Record Earnings Per Diluted Common Share of

$0.83

Return on average assets of 1.43 percent and

average common equity of 13.8 percent

Returned 77 percent of second quarter

earnings to shareholders

U.S. Bancorp (NYSE: USB) today reported net income of $1,522

million for the second quarter of 2016, or $0.83 per diluted common

share, compared with $1,483 million, or $0.80 per diluted common

share, in the second quarter of 2015. The second quarter of 2016

included notable items related to equity investments, legal and

regulatory matters and charitable contributions that, combined,

increased diluted earnings per common share by $0.01.

Highlights for the second quarter of 2016 included:

- Industry-leading return on average

assets of 1.43 percent, return on average common equity of 13.8

percent and efficiency ratio of 54.9 percent (54.0 percent

excluding notable items)

- Record revenue, net income and diluted

earnings per common share for the second quarter of 2016 both as

reported and excluding notable items

- Returned 77 percent of second quarter

earnings to shareholders through dividends and share buybacks

- Average total loans grew 1.6 percent on

a linked quarter basis and 8.1 percent over the second quarter of

2015 (6.5 percent year-over-year, excluding the credit card

portfolio acquisition at the end of the fourth quarter of 2015 and

student loans, which were carried in held for sale in the second

quarter of 2015)

- Average total deposits grew 3.9 percent

on a linked quarter basis and 7.6 percent over the second quarter

of 2015

- Net interest income grew 0.3 percent on

a linked quarter basis and 4.5 percent year-over-year

- Average earnings assets grew 1.9

percent on a linked quarter basis and 5.2 percent

year-over-year

- Net interest margin of 3.02 percent for

the second quarter of 2016 was down 4 basis points from 3.06

percent in the first quarter of 2016 and down 1 basis point from

3.03 percent in the second quarter of 2015

- Payments-related fee revenue grew 8.8

percent linked quarter and 4.9 percent year-over-year, driven by an

increase in credit and debit card revenue, including the impact of

recent portfolio acquisitions, as well as an increase in corporate

payment products revenue

- Credit quality was relatively stable

- Nonperforming assets decreased 2.7

percent on a linked quarter basis

- Commercial nonperforming assets within

the energy portfolio decreased $54 million linked quarter

- Reserves for energy portfolio

commercial loans were 8.8 percent of outstanding balances at June

30, 2016, compared with 9.1 percent at March 31, 2016

- Strong capital position. At June 30,

2016, the estimated common equity tier 1 capital to risk-weighted

assets ratio was 9.3 percent using the Basel III fully implemented

standardized approach and was 12.0 percent using the Basel III

fully implemented advanced approaches method

EARNINGS SUMMARY

Table 1 ($ in millions, except per-share data)

Percent Percent

Change Change 2Q

1Q 2Q 2Q16 vs 2Q16 vs YTD

YTD Percent 2016 2016

2015 1Q16 2Q15

2016 2015 Change Net

income attributable to U.S. Bancorp $1,522 $1,386 $1,483 9.8 2.6

$2,908 $2,914 (.2 ) Diluted earnings per common share $.83 $.76

$.80 9.2 3.8 $1.59 $1.56 1.9 Return on average assets (%)

1.43 1.32 1.46 1.38 1.45 Return on average common equity (%) 13.8

13.0 14.3 13.4 14.2 Net interest margin (%) 3.02 3.06 3.03 3.04

3.05 Efficiency ratio (%) (a) 54.9 54.6 53.2 54.8 53.7 Tangible

efficiency ratio (%) (a) 54.1 53.7 52.3 53.9 52.9 Dividends

declared per common share $.255 $.255 $.255 -- -- $.510 $.500 2.0

Book value per common share (period end) $24.37 $23.82 $22.51 2.3

8.3

(a) Computed as noninterest expense

divided by the sum of net interest income on a taxable-equivalent

basis and noninterest income excluding net securities gains

(losses), and for tangible efficiency ratio, intangible

amortization.

Net income attributable to U.S. Bancorp was $1,522 million for

the second quarter of 2016, 2.6 percent higher than the $1,483

million for the second quarter of 2015, and 9.8 percent higher than

the $1,386 million for the first quarter of 2016. Diluted earnings

per common share were $0.83 in the second quarter of 2016, $0.03

higher than the second quarter of 2015 and $0.07 higher than the

$0.76 reported for the first quarter of 2016. The second quarter of

2016 included $0.01 in notable items, including $180 million of

equity investment income, primarily the result of our membership in

Visa Europe Limited (“Visa Europe”) which was sold to Visa, Inc. on

June 21, 2016, and $110 million in accruals related to legal and

regulatory matters along with a $40 million charitable

contribution. Excluding the notable items, the increase in net

income year-over-year was primarily due to an increase in net

interest income of 4.5 percent , mainly a result of strong loan

growth, and higher noninterest income of 4.4 percent, driven by

growth in credit and debit card revenue, commercial products

revenue, and trust and investment management fees. This increase

was partially offset by higher noninterest expense related to merit

increases and higher variable compensation expense, increased

compliance costs, which peaked in the second quarter 2016, and

higher marketing expense as a result of brand investment. Excluding

the notable items, the increase in net income on a linked quarter

basis was principally due to total net revenue growth of 4.6

percent reflecting typical seasonality in certain lines of

businesses, including payments, mortgage banking and deposit

services, partially offset by higher noninterest expense of 3.4

percent related to increased compliance costs and marketing

expense.

U.S. Bancorp Chairman and Chief Executive Officer Richard K.

Davis said, “U.S. Bancorp reported strong second quarter results,

delivering record revenue and net income in an economy that

continues to be challenged by global concerns and low interest

rates. Despite these economic headwinds we continued to effectively

execute on our strategy to be the most trusted choice and to unify

the customer experience. The second quarter was a record quarter

for us as we once again delivered industry-leading returns, steady

loan growth and strength in our fee-based businesses. Steady loan

growth, demonstrated by continued strength in commercial loans and

momentum in consumer loans, led to increased net interest income

despite a decline in net interest margin. Growth in our fee revenue

continued across many of our fee-based businesses, including our

payments business lines. We also reported strong results in our

capital markets business as we were positioned well to provide

products and services to our customers as they navigated through

the recent market volatility. And we managed our capital

effectively, delivering 77 percent of our second quarter earnings

back to shareholders through dividends and share buybacks. During

the quarter, we were pleased to receive the Federal Reserve’s

non-objection to our capital plan, allowing us once again to return

value to our shareholders by increasing our annual common dividend

by 9.8 percent in the third quarter of 2016. We also made important

investments in our vision for the future, including investments in

the U.S. Bank brand that will help us more effectively articulate

our compelling story to customers in order to generate long-term

growth.

