UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

February 14, 2023

Commission File Number 001-33725

Textainer Group Holdings Limited

(Translation of Registrant’s name into English)

Century House

16 Par-La-Ville Road

Hamilton HM 08

Bermuda

(441) 296-2500

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable

This report contains a copy of the press release entitled “Textainer Group Holdings Limited Reports Fourth-Quarter and Full-Year 2022 Results and Increases Dividend,” dated February 14, 2023.

Exhibit

99.1 Press Release dated February 14, 2023

Textainer Group Holdings Limited

Reports Fourth-Quarter and Full-Year 2022 Results and Increases Dividend

HAMILTON, Bermuda – (GlobeNewswire) – February 14, 2023 –Textainer Group Holdings Limited (NYSE: TGH; JSE: TXT) (“Textainer”, “the Company”, “we” and “our”), one of the world’s largest lessors of intermodal containers, today reported financial results for the fourth-quarter and full-year ended December 31, 2022.

Key Financial Information (in thousands except for per share and TEU amounts) and Business Highlights:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QTD |

|

|

Full-Year |

|

|

|

Q4 2022 |

|

|

Q3 2022 |

|

|

Q4 2021 |

|

|

2022 |

|

|

2021 |

|

Total lease rental income |

|

$ |

202,912 |

|

|

$ |

205,152 |

|

|

$ |

198,222 |

|

|

$ |

810,014 |

|

|

$ |

750,730 |

|

Gain on sale of owned fleet containers, net |

|

$ |

15,033 |

|

|

$ |

22,788 |

|

|

$ |

16,007 |

|

|

$ |

76,947 |

|

|

$ |

67,229 |

|

Income from operations |

|

$ |

111,544 |

|

|

$ |

123,292 |

|

|

$ |

113,986 |

|

|

$ |

472,399 |

|

|

$ |

430,131 |

|

Net income attributable to common shareholders |

|

$ |

61,854 |

|

|

$ |

76,400 |

|

|

$ |

72,885 |

|

|

$ |

289,549 |

|

|

$ |

273,459 |

|

Net income attributable to common shareholders

per diluted common share |

|

$ |

1.38 |

|

|

$ |

1.64 |

|

|

$ |

1.45 |

|

|

$ |

6.12 |

|

|

$ |

5.41 |

|

Adjusted net income (1) |

|

$ |

61,993 |

|

|

$ |

76,562 |

|

|

$ |

73,229 |

|

|

$ |

289,946 |

|

|

$ |

284,087 |

|

Adjusted net income per diluted common share (1) |

|

$ |

1.38 |

|

|

$ |

1.64 |

|

|

$ |

1.46 |

|

|

$ |

6.13 |

|

|

$ |

5.62 |

|

Adjusted EBITDA (1) |

|

$ |

179,464 |

|

|

$ |

192,647 |

|

|

$ |

182,150 |

|

|

$ |

745,514 |

|

|

$ |

697,948 |

|

Average fleet utilization (2) |

|

|

99.0 |

% |

|

|

99.4 |

% |

|

|

99.7 |

% |

|

|

99.4 |

% |

|

|

99.8 |

% |

Total fleet size at end of period (TEU) (3) |

|

|

4,425,300 |

|

|

|

4,478,963 |

|

|

|

4,322,367 |

|

|

|

4,425,300 |

|

|

|

4,322,367 |

|

Owned percentage of total fleet at end of period |

|

|

93.6 |

% |

|

|

93.6 |

% |

|

|

92.8 |

% |

|

|

93.6 |

% |

|

|

92.8 |

% |

(1)Refer to the “Use of Non-GAAP Financial Information” set forth below.

(2)Utilization is computed by dividing total units on lease in CEUs (cost equivalent unit) by the total units in our fleet in CEUs, excluding CEUs that have been designated as held for sale and units manufactured for us but not yet delivered to a lessee. CEU is a unit of measurement based on the approximate cost of a container relative to the cost of a standard 20-foot dry container. These factors may differ from CEU ratios used by others in the industry.

(3)TEU refers to a twenty-foot equivalent unit, which is a unit of measurement used in the container shipping industry to compare shipping containers of various lengths to a standard 20-foot container, thus a 20-foot container is one TEU and a 40-foot container is two TEU.

