|

|

|

|

|

|

|

|

| Production |

|

|

|

|

|

|

|

|

|

|

|

|

| In thousand m3/day |

|

0.7 |

8,821 |

|

|

0.9 |

9,493 |

|

|

-22% |

-7% |

-8% |

| In million cubic feet/day |

|

|

312 |

|

|

|

335 |

|

|

| In thousand boe/day |

|

4.5 |

51.9 |

56.4 |

|

5.7 |

55.9 |

61.6 |

|

| Sales |

|

|

|

|

|

|

|

|

|

|

|

|

| In thousand m3/day |

|

0.6 |

8,634 |

|

|

0.9 |

9,368 |

|

|

-27% |

-8% |

-10% |

| In million cubic feet/day |

|

|

305 |

|

|

|

331 |

|

|

| In thousand boe/day |

|

4.1 |

50.8 |

54.9 |

|

5.5 |

55.1 |

60.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average Price |

|

|

|

|

|

|

|

|

|

|

|

|

| In US$/bbl |

|

68.9 |

|

|

|

66.9 |

|

|

|

+3% |

-17% |

|

| In US$/MBTU |

|

|

3.2 |

|

|

|

3.9 |

|

|

|

Note: The net production

in Argentina. The gas volume is standardized at 9,300 kilocalories (kCal).

In

operating terms, total production reached 56.4 kboe per

day in Q4 23 (-8% vs. Q4 22 and -30% vs. Q3 23). This decrease was mainly explained by a lower gas production, which recorded 8.8 million

m3 per day (-7% vs. Q4 22 and -31% vs. Q3 23 due to seasonality) because of the mild weather and higher hydro generation caused

by El Niño current in Argentina and Chile, resulting in lesser thermal dispatch and exports, on top of higher nuclear availability.

During Q4 23, it was the first time since January 2021 that our delivered volumes were under the ToP stipulated in the contracts.

Shale

gas from Vaca Muerta gained prominence, representing 47% of Q4 23 total gas production vs. 3% in Q4 22, thanks to the development campaign

in our operated blocks started in 2023. Analyzing the gas output by block,

53% of our total gas output in Q4 23 came from El Mangrullo, which recorded 4.7 million m3 per day (-31% vs. Q4 22 and -37%

vs. Q3 23). Although El Mangrullo’s campaign focused on shale wells, the production mostly came from tight gas. On the other hand,

due to the outstanding productivity of its shale wells, Sierra Chata’s output reached 2.2 million m3 per day (+283% vs.

Q4 22 and -35% vs. Q3 23). At non-operated blocks, Río Neuquén remained at 1.5 million m3 per day (similar to

Q4 22 and -6% vs. Q3 23), while Rincón del Mangrullo continues the natural depletion, contributing 0.2 million m3 per

day (-20% vs. Q4 22 and +5% vs. Q3 23).

Our

gas price in Q4 23 was US$3.2 per MBTU (-17% vs. Q4 22

and -32% vs. Q3 23 due to seasonality), explained by lower export prices and volumes.

Regarding

our gas deliveries during Q4 23, 58% supplied CAMMESA as

fuel for our thermal power units and 16% to the retail segment through distribution utility companies and ENARSA, both under Plan Gas.Ar

framework. Moreover, 15% was sold to the industrial/spot market, 5% was exported, and the remaining was sold as raw material to our petchem

plants. In contrast, in Q4 22, 46% supplied CAMMESA, 22% to the industrial/spot market, 14%

to the retail segment, 13% was exported, and the remaining was sold to our petchem plants.

| |

Pampa Energía ● Earnings release Q4 23 ● 14 |

Oil

production reached 4.5 kbbl per day in Q4 23 (-22% vs. Q4 22 and -5%

vs. Q3 23), explained by year-on-year drops of 0.9 kbbl per day at El Tordillo due to its natural depletion and 0.4 kbbl per day in other

blocks. Moreover, the volume sold decreased mainly due to exports effective in January 2024.

Our

oil price in Q4 23 had a slight increase of 3% vs. Q4 22,

reaching US$68.9 per bbl, explained by the gradual convergence of domestic pricing to Brent and a higher share of our production destined

to the foreign market, as 40% of the volume sold was exported vs. 17% in Q4 22.

By

the end of Q4 23, we accounted for 813 productive wells vs.