“The strength of our company continues to be driven by the

commitment of our employees. Through their hard work and

dedication, we continue to deliver consistent, predictable and

repeatable industry-leading financial results. We remain well

positioned to provide the right products and services to our

customers so that they may achieve their financial objectives as we

continue to create value for our shareholders.”

INCOME

STATEMENT HIGHLIGHTS

Table

2

(Taxable-equivalent basis, $ in millions,

except per-share data)

Percent Percent

Change Change 2Q 1Q

2Q 2Q16 vs 2Q16 vs YTD YTD

Percent 2016 2016 2015

1Q16 2Q15 2016

2015 Change Net interest income $2,896

$2,888 $2,770 .3 4.5 $5,784 $5,522 4.7 Noninterest income 2,552

2,149 2,272 18.8 12.3 4,701

4,426 6.2 Total net revenue 5,448 5,037 5,042

8.2 8.1 10,485 9,948 5.4 Noninterest expense 2,992

2,749 2,682 8.8 11.6 5,741 5,347

7.4 Income before provision and taxes 2,456 2,288 2,360 7.3

4.1 4,744 4,601 3.1 Provision for credit losses 327

330 281 (.9 ) 16.4 657 545

20.6 Income before taxes 2,129 1,958 2,079 8.7 2.4 4,087

4,056 .8 Taxable-equivalent adjustment 51 53 54 (3.8 ) (5.6 ) 104

108 (3.7 ) Applicable income taxes 542 504

528 7.5 2.7 1,046 1,007 3.9 Net

income 1,536 1,401 1,497 9.6 2.6 2,937 2,941 (.1 )

Net (income) loss attributable to

noncontrolling interests

(14 ) (15 ) (14 ) 6.7 -- (29 ) (27 ) (7.4 )

Net income attributable to U.S. Bancorp $1,522 $1,386

$1,483 9.8 2.6 $2,908 $2,914

(.2 )

Net income applicable to U.S. Bancorp

common shareholders

$1,435 $1,329 $1,417 8.0 1.3

$2,764 $2,782 (.6 ) Diluted earnings per

common share $.83 $.76 $.80 9.2

3.8 $1.59 $1.56 1.9

NET INTEREST INCOME

Table 3

(Taxable-equivalent basis; $ in millions)

Change

Change 2Q 1Q 2Q 2Q16 vs 2Q16

vs YTD YTD 2016 2016

2015 1Q16 2Q15

2016 2015 Change Components of

net interest income Income on earning assets $3,305 $3,275 $3,123

$30 $182 $6,580 $6,239 $341 Expense on interest-bearing liabilities

409 387 353 22

56 796 717 79

Net interest income $2,896 $2,888

$2,770 $8 $126

$5,784 $5,522 $262

Average yields and rates paid Earning assets yield 3.44 % 3.48 %

3.42 % (.04 )% .02 % 3.46 % 3.45 % .01 % Rate paid on

interest-bearing liabilities .58 .56

.52 .02 .06 .57

.54 .03 Gross interest margin 2.86 %

2.92 % 2.90 % (.06 )% (.04 )%

2.89 % 2.91 % (.02 )% Net interest margin 3.02 %

3.06 % 3.03 % (.04 )% (.01 )%

3.04 % 3.05 % (.01 )% Average balances

Investment securities (a) $107,132 $106,031 $102,391 $1,101 $4,741

$106,581 $101,556 $5,025 Loans 266,582 262,281 246,560 4,301 20,022

264,432 247,251 17,181 Earning assets 385,368 378,208 366,428 7,160

18,940 381,788 363,650 18,138 Interest-bearing liabilities 285,796

279,516 270,573 6,280 15,223 282,656 269,235 13,421 (a)

Excludes unrealized gain (loss)

Net Interest Income

Net interest income on a taxable-equivalent basis in the second

quarter of 2016 was $2,896 million, an increase of $126 million

(4.5 percent) over the second quarter of 2015. The increase was

driven by loan growth and higher rates, partially offset by the

loan portfolio mix. Average earning assets were $18.9 billion (5.2

percent) higher than the second quarter of 2015, driven by

increases of $20.0 billion (8.1 percent) in average total loans and

$4.7 billion (4.6 percent) in average investment securities. Net

interest income increased $8 million (0.3 percent) on a linked

quarter basis, primarily due to growth in average total loans,

partially offset by the loan portfolio mix and higher funding

costs. Average total loans were $4.3 billion (1.6 percent) higher

on a linked quarter basis.

The net interest margin in the second quarter of 2016 was 3.02

percent, compared with 3.03 percent in the second quarter of 2015,

and 3.06 percent in the first quarter of 2016. The decrease in the

net interest margin on a year-over-year basis was principally due

to securities purchases at lower average rates and lower

reinvestment rates on maturing securities, partially offset by

higher rates on new loans. On a linked quarter basis, the decrease

in net interest margin primarily reflected the loan portfolio mix

as well as lower average rates on new securities purchases and

lower reinvestment rates on maturing securities.

Investment Securities

Average investment securities in the second quarter of 2016 were

$4.7 billion (4.6 percent) higher year-over-year and $1.1 billion

(1.0 percent) higher than the prior quarter. These increases were

primarily due to purchases of U.S. Treasury and U.S. government

agency-backed securities, net of prepayments and maturities, to

support regulatory liquidity coverage ratio requirements.

