- Subdued demand and market overstock continue to severely

adversely impact the Company’s financial results and

liquidity

- Key restructuring measures include the termination or

winding down of non-performing assets, the rightsizing of

under-performing business units as well as the evaluation of

disposals of non-core assets

- In connection with the strategic realignment the Company

will delist its shares from the NYSE and terminate its SEC

reporting requirements

- The role of the current CEO of Internetstores, Torsten Waack

van Wasen, will be expanded to join the management team as Chief

Performance Officer (CPO) of the Group.

SIGNA Sports United N.V. (“SSU” or the “Company”), a specialist

sports e-commerce company with businesses in bike, tennis, outdoor,

and teamsports, today announced an acceleration of its strategic

realignment and performance enhancement program in light of

continuing macroeconomic headwinds, oversupply in the market and

the Company’s severe liquidity and profitability challenges.

The operating environment for the Company in the first nine

months of FY23 and thereafter was characterized by a continuation

of material disruptions which started in the second half of last

year. Although some economic indicators across core markets have

continued to improve slightly, the demand for the Company’s

products remains significantly below 2022 and pre-pandemic levels.

In addition, inventory levels across the industry remain elevated

as market participants still aim to clear excess inventory,

resulting in a material adverse effect on the Company’s gross

margins and increasing negative cash flows.

The Company’s management has responded to ongoing market

dynamics by undertaking a thorough review of the Company’s

operating model. Consistent with this initiative, and as a result

of the challenging macroeconomic environment, a sustained

oversupply in the Company’s relevant markets and the resulting

severe and materially adverse impact on the Company’s liquidity and

profitability situation, the Company’s Board of Directors has

resolved together with management to implement a transforming

strategic realignment, performance enhancement and downsizing

program for the Company and all of its subsidiaries with the aim of

returning the business to profitability and free cash flow

breakeven as soon as possible. The key performance enhancement

measures under consideration include the streamlining and

rightsizing of under-performing business units, the termination or

winding down of non-performing assets as well as the opportunistic

evaluation of disposals of non-core assets to strengthen the

company‘s distressed liquidity position and financial profile.

In addition, also taking into account the limited liquidity and

trading volume in the Company’s publicly listed shares since the

business combination in December 2021, the Company’s Board of

Directors has concluded that the benefits associated with being

listed on the New York Stock Exchange (“NYSE”) do not justify the

costs and demands of management’s time necessary to meet the

Company’s US regulatory commitments. Consequently, the Company’s

Board of Directors decided to immediately start the process to

delist the Company’s shares from the NYSE. It is expected that such

delisting will become effective on or around October 22, 2023.

After the NYSE delisting becomes effective, the Company intends to

promptly initiate the process for suspending its reporting

obligations under the US Securities Exchange Act of 1934, as

amended. The Company expects that the US deregistration of its

securities under the US Securities Exchange Act of 1934, as

amended, will become effective prior to December 31, 2023.

To support the accelerated realignment and performance

enhancement program the Board of Directors will extend the scope of

the duties of Torsten Waack van Wasen, CEO of Internetstores since

February 2023, to become part of the Company’s management team as

Chief Performance Officer (CPO) for the Group. Torsten Waack van

Wasen has many years of restructuring experience from his prior

positions, including at Alvarez & Marsal and Alteri Investors.

After expiry of the contract of the Company’s CEO Stephan Zoll in

the 1st quarter 2024, Torsten Waack van Wasen will follow him as

CEO of the Company.

The Company’s Board of Directors determined that the accelerated

broader strategic realignment and performance enhancement plan, in

conjunction with the NYSE delisting and suspension of US reporting

obligations, is in the overall best interests of the Company and

its stockholders.

Outlook & Guidance

Since announcing FY23 guidance, operating performance,

particularly in the Bike segment has continued to lag management

expectations. As a result of weaker consumer demand and elevated

promotional activity to rightsize inventory levels, SSU management

anticipates FY23 net revenue will fall below FY23 Guidance of (9)%

- (11)% and FY23 free cash flow may miss the low end of the

previously provided range.

As the Company enters FY24, it is the belief of SSU management

that the market disruptions associated with market overstock are

likely to persist into late FY24 and will adversely impact the

Company’s ability to achieve its near-term growth and profitability

targets. As a result, and in light of the upcoming accelerated

realignment and restructuring program, the Company is withdrawing

its previously stated mid / long-term guidance provided in H1

FY23.

About SIGNA Sports United:

SIGNA Sports United (SSU) is a specialist sports e-commerce

company with headquarters in Berlin. It has businesses operating

within bike, tennis, outdoor, and team sports. SSU has more than 80

online sites and partners with 500 shops serving over 6 million

customers worldwide. It includes Tennis-Point, WiggleCRC,

Fahrrad.de, Bikester, Probikeshop, Campz, Addnature, TennisPro and

Outfitter.

Further information: www.signa-sportsunited.com.

Forward-Looking Statements

These forward-looking statements include, but are not limited

to, statements regarding future events, the estimated or

anticipated future results and benefits of SSU following the

announced strategic realignment and performance enhancement

program, future opportunities for SSU, future planned products and

services, business strategy and plans, objectives of management for

future operations of SSU, market size and growth opportunities,

competitive position, technological and market trends, and other

statements that are not historical facts. Forward-looking

statements are generally accompanied by words such as believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” “should,” “could,” “would,” “plan,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook,” “suggests,”

“targets,” “projects,” “forecast” and similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. These forward-looking statements

are provided for illustrative purposes only and are not intended to

serve as, and must not be relied on, by any investor as a

guarantee, an assurance, a prediction or a definitive statement of

fact or probability. Actual events and circumstances are difficult

or impossible to predict and will differ from assumptions. All

forward-looking statements are based upon estimates and forecasts

and reflect the views, assumptions, expectations, and opinions of

the Company, which are all subject to change due to various factors

including, without limitation, changes in general economic

conditions as a result of the war in Ukraine, significant

inflation, higher financing costs, an increase in energy costs, a

negative consumer sentiment and COVID-19. Any such estimates,

assumptions, expectations, forecasts, views or opinions, whether or

not identified in this document, should be regarded as indicative,

preliminary and for illustrative purposes only and should not be

relied upon as being necessarily indicative of future results.