895 as of the end of 2022. The sharp decrease is explained by the exit agreements in Estación Fernández Oro and Anticlinal

Campamento gas blocks, and the production curtailment at El Tordillo oil block due to cost efficiency.

Pampa’s

proven reserves (P1) by the end of 2023 amounted to 199

million boe, 11% higher than the 179 million boe recorded by the end of 2022. Considering the production levels and additional reserves

achieved in 2023, the replacement ratio amounted to 1.8 times, and the average reserve life was approximately 8.6 years. Moreover, 94%

of the reserves are natural gas and 6% oil. The higher shale reserve quantification from the Vaca Muerta formation mainly explains this

increase, which is essentially driven by the performance of pilot wells at Sierra Chata. During 2023, we almost doubled the certified

shale volume, reaching 83 million boe, comprising 42% of Pampa’s P1 reserves (vs. 44 million boe or 24% of the 2022 P1 reserves).

Net

operating costs in Q4 23, excluding depreciation, amortization,

Plan Gas.Ar compensation (US$7 million) and the gains from the settlement of exports at a differential FX (US$12 million) remained similar

year-on-year, reaching US$84 million in Q4 23. This slight variation was mainly due to higher labor expenses and maintenance linked to

the ramp-up in shale activity, which were partially offset by higher commercial interests due to a rise in rates and delays, mainly charged

to CAMMESA, lower transportation costs, royalties and levies, linked to the decrease in sales. The decline in production also affected

the lifting cost per boe, which reached US$7.4 per boe

produced in Q4 23, a 14% increase year-on-year and +31% vs. Q3 23.

Financial

results in Q4 23 recorded higher losses of US$35 million, reaching a loss of US$68 million, explained

by the AR$ devaluation impact over certain receivables and a rise in financial expenses, mainly related to the AR$-debt. Higher gains

from holding financial securities partially offset these effects.

| |

Pampa Energía ● Earnings release Q4 23 ● 15 |

Our

oil and gas adjusted EBITDA amounted to US$50 million in

Q4 23, 30% lower than in Q4 22, mainly explained by the soft demand, both in local and foreign markets, linked to the mild weather, the

higher water input, increased nuclear power generation, hence the low thermal dispatch and gas prices. These effects were partially offset

by gains from settling exports at a differential FX. In addition, the adjusted EBITDA of Q4 23 excludes the impairment of PPE and inventories

and commercial interests for late collection, mainly charged to CAMMESA.

Finally,

in Q4 23, capital expenditures amounted to US$172 million,

51% higher than in Q4 22, mainly driven by the shale gas wells drilling and completion campaign and the beginning of the pilot plan for

shale oil in Rincón de Aranda.

