Diluted earnings per share of $1.13 vs.

$1.16 in 2Q22

Adjusted diluted earnings per share of $1.16

vs. $1.17 in 2Q22

Synovus Financial Corp. (NYSE: SNV) today reported financial

results for the quarter ended June 30, 2023. “Our second quarter

financial performance reflects the strength and resiliency of our

team, with pre-provision net revenue growing 8% year over year and

adjusted return on tangible common equity at 18%,” said Synovus

Chairman, CEO and President Kevin Blair. “Strong deposit

production, increased capital levels and stability in credit

metrics, as we saw during the second quarter, all serve as

mitigants to the risks of an environment with heightened levels of

volatility and uncertainty. And as we position the company for

sustainable, long-term growth, we’re proactively optimizing the

balance sheet, we’ve adjusted revenue expectations in response to

slower economic growth trends and deposit remixing, and we’ve

significantly reduced expense growth. Even as we execute amid

lingering challenging market conditions, we remain fully dedicated

to providing reliable and innovative financial solutions to our

clients. Their trust and confidence in our institution have been

paramount to our growth and sustained performance.”

Second Quarter 2023 Highlights

- Total revenue of $567.8 million increased $45.2 million, or 9%,

compared to the second quarter 2022, driven by net interest income

growth of 7%, in addition to growth in core client fee income,

excluding mortgage, of 7% year-over-year.

- Pre-provision net revenue of $260.6 million increased $20.0

million, or 8%, compared to the second quarter 2022.

- Period-end loans increased $308.6 million sequentially,

primarily driven by fundings of existing CRE commitments and growth

in consumer loans, somewhat offset by lower utilization from

C&I commitments.

- Total deposits increased $126.5 million sequentially and

included remixing due to the rate environment.

- Credit quality metrics at solid levels with a net charge-off

ratio of 0.24%, a modest increase in the ACL ratio to 1.19%, and

broader stable performance across the loan portfolio, asset types,

and industries.

- Preliminary CET1 ratio of 9.85% increased 8 bps sequentially as

capital generation continued to support client loan growth while

also buffering capital levels given economic uncertainty.

Second Quarter Summary

Reported

Adjusted

(dollars in thousands)

2Q23

1Q23

2Q22

2Q23

1Q23

2Q22

Net income available to common

shareholders

$

165,819

$

193,868

$

169,761

$

169,526

$

195,276

$

171,018

Diluted earnings per share

1.13

1.32

1.16

1.16

1.33

1.17

Total revenue

567,807

613,877

522,654

567,347

599,469

526,854

Total loans

44,353,537

44,044,939

41,204,780

N/A

N/A

N/A

Total deposits

50,080,392

49,953,936

49,034,700

N/A

N/A

N/A

Return on avg assets

1.15

%

1.36

%

1.26

%

1.18

%

1.37

%

1.27

%

Return on avg common equity

15.5

19.2

16.5

15.8

19.4

16.6

Return on avg tangible common equity

17.7

21.9

18.8

18.1

22.1

19.0

Net interest margin

3.20

3.43

3.22

N/A

N/A

N/A

Efficiency ratio-TE(1)(2)

53.99

52.33

53.87

52.57

50.48

53.43

NCO ratio-QTD

0.24

0.17

0.16

N/A

N/A

N/A

NPA ratio

0.59

0.41

0.33

N/A

N/A

N/A

(1)

Taxable equivalent

(2)

Adjusted tangible efficiency ratio

Balance Sheet

Loans*

(dollars in millions)

2Q23

1Q23

Linked

Quarter

Change

Linked

Quarter %

Change

2Q22

Year/Year

Change

Year/Year

% Change

Commercial & industrial

$

22,531.2

$

22,600.2

$

(68.9

)

—

%

$

20,778.3

$

1,752.9

8

%

Commercial real estate

13,293.9

12,996.8

297.1

2

11,503.4

1,790.5

16

Consumer

8,528.4

8,448.0

80.4

1

8,923.0

(394.6

)

(4

)

Total loans

$

44,353.5

$

44,044.9

$

308.6

1

%

$

41,204.8

$

3,148.8

8

%

*Amounts may not total due to rounding

- Total loans ended the quarter at $44.35 billion, up $308.6

million sequentially.

- Commercial and industrial (C&I) loans decreased $68.9

million sequentially, primarily driven by lower utilization from

existing commitments and a strategic decline in syndicated

loans.

- CRE loans increased $297.1 million sequentially, mostly due to

draws on existing multi-family commitments and continued low levels

of pay-offs.

- Consumer loans increased $80.4 million sequentially, largely a

result of growth in portfolio mortgages somewhat offset by

continued third-party decline from runoff.

Deposits*

(dollars in millions)

2Q23

1Q23

Linked

Quarter

Change

Linked

Quarter %

Change

2Q22

Year/Year

Change

Year/Year

% Change

Non-interest-bearing DDA

$

12,945.5

$

13,827.6

$

(882.0

)

(6

)%

$

15,781.1

$

(2,835.6

)

(18

)%

Interest-bearing DDA

6,255.3

5,841.0

414.3

7

6,327.1

(71.7

)

(1

)

Money market

10,803.7

11,776.0

(972.3

)

(8

)

13,793.0

(2,989.3

)

(22

)

Savings

1,222.9

1,312.7

(89.8

)

(7

)

1,498.7

(275.9

)

(18

)

Public funds

7,031.4

6,888.2

143.2

2

5,863.9

1,167.5

20

Time deposits

5,291.8

4,060.3

1,231.5

30

2,147.8

3,144.1

146

Brokered deposits

6,529.8

6,248.3

281.5

5

3,623.1

2,906.7

80

Total deposits

$

50,080.4

$

49,953.9

$

126.5

—

%

$

49,034.7

$

1,045.7

2

%

*Amounts may not total due to rounding

- Total deposits ended the quarter at $50.08 billion, up $126.5

million sequentially

- Money market deposits were primarily impacted by the continued

shifting to time deposits.

- Non-interest-bearing DDAs were impacted by pressures from

seasonal cash deployment of excess funds and continued pressures

from the higher rate environment.

- Total deposit costs increased 51 bps sequentially to 1.95% and

were impacted by the anticipated pricing lags on core

interest-bearing deposits (excludes brokered deposits) as well as

the decline in non-interest-bearing DDAs.