AVERAGE LOANS

Table 4 ($ in millions)

Percent Percent

Change Change 2Q 1Q 2Q 2Q16

vs 2Q16 vs YTD YTD Percent

2016 2016 2015

1Q16 2Q15 2016

2015 Change Commercial $86,899 $84,582

$77,932 2.7 11.5 $85,741 $77,062 11.3 Lease financing 5,255

5,238 5,321 .3 (1.2 ) 5,246 5,323 (1.4 ) Total

commercial 92,154 89,820 83,253 2.6 10.7 90,987 82,385 10.4

Commercial mortgages 31,950 31,836 32,499 .4 (1.7 ) 31,893 32,807

(2.8 ) Construction and development 11,038 10,565

9,947 4.5 11.0 10,801 9,751 10.8 Total commercial real

estate 42,988 42,401 42,446 1.4 1.3 42,694 42,558 .3

Residential mortgages 55,501 54,208 51,114 2.4 8.6 54,854 51,269

7.0 Credit card 20,140 20,244 17,613 (.5 ) 14.3 20,192

17,718 14.0 Retail leasing 5,326 5,179 5,696 2.8 (6.5 )

5,253 5,756 (8.7 ) Home equity and second mortgages 16,394 16,368

15,958 .2 2.7 16,381 15,928 2.8 Other 29,748 29,550

25,415 .7 17.0 29,649 26,504 11.9 Total other retail 51,468

51,097 47,069 .7 9.3 51,283 48,188 6.4

Total loans, excluding covered loans 262,251 257,770

241,495 1.7 8.6 260,010 242,118 7.4 Covered loans

4,331 4,511 5,065 (4.0 ) (14.5 ) 4,422 5,133

(13.9 ) Total loans $266,582 $262,281 $246,560

1.6 8.1 $264,432 $247,251 6.9

Loans

Average total loans were $20.0 billion (8.1 percent) higher in

the second quarter of 2016 than the second quarter of 2015 (6.5

percent excluding student loans and the credit card portfolio

acquisition). The increase was driven by growth in total commercial

loans (10.7 percent), residential mortgages (8.6 percent), and

credit card loans (14.3 percent, 5.8 percent excluding the credit

card portfolio acquisition), and total other retail loans (9.3

percent, 4.1 percent excluding student loans). These increases were

partially offset by a decline in the run-off covered loans

portfolio (14.5 percent). Average total loans were $4.3 billion

(1.6 percent) higher in the second quarter of 2016 than the first

quarter of 2016. The increase was driven by growth in total

commercial loans (2.6 percent), residential mortgages (2.4 percent)

and total commercial real estate (1.4 percent).

AVERAGE DEPOSITS

Table 5 ($ in millions)

Percent Percent

Change Change 2Q 1Q 2Q 2Q16

vs 2Q16 vs YTD YTD Percent

2016 2016 2015

1Q16 2Q15 2016

2015 Change Noninterest-bearing

deposits $79,171 $78,569 $77,347 .8 2.4 $78,870 $75,937 3.9

Interest-bearing savings deposits Interest checking 60,842 57,910

55,205 5.1 10.2 59,376 54,933 8.1 Money market savings 92,904

86,462 79,898 7.5 16.3 89,683 76,910 16.6 Savings accounts 40,258

39,250 37,071 2.6 8.6 39,754 36,555 8.8 Total

of savings deposits 194,004 183,622 172,174 5.7 12.7 188,813

168,398 12.1 Time deposits 34,211 33,687 36,223 1.6

(5.6 ) 33,949 37,787 (10.2 ) Total interest-bearing deposits

228,215 217,309 208,397 5.0 9.5 222,762

206,185 8.0 Total deposits $307,386 $295,878 $285,744

3.9 7.6 $301,632 $282,122 6.9

Deposits

Average total deposits for the second quarter of 2016 were $21.6

billion (7.6 percent) higher than the second quarter of 2015.

Average noninterest-bearing deposits increased $1.8 billion (2.4

percent) year-over-year, mainly in Consumer and Small Business

Banking and Wholesale Banking and Commercial Real Estate, partially

offset by a decline in Wealth Management and Securities Services.

Average total savings deposits were $21.8 billion (12.7 percent)

higher year-over-year, the result of growth across all business

lines. Growth in Consumer and Small Business Banking total savings

deposits included net new account growth of 2.8 percent. Average

time deposits were $2.0 billion (5.6 percent) lower than the prior

year quarter. Changes in time deposits are largely related to those

deposits managed as an alternative to other funding sources such as

wholesale borrowing, based largely on relative pricing and

liquidity characteristics.

Average total deposits increased $11.5 billion (3.9 percent)

over the first quarter of 2016. Average noninterest-bearing

deposits increased $602 million (0.8 percent) on a linked quarter

basis, mainly due to higher balances in Consumer and Small Business

Banking, partially offset by lower balances in Wholesale Banking

and Commercial Real Estate. Average total savings deposits

increased $10.4 billion (5.7 percent) reflecting increases across

all business lines. Average time deposits, which are managed based

on funding needs, relative pricing, and liquidity characteristics

increased $524 million (1.6 percent) on a linked quarter basis.

NONINTEREST INCOME

Table 6 ($ in millions)

Percent

Percent Change Change

2Q 1Q 2Q 2Q16 vs 2Q16 vs

YTD YTD Percent 2016 2016

2015 1Q16 2Q15

2016 2015 Change

Credit and debit card revenue $296 $266 $266 11.3 11.3 $562

$507 10.8 Corporate payment products revenue 181 170 178 6.5 1.7

351 348 .9 Merchant processing services 403 373 395 8.0 2.0 776 754

2.9 ATM processing services 84 80 80 5.0 5.0 164 158 3.8 Trust and

investment management fees 358 339 334 5.6 7.2 697 656 6.3 Deposit

service charges 179 168 174 6.5 2.9 347 335 3.6 Treasury management

fees 147 142 142 3.5 3.5 289 279 3.6 Commercial products revenue

238 197 214 20.8 11.2 435 414 5.1 Mortgage banking revenue 238 187

231 27.3 3.0 425 471 (9.8 ) Investment products fees 39 40 48 (2.5

) (18.8 ) 79 95 (16.8 ) Securities gains (losses), net 3 3 -- -- nm

6 -- nm Other 386 184 210 nm 83.8 570 409 39.4

Total noninterest income $2,552 $2,149 $2,272

18.8 12.3 $4,701 $4,426 6.2

Noninterest Income

Second quarter noninterest income was $2,552 million, which was

$280 million higher than the second quarter of 2015. Excluding the

Visa Europe sale, noninterest income increased 4.4 percent

reflecting increases in credit and debit card revenue, trust and

investment management fees, and commercial products revenue. Credit

and debit card revenue increased $30 million (11.3 percent)

reflecting higher transaction volumes including acquired

portfolios. Merchant processing services revenue increased $8

million (2.0 percent). Adjusted for the approximate $4 million

impact of foreign currency rate changes, year-over-year merchant

processing services revenue growth would have been approximately

3.0 percent. Trust and investment management fees increased $24

million (7.2 percent) reflecting lower money market fee waivers.

