- Orders up ~10% year over year; up mid single digits

sequentially

- Reported sales down (8.4)%; organic sales down (7.6)% year over

year

- Currency translation decreased sales by (0.9) pts

- Total ARR up 11% year over year

- Diluted EPS of $1.61 and adjusted EPS $1.83; down (13)% and

(10)% year over year, respectively

- Updates fiscal 2025 reported sales growth range to (5.5)% -

0.5% due to ~(1.5)% FX impact to sales; reaffirms organic sales

growth range of (4)% - 2%

- Reaffirms fiscal 2025 diluted EPS guidance range of $7.65 -

$8.85; reaffirms adjusted EPS guidance range of $8.60 - $9.80

Rockwell Automation, Inc. (NYSE: ROK) today reported first

quarter fiscal 2025 results.

"Q1 margins and EPS came in well above our expectations this

quarter, reflecting some early benefits of Rockwell’s renewed focus

on operational excellence and cost discipline. We continue to

deliver on our cost reduction and margin expansion projects we

outlined last year. From a demand perspective, we are encouraged by

better-than-expected order performance in the quarter with

sequential growth across all regions and business segments. While

there is still some macroeconomic and policy uncertainty weighing

on customers’ capex plans, Rockwell won multi-million dollar

strategic orders across key industries, especially in the U.S., our

home market," said Blake Moret, Chairman and CEO.

Fiscal Q1 2025 Financial

Results

Fiscal 2025 first quarter reported sales were $1,881 million,

down (8.4)% from $2,052 million in the first quarter of fiscal

2024. Organic sales decreased (7.6)% and currency translation

decreased sales by (0.9) pts.

Fiscal 2025 first quarter Net income attributable to Rockwell

Automation was $184 million or $1.61 per share, compared to $215

million or $1.86 per share in the first quarter of fiscal 2024. The

decreases in Net income attributable to Rockwell Automation and

diluted EPS were primarily due to lower sales volume. Fiscal 2025

first quarter adjusted EPS was $1.83, down (10)% compared to $2.04

in the first quarter of fiscal 2024 primarily due to lower sales

volume.

Pre-tax margin was 11.3% in the first quarter of fiscal 2025

compared to 12.7% in the same period last year. The decrease in

pre-tax margin was primarily due to lower sales volume partially

offset by the benefits from cost reduction and margin expansion

actions.

Total segment operating earnings were $321 million in the first

quarter of fiscal 2025, down (10)% from $356 million in the same

period of fiscal 2024. Total segment operating margin was 17.1%

compared to 17.3% a year ago. The decrease in segment operating

margin was primarily due to lower sales volume partially offset by

the benefits from cost reduction and margin expansion actions.

Cash flow generated by operating activities in the first quarter

of fiscal 2025 was $364 million, compared to $33 million in the

first quarter of fiscal 2024. Free cash flow in the first quarter

of fiscal 2025 was $293 million, compared to an outflow of $35

million in the same period last year. Increases in cash flow

provided by operating activities and free cash flow were primarily

due to no payout of incentive compensation in the first quarter of

fiscal 2025 related to fiscal 2024 performance.

Fiscal Year 2025 Outlook

The table below provides updated guidance for sales growth and

earnings per share for fiscal 2025.

Updated Guidance

Prior Guidance

Reported sales midpoint

~$8.1B

~$8.2B

Organic sales growth (1)

(4)% - 2%

(4)% - 2%

Inorganic sales growth

~ 0%

~ 0%

Currency translation

~ (1.5)%

~ 0%

Reported sales growth

(5.5)% - 0.5%

(4)% - 2%

Diluted EPS

$7.65 - $8.85

$7.65 - $8.85

Adjusted EPS (1)

$8.60 - $9.80

$8.60- $9.80

(1) Organic sales growth and Adjusted EPS

are non-GAAP measures. See Adjusted Income, Adjusted EPS, and

Adjusted Effective Tax Rate Reconciliation for more information

on these non-GAAP measures.

"We continue to expect gradual sequential improvement in our

sales and margins as we move through this fiscal year, including

potential impacts from tariffs. I’m pleased with the progress our

teams are making toward our long-term productivity and margin

expansion targets, and I’m confident we are making the right

investments to drive sustained growth and profitability. Nobody is

better positioned than Rockwell to help American manufacturers

create the future of industrial operations,” Moret continued.

