TWO (Two Harbors Investment Corp, NYSE: TWO), an

MSR-focused REIT, announced today the tax treatment of the

company’s common stock and preferred stock dividends declared in

2024. This information is provided to assist stockholders with tax

reporting requirements related to dividend distribution of taxable

income by TWO. Stockholders should review the 2024 tax statements

received from their brokerage firms or other institutions to ensure

that the statements agree with the information provided below.

Additionally, as each stockholder’s tax situation may be different,

stockholders are encouraged to consult with their own professional

tax advisor with respect to their individual tax consequences.

Tax Treatment of the Common and Preferred

Distributions

TWO is required to report the portion of its 2024 dividends that

are treated as excess inclusion income for federal income tax

purposes. No portion of the company’s 2024 dividend distributions

are expected to consist of excess inclusion income, which may be

treated as unrelated business taxable income (UBTI) and subject to

special tax reporting for certain tax-exempt investors.

The company declared dividends with respect to its common stock

and Series A, Series B and Series C preferred shares on December

18, 2023. The record date for the company’s common stock and Series

A, Series B and Series C preferred distributions was January 12,

2024. Accordingly, these common and preferred distributions were

treated as 2024 distributions for tax purposes and reported on the

2024 Form 1099-DIV. In addition, the company declared dividends

with respect to its common stock and Series A, Series B and Series

C preferred shares on December 18, 2024. The record date for the

company’s common stock distribution was January 3, 2025, and the

record date for the company’s Series A, Series B and Series C

preferred distributions was January 10, 2025. Accordingly, these

common and preferred distributions will be treated as 2025

distributions for tax purposes and reported on the 2025 Form

1099-DIV.

Distributions for TWO

The federal income tax classification of TWO’s 2024 common and

preferred stock distributions as it is expected to be reported on

Form 1099-DIV is set forth in the following tables.

2024 FORM 1099-DIV – Common

Stock

Box 1a Total

Box 1b Total

Box 2a Total

Box 3 Total

Box 5 Total

Distribution Type

Declaration Date

Record Date

Payable Date

2024 Total Distribution Per

Share

Adjustments

2024 Ordinary

Dividends

2024 Qualified

Dividends(1)

2024 Capital Gain

Distributions

2024 Nondividend

Distributions

Section 199A

Dividends(2)

Cash

12/18/2023

1/12/2024

1/29/2024

$0.450000

$0.000000

$0.300225

$0.169520

$0.000000

$0.149775

$0.130705

Cash

3/20/2024

4/4/2024

4/29/2024

$0.450000

$0.000000

$0.300225

$0.169520

$0.000000

$0.149775

$0.130705

Cash

6/18/2024

7/5/2024

7/29/2024

$0.450000

$0.000000

$0.300225

$0.169520

$0.000000

$0.149775

$0.130705

Cash

9/19/2024

10/1/2024

10/29/2024

$0.450000

$0.000000

$0.300225

$0.169520

$0.000000

$0.149775

$0.130705

Totals

$1.800000

$0.000000

$1.200900

$0.678080

$0.000000

$0.599100

$0.522820

(1) - Qualified Dividends

shows the portion of the amount in Box 1a that may be eligible for

capital gains tax rates

(2) - Section 199A

Dividends shows the portion of the amount in Box 1a that may be

eligible for the 20% qualified business income deduction under

Section 199A

2024 FORM 1099-DIV – Preferred

Series A

Box 1a Total

Box 1b Total

Box 2a Total

Box 3 Total

Box 5 Total

Distribution Type

Declaration Date

Record Date

Payable Date

2024 Total Distribution Per

Share

Adjustments

2024 Ordinary

Dividends

2024 Qualified

Dividends(1)

2024 Capital Gain

Distributions

2024 Nondividend

Distributions

Section 199A

Dividends(2)

Cash

12/18/2023

1/12/2024

1/26/2024

$0.507810

$0.000000

$0.507810

$0.286731

$0.000000

$0.000000

$0.221079

Cash

3/20/2024

4/12/2024

4/29/2024

$0.507810

$0.000000

$0.507810

$0.286731

$0.000000

$0.000000

$0.221079

Cash

6/18/2024

7/12/2024

7/29/2024

$0.507810

$0.000000

$0.507810

$0.286731

$0.000000

$0.000000

$0.221079

Cash

9/19/2024

10/11/2024

10/28/2024

$0.507810

$0.000000

$0.507810

$0.286731

$0.000000

$0.000000

$0.221079

Totals

$2.031240

$0.000000

$2.031240

$1.146924

$0.000000

$0.000000

$0.884316

(1) - Qualified Dividends shows

the portion of the amount in Box 1a that may be eligible for

capital gains tax rates

(2) - Section 199A Dividends

shows the portion of the amount in Box 1a that may be eligible for

the 20% qualified business income deduction under Section 199A

2024 FORM 1099-DIV – Preferred

Series B

Box 1a Total

Box 1b Total

Box 2a Total

Box 3 Total

Box 5 Total

Distribution Type

Declaration Date

Record Date

Payable Date

2024 Total Distribution Per

Share

Adjustments

2024 Ordinary

Dividends

2024 Qualified

Dividends(1)