Income Statement Summary**

(in thousands, except per share data)

2Q23

1Q23

Linked

Quarter

Change

Linked

Quarter %

Change

2Q22

Year/Year

Change

Year/Year

% Change

Net interest income

$

455,531

$

480,751

$

(25,220

)

(5

)%

$

425,388

$

30,143

7

%

Non-interest revenue

112,276

133,126

(20,850

)

(16

)

97,266

15,010

15

Non-interest expense

307,181

321,852

(14,671

)

(5

)

282,051

25,130

9

Provision for (reversal of) credit

losses

38,881

32,154

6,727

21

12,688

26,193

206

Income before taxes

$

221,745

$

259,871

$

(38,126

)

(15

)%

$

227,915

$

(6,170

)

(3

)%

Income tax expense

47,801

57,712

(9,911

)

(17

)

49,863

(2,062

)

(4

)

Net income

173,944

202,159

(28,215

)

(14

)

178,052

(4,108

)

(2

)

Less: Net income (loss) attributable to

noncontrolling interest

(166

)

—

(166

)

NM

—

(166

)

NM

Net income attributable to Synovus

Financial Corp.

174,110

202,159

(28,049

)

(14

)

178,052

(3,942

)

(2

)

Less: Preferred stock dividends

8,291

8,291

—

—

8,291

—

—

Net income available to common

shareholders

$

165,819

$

193,868

$

(28,049

)

(14

)%

$

169,761

$

(3,942

)

(2

)%

Weighted average common shares

outstanding, diluted

146,550

146,727

(177

)

—

%

146,315

235

—

%

Diluted earnings per share

$

1.13

$

1.32

$

(0.19

)

(14

)

$

1.16

$

(0.03

)

(3

)

Adjusted diluted earnings per share

1.16

1.33

(0.17

)

(13

)

1.17

(0.01

)

(1

)

Effective tax rate

21.56

%

22.21

%

21.88

%

** Amounts may not total due to

rounding

Core Performance

- Net interest income of $455.5 million was down $25.2 million

sequentially, or 5%, and increased $30.1 million, or 7%, compared

to the second quarter 2022.

- The quarter-over-quarter decline was largely driven by

increases in deposit costs and negative re- mixing in

non-interest-bearing DDA deposits partially offset by higher asset

yields and earning asset growth.

- Net interest margin was 3.20%, down 23 bps sequentially,

impacted by the same factors mentioned above.

- The year-over-year increase resulted primarily from loan growth

and interest rate increases somewhat offset by higher deposit costs

and negative remixing from non-interest DDA deposits.

- Non-interest revenue decreased $20.9 million, or 16%,

sequentially and increased $15.0 million, or 15%, compared to the

second quarter 2022. Adjusted non-interest revenue decreased $6.9

million, or 6%, sequentially and increased $10.2 million, or 10%,

compared to the second quarter 2022.

- The quarter-over-quarter decrease was impacted by the prior

quarter's $13.1 million one-time benefit from the recovery of a

non-performing asset related to the regulatory approval of our

Qualpay investment and strong growth in capital markets income in

the first quarter 2023, which normalized this quarter.

- The year-over-year increase primarily related to higher wealth

revenue from diverse sources including fees from short-term

liquidity management products and a $7 million write-down in the

second quarter 2022 on a minority tech investment.

- Non-interest expense decreased $14.7 million, or 5%,

sequentially and increased $25.1 million, or 9%, compared to the

second quarter 2022. Adjusted non-interest expense decreased $3.8

million, or 1%, sequentially and increased $17.0 million, or 6%,

compared to the second quarter 2022.

- The quarter-over-quarter decrease was largely due to the

previous quarter's $16.8 million loss associated with the move of

third-party consumer loans to held for sale in addition to

seasonally elevated personnel expense in the first quarter

2023.

- The year-over-year increase primarily resulted from new

business initiatives and infrastructure investments as well as

investments in our workforce and higher FDIC insurance and

healthcare costs.

- Overall credit performance and the credit quality of our recent

originations was solid. The non-performing loan and asset ratios

both moved to 0.59%; the net charge-off ratio for the quarter was

0.24%, and total past dues were 0.19% of total loans

outstanding.

- Provision for credit losses of $38.9 million increased $6.7

million sequentially and increased $26.2 million compared to the

second quarter 2022.

- Drivers of the quarter-over-quarter increase included higher

net charge-offs and a modest increase of 2 bps in the allowance for

credit losses coverage ratio (to loans).

- Drivers of the year-over-year increase largely included an 8

bps increase in the allowance for credit losses coverage ratio (to

loans), which resulted from deterioration in forecasted economic

scenarios mostly offset by continued solid loan portfolio

performance, and higher net charge-offs.

Capital Ratios

2Q23

1Q23

2Q22

Common equity Tier 1 capital (CET1)

ratio

9.85

%

*

9.77

%

9.46

%

Tier 1 capital ratio

10.88

*

10.81

10.56

Total risk-based capital ratio

12.79

*

12.72

12.43

Tier 1 leverage ratio

9.23

*

9.14

9.03

Tangible common equity ratio

6.17

6.12

6.26

* Ratios are preliminary.

Capital

- Preliminary CET1 ratio improved 8 bps during the quarter to

9.85%, and the preliminary total risk-based capital ratio of 12.79%

increased 7 bps from the previous quarter as core earnings

continued to support capital generation.

Second Quarter Earnings Conference Call

Synovus will host an earnings highlights conference call at 8:30

a.m. ET on July 20, 2023. The earnings call will be accompanied by

a slide presentation. Shareholders and other interested parties may

listen to this conference call via simultaneous internet broadcast.

For a link to the webcast, go to investor.synovus.com/event. The

replay will be archived for 12 months and will be available 30-45

minutes after the call.

Synovus Financial Corp. is a financial services company

based in Columbus, Georgia, with approximately $61 billion in

assets. Synovus provides commercial and consumer banking and a full

suite of specialized products and services, including private

banking, treasury management, wealth management, mortgage services,

premium finance, asset-based lending, structured lending, capital

markets and international banking. Synovus has 246 branches in

Georgia, Alabama, South Carolina, Florida and Tennessee. Synovus is

a Great Place to Work-Certified Company and is on the web at

synovus.com and on Twitter, Facebook, LinkedIn and Instagram.