Following is a discussion of first quarter results for our

business segments.

Intelligent Devices

Intelligent Devices first quarter fiscal 2025 sales were $806

million, a decrease of (13)% compared to $927 million in the same

period last year. Organic sales decreased (12)% and currency

translation decreased sales by less than (1) pt. Segment operating

earnings were $120 million compared to $150 million in the same

period last year. Segment operating margin decreased to 14.9% from

16.2% a year ago. The decrease from prior year was driven by lower

sales volume, partially offset by the benefits from cost reduction

and margin expansion actions.

Software & Control

Software & Control first quarter fiscal 2025 sales were $529

million, a decrease of (12)% compared to $604 million in the same

period last year. Organic sales decreased (12)% and currency

translation decreased sales by less than (1) pt. Segment operating

earnings were $133 million compared to $151 million in the same

period last year. Segment operating margin increased to 25.1% from

25.0% a year ago. The benefits from cost reduction and margin

expansion actions, and positive price/cost in the quarter were

mostly offset by lower sales volume.

Lifecycle Services

Lifecycle Services first quarter fiscal 2025 sales were $546

million, an increase of 5% compared to $521 million in the same

period last year. Organic sales increased 5% and currency

translation decreased sales by less than (1) pt. Segment operating

earnings were $68 million compared to $55 million in the same

period last year. Segment operating margin was 12.5% compared to

10.6% a year ago driven by the benefits from cost reduction and

margin expansion actions and higher sales volume.

Supplemental Information

ARR - Total ARR grew 11% compared to the end of the first

quarter of fiscal 2024.

Corporate and other - Fiscal 2025 first quarter Corporate and

other expense was $38 million compared to $40 million in the first

quarter of fiscal 2024.

Purchase accounting depreciation and amortization - Fiscal 2025

first quarter Purchase accounting depreciation and amortization

expense was $35 million, down $1 million from the first quarter of

fiscal 2024.

Tax - On a GAAP basis, the effective tax rate in the first

quarter of fiscal 2025 was 16.4% compared to 18.1% in the first

quarter of fiscal 2024. The adjusted effective tax rate for the

first quarter of fiscal 2025 was 17.5% compared to 17.9% in the

prior year. These decreases were primarily due to a favorable

geographic mix of pre-tax income and higher discrete benefits

recognized in the current year.

Share repurchases - During the first quarter of fiscal 2025, the

Company repurchased approximately 0.4 million shares of its common

stock at a cost of $99 million. At December 31, 2024, approximately

$1.2 billion remained available under our existing share repurchase

authorizations.

Return on Invested Capital (ROIC) - ROIC was 14.5% for the

twelve months ended December 31, 2024, compared to 18.5% for the

twelve months ended December 31, 2023. The decrease is primarily

driven by lower pre-tax net income.

Definitions

Non-GAAP Measures - Organic sales, total segment operating

earnings, total segment operating margin, adjusted income, adjusted

EPS, adjusted effective tax rate, free cash flow, free cash flow

conversion, and ROIC are non-GAAP measures that are reconciled to

GAAP measures in the attachments to this release.

Total ARR - Annual recurring revenue (ARR) is a key metric that

enables measurement of progress in growing our recurring revenue

business. It represents the annual contract value of all active

recurring revenue contracts at any point in time. Recurring revenue

is defined as a revenue stream that is contractual, typically for a

period of 12 months or more, and has a high probability of renewal.

The probability of renewal is based on historical renewal

experience of the individual revenue streams, or management's best

estimates if historical renewal experience is not available. Total

ARR growth is calculated as the dollar change in ARR, adjusted to

exclude the effects of currency, divided by ARR as of the prior

period. The effects of currency translation are excluded by

calculating Total ARR on a constant currency basis. Total ARR

includes acquisitions even if there was no comparable ARR in the

prior period. We believe that Total ARR provides useful information

to investors because it reflects our recurring revenue performance

period over period including the effect of acquisitions. Our

measure of ARR may be different from measures used by other

companies. Because ARR is based on annual contract value, it does

not represent revenue recognized during a particular reporting

period or revenue to be recognized in future reporting periods and

is not intended to be a substitute for revenue, contract

liabilities, or backlog.