| 3.4 | Analysis of the petrochemicals

segment |

Petrochemicals segment, consolidated

Figures in US$ million |

|

Fiscal year |

|

Fourth quarter |

| |

2023 |

2022 |

∆% |

|

2023 |

2022 |

∆% |

| Sales revenue |

|

507 |

617 |

-18% |

|

118 |

154 |

-23% |

| Domestic sales |

|

359 |

425 |

-16% |

|

86 |

117 |

-26% |

| Foreign market sales |

|

148 |

192 |

-23% |

|

32 |

37 |

-13% |

| Cost of sales |

|

(444) |

(536) |

-17% |

|

(103) |

(131) |

-21% |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

63 |

81 |

-22% |

|

15 |

23 |

-35% |

| |

|

|

|

|

|

|

|

|

| Selling expenses |

|

(15) |

(17) |

-12% |

|

(3) |

(5) |

-40% |

| Administrative expenses |

|

(6) |

(5) |

+20% |

|

(1) |

(1) |

- |

| Other operating income |

|

13 |

1 |

NA |

|

13 |

1 |

NA |

| Other operating expenses |

|

(7) |

(6) |

+17% |

|

(5) |

(4) |

+25% |

| Impairment of inventories |

|

(3) |

(2) |

+50% |

|

- |

(2) |

-100% |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

45 |

52 |

-13% |

|

19 |

12 |

+58% |

| |

|

|

|

|

|

|

|

|

| Finance costs |

|

(3) |

(3) |

- |

|

(1) |

(1) |

- |

| Other financial results |

|

15 |

6 |

+150% |

|

8 |

1 |

NA |

| Financial results, net |

|

12 |

3 |

+300% |

|

7 |

- |

NA |

| |

|

|

|

|

|

|

|

|

| Profit before tax |

|

57 |

55 |

+4% |

|

26 |

12 |

+117% |

| |

|

|

|

|

|

|

|

|

| Income tax |

|

(27) |

(15) |

+80% |

|

(22) |

(10) |

+120% |

| |

|

|

|

|

|

|

|

|

| Net income for the period |

|

30 |

40 |

-25% |

|

4 |

2 |

+100% |

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

53 |

59 |

-10% |

|

20 |

15 |

+33% |

| |

|

|

|

|

|

|

|

|

| Increases in PPE |

|

7 |

7 |

- |

|

3 |

2 |

+50% |

| Depreciation and amortization |

|

5 |

5 |

- |

|

1 |

1 |

- |

The

petrochemicals segment’s adjusted EBITDA reached

US$20 million in Q4 23, 33% higher than in Q4 22, mainly explained by lower costs correlated with the production decrease, mainly in octane

bases and aromatics destined for the domestic market, in addition to the profit from the settlement

of exports at a differential FX, that amounted US$12 million. These variations were partially offset

by lower SBR and reforming prices, in line with the decrease of international reference prices, lower reforming volumes and the impact

of import tax charges in force from August.

Total

volume sold decreased by 22% vs. Q4 22, reaching 94 thousand

tons, mainly explained by the lower demand for reforming products in the local market and a programmed overhaul in this plant in November

2023.

In

Q4 23, financial results reached a net profit of US$7 million,

while no financial results were recorded in Q4 22. This difference is explained by higher net gains due to the AR$ devaluation over payables.

| |

Pampa Energía ● Earnings release Q4 23 ● 16 |

| |

|

|

Petrochemicals'

key performance indicators |

|

Products |

|

Total |

| |

Styrene & polystyrene1 |

SBR |

Reforming & others |

|

| Fiscal year |

|

|

|

|

|

|

| Volume sold 2023 (thousand ton) |

|

112 |

43 |

250 |

|

405 |

| Volume sold 2022 (thousand ton) |

|

114 |

46 |

262 |

|

421 |

| Variation 2023 vs. 2022 |

|

-2% |

-6% |

-5% |

|

-4% |

| |

|

|

|

|

|

|

| Average price 2023 (US$/ton) |

|

1,886 |

1,796 |

874 |

|

1,251 |

| Average price 2022 (US$/ton) |

|

2,093 |

2,310 |

1,044 |

|

1,464 |

| Variation 2023 vs. 2022 |

|

-10% |

-22% |

-16% |

|

-15% |

| |

|

|

|

|

|

|

| Fourth quarter |

|

|

|

|

|

|

| Volume sold Q4 23 (thousand ton) |

|

28 |

11 |

55 |

|

94 |

| Volume sold Q4 22 (thousand ton) |

|

30 |

10 |

81 |

|

120 |

| Variation Q4 23 vs. Q4 22 |

|

-7% |

+16% |

-32% |

|

-22% |

| |

|

|

|

|

|

|

| Average price Q4 23 (US$/ton) |

|

1,966 |

1,744 |

812 |

|

1,264 |

| Average price Q4 22 (US$/ton) |

|

1,939 |

2,282 |

924 |

|

1,284 |

| Variation Q4 23 vs. Q4 22 |

|

+1% |

-24% |

-12% |

|

-2% |

Note: 1 Includes

Propylene.

