false

0000752642

0000752642

2025-01-06

2025-01-06

0000752642

UMH:CommonStock0.10ParValueMember

2025-01-06

2025-01-06

0000752642

UMH:Sec6.375SeriesDCumulativeRedeemablePreferredStock0.10ParValueMember

2025-01-06

2025-01-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 6, 2025

UMH

Properties, Inc.

(Exact

name of registrant as specified in its charter)

| Maryland |

|

001-12690 |

|

22-1890929 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| Juniper

Business Plaza, 3499 Route 9 North, Suite 3-C, Freehold, NJ |

|

07728 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including area code: (732) 577-9997

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a- 12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, $0.10 par value |

|

UMH |

|

New

York Stock Exchange |

| 6.375%

Series D Cumulative Redeemable Preferred Stock, $0.10 par value |

|

UMH

PRD |

|

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On

January 6, 2025, the Company provided investors with an update on its fourth quarter and full year 2024 operating results.

The

information being furnished pursuant to this Item 7.01, including Exhibits 99 to this report, shall not be deemed “filed”

for any purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of such section. The information in this report, including Exhibits 99, shall not be incorporated

by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, unless specifically incorporated by reference

into any such filing. This report will not be deemed an admission as to the materiality of any information in this report that is required

to be disclosed solely by Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

UMH

Properties, Inc. |

| |

|

|

| Date:

January 6, 2025 |

By: |

/s/

Anna T. Chew |

| |

Name: |

Anna

T. Chew |

| |

|

Executive

Vice President and Chief Financial Officer |

Exhibit

99

UMH

PROPERTIES, INC. FOURTH QUARTER AND FULL YEAR 2024 OPERATIONS UPDATE

FREEHOLD,

NJ, January 6, 2025…… UMH Properties, Inc. (NYSE: UMH) (TASE: UMH), a real estate investment trust (REIT)

specializing in the ownership and operation of manufactured home communities, is providing

investors with an update on the fourth quarter and full year 2024 operating results:

1. As

of yearend, UMH achieved an equity market capitalization of over $1.5 billion. During the year, UMH’s share price increased from

$15.25 on January 2nd, 2024, to $18.88 on December 31st, 2024, representing an increase of approximately 24%. Including

$0.85 in dividends paid during the year, UMH delivered a total shareholder return of approximately 30%.

2. During

the fourth quarter, UMH converted 122 new homes from inventory to revenue generating rental homes. For the year, UMH converted 565 new

homes from inventory to revenue generating rental homes. UMH now owns approximately 10,300 rental homes with an occupancy rate of 94%.

3. For

the fourth quarter, UMH achieved gross home sales revenue of $8.4 million as compared to $7.7 million last year, representing an increase

of approximately 9%. For the year, UMH achieved gross home sales revenue of $32.6 million as compared to $31.2 million last year, representing

an increase of approximately 4%.

4. Year-to-date,

overall occupancy increased by 280 units to 88%. During the fourth quarter, overall occupancy increased by 46 units.

5. Our

occupancy gains and rent increases achieved throughout 2023 and 2024 have increased our January 2025 rental and related charges by approximately

9%, resulting in our annualized monthly rent roll generating approximately $210 million in annual rental revenue.

6. In

the fourth quarter, we issued and sold approximately 3.1 million shares of common stock through our at-the-market sale program at a weighted

average price of $19.04 per share, generating gross proceeds of $58.5 million. In 2024, we issued and sold approximately 12.5 million

shares of common stock through our ATM at a weighted average price of $17.92 per share, generating gross proceeds of $224.5 million.

Samuel

A. Landy, President and CEO of UMH Properties, Inc., stated “We are pleased with the progress that we have made executing on our

long-term business plan and generating strong returns for our shareholders, which has allowed us to increase the dividend for four consecutive

years. During that period, the dividend has increased by approximately 19%.”

“In

2025, UMH plans on generating increased revenue through our 5% annual rent increase and the investment in 800 new rental homes. Additionally,

we have the potential to further increase our gross sales and sales profits. Our long-term business plan has given us the ability to

grow organically through infill of our vacant sites and the development of our vacant land.”

It

should be noted that the financial information set forth above reflects our preliminary estimates with respect to such information, based

on information currently available to management, and may vary from our actual financial results as of and for the quarter and year ending

December 31, 2024. UMH’s final fourth quarter

and full year 2024 results will be released on Wednesday, February 26, 2025, after the close of trading on the New York Stock Exchange

and will be available on the Company’s website at www.umh.reit, in the Financials section. Senior management will discuss

the results, current market conditions and future outlook on Thursday, February 27, 2025, at 10:00 a.m. Eastern Time.

UMH

Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 139 manufactured home communities containing

approximately 26,200 developed homesites, of which 10,300 contain rental homes, and over 1,000 self-storage units. These communities

are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama, South Carolina, Florida and

Georgia. Included in the 139 communities are two communities in Florida, containing 363 sites that UMH owns and operates through its

joint venture with Nuveen Real Estate.

Certain

statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current

expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking

statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and

uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual

report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation

to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Contact:

Nelli Madden

732-577-4062

v3.24.4

Cover

|

Jan. 06, 2025 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 06, 2025

|

| Entity File Number |

001-12690

|

| Entity Registrant Name |

UMH

Properties, Inc.

|

| Entity Central Index Key |

0000752642

|

| Entity Tax Identification Number |

22-1890929

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

Juniper

Business Plaza

|

| Entity Address, Address Line Two |

3499 Route 9 North

|

| Entity Address, Address Line Three |

Suite 3-C

|

| Entity Address, City or Town |

Freehold

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07728

|

| City Area Code |

(732)

|

| Local Phone Number |

577-9997

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.10 par value |

|

| Title of 12(b) Security |

Common

Stock, $0.10 par value

|

| Trading Symbol |

UMH

|

| Security Exchange Name |

NYSE

|

| 6.375% Series D Cumulative Redeemable Preferred Stock, $0.10 par value |

|

| Title of 12(b) Security |

6.375%

Series D Cumulative Redeemable Preferred Stock, $0.10 par value

|

| Trading Symbol |

UMH

PRD

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=UMH_CommonStock0.10ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=UMH_Sec6.375SeriesDCumulativeRedeemablePreferredStock0.10ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

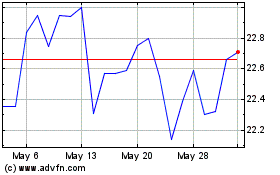

UMH Properties (NYSE:UMH-D)

Historical Stock Chart

From Dec 2024 to Jan 2025

UMH Properties (NYSE:UMH-D)

Historical Stock Chart

From Jan 2024 to Jan 2025