Conference Call

A conference call to discuss the quarterly results will be held

at 8:30 a.m. Eastern Time on February 10, 2025. The call will be an

audio webcast and accessible on the Rockwell Automation website

(www.rockwellautomation.com/en-us/investors.html). Presentation

materials will also be available on the website prior to the

call.

Interested parties can access the conference call by using the

following numbers: (888) 330-2022 in U.S.; (365) 977-0051 in

Canada; +1 (646) 960-0690 for other countries. Use the following

passcode: 5499533. Please call in 10 minutes prior to the start of

the call.

Both the presentation materials and a replay of the call will be

available on the Investor Relations section of the Rockwell

Automation website through March 10, 2025.

This news release contains statements (including certain

projections and business trends) that are “forward-looking

statements” as defined in the Private Securities Litigation Reform

Act of 1995. Words such as “believe,” “estimate,” “project,”

“plan,” “expect,” “anticipate,” “will,” “intend,” and other similar

expressions may identify forward-looking statements. Actual results

may differ materially from those projected as a result of certain

risks and uncertainties, many of which are beyond our control,

including but not limited to:

- macroeconomic factors, including inflation, global and regional

business conditions (including adverse impacts in certain markets,

such as Oil & Gas), commodity prices, currency exchange rates,

the cyclical nature of our customers’ capital spending, and

sovereign debt concerns;

- laws, regulations, and governmental policies affecting our

activities in the countries where we do business, including those

related to tariffs, taxation, trade controls, cybersecurity, and

climate change;

- our profitability and market competitiveness may be adversely

impacted by changes in trade policies, including tariffs or other

factors;

- the severity and duration of disruptions to our business due to

natural disasters (including those as a result of climate change),

pandemics, acts of war, strikes, terrorism, social unrest, or other

causes;

- the availability and price of components and materials;

- the availability, effectiveness, and security of our

information technology systems;

- our ability to manage and mitigate the risk related to security

vulnerabilities and breaches of our hardware and software products,

solutions, and services;

- the successful execution of our cost productivity and margin

expansion initiatives;

- our ability to attract, develop, and retain qualified

employees;

- the successful integration and management of strategic

transactions and achievement of the expected benefits of these

transactions;

- the successful development of advanced technologies and demand

for and market acceptance of new and existing hardware and software

products;

- our ability to manage and mitigate the risks associated with

our solutions and services businesses;

- competitive hardware and software products, solutions, and

services, pricing pressures, and our ability to provide high

quality products, solutions, and services;

- the availability and cost of capital;

- disruptions to our distribution channels or the failure of

distributors to develop and maintain capabilities to sell our

products;

- intellectual property infringement claims by others and the

ability to protect our intellectual property;

- the uncertainty of claims by taxing authorities in the various

jurisdictions where we do business;

- the uncertainties of litigation, including liabilities related

to the safety and security of the hardware and software products,

solutions, and services we sell;

- our ability to manage costs related to employee retirement and

health care benefits; and

- other risks and uncertainties, including but not limited to

those detailed from time to time in our Securities and Exchange

Commission (SEC) filings.

Rockwell Automation, Inc. (NYSE: ROK), is a global leader in

industrial automation and digital transformation. We connect the

imaginations of people with the potential of technology to expand

what is humanly possible, making the world more productive and more

sustainable. Headquartered in Milwaukee, Wisconsin, Rockwell

Automation employs approximately 27,000 problem solvers dedicated

to our customers in more than 100 countries as of fiscal year end

2024. To learn more about how we are bringing The Connected

Enterprise® to life across industrial enterprises, visit

www.rockwellautomation.com.

ROCKWELL AUTOMATION, INC.

CONDENSED STATEMENT OF OPERATIONS INFORMATION (in millions, except

percentages)

Three Months Ended

December 31,

2024

2023

Sales (a)

$

1,881

$

2,052

Cost of sales

(1,159

)

(1,257

)

Gross profit (b)

722

795

Selling, general and administrative

expenses (c)

(476

)

(514

)

Change in fair value of investments

—

3

Other income

6

9

Interest expense

(39

)

(33

)

Income before income taxes

213

260

Income tax provision

(35

)

(47

)

Net income

178

213

Net loss attributable to noncontrolling

interests

(6

)

(2

)

Net income attributable to Rockwell

Automation, Inc.