•Net income of $289.5 million for the full year, or $6.12 per diluted common share, and $61.9 million for the fourth quarter of 2022, or $1.38 per diluted common share;

•Adjusted net income of $289.9 million for the full year, or $6.13 per diluted common share, as compared to $284.1 million, or $5.62 per diluted common share in the prior year. Adjusted net income of $62.0 million for the fourth quarter of 2022, or $1.38 per diluted common share, as compared to $76.6 million, or $1.64 per diluted common share in the third quarter of 2022;

•Adjusted EBITDA of $745.5 million for the full year, as compared to $697.9 million in the prior year. Adjusted EBITDA of $179.5 million for the fourth quarter of 2022, as compared to $192.6 million in the third quarter of 2022;

•Average and ending utilization rate for the fourth quarter of 99.0% and 98.9%, respectively;

•Added $786 million of new containers in 2022, assigned to long-term and finance leases;

•Repurchased 1,543,267 shares and 5,636,772 shares of common stock at an average price of $29.29 per share and $31.69 per share during the fourth quarter and full year of 2022, respectively. As of the end of the year, the remaining authority under the share repurchase program totaled $122.5 million;

•Textainer’s board of directors approved and declared a quarterly preferred cash dividend on its 7.00% Series A and its 6.25% Series B cumulative redeemable perpetual preference shares, payable on March 15, 2023, to holders of record as of March 3, 2023; and

•Textainer’s board of directors approved and declared a $0.30 per common share cash dividend, payable on March 15, 2023 to holders of record as of March 3, 2023, an increase of $0.05 per common share, or 20%, from the previous quarter.

“We are pleased to deliver a record profit for 2022, confirming an extraordinary performance across all our key business fundamentals. For the full year 2022, lease rental income increased 8% to $810 million, driven by organic fleet growth from capex deployed in the first half of the year and the full year impact from capex investment in 2021. Adjusted net income reached $290 million, or $6.13 per diluted share, benefiting from our profitable fleet growth, exceptional resale market, and positive impact from our robust share repurchase program. Finally, we achieved an adjusted EBITDA of $746 million and a ROE of over 18% for the year,” stated Olivier Ghesquiere, President and Chief Executive Officer.

“The last two years were a pivotal period of growth within the container shipping industry, allowing us to expand our fleet and improve the quality of our top line while greatly strengthening our balance sheet. As exceptional gain on sale normalizes to more sustainable levels, our long-term lease contracts in particular will support high utilization and long-term profitability which places us in an ideal position to prepare for the next favorable market opportunity.”

“In the meantime, the strong cash flow generation of the fleet continues to support our ability to return capital to shareholders. During the year, share repurchases totaled 5.6 million shares, or 11.5% of our outstanding common shares as of the beginning of the year. Since commencing our share repurchase program in September of 2019, we have repurchased 15.7 million shares, demonstrating our commitment to efficiently managing shareholder returns. In addition, I am very pleased to announce that our board has increased our quarterly common dividend to $0.30 from $0.25 per share, further demonstrating their confidence in our underlying long-term business fundamentals and reliable cash generation.”

“In summary, 2022 was a tremendous year for Textainer and I am very proud of the strong performance across the organization, helping secure our profitability and cash flow for many years to come. Looking ahead, we expect stabilizing performance in 2023 as we continue to strategically assess the environment and invest only in opportunities in line with our long-term profitability objectives. Our core business model is durable and resilient, with contracted revenue and profits protected by our long-term lease contracts and fixed-rate financing policy. While we wait for market demand to turn, possibly towards the end of the year, we will continue to prioritize our capital allocation toward both strengthening our balance sheet and returning capital to our shareholders through ongoing share repurchase and dividend programs,” concluded Ghesquiere.

Fourth-Quarter and Full-Year Results

Total lease rental income for the year increased $59.3 million from 2021 due to an increase in fleet size and average rental rate. Total lease rental income for the quarter decreased $2.2 million from the third quarter of 2022 due to a slight decrease in both fleet size and utilization.

Trading container margin for the year decreased $8.9 million from 2021, mostly due to a decrease in average unit margin per container sold.

Gain on sale of owned fleet containers, net for the year increased $9.7 million from 2021, due to an increase in the number of containers sold, partially offset by a decrease in average gain per container sold. Gain on sale of owned fleet containers, net for the quarter decreased $7.8 million from the third quarter of 2022, due to lower resale prices resulting from market normalization, partially offset by higher container sales volume.