Forward-Looking Statements

This press release and certain of our other filings with the

Securities and Exchange Commission contain statements that

constitute “forward-looking statements” within the meaning of, and

subject to the protections of, Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended.

All statements other than statements of historical fact are

forward-looking statements. You can identify these forward-looking

statements through Synovus’ use of words such as “believes,”

“anticipates,” “expects,” “may,” “will,” “assumes,” “should,”

“predicts,” “could,” “would,” “intends,” “targets,” “estimates,”

“projects,” “plans,” “potential” and other similar words and

expressions of the future or otherwise regarding the outlook for

Synovus’ future business and financial performance and/or the

performance of the banking industry and economy in general. These

forward-looking statements include, among others, our expectations

regarding our future operating and financial performance;

expectations on our growth strategy, expense and revenue

initiatives, capital management, balance sheet management, and

future profitability; expectations on credit quality and

performance; and the assumptions underlying our expectations.

Prospective investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

known and unknown risks and uncertainties which may cause the

actual results, performance or achievements of Synovus to be

materially different from the future results, performance or

achievements expressed or implied by such forward-looking

statements. Forward-looking statements are based on the information

known to, and current beliefs and expectations of, Synovus’

management and are subject to significant risks and uncertainties.

Actual results may differ materially from those contemplated by

such forward-looking statements. A number of factors could cause

actual results to differ materially from those contemplated by the

forward-looking statements in this press release. Many of these

factors are beyond Synovus’ ability to control or predict.

These forward-looking statements are based upon information

presently known to Synovus’ management and are inherently

subjective, uncertain and subject to change due to any number of

risks and uncertainties, including, without limitation, the risks

and other factors set forth in Synovus’ filings with the Securities

and Exchange Commission, including its Annual Report on Form 10-K

for the year ended December 31, 2022, under the captions

“Cautionary Notice Regarding Forward-Looking Statements” and “Risk

Factors” and in Synovus’ quarterly reports on Form 10-Q and current

reports on Form 8-K. We believe these forward-looking statements

are reasonable; however, undue reliance should not be placed on any

forward-looking statements, which are based on current expectations

and speak only as of the date that they are made. We do not assume

any obligation to update any forward-looking statements as a result

of new information, future developments or otherwise, except as

otherwise may be required by law.

Non-GAAP Financial Measures

The measures entitled adjusted non-interest revenue,

non-interest expense; adjusted revenue; adjusted tangible

efficiency ratio; adjusted net income available to common

shareholders; adjusted diluted earnings per share; adjusted return

on average assets; adjusted return on average common equity; return

on average tangible common equity; adjusted return on average

tangible common equity; and tangible common equity ratio are not

measures recognized under GAAP and therefore are considered

non-GAAP financial measures. The most comparable GAAP measures to

these measures are total non-interest revenue; total non-interest

expense; total revenue; efficiency ratio- TE; net income available

to common shareholders; diluted earnings per share; return on

average assets; return on average common equity; and the ratio of

total Synovus Financial Corp. shareholders' equity to total assets,

respectively.

Management believes that these non-GAAP financial measures

provide meaningful additional information about Synovus to assist

management and investors in evaluating Synovus’ operating results,

financial strength, the performance of its business, and the

strength of its capital position. However, these non-GAAP financial

measures have inherent limitations as analytical tools and should

not be considered in isolation or as a substitute for analyses of

operating results or capital position as reported under GAAP. The

non-GAAP financial measures should be considered as additional

views of the way our financial measures are affected by significant

items and other factors, and since they are not required to be

uniformly applied, they may not be comparable to other similarly

titled measures at other companies. Adjusted non-interest revenue

and adjusted revenue are measures used by management to evaluate

non-interest revenue and total revenue revenue exclusive of net

investment securities gains (losses), fair value adjustment on

non-qualified deferred compensation, and other items not indicative

of ongoing operations that could impact period-to-period

comparisons. Adjusted non-interest expense and the adjusted

tangible efficiency ratio are measures utilized by management to

measure the success of expense management initiatives focused on

reducing recurring controllable operating costs. Adjusted net

income available to common shareholders, adjusted diluted earnings

per share, adjusted return on average assets, and adjusted return

on average common equity are measures used by management to

evaluate operating results exclusive of items that are not

indicative of ongoing operations and impact period-to-period

comparisons. Return on average tangible common equity and adjusted

return on average tangible common equity are measures used by

management to compare Synovus’ performance with other financial

institutions because it calculates the return available to common

shareholders without the impact of intangible assets and their

related amortization, thereby allowing management to evaluate the

performance of the business consistently. The tangible common

equity ratio is used by management to assess the strength of our

capital position. The computations of these measures are set forth

in the tables below.

Reconciliation of Non-GAAP Financial

Measures

(dollars in thousands)

2Q23

1Q23

2Q22

Adjusted non-interest revenue

Total non-interest revenue

$

112,276

$

133,126

$

97,266

Investment securities (gains) losses,

net

—

(1,030

)

—

Recovery of NPA

—

(13,126

)

—

Fair value adjustment on non-qualified

deferred compensation

(1,598

)

(1,371

)

3,240

Adjusted non-interest revenue

$

110,678

$

117,599

$

100,506

Adjusted non-interest expense

Total non-interest expense

$

307,181

$

321,852

$

282,051

(Loss) gain on other loans held for

sale

(2,360

)

(16,750

)

—

Gain (loss) on early extinguishment of

debt

377

—

—

Restructuring (charges) reversals

110

733

1,850

Valuation adjustment to Visa

derivative

(3,027

)

—

(3,500

)

Fair value adjustment on non-qualified

deferred compensation

(1,598

)

(1,371

)

3,240

Adjusted non-interest expense

$

300,683

$

304,464

$

283,641

Reconciliation of Non-GAAP Financial

Measures, continued

(dollars in thousands)

2Q23

1Q23

2Q22

Adjusted revenue and tangible

efficiency ratio

Adjusted non-interest expense

$

300,683

$

304,464

$

283,641

Amortization of intangibles

(2,420

)

(1,857

)

(2,118

)

Adjusted tangible non-interest expense

$

298,263

$

302,607

$

281,523

Net interest income

$

455,531

$

480,751

$

425,388

Total non-interest revenue

112,276

133,126

97,266

Total revenue

$

567,807

$

613,877

$

522,654

Tax equivalent adjustment

1,138

1,119

960

Total TE revenue

568,945

614,996

523,614

Recovery of NPA

—

(13,126

)