$

184

$

215

Gross profit as percent of sales

(b/a)

38.4

%

38.7

%

SG&A as percent of sales

(c/a)

25.3

%

25.0

%

ROCKWELL AUTOMATION, INC.

SALES AND EARNINGS INFORMATION (in millions, except per share

amounts and percentages)

Three Months Ended

December 31,

2024

2023

Sales

Intelligent Devices (a)

$

806

$

927

Software & Control (b)

529

604

Lifecycle Services (c)

546

521

Total sales (d)

$

1,881

$

2,052

Segment operating earnings

Intelligent Devices (e)

$

120

$

150

Software & Control (f)

133

151

Lifecycle Services (g)

68

55

Total segment operating earnings (1)

(h)

321

356

Purchase accounting depreciation and

amortization

(35

)

(36

)

Corporate and other

(38

)

(40

)

Non-operating pension and postretirement

benefit credit

—

5

Change in fair value of investments

—

3

Interest expense, net

(35

)

(28

)

Income before income taxes (i)

213

260

Income tax provision

(35

)

(47

)

Net income

178

213

Net loss attributable to noncontrolling

interests

(6

)

(2

)

Net income attributable to Rockwell

Automation, Inc.

$

184

$

215

Diluted EPS

$

1.61

$

1.86

Adjusted EPS (2)

$

1.83

$

2.04

Diluted weighted average outstanding

shares

113.5

115.2

Pre-tax margin (i/d)

11.3

%

12.7

%

Intelligent Devices segment operating

margin (e/a)

14.9

%

16.2

%

Software & Control segment operating

margin (f/b)

25.1

%

25.0

%

Lifecycle Services segment operating

margin (g/c)

12.5

%

10.6

%

Total segment operating margin (1)

(h/d)

17.1

%

17.3

%

(1) Total segment operating earnings and

total segment operating margin are non-GAAP financial measures. We

exclude purchase accounting depreciation and amortization,

corporate and other, non-operating pension and postretirement

benefit credit, change in fair value of investments, interest

expense, net, and income tax provision because we do not consider

these items to be directly related to the operating performance of

our segments. We believe total segment operating earnings and total

segment operating margin are useful to investors as measures of

operating performance. We use these measures to monitor and

evaluate the profitability of our operating segments. Our measures

of total segment operating earnings and total segment operating

margin may be different from measures used by other companies.

(2) Adjusted EPS is a non-GAAP earnings

measure that excludes purchase accounting depreciation and

amortization, non-operating pension and postretirement benefit

credit, change in fair value of investments, and net loss

attributable to noncontrolling interests, including their

respective tax effects. See "Other Supplemental Information -

Adjusted Income, Adjusted EPS, and Adjusted Effective Tax Rate" for

more information regarding non-operating pension and postretirement

benefit credit, and a reconciliation to GAAP measures.

ROCKWELL AUTOMATION, INC.

CONDENSED BALANCE SHEET INFORMATION (in millions)

December 31,

2024

September 30,

2024

Assets

Cash and cash equivalents

$

471

$

471

Receivables

1,675

1,802

Inventories

1,234

1,293

Property, net

763

777

Operating lease right-of-use assets

388

423

Goodwill and intangibles

4,942

5,059

Other assets

1,471

1,407

Total

$

10,944

$

11,232

Liabilities and Shareowners’

Equity

Short-term debt

$

1,049

$

1,078

Accounts payable

789

860

Long-term debt

2,564

2,561

Operating lease liabilities

326

356

Other liabilities

2,660

2,702

Shareowners' equity attributable to

Rockwell Automation, Inc.

3,385

3,498

Noncontrolling interests

171

177

Total

$

10,944

$

11,232

ROCKWELL AUTOMATION, INC.

CONDENSED CASH FLOW INFORMATION (in millions)

Three Months Ended

December 31,

2024

2023

Operating activities:

Net income

$

178

$

213

Depreciation and amortization

78

77

Change in fair value of investments

—

(3

)

Retirement benefits expense

10

5

Pension contributions

(3

)

(6

)

Receivables/inventories/payables

75

52

Contract liabilities

42

14

Compensation and benefits

(12

)

(243

)

Income taxes

(8

)

2

Other operating activities

4

(78

)

Cash provided by operating activities

364

33

Investing activities:

Capital expenditures

(71

)

(68

)

Acquisition of businesses, net of cash

acquired

—

(748

)

Other investing activities

(12

)

(1

)

Cash used for investing activities

(83

)

(817

)

Financing activities:

Net (repayment) issuance of short-term

debt

(28

)

409

Cash dividends

(149

)

(144

)

Purchases of treasury stock

(100

)

(120

)

Proceeds from the exercise of stock

options

28

11

Other financing activities

(5

)

(22

)

Cash (used for) provided by financing

activities

(254

)

134

Effect of exchange rate changes on

cash

(27

)

9

Decrease in cash and cash

equivalents

$

—

$

(641

)

ROCKWELL AUTOMATION, INC.