Direct container expense – owned fleet for the year increased $8.6 million from 2021 and for the quarter increased $2.2 million from the third quarter of 2022, due to higher maintenance, handling and storage expense resulting from redeliveries of predominantly older, sales age containers, in turn driving our increased resale activity.

Distribution to managed fleet container investors for the year decreased $6.2 million from 2021 and for the quarter decreased slightly when compared to the third quarter of 2022, due mostly to a reduction in the managed fleet size.

Depreciation and amortization for the year increased $8.7 million from 2021, primarily due to a net increase of our operating lease fleet. Depreciation and amortization for the quarter increased $0.9 million from the third quarter of 2022.

Interest expense for the year increased $30.0 million from 2021, due to a higher average debt balance and an increase in our average effective interest rate. Interest expense for the quarter increased $1.9 million from the third quarter of 2022, primarily driven by an increase in our average effective interest rate.

Debt termination expense for 2021 amounted to $15.2 million, which included a $10.6 million loan termination payment and a $4.2 million write-off of unamortized deferred debt issuance costs, resulting from the early redemption of certain higher-priced fixed-rate asset backed notes with proceeds from our lower-priced debt facilities. There was no debt termination expense in 2022.

Realized loss on financial instruments, net and unrealized gain on financial instruments, net for the year decreased $5.5 million and $4.9 million, respectively, from 2021, primarily due to the termination of all interest rate swaps not designated under hedge accounting during the second and third quarter of 2021. As of September 30, 2021, all of our outstanding interest rate swaps were designated under hedge accounting and no longer generate realized or unrealized gain (loss) on financial instruments.

Conference Call and Webcast

A conference call to discuss the financial results for the fourth quarter and full year of 2022 will be held at 11:00 am Eastern Time on Tuesday, February 14, 2023. The dial-in number for the conference call is 1-877-407-9039 (U.S. & Canada) and 1-201-689-8470 (International). The call and archived replay may also be accessed via webcast on Textainer’s Investor Relations website at http://investor.textainer.com.

About Textainer Group Holdings Limited

Textainer has operated since 1979 and is one of the world’s largest lessors of intermodal containers with more than 4 million TEU in our owned and managed fleet. We lease containers to approximately 200 customers, including all of the world’s leading international shipping lines, and other lessees. Our fleet consists of standard dry freight, refrigerated intermodal containers, and dry freight specials. We also lease tank containers through our relationship with Trifleet Leasing and are a supplier of containers to the U.S. Military. Textainer is one of the largest and most reliable suppliers of new and used containers. In addition to selling older containers from our fleet, we buy older containers from our shipping line customers for trading and resale and we are one of the largest sellers of used containers. Textainer operates via a network of 14 offices and approximately 400 independent depots worldwide. Textainer has a primary listing on the New York Stock Exchange (NYSE: TGH) and a secondary listing on the Johannesburg Stock Exchange (JSE: TXT). Visit www.textainer.com for additional information about Textainer.

Important Cautionary Information Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of U.S. securities laws. Forward-looking statements include statements that are not statements of historical facts and may relate to, but are not limited to, expectations or estimates of future operating results or financial performance, capital expenditures, introduction of new products, regulatory compliance, plans for growth and future operations, as well as assumptions relating to the foregoing. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “continue” or the negative of these terms or other similar terminology. Readers are cautioned that these forward-looking statements involve risks and uncertainties, are only predictions and may differ materially from actual future events or results. These risks and uncertainties include, without limitation, the following items that could materially and negatively impact our business, results of operations, cash flows, financial condition and future prospects: (i) As exceptional gain on sale normalizes to more sustainable levels, our long-term lease contracts in particular will support high utilization and long-term profitability which places us in an ideal position to prepare for the next favorable market opportunity; (ii) Looking ahead, we expect stabilizing performance in 2023 as we continue to strategically assess the environment and invest only in opportunities in line with our long-term profitability objectives; and other risks and uncertainties, including those set forth in Textainer’s filings with the Securities and Exchange Commission. For a discussion of some of these risks and uncertainties, see Item 3 “Key Information— Risk Factors” in Textainer’s Annual Report on Form 20-F filed with the Securities and Exchange Commission on March 17, 2022.

Textainer’s views, estimates, plans and outlook as described within this document may change subsequent to the release of this press release. Textainer is under no obligation to modify or update any or all of the statements it has made herein despite any subsequent changes Textainer may make in its views, estimates, plans or outlook for the future.