Commercial products revenue increased $24 million (11.2 percent)

driven by higher bond underwriting fees, foreign currency customer

activity and other capital markets activity as a result of market

volatility.

Noninterest income was $403 million higher in the second quarter

of 2016 than the first quarter of 2016. Excluding the Visa Europe

sale, noninterest income increased 10.4 percent reflecting

seasonally higher fee-based revenue including credit and debit card

revenue, merchant processing services revenue, mortgage banking

revenue and deposit service charges. Credit and debit card revenue

increased $30 million (11.3 percent), primarily due to seasonally

higher transaction volumes. Merchant processing services revenue

increased $30 million (8.0 percent) as a result of seasonally

higher transaction volumes. Mortgage banking revenue increased $51

million (27.3 percent) mainly due to seasonally higher production

volumes. Commercial products revenue increased $41 million (20.8

percent) primarily due to higher bond underwriting fees, foreign

currency customer activity and capital markets volume, partially

reflecting market volatility. Trust and investment management fees

increased $19 million (5.6 percent) primarily due to account

growth, improved market conditions and lower money market fee

waivers. Deposit service charges increased $11 million (6.5

percent) due to seasonally higher transaction volumes.

NONINTEREST EXPENSE

Table 7 ($ in millions)

Percent Percent

Change Change 2Q 1Q 2Q

2Q16 vs 2Q16 vs YTD YTD Percent

2016 2016 2015

1Q16 2Q15 2016

2015 Change Compensation $1,277 $1,249

$1,196 2.2 6.8 $2,526 $2,375 6.4 Employee benefits 278 300 293 (7.3

) (5.1 ) 578 610 (5.2 ) Net occupancy and equipment 243 248 247

(2.0 ) (1.6 ) 491 494 (.6 ) Professional services 121 98 106 23.5

14.2 219 183 19.7 Marketing and business development 149 77 96 93.5

55.2 226 166 36.1 Technology and communications 241 233 221 3.4 9.0

474 435 9.0 Postage, printing and supplies 77 79 64 (2.5 ) 20.3 156

146 6.8 Other intangibles 44 45 43 (2.2 ) 2.3 89 86 3.5 Other 562

420 416 33.8 35.1 982 852 15.3 Total

noninterest expense $2,992 $2,749 $2,682 8.8 11.6

$5,741 $5,347 7.4

Noninterest Expense

Second quarter noninterest expense was $2,992 million, which was

$310 million (11.6 percent) higher than the second quarter of 2015.

Excluding the notable expense items, noninterest expense increased

$160 million (6.0 percent) related to higher compensation expense,

professional services expense, and technology and communications

expense, partially offset by lower employee benefits expense.

Compensation expense increased $81 million (6.8 percent),

principally due to the impact of merit increases along with higher

variable compensation including performance-based incentives.

Professional services expense increased $15 million (14.2 percent)

primarily due to compliance-related matters, while technology and

communications expense increased $20 million (9.0 percent) due to

acquired card portfolio conversion costs. Excluding the notable

charitable contribution, the marketing and business development

increase of $13 million reflected brand advertising. Postage,

printing and supplies expense increased $13 million (20.3 percent)

reflecting the impact of a prior year reimbursement from a business

partner. Offsetting these increases was lower employee benefits

expense of $15 million (5.1 percent) mainly due to lower pension

costs.

Noninterest expense increased $243 million (8.8 percent) on a

linked quarter basis, $93 million (3.4 percent) excluding the

second quarter 2016 notable items, reflecting higher professional

services and compensation expenses, partially offset by lower

employee benefits expense. Excluding the notable charitable

contribution, the marketing and business development expense

increase of $32 million was driven by brand advertising.

Professional services expense was $23 million (23.5 percent) higher

compared with the first quarter of 2016 principally due to higher

costs for compliance-related matters. Compensation expense

increased $28 million (2.2 percent) due to merit increases and

higher variable compensation including performance-based

incentives. Partially offsetting these increases was a decrease in

employee benefits expense of $22 million (7.3 percent), driven by

seasonally lower payroll tax expense.

Provision for Income Taxes

The provision for income taxes for the second quarter of 2016

resulted in a tax rate on a taxable-equivalent basis of 27.9

percent (effective tax rate of 26.1 percent), compared with 28.0

percent (effective tax rate of 26.1 percent) in the second quarter

of 2015, and 28.4 percent (effective tax rate of 26.5 percent) in

the first quarter of 2016, reflecting the favorable settlement of

certain tax exam matters in the second quarter of 2016.

ALLOWANCE FOR CREDIT LOSSES

Table 8 ($ in millions)

2Q 1Q

4Q 3Q 2Q

2016 % (b) 2016 %

(b) 2015 % (b) 2015

% (b) 2015 % (b)

Balance, beginning of period $4,320 $4,306 $4,306 $4,326 $4,351

Net charge-offs Commercial 74 .34 78 .37 58 .28 68 .34 39

.20 Lease financing 5 .38 5 .38 5 .38 3

.23 3 .23 Total commercial 79 .34 83 .37 63 .29 71 .33 42

.20 Commercial mortgages (4 ) (.05 ) (2 ) (.03 ) 2 .02 -- -- 4 .05

Construction and development 4 .15 (3 ) (.11 ) (2 ) (.08 )

(11 ) (.43 ) (3 ) (.12 ) Total commercial real estate -- -- (5 )