OTHER SUPPLEMENTAL INFORMATION (in millions, except

percentages)

Organic

Sales

We translate sales of subsidiaries

operating outside of the United States using exchange rates

effective during the respective period. Therefore, changes in

currency exchange rates affect our reported sales. Sales by

acquired businesses also affect our reported sales. We believe that

organic sales, defined as sales excluding the effects of

acquisitions and changes in currency exchange rates, which is a

non-GAAP financial measure, provides useful information to

investors because it reflects regional and operating segment

performance from the activities of our businesses without the

effect of acquisitions and changes in currency exchange rates. We

use organic sales as one measure to monitor and evaluate our

regional and operating segment performance. When we acquire

businesses, we exclude sales in the current period for which there

are no comparable sales in the prior period. We determine the

effect of changes in currency exchange rates by translating the

respective period’s sales using the same currency exchange rates

that were in effect during the prior year. When we divest a

business, we exclude sales in the prior period for which there are

no comparable sales in the current period. Organic sales growth is

calculated by comparing organic sales to reported sales in the

prior year, excluding divestitures. We attribute sales to the

geographic regions based on the country of destination.

The following is a reconciliation of

reported sales to organic sales for the three months ended December

31, 2024, compared to sales for the three months ended December 31,

2023:

Three Months Ended December

31,

2024

2023

Reported Sales

Less: Effect

of Acquisitions

Effect of

Changes in

Currency

Organic

Sales

Reported Sales

North America

$

1,150

$

2

$

(3

)

$

1,151

$

1,247

EMEA

332

—

(1

)

333

388

Asia Pacific

251

—

—

251

276

Latin America

148

—

(14

)

162

141

Total

$

1,881

$

2

$

(18

)

$

1,897

$

2,052

The following is a reconciliation of

reported sales to organic sales for our operating segments for the

three months ended December 31, 2024, compared to sales for the

three months ended December 31, 2023:

Three Months Ended December

31,

2024

2023

Reported Sales

Less: Effect

of Acquisitions

Effect of

Changes in

Currency

Organic

Sales

Reported Sales

Intelligent Devices

$

806

$

—

$

(9

)

$

815

$

927

Software & Control

529

—

(5

)

534

604

Lifecycle Services

546

2

(4

)

548

521

Total

$

1,881

$

2

$

(18

)

$

1,897

$

2,052

The following is a reconciliation of

reported sales growth to organic sales growth for the three months

ended December 31, 2024, compared to sales for the three months

ended December 31, 2023:

Three Months Ended December

31, 2024

Reported Sales

Growth

Less: Effect

of Acquisitions

Effect of

Changes in

Currency

Organic Sales

Growth

North America

(8

)%

—

%

—

%

(8

)%

EMEA

(14

)%

—

%

—

%

(14

)%

Asia Pacific

(9

)%

—

%

—

%

(9

)%

Latin America

5

%

—

%

(10

)%

15

%

Total

(8

)%

—

%

(1

)%

(8

)%

The following is a reconciliation of

reported sales growth to organic sales growth for our operating

segments for the three months ended December 31, 2024, compared to

sales for the three months ended December 31, 2023:

Three Months Ended December

31, 2024

Reported Sales

Growth

Less: Effect

of Acquisitions

Effect of

Changes in

Currency

Organic Sales

Growth

Intelligent Devices

(13

)%

—

%

(1

)%

(12

)%

Software & Control

(12

)%

—

%

(1

)%

(12

)%

Lifecycle Services

5

%

—

%

(1

)%

5

%

Total

(8

)%

—

%

(1

)%

(8

)%

ROCKWELL AUTOMATION, INC.

