More than 40% of respondents are still facing

recession anxieties, which include the impact of the election,

according to TD Bank's 2024 Merry Money Survey.

TD Bank, America’s Most Convenient Bank®, today announced the

findings of its 2024 Merry Money Survey, revealing that more than

half (52%) are scaling back their spending due to recession

anxieties, and more than four out of every ten (42%) respondents

are weighing their holiday spending behavior based on the impact

from this election. Despite these concerns, 79% of consumers still

feel confident in their ability to manage their holiday spending,

with 64% indicating that they plan to spend less than $600 in total

on gifts.

TD polled 2,000+ U.S. consumers regarding their shopping and

overall money management habits ahead of the holiday season. The

survey found that shoppers are seeking out those special deals this

year, with 82% indicating that they are actively looking for offers

and price reductions for their shopping.

"The uncertainty of an election season, coupled with the current

volatile economic environment, is making this holiday season even

more stressful for consumers," said Courtney Mitchell, Retail

Market President, Metro PA/South Jersey Region at TD Bank. “That's

why trying to stick to a budget remains one of the most important

steps consumers can take to help ease some of the stress that comes

with the holiday shopping season."

Have Yourself a (Budget) Mindful Holiday

Though interest rates and inflation are trending down, shoppers

are still getting strategic with their spending and taking

advantage of seasonal deals. In fact, more than half (55%) of

respondents plan to make the bulk of their purchases on November’s

Black Friday.

To further combat overspending, 81% of respondents have

considered ways to keep their budgets in line. Some shoppers are

spending less this season, with one-third (33%) of respondents

indicating that they are reducing their gift spending compared to

previous years. As another way to avoid overspending, 22% are

setting aside extra money in advance of the holidays. Additionally,

61% of people are cutting back on other discretionary spending,

such as dining out, in preparation for holiday budgets.

While many are focusing on saving, Gen Z stands out as the most

likely to indulge in self-gifting, with 38% admitting to going over

budget to buy gifts for themselves, compared to 30% of Millennials,

25% of Gen X, and 17% of Baby Boomers.

Shoppers Unwrapping Memories

This year’s survey also revealed that shoppers are gradually

shifting from traditional wrapped presents to experiences,

reflecting a change in how they approach holiday giving. Nearly

half (45%) of consumers plan to gift experiences over physical

items, with younger generations leading the way. Gen Z (68%) and

Millennials (61%) are at the forefront of this movement, while Baby

Boomers (23%) remain more attached to conventional gifts.

The trend is particularly strong among higher-income households,

with 55% of those earning $100,000 or more opting for experiential

gifts. Dining experiences top the list, as 53% of consumers who

will gift an experience plan to treat loved ones to a special meal

or evening out.

All I Want This Year is Purchase Protection

When it comes to holiday shopping, consumers are prioritizing

both rewards and security in their payment choices. Debit cards

still lead the way, with 42% of shoppers choosing them as their

preferred method of payment. Credit cards follow closely at 34%,

with many consumers drawn to the perks they offer and 69% of those

who prefer credit cards citing rewards or cash back as the primary

reason for their choice. Additionally, 31% of credit card users say

the enhanced protections provided by credit cards, such as fraud

prevention and purchase protection, are key factors in their

decision. Meanwhile, 18% of respondents still prefer cash or checks

for their holiday spending.

“During the holiday season, shoppers are not only looking for

great deals but also for added protections that provide peace of

mind," said Chris Fred, Head of Credit Cards and Unsecured Lending

at TD Bank. “Using a credit card for holiday spending can offer

shoppers benefits like fraud and purchase protection, cell phone

coverage, emergency card replacement, and identity theft

protection, allowing them to shop confidently knowing their

purchases and personal information are secure.”

Festive and Financially Fit

Despite the holiday season bringing some financial uneasiness

for many shoppers, there’s a silver lining as consumers remain

optimistic about managing their budgets and are taking the steps to

remain financially well in periods of increased spending. Nearly

three-quarters (73%) of respondents admit to feeling financial

anxiety, yet most are determined to stay on top of their

spending.