(.05 ) -- -- (11 ) (.10 ) 1 .01 Residential mortgages 17 .12

19 .14 16 .12 25 .19 33 .26 Credit card 170 3.39 164 3.26

166 3.50 153 3.38 169 3.85 Retail leasing 2 .15 1 .08 1 .08

2 .14 1 .07 Home equity and second mortgages (1 ) (.02 ) 2 .05 6

.15 7 .17 11 .28 Other 50 .68 51 .69 53 .71 45

.65 39 .62 Total other retail 51 .40 54 .43 60 .47 54

.44 51 .43 Total net charge-offs,

excluding covered loans 317 .49 315 .49 305 .48 292 .47 296

.49 Covered loans -- -- -- -- -- -- --

-- -- -- Total net charge-offs 317 .48 315 .48 305 .47 292

.46 296 .48 Provision for credit losses 327 330 305 282 281 Other

changes (a) (1 ) (1 ) -- (10 ) (10 ) Balance, end of period

$4,329 $4,320 $4,306 $4,306 $4,326

Components Allowance for loan losses $3,806 $3,853

$3,863 $3,965 $4,013 Liability for unfunded credit commitments 523

467 443 341 313 Total allowance

for credit losses $4,329 $4,320 $4,306 $4,306

$4,326 Gross charge-offs $407 $405 $381 $372

$380 Gross recoveries $90 $90 $76 $80 $84 Allowance for

credit losses as a percentage of Period-end loans, excluding

covered loans 1.62 1.65 1.67 1.71 1.76 Nonperforming loans,

excluding covered loans 311 302 360 347 348 Nonperforming assets,

excluding covered assets 263 255 288 280 279 Period-end

loans 1.61 1.63 1.65 1.69 1.74 Nonperforming loans 312 303 361 347

349 Nonperforming assets 259 251 283 275 274

(a) Includes net changes in credit losses

to be reimbursed by the FDIC and reductions in the allowance for

covered loans where the reversal of a previously recorded allowance

was offset by an associated decrease in the indemnification asset,

and the impact of any loan sales.

(b) Annualized and calculated on average loan balances

Credit Quality

The Company’s provision for credit losses for the second quarter

of 2016 was $327 million, which was $3 million (0.9 percent) lower

than the prior quarter and $46 million (16.4 percent) higher than

the second quarter of 2015. Credit quality was relatively

stable.

The provision for credit losses was $10 million higher than net

charge-offs in the second quarter of 2016, $15 million higher than

net charge-offs in the first quarter of 2016 and $15 million lower

than net charge-offs in the second quarter of 2015. The reserve

build for the second quarter of 2016 was driven by portfolio

growth, partially offset by reduced energy portfolio exposures and

residential mortgage credit quality improvement. Total net

charge-offs in the second quarter of 2016 were $317 million,

compared with $315 million in the first quarter of 2016, and $296

million in the second quarter of 2015. Net charge-offs increased $2

million (0.6 percent) compared with the first quarter of 2016

mainly due to modest increases in construction and development and

credit card net charge-offs. Net charge-offs increased $21 million

(7.1 percent) compared with the second quarter of 2015 primarily

due to higher commercial loan net charge-offs, partially offset by

lower charge-offs related to residential mortgages. The net

charge-off ratio was 0.48 percent in the second quarter of 2016,

the first quarter of 2016 and in the second quarter of 2015.

The allowance for credit losses was $4,329 million at June 30,

2016, compared with $4,320 million at March 31, 2016, and $4,326

million at June 30, 2015. The ratio of the allowance for credit

losses to period-end loans was 1.61 percent at June 30, 2016,

compared with 1.63 percent at March 31, 2016, and 1.74 percent at

June 30, 2015. The ratio of the allowance for credit losses to

nonperforming loans was 312 percent at June 30, 2016, compared with

303 percent at March 31, 2016, and 349 percent at June 30,

2015.

Nonperforming assets were $1,672 million at June 30, 2016,

compared with $1,719 million at March 31, 2016, and $1,577 million

at June 30, 2015. The ratio of nonperforming assets to loans and

other real estate was 0.62 percent at June 30, 2016, compared with

0.65 percent at March 31, 2016, and 0.63 percent at June 30, 2015.

The $95 million (6.0 percent) increase in nonperforming assets on a

year-over-year basis was driven by commercial loans within the

energy portfolio, partially offset by improvements in the Company’s

residential and commercial real estate portfolios. The decrease in

nonperforming assets on a linked quarter basis of $47 million (2.7

percent) was driven by improvements in the energy portfolio and in

residential mortgages. Accruing loans 90 days or more past due were

$724 million ($478 million excluding covered loans) at June 30,

2016, compared with $804 million ($528 million excluding covered

loans) at March 31, 2016, and $801 million ($469 million excluding

covered loans) at June 30, 2015.

Commercial loans to customers in the energy sector were

approximately $3.0 billion ($11.3 billion of commitments) at June

30, 2016, compared with $3.4 billion ($11.9 billion of commitments)

at March 31, 2016. The decline was primarily driven by the

completion of our spring borrowing base redeterminations on

reserve-based loans within our energy portfolio. During the second

quarter 2016, criticized commitments within the energy portfolio

decreased by $509 million while nonperforming loans in the energy

portfolio decreased $54 million. Energy portfolio loans represent

1.1 percent of the Company’s total loans outstanding at June 30,

2016, and 1.3 percent at March 31, 2016. At June 30, 2016, the

Company had credit reserves of 8.8 percent of total outstanding

energy loan balances, compared with 9.1 percent of total

outstanding energy loan balances at March 31, 2016.

DELINQUENT LOAN RATIOS AS A PERCENT OF

ENDING LOAN BALANCES Table 9 (Percent)

Jun 30 Mar 31

Dec 31 Sep 30 Jun 30 2016

2016 2015 2015

2015 Delinquent loan ratios - 90 days or more past

due

excluding nonperforming loans Commercial .05 .05 .05 .05

.05 Commercial real estate .03 .04 .03 .05 .05 Residential

mortgages .27 .31 .33 .33 .30 Credit card .98 1.10 1.09 1.10 1.03

Other retail .13 .15 .15 .14 .14 Total loans, excluding covered

loans .18 .20 .21 .20 .19 Covered loans 5.81 6.23 6.31 6.57 6.66

Total loans .27 .30 .32 .32 .32 Delinquent loan ratios - 90

days or more past due

including nonperforming loans

Commercial .58 .57 .25 .25 .16 Commercial real estate .27 .28 .33

.39 .46 Residential mortgages 1.39 1.54 1.66 1.73 1.80 Credit card

1.00 1.14 1.13 1.16 1.12 Other retail .43 .45 .46 .47 .51 Total

loans, excluding covered loans .70 .75 .67 .70 .70 Covered loans

5.98 6.39 6.48 6.80 6.88 Total loans .79 .84 .78 .81 .82

ASSET QUALITY

Table 10 ($ in

millions)