—

Investment securities losses (gains),

net

—

(1,030

)

—

Fair value adjustment on non-qualified

deferred compensation

(1,598

)

(1,371

)

3,240

Adjusted revenue

$

567,347

$

599,469

$

526,854

Efficiency ratio-TE

53.99

%

52.33

%

53.87

%

Adjusted tangible efficiency ratio

52.57

50.48

53.43

Adjusted return on average

assets

Net income

$

173,944

$

202,159

$

178,052

Recovery of NPA

—

(13,126

)

—

Loss (gain) on other loans held for

sale

2,360

16,750

—

(Gain) loss on early extinguishment of

debt

(377

)

—

—

Restructuring charges (reversals)

(110

)

(733

)

(1,850

)

Valuation adjustment to Visa

derivative

3,027

—

3,500

Investment securities losses (gains),

net

—

(1,030

)

—

Tax effect of adjustments(1)

(1,193

)

(453

)

(393

)

Adjusted net income

$

177,651

$

203,567

$

179,309

Net income annualized

$

697,687

$

819,867

$

714,165

Adjusted net income annualized

$

712,556

$

825,577

$

719,206

Total average assets

$

60,515,077

$

60,133,561

$

56,536,940

Return on average assets

1.15

%

1.36

%

1.26

%

Adjusted return on average assets

1.18

1.37

1.27

Adjusted net income available to common

shareholders and adjusted diluted earnings per share

Net income available to common

shareholders

$

165,819

$

193,868

$

169,761

Recovery of NPA

—

(13,126

)

—

Loss (gain) on other loans held for

sale

2,360

16,750

—

(Gain) loss on early extinguishment of

debt

(377

)

—

—

Restructuring charges (reversals)

(110

)

(733

)

(1,850

)

Valuation adjustment to Visa

derivative

3,027

—

3,500

Investment securities losses (gains),

net

—

(1,030

)

—

Tax effect of adjustments(1)

(1,193

)

(453

)

(393

)

Adjusted net income available to common

shareholders

$

169,526

$

195,276

$

171,018

Weighted average common shares

outstanding, diluted

146,550

146,727

146,315

Diluted earnings per share

$

1.13

$

1.32

$

1.16

Adjusted diluted earnings per share

1.16

1.33

1.17

Reconciliation of Non-GAAP Financial

Measures, continued

(dollars in thousands)

2Q23

1Q23

2Q22

Adjusted return on average common

equity, return on average tangible common equity, and adjusted

return on average tangible common equity

Net income available to common

shareholders

$

165,819

$

193,868

$

169,761

Recovery of NPA

—

(13,126

)

—

Loss (gain) on other loans held for

sale

2,360

16,750

—

(Gain) loss on early extinguishment of

debt

(377

)

—

—

Restructuring charges (reversals)

(110

)

(733

)

(1,850

)

Valuation adjustment to Visa

derivative

3,027

—

3,500

Investment securities losses (gains),

net

—

(1,030

)

—

Tax effect of adjustments(1)

(1,193

)

(453

)

(393

)

Adjusted net income available to common

shareholders

$

169,526

$

195,276

$

171,018

Adjusted net income available to common

shareholders annualized

$

679,967

$

791,953

$

685,951

Amortization of intangibles, tax effected,

annualized

7,344

5,699

6,471

Adjusted net income available to common

shareholders excluding amortization of intangibles annualized

$

687,311

$

797,652

$

692,422

Net income available to common

shareholders annualized

$

665,098

$

786,242

$

680,910

Amortization of intangibles, tax effected,

annualized

7,344

5,699

6,471

Net income available to common

shareholders excluding amortization of intangibles annualized

$

672,442

$

791,941

$

687,381

Total average Synovus Financial Corp.

shareholders' equity less preferred stock

$

4,303,722

$

4,088,777

$

4,132,536

Average goodwill

(460,118

)

(452,390

)

(452,390

)

Average other intangible assets, net

(36,738

)

(26,245

)

(32,387

)

Total average Synovus Financial Corp.

tangible shareholders' equity less preferred stock

$

3,806,866

$

3,610,142

$

3,647,759

Return on average common equity

15.5

%

19.2

%

16.5

%

Adjusted return on average common

equity

15.8

19.4

16.6

Return on average tangible common

equity

17.7

21.9

18.8

Adjusted return on average tangible common

equity

18.1

22.1

19.0

(dollars in thousands)

June 30, 2023

December 31, 2022

June 30, 2022

Tangible common equity ratio

Total assets

$

60,655,591

$

59,731,378

$

57,382,745

Goodwill

(475,573

)

(452,390

)

(452,390

)

Other intangible assets, net

(61,538

)

(27,124

)

(31,360

)

Tangible assets

$

60,118,480

$

59,251,864

$

56,898,995

Total Synovus Financial Corp.

shareholders’ equity

$

4,782,528

$

4,475,801

$

4,584,438

Goodwill

(475,573

)

(452,390

)

(452,390

)

Other intangible assets, net

(61,538

)

(27,124

)

(31,360

)

Preferred Stock, no par value

(537,145

)

(537,145

)

(537,145

)

Tangible common equity

$

3,708,272

$

3,459,142

$

3,563,543

Total Synovus Financial Corp.

shareholders’ equity to total assets ratio

7.88

%

7.49

%

7.99

%

Tangible common equity ratio

6.17

5.84

6.26

(1) An assumed marginal tax rate of 24.3%

for 2Q23 and 1Q23 and 23.8% for 2Q22 was applied.