Forward-looking statements appear in a number of places in this

press release and include, but are not limited to, statements

regarding our intent, belief or current expectations.

Forward-looking statements are based on our management’s beliefs

and assumptions and on information currently available to our

management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or

implied in the forward-looking statements due to various factors.

The forward-looking statements in this press release may include,

without limitations, statements about:

- our liquidity and losses from operations and projected cash

flows and related impact on our ability to continue as a going

concern;

- our future financial condition and operating results;

- our ability to remain in compliance with financial covenants

under our financing arrangements;

- our ability to extend, renew or refinance our existing

debt;

- our growth, expansion and acquisition prospects and strategies,

the success of such strategies, and the benefits we believe can be

derived from such strategies;

- our ability to effectively manage our inventory and inventory

reserves;

- impairments of our goodwill or other intangible assets;

- changes in consumer spending patterns and overall levels of

consumer spending;

- our ability to further upgrade our information technology

systems and infrastructure, including our accounting processes and

functions, and other risks associated with the systems that operate

our online retail operations;

- our ability to continue to remedy weaknesses in our internal

controls;

- costs as a result of operating as a public company;

- our assumptions regarding interest rates and inflation;

- changes affecting currency exchange rates;

- continuing business disruptions arising from the on-going war

in Ukraine and in the aftermath of the coronavirus pandemic;

- our financial condition and ability to obtain financing in the

future to implement our business strategy and fund capital

expenditures, acquisitions and other general corporate

activities;

- estimated future capital expenditures needed to preserve our

capital base;

- changes in general economic conditions in the Federal Republic

of Germany (“Germany”), and the European Union and the Unites

States of America, including changes in the unemployment rate, the

level of energy and consumer prices, wage levels, etc.;

- the further development of online sports markets, in particular

the levels of acceptance of internet retailing;

- our behavior on mobile devices and our ability to attract

mobile internet traffic and convert such traffic into purchases of

our goods;

- our ability to offer our customers an inspirational and

attractive online purchasing experience;

- demographic changes, in particular with respect to

Germany;

- changes in our competitive environment and in our competition

level;

- the occurrence of accidents, terrorist attacks, natural

disasters, fires, environmental damage, or systemic delivery

failures;

- our inability to attract and retain qualified personnel,

consultants and collaborators;

- political changes;

- changes in laws and regulations;

- our expectations relating to dividend payments and forecasts of

our ability to make such payments; and

- other factors discussed in “Item 3. Key Information — D. Risk

Factors” in our 20-F filing as of February 7, 2023 and Exhibit 99.4

in our 6-K filing as of June 28, 2023.

Forward-looking statements are subject to known and unknown

risks and uncertainties and are based on potentially inaccurate

assumptions that could cause actual results to differ materially

from those expected or implied by the forward-looking statements.

Actual results could differ materially from those anticipated in

forward-looking statements for many reasons, including the factors

described in “Item 3. Key Information—D. Risk Factors” in our 20-F

filing as of February 7, 2023 and Exhibit 99.4 in our 6-K filing as

of June 28, 2023 and our ability to continue as a going concern.

Accordingly, you should not rely on these forward-looking

statements, which speak only as of the date of this press release.

You should, however, review the factors and risks we describe in

the reports we will file from time to time with the SEC after the

date of this press release.

In addition, statements such as “we believe” and similar

statements reflect our beliefs and opinions on the relevant

subject. These statements are based on information available to us

as of the date of this press release. And while we believe that

information provides a reasonable basis for these statements, that

information may be limited or incomplete. Our statements should not

be read to indicate that we have conducted an exhaustive inquiry

into, or review of, all relevant information. These statements are

inherently uncertain, and you are cautioned not to rely unduly on

these statements.

Although we believe the expectations reflected in the

forward-looking statements were reasonable at the time made, we

cannot guarantee future results, level of activity, performance or

achievements. Moreover, neither we nor any other person assumes

responsibility for the accuracy or completeness of any of these

forward-looking statements. You should carefully consider the

cautionary statements contained or referred to in this section in

connection with the forward-looking statements contained in this

press release and any subsequent written or oral forward-looking

statements that may be issued by us or persons acting on our

behalf.

About SIGNA Sports United:

SIGNA Sports United (SSU) is a NYSE-listed specialist sports

e-commerce company with headquarters in Berlin. It has businesses

operating within bike, tennis, outdoor, and team sports. SSU has

more than 80 online sites and partners with 500 shops serving over

6 million customers worldwide. It includes Tennis-Point, WiggleCRC,

Fahrrad.de, Bikester, Probikeshop, Campz, Addnature, TennisPro and

Outfitter.

Further information: www.signa-sportsunited.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230925460768/en/

SSU Investor & Media Contact Michael Cramer

mc@altcramer.com

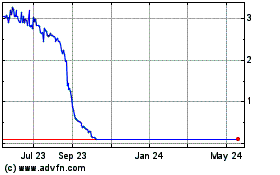

SIGNA Sports United NV (NYSE:SSU)

Historical Stock Chart

From Nov 2024 to Dec 2024

SIGNA Sports United NV (NYSE:SSU)

Historical Stock Chart

From Dec 2023 to Dec 2024