Jun 30

Mar 31 Dec 31 Sep 30 Jun 30 2016

2016 2015 2015

2015 Nonperforming loans Commercial $450 $457 $160 $157 $78

Lease financing 39 16 14 12 12 Total

commercial 489 473 174 169 90 Commercial mortgages 91 94 92

105 116 Construction and development 12 10 35

39 59 Total commercial real estate 103 104 127 144 175

Residential mortgages 628 677 712 735 769 Credit card 5 7 9

12 16 Other retail 157 157 162 171 178

Total nonperforming loans, excluding covered loans 1,382 1,418

1,184 1,231 1,228 Covered loans 7 7 8

11 11 Total nonperforming loans 1,389 1,425 1,192 1,242

1,239 Other real estate (a) 229 242 280 276 287 Covered

other real estate (a) 34 33 32 31 35 Other nonperforming assets 20

19 19 18 16 Total nonperforming

assets (b) $1,672 $1,719 $1,523 $1,567

$1,577 Total nonperforming assets, excluding covered assets

$1,631 $1,679 $1,483 $1,525 $1,531

Accruing loans 90 days or more past due, excluding covered

loans $478 $528 $541 $510 $469

Accruing loans 90 days or more past due $724 $804

$831 $825 $801 Performing restructured loans,

excluding GNMA and covered loans $2,676 $2,735 $2,766

$2,746 $2,815 Performing restructured GNMA and

covered loans $1,602 $1,851 $1,944 $2,031

$2,111 Nonperforming assets to loans plus ORE,

excluding covered assets (%) .62 .64 .58 .61 .63

Nonperforming assets to loans plus ORE (%) .62 .65 .58 .61 .63

(a) Includes equity investments in entities whose principal

assets are other real estate owned. (b) Does not include accruing

loans 90 days or more past due.

COMMON

SHARES

Table 11 (Millions)

2Q 1Q

4Q 3Q 2Q 2016

2016 2015 2015

2015 Beginning shares outstanding 1,732 1,745 1,754

1,767 1,780 Shares issued for stock incentive plans, acquisitions

and other corporate purposes 2 3 1 3 1 Shares repurchased (15 )

(16 ) (10 ) (16 ) (14 ) Ending shares

outstanding 1,719 1,732 1,745

1,754 1,767

CAPITAL POSITION

Table 12

($ in millions)

Jun 30 Mar

31 Dec 31 Sep 30 Jun

30 2016 2016 2015

2015 2015 Total U.S. Bancorp

shareholders' equity $47,390 $46,755 $46,131 $45,075 $44,537

Standardized Approach Basel III transitional

standardized approach Common equity tier 1 capital $33,444 $32,827

$32,612 $32,124 $31,674 Tier 1 capital 39,148 38,532 38,431 37,197

36,748 Total risk-based capital 47,049 45,412 45,313 44,015 43,526

Common equity tier 1 capital ratio 9.5 % 9.5 % 9.6 % 9.6 %

9.5 % Tier 1 capital ratio 11.1 11.1 11.3 11.1 11.0 Total

risk-based capital ratio 13.4 13.1 13.3 13.1 13.1 Leverage ratio

9.3 9.3 9.5 9.3 9.2

Common equity tier 1 capital to

risk-weighted assets estimated for the Basel III fully

implemented

standardized approach 9.3 9.2 9.1 9.2 9.2

Advanced

Approaches Common equity tier 1 capital to risk-weighted

assets for the Basel III transitional advanced approaches 12.3 12.3

12.5 13.0 12.9

Common equity tier 1 capital to

risk-weighted assets estimated for the Basel III fully

implemented

advanced approaches 12.0 11.9 11.9 12.4 12.4

Tangible

common equity to tangible assets 7.6 7.7 7.6 7.7 7.5

Tangible common equity to risk-weighted assets 9.3 9.3 9.2

9.3 9.2 Beginning January 1, 2014, the regulatory capital

requirements effective for the Company follow Basel III, subject to

certain transition provisions from Basel I over the following four

years to full implementation by January 1, 2018. Basel III includes

two comprehensive methodologies for calculating risk-weighted

assets: a general standardized approach and more risk-sensitive

advanced approaches, with the Company's capital adequacy being

evaluated against the methodology that is most restrictive.

Capital Management

Total U.S. Bancorp shareholders’ equity was $47.4 billion at

June 30, 2016, compared with $46.8 billion at March 31, 2016, and

$44.5 billion at June 30, 2015. During the second quarter, the

Company returned 77 percent of earnings to shareholders through

dividends and share buybacks.

All regulatory ratios continue to be in excess of

“well-capitalized” requirements. The estimated common equity tier 1

capital to risk-weighted assets ratio using the Basel III fully

implemented standardized approach was 9.3 percent at June 30, 2016,

compared with 9.2 percent at March 31, 2016, and at June 30, 2015.

The estimated common equity tier 1 capital to risk-weighted assets

ratio using the Basel III fully implemented advanced approaches

method was 12.0 percent at June 30, 2016, compared with 11.9

percent at March 31, 2016, and 12.4 percent at June 30, 2015.

On Friday, July 15, 2016, at 8:00 a.m. CDT, Richard K. Davis,

chairman and chief executive officer, and Kathy Rogers, vice chair

and chief financial officer, will host a conference call to review

the financial results. The conference call will be available online

or by telephone. To access the webcast and presentation, go to

www.usbank.com and click on “About U.S. Bank.” The

“Webcasts & Presentations” link can be found under the

Investor/Shareholder information heading, which is at the left side

near the bottom of the page. To access the conference call from

locations within the United States and Canada, please dial

866-316-1409. Participants calling from outside the United States

and Canada, please dial 706-634-9086. The conference ID number for

all participants is 8158556. For those unable to participate during

the live call, a recording will be available at approximately 11:00

a.m. CDT on Friday, July 15 and be accessible through Friday, July

22 at 11:00 p.m. CDT. To access the recorded message within the

United States and Canada, dial 855-859-2056. If calling from

outside the United States and Canada, please dial 404-537-3406 to

access the recording. The conference ID is 8158556.

Minneapolis-based U.S. Bancorp (NYSE: USB), with $438 billion in

assets as of June 30, 2016, is the parent company of U.S. Bank

National Association, the fifth largest commercial bank in the

United States. The Company operates 3,122 banking offices in 25

states and 4,923 ATMs and provides a comprehensive line of banking,

investment, mortgage, trust and payment services products to

consumers, businesses and institutions. Visit U.S. Bancorp on the

web at www.usbank.com.