Amounts may not total due to

rounding

Synovus

INCOME STATEMENT DATA

(Unaudited)

(Dollars in thousands, except per share

data)

Six Months Ended June

30,

2023

2022

23 vs '22

% Change

Interest income

$

1,476,022

$

869,834

70

%

Interest expense

539,739

52,199

934

Net interest income

936,283

817,635

15

Provision for (reversal of) credit

losses

71,035

24,088

195

Net interest income after provision for

credit losses

865,248

793,547

9

Non-interest revenue:

Service charges on deposit accounts

46,451

46,030

1

Fiduciary and asset management fees

39,723

40,377

(2

)

Card fees

32,884

30,846

7

Brokerage revenue

43,466

29,898

45

Mortgage banking income

8,467

9,857

(14

)

Capital markets income

20,700

12,864

61

Income from bank-owned life insurance

14,140

15,722

(10

)

Investment securities gains (losses),

net

1,030

—

nm

Recovery of NPA

13,126

—

nm

Other non-interest revenue

25,415

17,006

49

Total non-interest revenue

245,402

202,600

21

Non-interest expense:

Salaries and other personnel expense

371,926

325,747

14

Net occupancy, equipment, and software

expense

85,645

86,076

(1

)

Third-party processing and other

services

43,493

42,947

1

Professional fees

18,560

19,338

(4

)

FDIC insurance and other regulatory

fees

21,429

13,144

63

Restructuring charges (reversals)

(843

)

(8,274

)

nm

Loss on other loans held for sale

19,110

—

nm

Other operating expenses

69,714

75,523

(8

)

Total non-interest expense

629,034

554,501

13

Income before income taxes

481,616

441,646

9

Income tax expense

105,513

92,558

14

Net income

376,103

349,088

8

Less: Net income attributable to

noncontrolling interest

(166

)

—

nm

Net income attributable to Synovus

Financial Corp.

376,269

349,088

8

Less: Preferred stock dividends

16,581

16,581

—

Net income available to common

shareholders

$

359,688

$

332,507

8

%

Net income per common share, basic

$

2.46

$

2.29

8

%

Net income per common share, diluted

2.45

2.27

8

Cash dividends declared per common

share

0.76

0.68

12

Return on average assets *

1.26

%

1.24

%

2 bps

Return on average common equity *

17.28

15.28

200

Weighted average common shares

outstanding, basic

145,957

145,301

—

%

Weighted average common shares

outstanding, diluted

146,644

146,489

—

nm - not meaningful

bps - basis points

* - ratios are annualized

Amounts may not total due to rounding

Synovus

INCOME STATEMENT DATA

(Unaudited)

(Dollars in thousands, except per share

data)

2023

2022

Second Quarter

Second

Quarter

First

Quarter

Fourth

Quarter

Third

Quarter

Second

Quarter

'23 vs '22

% Change

Interest income

$

759,143

716,879

654,654

551,299

453,772

67

%

Interest expense

303,612

236,128

153,308

73,380

28,384

970

Net interest income

455,531

480,751

501,346

477,919

425,388

7

Provision for (reversal of) credit

losses

38,881

32,154

34,884

25,581

12,688

206

Net interest income after provision for

credit losses

416,650

448,597

466,462

452,338

412,700

1

Non-interest revenue:

Service charges on deposit accounts

23,477

22,974

23,639

23,398

23,491

—

Fiduciary and asset management fees

20,027

19,696

18,836

19,201

20,100

—

Card fees

17,059

15,824

15,887

15,101

16,089

6

Brokerage revenue

20,908

22,558

19,996

17,140

15,243

37

Mortgage banking income

4,609

3,858

2,554

5,065

3,904

18

Capital markets income

6,975

13,725

6,998

6,839

7,393

(6

)

Income from bank-owned life insurance

6,878

7,262

7,206

6,792

9,165

(25

)

Investment securities gains (losses),

net

—

1,030

—

—

—

nm

Recovery of NPA

—

13,126

—

—

—

nm

Other non-interest revenue

12,343

13,073

7,323

10,762

1,881

556

Total non-interest revenue

112,276

133,126

102,439

104,298

97,266

15

Non-interest expense:

Salaries and other personnel expense

183,001

188,924

182,629

173,334

161,063

14

Net occupancy, equipment, and software

expense

42,785

42,860

45,192

43,462

43,199

(1

)

Third-party processing and other

services

21,659

21,833

23,130

22,539

21,952

(1

)

Professional fees

9,597

8,963

11,096

6,755

10,865

(12

)

FDIC insurance and other regulatory

fees

11,162

10,268

8,232

7,707

6,894

62

Restructuring charges (reversals)

(110

)

(733

)

(2,372

)

956

(1,850

)

(94

)

Loss on other loans held for sale

2,360

16,750

—

—

—

nm

Other operating expenses

36,727

32,987

41,089

39,257

39,928

(8

)

Total non-interest expense

307,181

321,852

308,996

294,010

282,051

9

Income before income taxes

221,745

259,871

259,905

262,626

227,915

(3

)

Income tax expense

47,801

57,712

54,135

59,582

49,863

(4

)

Net income

173,944

202,159

205,770

203,044

178,052

(2

)

Less: Net income attributable to

noncontrolling interest

(166

)

—

—

—

—

nm

Net income attributable to Synovus

Financial Corp.

174,110

202,159

205,770

203,044

178,052

(2

)

Less: Preferred stock dividends

8,291

8,291

8,291

8,291

8,291

—

Net income available to common

shareholders

$

165,819

193,868

197,479

194,753

169,761

(2

)%

Net income per common share, basic

$

1.13

1.33

1.36

1.34

1.17

(3

)%

Net income per common share, diluted

1.13

1.32

1.35

1.33

1.16

(3

)

Cash dividends declared per common

share

0.38

0.38

0.34

0.34

0.34

12

Return on average assets *

1.15

%

1.36

1.38

1.39

1.26

(11) bps

Return on average common equity *

15.45

19.23

20.93

18.66

16.48

(103

)

Weighted average common shares

outstanding, basic

146,113

145,799

145,467

145,386

145,328

1

%

Weighted average common shares

outstanding, diluted

146,550

146,727

146,528

146,418

146,315

—

nm - not meaningful

bps - basis points

* - ratios are annualized

Amounts may not total due to rounding

Synovus

BALANCE SHEET DATA

June 30, 2023

December 31, 2022

June 30, 2022

(Unaudited)

(In thousands, except share data)

ASSETS

Cash and due from banks

$

576,148

$

624,097

$

583,323

Interest-bearing funds with Federal

Reserve Bank

1,391,961

1,280,684

1,023,030

Interest earning deposits with banks

50,254

34,632

29,139

Federal funds sold and securities

purchased under resale agreements

35,788

38,367

29,568

Cash, cash equivalents, and restricted

cash

2,054,151

1,977,780

1,665,060

Investment securities available for sale,

at fair value

9,621,175

9,678,103

9,889,850

Loans held for sale (includes $62,616,

$51,136 and $76,864 measured at fair value, respectively)

