TCI Subsidiary, Southern Properties Capital, Receives Bond Rating Increase by Standard & Poor’s Global Rating

February 05 2020 - 7:00AM

Business Wire

Transcontinental Realty Investors Inc. (NYSE: TCI) announces

that its subsidiary Southern Properties Capital (SPC), both

Dallas-based real estate investment companies, received Standard

& Poor’s Global Ratings increases on their A, B, and C series

bonds listed on the Tel Aviv Stock Exchange. As previously

reported, TCI/SPC was the first Dallas based firm to raise capital

on the Israeli bond market. Prior to the Southern Properties

Capital issuance, the market was previously dominated by Manhattan

based companies, but has once again shown increased demand for

additional bond issuers throughout the United States.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20200205005183/en/

TCI and Southern Properties Capital received notice of the

revised rating on February 2, 2020. S&P increased the A & B

bond series from a BBB+ rating to an A- rating and increased the C

series from AAA- to A rating.

The Series A was raised in August 2017 and the series B offering

was in March 2018 with a combined total of over 610 million

shekels, approximately $174 million. The company then raised an

additional $78 million bond series C on the Tel Aviv Stock Exchange

in July 2019.

”The enhanced rating demonstrates the company’s commitment to

owning and operating a quality portfolio of assets,” said Daniel J.

Moos, CEO and President. “The attention to detail by the management

organization is also reflected in the rating increase.”

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors maintains a strong emphasis on

creating greater shareholder value through acquisition, financing,

operation, development, and sale of real estate across every

geographic region in the United States. A New York Stock Exchange

company, Transcontinental is traded under the symbol "TCI".

Transcontinental produces revenue through the ownership and

professional management of income producing apartments and office

buildings that are "undervalued" or "underperforming" at the time

of acquisition. Value is added under Transcontinental ownership,

and the properties are repositioned into higher classifications

through physical improvements and improved management.

Transcontinental has dramatically expanded its development

capabilities associated with luxury apartment homes through its

wholly owned subsidiary Abode Properties, principally on land it

owns or acquires.

About Southern Properties Capital

Southern Properties Capital (SPC) operates in Southeast and

Southwest USA. The Company’s core assets are tied to owning and

operating Class A multi-family apartments and two very prominent

and viable Multi Use development properties in Greater Dallas. The

Company’s business strategy is to continue to expand its Class A

multifamily portfolio through new development and financially

attractive acquisitions. Victory Abode (VAA) is a joint venture

portfolio within Southern Properties.

About Victory Abode Apartments

Victory Abode Apartments (VAA) is one of the largest

multi-family operating companies in the country. VAA is immediately

poised to address existing and future demand for quality

multifamily residential housing through acquisition and development

of sustainable Class A multifamily housing in focused secondary and

tertiary markets. VAA’s strong equity position is balanced through

the use of fixed-rate, long-term HUD mortgage debt, commercial

mortgages, and the use of various conventional construction

lenders. The company will be principally operated by a dedicated

and highly professional management team with decades of industry

experience, with strategic support from the venture partner.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200205005183/en/

Media Contacts: Chris Childress, Pillar Income Asset

Management 469.522.4275 / press@pillarincome.com

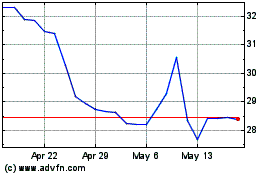

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

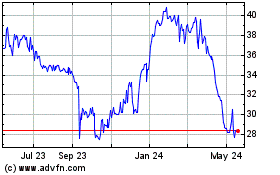

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Feb 2024 to Feb 2025