Textainer Group Holdings Limited

Investor Relations

Phone: +1 (415) 658-8333

ir@textainer.com

###

TEXTAINER GROUP HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited)

(All currency expressed in United States dollars in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

December 31, 2022 |

|

|

December 31, 2021 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

164,818 |

|

|

$ |

206,210 |

|

Marketable securities |

|

|

1,411 |

|

|

|

— |

|

Accounts receivable, net of allowance of $1,582 and $1,290, respectively |

|

|

114,805 |

|

|

|

125,746 |

|

Net investment in finance leases, net of allowance of $252 and $100, respectively |

|

|

130,913 |

|

|

|

113,048 |

|

Container leaseback financing receivable, net of allowance of $62 and $38, respectively |

|

|

53,652 |

|

|

|

30,317 |

|

Trading containers |

|

|

4,848 |

|

|

|

12,740 |

|

Containers held for sale |

|

|

31,637 |

|

|

|

7,007 |

|

Prepaid expenses and other current assets |

|

|

16,703 |

|

|

|

14,184 |

|

Due from affiliates, net |

|

|

2,758 |

|

|

|

2,376 |

|

Total current assets |

|

|

521,545 |

|

|

|

511,628 |

|

Restricted cash |

|

|

102,591 |

|

|

|

76,362 |

|

Marketable securities |

|

|

— |

|

|

|

2,866 |

|

Containers, net of accumulated depreciation of $2,029,667 and $1,851,664, respectively |

|

|

4,365,124 |

|

|

|

4,731,878 |

|

Net investment in finance leases, net of allowance of $1,027 and $643 respectively |

|

|

1,689,123 |

|

|

|

1,693,042 |

|

Container leaseback financing receivable, net of allowance of $52 and $75, respectively |

|

|

770,980 |

|

|

|

323,830 |

|

Derivative instruments |

|

|

149,244 |

|

|

|

12,278 |

|

Deferred taxes |

|

|

1,135 |

|

|

|

1,073 |

|

Other assets |

|

|

13,492 |

|

|

|

14,487 |

|

Total assets |

|

$ |

7,613,234 |

|

|

$ |

7,367,444 |

|

Liabilities and Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

24,160 |

|

|

$ |

22,111 |

|

Container contracts payable |

|

|

6,648 |

|

|

|

140,968 |

|

Other liabilities |

|

|

5,060 |

|

|

|

4,895 |

|

Due to container investors, net |

|

|

16,132 |

|

|

|

17,985 |

|

Debt, net of unamortized costs of $7,938 and $8,624, respectively |

|

|

377,898 |

|

|

|

380,207 |

|

Total current liabilities |

|

|

429,898 |

|

|

|

566,166 |

|

Debt, net of unamortized costs of $26,946 and $32,019, respectively |

|

|

5,127,021 |

|

|

|

4,960,313 |

|

Derivative instruments |

|

|

— |

|

|

|

2,139 |

|

Income tax payable |

|

|

13,196 |

|

|

|

10,747 |

|

Deferred taxes |

|

|

13,105 |

|

|

|

7,589 |

|

Other liabilities |

|

|

33,725 |

|

|

|

39,236 |

|

Total liabilities |

|

|

5,616,945 |

|

|

|

5,586,190 |

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative redeemable perpetual preferred shares, $0.01 par value, $25,000 liquidation preference

per share. Authorized 10,000,000 shares; 12,000 shares issued and outstanding (equivalent

to 12,000,000 depositary shares at $25.00 liquidation preference per depositary share) |

|

|

300,000 |

|

|

|

300,000 |

|

Common shares, $0.01 par value. Authorized 140,000,000 shares; 59,943,282 shares issued

and 43,634,655 shares outstanding at 2022; 59,503,710 shares issued and 48,831,855 shares

outstanding at 2021 |

|

|

599 |

|

|

|

595 |

|

Treasury shares, at cost, 16,308,627 and 10,671,855 shares, respectively |

|

|

(337,551 |

) |

|

|

(158,459 |

) |

Additional paid-in capital |

|

|

442,154 |

|

|

|

428,945 |

|

Accumulated other comprehensive income |

|

|

147,350 |

|

|

|

9,750 |

|

Retained earnings |

|

|

1,443,737 |

|

|

|

1,200,423 |

|

Total shareholders’ equity |

|

|

1,996,289 |

|

|

|

1,781,254 |

|

Total liabilities and shareholders' equity |

|

$ |

7,613,234 |

|

|

$ |

7,367,444 |

|

|

|

|

|

|

|

|

|

|

TEXTAINER GROUP HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Statements of Operations