514,450

391,502

917,679

Loans, net of deferred fees and costs

44,353,537

43,716,353

41,204,780

Allowance for loan losses

(471,238

)

(443,424

)

(407,837

)

Loans, net

43,882,299

43,272,929

40,796,943

Cash surrender value of bank-owned life

insurance

1,100,114

1,089,280

1,078,703

Premises, equipment, and software, net

365,443

370,632

383,060

Goodwill

475,573

452,390

452,390

Other intangible assets, net

61,538

27,124

31,360

Other assets

2,580,848

2,471,638

2,167,700

Total assets

$

60,655,591

$

59,731,378

$

57,382,745

LIABILITIES AND EQUITY

Liabilities:

Deposits:

Non-interest-bearing deposits

$

13,565,602

$

15,639,899

$

16,876,710

Interest-bearing deposits

36,514,790

33,231,660

32,157,990

Total deposits

50,080,392

48,871,559

49,034,700

Federal funds purchased and securities

sold under repurchase agreements

83,384

146,588

345,242

Other short-term borrowings

1,461

603,384

255,018

Long-term debt

4,021,411

4,109,597

1,804,104

Other liabilities

1,661,175

1,524,449

1,359,243

Total liabilities

55,847,823

55,255,577

52,798,307

Equity:

Shareholders' equity:

Preferred stock - no par value. Authorized

100,000,000 shares; issued 22,000,000

537,145

537,145

537,145

Common stock - $1.00 par value. Authorized

342,857,143 shares; issued 170,808,134, 170,141,492 and 170,012,527

respectively; outstanding 146,153,276, 145,486,634 and 145,357,669

respectively

170,808

170,141

170,013

Additional paid-in capital

3,933,548

3,920,346

3,908,118

Treasury stock, at cost; 24,654,858

shares

(944,484

)

(944,484

)

(944,484

)

Accumulated other comprehensive income

(loss), net

(1,395,175

)

(1,442,117

)

(1,026,705

)

Retained earnings

2,480,686

2,234,770

1,940,351

Total Synovus Financial Corp.

shareholders’ equity

4,782,528

4,475,801

4,584,438

Noncontrolling interest in subsidiary

25,240

—

—

Total equity

4,807,768

4,475,801

4,584,438

Total liabilities and equity

$

60,655,591

$

59,731,378

$

57,382,745

Synovus

AVERAGE BALANCES, INTEREST, AND

YIELDS/RATES

(Unaudited)

Second Quarter 2023

First Quarter 2023

Second Quarter 2022

(dollars in thousands)

Average

Balance

Interest

Yield/

Rate

Average

Balance

Interest

Yield/

Rate

Average

Balance

Interest

Yield/

Rate

Assets

Interest earning assets:

Commercial loans (1) (2) (3)

$

35,628,637

$

566,823

6.38

%

$

35,030,809

$

526,529

6.10

%

$

31,870,387

$

308,442

3.88

%

Consumer loans (1) (2)

8,470,478

104,545

4.94

8,762,631

104,147

4.78

8,720,488

83,826

3.86

Less: Allowance for loan losses

(466,700

)

—

—

(445,192

)

—

—

(415,372

)

—

—

Loans, net

43,632,415

671,368

6.17

43,348,248

630,676

5.89

40,175,503

392,268

3.92

Investment securities available for

sale

11,200,717

60,421

2.16

11,293,958

61,054

2.16

11,153,091

50,312

1.81

Trading account assets

21,328

309

5.80

11,338

124

4.39

11,987

73

2.44

Other earning assets(4)

1,446,425

18,081

4.95

1,513,800

17,212

4.55

813,028

1,660

0.81

FHLB and Federal Reserve Bank stock

280,248

4,301

6.14

306,935

3,355

4.37

179,837

1,820

4.05

Mortgage loans held for sale

54,603

852

6.24

36,497

566

6.20

85,299

921

4.32

Other loans held for sale

546,224

4,949

3.58

443,690

5,011

4.52

725,762

7,678

4.19

Total interest earning assets

57,181,960

$

760,281

5.33

%

56,954,466

$

717,998

5.11

%

53,144,507

$

454,732

3.43

%

Cash and due from banks

646,066

643,502

538,647

Premises and equipment

369,039

370,275

385,457

Other real estate

—

—

11,439

Cash surrender value of bank-owned life

insurance

1,095,866

1,091,080

1,077,231

Other assets(5)

1,222,146

1,074,238

1,379,659

Total assets

$

60,515,077

$

60,133,561

$

56,536,940

Liabilities and Equity

Interest-bearing liabilities:

Interest-bearing demand deposits

$

9,891,375

$

41,803

1.70

%

$

9,091,166

$

23,221

1.04

%

$

9,513,334

$

3,598

0.15

%

Money market accounts

13,468,210

85,397

2.54

14,395,050

72,615

2.05

15,328,395

6,850

0.18

Savings deposits

1,276,040

281

0.09

1,370,173

211

0.06

1,506,195

72

0.02

Time deposits

4,866,221

39,551

3.26

3,601,288

21,496

2.42

2,829,684

1,688

0.24

Brokered deposits

6,342,751

74,748

4.73

5,553,970

56,392

4.12

2,878,536

6,293

0.88

Federal funds purchased and securities

sold under repurchase agreements

88,591

351

1.57

133,360

670

2.01

246,737

219

0.35

Other short-term borrowings

455,050

5,566

4.84

1,677,519

18,994

4.53

480,999

896

0.74

Long-term debt

3,821,126

55,915

5.82

3,148,062

42,529

5.41

878,413

8,768

3.99

Total interest-bearing liabilities

40,209,364

$

303,612

3.03

%

38,970,588

$

236,128

2.46

%

33,662,293

$

28,384

0.33

%

Non-interest-bearing demand deposits

13,874,482

15,014,224

16,959,850

Other liabilities

1,556,863

1,522,827

1,245,116

Total equity

4,874,368

4,625,922

4,669,681

Total liabilities and equity

$

60,515,077

$

60,133,561

$

56,536,940

Net interest income and net interest

margin, taxable equivalent (6)

$

456,669

3.20

%

$

481,870

3.43

%

$

426,348

3.22

%

Less: taxable-equivalent adjustment

1,138

1,119

960

Net interest income

$

455,531

$

480,751

$

425,388

(1)

Average loans are shown net of deferred

fees and costs. NPLs are included.