OTHER SUPPLEMENTAL INFORMATION (in millions, except per share

amounts and percentages)

Adjusted Income,

Adjusted EPS, and Adjusted Effective Tax Rate

Adjusted Income, Adjusted EPS, and

Adjusted Effective Tax Rate are non-GAAP earnings measures that

exclude non-operating pension and postretirement benefit credit,

purchase accounting depreciation and amortization attributable to

Rockwell Automation, change in fair value of investments, and Net

loss attributable to noncontrolling interests, including their

respective tax effects.

We believe that Adjusted Income, Adjusted

EPS, and Adjusted Effective Tax rate provide useful information to

our investors about our operating performance and allow management

and investors to compare our operating performance period over

period. Adjusted EPS is also used as a financial measure of

performance for our annual incentive compensation. Our measures of

Adjusted Income, Adjusted EPS, and Adjusted Effective Tax Rate may

be different from measures used by other companies. These non-GAAP

measures should not be considered a substitute for Net Income

attributable to Rockwell Automation, diluted EPS, and effective tax

rate.

The following are the components of

operating and non-operating pension and postretirement benefit cost

(credit):

Three Months Ended

December 31,

2024

2023

Service cost

$

10

$

10

Operating pension and postretirement

benefit cost

10

10

Interest cost

34

37

Expected return on plan assets

(41

)

(42

)

Amortization of net actuarial loss

7

—

Non-operating pension and postretirement

benefit credit

—

(5

)

Net periodic pension and postretirement

benefit cost

$

10

$

5

The components of net periodic pension and

postretirement benefit cost other than the service cost component

are included in Other income in the Condensed Statement of

Operations.

The following are reconciliations of Net

income attributable to Rockwell Automation, diluted EPS, and

effective tax rate to adjusted income, adjusted EPS, and adjusted

effective tax rate, respectively:

Three Months Ended

December 31,

2024

2023

Net income attributable to Rockwell

Automation

$

184

$

215

Non-operating pension and postretirement

benefit credit

—

(5

)

Tax effect of non-operating pension and

postretirement benefit credit

—

1

Purchase accounting depreciation and

amortization attributable to Rockwell Automation

33

33

Tax effect of purchase accounting

depreciation and amortization attributable to Rockwell

Automation

(8

)

(6

)

Change in fair value of investments

—

(3

)

Tax effect of change in fair value of

investments

—

1

Adjusted income

$

209

$

236

Diluted EPS

$

1.61

$

1.86

Non-operating pension and postretirement

benefit credit

—

(0.04

)

Tax effect of non-operating pension and

postretirement benefit credit

—

0.01

Purchase accounting depreciation and

amortization attributable to Rockwell Automation

0.29

0.28

Tax effect of purchase accounting

depreciation and amortization attributable to Rockwell

Automation

(0.07

)

(0.05

)

Change in fair value of investments

—

(0.03

)

Tax effect of change in fair value of

investments

—

0.01

Adjusted EPS

$

1.83

$

2.04

Effective tax rate

16.4

%

18.1

%

Tax effect of non-operating pension and

postretirement benefit credit

—

%

(0.1

)%

Tax effect of purchase accounting

depreciation and amortization attributable to Rockwell

Automation

1.1

%

(0.1

)%

Tax effect of change in fair value of

investments

—

%

—

%

Adjusted effective tax rate

17.5

%

17.9

%

Fiscal 2025

Guidance

Diluted EPS (1)

$7.65 - $8.85

Non-operating pension and postretirement

benefit credit

—

Tax effect of non-operating pension and

postretirement benefit credit

—

Purchase accounting depreciation and

amortization attributable to Rockwell Automation

1.15

Tax effect of purchase accounting

depreciation and amortization attributable to Rockwell

Automation

(0.20)

Change in fair value of investments

(2)

—

Tax effect of change in fair value of

investments (2)

—

Adjusted EPS (1)

$8.60 - $9.80

Effective tax rate

~ 17%

Tax effect of non-operating pension and

postretirement benefit credit

~ —%

Tax effect of purchase accounting

depreciation and amortization attributable to Rockwell

Automation

~ —%

Tax effect of change in fair value of

investments (2)

~ —%

Adjusted effective tax rate

~ 17%

(1) Fiscal 2025 guidance based on adjusted

income attributable to Rockwell, which includes an adjustment for

SLB's non-controlling interest in Sensia.