(Unaudited)

(All currency expressed in United States dollars in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Years Ended December 31, |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating leases - owned fleet |

|

$ |

151,936 |

|

|

|

$ |

153,962 |

|

|

|

$ |

609,558 |

|

|

|

$ |

589,045 |

|

Operating leases - managed fleet |

|

|

11,994 |

|

|

|

|

13,055 |

|

|

|

|

49,635 |

|

|

|

|

56,037 |

|

Finance leases and container leaseback financing

receivable - owned fleet |

|

|

38,982 |

|

|

|

|

31,205 |

|

|

|

|

150,821 |

|

|

|

|

105,648 |

|

Total lease rental income |

|

|

202,912 |

|

|

|

|

198,222 |

|

|

|

|

810,014 |

|

|

|

|

750,730 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Management fees - non-leasing |

|

|

897 |

|

|

|

|

614 |

|

|

|

|

2,812 |

|

|

|

|

3,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading container sales proceeds |

|

|

4,990 |

|

|

|

|

9,397 |

|

|

|

|

23,791 |

|

|

|

|

32,045 |

|

Cost of trading containers sold |

|

|

(4,904 |

) |

|

|

|

(7,673 |

) |

|

|

|

(21,939 |

) |

|

|

|

(21,285 |

) |

Trading container margin |

|

|

86 |

|

|

|

|

1,724 |

|

|

|

|

1,852 |

|

|

|

|

10,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of owned fleet containers, net |

|

|

15,033 |

|

|

|

|

16,007 |

|

|

|

|

76,947 |

|

|

|

|

67,229 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct container expense - owned fleet |

|

|

10,965 |

|

|

|

|

5,590 |

|

|

|

|

31,980 |

|

|

|

|

23,384 |

|

Distribution expense to managed fleet container investors |

|

|

10,723 |

|

|

|

|

11,590 |

|

|

|

|

44,150 |

|

|

|

|

50,360 |

|

Depreciation and amortization |

|

|

74,140 |

|

|

|

|

73,165 |

|

|

|

|

292,828 |

|

|

|

|

284,115 |

|

General and administrative expense |

|

|

11,898 |

|

|

|

|

12,199 |

|

|

|

|

48,349 |

|

|

|

|

46,462 |

|

Bad debt (recovery) expense, net |

|

|

(3 |

) |

|

|

|

(60 |

) |

|

|

|

740 |

|

|

|

|

(1,285 |

) |

Container lessee default (recovery) expense, net |

|

|

(339 |

) |

|

|

|

97 |

|

|

|

|

1,179 |

|

|

|

|

(1,088 |

) |

Total operating expenses |

|

|

107,384 |

|

|

|

|

102,581 |

|

|

|

|

419,226 |

|

|

|

|

401,948 |

|

Income from operations |

|

|

111,544 |

|

|

|

|

113,986 |

|

|

|

|

472,399 |

|

|

|

|

430,131 |

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(43,105 |

) |

|

|

|

(34,888 |

) |

|

|

|

(157,249 |

) |

|

|

|

(127,269 |

) |

Debt termination expense |

|

|

— |

|

|

|

|

(131 |

) |

|

|

|

— |

|

|

|

|

(15,209 |

) |

Realized loss on financial instruments, net |

|

|

(91 |

) |

|

|

|

(118 |

) |

|

|

|

(91 |

) |

|

|

|

(5,634 |

) |

Unrealized (loss) gain on financial instruments, net |

|

|

(176 |

) |

|

|

|

(272 |

) |

|

|

|

(502 |

) |

|

|

|

4,409 |

|

Other, net |

|

|

658 |

|

|

|

|

160 |

|

|

|

|

2,406 |

|

|

|

|

(367 |

) |

Net other expense |

|

|

(42,714 |

) |

|

|

|

(35,249 |

) |

|

|

|

(155,436 |

) |

|

|

|

(144,070 |

) |

Income before income taxes |

|

|

68,830 |

|

|

|

|

78,737 |

|

|

|

|

316,963 |

|

|

|

|

286,061 |

|

Income tax expense |

|

|

(2,007 |

) |

|

|

|

(883 |

) |

|

|

|

(7,539 |

) |

|

|

|

(1,773 |

) |

Net income |

|

|

66,823 |

|

|

|

|

77,854 |

|

|

|

|

309,424 |

|

|

|

|

284,288 |

|

Less: Dividends on preferred shares |

|

|

4,969 |

|

|

|

|

4,969 |

|

|

|

|

19,875 |

|

|

|

|

10,829 |

|

Net income attributable to common shareholders |

|

$ |

61,854 |

|

|

|

$ |

72,885 |

|

|

|

$ |

289,549 |

|

|

|

$ |

273,459 |

|

Net income attributable to common shareholders per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.40 |