Most consumers (86%) who have overspent during past holidays

have considered adjusting their future holiday spending habits to

avoid overspending. Additionally, 62% of credit card users plan to

pay off their holiday shopping balances in full by January 2025.

This shows a proactive approach to financial management, with many

consumers seeking out deals and being thoughtful of their spending

habits. Even in the face of high gift prices, shoppers are

determined to enjoy the season while keeping their finances in

check.

With global trends top of mind for many this holiday season,

consumers also revealed:

- Jingle All the Way, AI is in Play: Almost one-fifth

(19%) of respondents are considering using generative AI for their

holiday shopping ideas this year. Of those respondents, more than

two-thirds (69%) indicated that they have a preference for brands

that offer AI or virtual reality features.

- Some Gifts Come with Expectations: Of those who do plan

to give cash gifts, more than half (52%) of respondents have a

specific hope for what recipients will use the money for.

- In Hopes that Retirement Soon Would Be Here: Alarmingly,

17% of respondents have adjusted their contributions to their

retirement savings in order to account for an increase in holiday

spending. This change is most noticeable among Gen Z and

Millennials, with 25% of each group making adjustments, compared to

just 14% of Gen X and 7% of Baby Boomers.

“Budgeting, maximizing deals, and strategically using credit

card rewards are all great ways to keep spending in check. By

planning ahead and taking advantage of available offers, people can

enjoy the holidays without the financial strain that can follow the

season,” added Mitchell.

This data is for general informational purposes only. It is not

intended to provide specific financial, investment, tax, legal,

accounting, or other advice and should not be acted or relied upon

without the advice of a professional advisor. A professional

advisor will recommend action based on your personal circumstances

and the most recent information available.

Methodology

Big Village surveyed 2,005 Americans 18 years of age or older

who celebrate the holidays. The online survey was conducted

September 25-29, 2024.

About Big Village Insights

Big Village Insights is a global research and analytics business

uncovering not just the ‘what’ but the ‘why’ behind customer

behavior, supporting clients' insights needs with agile tools, CX

research, branding, product innovation, data & analytics, and

more. Big Village Insights is part of Bright Mountain Media. Find

out more at https://big-village.com.

About TD Bank, America's Most Convenient Bank®

TD Bank, America's Most Convenient Bank, is one of the 10

largest banks in the U.S. by assets, providing over 10 million

customers with a full range of retail, small business and

commercial banking products and services at more than 1,100

convenient locations throughout the Northeast, Mid-Atlantic, Metro

D.C., the Carolinas and Florida. In addition, TD Auto Finance, a

division of TD Bank, N.A., offers vehicle financing and dealer

commercial services. TD Bank and its subsidiaries also offer

customized private banking and wealth management services through

TD Wealth®. TD Bank is headquartered in Cherry Hill, N.J. To learn

more, visit www.td.com/us. Find TD Bank on Facebook at

www.facebook.com/TDBank and on Instagram at

www.instagram.com/TDBank_US/.

TD Bank is a subsidiary of The Toronto-Dominion Bank, a top 10

North American bank. The Toronto-Dominion Bank trades on the New

York and Toronto stock exchanges under the ticker symbol "TD". To

learn more, visit www.td.com/us.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119308982/en/

Media: Catherine Achey Corporate Communications Manager

catherine.achey@td.com

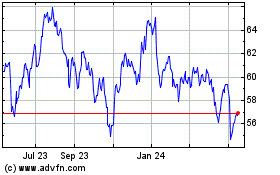

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Dec 2024 to Jan 2025

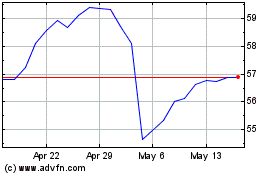

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Jan 2024 to Jan 2025