Forward-Looking Statements

The following information appears in accordance with the Private

Securities Litigation Reform Act of 1995:

This press release contains forward-looking statements about

U.S. Bancorp. Statements that are not historical or current facts,

including statements about beliefs and expectations, are

forward-looking statements and are based on the information

available to, and assumptions and estimates made by, management as

of the date hereof. These forward-looking statements cover, among

other things, anticipated future revenue and expenses and the

future plans and prospects of U.S. Bancorp. Forward-looking

statements involve inherent risks and uncertainties, and important

factors could cause actual results to differ materially from those

anticipated. A reversal or slowing of the current economic recovery

or another severe contraction could adversely affect U.S. Bancorp’s

revenues and the values of its assets and liabilities. Global

financial markets could experience a recurrence of significant

turbulence, which could reduce the availability of funding to

certain financial institutions and lead to a tightening of credit,

a reduction of business activity, and increased market volatility.

Stress in the commercial real estate markets, as well as a downturn

in the residential real estate markets could cause credit losses

and deterioration in asset values. In addition, U.S. Bancorp’s

business and financial performance is likely to be negatively

impacted by recently enacted and future legislation and regulation.

U.S. Bancorp’s results could also be adversely affected by

deterioration in general business and economic conditions; changes

in interest rates; deterioration in the credit quality of its loan

portfolios or in the value of the collateral securing those loans;

deterioration in the value of securities held in its investment

securities portfolio; legal and regulatory developments;

litigation; increased competition from both banks and non-banks;

changes in customer behavior and preferences; breaches in data

security; effects of mergers and acquisitions and related

integration; effects of critical accounting policies and judgments;

and management’s ability to effectively manage credit risk, market

risk, operational risk, compliance risk, strategic risk, interest

rate risk, liquidity risk and reputational risk.

For discussion of these and other risks that may cause actual

results to differ from expectations, refer to U.S. Bancorp’s Annual

Report on Form 10-K for the year ended December 31, 2015, on file

with the Securities and Exchange Commission, including the sections

entitled “Risk Factors” and “Corporate Risk Profile” contained in

Exhibit 13, and all subsequent filings with the Securities and

Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the

Securities Exchange Act of 1934. However, factors other than these

also could adversely affect U.S. Bancorp’s results, and the reader

should not consider these factors to be a complete set of all

potential risks or uncertainties. Forward-looking statements speak

only as of the date hereof, and U.S. Bancorp undertakes no

obligation to update them in light of new information or future

events.

Non-GAAP Financial Measures

In addition to capital ratios defined by banking regulators, the

Company considers various other measures when evaluating capital

utilization and adequacy, including:

- Tangible common equity to tangible

assets,

- Tangible common equity to risk-weighted

assets,

- Common equity tier 1 capital to

risk-weighted assets estimated for the Basel III fully implemented

standardized approach, and

- Common equity tier 1 capital to

risk-weighted assets estimated for the Basel III fully implemented

advanced approaches.

These measures are viewed by management as useful additional

methods of reflecting the level of capital available to withstand

unexpected market or economic conditions. Additionally,

presentation of these measures allows investors, analysts and

banking regulators to assess the Company’s capital position

relative to other financial services companies. These measures

differ from currently effective capital ratios defined by banking

regulations principally in that the numerator includes unrealized

gains and losses related to available-for-sale securities and

excludes preferred securities, including preferred stock, the

nature and extent of which varies among different financial

services companies. These measures are not defined in generally

accepted accounting principles (“GAAP”), or are not currently

effective or defined in federal banking regulations. As a result,

these measures disclosed by the Company may be considered non-GAAP

financial measures.

There may be limits in the usefulness of these measures to

investors. As a result, the Company encourages readers to consider

the consolidated financial statements and other financial

information contained in this press release in their entirety, and

not to rely on any single financial measure. A table follows that

shows the Company’s calculation of these non-GAAP financial

measures.

U.S. Bancorp

Consolidated Statement of

Income

(Dollars and Shares in Millions, Except

Per Share Data)

Three Months Ended Six Months Ended June 30, June 30,

(Unaudited) 2016 2015 2016

2015

Interest Income Loans $ 2,664 $ 2,463 $

5,308 $ 4,956 Loans held for sale 36 65 67 106 Investment

securities 523 505 1,040 1,000 Other interest income 29

35 58

67 Total interest income 3,252 3,068 6,473

6,129

Interest Expense Deposits 152 113 291 231 Short-term

borrowings 66 62 131 123 Long-term debt 189

177 371 361

Total interest expense 407 352

793 715 Net

interest income 2,845 2,716 5,680 5,414 Provision for credit losses

327 281 657

545 Net interest income after provision

for credit losses 2,518 2,435 5,023 4,869

Noninterest Income

Credit and debit card revenue 296 266 562 507 Corporate payment

products revenue 181 178 351 348 Merchant processing services 403

395 776 754 ATM processing services 84 80 164 158 Trust and

investment management fees 358 334 697 656 Deposit service charges

179 174 347 335 Treasury management fees 147 142 289 279 Commercial

products revenue 238 214 435 414 Mortgage banking revenue 238 231

425 471 Investment products fees 39 48 79 95 Securities gains

(losses), net 3 -- 6 -- Other 386 210

570 409

Total noninterest income 2,552 2,272 4,701 4,426

Noninterest

Expense Compensation 1,277 1,196 2,526 2,375 Employee benefits

278 293 578 610 Net occupancy and equipment 243 247 491 494

Professional services 121 106 219 183 Marketing and business

development 149 96 226 166 Technology and communications 241 221

474 435 Postage, printing and supplies 77 64 156 146 Other

intangibles 44 43 89 86 Other 562 416

982 852

Total noninterest expense 2,992 2,682

5,741 5,347

Income before income taxes 2,078 2,025 3,983 3,948 Applicable

income taxes 542 528

1,046 1,007 Net income

1,536 1,497 2,937 2,941 Net (income) loss attributable to

noncontrolling interests (14 ) (14 )

(29 ) (27 ) Net income attributable to

U.S. Bancorp $ 1,522 $ 1,483 $

2,908 $ 2,914 Net income applicable to U.S.