(2)

Interest income includes net loan fees as

follows: Second Quarter 2023 — $11.3 million, First Quarter 2023 —

$11.5 million, and Second Quarter 2022 — $13.0 million.

(3)

Reflects taxable-equivalent adjustments,

using the statutory federal tax rate of 21%, in adjusting interest

on tax-exempt loans to a taxable-equivalent basis.

(4)

Includes interest-bearing funds with

Federal Reserve Bank, interest earning deposits with banks, and

federal funds sold and securities purchased under resale

agreements.

(5)

Includes average net unrealized

gains/(losses) on investment securities available for sale of

$(1.46) billion, $(1.52) billion, and $(923.1) million for the

Second Quarter 2023, First Quarter 2023, and Second Quarter 2022,

respectively.

(6)

The net interest margin is calculated by

dividing annualized net interest income-taxable equivalent by

average total interest earning assets.

Synovus

AVERAGE BALANCES, INTEREST, AND

YIELDS/RATES

(Unaudited)

Six Months Ended June

30,

2023

2022

(dollars in thousands)

Average Balance

Interest

Yield/

Rate

Average Balance

Interest

Yield/

Rate

Assets

Interest earning assets:

Commercial loans (1) (2) (3)

$

35,331,375

$

1,093,352

6.24

%

$

31,316,646

$

589,029

3.79

%

Consumer loans (1) (2)

8,615,748

208,693

4.87

8,657,598

165,194

3.83

Less: Allowance for loan losses

(456,005

)

(419,639

)

Loans, net

43,491,118

1,302,045

6.03

39,554,605

754,223

3.84

Investment securities available for

sale

11,247,080

121,475

2.16

11,206,150

97,562

1.74

Trading account assets

16,360

434

5.30

10,540

112

2.13

Other earning assets(4)

1,479,926

35,292

4.74

1,363,223

2,475

0.36

FHLB and Federal Reserve Bank stock

293,518

7,656

5.22

170,006

2,505

2.95

Mortgage loans held for sale

45,600

1,418

6.22

94,542

1,803

3.81

Other loans held for sale

495,240

9,960

4.00

661,768

12,978

3.90

Total interest earning assets

57,068,842

$

1,478,280

5.22

%

53,060,834

$

871,658

3.31

%

Cash and due from banks

644,791

543,638

Premises and equipment

369,654

392,079

Other real estate

—

11,598

Cash surrender value of bank-owned life

insurance

1,093,486

1,074,076

Other assets(5)

1,148,600

1,613,313

Total assets

$

60,325,373

$

56,695,538

Liabilities and Equity

Interest-bearing liabilities:

Interest-bearing demand deposits

$

9,493,481

$

65,024

1.38

%

$

9,531,330

$

5,970

0.13

%

Money market accounts

13,929,069

158,012

2.29

15,685,030

12,199

0.16

Savings deposits

1,322,846

491

0.07

1,483,547

139

0.02

Time deposits

4,237,249

61,047

2.91

2,919,242

3,826

0.26

Brokered deposits

5,950,539

131,141

4.44

2,833,580

10,026

0.71

Federal funds purchased and securities

sold under repurchase agreements

110,852

1,021

1.83

220,689

230

0.21

Other short-term borrowings

1,062,908

24,559

4.60

244,202

896

0.73

Long-term debt

3,486,453

98,444

5.63

930,131

18,913

4.07

Total interest-bearing liabilities

39,593,397

$

539,739

2.75

%

33,847,751

$

52,199

0.31

%

Non-interest-bearing demand deposits

14,441,205

16,727,040

Other liabilities

1,539,939

1,195,043

Total equity

4,750,832

4,925,704

Total liabilities and equity

$

60,325,373

$

56,695,538

Net interest income, taxable equivalent

net interest margin (6)

$

938,541

3.32

%

$

819,459

3.11

%

Less: taxable-equivalent adjustment

2,258

1,824

Net interest income

$

936,283

$

817,635

(1)

Average loans are shown net of deferred

fees and costs. NPLs are included.

(2)

Interest income includes net loan fees as

follows: 2023 — $22.8 million and 2022 — $33.7 million.

(3)

Reflects taxable-equivalent adjustments,

using the statutory federal tax rate of 21%, in adjusting interest

on tax-exempt loans to a taxable-equivalent basis.

(4)

Includes interest-bearing funds with

Federal Reserve Bank, interest earning deposits with banks, and

federal funds sold and securities purchased under resale

agreements.

(5)

Includes average net unrealized

gains/(losses) on investment securities available for sale of

$(1.49) billion and $(587.1) million for the six months ended June

30, 2023 and 2022, respectively.

(6)

The net interest margin is calculated by

dividing annualized net interest income-taxable equivalent by

average total interest earning assets.

Synovus

LOANS OUTSTANDING BY TYPE

(Unaudited)

Total Loans

Total Loans

Linked Quarter

Total Loans

Year/Year

(Dollars in thousands)

Loan Type

June 30, 2023

March 31, 2023

% Change

June 30, 2022

% Change

Commercial, Financial, and

Agricultural

$

14,166,890

$

14,201,398

—

%

$

13,018,089

9

%

Owner-Occupied

8,364,342

8,398,778

—

7,760,236

8

Total Commercial &

Industrial

22,531,232

22,600,176

—

20,778,325

8

Multi-Family

3,597,497

3,374,129

7

2,547,706

41

Hotels

1,771,381

1,737,163

2

1,597,930

11

Office Buildings

3,031,806

3,071,236

(1

)

2,680,399

13

Shopping Centers

1,329,492

1,332,078

—

1,458,902

(9

)

Warehouses

1,068,734

1,020,921

5

811,738

32

Other Investment Property

1,471,356

1,441,303

2

1,311,373

12

Total Investment Properties

12,270,266

11,976,830

2

10,408,048

18

1-4 Family Construction

205,459

201,896

2

234,379

(12

)

1-4 Family Investment Mortgage

410,267

394,754

4

407,476

1

Total 1-4 Family Properties

615,726

596,650

3

641,855

(4

)

Commercial Development

60,910

63,004

(3

)

109,764

(45

)

Residential Development

98,229

106,872

(8

)

156,816

(37

)

Land Acquisition

248,767

253,399

(2

)

186,934

33

Land and Development

407,906

423,275

(4

)