|

|

|

$ |

1.48 |

|

|

|

$ |

6.23 |

|

|

|

$ |

5.51 |

|

Diluted |

|

$ |

1.38 |

|

|

|

$ |

1.45 |

|

|

|

$ |

6.12 |

|

|

|

$ |

5.41 |

|

Weighted average shares outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

44,149 |

|

|

|

|

49,093 |

|

|

|

|

46,471 |

|

|

|

|

49,624 |

|

Diluted |

|

|

44,938 |

|

|

|

|

50,097 |

|

|

|

|

47,299 |

|

|

|

|

50,576 |

|

TEXTAINER GROUP HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(Unaudited)

(All currency expressed in United States dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

Years Ended December 31, |

|

|

|

2022 |

|

|

2021 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

309,424 |

|

|

$ |

284,288 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

292,828 |

|

|

|

284,115 |

|

Bad debt expense (recovery), net |

|

|

740 |

|

|

|

(1,285 |

) |

Container write-off (recovery) from lessee default, net |

|

|

1,910 |

|

|

|

(4,868 |

) |

Unrealized loss (gain) on financial instruments, net |

|

|

502 |

|

|

|

(4,409 |

) |

Amortization of unamortized debt issuance costs and accretion

of bond discounts |

|

|

10,129 |

|

|

|

9,845 |

|

Debt termination expense |

|

|

— |

|

|

|

15,209 |

|

Gain on sale of owned fleet containers, net |

|

|

(76,947 |

) |

|

|

(67,229 |

) |

Share-based compensation expense |

|

|

7,728 |

|

|

|

6,699 |

|

Changes in operating assets and liabilities |

|

|

206,205 |

|

|

|

89,418 |

|

Total adjustments |

|

|

443,095 |

|

|

|

327,495 |

|

Net cash provided by operating activities |

|

|

752,519 |

|

|

|

611,783 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of containers |

|

|

(403,783 |

) |

|

|

(2,082,577 |

) |

Payment on container leaseback financing receivable |

|

|

(533,867 |

) |

|

|

(18,705 |

) |

Proceeds from sale of containers and fixed assets |

|

|

199,158 |

|

|

|

142,276 |

|

Receipt of principal payments on container leaseback financing receivable |

|

|

59,719 |

|

|

|

30,119 |

|

Other |

|

|

(2,538 |

) |

|

|

(1,242 |

) |

Net cash used in investing activities |

|

|

(681,311 |

) |

|

|

(1,930,129 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from debt |

|

|

989,650 |

|

|

|

4,863,756 |

|

Payments on debt |

|

|

(831,010 |

) |

|

|

(3,635,663 |

) |

Payment of debt issuance costs |

|

|

(4,370 |

) |

|

|

(27,895 |

) |

Proceeds from container leaseback financing liability, net |

|

|

— |

|

|

|

16,305 |

|

Principal repayments on container leaseback financing liability, net |

|

|

(799 |

) |

|

|

(3,314 |

) |

Issuance of preferred shares, net of underwriting discount |

|

|

— |

|

|

|

290,550 |

|

Purchase of treasury shares |

|

|

(179,092 |

) |

|

|

(72,220 |

) |

Issuance of common shares upon exercise of share options |

|

|

5,485 |

|

|

|

9,043 |

|

Dividends paid on common shares |

|

|

(46,235 |

) |

|

|

(12,285 |

) |

Dividends paid on preferred shares |

|

|

(19,875 |

) |

|

|

(9,975 |

) |

Purchase of noncontrolling interest |

|

|

— |

|

|

|

(21,500 |

) |

Other |

|

|

— |

|

|

|

(970 |

) |

Net cash (used in) provided by financing activities |

|

|

(86,246 |

) |

|

|

1,395,832 |

|

Effect of exchange rate changes |

|

|

(125 |

) |

|

|

(79 |

) |

Net (decrease) increase in cash, cash equivalents and restricted cash |

|

|

(15,163 |

) |

|

|

77,407 |

|

Cash, cash equivalents and restricted cash, beginning of the year |

|

|

282,572 |

|

|

|

205,165 |

|

Cash, cash equivalents and restricted cash, end of the year |

|

$ |

267,409 |

|

|

$ |

282,572 |

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

Cash paid for interest expense and realized loss and settlement on derivative instruments, net |