Bancorp common shareholders $ 1,435 $ 1,417

$ 2,764 $ 2,782 Earnings

per common share $ .83 $ .80 $ 1.60 $ 1.57 Diluted earnings per

common share $ .83 $ .80 $ 1.59 $ 1.56 Dividends declared per

common share $ .255 $ .255 $ .510 $ .500 Average common shares

outstanding 1,725 1,771 1,731 1,776 Average diluted common shares

outstanding 1,731 1,779

1,737 1,784

U.S. Bancorp

Consolidated Ending

Balance Sheet June 30, December 31, June 30, (Dollars in

Millions) 2016 2015 2015

Assets

(Unaudited) (Unaudited) Cash and due from banks $ 14,038 $ 11,147 $

17,925 Investment securities Held-to-maturity 42,030 43,590 46,233

Available-for-sale 66,490 61,997 57,078 Loans held for sale 4,311

3,184 8,498 Loans Commercial 92,514 88,402 84,620 Commercial real

estate 43,290 42,137 42,258 Residential mortgages 55,904 53,496

51,337 Credit card 20,571 21,012 17,788 Other retail 52,008

51,206 47,652

Total loans, excluding covered loans 264,287 256,253 243,655

Covered loans 4,234 4,596

4,984 Total loans 268,521 260,849 248,639 Less

allowance for loan losses (3,806 ) (3,863 )

(4,013 ) Net loans 264,715 256,986 244,626 Premises

and equipment 2,459 2,513 2,551 Goodwill 9,359 9,361 9,374 Other

intangible assets 2,852 3,350 3,225 Other assets 32,209

29,725 29,565

Total assets $ 438,463 $ 421,853 $

419,075

Liabilities and Shareholders' Equity

Deposits Noninterest-bearing $ 86,572 $ 83,766 $ 86,189

Interest-bearing 231,018 216,634

210,659 Total deposits 317,590 300,400 296,848

Short-term borrowings 18,433 27,877 27,784 Long-term debt 36,941

32,078 34,141 Other liabilities 17,470

14,681 15,071 Total liabilities 390,434

375,036 373,844 Shareholders' equity Preferred stock 5,501 5,501

4,756 Common stock 21 21 21 Capital surplus 8,402 8,376 8,335

Retained earnings 48,269 46,377 44,434 Less treasury stock (14,241

) (13,125 ) (12,144 ) Accumulated other comprehensive income (loss)

(562 ) (1,019 ) (865 ) Total

U.S. Bancorp shareholders' equity 47,390 46,131 44,537

Noncontrolling interests 639 686

694 Total equity 48,029

46,817 45,231 Total liabilities

and equity $ 438,463 $ 421,853

$ 419,075

U.S. Bancorp

Non-GAAP Financial Measures

(Dollars in Millions, Unaudited)

June 30,

March 31,

December 31,

September 30,

June 30,

2016

2016

2015

2015

2015

Total equity $ 48,029 $ 47,393 $ 46,817 $ 45,767 $ 45,231 Preferred

stock (5,501 ) (5,501 ) (5,501 ) (4,756 ) (4,756 ) Noncontrolling

interests (639 ) (638 ) (686 ) (692 ) (694 ) Goodwill (net of

deferred tax liability) (1) (8,246 ) (8,270 ) (8,295 ) (8,324 )

(8,350 ) Intangible assets, other than mortgage servicing rights

(796 ) (820 ) (838 )

(779 ) (744 ) Tangible common equity (a)

32,847 32,164 31,497 31,216 30,687 Tangible common equity

(as calculated above) 32,847 32,164 31,497 31,216 30,687

Adjustments (2) 133 99

67 118 125

Common equity tier 1 capital estimated for the Basel III fully

implemented standardized and advanced approaches (b) 32,980 32,263

31,564 31,334 30,812 Total assets 438,463 428,638 421,853

415,943 419,075 Goodwill (net of deferred tax liability) (1) (8,246

) (8,270 ) (8,295 ) (8,324 ) (8,350 ) Intangible assets, other than

mortgage servicing rights (796 ) (820 )

(838 ) (779 ) (744 ) Tangible

assets (c) 429,421 419,548 412,720 406,840 409,981

Risk-weighted assets, determined in accordance with prescribed

transitional standardized approach regulatory requirements (d)

351,462

*

346,227 341,360 336,227 333,177 Adjustments (3)

3,079

*

3,485 3,892

3,532 3,532 Risk-weighted assets

estimated for the Basel III fully implemented standardized approach

(e)

354,541

*

349,712 345,252 339,759 336,709 Risk-weighted assets,

determined in accordance with prescribed transitional advanced

approaches regulatory requirements

271,495

*

267,309 261,668 248,048 245,038 Adjustments (4)

3,283

*

3,707 4,099

3,723 3,721 Risk-weighted assets

estimated for the Basel III fully implemented advanced approaches

(f)

274,778

*

271,016 265,767 251,771 248,759

Ratios * Tangible

common equity to tangible assets (a)/(c) 7.6 % 7.7 % 7.6 % 7.7 %

7.5

%

Tangible common equity to risk-weighted assets (a)/(d) 9.3 9.3 9.2

9.3 9.2 Common equity tier 1 capital to risk-weighted assets

estimated for the Basel III fully implemented standardized approach

(b)/(e) 9.3 9.2 9.1 9.2 9.2 Common equity tier 1 capital to

risk-weighted assets estimated for the Basel III fully implemented

advanced approaches (b)/(f) 12.0

11.9 11.9 12.4

12.4 * Preliminary data. Subject

to change prior to filings with applicable regulatory agencies.

(1)

Includes goodwill related to certain

investments in unconsolidated financial institutions per prescribed

regulatory requirements.

(2)

Includes net losses on cash flow hedges

included in accumulated other comprehensive income (loss) and other

adjustments.

(3)

Includes higher risk-weighting for

unfunded loan commitments, investment securities, residential

mortgages, mortgage servicing rights and other adjustments.

(4) Primarily reflects higher risk-weighting for mortgage servicing

rights.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160715005064/en/

U.S. BancorpMediaDana Ripley,

612-303-3167orInvestors/AnalystsJennifer Thompson, 612-303-0778

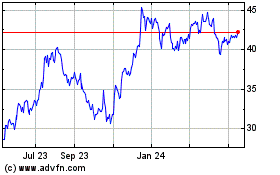

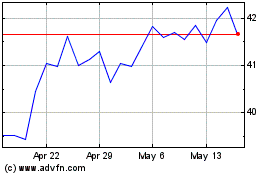

US Bancorp (NYSE:USB)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From Apr 2023 to Apr 2024