453,514

(10

)

Total Commercial Real Estate

13,293,898

12,996,755

2

11,503,417

16

Consumer Mortgages

5,379,284

5,246,640

3

5,124,523

5

Home Equity

1,773,987

1,757,250

1

1,579,218

12

Credit Cards

187,677

184,595

2

194,290

(3

)

Other Consumer Loans

1,187,459

1,259,523

(6

)

2,025,007

(41

)

Total Consumer

8,528,407

8,448,008

1

8,923,038

(4

)

Total

$

44,353,537

$

44,044,939

1

%

$

41,204,780

8

%

NON-PERFORMING LOANS

COMPOSITION

(Unaudited)

Total

Non-performing Loans

Total

Non-performing Loans

Linked Quarter

Total

Non-performing Loans

Year/Year

(Dollars in thousands)

Loan Type

June 30, 2023

March 31, 2023

% Change

June 30, 2022

% Change

Commercial, Financial, and

Agricultural

$

144,415

$

94,196

53

%

$

48,601

197

%

Owner-Occupied

22,197

25,591

(13

)

11,398

95

Total Commercial &

Industrial

166,612

119,787

39

59,999

178

Multi-Family

1,748

1,806

(3

)

2,598

(33

)

Office Buildings

28,024

190

nm

1,796

nm

Shopping Centers

699

727

(4

)

750

(7

)

Warehouses

218

222

(2

)

924

(76

)

Other Investment Property

664

668

(1

)

1,302

(49

)

Total Investment Properties

31,353

3,613

768

7,370

325

1-4 Family Construction

632

—

nm

55

nm

1-4 Family Investment Mortgage

3,525

3,515

—

3,063

15

Total 1-4 Family Properties

4,157

3,515

18

3,118

33

Commercial Development

—

—

nm

432

(100

)

Residential Development

267

267

—

399

(33

)

Land Acquisition

871

886

(2

)

1,093

(20

)

Land and Development

1,138

1,153

(1

)

1,924

(41

)

Total Commercial Real Estate

36,648

8,281

343

12,412

195

Consumer Mortgages

41,877

39,536

6

22,857

83

Home Equity

9,936

7,967

25

8,100

23

Other Consumer Loans

6,433

6,889

(7

)

5,656

14

Total Consumer

58,246

54,392

7

36,613

59

Total

$

261,506

$

182,460

43

%

$

109,024

140

%

Synovus

CREDIT QUALITY DATA

(Unaudited)

(Dollars in thousands)

2023

2022

Second

Quarter

Second

First

Fourth

Third

Second

'23 vs '22

Quarter

Quarter

Quarter

Quarter

Quarter

% Change

Non-performing Loans (NPLs)

$

261,506

182,460

128,061

122,094

109,024

140

%

Impaired Loans Held for Sale

—

—

—

447

—

nm

Other Real Estate and Other Assets

—

—

15,320

15,320

26,759

(100

)

Non-performing Assets (NPAs)

261,506

182,460

143,381

137,861

135,783

93

Allowance for Loan Losses (ALL)

471,238

457,010

443,424

421,359

407,837

16

Reserve for Unfunded Commitments

55,729

57,473

57,455

57,936

50,559

10

Allowance for Credit Losses (ACL)

526,967

514,483

500,879

479,295

458,396

15

Net Charge-Offs - Quarter

26,396

18,550

13,300

4,682

16,565

Net Charge-Offs - YTD

44,947

18,550

53,156

39,856

35,174

Net Charge-Offs / Average Loans - Quarter

(1)

0.24

%

0.17

0.12

0.04

0.16

Net Charge-Offs / Average Loans - YTD

(1)

0.20

0.17

0.13

0.13

0.18

NPLs / Loans

0.59

0.41

0.29

0.29

0.26

NPAs / Loans, ORE and specific other

assets

0.59

0.41

0.33

0.32

0.33

ACL/Loans

1.19

1.17

1.15

1.13

1.11

ALL/Loans

1.06

1.04

1.01

0.99

0.99

ACL/NPLs

201.51

281.97

391.13

392.56

420.45

ALL/NPLs

180.20

250.47

346.26

345.11

374.08

Past Due Loans over 90 days and Still

Accruing

$

3,643

3,529

3,373

3,443

2,251

62

As a Percentage of Loans Outstanding

0.01

%

0.01

0.01

0.01

0.01

Total Past Due Loans and Still

Accruing

$

84,946

55,053

65,568

63,545

56,160

51

As a Percentage of Loans Outstanding

0.19

%

0.12

0.15

0.15

0.14

(1) Ratio is annualized.

SELECTED CAPITAL INFORMATION

(1)

(Unaudited)

(Dollars in thousands)

June 30,

2023

December 31,

2022

June 30,

2022

Common Equity Tier 1 Capital Ratio

9.85

%

9.63

9.46

Tier 1 Capital Ratio

10.88

10.68

10.56

Total Risk-Based Capital Ratio

12.79

12.54

12.43

Tier 1 Leverage Ratio

9.23

9.07

9.03

Total Synovus Financial Corp.

shareholders' equity as a Percentage of Total Assets

7.88

7.49

7.99

Tangible Common Equity Ratio (2) (4)

6.17

5.84

6.26

Book Value Per Common Share (3)

$

29.05

27.07

27.84

Tangible Book Value Per Common Share

(2)

25.37

23.78

24.52

(1) Current quarter regulatory capital

information is preliminary.

(2) Excludes the carrying value of

goodwill and other intangible assets from common equity and total

assets.

(3) Book Value Per Common Share consists

of Total Synovus Financial Corp. shareholders’ equity less

Preferred stock divided by total common shares outstanding.

(4) See "Non-GAAP Financial Measures" for

applicable reconciliation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230719590036/en/

Media Contact Audria Belton Media Relations

media@synovus.com

Investor Contact Jennifer Demba Investor Relations

investorrelations@synovus.com

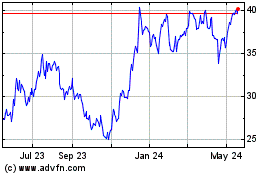

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Jan 2025 to Feb 2025

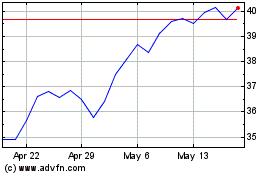

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Feb 2024 to Feb 2025