2024 Capital Gain

Distributions

2024 Nondividend

Distributions

Section 199A

Dividends(2)

Cash

12/18/2023

1/12/2024

1/26/2024

$0.476560

$0.000000

$0.476560

$0.269086

$0.000000

$0.000000

$0.207474

Cash

3/20/2024

4/12/2024

4/29/2024

$0.476560

$0.000000

$0.476560

$0.269086

$0.000000

$0.000000

$0.207474

Cash

6/18/2024

7/12/2024

7/29/2024

$0.476560

$0.000000

$0.476560

$0.269086

$0.000000

$0.000000

$0.207474

Cash

9/19/2024

10/11/2024

10/28/2024

$0.476560

$0.000000

$0.476560

$0.269086

$0.000000

$0.000000

$0.207474

Totals

$1.906240

$0.000000

$1.906240

$1.076344

$0.000000

$0.000000

$0.829896

(1) - Qualified Dividends shows

the portion of the amount in Box 1a that may be eligible for

capital gains tax rates

(2) - Section 199A Dividends

shows the portion of the amount in Box 1a that may be eligible for

the 20% qualified business income deduction under Section 199A

2024 FORM 1099-DIV – Preferred

Series C

Box 1a Total

Box 1b Total

Box 2a Total

Box 3 Total

Box 5 Total

Distribution Type

Declaration Date

Record Date

Payable Date

2024 Total Distribution Per

Share

Adjustments

2024 Ordinary

Dividends

2024 Qualified

Dividends(1)

2024 Capital Gain

Distributions

2024 Nondividend

Distributions

Section 199A

Dividends(2)

Cash

12/18/2023

1/12/2024

1/26/2024

$0.453130

$0.000000

$0.453130

$0.255856

$0.000000

$0.000000

$0.197274

Cash

3/20/2024

4/12/2024

4/29/2024

$0.453130

$0.000000

$0.453130

$0.255856

$0.000000

$0.000000

$0.197274

Cash

6/18/2024

7/12/2024

7/29/2024

$0.453130

$0.000000

$0.453130

$0.255856

$0.000000

$0.000000

$0.197274

Cash

9/19/2024

10/11/2024

10/28/2024

$0.453130

$0.000000

$0.453130

$0.255856

$0.000000

$0.000000

$0.197274

Totals

$1.812520

$0.000000

$1.812520

$1.023424

$0.000000

$0.000000

$0.789096

(1) - Qualified Dividends shows

the portion of the amount in Box 1a that may be eligible for

capital gains tax rates

(2) - Section 199A Dividends

shows the portion of the amount in Box 1a that may be eligible for

the 20% qualified business income deduction under Section 199A

Consult Your Tax Advisor

Stockholders may have additional reporting obligations to the

Internal Revenue Service and/or other tax authorities.

The U.S. federal income tax treatment of holding TWO common

and preferred stock to any particular stockholder will depend on

the stockholder’s particular tax circumstances. You are urged to

consult your tax advisor regarding the U.S. federal, state, local

and foreign income and other tax consequences to you, in light of

your particular investment or tax circumstances, of acquiring,

holding and disposing of TWO common and preferred stock.

TWO does not provide tax, accounting or legal advice. Any tax

statements contained herein were not intended or written to be

used, and cannot be used for the purpose of avoiding U.S., federal,

state or local tax penalties. Please consult your advisor as to any

tax, accounting or legal statements made herein.

About TWO

TWO (Two Harbors Investment Corp., NYSE: TWO), a Maryland

corporation, is a real estate investment trust that invests in

mortgage servicing rights, residential mortgage-backed securities

and other financial assets. TWO is headquartered in St. Louis Park,

MN.

Additional Information

Stockholders of TWO and other interested persons may find

additional information regarding the company at www.twoinv.com, at

the Securities and Exchange Commission’s internet site at

www.sec.gov or by directing requests to: TWO, 1601 Utica Avenue

South, Suite 900, St. Louis Park, MN 55416, (612) 453-4100.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129963148/en/

Margaret Karr, Head of Investor Relations, TWO, (612) 453-4080,

Margaret.Karr@twoinv.com

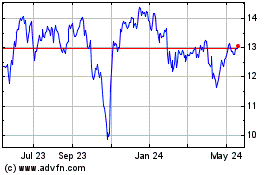

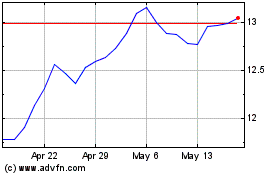

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Two Harbors Investment (NYSE:TWO)

Historical Stock Chart

From Feb 2024 to Feb 2025