|

$ |

144,637 |

|

|

$ |

145,711 |

|

Income taxes paid |

|

$ |

815 |

|

|

$ |

1,567 |

|

Receipt of payments on finance leases, net of income earned |

|

$ |

193,157 |

|

|

$ |

104,770 |

|

Supplemental disclosures of noncash operating activities: |

|

|

|

|

|

|

Receipt of marketable securities from a lessee |

|

$ |

- |

|

|

$ |

5,789 |

|

Right-of-use asset for leased property |

|

$ |

- |

|

|

$ |

272 |

|

Supplemental disclosures of noncash investing activities: |

|

|

|

|

|

|

Decrease in accrued container purchases |

|

$ |

(134,320 |

) |

|

$ |

(90,679 |

) |

Containers placed in finance leases |

|

$ |

219,813 |

|

|

$ |

1,043,323 |

|

Use of Non-GAAP Financial Information

To supplement Textainer’s consolidated financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”), the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include adjusted net income, adjusted net income per diluted common share, adjusted EBITDA, headline earnings and headline earnings per basic and diluted common share.

Management believes that adjusted net income and adjusted net income per diluted common share are useful in evaluating Textainer’s operating performance. Adjusted net income is defined as net income attributable to common shareholders excluding debt termination expense, unrealized (loss) gain on derivative instruments and marketable securities and the related impacts on income taxes. Management considers adjusted EBITDA a widely used industry measure and useful in evaluating Textainer’s ability to fund growth and service long-term debt and other fixed obligations. Headline earnings is reported as a requirement of Textainer’s listing on the JSE. Headline earnings and headline earnings per basic and diluted common shares are calculated from net income which has been determined based on GAAP.

Reconciliations of these non-GAAP measures to the most directly comparable GAAP measures are included in the tables below for the three and twelve months ended December 31, 2022 and 2021 and for the three months ended September 30, 2022.

Non-GAAP measures are not financial measures calculated in accordance with GAAP and are presented solely as supplemental disclosures. Non-GAAP measures have limitations as analytical tools, and should not be relied upon in isolation, or as a substitute to net income, income from operations, cash flows from operating activities, or any other performance measures derived in accordance with GAAP. Some of these limitations are:

•They do not reflect cash expenditures, or future requirements, for capital expenditures or contractual commitments;

•They do not reflect changes in, or cash requirements for, working capital needs;

•Adjusted EBITDA does not reflect interest expense or cash requirements necessary to service interest or principal payments on debt;

•Although depreciation expense and container impairment are a non-cash charge, the assets being depreciated may be replaced in the future, and neither adjusted EBITDA, adjusted net income or adjusted net income per diluted common share reflects any cash requirements for such replacements;

•They are not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; and

•Other companies in our industry may calculate these measures differently than we do, limiting their usefulness as comparative measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended, |

|

|

Years Ended, |

|

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

|

December 31, 2021 |

|

|

December 31, 2022 |

|

|

December 31, 2021 |

|

|

|

(Dollars in thousands, |

|

|

(Dollars in thousands, |

|

|

|

except per share amounts) |

|

|

except per share amounts) |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Reconciliation of adjusted net income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to common shareholders |

|

$ |

61,854 |

|

|

$ |

76,400 |

|

|

$ |

72,885 |

|

|

$ |

289,549 |

|

|

$ |

273,459 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt termination expense |

|

|

— |

|

|

|

— |

|

|

|

131 |

|

|

|

— |

|

|

|

15,209 |

|

Unrealized loss (gain) on financial instruments, net |

|

|

176 |

|

|

|

204 |

|

|

|

272 |

|

|

|

502 |

|

|

|

(4,409 |

) |

Loss on settlement of pre-existing management agreement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