(2) The actual year-to-date adjustments

are used for guidance, as estimates of these adjustments on a

forward-looking basis are not available due to variability,

complexity, and limited visibility of these items.

Note: Guidance as of February 10,

2025

ROCKWELL AUTOMATION, INC.

OTHER SUPPLEMENTAL INFORMATION (in millions, except

percentages)

Free Cash

Flow

Our definition of free cash flow, which is

a non-GAAP financial measure, takes into consideration capital

investments required to maintain the operations of our businesses

and execute our strategy. In our opinion, free cash flow provides

useful information to investors regarding our ability to generate

cash from business operations that is available for acquisitions

and other investments, service of debt principal, dividends, and

share repurchases. We use free cash flow, as defined, as one

measure to monitor and evaluate our performance, including as a

financial measure for our annual incentive compensation. Our

definition of free cash flow may be different from definitions used

by other companies.

The following table summarizes free cash

flow by quarter:

Mar. 31,

2023

Jun. 30,

2023

Sep. 30,

2023

Dec. 31,

2023

Mar. 31,

2024

Jun. 30,

2024

Sep. 30,

2024

Dec. 31,

2024

Cash provided by operating activities

$

187

$

282

$

839

$

33

$

120

$

279

$

432

$

364

Capital expenditures

(31

)

(42

)

(63

)

(68

)

(51

)

(41

)

(65

)

(71

)

Free cash flow

$

156

$

240

$

776

$

(35

)

$

69

$

238

$

367

$

293

Free cash flow conversion (free cash flow

as a percentage of adjusted income) is a non-GAAP financial

measure, which reflects our ability to generate cash from the

operations of our business while considering the capital

investments required to maintain operations and execute our

strategy as a ratio of our operating performance. We believe free

cash flow conversion provides useful information to investors about

our ability to convert operating performance into cash generation.

Our measure of free cash flow conversion may be different from

measures used by other companies.

The table below provides free cash flow

conversion for the three months ended December 31, 2024 and

2023:

Quarter Ended

Dec. 31, 2024

Dec. 31, 2023

Free cash flow (a)

$

293

$

(35

)

Adjusted income (b)

209

236

Free cash flow conversion (a/b)

140

%

(15

)%

Return On

Invested Capital

Our press release contains information

regarding ROIC, which is a non-GAAP financial measure. We believe

that ROIC is useful to investors as a measure of performance and of

the effectiveness of the use of capital in our operations. We use

ROIC as one measure to monitor and evaluate our performance. Our

measure of ROIC may be different from that used by other companies.

We define ROIC as the percentage resulting from the following

calculation:

(a) Net income, before Interest expense,

Income tax provision, and purchase accounting depreciation and

amortization, divided by;

(b) average invested capital for the year,

calculated as a five quarter rolling average using the sum of

Short-term debt, Long-term debt, Shareowners’ equity, and

accumulated amortization of goodwill and other intangible assets,

minus Cash and cash equivalents, short-term investments, and

long-term investments (fixed income securities), multiplied

by;

(c) one minus the effective tax rate for

the period.

ROIC is calculated as follows (in

millions, except percentages):

Twelve Months Ended

December 31,

2024

2023

(a) Return

Net income

$

913

$

1,112

Interest expense

160

135

Income tax provision

139

288

Purchase accounting depreciation and

amortization

144

274

Return

$

1,356

$

1,809

(b) Average invested capital

Short-term debt

$

968

$

754

Long-term debt

2,626

2,866

Shareowners’ equity

3,615

3,558

Accumulated amortization of goodwill and

intangibles

1,366

1,168

Cash and cash equivalents

(452

)

(574

)

Short-term and long-term investments

(2

)

(3

)

Average invested capital

$

8,121

$

7,769

(c) Effective tax rate

Income tax provision

$

139

$

288

Income before income taxes

1,052

1,400

Effective tax rate

13.2

%

20.6

%

(a) / (b) * (1-c) Return On Invested

Capital

14.5

%

18.5

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210092864/en/

Ed Moreland Media Relations Rockwell Automation 571.296.0391

Aijana Zellner Investor Relations Rockwell Automation

414.382.8510

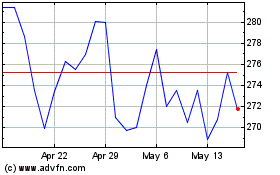

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Feb 2024 to Feb 2025