| 3.5 | Analysis of the holding

and others segment |

| |

|

|

|

|

|

|

|

|

Holding and others segment, consolidated

Figures in US$ million |

|

Fiscal year |

|

Fourth quarter |

| |

2023 |

2022 |

∆% |

|

2023 |

2022 |

∆% |

| Sales revenue |

|

14 |

20 |

-30% |

|

3 |

4 |

-25% |

| Domestic sales |

|

14 |

20 |

-30% |

|

3 |

4 |

-25% |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

14 |

20 |

-30% |

|

3 |

4 |

-25% |

| |

|

|

|

|

|

|

|

|

| Administrative expenses |

|

(55) |

(38) |

+45% |

|

(21) |

(12) |

+75% |

| Other operating income |

|

3 |

44 |

-93% |

|

2 |

38 |

-95% |

| Other operating expenses |

|

(22) |

(9) |

+144% |

|

(6) |

(3) |

+100% |

| Impairment of financial assets |

|

- |

(2) |

-100% |

|

4 |

- |

NA |

| Recovery from impair. (Impairment) of intangible assets |

|

2 |

(6) |

NA |

|

- |

(1) |

-100% |

| Income from the sale of associates |

|

9 |

- |

NA |

|

8 |

- |

NA |

| Results for participation in joint businesses |

|

16 |

40 |

-60% |

|

(17) |

7 |

NA |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

(33) |

49 |

NA |

|

(27) |

33 |

NA |

| |

|

|

|

|

|

|

|

|

| Finance income |

|

7 |

9 |

-22% |

|

2 |

1 |

+100% |

| Finance costs |

|

(45) |

(36) |

+25% |

|

(8) |

(15) |

-47% |

| Other financial results |

|

278 |

116 |

+140% |

|

121 |

58 |

+109% |

| Financial results, net |

|

240 |

89 |

+170% |

|

115 |

44 |

+161% |

| |

|

|

|

|

|

|

|

|

| Profit before tax |

|

207 |

138 |

+50% |

|

88 |

77 |

+14% |

| |

|

|

|

|

|

|

|

|

| Income tax |

|

(95) |

(20) |

NA |

|

(81) |

(14) |

NA |

| |

|

|

|

|

|

|

|

|

| Net income for the period |

|

112 |

118 |

-5% |

|

7 |

63 |

-89% |

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

16 |

107 |

-85% |

|

(36) |

10 |

NA |

| |

|

|

|

|

|

|

|

|

| Increases in PPE |

|

5 |

5 |

- |

|

1 |

2 |

-50% |

| Depreciation and amortization |

|

- |

- |

NA |

|

- |

- |

NA |

| |

Pampa Energía ● Earnings release Q4 23 ● 17 |

The

holding and others segment, without considering the affiliates’ equity income (Transener and TGS), posted a US$10 million operating

loss in Q4 23, while it was a US$26 million profit in Q4 22, mainly explained by the arbitration

award obtained in Ecuador for US$37 million and, to a lesser extent, the share price outperformance impacting the executive compensation

plan.

In

Q4 23, financial results increased by 161% year-on-year,

reaching a net gain of US$115 million, mainly due to higher net FX profits from the dilution of fiscal liabilities in AR$.

The

adjusted EBITDA of our holding and others segment recorded

a US$36 million loss in Q4 23, while it was a US$10 million profit in Q4 22. The adjusted EBITDA excludes the equity income from our participation

in TGS and Transener. In turn, it adds the EBITDA adjusted by equity ownership in these businesses. Besides, it excludes the impairment

and recovery of intangible assets and the income from the sale of associates.

In

TGS, the EBITDA adjusted by our stake recorded a US$10

million loss in Q4 23 vs. US$22 million profit in Q4 22. TGS reports under IFRS IAS 29 – inflation adjustment, so Q4 23 was mainly

impacted by the lag between the 57% AR$ devaluation and the 21% average inflation. Moreover, the regulated business performance remains

underperforming inflation, as its tariffs have not been raised since May 2023, and the drop in international prices and production volume

affected the liquids segment. Higher midstream sales partially offset these effects, mainly due to higher natural gas transportation and

conditioning services in Vaca Muerta and, to a lesser extent, to the GPNK operation.

In

Transener, the EBITDA adjusted by our stake recorded a

US$8 million loss in Q4 23 vs. a US$2 million loss in Q4 22. As TGS, Transener was affected by the restatement under inflation adjustment.

The AR$ devaluation impacted the regulated tariff. In Q4 23, extraordinary expenses of US$11 million were recorded due to synchronous

compensator failure at the Ezeiza transformer station. That expense was excluded from the EBITDA, as well as the insurance collection.

| |

Pampa Energía ● Earnings release Q4 23 ● 18 |

| 3.6 | Analysis of the fiscal year,

by subsidiary and segment |

Subsidiary

In US$ million |

Fiscal year 2023 |

|

Fiscal year 2022 |

| % Pampa |

Adjusted EBITDA |

Net debt2 |

Net income3 |

|

% Pampa |

Adjusted EBITDA |

Net debt2 |

Net income3 |

| |

| Power generation segment |

|

|

|

|

|

|

|

|

|

| Diamante |

61.0% |

1 |

(0) |

2 |

|

61.0% |

3 |