116 |

|

Impact of reconciling items on income tax |

|

|

(37 |

) |

|

|

(42 |

) |

|

|

(59 |

) |

|

|

(105 |

) |

|

|

(288 |

) |

Adjusted net income |

|

$ |

61,993 |

|

|

$ |

76,562 |

|

|

$ |

73,229 |

|

|

$ |

289,946 |

|

|

$ |

284,087 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income per diluted common share |

|

$ |

1.38 |

|

|

$ |

1.64 |

|

|

$ |

1.46 |

|

|

$ |

6.13 |

|

|

$ |

5.62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended, |

|

|

Years Ended, |

|

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

|

December 31, 2021 |

|

|

December 31, 2022 |

|

|

December 31, 2021 |

|

|

|

(Dollars in thousands) |

|

|

(Dollars in thousands) |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Reconciliation of adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to common shareholders |

|

$ |

61,854 |

|

|

$ |

76,400 |

|

|

$ |

72,885 |

|

|

$ |

289,549 |

|

|

$ |

273,459 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

(1,818 |

) |

|

|

(1,150 |

) |

|

|

(40 |

) |

|

|

(3,261 |

) |

|

|

(123 |

) |

Interest expense |

|

|

43,105 |

|

|

|

41,242 |

|

|

|

34,888 |

|

|

|

157,249 |

|

|

|

127,269 |

|

Debt termination expense |

|

|

— |

|

|

|

— |

|

|

|

131 |

|

|

|

— |

|

|

|

15,209 |

|

Realized loss on derivative instruments, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,408 |

|

Unrealized loss (gain) on financial instruments, net |

|

|

176 |

|

|

|

204 |

|

|

|

272 |

|

|

|

502 |

|

|

|

(4,409 |

) |

Loss on settlement of pre-existing management agreement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

116 |

|

Income tax expense |

|

|

2,007 |

|

|

|

1,846 |

|

|

|

883 |

|

|

|

7,539 |

|

|

|

1,773 |

|

Depreciation and amortization |

|

|

74,140 |

|

|

|

73,238 |

|

|

|

73,165 |

|

|

|

292,828 |

|

|

|

284,115 |

|

Container write-off (recovery) from lessee default, net |

|

|

— |

|

|

|

867 |

|

|

|

(34 |

) |

|

|

1,108 |

|

|

|

(4,869 |

) |

Adjusted EBITDA |

|

$ |

179,464 |

|

|

$ |

192,647 |

|

|

$ |

182,150 |

|

|

$ |

745,514 |

|

|

$ |

697,948 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended, |

|

|

Years Ended, |

|

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

|

December 31, 2021 |

|

|

December 31, 2022 |

|

|

December 31, 2021 |

|

|

|

(Dollars in thousands, |

|

|

(Dollars in thousands, |

|

|

|

except per share amount) |

|

|

except per share amount) |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Reconciliation of headline earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to common shareholders |

|

$ |

61,854 |

|

|

$ |

76,400 |

|

|

$ |

72,885 |

|

|

$ |

289,549 |

|

|

$ |

273,459 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Container write-off (recovery) from lessee default, net |

|

|

— |

|

|

|

867 |

|

|

|

(34 |

) |

|

|

1,108 |

|

|

|

(4,869 |

) |

Loss on settlement of pre-existing management agreement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

116 |

|

Impact of reconciling items on income tax |

|

|

— |

|

|

|

(8 |

) |

|

|

— |

|

|

|

(10 |

) |

|

|

21 |

|

Headline earnings |

|

$ |

61,854 |

|

|

$ |

77,259 |

|

|

$ |

72,851 |

|

|

$ |

290,647 |

|

|

$ |

268,727 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Headline earnings per basic common share |

|

$ |

1.40 |

|

|

$ |

1.68 |

|

|

$ |

1.48 |

|

|

$ |

6.25 |

|

|

$ |

5.42 |

|

Headline earnings per diluted common share |

|

$ |

1.38 |

|

|

$ |

1.65 |

|

|

$ |

1.45 |

|

|

$ |

6.14 |

|

|

$ |

5.31 |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 14, 2023

|

Textainer Group Holdings Limited |

|

/s/ OLIVIER GHESQUIERE |

Olivier Ghesquiere |

President and Chief Executive Officer |

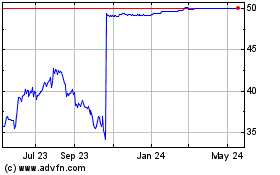

Textainer (NYSE:TGH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Textainer (NYSE:TGH)

Historical Stock Chart

From Dec 2023 to Dec 2024